“PERTEs”: Level of execution and role in mobilising Next Generation EU funds

Under Next Generation EU (NGEU), the Strategic Projects for Economic Recovery and Transformation (PERTEs, in their Spanish acronym) were created to channel over 40 million euros in funds into areas identified as priorities for the modernisation and competitiveness of the national economy. However, numerous challenges have resulted in PERTE execution by the end of 2022 of around only 5.6 billion euros and going forward, it will be important to assess both ex-ante and post grant award initiatives to ensure maximizing the funds’ potential.

Abstract: The Strategic Projects for Economic Recovery and Transformation (PERTEs) were created to channel the Next Generation EU (NGEU) funds into areas identified as priorities for the modernisation and competitiveness of the national economy. The idea is to channel over 40 billion euros of public investment into a dozen strategic areas. That is around one-quarter of all the funds Spain stands to receive under the Recovery and Resilience Facility. Despite having been created to allocate funds into areas of strategic importance for Spain’s economic advancement, PERTE execution has stumbled upon certain difficulties. By year end 2022, only around 5.6 billion euros had been committed (tenders and grants adjudicated), which is less than half of the funds channelled using this instrument. The key challenges to have emerged since approval of the first PERTE in July 2021 can be classified into three major categories: (i) challenges associated with requirements specific to the grant calls; (ii) challenges linked to the regulatory environment; and, (iii) challenges derived from economic and market conditions. Going forward, in addition to ex-ante assessments performed prior to the publication of calls for PERTE grants, it will be important to monitor and evaluate the initiatives after adjudication to ensure European funds are channelled effectively and maximize their reach.

Role played by the PERTEs in channelling high volumes of European funds

The PERTEs are a recently-created public-private partnership instrument inspired by the Important Projects of Common European Interest (IPCEIs). They were set in motion to help channel investment of the Next Generation EU funds into areas of priority importance. For legal purposes, the PERTE concept was set down in Royal Decree-Law 36/2020 approving urgent measures for modernising government and executing Spain’s Recovery, Transformation and Resilience Plan (hereinafter, the Recovery Plan).

Indeed, the Strategic Projects are designed to facilitate delivery of the Recovery Plan targets. Moreover, they are meant to make an important contribution to job creation and Spanish economic growth and competitiveness. They emphasise innovation, the involvement of SMEs and the development of new forms of collaboration among agents in order to bring broader know-how, experience and financial capabilities into play. The PERTEs must be ambitious in scope from the quantitative and qualitative standpoint (e.g., by addressing a significant financial risk). That last point is important to rolling out efficient formulas for implementing the European funds.

It is worth recalling that Spain stands to receive over 160 billion euros under the Recovery and Resilience Facility (RRF), the main NGEU instrument. The scale of those funds, coupled with the funds due under the Multi-Annual Financial Framework (MFF), raises the stakes around the European fund absorption challenge. In fact, as of September 2020 (with three years to go to complete execution as per the n+3 principle), just 39% of the funds allocated under the European Structural Investment Funds for 2014-2020 had been channelled in Spain (Darvas, 2020). For that reason, the Strategic Projects are also intended to play a key role in addressing the European fund absorption challenge by taking advantage of the opportunity presented by the RRF to finance high-impact investments with the capacity to transform the Spanish economy.

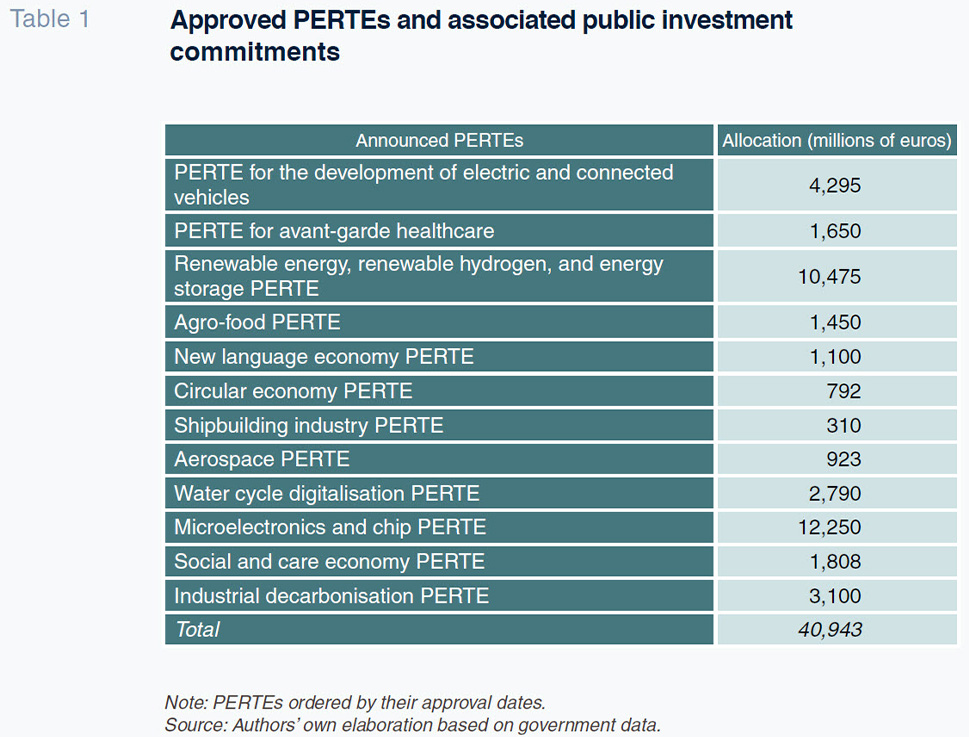

The volume of public funds to be earmarked to the dozen PERTEs announced to date amounts to 40.94 billion euros

[1]. That figure is equivalent to one-quarter of the NGEU funds Spain is expected to receive (under the original Recovery Plan as well as its pending Addendum).

The dozen PERTEs were articulated around strategic initiatives encompassing a series of sectors identified as conducive to making the Spanish economy more competitive. They are associated with industries with a significant weight in Spanish GDP, such as the automotive (development of electric and connected vehicles) and food industries. The shipping and aerospace industries have also been flagged as important for industrial autonomy purposes.

There are also PERTEs in areas closely linked with the green transition, covering renewable energies, the circular economy and industrial decarbonisation. Others are intrinsically entwined with the digital transformation thrust, such as the Strategic Project designed to foster content in Spanish and the ‘co-official languages’ in the digital economy, digitalisation of the water cycle and development of the microelectronics and chip industries. The PERTEs also cover areas with the potential to address major societal issues, including avant-garde healthcare and the social and care economy.

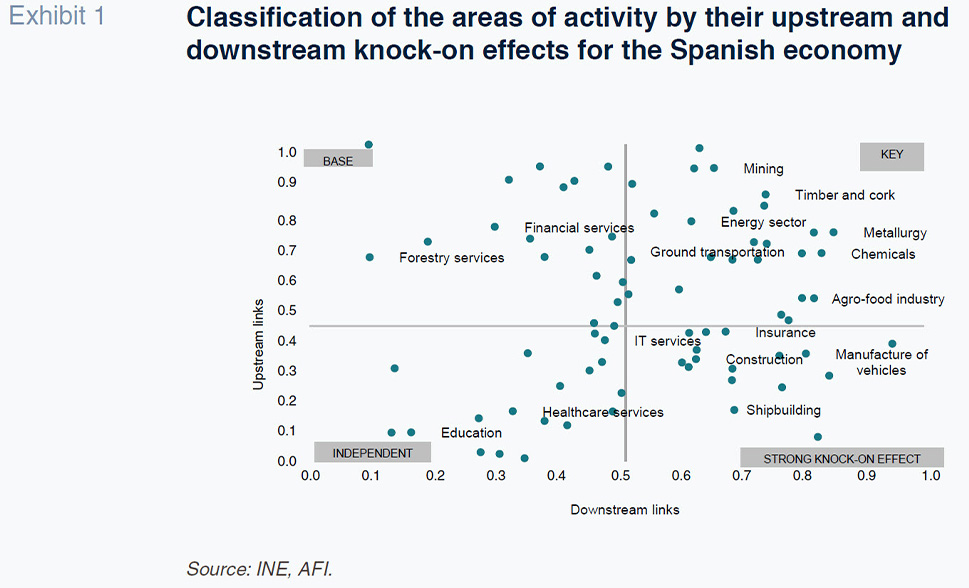

Several of the economic activities around which the Strategic Projects have been articulated have important knock-on effects on other sectors. For example, the manufacture of vehicles is considered a “strong knock-on effect” activity (as shown in quadrant 4 of Exhibit 1), specifically benefitting a number of links upstream in other supplier sectors. Others, such as the agro-food industry, are deemed “key” activities as they benefit a number of links in the upstream and downstream chains (quadrant 2 of Exhibit 1).

All of which translates into higher-impact public investing when the direct and indirect, or knock-on, effects on other activities supplying goods and services to the primary recipients are added together.

Overall, the PERTE catalogue is remarkably heterogeneous in terms of size, budget allocations (refer to Table 1) and mechanisms for channelling the funds (grant, loan or tender). Moreover, some of the Strategic Projects are associated with standalone projects while others cover integrated initiatives encompassing several projects with a common objective (integrated value chain initiatives).

Level of PERTE execution and key challenges identified

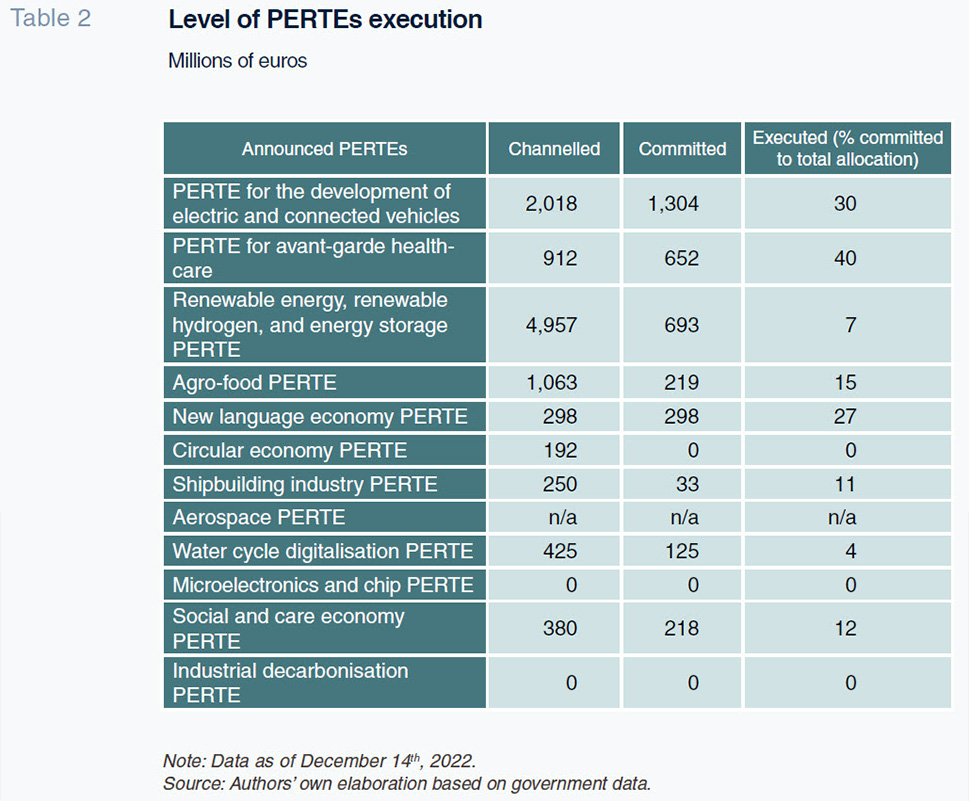

Despite having been created to channel funds into areas of strategic importance for Spain’s economic advancement, PERTE execution has stumbled upon certain difficulties. By year end 2022, only around 5.6 billion euros had been committed (tenders and grants adjudicated), which is less than half of the funds channelled using this instrument. Although there is heterogeneity in the degree of execution of each PERTE (refer to Table 2), even those that enjoy a higher degree of execution (in terms of percentage of resources committed to the total allocation of the PERTE) have shown difficulties.

The first call for grants for end-to-end initiatives in the electric and connected vehicle industrial chain was symptomatic of the issues encountered in implementing the Strategic Projects. Of the 2.98 billion euros contemplated for that call, over 2.1 billion euros went unallocated

[2].

The key challenges to have emerged since approval of the first PERTE in July 2021 can be classified into three major categories: (i) challenges associated with requirements specific to the grant calls; (ii) challenges linked to the regulatory environment; and, (iii) challenges derived from the economic and markets situation.

In the first category, related with calls for grants requirements, it is worth highlighting the difficulty in configuring groups made up of multiple companies and entities, with a significant SME presence, as well as other specific agents (technology or know-how providers). Those groups have to present projects that qualify as “levers”, which are in turn made up of other primary projects to be executed by the various members of the group. Moreover, the projects need to have a geographic reach that includes two or more autonomous regions.

It is certainly proving hard to meet those demands in a business environment and culture marked by individualism and in specific sectors in which the supply chain is particularly concentrated and/or of a nature that makes it hard to form such groupings. Moreover, it takes time to put these collaborative business structures – economic interest groups – together properly and plan the distribution of tasks. Time not contemplated in many of the NGEU grant calls.

As a result, the deadline for presenting bids has had to be extended for a number of PERTE calls (e.g., the deadline for presenting bids for the first calls linked with the EV value chain had to be extended as many as three times, delays which also occurred in the agro-food and shipbuilding calls). In parallel, the conditions required of these groupings have been made somewhat more flexible. For example, in the case of the agro-food PERTE, the requirement was eased from groupings made up of at least one large enterprise and three SMEs to allow four SMEs to bid (so long as two qualify as medium-sized enterprises). And to help them meet the geographic reach requirement of at least two autonomous regions, the groupings have been allowed to include outsourced activities in the eligibility calculation. Likewise, when meeting the requirement that 30% of the grants affect SMEs, the first electric and connective vehicle PERTE call was amended to allow subcontracted SMEs execute part of the projects (indirect impact).

Another constraint on participation, especially for SMEs, relates to the size of the guarantees which need to be posted. This was flagged as one of the barriers to the success of the first electric and connected vehicle grant call. However, in later calls, such as the agro-food PERTE, the guarantees required were lowered and the several liability required of the group members was eased.

Turning to the challenges associated with the regulatory framework, one worth mentioning is the project execution timeframe, which must be aligned with the schedule of milestones and targets set down in the Recovery Plan and, more generally, in the RRF rules. That means that all initiatives must be complete by year-end 2026 at the latest. However, that time horizon looks short in light of the significant volume of funds to be put to work and the scale and complexity of some of the proposals eligible for financing under the Strategic Projects. In fact, institutional sources are already contemplating extending execution deadlines to 2027 or 2028 in order to draw more participants to future PERTE calls. That will not be an easy task, however, as it would require modifying the own resources decision so as to authorise the European Commission to issue new debt to finance the RRF. The modification would have to be adopted by the Council unanimously and approved by all EU member states.

Elsewhere, another NGEU fund management requirement is respect for the Do No Significant Harm (DNSH) principle. That requires substantiating the fact that the initiatives financed make a positive contribution to the EU’s climate change targets. That requirement applies to the authorities (as manager of the funds) and the beneficiaries (as recipients) and is based on a self-assessment that has to be validated by a third party certified by Spain’s national certification body, ENAC (or an analogous entity of another EU member state). As a result, the technical requirements, coupled with a lack of specialist means and resources, can cause bottlenecks. Note that mere compliance with prevailing environmental legislation is not sufficient to comply with the DNSH principle (Vicente, 2023). In reality, some companies have encountered difficulties in presenting DNSH compliance certification issued by a certified body for some of the calls for which it has been required.

In other calls it has sufficed to present an affidavit in order to apply for the grants but that does not solve the issue. It simply delays when the certification has to be presented and in the event compliance cannot be certified the breach would affect the companies (who would have to reimburse any funds received upfront), other entities co-financing the projects and the timely execution of the NGEU funds.

Lastly, there are certain challenges derived from the economic situation and markets. For example, the job market (on the supply side) needs to be able to supply the talent needed to carry out innovative projects in new segments of the economy being targeted by the PERTEs in order to contribute to the dual digital and green transition thrusts. The scarcity of highly skilled labour could reduce the Plans’ impact (Bank of Spain, 2022).

Market and sector structures in which small-sized companies predominate also cause friction in the absorption of the funds earmarked to the Strategic Projects. Smaller firms have more limited resources with which to identify the opportunities derived from implementation of the PERTEs and to deal with the red tape and other technical requirements involved in applying for the grants and subsequently monitoring and reporting on execution of the projects funded.

This category of challenges includes the impact of the economic climate. The supply chain friction caused by the COVID-19 pandemic and later exacerbated by the war in Ukraine, rampant inflation and the interest rate tightening embarked on to curb the latter are some of the aspects creating uncertainty and tension around corporate investment plans. These issues could constrain the scope and timing of execution of certain business projects, that could be eligible for grants under the Strategic Projects, and that need complementary funding.

Lessons learned and guidance for boosting the PERTEs’ impact

Having identified the main PERTE execution challenges being encountered, it is easier to pinpoint ways to better channel the NGEU funds, both those pending implementation as per the existing Recovery Plan and those contemplated in the Plan Addendum [3]. The latter will clearly be geared at reinforcing the Strategic Projects which are expected to be bolstered by 7.7 billion euros of non-repayable grants and over 18.6 billion euros of loans.

In order to involve a bigger number of SMEs in execution of the PERTEs, it is necessary to simplify the processes and facilitate compliance with the requirements for qualifying for the grants. It would be good to make greater use of digital technology to: (i) alleviate some of the red tape; and, (ii) unlock synergies across the initiatives undertaken by different agents in the sector value chains (public and private). It should be made possible to find those synergies without having to create overly complex structures from the standpoint of governance and project management.

Moreover, in order to ensure effective use of the European funds, mechanisms are needed to let the companies prepare to participate in future calls. Initiatives that provide information about the NGEU funds, present case studies and other practical information, engaging different socio-economic agents that form part of the SME ecosystem, are key in that respect.

In addition, given that most of the calls for grants take the form of competitive tenders in which the best projects are selected from those that pass certain assessment criteria, SMEs would stand to benefit greatly from expert advice on the process. Such advice could be valuable during the grant application phase but also during execution of the beneficiary projects when reports and certifications have to be provided, including, for example, certification of respect for the DNSH principle.

Elsewhere, in terms of eligible areas and aid intensity and the idea of making future PERTE calls more attractive, it is important to consider the amendments, soon to take effect, of the EU’s State aid general block exemption Regulation and the Temporary Crisis Framework (European Commission, 2023). Those amendments will permit the inclusion of new costs that are compatible with the projects and increase maximum aid intensity. Moreover, amendment of the State aid scheme is expected to pave the way for increased intensity in some forms of aid (categories of aid exempt from prior notification to the Commission) and broaden the provision of state aid in the areas of environmental protection, energy, green hydrogen, decarbonisation projects, energy efficiency and support for green mobility. It will also raise the thresholds above which the member states are required to apply to the European Commission for authorisation in the areas of environmental and research project aid.

Lastly, in addition to the ex-ante assessments performed prior to publication of the Strategic Project grant calls, it is important to monitor and evaluate the initiatives after adjudication. That will make it possible to fine-tune where the public aid is targeted, validate the instrument’s (PERTE) fit for purpose and take future economic policy decisions that maximise the impact of the funds devoted to modernising the Spanish economy and making it more competitive.

Notes

Amount of funds set down in the third Recovery Plan Execution Report presented by the Spanish government in February 2023, which includes the additional PERTE endowment contemplated in the draft Addendum to the Recovery Plan, published in December 2022.

[2]

The first call for grants for end-to-end initiatives in the electric and connected vehicle was published with an endowment of 2,975 million euros. However, only ten projects involving public aid of 793.72 million euros were approved, leaving more than 2,100 million unexecuted. That call for aid is the largest, but there are other aid programs under the PERTE for the development of electric and connected vehicles (

i.e., MOVES III, PTAS, Moves Singulares II), as reflected in the amounts of the mobilized and committed resources, under the PERTE shown in Table 2.

[3]

The Spanish government still had to present its Addendum to the Recovery Plan to the European Commission at the time of writing this paper.

References

BANK OF SPAIN. (2022). Heterogeneity of the impact of the Spanish programme of incentives for the purchase of electric vehicles. Analytical Articles. Economic Bulletin, 4/2022.

CEOE. (2022). Informe de seguimiento de los Proyectos Estratégicos para la Recuperación y Transformación Económica (PERTE) [PERTE monitoring report].

DARVAS, Z. (2020). Will European Union countries be able to absorb and spend well the bloc’s recovery funding? Bruegel Blog, 24 September.

EUROPEAN COMMISSION. (2023). Approval of the content of a draft for a Commission Regulation amending Regulation (EU) No 651/2014 declaring certain categories of aid compatible with the internal market in application of Articles 107 and 108 of the Treaty and Regulation (EU) 2022/2473 declaring certain categories of aid to undertakings active in the production, processing and marketing of fishery and aquaculture products compatible with the internal market in application of Articles 107 and 108 of the Treaty. C(2023) 1712 final.

GOVERNMENT OF SPAIN. (2022, 2023). Descriptive reports, presentations and other documents about the PERTEs.

GOVERNMENT OF SPAIN. (2023). III Informe de Ejecución del Plan de Recuperación [Third Recovery Plan Execution Report] February 2023.

VICENTE, F. (2023). El cumplimiento del principio de no causar perjuicio significativo al medio ambiente (DNSH) como condicionante para la recepción de los fondos Next Generation [Respect for the DNSH principle as a constraint for receipt of the NGEU funds]. Fundación Democracia y Gobierno Local.

Ana Domínguez and Mariola Gomariz. Afi