Scant use of capital buffers during the pandemic: Potential stigma effect

In order to alleviate the pressure wrought by COVID-19 on the banking sector, regulators and supervisors permitted banks to utilise capital buffers prescribed under Basel III, including the so-called countercyclical buffer and the capital conservation buffer. Econometric analysis shows that the ‘stigma effect’ most likely explains banks’ hesitancy to take advantage of this flexibility.

Abstract: One of the fundamental new aspects of Basel III compared to its previous iterations is the introduction of capital buffer requirements. While most capital buffers are set either as a fixed amount or established during the supervisory cycle, the countercyclical buffer can be adjusted in a discretionary manner depending on economic trends. Due to the unprecedented nature of the COVID-19 crisis, regulators and supervisors permitted banks to utilise their capital buffers, including the countercyclical buffer. Despite also curbing dividend payments and committing to a generous timeframe to allow banks to replenish their initial capital positions, banks have not taken advantage of the more flexible treatment of capital buffers. Results from econometric analysis show a reduction in an entity’s capital ratio is penalised by the market, confirming the hypothesis of a ‘stigma effect’. However, if it is accompanied by a reduction in regulatory capital and the entities continue to hold the same margin over the minimum required, that penalty is mitigated. These findings suggest regulators should consider fine-tuning the current buffer system to increase releasability.

Introduction

An important aspect of the new risk-based regulatory framework articulated in the wake of the financial crisis of 2008-2012 was the introduction of capital buffers. These buffers safeguard the minimum level of solvency required to ensure business continuity in adverse cyclical conditions (microprudential function) and mitigate the incentives to pare back the supply of credit under those same circumstances (macroprudential function).

The Basel III capital buffer system consists of a releasable component that kicks in depending on cyclical conditions. These include the countercyclical capital buffer (CCyB) and other buffers, such as the capital conservation buffer (CCoB), whose size does not depend directly on the state of the economy. In the case of the latter, the regulator permits the banks, on certain conditions and in adverse circumstances, to temporarily breach that capital requirement. In short, these constitute usable buffers.

Because the countercyclical capital buffer was at or near zero at the start of the crisis, its impact has been diminished. Consequently, regulators have urged the banks to deplete those usable buffers if needed to keep credit flowing to the real economy (BCBS, 2020a and b). However, the banks have proven reluctant to use their capital buffers despite the authorities’ encouragement. Their aversion to depleting their capital ratios is consistent with the analytical research demonstrating a negative correlation between capital margin with respect to the regulatory minimum and the supply of credit (ECB, 2020b).

The most plausible hypothesis for explaining this behaviour is the existence of a market penalty (stigma effect) for capital depletion. That assumption has been endorsed by Andreeva et al. (2020), who find that the capital targets reported by the banks have barely moved in the wake of the authorities’ recommendation to use their buffers. In addition, Schmitz et al. (2021) finds a stigma effect in the price of debt that is eligible as capital for regulatory purposes, which depends on the level of own funds.

However, these studies do not directly analyse the nature of that stigma effect. Specifically, they do not examine whether the stigma effect is attributable to difficulties faced by an entity in achieving the absolute level of capital the market deems adequate or whether it is due to insufficient room for manoeuvre to ensure compliance with the minimum ratio required by the regulator.

The difference between the two hypotheses is potentially relevant for the optimal design of the regulatory framework. If the first hypothesis is true, it would not make sense to attribute any impact on the banks’ behaviour to the size or nature of the buffers. If the second hypothesis is accurate, the results would justify the redesign of the capital buffers to better align the formal regulatory requirements with cyclical conditions. In other words, such a thesis would lend support to the strategy of rebalancing the buffer system to give greater weight to the releasable buffers relative to the usable buffers.

Against that backdrop, this paper analyses the extent to which the regulatory framework may be falling short of its stated stabilisation function. Our analysis focuses on verifying whether the assumption that the banks’ reluctance to use their buffers is due to a possible market penalisation (stigma effect) and, if so, whether that penalty is due to the reduction in margin with respect to minimum capital thresholds.

Capital buffers under Basel III

One of the fundamental new aspects of Basel III compared to its previous iterations is the consideration of the macroprudential dimension. Key instruments used in Basel III are the above-mentioned capital buffer requirements. They are designed to ensure that banks have some flexibility over and above their minimum capital requirements. Each buffer is designed to mitigate a specific type of risk but they all share certain common characteristics:

- Capital conservation buffer (CCoB). Its overriding purpose is to ensure that banks keep an additional layer of capital for use when they incur losses. That buffer, which took full effect in 2019, has been set at 2.5% of total risk-weighted assets (RWA).

- Countercyclical capital buffer (CCyB). This buffer is intended to protect the banking sector against periods of excessive growth in credit that have customarily been associated with episodes of build-up of systemic risks.

- Capital buffers for systemically important institutions (SIIs). The systemic risk buffer is mandatory for banks identified as systemically important, whether globally (G-SII) or domestically (O-SII).

The total level of CET1 needed to meet the capital conservation and countercyclical buffering requirements and the add-ons applicable as a function of the banks’ systemic risk is known as the combined buffer requirement, or CBR. The CBR, together with the Pillar 1 requirements (which are common for all entities) and Pillar 2 requirements (which are set at the firm level), constitute the capital requirements that are overseen by the supervisor.

Failure to meet the CBR can lead to restrictions on the distribution of dividends, remuneration on fixed-income instruments that qualify as additional tier-1 capital (such as contingent convertible bonds, or CoCos) and employee bonuses.

Banks that breach their CBR become subject to more stringent oversight and are required to submit a plan for replenishing their capital and upholding their buffer commitments within a reasonable timeframe. The consequences are, therefore, less severe than the revocation of their business license or the triggering of insolvency procedures. Nevertheless, they are sufficiently serious to motivate the banks to avoid, unless strictly necessary, breaching the CBR and, when they do, replenish their capital as quickly as possible.

Of all the buffers, only the countercyclical buffer can be adjusted in a discretionary manner depending on economic trends. That is why it is classified as releasable. The other buffers are not releasable as they are either a fixed amount (such as the capital conservation buffer) or they are set in the course of the supervisory cycle (such as the SII surcharge and structural buffers), with the stipulated frequency, usually of one year. All of the macroprudential buffers and the CCoB can be used to absorb losses in adverse circumstances and are therefore deemed usable capital buffers.

Buffer usability in the COVID-19 crisis

The Basel Committee has reiterated throughout the pandemic (BCBS, 2020a and b) that an orderly reduction in buffers is appropriate in a crisis of this nature and that until it is over the supervisors will give banks enough time to replenish the previous levels over their minimum requirements, taking prevailing economic and market conditions as well as the banks’ performances into consideration (ECB. 2020a). Consequently, regulators such as the ECB have permitted the banks to temporarily operate below the level stipulated in the Pillar 2 Guidance (P2G), CCoB and liquidity coverage ratio (LCR) (ECB, 2020). The national prudential authorities have also eased the CCyB requirements.

The CCyB is the most effective tool for stimulating lending in adverse economic climates because its size is calibrated as a function of cyclical conditions. However, given the absence of any real signs of credit overheating prior to the crisis, the CCyB was close to zero in most jurisdictions.

The purpose of the CCoB is to absorb losses as needed but its design renders it a transitory tool due to the incentives attached for relatively fast replenishment. It is, therefore, an effective instrument for cushioning the effect of adverse situations on the banks’ ability to operate, but less so for the purpose of inducing growth in the supply of credit under those conditions. However, given the lack of other mechanisms for stimulating lending, supervisors urged the banks to use this buffer to prevent excessive deleveraging.

So far, the banks have proven reluctant to deplete their capital buffers despite the authorities’ clear messaging. Furthermore, some of the banks appear to have embarked on deleveraging, albeit with different levels of intensity. There are three possible reasons for the entities’ conduct: a) restrictions on the distribution of dividends; b) uncertainty regarding the path for replenishing their buffers; and, c) a possible stigma effect.

Intervention by the authorities may have deactivated, at least partially, the first two factors. Specifically, the supervisors have intervened to curb and suspend the payment of dividends, irrespective of individual entities’ capital levels. As a result, the use or non-use of capital buffers does not determine an entity’s ability to pay dividends. The authorities have also expressly committed to providing a generous timeframe for the replenishing of initial capital positions in the event buffers are used to prop up credit (ECB, 2020a).

Thus, the stigma effect looks like the most plausible explanation, albeit one that needs verification. The next step is to analyse whether the market penalisation is triggered when the relevant capital ratios fall in absolute terms or only when the margin between available capital and the minimum level required narrows. The second case implies the banks are likely to remain reluctant to use their buffers unless the regulator formally and credibly modifies them. A reduction in the buffers required in adverse conditions (such as the CCyB) would enable the banks to use the marginal capital so freed up to lift their supply of credit without any impact on market valuations.

Empirical analysis

The model

Our econometric model attempts to explain the relationship between an entity’s share price, its actual capital ratios and the minimum capital ratio stipulated for regulatory purposes. As outlined in the last section, the idea is to ascertain whether their capital ratios affect their market values and how that effect may be impacted by possible changes in regulatory requirements.

The panel data regression model estimated is the following:

where PBVi,t is the ratio of market value (price) to the book value of entity i’s CET1 at time t.

The explanatory variables aim to reflect the banks’ capital positions. To do that, we used the regulatory capital ratio reported by the banks (CET1_RATIO) (AFI, 2021a) and the minimum regulatory capital requirement imposed by the authorities (CET1_REG). The regulatory capital ratio is the ratio between an entity’s capital and its risk-weighted assets, both measured in accordance with the Basel III framework. The capital requirement is the minimum ratio required by the supervisor, in conformity with the Basel III guidelines.

We also added control variables. Firstly, we introduced profitability (ROE), a key factor in the valuation ascribed to the banks by the market relative to their book value, as a proxy for the market’s forward-looking expectations.

We then layered in an indicator of the quality of their balance-sheet assets (PROVISIONS_TO_LOANS). This variable can affect price-to-book value as weak asset quality introduces uncertainty regarding the sufficiency of provisions relative to losses, potentially undermining the credibility of reported book value and, by extension, market value.

The estimation of the coefficients, β1 and β2, make it possible to verify the main hypotheses. If the estimator β1 is positive and significantly above zero, a stigma effect exists. On the other hand, a significantly negative β2 estimator indicates the importance of the margin over minimum required capital. More specifically, a negative β2 reading that is similar in absolute terms to the β1 value would imply that the capital variable that exclusively explains the stigma effect is the margin between reported and required capital.

The sample used is made up of 50 listed European banks whose core business is commercial banking. We selected entities with a market cap of over €1 billion and assets in excess of €30 billion. The frequency of the data used is annual and the data pertain to 2019, 2020 and 2021.

The accounting variables and capitalisation figures were obtained from the entities’ annual reports. The valuation variable (P/BV) was calculated using the banks’ share prices at the end of March of the year after the year of reference. This ensures market prices have discounted all the relevant accounting and regulatory information for each year, which tends to be published during the first quarter of the following year.

Findings

The panel regression is estimated using the Ordinary Least Squares method, introducing time fixed effects.

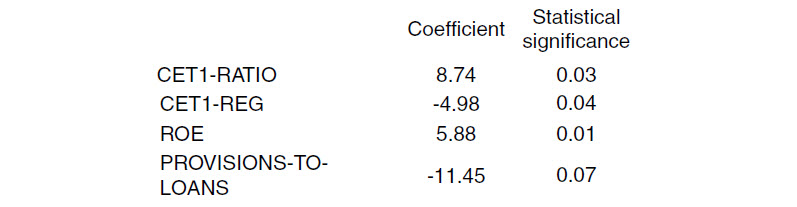

The parameters estimated, and their levels of statistical significance, are as follows:

The results indicate a positive and significant [1] correlation with the capital ratio (CET1_RATIO) and a negative and significant correlation with the capital requirement (CET1_REG). As for the control variables, profitability (ROE) has the anticipated positive effect on price-to-book, whereas asset quality (PROVISIONS_TO_LOANS) presents the expected negative effect.

The estimate of the fixed effects indicates a negative effect associated with 2019 relative to 2018 and 2020. Given that the share prices used date to the March after the year-end of reference for the estimations, the results are consistent with the widespread correction in the banks’ share prices when the WHO declared the coronavirus a global pandemic in the first quarter of 2020 and their partial recovery during the second half of that year and early part of 2021 (Berges et al., 2021).

We also verified the null hypothesis that the absolute values for CET1_RATIO and CET1_REG are identical (zero difference between them). The result of that exercise is that is it not possible to reject that they are equal with a confidence level of 90%.

Model interpretation

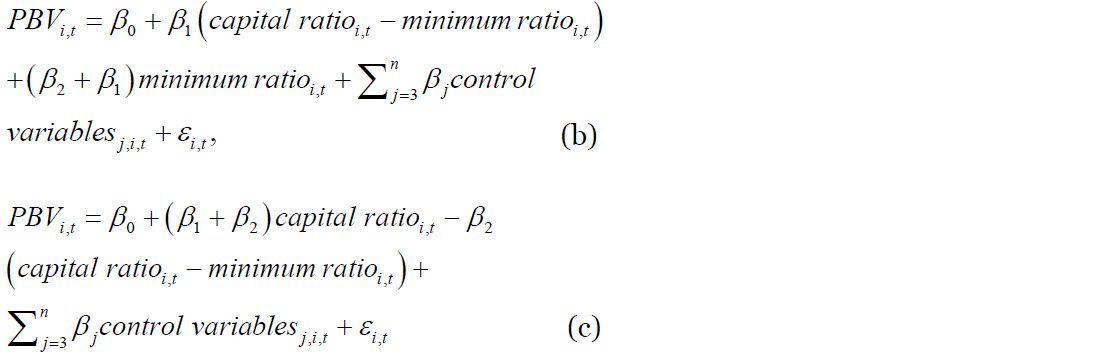

Working with equation (a), it is possible to derive equations (b) and (c):

The coefficient β1 in (a) corresponds to the capital ratio (whereas β2 is the minimum required capital ratio coefficient). Given the coefficients estimated for those variables, the effect of the margin over the minimum required ratio is positive in both (b) and (c).

Looking at approach (b), the regulatory requirement, on its own has a negative effect, insofar as β2 is negative and β1, positive. That coincides with the effect estimated in model 1.

Taking approach (c), the capital ratio on its own has a positive effect, so long as

β1 is higher in absolute terms than

β2. Model 1 effectively gives rise to a higher capital ratio coefficient than the minimum ratio coefficient, thus corroborating that net positive effect. This leads us to conclude that the market not only values the headroom over the minimum capital ratio but also the entities’ absolute capital levels. However, the Wald test

[2] indicates that it is not possible to reject that

β1 is equal to -

β2 with a confidence level of 90%.

In short, the stigma effect is not independent of supervisors’ demands with respect to the minimum level of capital the entities must hold. A reduction in an entity’s capital ratio is penalised by the market. However, if it is accompanied by a reduction in regulatory capital and, therefore, the entities continue to hold the same margin over the minimum required, that penalty is mitigated. Moreover, it is not possible to reject the hypothesis that it is completely neutralised.

The results, therefore, indicate that there is a stigma effect associated with the utilisation of available capital. That effect is not, however, independent of supervisory requirements. When the depletion of capital at an entity is accompanied by a reduction in the regulatory requirement and that entity preserves the same buffer over its minimum ratio, the market penalisation is largely neutralised.

Given these findings, regulators should consider fine-tuning the current buffer system to increase releasability. That would reduce the capital requirement in episodes of recession or significant economic tension, much like the CCyB already works. However, unlike the CCyB mechanism, regulators would need to permit the flexible release of capital buffers in times of unexpected stress (regardless of whether or not linked to the credit cycle). This, by extension, would enable the supervisor to encouraging banks to temporarily use a buffer though the allowance of lower levels of capital on the basis of a wide spectrum of macroeconomic indicators.

Notes

The threshold for statistical significance is 90%, unless stated otherwise.

In statistics, the Wald test assesses constraints on statistical parameters based on the weighted distance between the unrestricted estimate and its hypothesized value under the null hypothesis. The Wald test is one of three classical approaches to hypothesis testing.

References

ANALISTAS FINANCIEROS INTERNACIONALES (2021a). Coste de capital de la banca europea: evolución y factores explicativos [European banks’ cost of capital: trend and explanatory variables] Banking report. Financial Services Research and Watch.

ANALISTAS FINANCIEROS INTERNACIONALES (2021b). Bancos en Bolsa en 2020: líderes en caídas y en recuperación [The banks in the market in 2020: Harshest correction but fastest recovery] Banking report. Financial Services Research and Watch.

ANDREEVA, D., BOCHMANN, P. and COUAILLIER, C. (2020). Financial market pressure as an impediment to the usability of regulatory capital buffers. ECB. Macroprudential Bulletin.

BASEL COMMITTEE ON BANKING SUPERVISION (2020a). Basel Committee coordinates policy and supervisory response to COVID-19. Press release. March 20th, 2020.

BASEL COMMITTEE ON BANKING SUPERVISION (2020b). Basel Committee meets; discusses impact of COVID-19; reiterates guidance on buffers, Press release issued June 17th, 2020.

BEHN, M., RANCOITA. E. and RODRÍGUEZ D’ACRI, C. (2020). Macroprudential capital buffers – objectives and usability. ECB. Macroprudential Bulletin. October 2020.

BERGES, A., ROJAS, F. and AIRES, D. (2021). Market values of European and Spanish banks. Spanish Economic and Financial Outlook, Vol. 10, No. 3, May 2021 AFI.

BORSUK, M., BUDNIK, K. and VOLK, M. (2020). Buffer use and lending impact. ECB. Macroprudential Bulletin.

ECB (2020a). Banking Supervision provides temporary capital and operational relief in reaction to coronavirus. Press release. March 12th.

ECB (2020b). Financial Stability Review, November 2020.

HERNÁNDEZ DE COS, P. (2020). COVID-19 and banking supervision: where do we go from here? Keynote speech at the 21st International Conference of Banking Supervisors, October 19th.

HERNÁNDEZ DE COS, P. (2021). Evaluating the effectiveness of Basel III during COVID-19 and beyond. BCBS-Bundesbank-CEPR workshop.

INTERNATIONAL MONETARY FUND (2021). Global Financial Stability Report: Pre-empting a Legacy of Vulnerabilities. Chapter 1.

MICHAL, K. and MARCIN, W. (2020). Divulgence of Additional Capital Requirements in the EU Banking Union. Economies 2020.

RESTOY, F. (2021). Prudential policy after the pandemic. Speech given at the 33rd Annual Conference of the Group of Banking Supervisors from Central and Eastern Europe, Astana, Kazakhstan, May 27th.

SCHMITZ, S. W., NELLSSEN, V., POSCH, M. and STROBL, P. (2021). Buffer usability and potential stigma effects. SUERF Policy Note.

Javier Restoy and Ángel Berges. A.F.I. – Analistas Financieros Internacionales, S.A.