Economic projections for Spain: 2023-2024

Despite a period marked by uncertainty, the Spanish economy has remained resilient, outperforming analysts’ expectations. Export performance has been particularly strong; nonetheless, downside risks remain, particularly those related to a sharper than anticipated monetary policy tightening, vulnerabilities in the shadow banking system at the EU level, and the elevated stock of public debt.

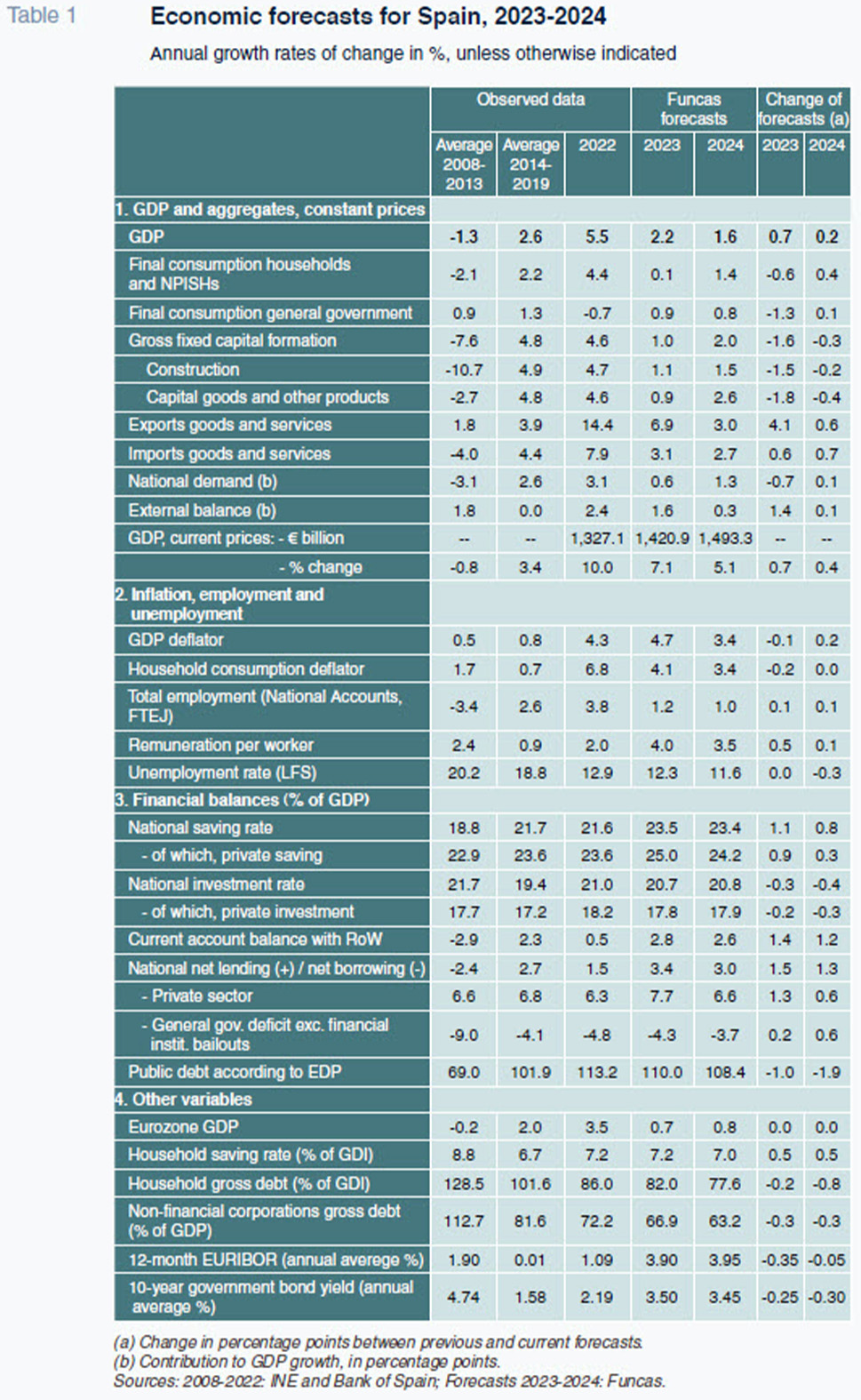

Abstract: The energy crisis and war in Ukraine marked the start of a period of uncertainty for the Spanish economy (Torres and Fernandez, 2022). However, the main macroeconomic variables have performed better than most analysts were expecting. This resilience may be attributable to the competitiveness of Spanish exporters, the absence of a property bubble (in contrast to the situation prevailing in many other European economies) and low household indebtedness. In the months ahead, the Spanish economy will be shaped by the disinflation process and monetary policy developments. Overall, despite anticipated cooling, the strong start to the year is expected to leave GDP growth at 2.2% in 2023, up 0.7 points from our last set of forecasts. In 2024, growth is expected to slow to 1.6%, albeit improving as the year unfolds. There are also downside risks, however, especially surrounding the risk of sharper than anticipated monetary tightening. A more pronounced increase in borrowing costs than we are estimating would exacerbate risks in the more vulnerable sectors. Elsewhere, the ECB has warned of vulnerabilities in the finances of the shadow banking system with potential consequences for the European economy. Lastly, the persistence of a high public deficit is a source of vulnerability for the Spanish economy with the European fiscal rules about to come back into play and the ECB withdrawing support in the form of low rates and debt repurchases, a worry with Spain due to step up public debt issuance this year.

Recent economic performance in Spain

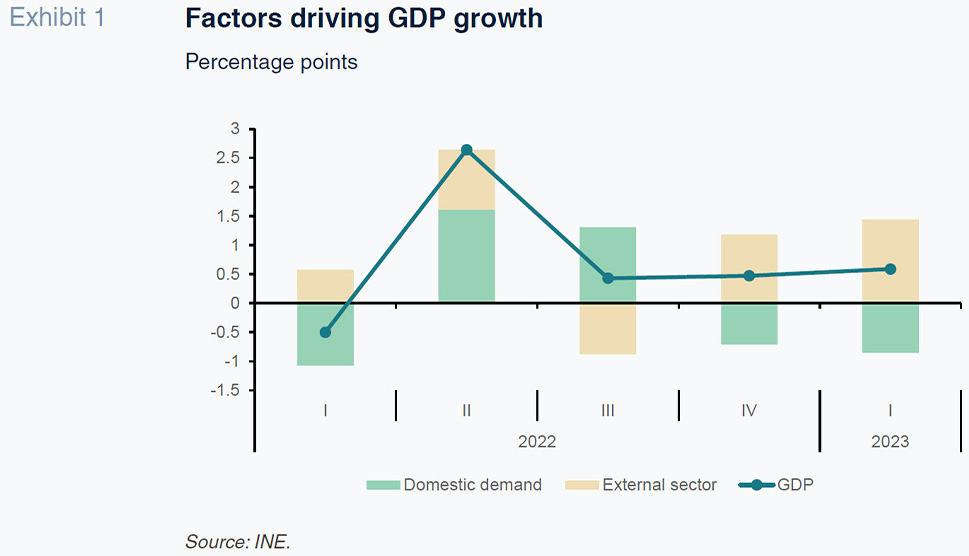

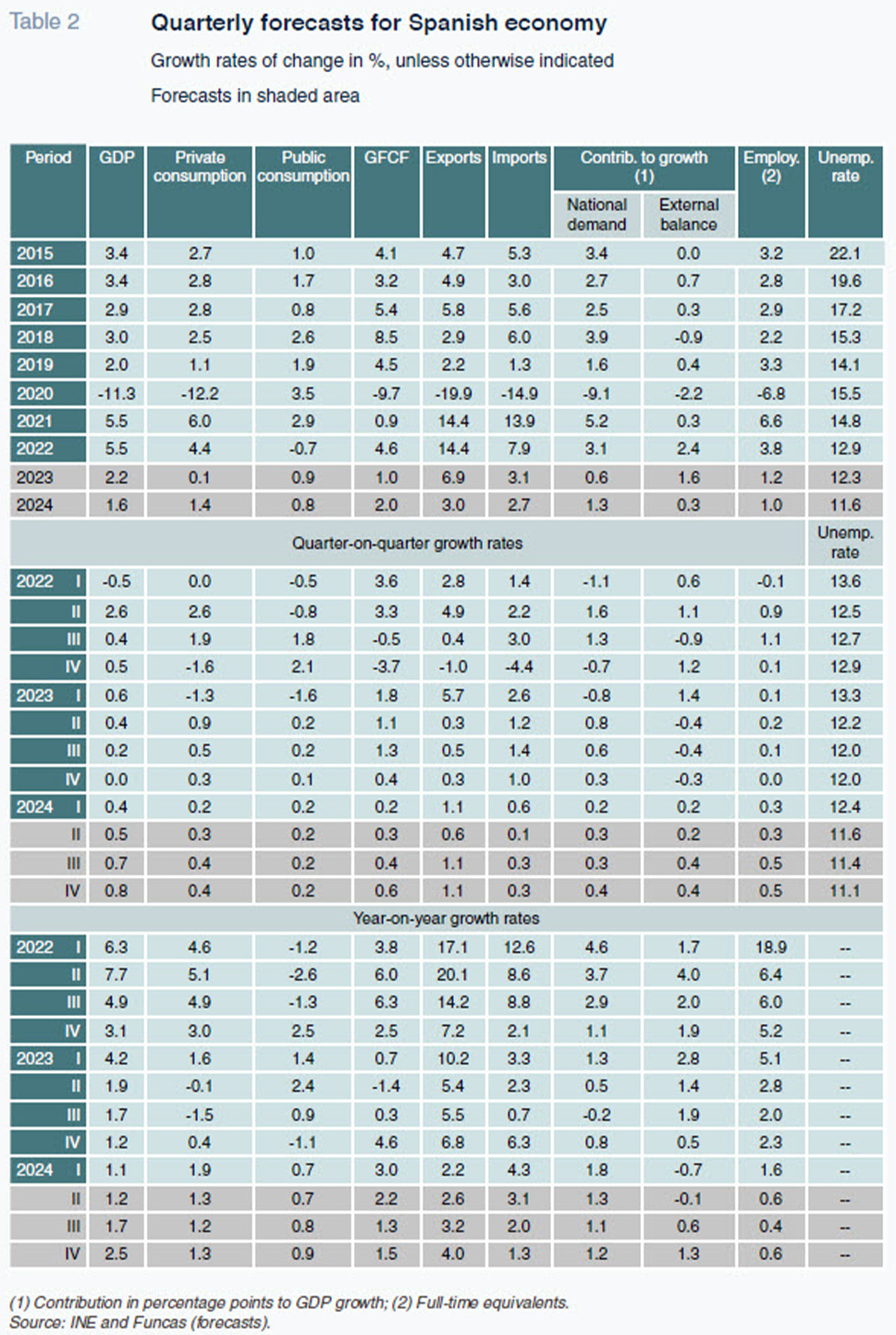

According to the revised quarterly national accounts, Spanish GDP recovered pre-pandemic levels in the first quarter of 2023, having increased by 0.6% from the previous quarter. The fourth quarter 2022 growth figure was revised upwards to 0.5%. These figures contrast with the contractions recorded by the eurozone in both periods. They do, however, mask considerable weakness in domestic demand, which contracted in both quarters, with the slump in private consumption particularly noteworthy, having shrunk by an accumulated 2.9% in the two periods in real terms. Therefore, GDP growth was fuelled by external trade: imports fell in the last quarter of 2022, while tourism exports rebounded sharply in the first quarter of 2023 (Exhibit 1).

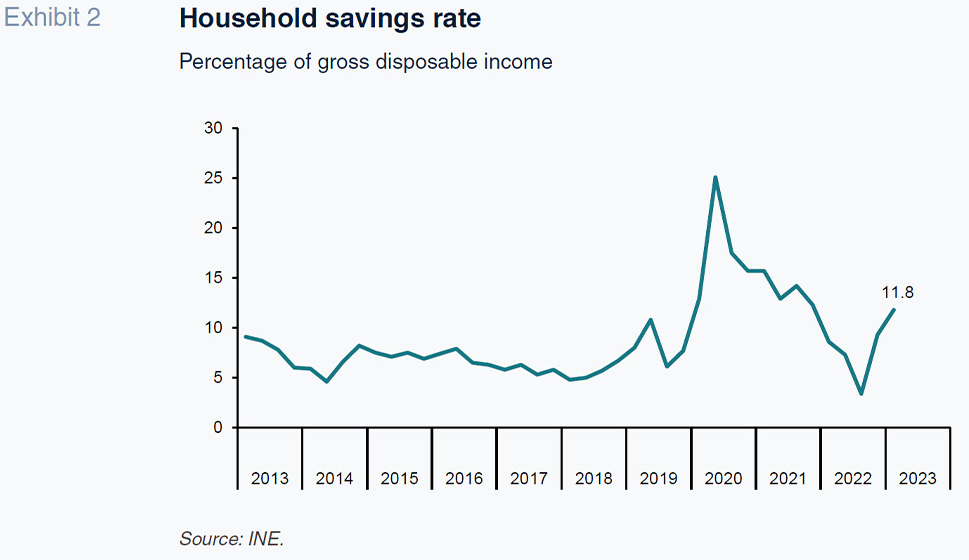

While private consumption fell, growth in household disposable income accelerated by 10.1% year-on-year in the first quarter of 2023, thanks to gains in employee compensation, social benefits (mainly pensions) and, to a lesser degree, property income, and despite a 52% jump in interest payments. As a result, the savings rate recorded in the first quarter of 2023 was the highest first-quarter figure since 2004, excluding the years of the pandemic – 2020 and 2021, which were marked by anomalous surplus savings. In deseasonalised terms, the household savings rate rose to 11.8% from 9.3% the previous quarter (Exhibit 2).

As for the second quarter, available indicators provide mixed signals. In general, those related with industrial activity began the quarter weaker, whereas those related with services fared somewhat better. In June, most of the sentiment indicators sustained widespread deterioration, as did both the manufacturing and services PMI readings. Employment, according to the Social Security contributor reports, also slowed considerably in June, following an excellent performances in the previous two months. Elsewhere, housing sales are easing, as are new mortgages. Likewise, new business loans, which started to contract at the end of last year, remained lacklustre at the start of the second quarter.

The result is that the economy as a whole appears to have lost momentum as the quarter unfolded. Quarterly growth is estimated at 0.4%.

Headline inflation fell to 1.9% in June, its lowest level since March 2021, as a result of a pronounced base effect in energy products, for which prices peaked in June of last year. Core inflation – at 5.9% – continues its sluggish descent. Inflationary pressures, while remaining strong in food and services, seem to be easing. With respect to food prices, the trend in agricultural commodity prices in the international markets and in the prices fetched along the production chain foreshadow a potential end to the upward spiral of costs. It will take time, however, before the slowdown in costs is transmitted to final consumer prices, in light of lags in price transmission coupled with the fallout from the drought.

The ECB increased rates by a total of 50 basis points in May and June. 12-month Euribor continued its upward trend, ending June at 4.1%, which is 3.2 percentage points higher year-on-year. The yield on 10-year government bonds held relatively steady with respect to prior months at around 3.4%. The risk premium was likewise stable.

The current account surplus hit a new record in the first quarter of 2023 of 10.3 billion euros. The goods trade deficit narrowed year-on-year, whereas the services trade surplus, in both tourism and non-tourism exports, registered strong growth, offset only slightly by a small increase in net property income paid overseas.

The public deficit amounted to 2.2 billion euros in the first quarter of 2023, compared to 6 billion euros in the same period of 2022. The improvement was driven by revenue growth, particularly from personal income taxes and social security contributions. On the spending side, pensions increased a substantial 3.7 billion euros compared to the first quarter of 2022. Public consumption, however, is growing at moderate rates.

Projections for 2023-2024

In the months ahead, the Spanish economy will be shaped by both the disinflation process and monetary policy developments. It is therefore worth outlining the assumptions underpinning our forecasts in both respects. Firstly, exogenous drivers will keep inflation on a slowing path, thanks to stabilisation in energy and agricultural commodity markets and the resolution of supply chain bottlenecks in key sectors such as microchips. Elsewhere, in line with the ECB’s diagnosis, the weakening of demand is conducive to reduced profit-push inflation, all the more so because corporate profits are already back above pre-pandemic levels – on average and on a per-unit-of-product basis – (Hahn, 2023). All of that should create room for a slight recovery in the purchasing power of wages as from next year, without, however, triggering major second-round effects. In other words, we are not expecting a widespread wage-profit doom loop.

Secondly, considering the ECB’s concerns about high core inflation in most eurozone countries, our projections assume two additional interest rate hikes to leave the deposit facility rate at 4% by the end of September. We think interest rates will stay at that level until at least the second quarter of 2024, i.e., until the ECB considers the disinflation process well entrenched.

Starting from these assumptions, in the near-term we are looking at a heightening of the signs of weakness observed of late as a result of monetary tightening, with growth slowing in the second half of the year. Beyond that, however, the stabilisation of interest rates, coupled with slight growth in real wages (thanks to the incomes agreement), should lead to a gradual economic recovery.

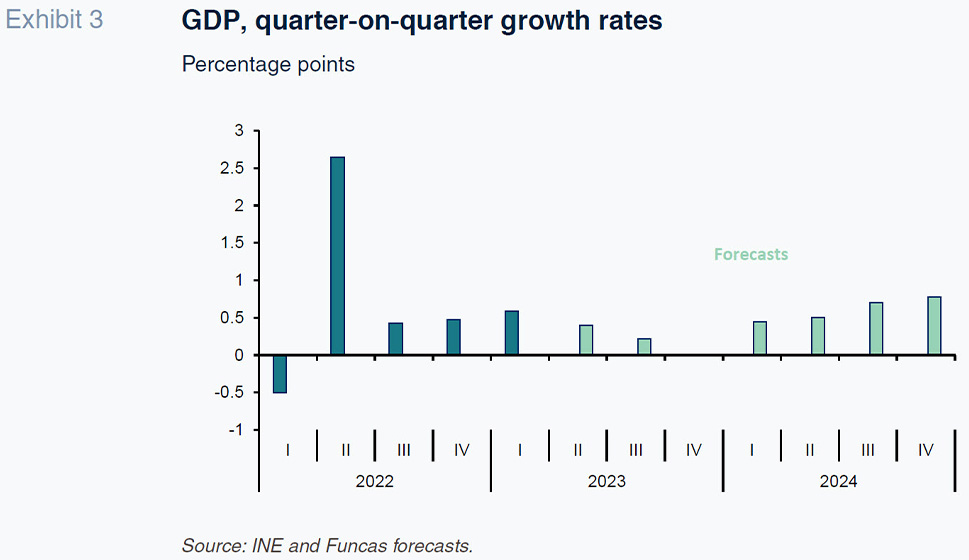

Overall, despite the anticipated cooling, the strong start to the year is expected to leave GDP growth at 2.2% in 2023, up 0.7 points from our last set of forecasts. This revision is driven almost entirely by the carryover effect of the upward revision of the fourth-quarter 2022 growth figure by the INE and the stronger than expected economic performance in the first quarter (adjustments not known at the time of our last report).

Growth will come mainly from external trade, which is expected to contribute 1.6 percentage points of the total, thanks largely to momentum in tourism, but not only: Spain is expected to gain market share in trade in both goods and non-tourism services, reflecting the strong competitive positioning of Spanish companies –a factor especially relevant at a time of “de-risking” of global supply chains.

The strong results by the external sector should offset the impact of weak internal demand, which is only expected to contribute 0.6 points to GDP, due to stagnating private spending, undermined by households’ loss of purchasing power and the inability of many families to continue to draw from savings to fund their consumption. Public consumption, meanwhile, is expected to increase at a moderate pace, in line with the recent trend in this aggregate. Investment should prove a little more dynamic thanks to the impetus provided by the NGEU funds, albeit losing steam as the year progresses as a result of the higher borrowing costs.

In short, the contractionary effects of prevailing monetary policy will be felt more keenly in the second half of the year (Exhibit 3).

This slowdown will carry over to 2024, when growth is expected to slow to 1.6%, albeit improving as the year unfolds. Next year the main driver should be internal demand, thanks to a slight recovery in household purchasing power as a result of the anticipated disinflation and the incomes agreement. The pause in rate tightening, coupled with the delayed effect of exports, should provide a stimulus for new investments at the end of the projection period. On the other hand, no major changes are expected with respect to public consumption trends, pending more insight into where fiscal policy could be headed next year. The external sector is expected to continue to make a positive contribution to growth, albeit smaller than in 2023 as the impact of the normalisation of tourism runs its course.

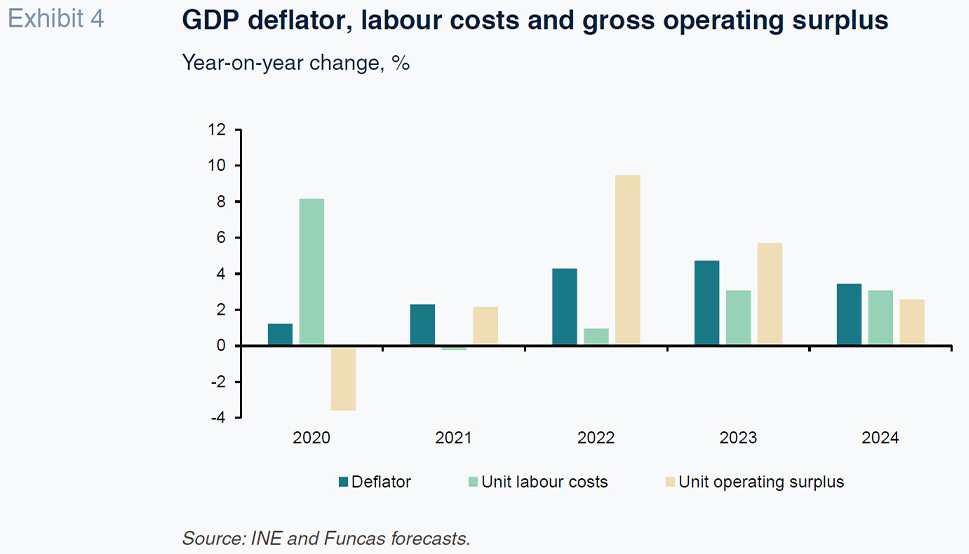

The drop in energy prices will help ease inflation, which is nevertheless expected to remain above the ECB’s target throughout the projection horizon. The deflator for household consumption is forecast to decrease to 4.1% this year (which is 0.2 points below our previous estimate) and to fall to 3.4% in 2024 (unchanged). The GDP deflator, which measures the pressure exerted by internal prices by stripping out imported costs, is expected to rise sharply to 4.7% in 2023 and return to 3.4% in 2024. This tendency towards moderation should lead to gradual contention of corporate profits, which would facilitate a slight recovery in wages in 2024 (Exhibit 4).

[1]

The boom in net exports of goods and services, coupled with an improvement in the real terms of trade associated with cheaper imports, is expected to yield a significant increase in the external surplus. The current account surplus is forecast at over 2.5% of GDP throughout the projection period, five times more than in 2022. The result in terms of the total external surplus (which is deduected by adding European fund transfers to the current account surplus), looks even stronger, accelerating the reduction in Spain external indebtedness.

In addition to the external surplus, the labour market should remain one of the main sources of economic resilience in Spain. The rate of unemployment is forecast at 11.6% in 2024, which would still be double the European average.

The economic slowdown, coupled with the measures taken to combat inflation, the indexation of pensions and the increase in debt service costs generated by the increase in interest rates, will make it hard to correct budget imbalances. In the absence of further deficit-cutting measures, we are estimating a deficit of 3.7% in 2024, with public debt at over 108% of GDP, which is 10 points higher than before the onset of the pandemic.

Risks

It is important to note that the Spanish economy is performing better than predicted by most analysts. Its relative resilience may be attributable to the competitiveness of Spanish exporters, the absence of a property bubble (in contrast to the situation prevailing in many other European economies) and low household indebtedness. Those factors could therefore yield further positive surprises in the months to come.

There are also downside risks, however, especially around the impact of monetary policy tightening. Interest rate increases could be sharper than we are currently anticipating if inflationary pressures continue –a stance which cannot be ruled out considering that some eurozone economies are close to full employment. A more pronounced increase in borrowing costs than we are estimating would magnify the risks facing the more vulnerable sectors. Elsewhere, the ECB has warned of vulnerabilities in the finances of the shadow banking system with potential consequences for the European economy, a source of potential instability that is increasing with each turn of the monetary policy screw.

Lastly, the persistence of a high public deficit is a source of vulnerability for the Spanish economy, with the European fiscal rules about to come back into play and the ECB withdrawing monetary and liquidity support –a worry with Spain due to step up public debt issuance this year. In addition, yields on 10-year bonds have risen from below 1% not long ago to around 3.5%, which will increase the ratio of debt service payments over GDP. In the absence of fiscal consolidation measures, there is no guarantee that debt will come down as a percentage of GDP as from 2025. Although the risk premium remains stable for now, the situation could change in the event of turbulence in the financial markets.

Notes

[1] For an analysis of margin and wage dynamics in inflation, refer to R. Torres (2023).

References

Raymond Torres and María Jesús Fernández. Funcas