Public revenue in Spain: Strong momentum meets demographic headwinds

Tax receipts continue to surge on the back of job creation, corporate profits, and fiscal drag. Yet, the ageing population is quietly reshaping personal income tax dynamics, posing long-term sustainability risks.

Abstract: Spain’s public revenue continues to post robust gains, with 2024 marking another year of exceptional tax and social security receipts. Growth in 2025 remains dynamic, driven by employment, wages, and corporate profitability, although underpinned by the fiscal drag effect rather than structural reform. Despite these tailwinds, the persistence of a “stopgap” fiscal strategy has delayed the long-recommended shift toward higher indirect and environmental taxation. Looking ahead, demographic forces are becoming an increasingly important constraint: population ageing is changing the composition of taxable income and eroding personal income tax buoyancy. Immigration has cushioned the decline but cannot fully offset it. Indeed, Spain would need at least one immigrant worker for every new pensioner in order to prop up tax revenue. Moreover, most immigrant workers earn below-average wages and will eventually become pensioners themselves. Without a sustained increase in higher-wage employment or structural tax reform, ageing could weigh heavily on revenue growth and threaten fiscal sustainability in the coming decades.

A glance back at 2024

Growth in public revenue remained strong in 2024 and remains dynamic in 2025. The government has not introduced measures for correcting the snowball effect of fiscal drag on personal income tax (Romero-Jordán, 2025). Tax modifications are helping shore up receipts, framed by the long-standing approach of introducing stopgap solutions. Those measures are, however, nowhere near the persistent recommendations of the OECD or European Commission for easing the burden on the labour factor while increasing indirect taxes, particularly environmental taxes. Against this backdrop, overall tax and social security receipts grew by 7.3% in 2024 to 591.7 billion euros (IGAE, 2025a). Clearly very robust growth, albeit marked by a —naturally unfolding— loss of momentum (11.8% in 2021; 9.1% in 2022; and 8.0% in 2023). In year-on-year terms, the main contributors to the 2024 increase were social security contributions (+€13.3 billion) and personal income tax (+€11.5 billion). VAT and excise duties also performed strongly, together adding almost €12.6 billion in 2024.

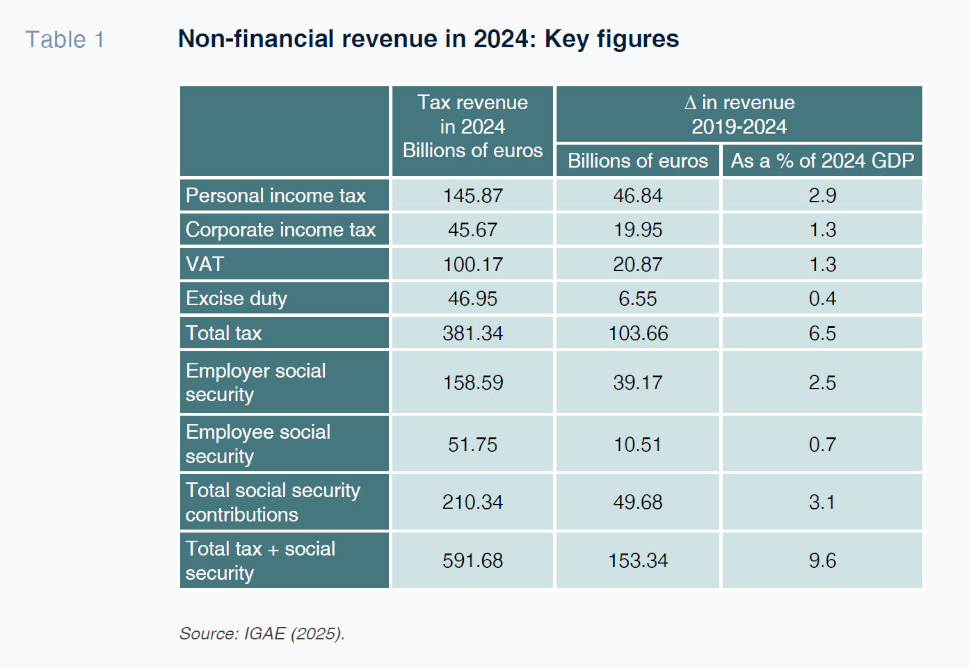

Looking back a little further, non-financial revenue as a whole has been growing very intensely since 2019, increasing a cumulative 153.3 billion euros, which is equivalent to 9.6 points of 2024 GDP. Tax revenue in particular increased by 103.6 billion euros between 2019 and 2024. Personal income tax has been the main engine of this growth, accounting for 46.8 billion euros of the increase, equivalent to 2.9 points of 2024 GDP. This sharp growth is attributable to a combination of more people in work, growth in nominal wages and the significant effect of fiscal drag.

During this period, VAT revenue reached a major milestone when it topped 100 billion euros, registering cumulative growth in the last five years to 20.8 billion euros. However, the sharp impact of inflation on revenue has been offset by the cost of social protection measures. Revenue from excise duties increased by 6.5 billion euros during the period, reflecting more stable tax bases and less dynamic consumption patterns than the overall expenditure on which VAT is levied. Lastly, corporate income tax receipts hit a record 45.6 billion euros in 2024, growth of 20.0 billion euros since 2019, in line with higher corporate profits and higher pass-through of taxable profits to effective tax payments in a context of economic growth. Social security contributions reached 210.3 billion euros in 2024. Those borne by employers (158.6 billion euros) accounted for the bulk of the increase in payments with both the stock of pre-tax wages and contribution bases widening significantly on the back of combined growth in employment and pay.

This upward trajectory, with tax revenue consistently outperforming year after year, is expected to yield an improvement in the deficit to 2.5% of GDP in 2025 and 2.0% in 2026 (AIReF, 2025), far below the levels burdening the Spanish economy ever since the financial crisis. Recall, however, that much of the growth in revenue is explained by the elasticity of personal and corporate income tax revenue to the cycle (elasticities of well over 1) (AIReF, 2024).

Performance in 2025

Non-financial revenue increased by 7.3% year-on-year in the first seven months of 2025 (to 331.5 billion euros) (IGAE, 2025a).[1] In absolute terms, the growth is close to 25 billion euros. The strongest growth came in the income taxes, which increased by 10.7% (9.9 billion euros), followed by the taxes levied on consumption (7.0 billion euros) and social security contributions (6.8 billion euros). The increase in receipts in the first seven months of 2025 is equivalent to 59.5% of the increase in all of 2024, which was roughly 40 billion euros.

Another record is looking likely in 2025. However, the Spanish tax authority (AEAT, 2025)

[2] estimates that close to 5.7 billion euros of the increase is attributable to regulatory changes, including the reinstatement of the original VAT and excise duty rates on energy products. The so-called tax reforms of 2024 have contributed around 4.3 billion euros to date, particularly via the tax levied on the banks (1.3 billion euros) and the reinstated limits on the offset of tax losses (1.0 billion euros). Given where we are in the year and the current political context, we are looking at another carryover of the 2023 budget. This situation will make it even harder to pass any new tax measures in 2026, as we saw with the tax package approved at the end of 2024. Assuming this scenario, AIReF (2025) is forecasting growth in tax revenue of 0.3 points of GDP and growth in social security contributions of 0.1 points.

Population ageing and personal income tax receipts: Grey zones

Tax revenue dynamics in the wake of the pandemic have been underpinned by strong momentum in job creation, wages and corporate profits, which have fattened up the various tax bases (AIReF, 2024). Between 2021 and 2024, household gross disposable income increased at an annual average of 7.7%, consolidated corporate taxable income jumped 21.0% and final expenditure subject to VAT rose by 11.9% (AEAT, 2025). A substantial part of the momentum is cyclical, as it stems from the Spanish economy’s healthy growth. However, growth is expected to slow due to domestic matters (end of the NGEU funds) and international developments (trade protectionism and heightened geopolitical tensions), affecting the cyclical momentum in public revenue. The Bank of Spain, BBVA and Funcas are expecting growth to taper from close to 3% in 2025 to below 2.0% in 2027. This slowdown, shaped in part by population ageing, is set to continue over the coming decade, with GDP growth expected to settle at close to 1.5% (AIReF, 2025).

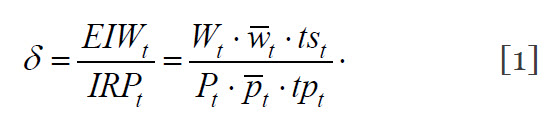

This demographic phenomenon is already affecting personal income tax receipts although the net effect is not directly observable. What we can say is that it is altering the composition of the income mix comprising the personal income tax base. In 2000, aggregate earned income subject to taxation was 3.7 times higher than total pension income. This ratio has been falling to 2.7 times by 2024 (AEAT, 2025). To analyse the impact of retirement on personal income tax, we related earned income from work (EIW) to income from retirement pensions (IRP).

[3]

where

W and

P are the number of people in work and the number of pensioners receiving a contributory retirement pension.

[4] Whereas,

and

represent average earnings and the average pension. Therefore, the product

is a proxy for taxable wage income, while

is a proxy for the base of retirement pensions. Lastly,

ts and

tp are the effective rates of tax borne by both sources of income. We establish those variables using the closest information available from the statistics office (INE), Social Security and tax authority (AEAT).

Ceteris paribus, the conclusions obtained from [1] are the following:

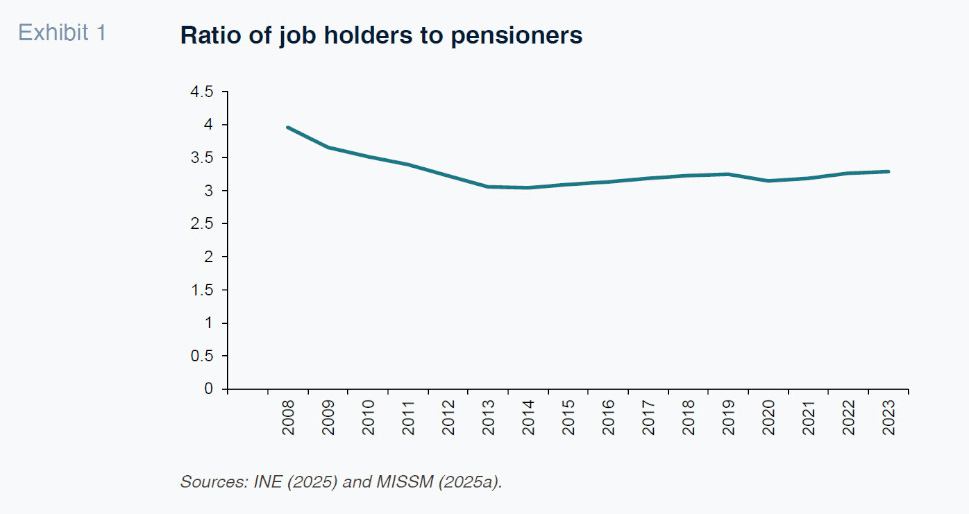

Firstly, the ratio of job holders to pensioners has been falling since 2008 when there were four job holders per pensioner (Exhibit 1)

[5] (INE, 2025; Ministry of Inclusion, Social Security and Migration (MISSM), 2025a). In 2014, after the financial crisis, the ratio hit a low of 3.2. Since then, immigration has slowed the downtrend, nudging the ratio back up to 3.3 in 2023. The total number of job holders increased by 4.3 million between 2014 and 2024, of which 2.1 million are immigrants (INE, 2025a).

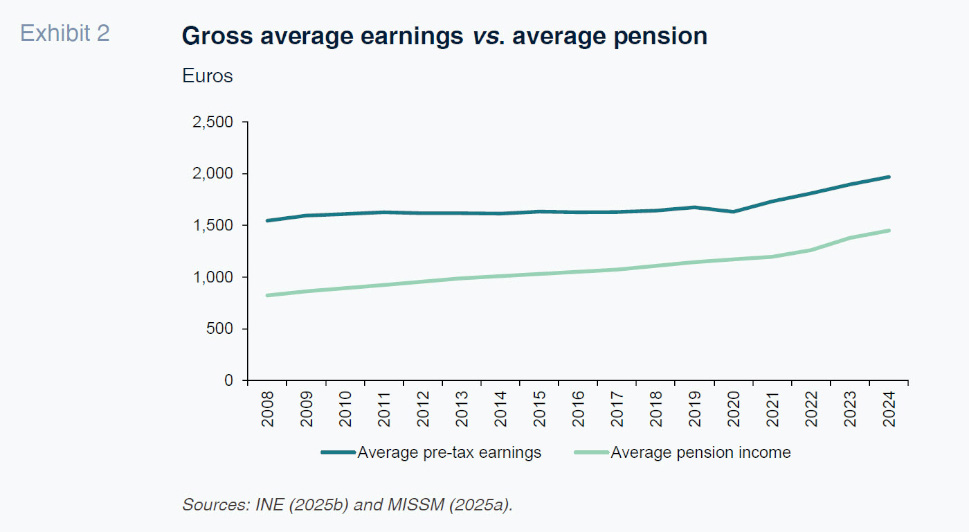

Secondly, on average, wages are higher than retirement pensions. In 2008, the  /

/  ratio was 1.9 (INE, 2025b; MISSM, 2025a, 2025b). As shown in Exhibit 2, this ratio has gradually declined since 2000 to 1.4. The baby boomer generation is a key factor in this downtrend as their starting pensions are higher than the average existing pension. By way of illustration, the average pension of new pensioners was over 1,600 euros in 2025, whereas the average overall retirement pension in 2024 was 1,450 euros (INSS, 2025; MISSM, 2025b).

ratio was 1.9 (INE, 2025b; MISSM, 2025a, 2025b). As shown in Exhibit 2, this ratio has gradually declined since 2000 to 1.4. The baby boomer generation is a key factor in this downtrend as their starting pensions are higher than the average existing pension. By way of illustration, the average pension of new pensioners was over 1,600 euros in 2025, whereas the average overall retirement pension in 2024 was 1,450 euros (INSS, 2025; MISSM, 2025b).

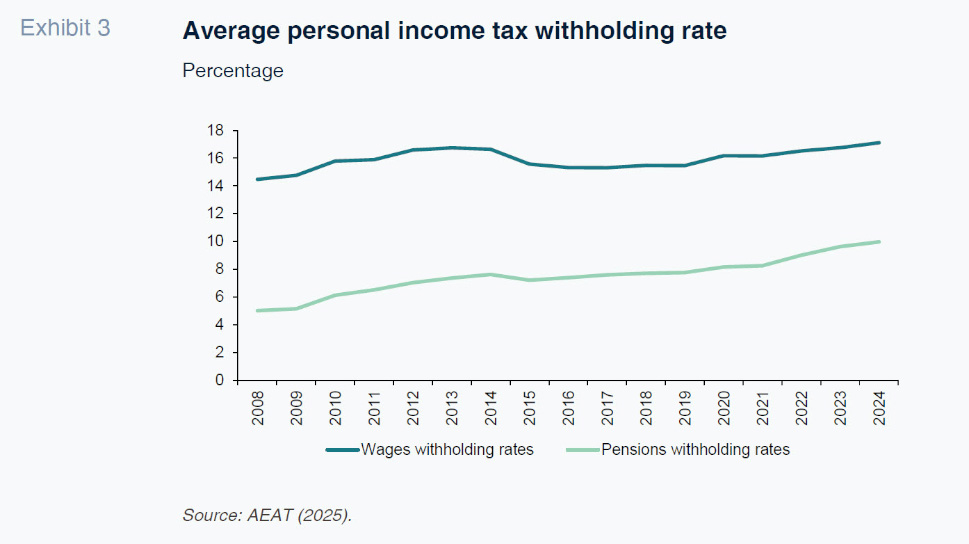

Thirdly, as shown in Exhibit 3, the personal income tax withholding rate on wages is higher than the rate withheld on pensions (AEAT, 2025). These withholding rates can be used as proxies for the differences in taxation levels. [6] However, these differences have been narrowing with the gradual retirement of the baby boomers.

In sum, revenue from personal income tax faces potential structural risks derived from population ageing. Immigration has its limits in terms of helping to prop up tax revenue and sustain the welfare state:

[7]

- The immigrant population is employed proportionately more in sectors with lower wages, such as services and agriculture [8] (INE, 2025c). Less than 11% of foreign workers work in manufacturing, where average earnings are higher.

- Average annual earnings per worker of Spanish nationality were 28,662 euros in 2023. In the case of immigrants originating from Africa and the Americas, the annual average was 18,838 euros (INE, 2025b). According to AIReF (2024), the gross replacement rate (the ratio of average pension to pre-retirement earnings) in Spain is 66%. Therefore, the average pension of new pensioners (18,916 euros, before tax) is very close to the average annual earnings of an immigrant. By these calculations, Spain would need approx. one immigrant worker for every new pensioner in order to keep personal income tax receipts intact (assuming all other sources of income remain constant). That looks doable if we look at the net immigrant flows projected by AIReF (2025): around 300,000 people out to 2050.

- In the next two decades, a significant share of the working immigrant population will join the ranks of pensioners. Some 8.83 million of the people currently living in Spain were born abroad (INE, 2025d). [9] Of the total, 1.03 million came to Spain before 2001 and 2.64 million came between 2001 and 2010. The average age of the immigrants arriving in Spain is close to 32 (INE, 2025e). Therefore, it is foreseeable that a significant share of the 3.54 million immigrants who arrived prior to 2010 will have generated entitlement to a contributory retirement pension over the next two decades. The uncertainty and extreme importance of these factors for the sustainability of Spain’s welfare state requires a more analytical micro assessment.

Notes

Using the accrual basis of accounting.

Using the cash basis of accounting.

We leave other variables like productivity constant.

In 2024, contributory pensions accounted for 74.6% of total pension expenditure (MISSM, 2025b).

The trend is similar if Social Security contributors are used instead.

The pension withholding rate shown in the exhibit includes all pensions. However, the total average pension is lower than the average retirement pension: 1,282 euros versus 1,450 euros in 2024.

The difference between the average number of children is very small: 1.09 for Spanish mothers and 1.25 for foreign mothers (INE, 2025d).

In 2024, the average annual salary in manufacturing was 31,708 euros, followed by services (27,010 euros) and construction (25,561 euros) (INE, 2025b).

Irrespective of the fact that a considerable percentage will have already obtained Spanish nationality.

References

Desiderio Romero-Jordán. Rey Juan Carlos University and Funcas