Importance and characteristics of the bancassurance business in Spain

The weight of bancassurance in Spain´s insurance business and its contribution to parent banks’ domestic earnings are very significant. As a result, as evidenced by the recent COVID-19 crisis, as well as in normal times, the relatively substantial contribution of the bancassurance business lends earnings stability and solidity to the banks with the most developed such businesses.

Abstract: Of the 199 insurance providers doing business in Spain, 33 have ties to the main banking groups. Their weight in the country’s insurance business, especially the life insurance segment, and their contribution to their parent banks’ domestic earnings are very significant. As a result, the bancassurance business has been key to propping up the banks’ earnings during periods of significant loan loss provisioning. That is true of the banking crisis of the last decade and, more recently, the COVID-19 crisis. Even during more normal times, the relative contribution of the bancassurance business to the banking sector’s earnings is very substantial, lending earnings stability and solidity to the banks with the most developed such businesses.

Introduction

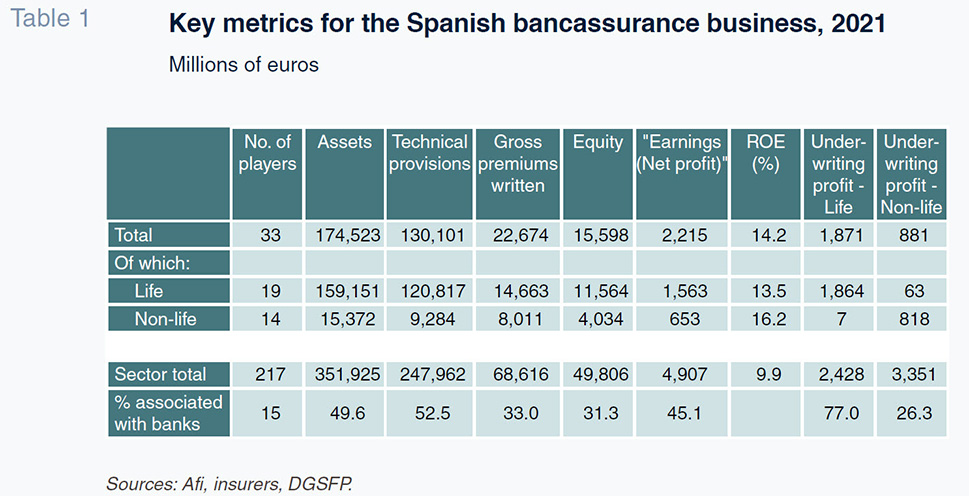

Of the 199 insurance companies doing business in Spain as of the end of 2021, 33 had ties to institutions or banking groups covering almost the entire market. The links with those insurers, whose key metrics and ratios are provided in Table 1, come in many different forms: wholly- or majority-owned subsidiaries of banking groups; substantial interests associated with bancassurance agreements with benchmark providers; or, lastly, significant minority interests in insurance companies.

Consistent with the fact that the banks are the main channel for the distribution of life insurance in Spain (savings and life insurance), the majority of them - 19 - operate in the life insurance segment, while the remaining 14 are active in non-life insurance. That being said, the banks are increasingly displaying interest in the non-life segment.

The 33 insurers with bank ties account for 50% of the insurance business in Spain measured in terms of assets, technical provisions managed or earnings, as shown in Table 1. Those entities’ heavyweight status in the Spanish insurance sector is, nevertheless, clearly concentrated in the life business (with a significant financial component). In 2021, they were responsible for 77% of the aggregate income generated by that business line in Spain. In contrast, the entities associated with banking groups generated ‘only’ just over 26% of the non-life business line’s earnings.

The second important trait of the insurers associated with the banks, as noted in previous reports, is their greater earnings generation capacity. In contrast, their use of own funds (their capitalisation) is relatively smaller than the rest of the sector. By way of illustration, in 2021, those companies generated 45% of the insurance sector’s earnings, while their equity accounted for a lower 31% of the total of the players operating in Spain. Here there are two factors at play: (i) relatively lower capitalisation levels at the entities associated with banking groups as a result of the preference to place ‘surplus’ capital at the parent (a bank); and, in parallel (ii) relatively greater business efficiency (compared to the universe of entities not associated with banks), with a positive impact on earnings.

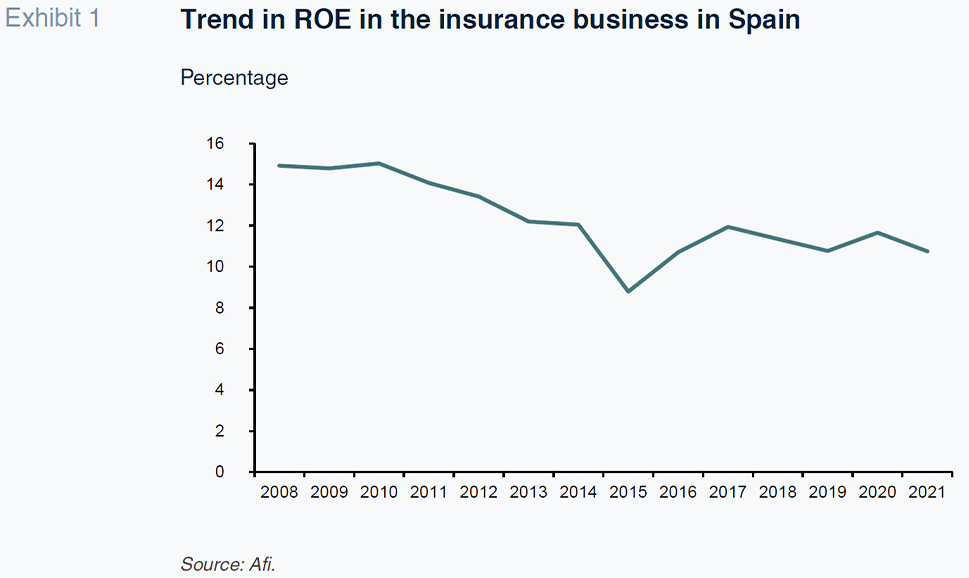

The combination, in relative terms, of higher earnings and reduced use of own funds for accounting purposes translates into a third noteworthy characteristic: considerably higher profitability compared to the rest of insurance providers. Specifically, the average ROE of the 33 insurers related to banking groups topped 14.2% in 2021, compared to under 8% across the rest of insurers. [1] As a result, the Spanish insurance sector would have reported an average ROE of virtually 10% in 2021 [2] (11.2% in 2020).

Although the sector as a whole has historically stood out for its double-digit returns, as shown in Exhibit 1, those returns have declined of late. Last year, the Spanish insurance sector was marked by a ‘return to normal’ following the exceptionally-high returns obtained during the pandemic (see Manzano and Milner, 2022),shaped largely by the reduction in mobility and claims during the lockdown.

By comparison, the Spanish banking business’ earnings and profitability rose sharply in 2021 as a result of the significant provisioning effort undertaken in 2020 (the year of the pandemic) and the buoyant subsequent business recovery.

Banks, leader in life segment

The insurers with ties to the banking industry continue to present a mix of organisational structures in both the life and non-life segments. In life, half of the banking groups have opted for autonomous operation of the insurance business; however, very few banks operate in the segment independently, with most sharing ownership with specialist partners.

The fact that the banks are the predominant distribution channel in the life insurance business (for both savings and risk products) is the key determinant of the banks’ supremacy in this segment (a little over 75% in terms of the underwriting profit of the insurers with ties to the banks in the life segment). Contributing factors include the reach of the Spanish banks’ branch networks, the proximity between savings insurance and the financial business and the importance of mortgages in the sale of life insurance products (an area that has registered growth in the wake of the pandemic).

The relative importance of each business varies from one bank to the next. Overall, the seven biggest banking groups account for over 90% of the life bancassurance business in Spain, which generated 1.56 billion euros of profits in 2021. A very substantial portion of that figure (90% of the total, derived from each of the banks’ percentage interests in their insurance investees) translated into profits for the banks last year.

Albeit much smaller than in life insurance, the banks’ share of 20%-30% of the non-life insurance business is not insignificant and is particularly relevant at certain specific institutions. The non-life insurers associated with the banks generated a little over 650 million euros of profits in 2021, of which close to 50% made a direct contribution to their shareholding banks’ P&Ls. [4]

In other words, the bancassurance business makes a significant direct contribution to the banks’ profits. Indeed, their interest in the domestic insurance business contributed 1.69 billion euros to the universe of Spanish banks’ aggregate earnings in 2021. That figure is significantly lower than in 2020.

Conclusions

Overall, the following conclusions can be drawn:

- The importance of the insurance business for the banks’ businesses in Spain - its direct contribution alone (profit attributable to their interests in their insurance subsidiaries) represented around 15% of the banks’ reported earnings in 2021.

- In addition to that direct contribution in their capacity as shareholders of their insurance investees, the banks earn fee and commission income from the distribution of those policies via their branch networks. [5] Although the public information available is not sufficiently detailed to make an accurate estimate, it is reasonable to assume that layering in that indirect contribution, the insurance business (direct and indirect contribution) accounts for around 25%-30% of the banks’ earnings in Spain.

- That contribution declined considerably from 2020, converging towards that of prior years. That year (the year of the pandemic), the combination of: (i) growth in the profitability of the insurance business; coupled with (ii) a very considerable drop in the banks’ income due to the sizeable provisions recognised in anticipation of credit impairment in the context of the pandemic, drove the relative contribution by the insurance business to the banks’ overall income sharply higher. So much so that the direct contribution that year represented as much as 56% of the banks’ overall income, a figure that would rise to around 75% if the indirect contribution were layered in.

Notes

That universe of firms includes a host of mutual societies. Although their relative weight as a cohort is small, their non-profit status tends to lead to very low returns.

Measured as the ratio of earnings over equity at year-end as per their separate financial statements.

That figure of 1.56 billion euros is the aggregate profit of the 19 bank subsidiaries active in the life insurance segment. Of that total, the bulk, nearly 1.38 billion euros, trickles through to the banks’ P&Ls thanks to their generally majority interests in their life insurers.

That figure of a little over 650 million euros is the aggregate profit of the 14 bank subsidiaries active in the non-life insurance segment. On the basis of their ownership interests and resulting consolidation methods, the banks recognise 313 million euros in their statements of profit or loss.

The insurers owned by the banks recognised over 2.5 billion euros of policy acquisition costs in their financial statements in 2021, a substantial percentage of which are fees and commissions paid to market and sell their policies through banking networks.

References

BLASCO, I., MANZANO, D. and MILNER, A. (2021). The pandemic and its impact on the insurance business in Spain.

SEFO Spanish and International Economic & Financial Outlook, Vol. 10, No. 6 (Nov.).

https://www.sefofuncas.com//Spain%E2%80%99s-bumpy-post-COVID-19-recovery/The-pandemic-and-its-impact-on-the-insurance-business-in-SpainMANZANO, D. (2017). Spain’s banking and insurance sectors: A contrasting story.

SEFO Spanish Economic and Financial Outlook, Vol. 6, No. 4.

https://www.funcas.es/wp-content/uploads/Migracion/Articulos/FUNCAS_SEFO/032art08.pdfMANZANO, D. and MILNER, A. (2022). Readiness of the Spanish insurance sector in a shifting economic and financial environment.

SEFO Spanish Economic and Financial Outlook, Vol. 11, No. 4. (Jul.).

https://www.sefofuncas.com/The-Spanish-economy-in-the-context-of-a-shift-in-monetary-policy/Readiness-of-the-Spanish-insurance-sector-in-a-shifting-economic-and-financial-environment

Daniel Manzano. Partner at Afi