Interest rate risk hits central banks

The interest rate risk deriving from the mismatch between asset and liability maturities and/or repricing, which had spread across the US banking system one year ago, has now hit the central banks – with some reporting zero profit, or even losses in 2023. While this phenomenon is not expected to have implications for financial markets stability, there may be important implications related to fiscal policy and monetary policy settings going forward.

Abstract: In the wake of the problems affecting several US banks, one year ago we assessed the issue of interest rate risk in the banking book and the effectiveness of the regulatory environment and applicable accounting rules in the prevention and mitigation of such risk. This type of interest rate risk, particularly the risk implicit in an excessive mismatch between asset and liability maturities and/or repricing, has now hit the central banks hard, with some reporting no profits, or even losses, in 2023. An analysis of the asset and liability structure of the Federal Reserve, the European Central Bank (ECB) and the Bank of Spain reveals that interest rate risks, and hence expected losses, are likely to continue to materialize across all three central banks in the coming years albeit along distinct timeframes and in different magnitudes – with the ECB and Bank of Spain expected to report smaller absolute values than the Fed. That said, it is important to note that, unlike private sector banks, central banks are not obliged to recognize their holdings at fair value (i.e. they do not have to recognized unrealized losses) or unwind positions, which means that market implications would be very different. As well, central banks should not be judged for their earnings performance, but rather whether they fulfil their mandates. In any event, there may be other implications related to the need for central banks to assess monetary policy rates from the perspective of how they relate to central bank transfers to the commercial banking system.

Introduction

Silicon Valley Bank (SVB) went bankrupt in March 2023 and was swiftly followed by Signature Bank and First Republic Bank. Beyond their size and regional specialisation, what the three failed entities truly had in common, and which was undoubtedly the cause of their failure, was excessive exposure to interest rate and liquidity risk, as their assets were all significantly long-dated, in the form of long-term, fixed-rate bonds (nearly half of all assets in the case of SVB), while their liabilities came from short-term deposits subject to repricing risk, opening them up to the risk of eroding margins or even a run on deposits, as ultimately happened.

The intensity and speed with which both risks –interest and liquidity– materialised and fed off each other, causing SVB to fail, spreading quickly to other banks with similar structures and triggering intervention by the competent US authorities (the Fed, Treasury and FDIC) to curb further and more widespread contagion, raised questions about the regulatory, supervisory, and accounting framework governing these risks, as analysed in Alberni et al. (2023).

Now that the ripples from that episode of interest rate risk in the private sector banks appear to have receded, we are seeing these same risks begin to materialise at the central banks – intensely, albeit different in origin: they are not the result of speculation about the interest rate curve but rather monetary policy execution. The implications are also quite different as there are mechanisms for absorbing or even correcting these imbalances, which was not the case with the US banks that had to be intervened.

In terms of sensitivity to interest rate risk, it is worth noting that the mismatches in the Fed’s and ECB’s balance sheets are not very different from those presented by SVB. To explain this phenomenon, recall that the central banks’ finance income comes, fundamentally, from: (i) the interest collected from the commercial banks for the money it lends them; (ii) the finance income generated by the acquisitions made under their asset purchase programmes (in the case of the central banks in the eurozone, the income generated by their investments under the APP and PEPP schemes); and (iii) other income from their foreign currency reserves and other interest-generating investments.

On the debit side of their accounts, their finance costs are, primarily, the interest paid to the commercial banks for their deposits and other placements, such as repos held at the central banks. The difference between their interest income and interest costs constitutes their net interest margin, from which they have to deduct operating expenses and provisions for non-performing loans, or the reversal thereof, which in recent years have played a significant role at some central banks, as we will see below.

Balance sheet analysis: Federal Reserve

Let’s first look at the US Federal Reserve, using its audited financial statements for 2023 (Federal Reserve, 2024). The Fed had USD 7.8 trillion of total assets at year-end 2023. The main component of the assets on its balance sheet are the Treasury bonds purchased under its quantitative easing programmes, which represent nearly USD 5 trillion, plus a further USD 2.4 trillion issued by Federal agencies such as Fannie Mae and Freddie Mac. The two portfolios, which between them amount to USD 7.4 trillion (over 90% of total assets) have long-term maturities (7+ years on average) and generate average returns of just 2.2%, which is well below current rate levels, as they were bought back during the period of ultra-low rates.

Compared to this portfolio of long-term bonds at low fixed rates, the main liability component is bank deposits, in the amount of USD 3.2 trillion, plus USD 1.4 trillion of repos, likewise held by the banks. Both classes of liabilities, which between them are equivalent to 55% of total assets, bear interest tied to market rates, which are certainly much higher than the rates being accrued on the bonds held as assets.

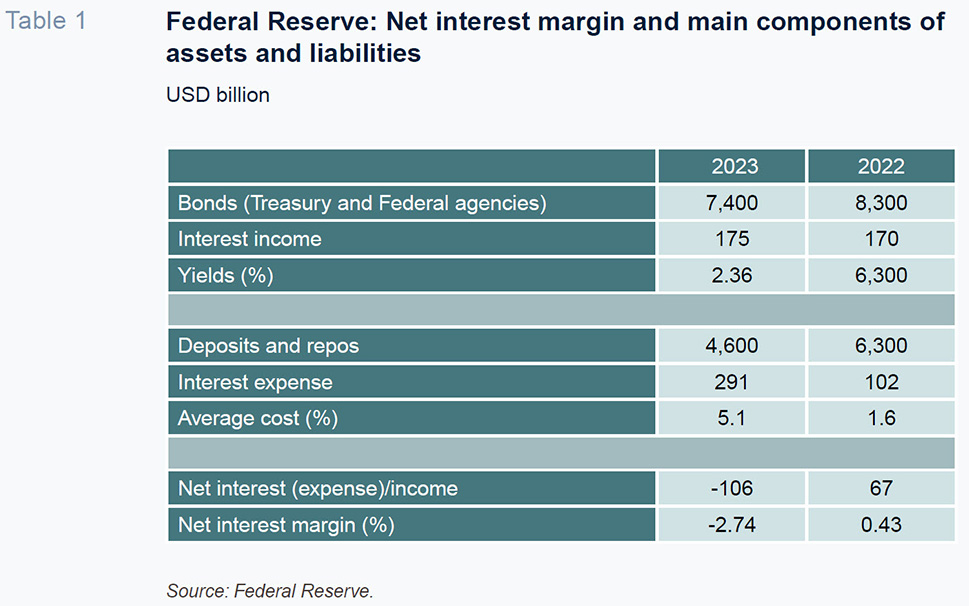

Table 1 succinctly shows the trend in the Fed’s net interest margin in the last two years, which went from a positive USD 67 billion in 2022 to a negative USD 106 billion in 2023. The key reason for this deterioration lies with the fact that while finance income has barely increased, as it mostly comes from fixed-rate bond holdings, finance costs have increased sharply (almost tripling), as most of the Fed’s liabilities (deposits and repos) are benchmarked to market rates, which jumped from 1% at the start of 2022 to 5%-5.5% for nearly all of 2023.

The rest of the Fed’s profit and loss account is dominated by its operating expenses (USD 9.2 billion) and, above all, net earnings remittances to the Treasury, which went from a positive flow (dividends) of USD 58.8 billion in 2022 to a negative flow of USD 114 billion in 2023; that “negative dividend” is the amount of earnings the Fed needs to realise before remittances to the Treasury resume. After that negative liability for remittances to the Treasury, the Fed reported net income of USD 1.49 billion.

Balance sheet analysis: Eurosystem

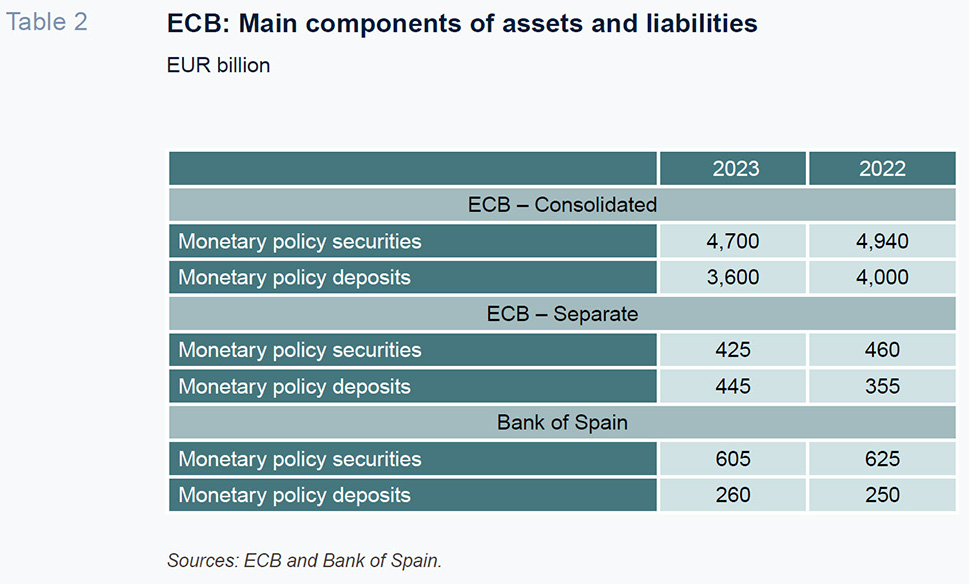

Next, we carry out a similar exercise for the Eurosystem, noting that the consolidated accounts are made up of a parent (the ECB, considered as an individual entity) and the 19 national central banks (NCBs). We have the aggregated balance sheets at the consolidated and separate levels, but we only have the separate profit and loss account (a consolidated profit and loss account has not been published).

Table 2 summarises the main asset and liability headings at the consolidated, separate ECB and separate Bank of Spain levels, which reveal a very similar structural mismatch in terms of exposure to interest rate risk to that of the Fed, albeit notably smaller in absolute terms.

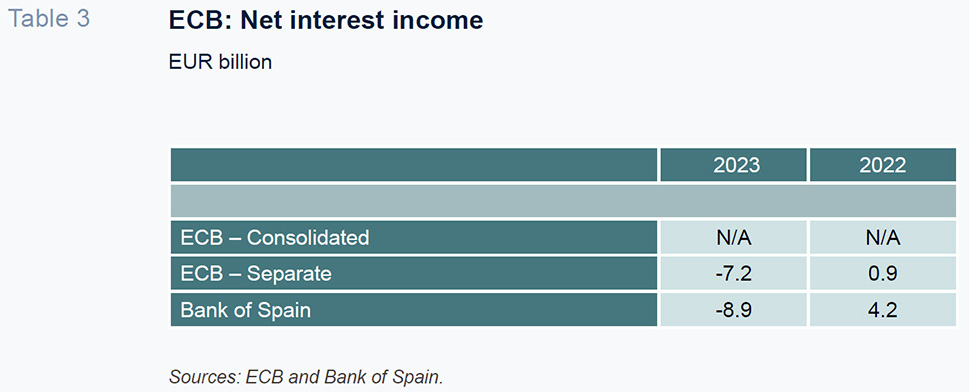

The overlap between fixed-rate bond holdings on the asset side and deposits remunerated at official rates on the liability side (the deposit facility), which went from -0.5% in early 2022 to 4% for all of 2023, unquestionably had an extraordinarily adverse impact on the net interest margin last year, as happened to the Fed (Table 3).

As shown in Table 3, the mismatch between the yield on bond holdings and the cost of deposits translated into a negative net interest margin at both the ECB (considered separately) and the Bank of Spain.

In both instances, the bottom line has been salvaged by releasing previously recognised provisions, 6.5 billion euros in the case of the ECB and 6.6 billion euros by the Bank of Spain. As a result, the ECB reported a net loss of 1.3 billion euros in 2023 (compared to zero in 2022) and the Bank of Spain reported a profit of zero (versus 2.4 billion euros in 2022).

Estimating central bank losses

It appears clear, therefore, that the mismatch between fixed-rate assets and liabilities remunerated at market rates is already fully impacting net interest income at the central banks, which are notching up significant losses. The central banks were able to mitigate those losses in 2023, cushioning the impact on their bottom lines, by releasing previously recognised provisions, something they will not have much room to do again in 2024, as those provisions have been virtually all used up.

It is therefore important to discern whether the mismatch between interest income and interest expense was a one-off affecting 2023 or whether it could occur again in 2024 and beyond.

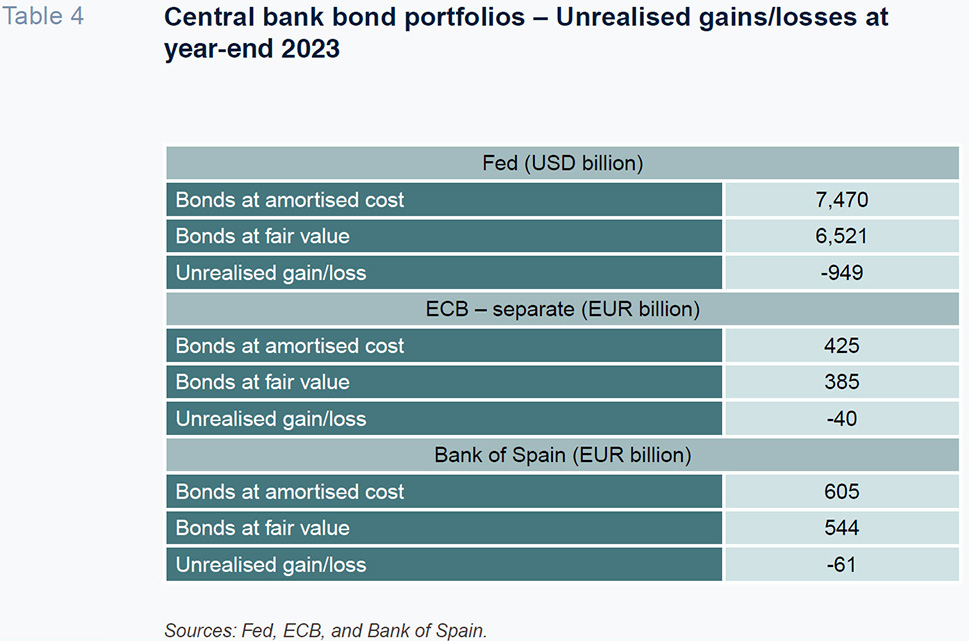

One way of modelling that impact, at least on the income side, is to analyse the opportunity cost (unrealised losses) on the bond portfolios implied by current market prices. This information can be gleaned from the central banks’ financial statements as they publish the bonds’ carrying amount (amortised cost) as well as their fair value, as is replicated in Table 4.

The unrealised losses are very significant, depicting the opportunity cost implied by the repurchased bonds in the current high-rate environment, especially considering their average remaining maturity, or duration: between 6 and 7 years in the case of the ECB and Bank of Spain and even longer in the case of the Fed’s holdings.

That being said, it is important to underline that the central banks, unlike private sector banks, are not obliged to recognise their holdings at fair value (and therefore do not have to recognise those unrealised losses) or to unwind these positions. And even if they had to, the implications would be very different. Nevertheless, if rates stay at current levels, these unrealised losses will materialise over several years more in the form of negative interest margins relative to the cost of bank deposits. By way of example, the Dutch central bank recently published long-term projections showing that it would probably have to use provisions until 2027 in order to offset its negative net interest margins.

Implications

At this juncture the next logical question is to consider just how problematic it is if central banks continue to report losses, considering the fact that, in light of the gap between the average return on bond portfolios and interest expense on deposits, the impact, albeit waning, will remain negative for the next few years. Moreover, it now seems highly probable that the central banks will keep rates higher in the coming years than was initially expected a few quarters ago in order to deliver their inflation targets.

The Bank of International Settlements (BIS, 2023), anticipating the jitters the publication of losses by the central banks would have, published a report in which it drew the following key conclusions:

- The losses and negative equity do not directly affect the central banks’ ability to operate effectively.

- Central banks should not be judged for their earnings performance but rather whether they fulfil their mandates.

- The central banks that report losses need to make an effort to clearly communicate the reasons for their losses, highlighting the broader benefits of their policy measures. This recommendation has been widely taken up. For example, the Dutch central bank, which reported a loss in 2023, recently noted that the interest savings implied by the bonds repurchased by the Dutch treasury amounted to 28 billion euros, which is significantly more than the loss reported in 2023 and potentially reported in future years. Elsewhere, the ECB also reported that the eurozone central banks as a whole had generated around 300 billion euros of profits between 2012 and 2021.

Nevertheless, while it is true that the fact that the central banks are reporting losses does not pose an issue at the operating level, they do have an impact on fiscal policy. In theory there will be no need to inject capital, which would have a negative impact on public finances in the short-term, as many of the central banks have recognised ample provisions to cover such losses and those that use them up could continue to operate with negative equity to be replenished from future earnings. There is one immediate impact, however. Over the past decade, the treasuries have been receiving dividends from the profits generated by the central banks, which they will now cease to collect. The Bank of Spain, for example, generated an average of around 2 billion euros of dividends over the last decade.

This debate over central bank transfers is proving particularly intense in the US (and is growing in the eurozone), with several observers suggesting that we may be witnessing an excessive transfer of tax payer money to the banks, with some even suggesting a potential loss of credibility and effectiveness if the losses prove protracted.

Therefore, although a new equilibrium may arrive as a result of gradual convergence between the interest collected on debt portfolios and that paid in exchange for deposits, it is feasible that the current mismatch could continue to fuel media (and political) pressure on the central banks to pare back their generosity to the commercial banks.

For example, the ECB (and the NCBs) could take measures such as increasing the spread between the deposit facility (DR) rate and the main refinancing operations (MRO) rate or introduce a tier of reserves in excess of the minimum that does not get remunerated at the deposit facility rate. While such moves could help balance the central banks’ finances sooner, they could have significant implications on monetary policy transmission so that all collateral effects would have to be carefully analysed. Indeed, some agents are calling for an increase in the minimum reserve ratio. Even though the ECB certainly analysed this issue during its recent operating framework review process, it did not take any decisions in this respect and is considered unlikely to do so.

Indeed, from 18 September 2024, the ECB is planning to decrease the difference between the MRO and DF rates from 50bp to 15bp. The European monetary authority took that decision with the aim of reducing volatility in Euribor rates, while providing an incentive for the banks to bid in the weekly liquidity operations (as the current gap of 50bp virtually eliminates that appeal).

Irrespective of these potential moves, which in any event would be assessed purely in monetary policy terms and not in terms of the central banks’ profit and loss accounts, the central banks will definitely have to continue to educate their audiences about the positive effects their quantitative easing measures have had, as they are set to continue to report losses for the next couple of years at least (with scope for higher losses to the extent they run out of provisions to release). Hernandez de Cos (2024) and Knot (2024), the governors of the Bank of Spain and Dutch central bank, respectively, have recently published papers to this effect.

References

ALBERNI, M., BERGES, A. and RODRIGUEZ, M. (2023). Interest rate risk in the banking book and financial instability: Europe

versus the US.

Spanish Economic and Financial Outlook, Vol. 12(4), July 2023.

https://www.sefofuncas.com/Spain-Economic-and-fiscal-outlook/Interest-rate-risk-in-the-banking-book-and-financial-instability-Europe-versus-the-US BANK OF SPAIN. (2024).

Annual accounts of the Banco de España 2023. April 2024.

BIS. (2023). Why are central banks reporting losses? Does it matter?

BIS Bulletin, No. 68, February 2023.

ECB. (2024).

Annual accounts of the ECB 2023. March 2024.

FED. (2024).

Federal Reserve Banks Combined Financial Statements. March 2024.

HERNANDEZ DE COS, P. (2024).

The Banco de España didn’t report profits in 2023? Why not? Bank of Spain blog post dated 27 March 2024.

KNOT, K. (2024).

Central bank capital – of capital importance?

Ángel Berges and Salvador Jiménez. Afi