Interest rate risk in the banking book and financial instability: Europe versus the US

Although the new interest rate scenario is clearly good news for the banks’ margins, the intensity, speed and persistence with which the increases have affected all tenors of the curve have other potentially very adverse effects for the banks more exposed to interest rate risk. While a comparison of EU versus US banks reveals that EU banks are less exposed to interest rate and liquidity risk, these aggregate parameters mask significant dispersion among the various entities on both sides of the Atlantic.

Abstract: Although the new interest rate scenario is clearly good news for the banks’ margins, the intensity, speed and persistence with which the increases have affected all tenors of the curve have other potentially very adverse effects for the banks more exposed to interest rate risk, as evidenced in the recent crises affecting several American banks and, here in Europe, Credit Suisse. In order to prevent contagion with implications for financial stability, it is vital to correctly measure latent interest rate and liquidity risk on both the asset (looking beyond conventional portfolio classification for accounting purposes) and liability sides of the banking business in terms of financial stability and sensitivity. It is against that backdrop that we raise and address two questions. The first relates to the sufficiency of the current regulatory and supervisory framework governing these two principal risks, having failed to prevent or sufficiently foresee the excessive build-up of both risks at the banks in question. The second has to do with risks to financial stability, to which end we analyse the European and US banking sectors to conclude that while EU banks on the whole appear to be less exposed to interest rate and liquidity risk, these aggregate parameters mask significant dispersion among the various entities on both sides of the Atlantic.

Interest and liquidity risk: Dimensions and measurement metrics

The assumption of interest rate and liquidity risk, closely entwined, is intrinsic to the banking business. Specifically, in their intermediation role, they assume liabilities that are mainly due in the short-term (on demand in the case of most deposits) and place the money borrowed in long-term assets, extending loans (mainly home mortgages) and investing in fixed-income securities (bonds and notes). This maturity transformation, borrowing short to lend long, results in asset and liability maturity mismatches that give rise to what are known as structural balance sheet risks –liquidity and interest rate risk– in prevailing bank risk regulations.

Interest rate risk derives precisely from maturity mismatches between bank assets and liabilities, exposing the banks to potential losses as a result of movements in market rates.

This risk needs to be measured and managed from a dual time perspective:

- Over the short-term, by analysing the impact on net interest income, specifically the sensitivity of an entity’s earnings in the near-term (12 months) to a specific shock by comparison with a baseline interest rate scenario. The sensitivity of net interest income, defined as the difference between the interest and similar income obtained on a range of financial products (loans, fixed-income securities and interbank assets) and the cost of funding (deposits, interbank liabilities and wholesale funding), to movements in market rates depends on the repricing gaps affecting the various balance sheet items and the linkages between repriced and market rates.

- Taking a longer-term view, interest rate risk also needs to be measured by modelling the sensitivity of economic value to movements in interest rates. Economic value to this end is defined as the present value of all future cash flows as a result of the existing balance sheet structure and its sensitivity is measured by comparing that value under a baseline scenario with an adverse interest rate scenario. As a result, the time horizon considered for this measurement is much longer than the annual horizon used to measure earnings sensitivity.

In addition to interest rate risk, where asset and liability repricing gaps are key, it is important to consider liquidity risk, for which the maturity structure of an entity’s balance sheet is what counts, as that determines the availability of assets to service liabilities.

Specifically, liquidity risks arises from contractual mismatches between liabilities and assets, in addition to the high cost of potentially having to monetise an asset if needed, giving rise to two approaches to liquidity risk management:

- Basic liquidity risk: the risk in the short- term of not having enough liquid assets to meet an entity’s obligations at a given point in time.

- Structural liquidity risk: taking a longer-term and more strategic approach, this is the risk that an entity could face difficulties in raising the funding needed to unlock growth in assets.

These complementary interest and liquidity risk measurement dimensions may not, however, provide enough information about the adverse impacts of sudden movements in interest rates of the calibre observed in the past year, particularly if accompanied by customer behaviour (runs on deposits, loan prepayments, etc.) that can accentuate the perceived weakness of certain entities in the face of those risks.

The American bank SVB clearly fell victim to this phenomenon, as did, to a degree, Signature and First Republic, whose balance sheets exposed them to too much interest rate and liquidity risk through a combination of long positions in fixed-coupon, long-term bonds equivalent to nearly half of their assets coupled with funding that was overly reliant on short-term deposits (80% of assets at some banks), exposing them to margin contraction via repricing risk and a run on deposits in light of their unstable nature, as ultimately occurred.

The intensity and speed with which both risks –interest rate and liquidity– materialised and fed off each other triggered the collapse of SVB, contagion at other banks with similar structures (Signature and First Republic) and intervention by the competent authorities (the Fed, Treasury and Federal Deposit Insurance Corporation (FDIC)) to stem the contagion that was threatening to spread unchecked, potentially jeopardising financial stability.

It is against that backdrop that we raise and address two questions in the rest of this paper. The first relates to the sufficiency of the current regulatory and supervisory framework governing interest rate and liquidity risk, having failed to prevent or sufficiently foresee the excessive build-up of both risks at the banks in question. The second has to do with risks to financial stability, to which end we analyse the European and US banking systems for the presence of potentially excessive risks.

Interest rate risk: The regulatory and supervisory framework

Unlike credit risk, which translates directly into Pillar 1 capital requirements for all entities, interest rate risk does not require the banks to explicitly set aside capital and is monitored at the supervisory level. The supervisor can impose higher capital requirements for individual banks under their Pillar 2 requirements if it believes their exposure to interest rate risk is excessive.

The first key differences between the European and American systems are to be found in this regulatory and supervisory framework. The framework applicable in the US to entities with between 100 and 250 billion dollars of assets was eased during the Trump administration leaving entities of that size under a regulatory and supervisory umbrella seen as relatively lax. The regulatory exceptions provided for entities of a size that could be relevant for financial stability purposes have been criticised for permitting the three mentioned American banks (SVB, Signature and First Republic) to operate in an interest rate and liquidity risk management and control environment that has clearly proven deficient. It is therefore likely that this framework will be revised in certain respects, including in the area of capital requirements, judging by the press release [1] put out by the Vice Chair of the Federal Reserve, Michael S. Barr, following his analysis of the SVB crisis.

The different framework applicable to entities of a certain size is not the only difference between the regulatory environments on either side of the Atlantic associated with recent events. Another difference worth highlighting, this time an accounting consideration, may have played an even bigger role in the fall of the American banks and unquestionably did so in the case of SVB. Recall that the accounting framework is extraordinarily relevant in the case of investments in long-term fixed-income instruments, such as Treasury bonds. Banks invest in these instruments for several reasons, including as purely speculative trades (betting on rates going lower, increasing the value of bond holdings), for structural balance sheet management purposes (hedging against low rates for a protracted period of time) or simply as an investment in highly liquid assets to meet regulatory liquidity risk coverage requirements.

Under the European financial reporting framework, IFRS, the banks have to classify these investments in accordance with the “business model” used to manage their portfolios, whereas under US GAAP that classification is tied to the banks’ intention when acquiring the securities. Framed by these differing accounting criteria on either side of the Atlantic, the banks have to classify their assets in one or another portfolio and that classification in turn determines different criteria for recognising the gains or losses associated with movements in the market or fair value of the financial instruments they have invested in. Specifically, changes in the value of investment portfolios held for trading in the short-term or with the aim of maximising their value for the investor over the lives of the securities must be recognised instantly, whereas with investments in portfolios held to maturity (HTM), the banks do not have to reflect the impact on their assets of valuation changes derived from movements in market interest rates until the bonds are sold.

That is exactly what happened at SVB, which was forced to sell some of its held-to-maturity bond portfolio to replenish liquidity in the face of a sharp run on deposits, accelerated by that bank’s specialisation in highly volatile depositors who proved very sensitive to remuneration and social media rumours. The sale of that portfolio to cover deposit withdrawals triggered the recognition of a sizeable loss, not only on the bonds sold but on the entire portfolio classified as held to maturity. As explained by Coelho-Restoy-Zamil (2023), this is another major difference between the US and Europe, as European accounting rules permit the banks to identify different business models for their portfolios so curtailing the potential contamination effect and preventing the reclassification of the entire HTM portfolio. This difference is particularly relevant in a context in which market rates have increased by over 300 basis points from their lows at the end of 2022, prompting losses on 10-year bonds purchased at the time of close to 20%. Recall that in the case of SVB, its HTM portfolio represented nearly half of its assets so that the mandatory and full reclassification of that portfolio under US GAAP clearly accelerated the entity’s downfall.

It could be said that the European approach better ring-fences capital against market movements, while the US approach is more propitious to incorporating market value into bank management. Each approach has its advantages and disadvantages. The US model is more transparent but also more procyclical and conducive to self-fulfilling panics.

Note that the challenge posed by these potential self-fulfilling panics has been heightened by the immediacy with which bank runs can take place in the context of mainstream and widespread use of digital channels in the banking business, especially in certain customer segments. Recent events have prompted additional debate about the sufficiency of current liquidity coverage requirements and whether current methodology used to calculate these ratios is fit for purpose considering that they are calibrated around historical patterns that may not factor in highly destabilising elements that are currently playing a crucial role in behavioural models, particularly around deposit withdrawals. In fact, the shorter-term liquidity coverage ratio, or LCR, assumes a stress scenario in which deposits are withdrawn over a month. The recent crises of confidence show how funds can be withdrawn in sizeable amounts much quicker than that, unfolding faster even than other episodes of instability observed. Moreover, these coverage ratios fail to contemplate aspects that could be key to measuring an entity’s vulnerability to intense withdrawals, such as balance concentration metrics or average deposit size.

The unusual structure of SVB’s depositors, with higher average deposits (much higher than the amounts theoretically covered by the FDIC), highly concentrated among digital users capable of moving all of their money instantly to more profitable and/or safer investments, highlighted the vulnerability of certain banks to deposit concentration factors.

European versus American banks’ positioning against interest rate and liquidity risk: Aggregate positioning and dispersion across the individual entities

American banks’ positioning against interest rate and liquidity risk: Aggregate positioning and dispersion across the individual entities

Framed by the above considerations about certain gaps in interest rate and liquidity risk controls, related with accounting and regulatory approaches in the case of the former and measurement metrics that seem to be missing certain aspects that proved critical in the recent episodes of crisis in the case of the latter, we next analyse how the European banking system is positioned relative to the American system before drawing a few conclusions at both the aggregative level and in relation to potential flashpoints. To do that we rely on data taken from the European Central Bank (ECB), European Banking Authority (EBA) and the International Monetary Fund (IMF).

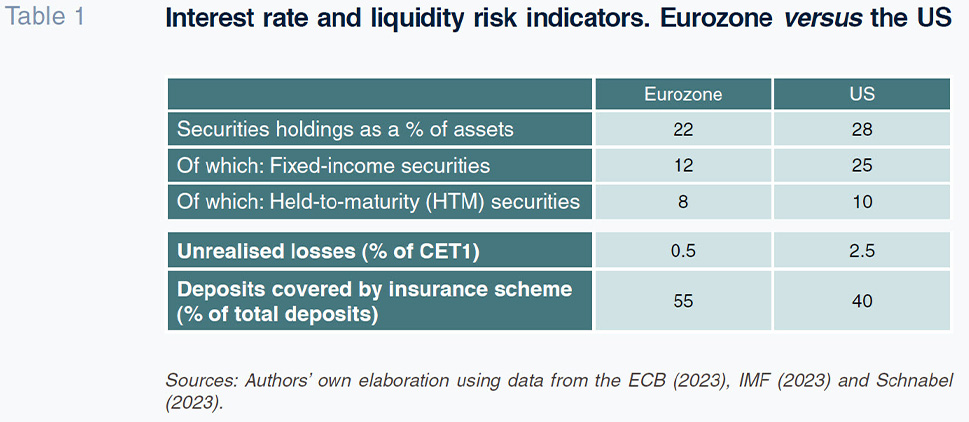

An initial high-level look at the two systems indicates that the European system is substantially less exposed to interest rate and liquidity risk than the American system, as shown by the synthetic indicators provided in Table 1:

- On the asset side, the European banks have relatively smaller amounts of fixed-income portfolios on their balance sheets and, by extension, smaller unrealised losses on their held-to-maturity (HTM) portfolios.

- On the liability side, the European banks’ deposits are more atomised with a higher weight of smaller-sized deposits that are covered by the various national deposit guarantee schemes.

These aggregate parameters mask significant dispersion among the various entities on both sides of the Atlantic, making it important to analyse the outliers that present more evident risk. According to the IMF’s estimates, in the US, the 5% of banks with more exposure to interest rate risk carry unrealised losses on their HTM portfolios that would erode their tier 1 (CET1) capital by 700bp. Clearly, the three recently intervened banks (SVB, Signature and First Republic) fell into that percentile of riskier banks. In Europe, a similar exercise by the IMF suggests that the 5% of banks with greatest exposure to fixed-income securities are sitting on unrealised losses that would reduce their CET1 by 300bp.

By the same token, likewise using IMF estimates, the degree of median deposit coverage, which is substantially higher in Europe than the US, is very uneven from one entity to the next, with coverage dropping to around 30% in both jurisdictions in that same percentile.

In short, these high-level comparative figures for the two banking systems, coupled with the observations made above, yield three interesting conclusions:

- Firstly, the interest rate and liquidity risks materialising across a few American banks would appear to be fairly contained within a small number of entities and their issues are far from generalised or systemic. The supervisory exceptions provided for smaller-sized US banks (assets of under 250 billion dollars) could be behind the failure to identify their risks sooner, so requiring their preventive recapitalisation.

- That oversight, coupled with the sense that information was not forthcoming about the rest of the banks, may have helped spark contagion to entities with similar exposures to those initially affected.

- In Europe, the system is less exposed to interest rate risk on aggregate than the US system, although there are outliers where risk is high. While oversight in Europe does not leave any entities out on account of size, greater transparency around individual entity exposure to interest rate risk would be a welcome step in stemming contagion in the future.

Notes

References

BARR, M. (2023). Review of the Federal Reserve’s Supervision and Regulation of Silicon Valley Bank.

COELHO, R., RESTOY, F. and ZAMIL, R. (2023). Rising interest rates and implications for banking supervision. BIS-FSI Briefs, No. 19, May 2023.

ECB. (2023). Financial Stability Review, May 2023.

IMF. (2023). Global Financial Stability Report, April 2023.

SCHNABEL, I. (2023). Monetary and financial stability – can they be separated? Conference on Financial Stability and Monetary Policy. London: London School of Economics, May 2023.

Marta Alberni, Ángel Berges and María Rodríguez. Afi