Countercyclical capital in Spanish banks: A review in the context of capital buffers

In efforts to achieve convergence with EU supervisory standards and in response to recommendations from the European Systemic Risk Board (ESRB), the Bank of Spain has recently announced significant revisions to the countercyclical capital buffer (CCyB), increasing it gradually from 0% at present to 1% by year-end 2026 and introducing greater flexibility. The changes highlight the need to recalibrate Spain’s CCyB, taking into account potential tensions between micro and macro perspectives, to allow for greater adaptability in response to the economic cycle.

Abstract: The Bank of Spain recently announced significant changes to the countercyclical capital buffer (CCyB) as part of a process of ongoing convergence with the European supervisory standards and at the recommendation of the European Systemic Risk Board (ESRB), the institution tasked with issuing macroprudential supervisory guidelines in the eurozone. Framed by the move to increase the buffer rate from 0% at present to 1% in two stages (the first by year-end 2025 and the second by year-end 2026), the new buffer will feature a much more important modification – the requirement to set the neutral buffer rate at 1%, from where it can be increased, but also the possibility of releasing the buffer when warranted by an episode of crisis. These modifications of the CCyB are just the first step in a higher-level review of capital buffers, framed by dual micro and macroprudential dimensions, designed to reinforce banking system resilience. The changes highlight the need to recalibrate Spain’s CCyB, taking into account potential tensions between micro and macro perspectives, to allow for greater adaptability in response to the economic cycle. As well, going forward, stress tests should be a crucial part of the toolkit for linking the two perspectives, particularly when determining and redefining the P2G requirement. Nevertheless, the tests existing weaknesses, such as the static balance sheet assumption or the failure to consider the probability of occurrence of the scenario analysed, should be addressed by reforms in order to deliver both financial stability and economic efficiency.

Foreword

The Bank of Spain’s recent decision to set the neutral countercyclical buffer rate at 1% marks an inflection point in the country’s macroprudential policy. The announcement signals the start of a gradual increase, with a buffer of 0.5% required by October 2025, followed by an additional 50bp increase by October 2026. This move provides an excellent opportunity to assess the effectiveness and drawbacks of the countercyclical capital buffer for banking regulation purposes.

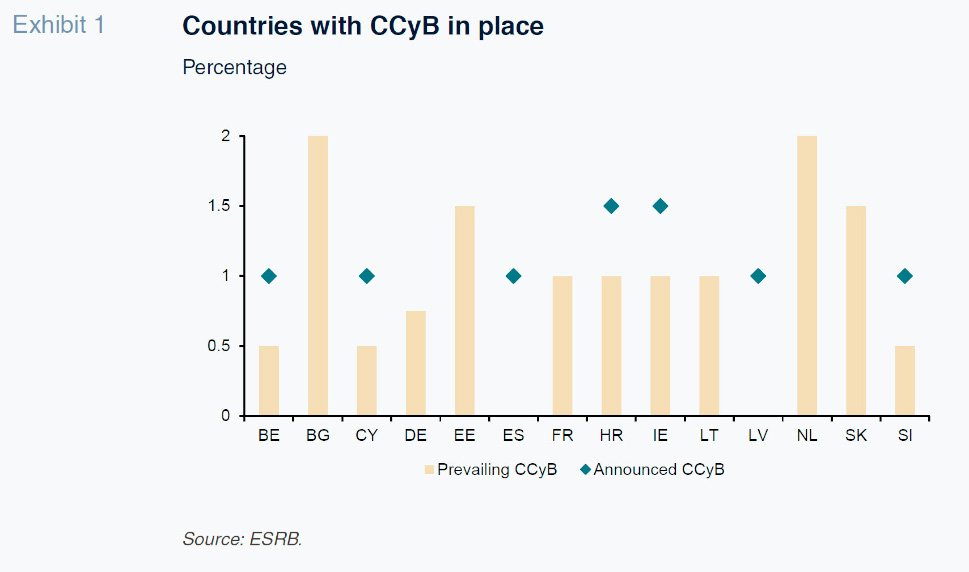

It is worth noting that the European Systemic Risk Board (ESRB) had explicitly recommended a positive neutral countercyclical capital buffer, prompting several European countries to introduce this change already. The early activation of these mechanisms has been advised so as to foster the stability and efficiency of the financial system.

The countercyclical buffer is a key macroprudential policy instrument. Its main purpose is to create a flexible capital buffer that can be adjusted in line with evolving economic conditions. The aim is to increase capital requirements during periods of economic growth to curb excessive credit growth and facilitate their reduction during recessionary episodes in order to stimulate lending and support economic recovery.

The Bank of Spain believes that a positive neutral countercyclical buffer is not harmful for several reasons and can even be beneficial for the Spanish economy at present:

- Spain’s financial cycle is very volatile: The Spanish economy is characterised by financial cycles marked by more pronounced phases of growth and contraction than other European economies. A positive CCyB provides a reserve of capital that can released to cushion the negative effects of contractions and decouple credit cyclicality. Early activation of this buffer, in anticipation of problems, rather than in response to their materialisation, reduces the severity of recessions.

- Importance of the banking sector in financing the economy: The Spanish financial system plays an outsize role in financing the real economy. A positive CCyB gives the banks additional room for continuing to lend money in times of adversity, preventing excessive credit contractions during cyclical downturns.

- Historical experience and empirical evidence: Recent evidence shows that the banks are reluctant to dip into their non-releasable capital buffers to absorb losses during recessions. This phenomenon can lead to procyclicality. A positive CCyB could help prevent this pattern by ensuring the availability of a buffer that can be released if needed.

- Spanish and international macroeconomic context: The IMF’s recommendations and the ECB’s approach to the build-up of releasable macroprudential space support this measure. The global climate of uncertainty reinforces the advisability of putting this buffer in place.

- Gradual build-up implies reduced costs: The cost of building up a positive neutral CCyB is low, particularly if done gradually. The benefits of having this capital buffer which can be released during adverse episodes easily outweigh the costs.

The modus operandi for the CCyB proposed by the Bank of Spain over the macro-financial cycle can be summed up as follows:

- Phase 1 (Low risk |systemic risks have already materialised): The CCyB is equal to zero. The Bank of Spain would make public its expectations regarding the reactivation of this buffer, which would not take place until cyclical systemic risks had reached a standard level.

- Phase 2 (Standard risk): The CCyB is built up gradually, in quarterly increments or multiples of 0.25 percentage points until it reaches 1%. Its build-up is gradual and decisions can be modified or reversed as new information becomes available. The goal is to lift the buffer to 1% within a defined timeframe (of two years, for example).

- Phase 3a (High risk): If system vulnerability increases significantly or systemic risks are expected to have a bigger impact, the CCyB would be raised to above 1%.

- Phase 3b (Risk materialisation): If the risks materialise, the CCyB built up will be released, in part or in full, so that the banks can absorb losses.

- Phase 4 (Return to standard risk): Once the crisis is over and risk is considered back at standard levels, the CCyB is gradually rebuilt until it reaches the neutral 1% rate once again.

In essence, the way the CCyB works is dynamic and flexible. It starts with gradual build-up in a situation of standard risk, allows a flexible response to increases in risk or materialisation thereof and ends after a crisis with gradual rebuilding to the neutral rate of 1%. The main goal is to act as a countercyclical buffer, preventing procylicality and shoring up the financial system’s resilience.

Despite its theoretically well-defined purpose, the countercyclical buffer’s design bumps up against certain challenges that limit its effectiveness at smoothing the credit cycle.One of the main issues is its asymmetrical impact during different phases of the economic cycle. Studies and observations (refer to Restoy and Berges ,2021) have found that whereas the buffer is fairly effective at containing credit growth during times of economic overheating, its ability to stimulate credit during periods of recession is considerably lower. This asymmetry raises questions about how to best design and implement the buffer so as to serve its purpose during upswings and downswings alike.

This asymmetric performance by the CCyB can be understood by looking at several factors intrinsic to the credit market and efficiency of the financial markets. Those factors explain why the buffer works differently at different stages of the economic cycle.

Utility of the countercyclical buffer

Does supply or demand drive the credit cycle?

Firstly, the observed asymmetry can be attributed to how the credit market works. The traditional theory behind the countercyclical buffer presumed that the credit market is mainly supply-driven, i.e., driven by the supply of credit offered by the banks. It was assumed that when capital requirements are reduced, the banks are more willing to increase their supply of credit.

Recent experience, however, suggests that the credit market may in fact be more demand-driven. In a recessionary climate, even if capital is released on the back of lower requirements, the downturn in macroeconomic conditions and expectations often undermines demand for credit. This means that from the banks’ point of view, the little credit in demand is neither attractive nor lucrative, so limiting the impact of the capital release. In other words, the assumption that the market is supply driven does not always hold during episodes of recession, limiting the countercyclical buffer’s ability to stimulate credit.

Interlinkage with economic capital

A second reason for the observed asymmetry lies with how the banks manage their economic capital in a context of efficient financial markets, whereby the banks and investors set a level of economic capital adjusted for the nature of the entity’s business, irrespective of regulatory capital requirements. Through this lens, the existence of adjustable capital requirements will be irrelevant if the banks are holding more economic capital than is required of them for regulatory purposes. Therefore, a sufficiently intense increase in regulatory capital requirements can always restrict banking activity. On the other hand, if the reduced capital requirement lies below the economic capital threshold set internally by the bank, the release will not be effective at stimulating lending activity.

That being said, this second argument is weakened by how the market really works, which is not always perfectly efficiently. Often times, economic capital is calculated as a spread over regulatory capital, adjusted for each entity’s specific circumstances. So, when capital requirements are eased during a recession, economic capital can be reduced by an equivalent amount, which should, in theory, stimulate the provision of credit.

In Spain, there is evidence in defence of the utility of countercyclical buffers. In fact, the literature points to a more intense positive impact when they are released than the contractionary impact during their build-up (refer to Broto y Galán, 2021).

Beyond the possible fundamental, almost philosophical, problems around the mere definition of countercyclical buffers as a tool, there are specific design questions that affect the utility of this instrument. Those questions relate to how this tool is perceived and used in the context of bank regulations.

Countercyclical buffer design issues

The way the countercyclical buffer is designed presents several practical challenges. One of the main issues has been its “usability”. Until the recent reforms announced by the Bank of Spain, the countercyclical buffer was set at a neutral rate of 0% in normal economic conditions. That design meant that during episodes of recession that did not follow a period of overheating, the banks did not have any capital that could be released to stimulate credit. The Bank of Spain’s decision to set the buffer at 1% in neutral circumstances stems directly from that limitation: the aim is to provide the banks with a higher buffer for use in the event of recession.

Despite this design improvement, there isstill an important impediment to using the buffer as a broader regulatory tool. The key issue is that using a single tool to deliver macro and microprudential objectives poses a dilemma, especially during recessionary periods. During a recession, the macroprudential goal of stabilising the financial system and the microprudential goal of guaranteeing the stability of each entity could come into conflict.

In the current framework, the microprudential and macroprudential authorities share the goal of making the financial system more resilient but their approaches can take different tacks. During periods of economic growth, supervisory measures can be reinforced by macroprudential policies that increase the banks’ capital requirements to protect the system from rising risks and curb the supply of credit. During recessions, however, divergent perspectives may arise. The banking supervisors tend to focus their attention on the stability of the individual banks, whereas the macroprudential authorities worry about the risk of excessive deleveraging that could exacerbate the crisis. This can lead both authorities to use their tools to counteract policies considered too strict or lax by the other party, creating friction and inconsistencies at the policy level.

The countercyclical buffer and the stress tests

Several reforms have been suggested for tackling these complexities. The Bank of International Settlements (BIS) Financial Stability Institute (FSI) has suggested modifying the buffer system to include a component under Pillar 2, adapted for each financial institution’s individual profile. This approach would allow specific adjustments to factor in the idiosyncrasies of each institution, facilitating more efficient management of the simultaneous prudential objectives. In the EU, this role is played by the Pillar 2 Guidance (P2G), a requirement that emerges from the individual assessments of the various banks as part of the stress tests conducted by the European Banking Authority (EBA).

The use of this Pillar 2 component from this dual perspective – micro and macroprudential – provides an extra layer of flexibility and personalisation, potentially mitigating the conflicts between macroprudential and microprudential goals. This approach would take stock of the need for greater tailoring of regulatory practices, adjusting capital requirements for the specific characteristics and risks of each bank, thereby optimising their impact during different phases of the economic cycle.

To maximise harmonisation between the Pillar 2 Guidance and macroprudential approach of the countercyclical buffer, it is vital to revisit and fine-tune the economic scenarios modelled for stress-testing purposes. The scenarios are what should serve to make the two tools compatible, ensuring a P2G requirement that adequately factors in the considerations related to the economic cycle. This would not only reinforce the banks’ capital planning processes but would also ensure a coordinated response to economic fluctuations, so supporting financial stability in the long-run.

At this juncture, we need to analyse the problems inherent to how the stress tests are currently configured. The design and assumptions underlying these tests need to be revisited in order to accurately capture the real-world economic and financial dynamics. A rigorous and flexible approach is needed to ensure that these scenarios are not only theoretical but also practical and relevant for prevailing conditions.

Here it is worth pausing to assess the ways in which the stress tests have been adapted for the European banking universe since the Single Supervisory Mechanism (SSM) was created. Since 2014, the EBA has conducted five rounds of stress tests to evaluate the impact on the banks’ capital of stressed scenarios considered low probability yet plausible that would have a significant adverse impact on the institutions.

The testing methodology has been adapted over the years to factor in developments in accounting and prudential regulations, such as the introduction of IFRS 9 in 2018 or the completion of Basel III in 2025, and to reflect certain ad-hoc developments in the business environment, such as the treatment of moratoria and public guarantees during the COVID-19 crisis.

Until 2016, the EBA used a ‘pass or fail’ stress testing system articulated around the banks’ ability to maintain common equity tier 1 (CET1) capital above the minimum thresholds set by the regulator in the scenarios modelled.

For the 2014 tests, the EBA set a pass-fail cutoff for CET1 of 8% in the baseline scenario and 5.5% in the adverse scenario. Failure to meet one or both thresholds meant the banks failed the tests and were required to announce credible measures for recapitalising in the short-term.

Since 2016, when the EBA discontinued the pass or fail approach, the results of the European stress tests are used by the supervisors to help determine the banks’ minimum Pillar 2 capital requirement. Specifically, the supervisor sets different ranges for CET1 depletion in the adverse stress test scenario which are paired with minimum and maximum P2G top-up requirements. Specification of a higher or lower capital requirement for a given range of capital depletion in the adverse scenario reflects circumstances specific to each individual bank, such as its risk profile or the year in which its capital ratio reaches its lowest level during the stress test time horizon.

The above regulatory and methodological adjustments have reinforced the role of the stress tests as a standardised tool for assessing the stability of the financial system. However, there are still some limitations, such as the static balance sheet assumption, the lack of idiosyncratic or business scenarios and the failure to address emerging risk factors

[1] that would make the tests more robust.

Elsewhere, the current European stress testing methodology is based on a predetermined level of severity that does not always reflect changing market conditions or the dynamics of the economic cycle. Insofar as the goal is to capture the potential risks on the economic horizon, this approach may be handicapped by failing to take stock of changes in the probability of occurrence of disruptions in the credit market.

Taking a probability-based approach to the scenarios could provide more value, particularly during recessionary episodes, when the likelihood of significant credit disruptions diminishes, which should in turn influence both the microprudential and macroprudential approaches.

Under this approach, the microprudential buffer could be adapted to better capture the effects of the cyclical position on the financial system, paving the way for opportune adjustments to the capital requirements based on the results of the stress tests. By so doing, there would be less pressure to reduce the macroprudential buffer, as the two mechanisms could operate in harmony, diminishing potential tensions between micro and macroprudential policies.

Transitioning towards a probability-based approach to scenario modelling would not only enrich the tests’ predictive capacity but would also bring about greater cohesion between the microprudential and macroprudential perspectives. This change would deliver two fundamental objectives for the macroprudential authority and the supervisors: the financial system would be better prepared to absorb shocks, taking advantage of cyclical dynamics to streamline capital requirements, while also fostering lending and economic stability in the long-term.

The proposed changes to the current stress-testing system seek to mitigate the bias towards an excessively restrictive scenario focused on extremely adverse scenarios, without factoring in their probability of occurrence, and the static balance sheet assumption, which underestimates the banks’ ability to respond to these scenarios. This overly restrictive approach may be counterproductive for the banks, preventing a more balanced risk assessment. The idea is, therefore, to integrate a “pro-growth” perspective that lends itself to a more dynamic and realistic risk assessment, while also fostering policies that facilitate financial reactivation and stability in the long-term, which are critical for processes such as the (de)activation of the countercyclical capital buffer.

Notes

So far, the EBA stress tests have not embraced macroprudential approaches based on the measurement of emerging risk scenarios. Climate and cybersecurity risks were analysed by the European Central Bank in specific stress tests in 2022 and 2024. Those tests, which rely on methodology that differs considerably from that used by the EBA in its bi-annual tests, carry out isolated assessments of those risks and until now have been focused on evaluating the banks’ ability to collect data and develop methodologies. In the future it would be better to integrate their assessment within the EBA’s financial stress tests to include in-depth analysis of the linkages that exist between the materialisation of emerging risks and other adverse scenarios with an impact on the macroeconomic environment and on the banks’ business.

References

BANK OF SPAIN. (2024). Revision of the framework for setting the countercyclical capital buffer in Spain.

Briefing note (24 May 2024).

COELHO, R., and RESTOY, F. (2024). Capital buffers and the micro-macro nexus.

FSI Briefs, 24 (July 2024).

HERNÁNDEZ DE COS, P. (2023). The role of macroprudential policy in the stabilisation of macro-financial fluctuations.

Speech given at the Conference on Financial Stability in Lisbon, Portugal (2 October 2023).

RESTOY J., and BERGES, Á. (2021). Scant use of capital buffers during the pandemic: Potential stigma effect.

Spanish and International Economic and Financial Outlook, Vol. 10, No. 5.

https://www.sefofuncas.com/Monetary-policy-at-a-crossroads/Scant-use-of-capital-buffers-during-the-pandemic-Potential-stigma-effect

Ángel Berges, Jesús Morales and Javier Restoy. Afi