Readiness of the Spanish insurance sector in a shifting economic and financial environment

Increasing interest rates and rising inflation bring a mixture of opportunity and concern for Spain’s insurance sector. Rising rates should support life insurance and savings products, while slowing growth and higher inflation may erode demand and margins for other products and segments.

Abstract: The bottlenecks caused by the pandemic and the war in Ukraine are sending prices soaring and leading to inflationary pressures not seen in decades. Major central banks have announced sharp and sustained rate hikes, while clouds have gathered over forecasts for economic growth. Spain’s insurance sector has traditionally proven highly resilient and capable of adapting to shifting market environments. The changes taking hold will impact the sector’s investment portfolios and trigger a business response mainly in life insurance and traditional savings products, which have suffered from under-development in recent years due to a period of protracted low interest rates. The anticipated economic slowdown could also negatively impact demand for certain non-life products. Finally, inflation is expected to increase the costs of claims as not all segments can pass on rising costs to client premiums.

Foreword

The economic and financial scenario has shifted considerably in recent months. The yield curve has sustained a prolonged and accelerated upward shift and clouds have gathered over the outlook for growth for the year ahead. The immediate explanation for the sudden shift in expectations lies with persistently elevated inflation, which has reached levels not seen in advanced economies in decades. The key driver of the latest surge in inflation is energy and commodity prices induced by the war in Ukraine. This was preceded by a wave of elevated inflation that had begun mid-last year, when the ‘end’ of the pandemic brought robust demand in contact with constrained supply handicapped by bottlenecks related to pandemic closures and lockdowns. The sharp increase in yield curves is a reflection of market expectations that the main central banks, including the ECB, will follow the paths already embarked on by the Federal Reserve and Bank of England. In the immediate future, we will see the unwinding of the extraordinarily accommodative monetary policies of recent years, including a considerable increase in benchmark interest rates.

Following years of navigating zero and negative interest rates, the financial industry will return to a landscape characterized by higher rates. The shift to higher rates reflects a return to more traditional conditions for carrying out certain financial industry businesses, and has been accompanied by a rally in the share prices of banks. The return to higher rates will also facilitate the development of the life and savings businesses in the insurance industry. On the other hand, tighter monetary conditions have led to stock market corrections for other sectors.It is important to point out the adverse effects that accompany rising interest rates and high inflation. The increase in rates will carry some negative implications for financial entities’ asset portfolios, while high inflation will erode the economy’s growth potential. The extent to which economic activity and by extension, the health of the banking and/or underwriting businesses, will be ultimately impacted is dependent on whether central banks manage to bring inflation back to target and how long it takes. This paper focuses on the exposure of the insurance business to the dramatic shift in macroeconomic conditions. In the first section we analyse the sector’s current health based on the most recent information available. We then asses firms’ foreseeable responses and the key implications for Spain’s insurance sector.

Current situation

Using information that runs until the middle of 2021, in an earlier article published in this journal (Blasco, Manzano and Milner, 2021) we concluded that, as a result of the impact of the pandemic on the insurance business, …notwithstanding asymmetries across the various lines of business and markets, the sector has once again displayed a unique ability, compared to other sectors, to ride out the storm. Indeed, its profitability and solvency continue to present solid foundations in the current context and the sector looks poised to maintain its pre-pandemic cruising speed. Moreover, the most recently released indicators point to a smaller impact and faster rebound that one would expect following the initial shock.

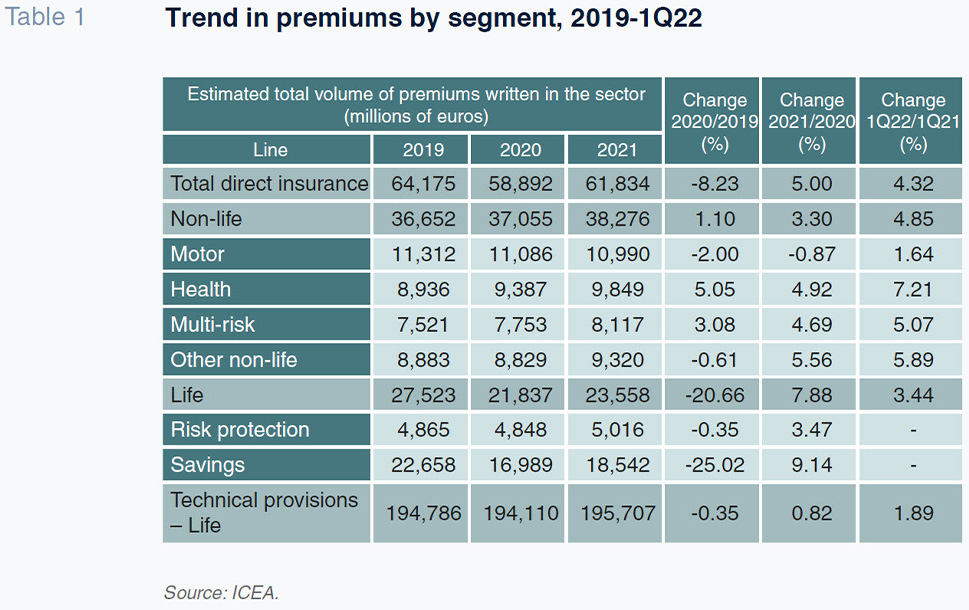

Subsequent data for the second half of 2021 and the first half of 2022 have enforced this assessment. In 2021, for the non-life business, except for motor insurance, revenue (premium) growth was solid. Health insurance (+4.92% year-on-year), multi-risk (+4.69%) and ‘other’ (5.56%) segments also reported vigorous growth, which have accelerated even further over the first quarter of 2022 (Table 1). The weak performance in motor insurance is intuitively related to the meagre growth in the stock of cars against the backdrop of the many bottlenecks plaguing the industry worldwide and, perhaps, also the car-as-a-service trend.

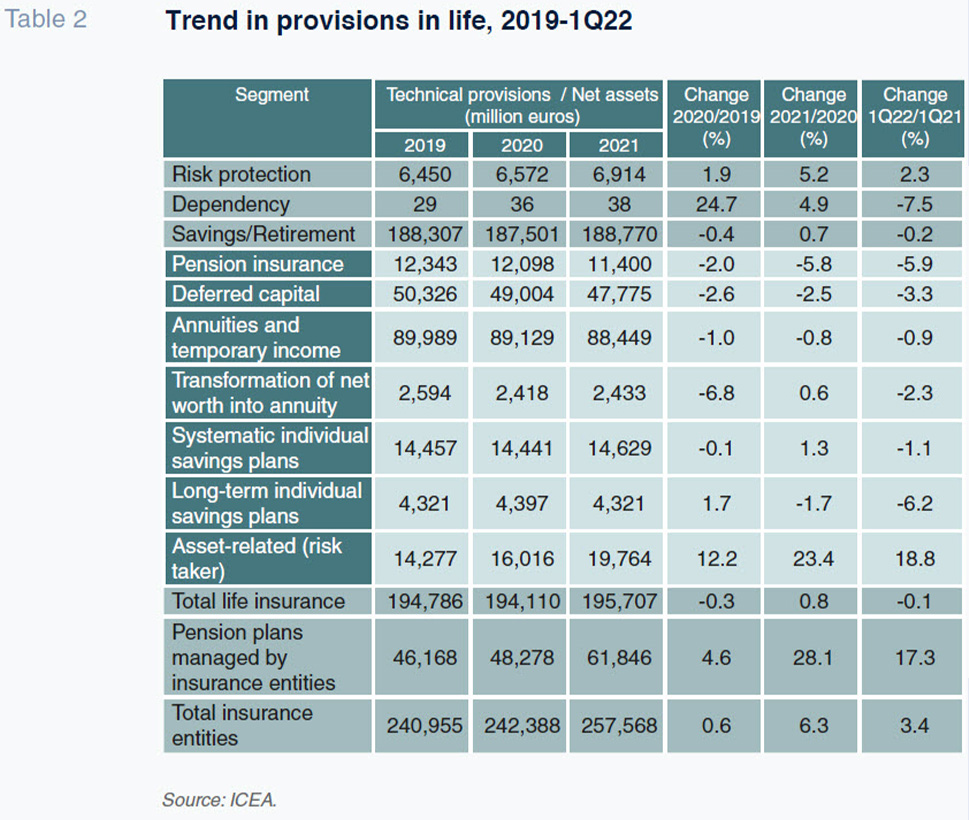

In the case of life insurance, it is worth noting that the significant recovery (+7.88%) in revenue followed an extraordinary contraction the year before (-20.66%). Life and savings products were also considerably weak in the years prior the pandemic for structural reasons (protracted low interest rates). Since markets expected low rates to continue for some time until just a few months ago the partial recovery in the life business is attributable to the life-risk segment and the noteworthy growth in the sale of unit-linked (policyholder risk) products. The welcome recent surge in unit-linked products, generally underdeveloped in the Spanish market compared to other major European countries, has been fuelled by their novel offering of attractive interest rates to customers in traditional medium- and long-term savings products. The highly favourable returns in securities markets until just a few months ago also contributed to their attractiveness. The trend of life insurance products is depicted in Table 2, which illustrates the contraction in more traditional life and savings products relative to products in which the policyholder bears the risk. That pattern has continued throughout the early months of 2022.

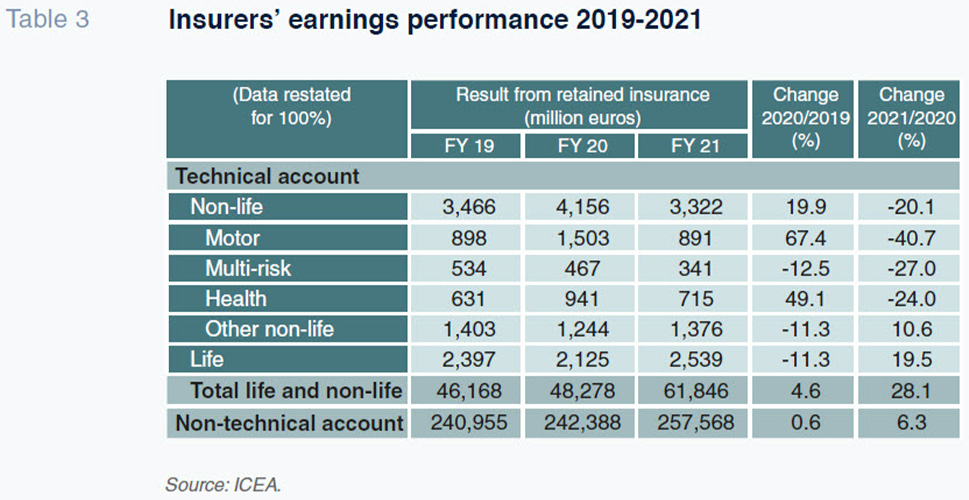

The positive trend in revenue in the non-life business, which continued to expand (as a whole) in spite of the pandemic, coupled with favourable trends in claims, has meant that the sector’s earnings have not suffered in recent years. In 2020, the extraordinarily low level of claims, shaped by the lockdown and mobility restrictions, drove the sector’s profitability to levels not seen for many years (5.8 billion euros). The recovery in claims during the gradual return to normality in 2021 left sector profits a little above pre-crisis levels.

In short, the sector has once again displayed tremendous resilience. Moreover, notwithstanding obvious asymmetries across the various segments, it has navigated the complexity wrought by the unexpected COVID crisis with notable success. The role of the insurance business in bolstering the banks’ earnings, which took a heavy hit in 2020 due to the fallout from the pandemic, was also noteworthy. Recall that the Spanish banks have significant positions in the bancassurance business, particularly in the non-life segment, of which it controls more than half (Manzano, 2017).

Outlook for the insurance sector in the shifting economic and financial environment

Less buoyant growth expectations, a sharp increase in inflation, and the end of zero and negative rates (with markets expecting a period of sustained central bank rate hikes) are ingredients for a major shift accelerated by the ‘end’ of the COVID crisis. The shift in each factor is of sufficient magnitude to trigger some manner of response by the insurance sector, with differing impacts from one segment to another.

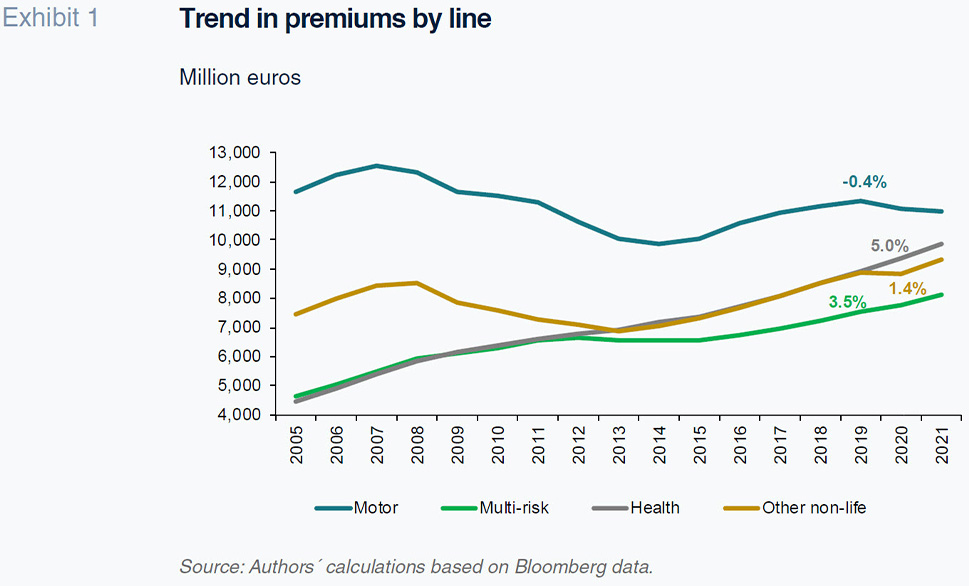

In the case of non-life insurance, the current robust growth in demand for coverage (except for motor insurance) may slow over the coming quarters as the economy decelerates, which leading indicators suggest is already occurring. However, despite the recent downward revisions by the leading international and national organisations, the Spanish economy is still expected to grow by 4% in 2022 and by around 3% in 2023. These projected rates of economic expansion mean that Spain is on track to experience some of the highest levels of forecast growth among major economies and by historical standards. In the new context, it is also likely that less cyclical businesses, including multi-risk and health insurance, which have been posting sustained annual growth of over 5% during the last 15 years, further bolstered by the health crisis (Exhibit 1), are likely to extend their current momentum. Meanwhile, the more cyclical businesses –motor and other non-life insurance –should find a solid floor if growth materialises at the levels currently forecast.

In nominal terms, inflation should also boost revenue, although the ultimate impact on the earnings of the entities active in non-life is not clear. The ability to pass on the evident increase in claims costs to end prices (by hiking premiums) in the current context of high inflation will vary significantly from one segment to the next. The ‘ease’ with which the health insurance business has historically been able to raise its premiums, given the strength in demand for its products, contrasts developments in the motor insurance business, which although still the biggest generator of revenue is very mature and extremely competitive.

Management of costs and the ability to pass higher costs on to premium prices for new coverage will be essential to determining the ultimate impact on the players’ earnings, especially in the context of posting robust double digits overall margins in recent years.

In the short-term, the speed of the increase in rates and widening of credit spreads along with the current rout in the stock market will be bad news for investment portfolios in the non-life business. Life insurance portfolio valuations will also be adversely affected, but if we compare the Spanish market to other European markets, the impact should be more moderate thanks to the active pursuit of flow matching that is characteristic of the Spanish insurance industry.

What will likely experience a dramatic change in the life business is its orientation. Yield curve ‘normalisation’ will create the conditions, which have been absent for some time, for renewed development of traditional life and savings products. These products have languished for years against the backdrop of zero or even negative rates. To justify investment in these traditional products, which continue to account for the bulk of the market, as shown in Table 2, agents need to perceive that the current inflationary pressures will eventually be reined in by central banks. Nevertheless, the prevailing high levels of uncertainty and the downturn in markets are not the ideal environment for renewed demand for traditional life and savings products. This also holds true for alternative products, such as unit-linked products, that have historically garnered a very small share of the Spanish market by comparison with other major European markets. Unit-linked products had been booming in recent years in the wake of the market rally and the drying up of net demand for products with guaranteed rates in the prevailing conditions. Considering all these factors, it is not easy to make short-term projections for the life insurance business. However, barring a major economic or financial crisis, we do believe that, on balance, the new rate climate will usher in brighter prospects.

Daniel Manzano and Aitor Milner. A.F.I. - Partners at Analistas Financieros Internacionales, S.A.