The conflict in Ukraine and the Spanish economy

The invasion of Ukraine is adding upward pressure to energy markets, which were already the main obstacle to Spain’s recovery before the conflict. The precise effects of the crisis will depend on its scale and duration, but already the projections are for markedly higher inflation, significant cuts in consumer purchasing power and lower economic growth.

Abstract: The conflict in Ukraine is exacerbating pre-existing tensions in European energy markets, hugely dependent on Russia for supplies, with oil and gas prices already up 12% and 15%, respectively, since the start of hostilities. Those pre-existing tensions are precisely what drove the sharp uptick in inflation in Spain since mid-2021, with inflation becoming widespread from last summer on, affecting a growing number of goods and services. Since the eruption of the conflict in Eastern Europe, initial expectations that commodity prices would start to ease by spring have been set aside, painting a worrying picture for inflation, already at its highest levels in decades, with a severe impact on consumer purchasing power and, by extension, economic growth. Spain’s economic recovery is therefore more complicated – promising more inflation and less growth. A supportive monetary policy and smart fiscal policy are crucial to containing the risks. The permanent nature of the energy shock, along with the geopolitical context, also underlines the need for a higher profile role for the EU in coming years, notably as regards European-wide fiscal, technology and energy policy. Spain would be wise to understand these dynamics and, framed by its clear European commitment, bring its contribution to the table.

Energy prices, the key impediment for the recovery already before the crisis, have soared...

The initial effects of the conflict are hitting the energy markets, hugely dependent on Russia for supplies, particularly hard. Russia holds one-quarter of the world’s gas reserves and is practically the only producer in a position to adjust extraction and exports as a function of market swings or its own interests.

It is also the second largest exporter of oil and its reserves account for almost 5% of the world total. Russia is likewise home to 41% of known reserves of palladium, an essential component for the technology and electric vehicle sectors. It supplies cereals and several of the minerals responsible for causing supply bottlenecks around the world.

The geopolitical shock has already had an impact on gas and oil prices, which are up 12% and 15%, respectively, since the start of the hostilities. Both markets are very volatile, inclined to overreact, leaving the door open to a potential correction, as we have seen more recently. However, prices are likely to trend higher. Firstly, because Russia uses energy to exert pressure on importing nations. Secondly, it is likely that Russia will deviate some of its exports to China. All of which without considering the potential unavailability of the gas pipeline that runs through war-torn Ukraine. Above all, the EU has already made up its mind to reduce its dependence on Russian energy.

…threatening even higher inflation…

As is well known, Russian gas is a crucial input for electricity price formation in the European wholesale markets, even in countries like Spain whose exposure to Russia is relatively small. Higher electricity bills are precisely what caused the sharp uptick in inflation observed in the country since mid-2021.

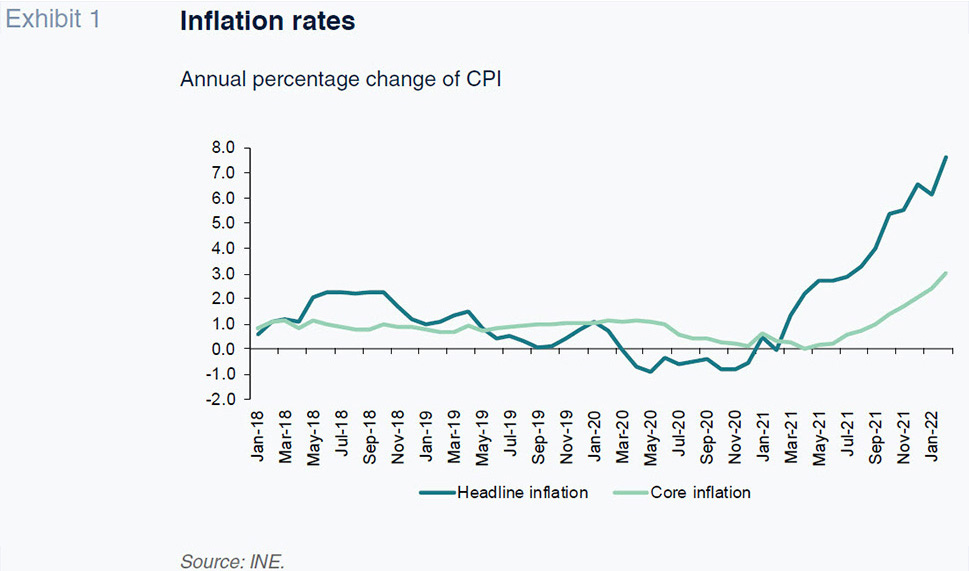

Headline inflation actually began 2021 at very low levels –close to zero– and started to inch higher from March, reaching 6.5% in December of last year and 7.6% by February of this year (Exhibit 1). Initially, the run-up in inflation was driven exclusively by energy products and was the consequence of oil price normalisation following the sharp correction sustained the year before on account of the pandemic, as well as higher electricity prices. Core inflation, therefore, remained at close to zero. Thus, the initial increase in inflation was not a structural increase in the inflation rate, with the exception of electricity prices, but rather the growth in inflation was simply the reflection of price recovery in a very limited number of products following the reopening of the economy.

Other forces began to come into play from the summer, however. Oil prices continued to climb even after recovering pre-pandemic levels, likewise pushing fuel prices above those thresholds. Indeed, price increases had become widespread across all international energy and food commodity markets. Meanwhile, shipping costs surged and certain semi-finished products, such as chips, began to run scarce due to malfunctions derived from the pausing and subsequent rebooting of the economy in the wake of the pandemic, as well as sharp growth in demand and international trade. All of which sent production costs soaring, translating into record growth in the industrial price index, which sustained inflation of over 30% during the final months of the year, and of over 10% even stripping out energy products.

In addition to the factors listed above, one of the factors that drove consumer price inflation from the summer on was the sharp increase in electricity prices, shaped in turn by the growth in international natural gas prices. Finally, core inflation began its ascent. Indeed, core inflation went from readings of 0.6% in the first half of the year to 2.1% by December and 3% in February 2022 (Exhibit 1).

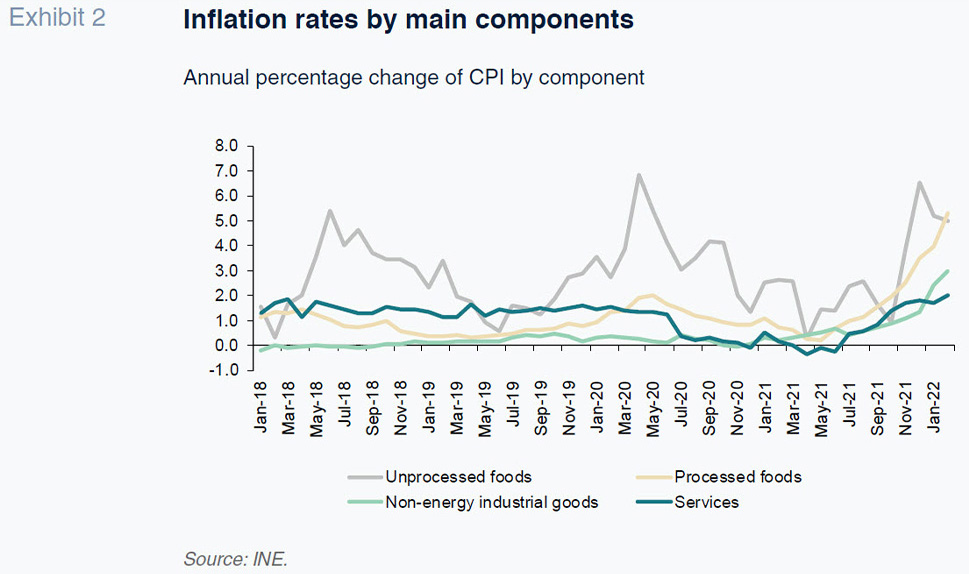

The rise in core inflation was partially driven by price recovery in certain service sectors where prices had fallen at the start of the pandemic, such as hotels and international tour packages, i.e., due to non-structural, transient circumstances. However, inflation also rose, particularly from October, in other service categories whose prices had not corrected in 2020, and in non-energy industrial goods (which, likewise, were not adversely affected by the pandemic) and processed foods. Unprocessed food prices were highly erratic all year long, not uncommon for this category; it was not until December that inflation reached relatively high levels, of over 5%, albeit not an anomalous reading (Exhibit 2).

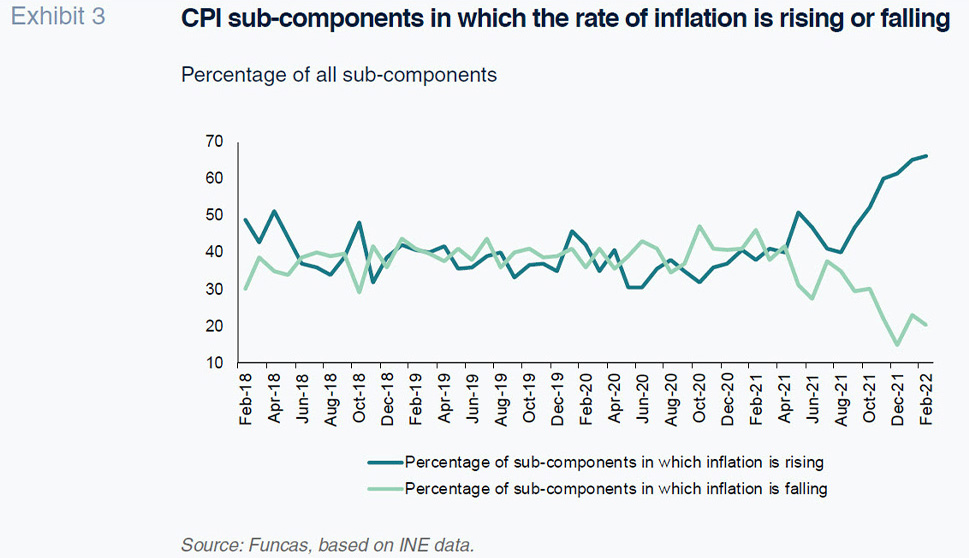

In short, inflation became widespread from last summer on, affecting a growing number of goods and services in consumers’ shopping baskets. From then on, the number of CPI sub-components registering rising inflation began to increase, while the number of sub-components in which inflation was falling started to come down (Exhibit 3). By the same token, the number registering an inflation rate of over 2%, which before the pandemic stood at around 17% of all sub-components, had risen to 34% by last December and 54% by February of this year. This generalisation of inflationary pressures is attributable to the passing on of higher production costs (derived from the increase in commodity and shipping costs) to end retail prices.

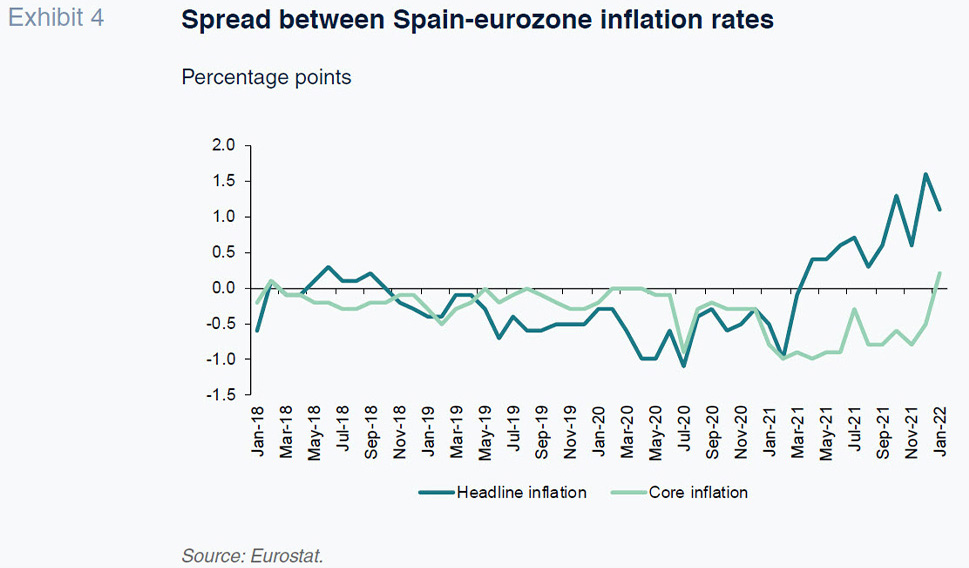

The pattern across the broader eurozone was largely similar to that of Spain, although the increase in headline inflation was less intense, so that the spread between the two rates, which had been favourable for Spain until April, swapped sign, and has been in the eurozone’s favour since then (Exhibit 4). That was the result of more intense growth in energy product prices in Spain, whereas core inflation was lower in Spain than in the eurozone all year long. However, the spread on core inflation also shifted in favour of the eurozone in January 2022.

… and less growth

Although uncertainty regarding the outlook for inflation has been high ever since the onset of the current inflationary outbreak, it was generally expected that commodity prices would start to ease by the spring and that the disruption affecting shipping and other sectors would dissipate. That would have unlocked a gradual decline in inflation during the second half of the year. However, the eruption of the war in Ukraine and the attendant worsening of existing tensions in the international energy and food commodity markets paints a worrying picture for inflation, already at its highest levels in decades, with a severe impact on consumer purchasing power and production costs, and, by extension, economic growth.

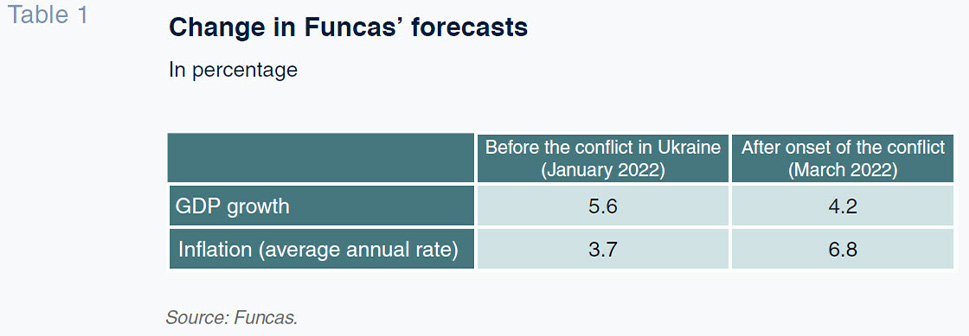

All of which will lead to a loss of household purchasing power and erode business margins. Even assuming a moderate impact, presuming gas prices unchanged at 100 euros per bcm and oil prices at 100 dollars a barrel (15 dollars less than at present), the Spanish economy’s CPI would increase by over two percentage points relative to Funcas´ pre-conflict scenario. In other words, inflation would remain above 8% for a few months before starting to come down, so that the average rate for all of 2022 would be around 6.8%, compared to our January forecast of 3.7%.

We are therefore looking at a loss of household purchasing power. Collectively bargained salaries are currently increasing at an annual rate of 2.6%, according to February data. To keep up their spending, Spanish households could use some of the savings set aside during the pandemic; however, that would undermine the economy’s growth potential in future years. A slump in consumption therefore looks inevitable in the short- and medium-term.

Spanish businesses will also encounter new difficulties in the form of costs that were already rising sharply before the conflict. In January, the industrial price index registered year-on-year growth of 35.7%, fuelled by energy products (91.4%) and, to a lesser degree, non-energy products (12%, the highest level since 1984). That sharp upward trend echoes, above all, the surge in the cost of commodities and other crucial inputs for the productive process, such as chips and metals. So far, the growth in those costs has only been partially passed on to end prices by non-energy firms, suggesting that profits have been eroded. That unquestionably explains the social unrest taking hold in sectors, such as transport and agriculture.

The corollary is a slowdown in corporate investment, due to the pressure on profits, exacerbation of supply-chain bottlenecks in products affected by the shortage of inputs and, above all, a sense of heightened uncertainty on account of the war playing out in Eastern Europe. Without a doubt, the European funds can offset this risk to a degree. For that to happen, however, in addition to resolving the delays in their management, it is important to prioritise deployment of the funds so as not to add further to inflation. Some sectors, like construction, were already seeing costs spiral before the conflict, not to mention supply issues.

In short, the crisis promises more inflation and less growth. In the best case scenario, i.e., a relatively short-lived conflict and an agreement between the parties, the impact will be transient, so that the recovery would lose steam but continue. However, if it drags on or spreads to other countries, there would be a risk of stagflation, thus exacerbating social unrest. A prospect of grave concern for a country like Spain that is still lagging in the recovery in the wake of the pandemic and carries a high public debt burden.

Economic forecasting in a climate like this is affected by significant uncertainty regarding the performance of factors that are impossible to predict and for which we can only draw up hypotheses and a range of scenarios. Delivery of such forecasts is, therefore, conditional upon materialization of those assumptions. Against that backdrop, Funcas has revisited its growth and inflation forecasts, starting from a baseline scenario in which oil prices remain at around 120 dollars all year and gas and electricity prices hover around 25% above the levels prevailing in January and February of this year. In that scenario, our GDP forecast for 2022 would be 1.4 percentage points lower than our January forecast, at 4.2%, while our inflation forecast increases to an annual average of 6.8%, up from the 3.7% we were forecasting in January (Table 1). As for the expected quarterly profile, we are not expecting a recession –negative growth–, although we could see growth stall in one or more quarters, putting Spain on the cusp of stagflation. At any rate, the significant carry-over momentum implied by the sharp growth registered in the second half of 2021 makes it unlikely that annual growth will dip below 3%.

The crucial role of economic policy and sanctions

Economic policy has a key role to play. Without a doubt, the ECB will have to fine-tune its interest rate strategy in the face of significantly more persistent inflation than had been expected, with the markets currently discounting rate increases by the end of the year, if not sooner. However, it also needs to provide enough liquidity and withdraw its public bond repurchases as gradually as the situation requires. It is crucial to prevent fresh episodes of sovereign risk stress. The risk of an interruption in financing flows is particularly significant for the more indebted countries such as Spain.

Fiscal policy, meanwhile, presents more of a dilemma. In the event of a prolonged conflict, it is the only policy lever capable of mitigating, to a degree, the impact of the run-up in energy prices on household income and economic growth. However, that strategy faces obvious limits due to the debt piled up during the pandemic. That is why a growing number of people in Brussels are calling for hydrocarbon and electricity reforms to lessen the impact of gas prices.

Management of the sanctions imposed on Russia will also be key to determining the length of the conflict. Partial disconnection from the SWIFT platform and, above all, the freezing of nearly half of the 630 billion dollars of Russia’s foreign exchange reserves, are causing a run on deposits, devaluation of the rouble and increasing disarray in the financial system. Major western companies have withdrawn from the Russian market. Russia is therefore watching on as its economy nears collapse and social unrest mounts, both of which argue in favour of an agreement with Ukraine and a shorter conflict. Chinese affinity, however, in harmony with the joint declaration sealed during the Winter Olympics, has been on display, breathing life into Russia’s strategy (support that will unquestionably come at a price).

On balance, the conflict unleashed in Eastern Europe complicates Spain’s economic recovery. A supportive monetary policy and smart fiscal policy action, in coordination with the rest of the EU, are crucial to containing the risks. However, the pre-conflict investment priorities –decarbonisation and reforms negotiated with the social parties– are as valid as ever, framed by the durable and unavoidable nature of the energy shock, even if we are lucky enough to witness a truce between Russia and Ukraine.

A new world order

Lastly, the need for coordinated European action, in economic and defence policy alike, is more important than ever in the current context of international polarisation. Behind the macroeconomic fallout from the conflict lurk geopolitical trends that have been on display for years and are now coming to the fore. China’s support for Russia, while not unconditional, reinforces the Asian giant’s position in its battle with the US and foreshadows changes in the multilateral system. Elsewhere, the crisis is highlighting the EU’s defence and energy vulnerabilities. Germany’s recent decision to increase its military spending is significant in that respect. And reducing dependence on Russian oil will unquestionably be one of Brussels’ top priorities. All of which bodes for a higher-profile role for the EU in fiscal, technology and energy policy in the coming years. Spain would be wise to understand these dynamics and, framed by its clear European commitment, bring its contribution to the table.

Raymond Torres and María Jesús Fernández. Funcas