Spain’s knowledge economy and the NGEU: Recent progress and outstanding challenges

Supported by NGEU funds, Spain’s knowledge economy has made progress in key areas such as R&D investment and product innovation-related sales. However, gaps in talent formation, digitalization, and a weakening focus on sustainability threaten long-term growth unless more targeted reforms are implemented.

Abstract: Spain’s knowledge economy has experienced mixed progress since 2019, according to the European Innovation Scoreboard (EIS). Notable improvements include increased R&D investment, public-private partnerships and sales derived from product innovation, especially among SMEs, suggesting positive impacts from Spain’s Recovery Plan – the government’s main mechanism for implementation of NGEU funding. However, critical challenges remain, including declining STEM talent, insufficient ICT training across firms, and a weakening focus on environmental sustainability. Of the Recovery Plan’s almost 80 billion euros, allocations directly linked to the knowledge economy represent just under 12% of the total budget, indicating a need for more targeted support to strengthen Spain’s competitive position in the knowledge economy through enhanced structural reforms, increased investment in digitalization, strengthening of the regulatory environment and prioritizing sustainability within innovation policies.

Foreword

The knowledge economy is a fundamental driver of economic and social development in advanced economies. This paper analyses the state of the knowledge economy in Spain relying on the results of the most recent European Innovation Scoreboard (EIS), published in 2024 and containing data for 2023. This Scoreboard, which creates a benchmark index for the European Union (EU = 100), assesses countries’ performance along four key dimensions: framework conditions, investments, innovation activities and impacts. By referencing the EIS we are also able to sketch out a definition of the “knowledge economy” and focus on certain specific aspects.

Against a global backdrop marked by digitalisation, technological innovation and transition to more sustainable models, Spain is rolling out several strategies and investments under its Recovery, Transformation and Resilience Plan (the Recovery Plan), framed by the Next Generation EU (NGEU) Programme, the European Union’s effort to revive and strengthen the economy in the aftermath of the crisis induced by the COVID-19 pandemic. This paper also attempts to identify the Plan investments most closely linked with the knowledge economy.

Some of these aspects have been analysed separately in earlier papers (Kasperksaya and Xifré, 2016; Xifré, 2014, 2020a, 2020b, 2024) but here we aim to provide an integrated and qualitatively-different analysis.

Analysis of the European Innovation Scoreboard results

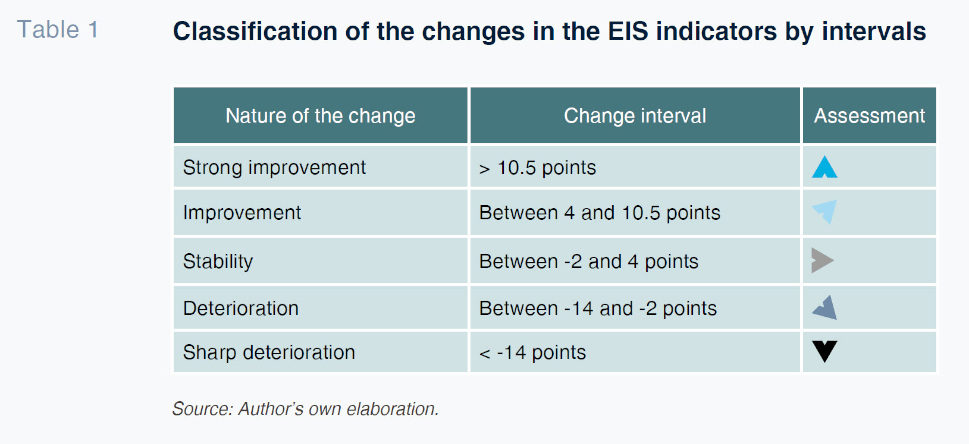

In this section, we analyse the most recent results of the European Innovation Scoreboard (EIS) for Spain, taken from the 2024 edition (with data up to 2023) by comparison with those obtained the year before the COVID-19 crisis, in 2019. The EIS is divided into four categories – framework conditions, investments, innovation activities and impacts – with each subdivided into eight indicators. In the next four subsections we analyse the resulting 32 indicators for Spain, indexed to the EU average (EU = 100). We calculate the changes in all 32 indicators and categorise the trends in those indicators into one of the following five intervals (Table 1), which are then used in Tables 2 to 5.

Framework conditions

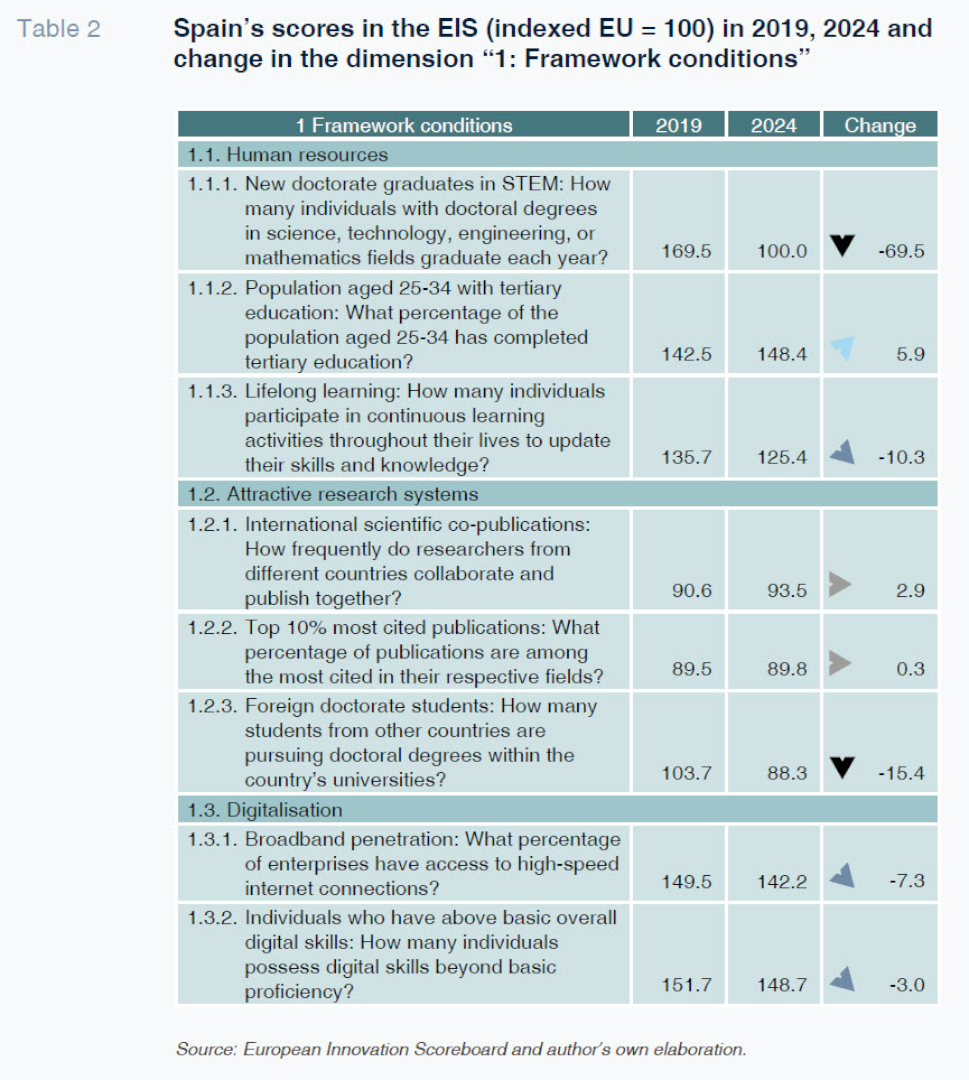

Table 2 provides the readings for the framework conditions category, which includes three subdimensions: human resources, attractive research systems and digitalisation.

The most concerning reading is the 69.5 point drop in new doctorate graduates in STEM (science, technology, engineering and maths), indicating significant erosion of highly qualified talent in critical areas of the knowledge economy. If this decline is not reverted, there could be long-term consequences for Spain’s ability to innovate and compete internationally. In contrast, the percentage of the population aged 25-34 with third level education increased by 5.9 points to 148.4 points.

The drop of over 10 points in the lifelong learning indicator could be an issue in an increasingly dynamic labour market in which constant reskilling is vital.

Within attractive research systems, international scientific co-publications increased slightly. However, the number of foreign doctorate students fell sharply, suggesting that the Spanish universities are not attractive enough to international talent.

As for digitalisation, both broadband penetration and above basic overall digital skills decreased, adversely affecting corporate competitiveness and the adoption of new technology.

Investments

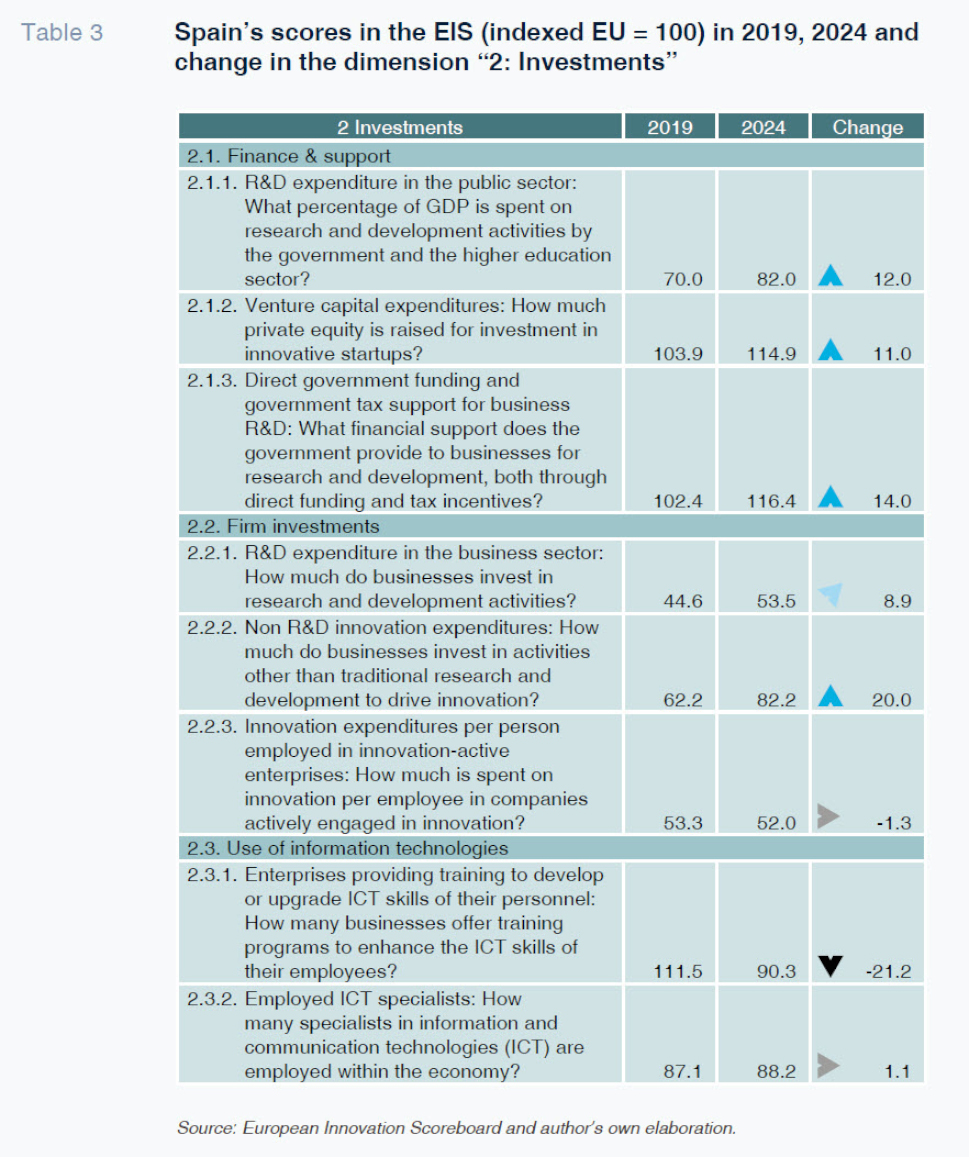

Table 3 provides the readings for the investment dimension, which encompasses three subdimensions: finance and support, firm investments and the use of information technologies. This is the dimension that would be expected to benefit most from the NGEU funds, a topic addressed in the next section.

In 2019, Spain presented a significant gap in investments, specifically an investing intensity of 70% of the EU average in the public sector and less than 45% in the business sector.

According to the data published in 2024, the situation has improved significantly. Investments in the knowledge economy have increased considerably, driven by expenditure in both the public and private sectors. The trends in the results reveal an improvement in most of the indicators, particularly finance and support for R&D, with R&D expenditure in the public sector increasing 12 points.

Venture capital for investment in innovative startups also registered strong growth, increasing 11 points to 114.9. This trend indicates an increasingly favourable climate for new technology companies, supported by private investments and public policies that are stimulating entrepreneurship. Direct government funding and government tax support for business R&D also improved, by 14 points, to 116.4. This improvement evidences the government’s efforts to facilitate direct and indirect business finance and foster innovation through tax breaks and grants.

In terms of firm investments, the 20 point increase (to 82.2 points) in non-R&D innovation expenditure stands out, suggesting that Spanish firms are innovating beyond their formal R&D efforts. The increase in private sector investment, the weakest indicator in 2019, is much smaller (at 8.9 points), putting this reading barely above 50% (53.5%) of the EU average. Innovation expenditures per person employed in innovation-active enterprises decreased slightly.

Within the use of information technologies (ICT), the metric tracking enterprises providing training to develop or upgrade ICT skills fell very significantly (21.2 points) but employed ICT specialists improved slightly.

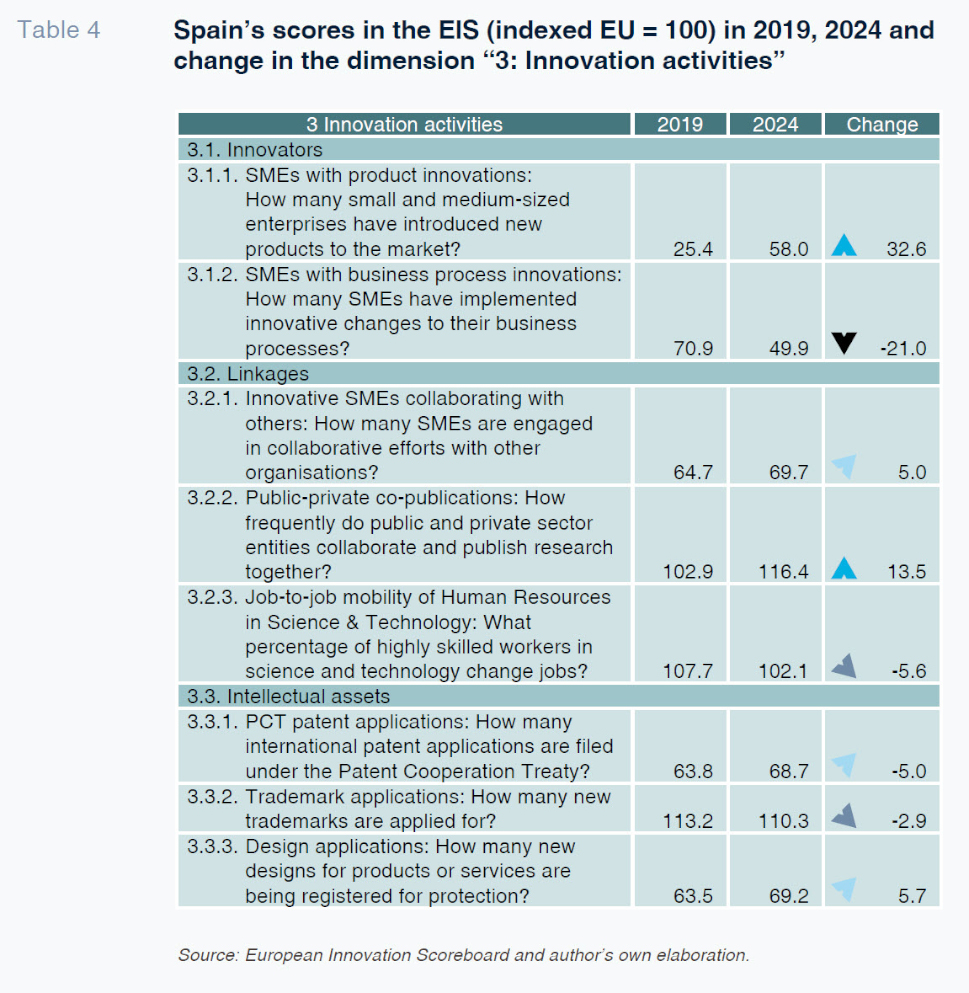

Innovation activities

Table 4 provides the readings for the innovation activities category, which includes three subdimensions: innovators, linkages and intellectual assets. In 2019, Spain fared very poorly on one particular indicator: SMEs with product innovations, which was just 25% of the EU average. Another two indicators related with SMEs (SMEs with business process innovations and innovative SMEs collaborating with others) also presented significant gaps, at levels of 65-70% of the EU average. The snapshot from 2019 was one of Spanish SMEs finding it hard to integrate innovation into their competitive strategies, limiting their ability to access international markets and increase their productivity.

Looking at the 2024 scores, the indicator presenting the biggest increase is indeed the one that was lagging the most in 2019, SMEs with product innovations, which improved by 32.6 points. This increase depicts a significant effort in new product development, possibly fuelled by public incentives and more intense market competition. However, this improvement contrasts with the 21 point drop in SMEs with process innovations.

Within linkages, the growth in public-private co-publications is a sizeable 13.5 points. This is an important figure as it reveals an improvement in one of the key issues facing Spain’s knowledge economy: the transfer of knowledge and open innovation. The metric tracking innovative SMEs collaborating with others also improved by 5 points.

Turning to intellectual assets, there were no major changes in any of the three indicators assessed (PCT patent applications, trademark applications and design applications).

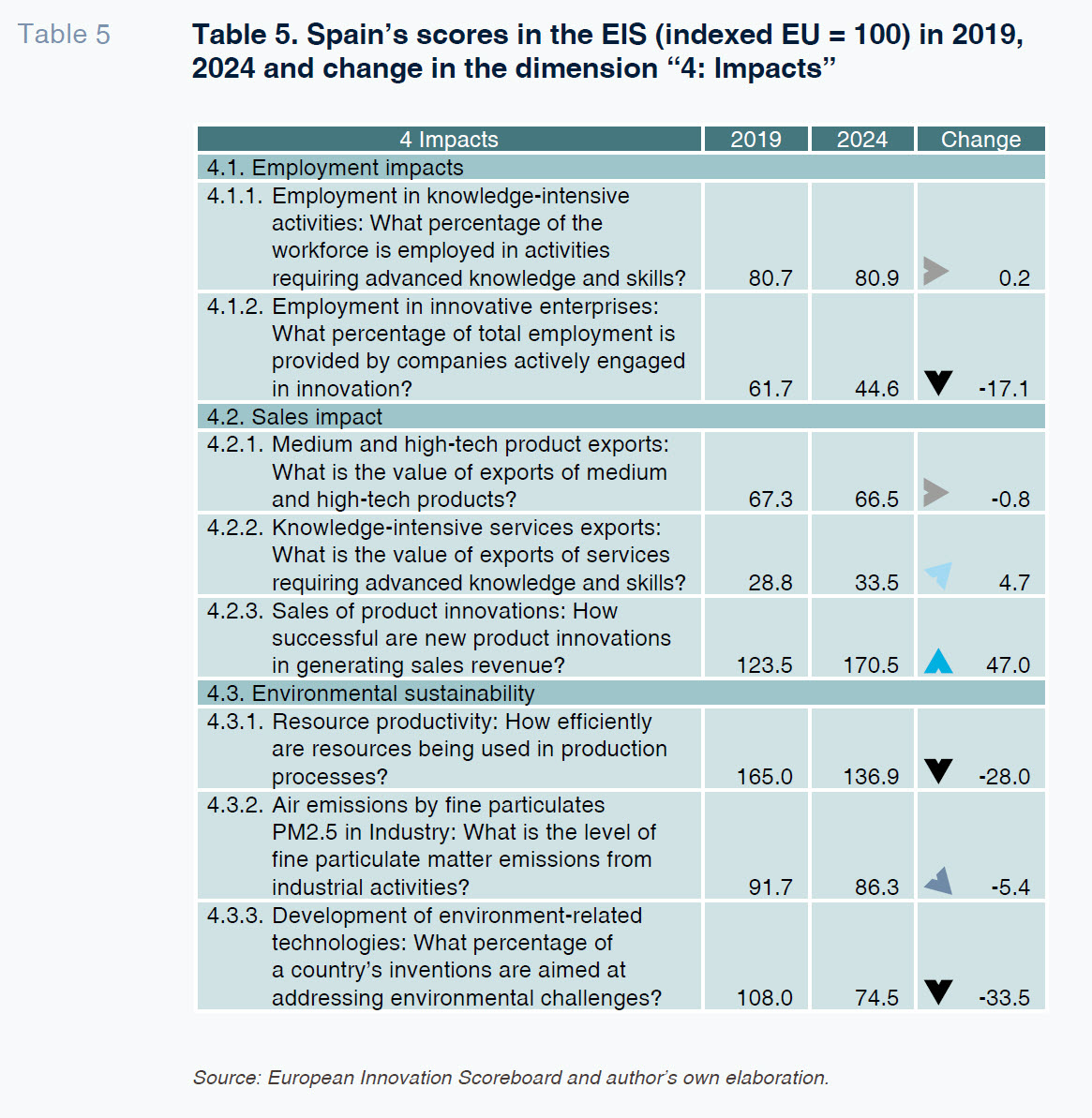

Impacts

Table 5 provides the readings for the impacts category, which again includes three subdimensions: employment impacts, sales impact and environmental sustainability. The most worrying metric in 2019 related to knowledge-intensive services exports, which was 30% below the EU average.

The 2024 EIS reveals a sharp reduction (17.1 points) in the percentage of employment in innovative enterprises, whereas employment in knowledge-intensive activities was practically stable. These figures may point to difficulties in scaling up innovative projects or a low rate of business growth.

Within the sales impact indicators, there was very strong growth in the role of product innovations in sales growth, which increased by 47 points between the 2019 and 2024 editions. This increase suggests that the Spanish companies have become more effective at selling new products, probably indicating a more robust focus on market-oriented innovation. Medium and high-tech product exports registered a very small decrease, while knowledge-intensive services exports (the worst-performing indicator in 2019) registered slight growth.

Within environmental sustainability, two indicators are of concern: resource productivity decreased by 28 points and the development of environment-related technologies dropped 33.5 points, suggesting reduced prioritisation of sustainability in innovative activities and investments. In contrast, air emissions by fine particulates in industry fell slightly.

The knowledge economy under the Recovery Plan

The Recovery, Transformation and Resilience Plan is the strategy formulated by the Spanish government to fuel economic recovery in the wake of the COVID-19 pandemic under the umbrella of the NGEU funds. The NGEU funds include the Recovery and Resilience Facility (RRF), which is the largest financial instrument with a budget of 723.8 billion euros for supporting member state reforms and investments.

The RRF provides Spain with 69.5 billion euros of direct transfers, as well as the possibility of applying for additional loans. These funds are being earmarked to strategic projects aimed at fortifying key sectors of the economy.

Spain’s Recovery Plan is articulated around four main pillars: the green transition, digital transformation, social and territorial cohesion and gender equality, implemented by means of 30 lines of initiative.

A number of papers have tracked the Recovery Plan and NGEU funds in Spain (Xifré, 2020b; Maudos, 2023; Domínguez and Gomariz, 2023; Hidalgo et al. 2024; Afi, 2024; García-Arenas, 2024, and AIReF, 2025) and, more recently, their impacts (ECB, 2024, and Creel and Kaiser, 2024). To update this line of work, in this section we present the most recent information available, updated to 31 December 2024, based on AIReF’s interactive tool (the RTRP Observatory) (AIReF, 2025), relating it with the developments outlined in the last section regarding the progress of Spain’s knowledge economy.

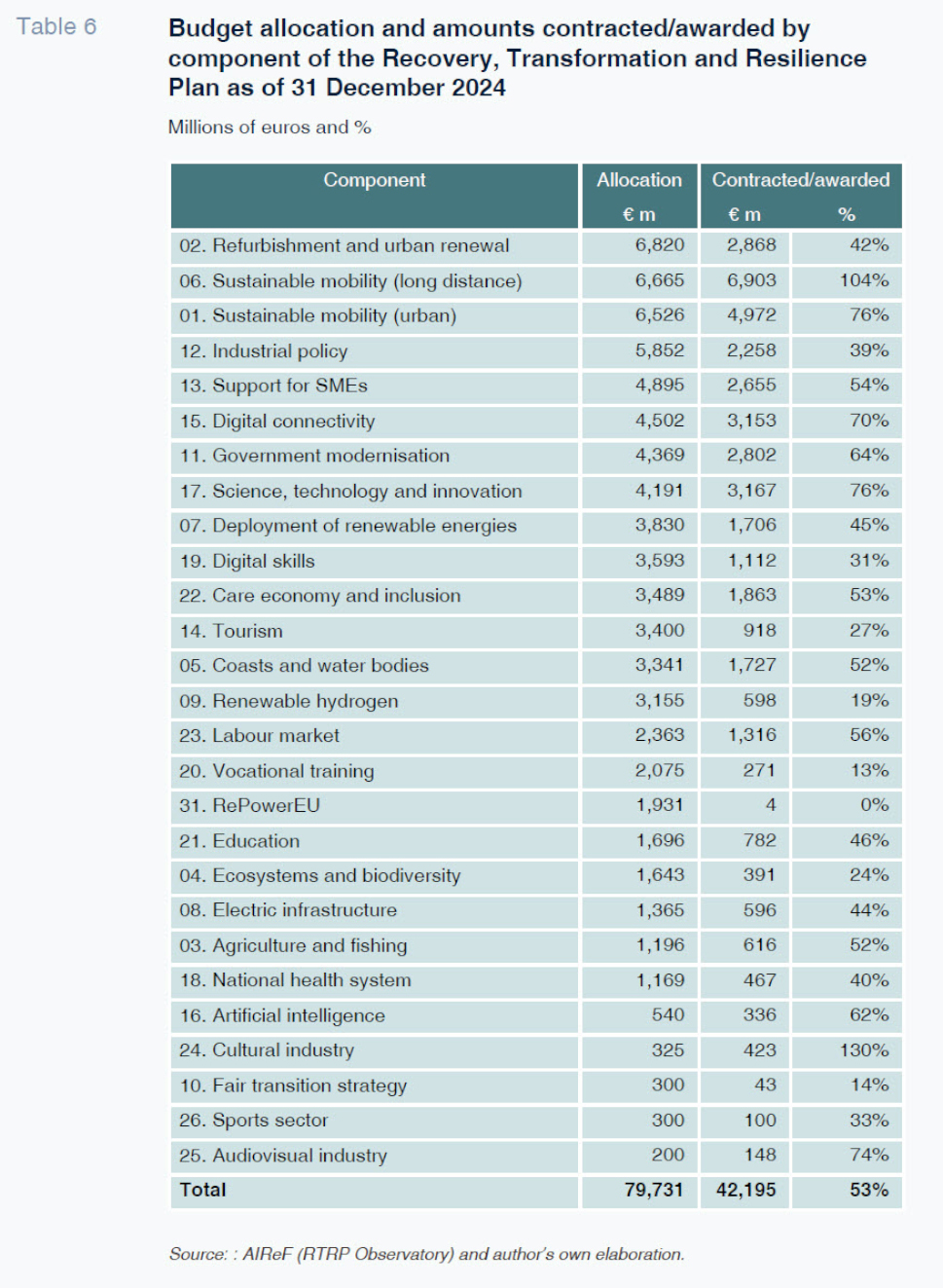

Table 6 itemises the initial budget allocation for the 30 components of the Recovery Plan (which is how the table is ordered) and the amounts contracted or awarded by the end of 2024, according to the methodology used by AIReF.

The table illustrates considerable heterogeneity by component in the amounts allocated and the amounts of the allocations that have been contracted or awarded. The data available are not conducive to analysing what impact the Recovery Plan investments may have had on the EIS results but it is possible to make certain observations. Note that a given component may encompass initiatives or investments with varying degrees of impact on knowledge or technology so that it may be inaccurate to associate all the investments related with that component with a particular level of knowledge or technology contribution.

Bearing in mind these limitations, there are three key takeaways. Firstly, the five components of the Recovery Plan with the biggest budgets (refurbishment, long-distance and urban sustainable mobility, industrial policy and support for SMEs) do not appear to have a direct correlation with the knowledge economy. Combined, these five components have been earmarked a budget of 30.76 billion euros, representing 38% of the total.

Secondly, there are five components that can be considered directly associated with the knowledge economy and digitalisation as captured by the EIS: digital connectivity, science, technology and innovation, the deployment of renewable energies, digital skills and artificial intelligence. Combined, these five components have been earmarked a budget of 16.66 billion euros, which is equivalent to 20% of the total.

Lastly, as of 31 December 2024, the volume of contracts and grants awarded under the scope of these five components stood at 9.47 billion euros, which is 56% of their total budget and 11.8% of the total Recovery Plan assignation.

Conclusions

This analysis of the four dimensions of the European Innovation Scoreboard (EIS) for Spain between 2019 and 2024 paints a mixed picture marked by significant progress in some areas and persistent challenges in others.

The strongest improvements in Spain’s knowledge economy between 2019 and 2023 came in three areas: firm investments in R&D, the number of SMEs placing new products on the market and the impact of product innovation on sales generation. It is in the investment area, where there has been considerable growth in public expenditure on R&D and venture capital expenditure on innovative startups, that there are clearer signs that the NGEU funds and Recovery Plan have had a meaningful impact.

As for the outstanding challenges, four areas deteriorated sharply during the period analysed. In ascending order of magnitude of the deterioration observed, we have: enterprises providing training to develop or upgrade ICT skills; environmentally-efficient use of productive resources; the development of environment-related technologies, and, very notably, the number of new doctorate graduates in STEM. Trying to take a constructive approach to these challenges, some of these deficiencies can still be tackled through the conducive components of the Recovery Plan where there is still considerable unallocated budget.

We estimate that as of 31 December 2024, the investments contracted or awarded that can be considered directly related with the knowledge economy represent just under 12% of the total Recovery Plan budget allocation. To improve its positioning as a knowledge economy, Spain needs to continue to push through structural reforms, fostering digitalisation, strengthening the regulatory environment and prioritising sustainability in innovation policies.

References

AFI. (2024). NGEU-Assist.

https://www.ngeu-assist.com/es-es/contenido/1462/analisis-de-ejecucion-de-los-fondos-ngeu-a-30-de-junio-de-2024AIReF. (2025). RTRP Observatory.

https://www.airef.es/es/datalab/herramientas-interactivas-de-la-airef/observatorio-del-prtr/ECB. (2024). Four years into the Next Generation EU programme: an updated preliminary evaluation of its economic impact.

ECB Economic Bulletin, Issue 8/2024.

CREEL, J., KAISER, J. (2024).

The real effects of Next Generation EU. FEPS Foundation for European Progressive Studies.

DOMÍNGUEZ, A. M., GOMARIZ, M. (2023). “PERTEs”: Level of execution and role in mobilising Next Generation EU funds.

Spanish Economic and Financial Outlook, Vol. 12, No. 3.

https://www.sefofuncas.com//Deconstructing-inflation-in-Spain/PERTEs-Level-of-execution-and-role-in-mobilising-Next-Generation-EU-fundsGARCÍA-ARENAS, J. (2024). Next Generation EU funds: how has the third year of European funding gone? CaixaBank Research, Spanish Economy Focus, March 2024.

HIDALGO, M., GALINDO, J., MARTÍNEZ, J. (2024). Evolución de los Fondos Next-Gen EU en España [Outcomes for Next-Gen EU Funds in Europe].

EsadeEcPol Policy Brief.

KASPERSKAYA, Y., XIFRÉ, R. (2016). Gasto público en I+D+i en España: análisis y propuestas [Public expenditure on R&D+I in Spain: Analysis and proposals].

Papeles de Economía Española, No. 147, 92-107.

MAUDOS, J. (2023). Allocation of NGEU funds in Spain: Companies and sectors.

Spanish Economic and Financial Outlook, Vol. 12, No. 5.

https://www.sefofuncas.com//Assessing-the-impact-of-the-interest-rate-tightening-cycleXIFRÉ, R. (2014). R&D+I in Spain: Is the growth engine damaged?

Spanish Economic and Financial Outlook, Vol. 3, No. 6.

https://www.funcas.es/wp-content/uploads/Migracion/Articulos/FUNCAS_SEFO/016art03.pdfXIFRÉ, R. (2020a). Spanish high-tech exports.

Spanish Economic and Financial Outlook, Vol. 9, No. 4.

https://www.funcas.es/wp-content/uploads/2020/08/SEFO050art08.pdfXIFRÉ, R. (2020b). The NGEU recovery package in Spain: Structural challenges and proposal analysis.

Spanish Economic and Financial Outlook, Vol. 9, No. 6.

https://www.funcas.es/wp-content/uploads/2020/12/Xifre.pdfXIFRÉ, R. (2024). The evolution of Spain’s high tech exports through to 2023.

Spanish Economic and Financial Outlook, Vol. 13, No. 6.

https://www.sefofuncas.com/Spain-and-Europe-in-an-era-of-policy-uncertainty/The-evolution-of-Spains-high-tech-exports-through-2023

Ramon Xifré. IQS School of Management, Universitat Ramon Llull