Sub-central finances: Year two of the pandemic

While the Spanish central government’s debt and deficit increased significantly as a result of the pandemic, regional governments’ finances emerged in relatively better shape thanks to extraordinary support from the former. That said, there are notable differences across the regions both in terms of debt and deficit levels, which could make the transition back to normality a challenge.

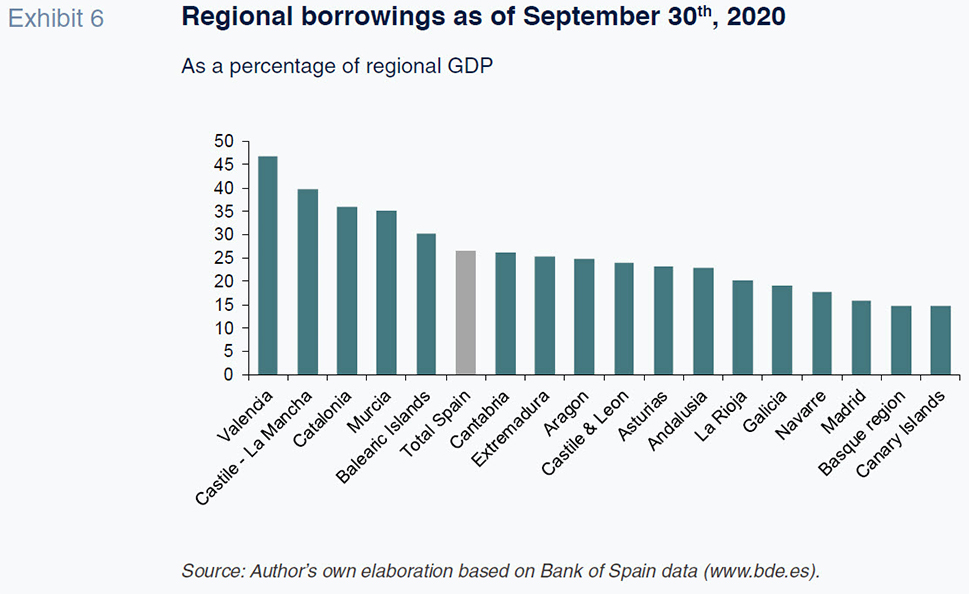

Abstract: The pandemic has had the dual effect of raising public deficit levels and reducing government revenue. In Spain, deficit increases differ across the various levels of government, with the central government’s deficit rising to 7.82% against the regional governments’ surplus of 0.29% up to the end of November 2020. This divergence is due to the extraordinary level of financial support provided by the federal government to the sub-central governments. However, updated data from December is expected to show that the regional governments dropped back into deficit by year-end. Some regions like the Basque region and Navarre are forecast to run a deficit of 2% or more while the Canary Islands should record a surplus. The deficit outlook for 2021 is clouded by uncertainty and will be influenced by Spain’s sensitivity to changes in GDP, the scale of discretionary measures, and the extent to which loans channelled by ICO become non-performing. Spain’s independent fiscal authority (AIReF) is forecasting an increase in the regional government deficit from 0.6% to 0.8%, with differences across regions persisting into 2021. Notably, Spain’s regions also differ in terms of their debt levels, with Valencia presenting a leverage ratio of 46.7%, triple that of the Canary Islands. These divergences mean solutions that involve debt forgiveness or risk-pooling would likely prove divisive.

Introduction [1]As expected, the COVID-19 pandemic has had a severely adverse impact on Spain’s public finances in 2020. The combination of the structural deficit of around 3% carried over from 2019, the cyclical deficit associated with a GDP contraction of over 10% and the countervailing measures taken on the employment, business and public services fronts correctly foreshadowed a double-digit deficit. By as early as last May, Lago Peñas (2020a) had already estimated a public deficit of 11.5% of GDP or higher.

The corollary of that significant hole in Spain’s public finances was a sharp rise in public debt and an even bigger jump as a percentage of GDP due to the severe contraction in output. The Bank of Spain’s figures reveal an increase in the debt-to-GDP ratio from 95.5% at the end of 2019 to 117% by December 2020. However, the increase in debt differs across the various levels of government, with the central government’s debt ratio having taken the biggest hit due to its ring-fencing of the regional and local governments’ finances. This strategy is set to continue in 2021 with similar implications for the debt ratios of different levels of government.

In order to analyse these developments in detail, this paper consists of three sections. In the first section, we analyse available data and the outlook for the final 2020 figures. The authorities will not officially announce these numbers until the end of March and Eurostat will then validate or revise them in April. We also look at the differing deficit trends and drivers at the sub-central government levels. The subsequent section presents the outlook for 2021 in light of the general state budget for 2021 (2021-GSB) and public and private forecasters’ current estimates for growth and the deficit. The next section tackles questions relating to regional government financing in the short- and medium-term. The paper ends with a brief analysis of the current debt situation at the regional level.

2020 budget outturn

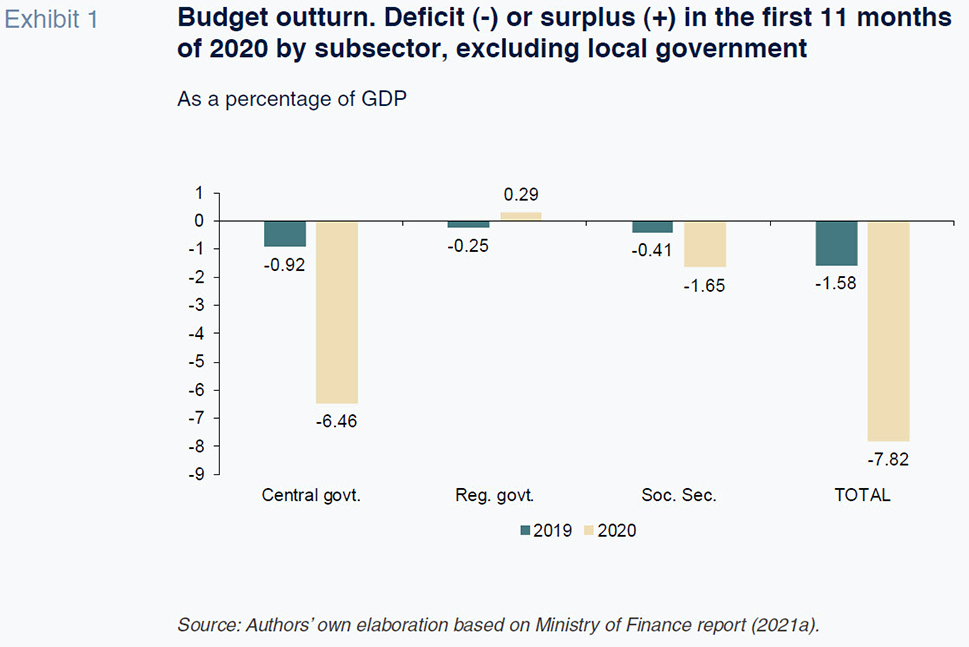

Exhibit 1 depicts the preliminary budget outturn as of November 30

th, 2020. As is customary, the figures exclude the local governments as the multiplicity of local entities results in data collection delays. The figures for the same period of 2019 are provided for comparative purposes. The two points that stand out from the exhibit are the surge in the deficit, which rises five-fold (from 1.58% to 7.82%) and the surplus posted at the regional government level: +0.29%. In short, the central government has channelled extraordinary funds to the regional governments so that they could increase their spending on those essential services affected by the pandemic (health and education) without generating a deficit. Local governments as a whole are expected to end the year with a deficit of close to zero, putting an end to the surpluses recorded in recent years (AIReF, 2020b).

Although official data at the international level makes comparison difficult, all countries have approved measures that support their sub-central governments (OECD, 2020). Nevertheless, the extent to which Spain has shielded its regional governments is likely to be one of the greatest, if not the greatest. Spain has shielded its regional governments primarily by transferring the full amount of funds planned prior to the onset of the pandemic plus an extraordinary 16 billion euros.

[2] Although the central government boosted the non-finance income of the Social Security by 14%, spending rose sharply (22%) due to the combined effect of the furlough scheme as well as the extraordinary benefits provided to self-employed professionals forced to close their businesses, to domestic staff left without work, and to COVID-19 sufferers in the form of temporary disability leave.

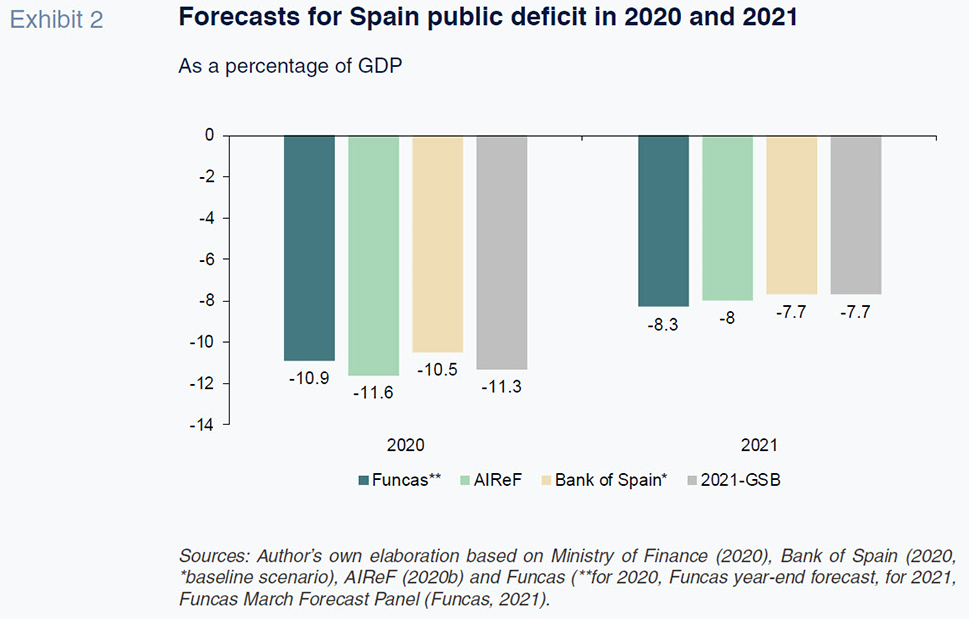

However, the picture is set to deteriorate considerably by the end of the year, primarily because all levels of government have yet to disclose the full extent of their 2021 planned expenditure. The left-hand side of Exhibit 2 shows the deficit forecasts for 2020 as per the latest Funcas forecasts, as well those of AIReF (2020b), the Bank of Spain’s baseline scenario (2020), and the Spanish government’s forecasts as per its 2021-GSB (Ministry of Finance, 2020).

[3] The figures range from AIReF and the Ministry at 11.6% and 11.3%, respectively to 10.9% (Funcas) and 10.5% (Bank of Spain).

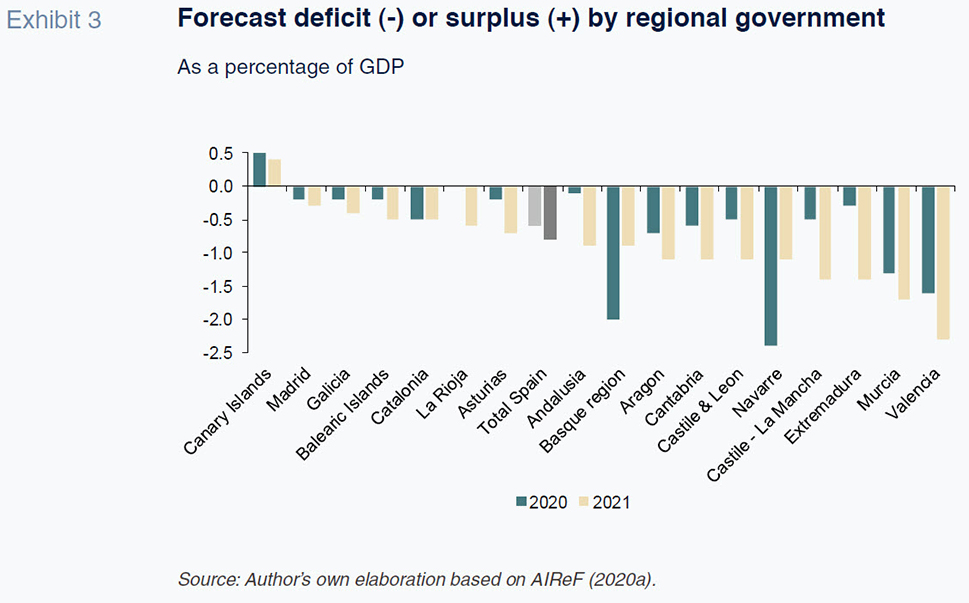

Broken down by region, the figures forecast by AIReF (2020a) for 2020 and 2021 reveal significant dispersion. The regions are presented in the order of magnitude of their forecasted 2020 deficits. As already noted, the level of expenditure accounted for is set to increase sharply in December 2020. Specifically, the surplus as of November (+0.29) is expected to fall back into deficit territory at year-end of 0.6%, along the lines of the levels as observed in 2019 (-0.55%). That being said, the situation is expected to vary considerably from one region to the next. The Canary Islands are expected to record a surplus in 2020. Conversely, the Basque region and Navarre are forecast to run a deficit of 2% or more. This is because their financing systems do not include the overestimated advance payments, payments on account, or the portion of the extraordinary 16-billion-euro fund tied to the loss of revenues, from which the other regions benefit. Murcia and Valencia are expected to report deficits of around 1.5%, in part due to their reduced financing per adjusted inhabitant. Lastly, six regions are set to present deficits of under 0.2% of GDP (Madrid, Galicia, Balearics, La Rioja, Asturias and Andalusia), with the rest falling between that 0.2% threshold and the average deficit of 0.6%. This outlook for the end of the year coincides with the estimates previously made by Conde-Ruíz

et al. (2020). Nevertheless, it is conceivable that the deficit will come in slightly lower than estimated, judging by several reports about the state of the regional governments’ treasury positions compared to 2019.

Outlook for 2021

The economic forecasts for 2021 remain clouded by a high degree of uncertainty, as is evident in the use of scenario-based analysis and the speed with which the forecasters are updating their estimates. Growth in 2021 will depend to a large extent on how long restrictions on mobility and social interaction last and the speed and effectiveness of the ongoing vaccination effort. This economic uncertainty impacts the deficit forecasts in three ways.

Firstly, the Spanish public deficit is highly sensitive to every point change in GDP. The most recent estimates of the impact of the cycle, measured by the output gap, on the budget balance rank Spain as one of the countries with the highest elasticities in the European Union, at around -0.6 (Mourre, Poissinier and Lausegger, 2019).

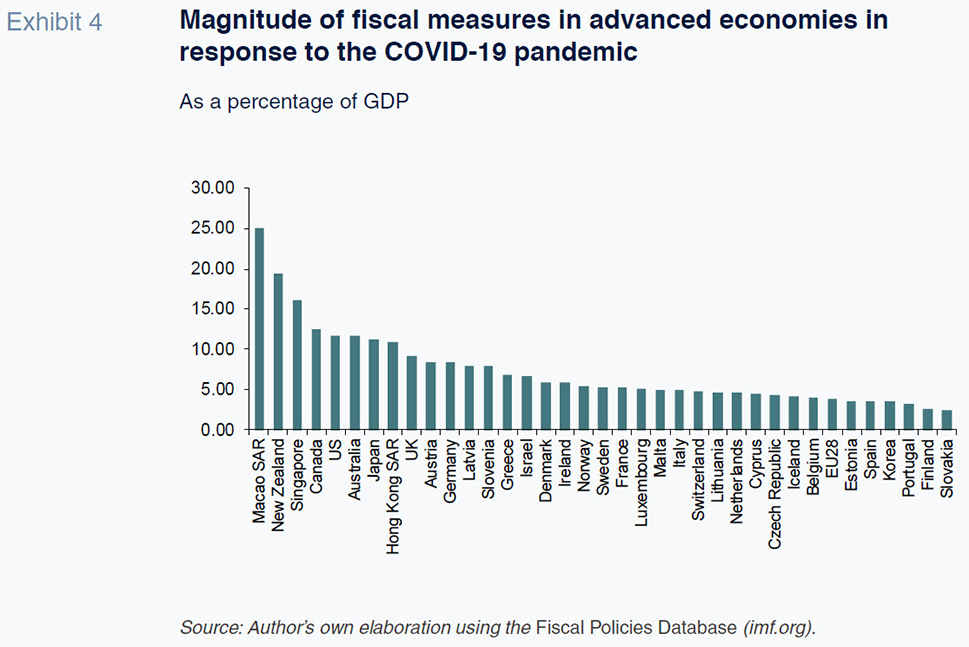

Secondly, the scale of the discretionary measures matters significantly. Although Spain has trailed the average value of discretionary measures enacted across advanced economies, Spain’s measures did have a significant impact on the deficit in 2020 and could do so again in 2021. Exhibit 4, prepared using the International Monetary Fund’s data on the scale of those measures with a fiscal impact across 37 advanced economies, expressed as a percentage of GDP, ranks Spain in thirty-third place. Only Korea, Portugal, Finland, and Slovakia have passed smaller packages. Nevertheless, the measures represent over 3% of Spanish GDP.

Lastly, there is the possibility that an unquantifiable portion of the pandemic-related state-guaranteed loans channelled via ICO, the official credit institute (capped at 140 billion euros, of which 90 billion euros had been deployed by January 31

st, 2021),

[4] could become non-performing, so adding to the deficit and public debt figures. The sooner and faster the recovery comes, the fewer business failures we will face.

The right-hand side of Exhibit 2 provides the 2021 deficit forecasts for the same four bodies. The Funcas consensus and AIReF forecasts are more pessimistic than the government in its 2021-GSB, although the disparity is smaller. In general, the estimates point to a moderate correction in the deficit of around 3.5 percentage points of GDP. The high elasticity of the budget balance to the output gap plays to Spain’s advantage in 2021. The deficit correction is compatible with GDP growth in the region of the consensus forecasts compiled by Funcas (5.9% as of March 2021). Nevertheless, a detailed analysis of the 2021-GSB, such as that done by Sanz and Romero (2021), raises questions about some of the revenue and expenditure headings that could weigh on that budget consolidation process.

Turning to the regional governments’ finances, the idea is to extend the policy of shielding them from the impacts of the pandemic. The 2021-GSB contemplates a slight reduction in income under the regional financing system from 116 billion euros in 2020 to 114 billion euros in 2021. Money from the extraordinary COVID Fund is also forecast to decrease from 16 billion euros in 2020 to 13.49 billion euros in 2021. However, the regional governments will directly manage 18.79 billion of the new European Community funds for bolstering the economy, funds that are set to push those administrations’ budgets to record highs in 2021 (Ministry of Finance, 2021b).

Regional government deficits are expected to increase slightly in 2021. Exhibit 3 shows the AIReF’s forecasts for 2021 too. Spain’s independent fiscal authority is forecasting an increase in the regional government deficit from 0.6% to 0.8%, which is nevertheless below the threshold stipulated by the central government. Once again, the situation will differ from one region to the next. The Basque region and Navarre should see their finances improve significantly, fuelled by the anticipated economic recovery, while Castile-La Mancha, Extremadura and Valencia will see theirs deteriorate notably.

Upcoming regional financing agenda

The risk of significant financial shortages was high for Spain’s regional governments in 2020 and 2021 due to their spending structures and limited ability to generate new sources of income. The central government’s solution gave them the funds and liquidity they needed, surpassing most regional leaders’ and analysts’ expectations. Having addressed the sufficiency issue in the short-term, a few new challenges are gathering on the horizon.

First, it is important that the regional governments fully understand that the funding collected in 2020 and 2021 is extraordinary and not recurrent. It is vital, therefore, to make a clear distinction when identifying and allocating those funds so that the regions do not view these funds as a permanent strategy for financing recurring expenditure.

Second, the governance model used to manage to the Next Generation EU Fund is highly centralised, not fully taking advantage of a state as decentralised as Spain. It is not easy to identify and develop good projects with proven knock-on effects that absorb billions of euros and fit with the priorities established by the European Union in just a few months. It is essential to work fast and bring as much expertise to the task as possible. To help with that task, Spain boasts regional governments that are well positioned to play a key role in championing, defining, and articulating those projects.

Third, it is unclear what role the regional and local governments are expected to play when it comes to supporting those sectors hardest hit by the pandemic. Significantly, the risk of business failures in the absence of temporary support is high. It is true that the sub-central governments have relatively more fiscal margin than the central government to offer support. Local governments’ advantages include healthy finances and surpluses built up in the past while regional governments benefit from the transfer of ordinary and extraordinary funds. It is not clear, however, that the reliance on a variety of different sub-central potential support mechanisms is the best strategy. Specifically, municipalities and regions have differing degrees of fiscal flexibility and the existence of significant financial externalities in the economic system could trigger payment default issues that ripple beyond local or regional borders. The approval in the extraordinary meeting of the Council of Ministers on March 12th, 2021, of a package of direct aid of 7 billion euros to be managed by the regional governments aims to address this issue. However, its implementation raises, once again, doubts. If it is a question of compensating regional governments for the extra cost of the pandemic and the collapse of their income, it is reasonable that these variables are used to determine regional distribution. But if the final recipients of the funds are the impacted companies and the program is financed by the central government, the logical thing would be that all the companies that certify that they comply with the requirements established by the central government should be able to access the common fund on equal terms, without a prior territorial distribution based on the macroeconomic impact of the pandemic in each region, as it seems will be the approach taken.

Fourth, the regional governments will have to repay surplus settlements in 2022 and 2023. That problem, however, can be easily resolved by repeating the settlements in 2008 and 2009. This would involve deferring their payment over a sufficiently long period of time and offsetting them against settlements due. Bear in mind that the expected size of the settlements payable is substantially smaller this time.

Fifth, it is inevitable that the fiscal consolidation course that will kick off in 2022 or 2023 will also affect the regional governments. It is therefore necessary to sort out another three processes that were underway before the pandemic: reforming the regional financing system against the backdrop of an overhaul of the Spanish tax system; supporting the return of regional authorities to the financial markets for debt placement purposes; and, tightening fiscal governance to enhance budget stability at the regional level. The latter needs to include a review of the sub-central fiscal rules as part of a reform process already underway at the European level.

Final thoughts about regional debt sustainability

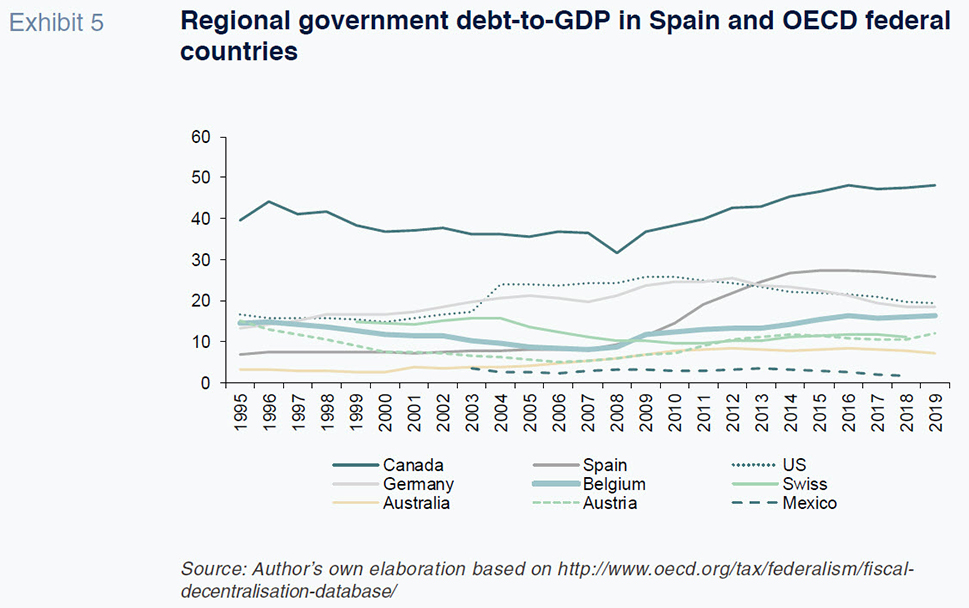

This last section focuses on the debt accumulated by the regional governments, comparing the situation in Spain with that of the developed federal states and examining the interregional differences.

To achieve our first objective, we used the OECD’s database to construct Exhibit 5. The figures are expressed as a percentage of GDP. As a general rule, public debt increased across the board in 2020, so that we will see a step change when the new data are available.

In Spain, the regional governments’ debt has increased only slightly in absolute terms, as they are expected to end the year with close to balanced budgets. According to the Bank of Spain’s statistics, the regional debt calculated for Excessive Deficit Procedure (EDP) purposes increased from 295 billion euros to 302 billion euros (a little over 2%) between the fourth quarter of 2018 and the third quarter of 2020. However, the contraction in nominal GDP will trigger a very significant increase in the leverage ratio, of over 10%. Specifically, that ratio increased from 23.7% to 26.3% (+11%) over those three quarters. Although the GDP contraction has been smaller in other developed countries, it is likely that deficits and borrowings at the intermediate levels of government will increase by more than in Spain, so that Spain’s relative position does not change substantially with respect to 2019.

Until the Great Recession that began in 2008, Spain’s regional borrowings had been trending flat, at well below 10% of GDP, putting it within the OECD group of federal countries with the least indebted intermediate governments. That situation has changed drastically since then. Leverage embarked on a swift and steady rise over the following decade, stabilising at around 25%. Today, only Canada presents a higher subnational leverage ratio.

Again, there is significant interterritorial diversity in the leverage ratio. As shown in Exhibit 6, as of September 30

th, 2020, Valencia presented a leverage ratio of 46.7%, triple that of the Canary Islands (14.7%), the least indebted region. This means that the debt burden and the related sustainability issues are similarly uneven. It is also true that short- and medium-term interest rates remain at record lows and the creditor for most of that debt is the central government, via the extraordinary liquidity mechanisms. According to the Bank of Spain’s statistics, 185 billion out of the 302 billion euros of regional debt is owed to the so-called Regional Financing Fund (61%). However, the use of these mechanisms is also highly varied across the regions, making it hard to come up with solutions. Whereas that percentage is below 10% in some regions, in Catalonia it stands at over 80%: 62.4 billion euros out of a total 78.3 billion euros. For these reasons, solutions that involve debt forgiveness or risk-pooling would prove divisive.

Notes

The author would like to thank Diego Martínez (UPO) for his valuable input and Fernanda Martínez and Alejandro Domínguez for their assistance.

Refer to Lago Peñas (2020b) for further details.

Refer to Informe de seguimiento de la Línea Avales COVID-19 [Covid-19 Guarantee Line Monitoring Report] on the ICO website:

https://www.ico.es

References

AIReF (2020a).

Reports on the main budgetary lines of the autonomous regions and local governments: 2021. December 2020. Retrievable from:

www.airef.es —(2020b).

Monthly stability target monitoring. A. General Government. December 2020. Retrievable from:

www.airef.es BANK OF SPAIN (2020).

Macroeconomic projections for the Spanish economy (2020-2023): The Banco de España’s contribution to the Eurosystem’s December 2020 joint forecasting exercise. Retrievable from:

www.bde.es CONDE-RUIZ, J. I., DÍAZ, M., MARÍN, C. and RUBIO-RAMÍREZ, J. (2020).

Observatorio fiscal y financiero de las CCAA. Previsiones de cierre 2020 [Regional Government Fiscal and Finance Watch. Year-end 2020 Forecasts]. Estudios sobre la Economía Española, 2020/35. Retrievable from:

www.fedea.es FUNCAS (2021).

Spanish Economic Forecasts Panel. March 2021. Retrievable from:

www.funcas.es LAGO-PEÑAS, S. (2020a). COVID-19: A Tsunami for Public Finances.

SEFO, 9(3). Retrievable from:

https://www.sefofuncas.com/Spain-and-the-EU-Assessment-of-policy-responses-to-COVID-19/COVID-19-A-tsunami-for-public-finances — (2020b). Spain’s Fiscal Context: A Regional Perspective.

SEFO, 9(6). Retrievable from:

https://www.sefofuncas.com/The-Spanish-economy-Outlook-for-recovery/Spain%E2%80%99s-fiscal-context-A-regional-perspective MINISTRY OF FINANCE (2020).

Presentación del Proyecto de Presupuestos Generales del Estado 2021 [Presentation of the Draft National Budget for 2021]. Retrievable from:

www.hacienda.gob.es — (2021a).

Ejecución presupuestaria de las Administraciones Públicas [Budget outturn figures] November 2020. Retrievable from:

www.hacienda.gob.es — (2021b).

Draft regional government budgets for 2021. Retrievable from:

www.hacienda.gob.es MOURRE, G., POISSINIER, A. and LAUSEGGER, M. (2019). The Semi-Elasticities Underlying the Cyclically-Adjusted Budget Balance: An Update and Further Analysis.

Discussion Paper, 098. Retrievable from:

www.ec.europa.eu OECD (2020).

The Territorial Impact of COVID-19: Managing the crisis across levels of government. Retrievable from:

www.oecd.org SANZ, J. F. and ROMERO, D. (2021). Spain’s 2021 budget: An assessment.

SEFO, 10(1). Retrievable from:

https://www.sefofuncas.com/The-fiscal-implications-of-COVID-19-in-Europe-and-in-Spain/Spain%E2%80%99s-2021-budget-An-assessment

Santiago Lago Peñas. Professor of Applied Economics and Director of GEN, University of Vigo