Spanish fiscal policy in an EU context: The transition back to normal

Although Spain recorded a fiscal deficit in 2022 that was worse than expected, lower extraordinary fiscal support measures, together with upside surprises in GDP and employment, make attainment of the 2023 deficit target look feasible. Going forward, any sound fiscal consolidation strategy for Spain should contemplate that the country’s high structural deficit requires gradual but unflagging and urgent correction.

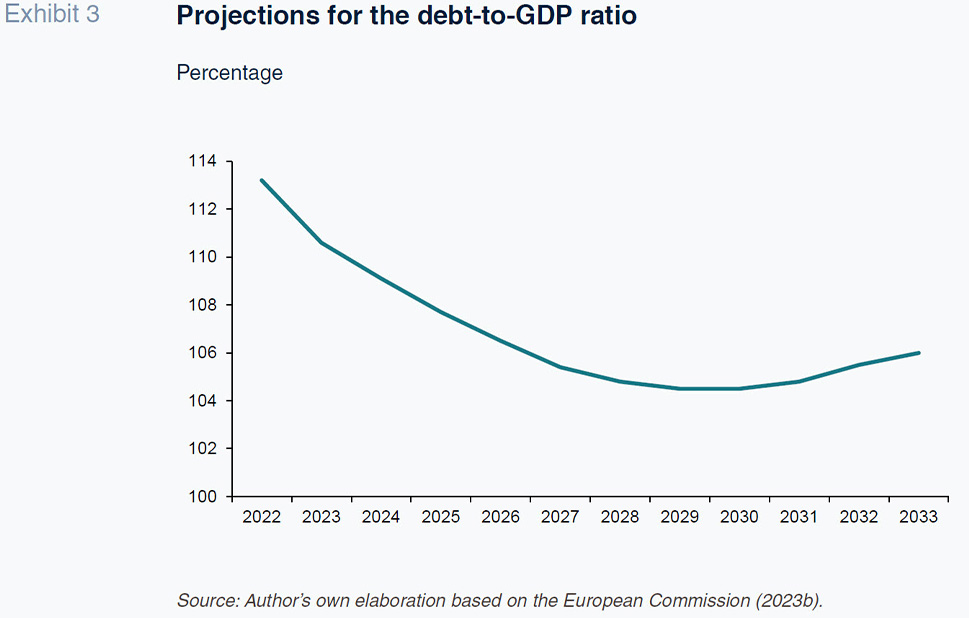

Abstract: Spain recorded a deficit of 4.8% of GDP in 2022, which was better than initially forecast by the government, but worse than the analyst community was forecasting by the end of the year. However, the curtailment of the cost of the expansionary fiscal package and positive surprises in GDP and employment make the 2023 deficit target look feasible. Moreover, 2023 will end four years of extraordinary budget and fiscal policies, with next year marking the year that the Stability and Growth Pact’s fiscal straitjacket will be reinstated, albeit likely in a reformed version. Along these lines, the government is forecasting a gradual reduction to leave the deficit at the permitted threshold of 3% by 2024. As for public debt, starting from a figure of 113.2% of GDP in 2022, indebtedness is expected to decline by 6.4 points to 106.8% by 2026, the end of the projection period. The European Commission’s assessment of Spanish fiscal policy calls for stronger consolidation efforts in 2024, with conclusions and recommendations more general for 2025 and beyond. As regards the Commission’s new fiscal rules framework, the goal of the latest proposal currently under debate is to keep national deficits under 3% in the medium-term and converge towards the debt ratio established by way of common anchor. Any sound fiscal consolidation strategy for Spain should contemplate that the country’s high structural deficit requires gradual but unflagging and urgent correction.

2023 budget outturn

Spain recorded a deficit of 4.8% of GDP in 2022, which was better than initially forecast by the government (5.0%), but worse than the analyst community was forecasting by the end of the year (Lago Peñas, 2022). The consensus forecast was for a deficit of 4.3% of GDP, which would have made delivery of the target set for 2023 very achievable (3.9%).

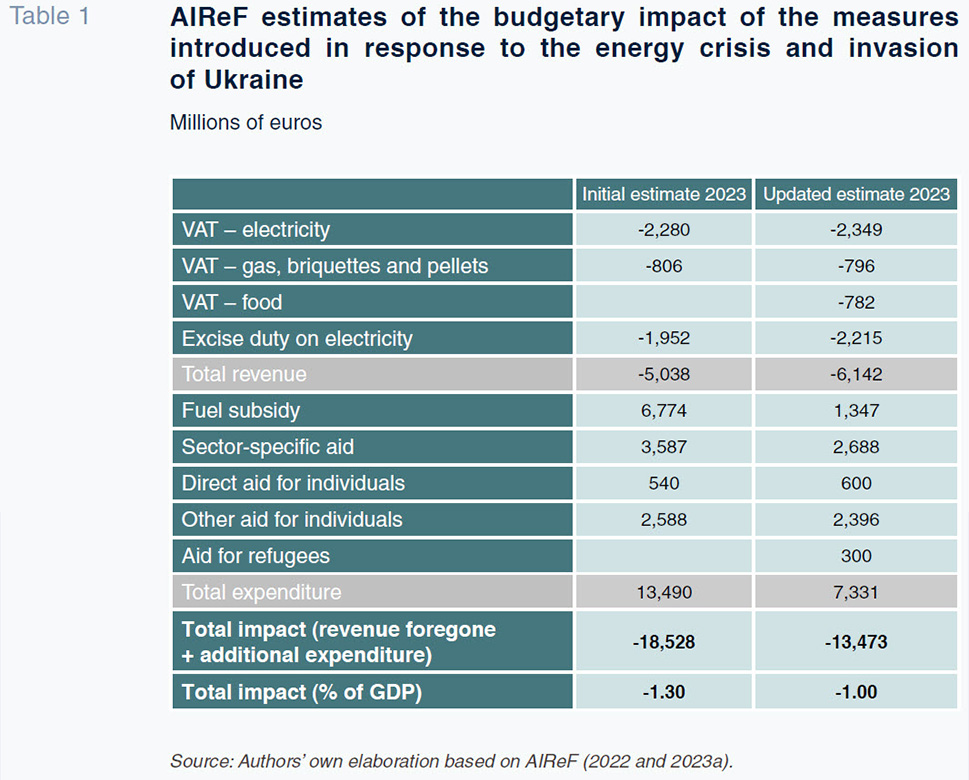

On the positive side, the rollover of the measures for tackling the fallout from the war in Ukraine and resulting inflationary pressures will be less expensive than initially expected. In October 2022, AIReF estimated that the full rollover of the initial measures would have had a financial impact equivalent to 1.3% of GDP. However, the government has pared those measures back, specifically eliminating the non-targeted fuel subsidy to households. In fact, despite the introduction of new measures, such as reduced VAT on food products, the overall cost of the package has decreased by around 5 billion euros, or 0.3pp of GDP. Table 1 presents the difference between AIReF’s

ex-ante simulations and its recent estimates, dated to May.

Moreover, Spanish GDP is performing considerably better than expected by analysts. When the 2023 budget was presented and debated, the government’s growth forecast (2.1%) was widely considered too optimistic. The Funcas consensus as of November 2022 was for growth of 1.1%. Since then, however, the analyst community has been revising those growth estimates upwards. Specifically, the Bank of Spain is now looking for growth of 2.3% (2023) and the Funcas (2023) consensus forecast has risen to 2.1%.

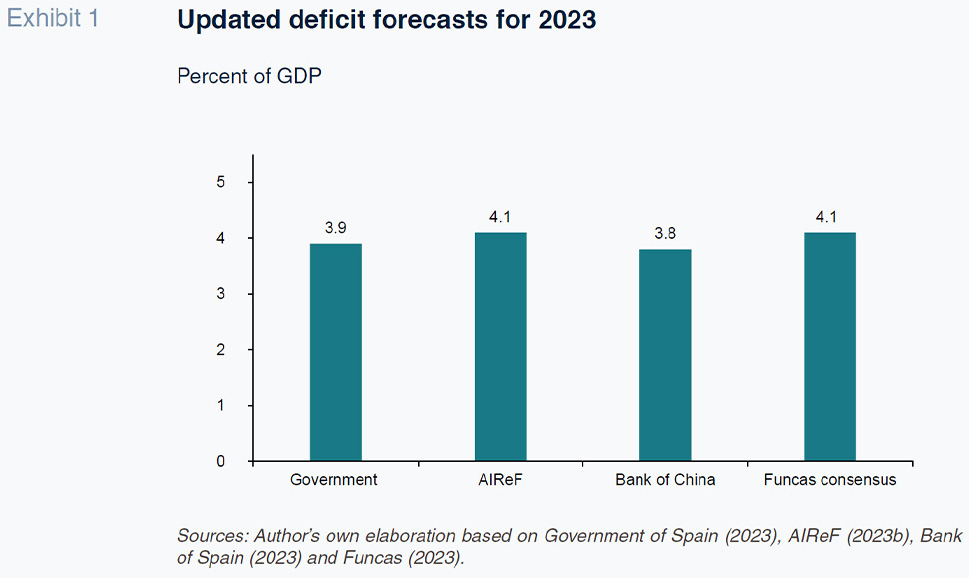

In short, although 2022 ended worse than expected the curtailment of the cost of the expansionary fiscal package and the positive surprises in GDP and employment make the 2023 deficit target look feasible (Exhibit 1).

Government plan for 2023-2026

2023 will end four years of extraordinary budget and fiscal policies. The chain of crises triggered by the pandemic and invasion of Ukraine prompted activation of the Stability and Growth Pact (SGP) escape clause, so preventing the application of the excessive deficit procedure. In 2024, however, the Pact straitjacket will be reinstated, albeit in all probability in a reformed version. In the last section of this article, we refer to the current status of the debate around this development. Suffice to say here that whatever shape the new version takes, it will usher in a period of fiscal consolidation and the end of the current exceptional situation.

Two additional factors define the era beginning in 2024. The first and most important: the general elections in July open the possibility of a change of government and will at any rate mark the start of a new legislative term with a host of implications for government impetus. The second is the fact that the fiscal package implemented to mitigate the effects of the invasion of Ukraine will have only a marginal impact: 184 million euros according to AIReF (2023a), which is equivalent to less than 0.2pp of GDP.

In light of the foregoing, the updated Stability Programme for 2023-2026 should be viewed as a scenario subject to potentially significant changes, whether at the government’s initiative or required under the reinstated Pact. As a result, the most interesting aspect is an assessment from the credibility standpoint. To what extent do the deficit and debt figures fit with current macroeconomic projections and foreseeable spending and revenue dynamics?

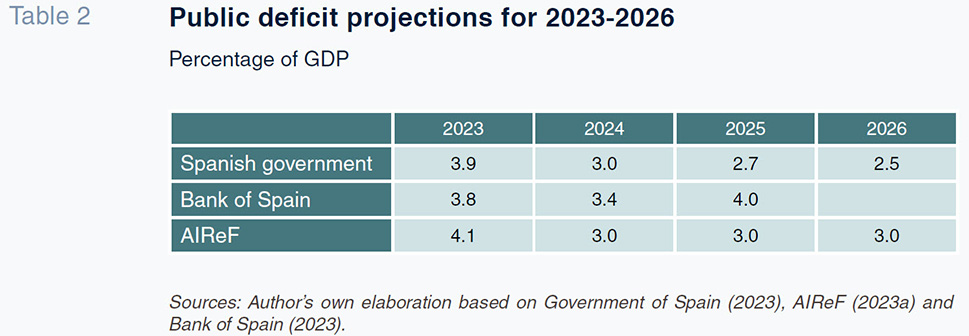

Table 2 sheds light on the deficit variable. The government is forecasting a gradual reduction to leave the deficit at the permitted threshold of 3% by 2024. AIReF is a little less optimistic about the probability of bringing the deficit under that threshold in the absence of additional adjustments. The Bank of Spain is forecasting a lower deficit than the government is targeting in 2023 but thinks it will climb back up to 4% in 2025.

The differences between the government and AIReF figures lie with the revenue estimates. AIReF is forecasting less dynamic tax revenue, specifically due to lower growth in personal income tax and, in 2023, the tax breaks introduced to mitigate the effects of the energy crisis and inflation. In 2024, the gap between the two institutions’ sets of forecasts narrows due to the withdrawal of the energy product tax relief and the spike in collection from temporary tax measures. By 2025, those measures disappear, leaving only the impact of the regulatory changes made to personal income tax this year. Elsewhere, most of the differences with respect to the trajectory forecast by the Bank of Spain similarly lie on the revenue side, namely the withdrawal of the temporary tax measures in 2025 and the assumption that the surprising increase in tax revenue observed in 2020-2021 will partially revert. On top of that, the losses on the loans extended by Spain’s official credit institute, ICO, in response to the pandemic are expected to materialise for the most part in 2024 and 2025. Overall, the Bank of Spain believes fiscal policy will be slightly expansionary in 2023, moderately contractionary in 2024 and expansionary in 2025.

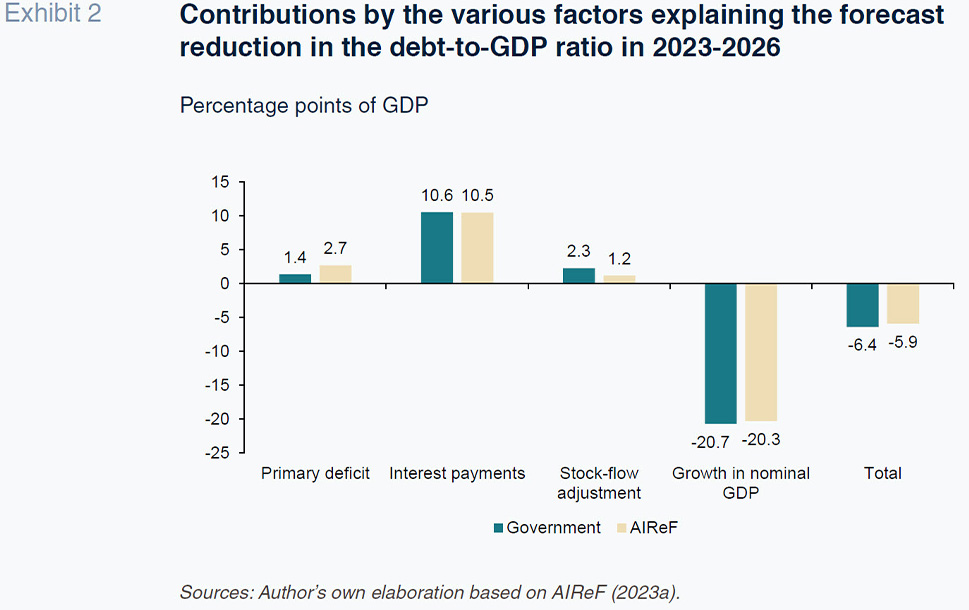

As for public debt, AIReF has, essentially, endorsed the scenario contemplated by the government in its updated Stability Programme. Exhibit 2 provides the breakdown of the estimated change in the debt ratio between 2023 and 2026. Starting from a figure of 113.2% of GDP in 2022, indebtedness is expected to decline by 6.4 points to 106.8% by the end of the projection period. According to AIReF, debt will be half a point higher in 2026: 107.3%. In both instances, the only factor helping Spain deleverage is the growth in nominal GDP. To illustrate the power of this force, in a zero deficit scenario and assuming no adjustments, the debt ratio would drop to 92.5% over the four-year period. That highlights how ambitious intervention to reduce the structural deficit is, in general, sufficient to unlock a swift and sizeable reduction in the debt ratio.

Fiscal stability in Spain from the European Commission’s viewpoint

The contents of the European Commission’s assessment of Spanish fiscal policy is a mix of analysis and regulatory considerations and refers to both the short- (2023 and 2024) and longer-term.

In 2023, the Commission’s forecast for Spain’s deficit (4.1%) is a little higher than the government’s (European Commission, 2023a). It is likely, however, that the gap will narrow or disappear altogether in light of the widespread improvement in the outlook for GDP growth. The Commission has corroborated that the growth in nationally financed primary current expenditure will be in line with the country specific recommendation (CSR) made by the European Council.

The assessment calls for stronger fiscal consolidation efforts in 2024. The deficit is not expected to drop below 3.3%, with the debt ratio forecast at 109.1%. As a result, the Commission believes Spain needs to reduce its structural deficit by an amount equivalent to at least 0.7pp of GDP, prompting the recommendation that Spain keep growth in nationally financed current expenditure at under 2.6% in 2024. The reality is that both figures are feasible. The Stability Programme already contemplates a reduction of 0.5pp in the total structural deficit and of 0.7pp in the primary structural deficit, while the European Commission itself notes in its assessment that, by its calculations, assuming no major policy changes, net primary expenditure will only increase by 1.4% in 2024.

For 2025 and beyond, the conclusions and recommendations are more general. The Commission simply underlines the need to combine a gradual and sustainable fiscal consolidation strategy with reforms designed to stimulate higher sustainable growth so as to attain a prudent fiscal situation in the medium-term. The debt sustainability analysis included in the Country Report accompanying the Recommendations (European Commission, 2023b) provides additional insight into the Commission’s thinking. Although the short-term fiscal sustainability risks (2023-2024) are classified as low, the medium-term risks (2033) are perceived as high. The projection for 2033 in the baseline scenario is that debt will remain at 106% of GDP (Exhibit 3), while the stochastic debt projections suggest a 32% probability that in 2027, Spain’s public debt ratio will be higher than that of 2022. It is interesting to note that the baseline ratio projected by the Commission for 2026 (106.5%) is, in fact, slightly lower than that calculated by the government and AIReF. That suggests that Spain has ample time to design and implement a consolidation strategy that would put Spanish debt well below the 100% mark by the end of the decade.

The new fiscal rules: Notes on the reforms underway

The European Commission published its proposals for redefining the European Union’s fiscal governance framework on 11 November 2022. The proposal respects the limits set down in the EU Treaty: a maximum deficit of 3% of GDP and a maximum debt ratio of 60%. It acknowledges, however, that many member states are far from meeting these thresholds, especially the debt ceiling. To prevent sharp and costly adjustments, the Commission proposes a dual approach in the medium- and long-term. The countries that are close to meeting the thresholds should stick with them, whereas those that are far from them must commit to gradually converging towards them. As for simplification of the rules, the idea is to use the rate of growth in nationally financed net primary spending as a key indicator. That indicator excludes interest payments, expenditure on unemployment benefits and expenditure financed by discretionary measures or European funds. The structural deficit and the requirement to reduce debt by one-twentieth will no longer be relevant variables. The goal is to keep national deficits under 3% in the medium-term and converge towards the debt ratio established by way of common anchor. The proposal is to take a multi-year approach with time horizons of four to seven years for government fiscal plans. One idea is to evaluate budget stability as a process using tools such as stress tests and stochastic analysis. The member states would be required to design plans that are consistent with these evaluations in order to ensure fiscal stability. The escape clauses will be left place for tackling symmetric and asymmetric shocks such as the pandemic or intense crises that affect a single member state. Although public investment financed nationally would be considered expenditure, the Commission acknowledges the importance of the investments needed for the green and digital transitions. The role of the national fiscal authorities will be reinforced around plan definition and supervision, but the European Commission will remain the key player. The proposal entails revising the enforcement regime, lowering financial penalties but making them more frequent and introducing reputational penalties.

Publication of this Communication marked the start of debate among the member states which gave rise to a legislative proposal presented on 26 April 2023, which introduces some significant changes. Firstly, countries with a deficit of over 3% of GDP will be required to reduce their deficits annually by an amount equivalent to 0.5% of GDP. Secondly, the debt/GDP ratio must come down significantly over the course of the national four-year plans. Thirdly, when the plans are extended to seven years, the bulk of the adjustments must take place in the initial years. Fourthly, national net expenditure must be always kept below medium-term output growth. And fifthly: countries that deviate from their plans in the medium-term will by default come under the umbrella of an excessive deficit procedure.

Although this legislative proposal has already garnered significant backing, having been endorsed by the International Monetary Fund, [1] the agreement will require a second round of modifications. At the time of writing, the debate was ongoing. From what has reached the media, it appears that some of the member states are advocating for greater rigidity and controls. In an Op-Ed article published in several European newspapers on 15 June by the German Finance Minister, Christian Lindner, which was endorsed by another 10 finance ministers, [2] the message was clear: “These proposals should be seen as a steppingstone in our discussions in the Council, not as a conclusion”. The article emphasises the need to balance finances and reduce debt in good times to prevent continuous and unsustainable growth in debt. This idea is borne out by the German government in its reiterated proposal of having the most indebted nations reduce their debt ratios by at least 1% per annum. He also warns that, irrespective of its use, debt is debt in the eyes of the capital markets, calling into question the golden rules for public investment that does not compute for the purposes of application of the fiscal rules, and he expresses scepticism about time horizons for necessary consolidation work that go beyond one term of office on account of the risk of postponing difficult decisions.

The final agreement should be reached during Spain’s Presidency of the European Semester, giving the Spanish government a prominent role and some control over the process. However, that role also requires it to act neutrally. The fact that major economies, such as France and Italy, are in similar situations to Spain ensures that its interests will be well represented. Moreover, it must be said that, to some extent, Germany’s demands should in actuality constitute core elements of any sound fiscal consolidation strategy for Spain: the country’s high structural deficit requires gradual but unflagging and urgent correction; reductions of 0.5-0.7pp per annum in the structural deficit over the next four years and of 1% per annum in the debt ratio may be seen as ambitious but necessary if the country wants to regain margin for fiscal policy and be able to cushion the higher cost of money any time soon.

Notes

“The European Commission’s legislative proposal for economic governance reform would appropriately promote a differentiated, risk-based medium-term fiscal adjustment. Relying on net primary expenditure as the operational target simplifies the framework and allows countercyclical automatic stabilizers to operate. At the same time, cautious implementation of the framework would be critical. The possibility to extend adjustment periods in return for growth-enhancing reforms and investment is positive but relying on overly optimistic growth estimates must be avoided. In this context, an Independent European fiscal council could add credibility to the process. An EU-wide fiscal capacity for macroeconomic stabilization and provision of public goods would also strengthen the framework. It is vital that an agreement is reached soon so the new framework can anchor fiscal policies in 2025 and beyond.” (

https://www.imf.org/en/News/Articles/2023/06/15/euro-area-imf-staff-concluding-statement-of-2023-mission-on-common-policies-for-member-countries).

References

Santiago Lago Peñas. Professor of Applied Economics at Universidade de Vigo and Senior Researcher at Funcas