The impact of the COVID-19 crisis on businesses and the self-employed

The COVID-19 crisis prompted a slowdown in business creation across all the main legal forms of incorporation, but underpinned a continuation of a trend observed even prior to the onset of the pandemic– a shift away from limited liability companies to individuals. In order to tackle the deterioration in business creation dynamics as a result of the COVID crisis, it will be necessary to take measures to foster business creation and entrepreneurship.

Abstract: In 2020, Spain created over 100,000 fewer businesses than in 2019, a reduction of close to 24% to levels not seen since the aftermath of the crisis of 2008. Business creation fell across all main forms of incorporation –public limited and limited liability companies– albeit somewhat less intensely in the case of the self-employed. However, based on the available data, the number of businesses closed also decreased, albeit much less intensely (less than 2%) in 2020. Looking at the intensity of business creation and destruction between 2019 and 2020, on the creation side, financial services, postal and courier activities and certain transport segments were more dynamic, while on the destruction side, travel agencies and retail establishments stand out. If we break down the analysis by both business activity and legal form of incorporation, the data point to a degree of business reorganisation in some activities related with construction, with the number of incorporated enterprises declining and the number of self-employed professionals increasing. More broadly, in addition to pandemic-related factors, the figures reveal the continuation of a trend observed before the pandemic– 2008 marked a shift in the most dynamic type of business format, away from limited liability companies to individuals, a trend that continued in 2020.

Introduction

The Spanish economy, like most of the world’s economies, is in the midst of a recovery from the COVID pandemic that has been abruptly truncated by the ramifications of Russia’s invasion of Ukraine (Torres and Fernández, 2022).

This paper attempts to analyse the impact of the pandemic, specifically its impact on Spain’s business fabric, covering both corporate enterprises (public limited companies and limited liability companies) and individuals (self-employed professionals). The work presented here is based on the most recent data available in the National Statistics Institute´s (INE’s) central companies database, known in in its Spanish acronym as DIRCE, which runs through year-end 2020.

This paper represents an update of previous analysis published not long after the onset of the COVID crisis (Xifré, 2021) for which it was not possible to capture, due to a lack of updated DIRCE data, the direct impact on business demographics. It also provides an update, using post-COVID data, of two previous pieces of analysis that likewise centred on data gleaned from DIRCE (Xifré 2016, 2019) and can be read in conjunction with other papers with more of a policy focus that make proposals for fostering entrepreneurship in Spain (Huerta Arribas, Nogales Cinca, Salas Fumás, 2021).

The paper first analyses the business creation and destruction flows and the stock of active businesses on aggregate by form of incorporation. We then break that analysis down further, looking at the data by form of incorporation and core business. Lastly, we present our conclusions.

Aggregate analysis

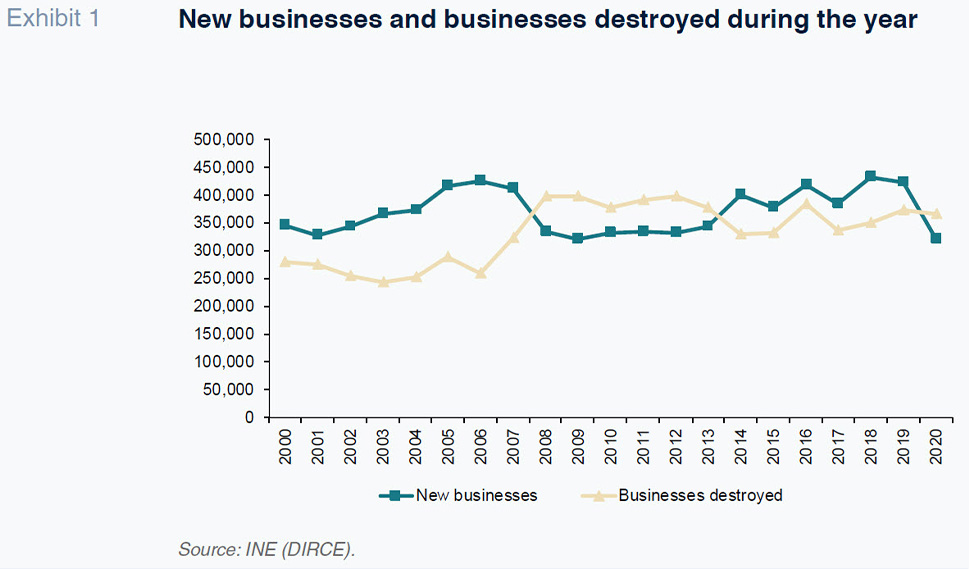

Exhibit 1 provides the trend in business start-ups and closures (including all forms of incorporation) as of December 31st, 2020, between 2000 and 2020. That analysis reveals three distinct phases. In the first, between 2000 and 2007, the period prior to the global economic and financial crisis, business creation significantly outnumbered business destruction. Between 2009 and 2013, the number of businesses clearly contracted. The universe of businesses began to register net growth once again from 2014, albeit less intensely than during the first period, which was interrupted in 2020 by the COVID crisis, with the number of businesses created falling significantly from 2019. Having created 423,837 businesses in 2019, Spain created just 321,749 in 2020, i.e., over 100,000 fewer, which is equivalent to a reduction of 24% and puts the number of new businesses back at the level last seen in the wake of the economic and financial crisis.

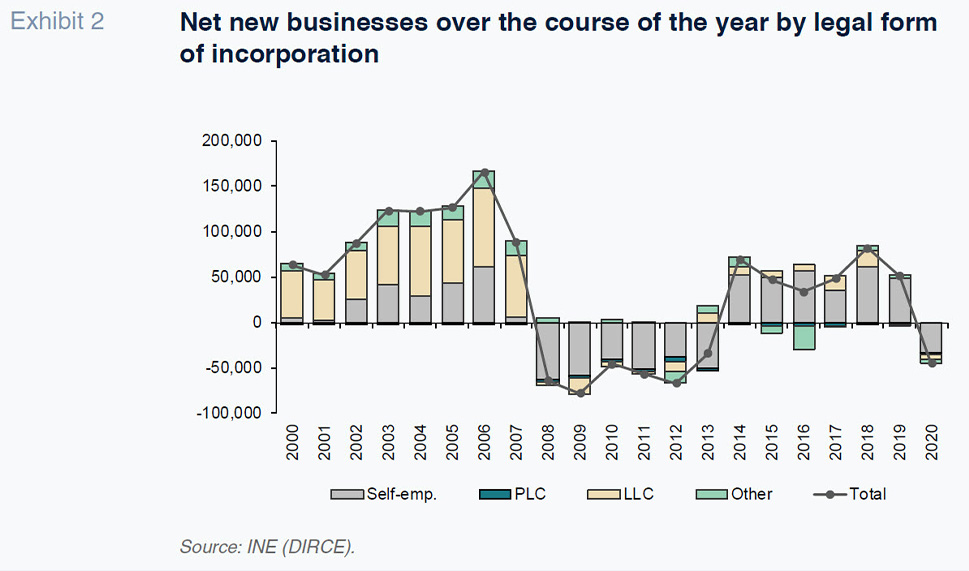

Exhibit 2 breaks down the net additions (new businesses less closures) by legal form of incorporation (self-employed, public limited company, limited liability company and other types of enterprises) over that same timeframe. That breakdown shows how the contraction in the number of businesses in 2020 was observed across the board. Such widespread business destruction had only ever taken place previously in 2009, 2011 and 2012. In the other years marked by net business destruction (2008, 2010 and 2013) other types of enterprises (such as cooperatives, partnerships or limited partnerships) and even limited liability companies (in 2013) sustained net growth. Elsewhere, Exhibit 2 also reveals a shift in the type of enterprise sustaining the biggest variations, from limited liability companies (which in 2000-2007 saw their numbers increase significantly) to the self-employed (whose ranks contracted after 2007 albeit recovering strongly after the financial crisis).

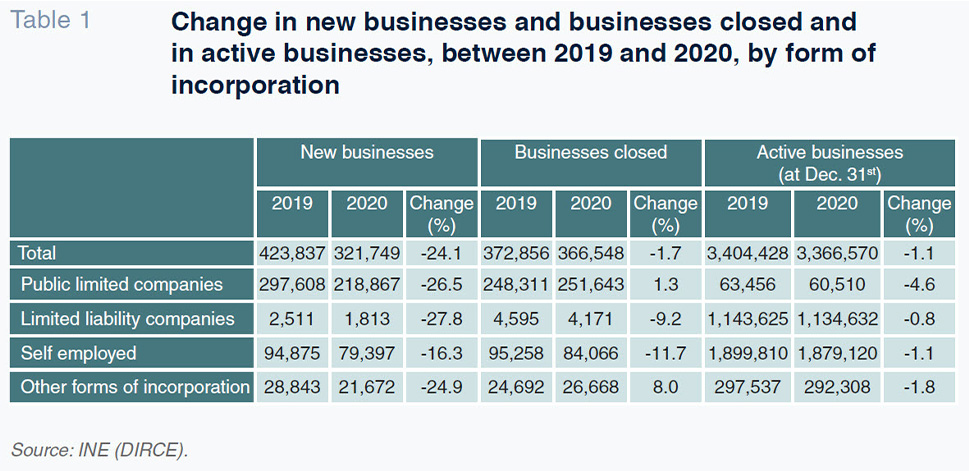

Table 1 provides the movements in the number of start-ups and closures and in the stock of active businesses between 2019 and 2020 by business type. The number of start-ups declined across all forms of incorporation. However, the number of public limited companies and other types of enterprises that closed increased as expected but the number of self-employed professionals and limited liability companies that went out of business in 2020 decreased by comparison with 2019.

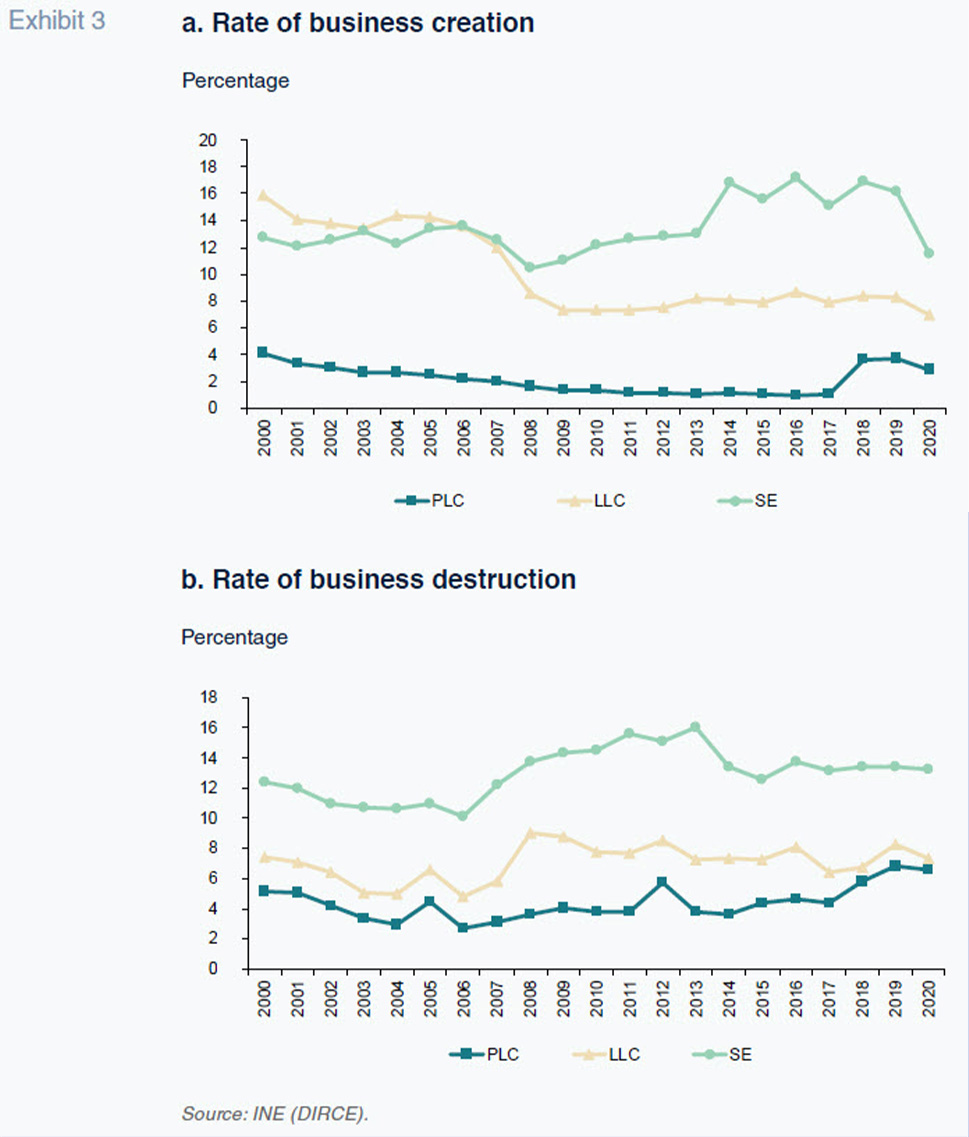

The relative dynamism in self-employment relative to incorporated enterprises is likewise evident in Exhibits 3a and 3b, which show the rates of business creation (businesses created over total businesses) and destruction (businesses closed over total businesses).

On the creation side (Exhibit 3a), the most dynamic type of enterprise has gone from being the limited liability company in the first two years of the series to self-employed professionals since 2008. The creation of public limited companies has been more stable, declining clearly between 2000 and 2017, but registering strong growth in 2018. In all three types of businesses, the rate of creation fell in 2020, most notably in the case of the self-employed (whose rate of business creation fell from 16.1% in 2019 to 11.5% in 2020, to near the series low of 10.4% in 2008).

As for business destruction (Exhibit 3b), those rates have consistently been higher among the self-employed relative to the other types of enterprises. The evolution of business destruction for all three categories was largely similar between 2000 and 2020, with no major changes in 2020 other than in the limited liability category, where the rate of destruction narrowed (from 8.3% to 7.4%).

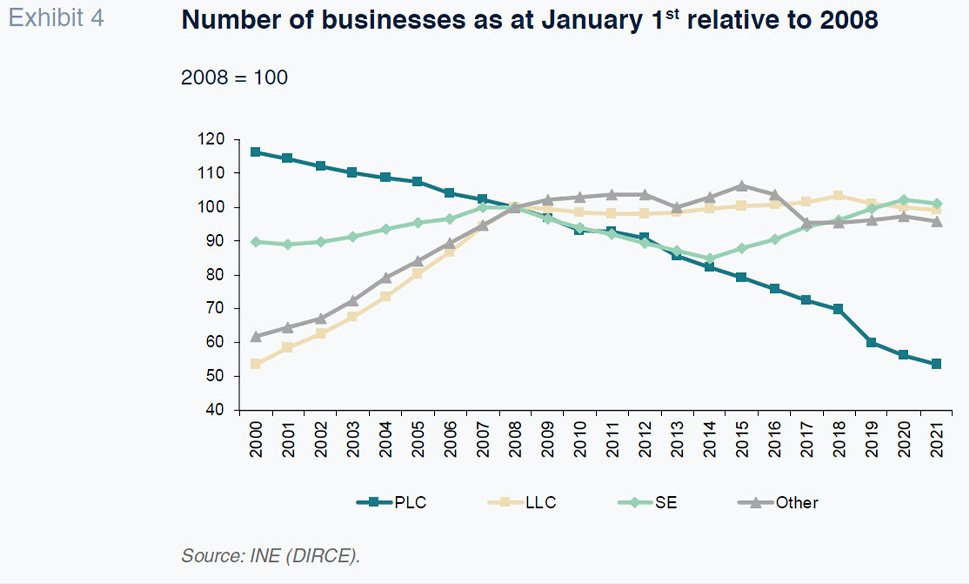

To wrap up the aggregate analysis, Exhibit 4 provides the number of companies active as of January 1

st each year with respect to 2008. That analysis shows how public limited companies have been consistently on the wane since 2000. The number of active self-employed professionals has passed through three distinct phases: Growth between 2000 and 2008 and then again between 2015 and 2020; contractions between 2009 and 2014. In the other two types of enterprises, data reveal growth in the number of active companies between 2000 and 2008, followed by a period of stabilisation.

Disaggregated analysis

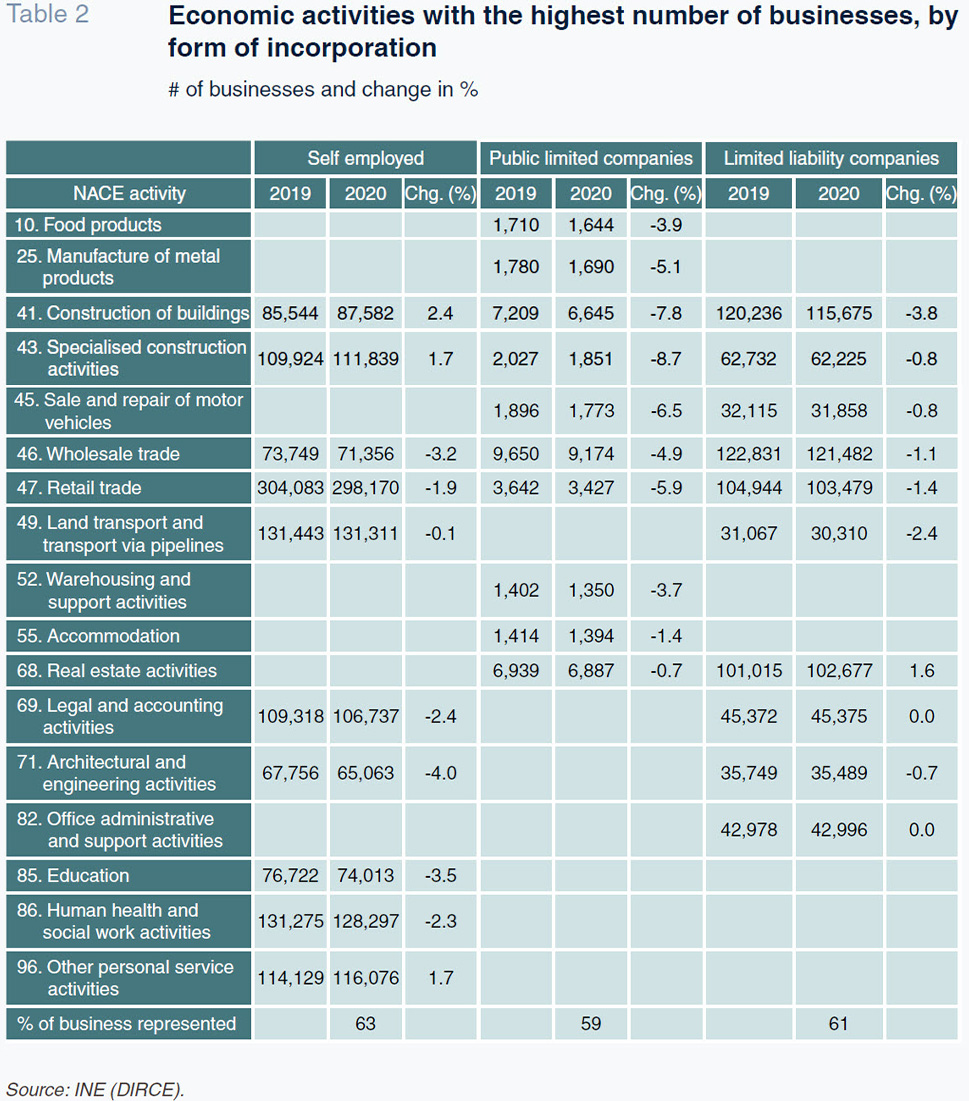

Table 2 presents the 10 NACE economic activities with the highest number of businesses for the three main forms of incorporation: Self-employed professionals; public limited companies and limited liability companies. For each NACE activity presented, the table provides the number of businesses active as at December 31st, 2019, and December 31st, 2020, along with the percentage change. Given that some of the activities encompass more than one type of business, the statistics are presented side by side to facilitate the comparison. The last row of the table provides the percentage that the businesses belonging to the 10 activities selected represent in relation to the total number of businesses.

As the analysis shows, there are four lines of activity with all three forms of incorporation: Construction of buildings, specialised construction activities, wholesale trade and retail trade. In the last two activities, the number of businesses in all three forms of incorporation decreased, with a noteworthy contraction in the number of public limited companies (business loss of between 5% and 6%). In the activities related with the construction sector, the situation is more nuanced – the number of businesses decreased (marked by contractions of around 8% or higher in the case of public limited companies), but the number of self-employed actually increased (by between 1.7% and 2.4%), indicating a degree of restructuring between the types of incorporation.

Meanwhile, in all of the top 10 activities carried on by public limited companies, the number of companies decreased, most intensely in the sectors related with construction, followed by the sale of motor vehicles. In the case of the top 10 activities performed by limited liability companies, the number of businesses declined in all instances (notably ground transportation, where the number of businesses contracted by 2.4%), except for those devoted to real estate activities (whose number increased by 1.6%). And in the case of the top 10 activities performed by self-employed professionals, the number of businesses active in activities related with construction increased, as already noted, as did the number of firms devoted to the provision of personal services (+1.7%).

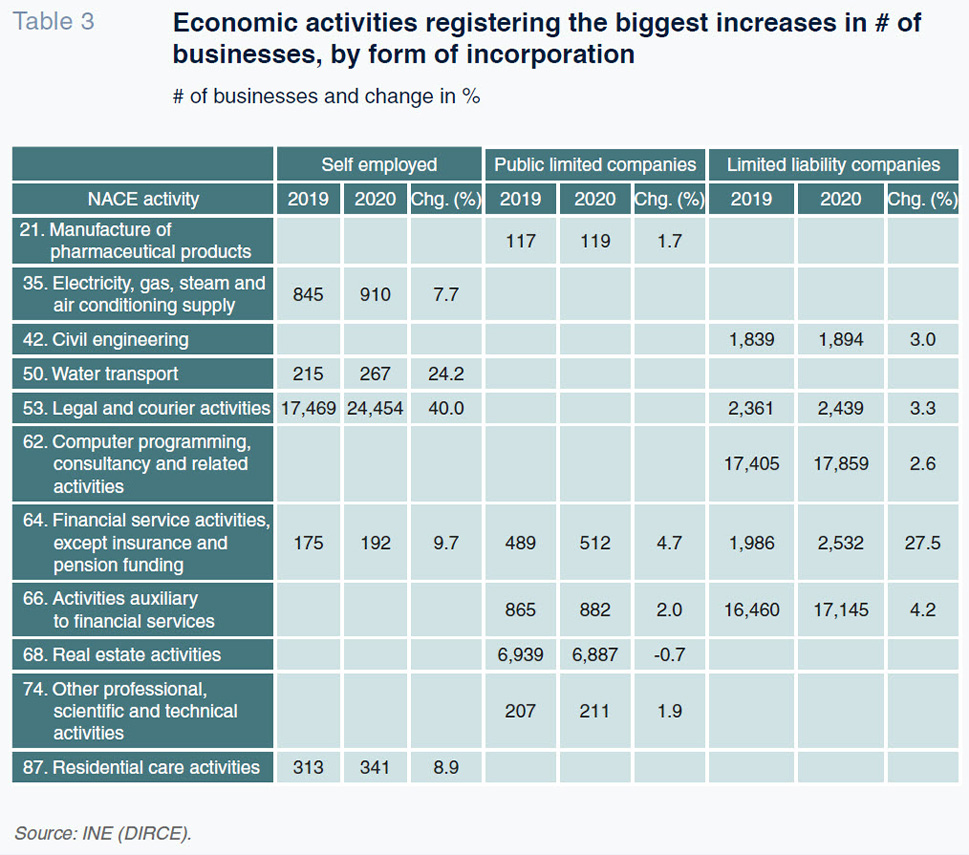

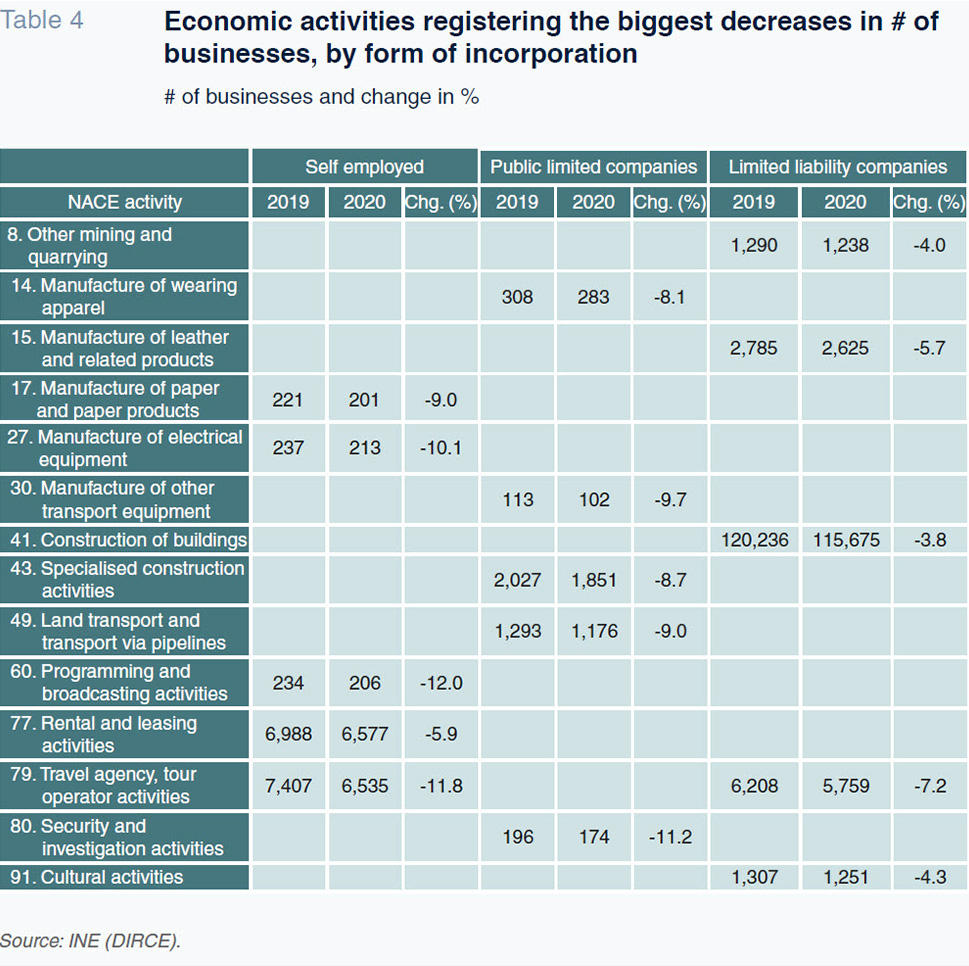

The next two tables provide analogous analysis for the five NACE activities registering the biggest increases (Table 3) and the biggest decreases (Table 4) in the number of businesses between 2019 and 2020 for all three formats.

As shown by both analyses, there are very few activities with all three forms of incorporation. In the case of the self-employed, the activities registering the strongest growth in the number of businesses were postal and courier activities (+40%) and water transportation (+24%), while the sectors registering the greatest business destruction were travel agencies and radio and television programming and broadcasting activities (-12% in both instances).

In the case of the public limited companies, the bright spots within the overall negative panorama were financial services (4.7%) and auxiliary financial services (2.0%), as well as other professional and scientific activities (growth of close to 2%). The areas that lost the highest number of public limited companies were security and investigation activities (-11.2%) and the manufacture of other transport equipment (-9.7%).

Lastly, turning to the universe of limited liability companies, it is worth highlighting the growth in the number of firms in the financial services sector (+27.5%), well above that sustained in any other sector, and the decrease in the number of travel agencies (loss of companies of 7.2%) and companies in the leather and footwear industry (business destruction of 5.7%).

Conclusions

This paper documents some of the main changes in the business fabric in Spain as a result of the COVID crisis, using data that run until year-end 2020. Spain created over 100,000 fewer businesses in 2020 than in 2019, a reduction of close to 24%. Business creation slowed in all the main legal forms of incorporation. However, judging by the available data, the pace of business destruction did not increase commensurably and in some forms of incorporation, the pace of destruction actually narrowed. Insofar as it is likely that not all of the effects of the health crisis will have materialised by the end of 2020, we will have to continue to analyse these trends in order to fully assess the impact of the COVID crisis. It is also worth recalling that the immediate impacts of the COVID crisis may have been absorbed initially, as intended, by means of the special employment support measures such as the furlough scheme (Malo, 2021; Torres and Fernandez, 2021a, 2021b), rather than via business destruction.

This analysis also documents a trend already observed before the pandemic (Xifré, 2019): The most dynamic form of incorporation changed in 2008, from limited liability company to self-employment.

Regardless, in order to tackle the possible deterioration in business creation dynamics as a result of the COVID crisis, a situation that could be exacerbated by Russia’s invasion of Ukraine, it will be necessary to take measures to foster business creation and entrepreneurship. The contributions made recently in this same publication (Huerta Arribas, Novales Cinca, Salas Fumás, 2021) are relevant in that respect and focus on reducing the internal costs or other obstacles that limit business growth and curtail business creation. To cite a few, those measures include: Resolving the financing issues facing opportunity-driven start-ups; shoring up the technology innovation and knowledge-sharing system; and designing public policies targeted at pushing disruptive innovation.

References

HUERTA ARRIBAS, E., NOVALES CINCA, A. and SALAS FUMÁS, V. (2021). Stimulating business creation: Analysis and proposals.

Spanish Economic and Financial Outlook, Vol. 10(3), May.

http://www.sefofuncas.com/The-impact-of-the-pandemic-on-Spains-businesses/Stimulating-business-creation-Analysis-and-proposalsMALO, M. A. (2021). El empleo en España durante la pandemia de la COVID-19 [Employment in Spain during the Covid-19 pandemic].

Panorama Social, No. 33, pp. 55-73.

TORRES, R. and FERNÁNDEZ, M. J. (2021a). Spanish economy in recovery mode: Opportunities and challenges.

Spanish Economic and Financial Outlook, Vol. 10(4), July.

http://www.sefofuncas.com/Spains-outlook-for-pandemic-recovery-Areas-of-outperformance-and-pending-challenges/The-Spanish-economy-in-recovery-mode-Opportunities-and-challengesTORRES, R. and FERNÁNDEZ, M. J. (2021b). La estrategia de contención del impacto social de la crisis: resultados y desafíos [The strategy for containing the social impact of the crisis: Results and challenges].

Panorama Social, No. 33 (June).

TORRES, R. and FERNÁNDEZ, M. J. (2022). The conflict in Ukraine and the Spanish economy.

Spanish Economic and Financial Outlook, Vol. 11(2),

March.

http://www.sefofuncas.com/The-war-in-Ukraine-and-implications-for-Spain/The-conflict-in-Ukraine-and-the-Spanish-economyXIFRÉ, R. (2016). Spain’s business landscape: Structure, recent developments and remaining challenges.

Spanish Economic and Financial Outlook, Vol. 5(3), May.

https://www.funcas.es/wp-content/uploads/Migracion/Articulos/FUNCAS_SEFO/025art06.pdfXIFRÉ, R. (2019). Business dynamism in Spain: Recent trends and outlook.

Spanish Economic and Financial Outlook, Vol. 8(4), July.

https://www.funcas.es/wp-content/uploads/Migracion/Articulos/FUNCAS_SEFO/044art08.pdf

XIFRÉ, R. (2021). Business demographics post-Covid: An initial assessment. Spanish Economic and Financial Outlook, Vol. 10(3), May. http://www.sefofuncas.com/The-impact-of-the-pandemic-on-Spains-businesses/Spains-business-demographics-post-COVID-19-An-initial-assessment

Ramon Xifré. ESCI-Univeristat Pompeu Fabra, UPF Barcelona School of Management, PPSRC – IESE Business School