Increases in Euribor and potential impact on mortgages and the Spanish economy

The rise in Euribor has cooled the housing market –transaction volumes have slowed and the price curve is beginning to bend. While at present the situation does not seem to pose a risk of a crisis for the Spanish economy, going forward, the evolution of employment will be key, as this is the main variable underpinning households’ ability to service their debts.

Abstract: The impact of the rise in Euribor on mortgage payments depends primarily on households’ outstanding principal. Although the average size of a new mortgage stands at close to 145,000 euros, the average balance on outstanding mortgages is lower, at 82,700 euros. Circumstances therefore vary significantly depending on the age of the loan, just as a household’s vulnerability depends on its income levels. Overall, the rise in Euribor has cooled the housing market

–transaction volumes have slowed and the price curve is beginning to bend. For now, however, the situation cannot be said to pose a major recessionary risk to the Spanish economy. Longer-term, the key will lie with the trend in employment, the main determinant of households’ ability to service their debts. Nevertheless, households that have taken out floating-rate mortgages more recently with low- or medium-low income levels are set to face a sharp increase in financial burden relative to their disposable income, highlighting the importance of policy measures targeted at those most at-risk.

Introduction

The surge in Euribor has caused great concern over mortgage costs and families’ ability to absorb them. The prospect of further rate increases by the European Central Bank (ECB), with inflation still running far above its target, is fuelling those worries. [1]

Often, however, the debate centres on estimates of the impact of the increase in interest rates at the aggregate level without sufficiently layering in the diversity of relevant additional circumstances or the structure of the mortgage market, which impedes assessment of the level of monetary policy restrictiveness. The purpose of this paper is, firstly, to quantify the impact by looking at disaggregated figures gleaned from official sources. And secondly, to examine the macroeconomic implications.

Impact of the increase in interest rates on mortgage costs

One of the consequences of the current bout of inflation in the wake of the energy shock and supply chain disruptions is the contractionary shift in monetary policy. In July of last year, the deposit facility rate (the ECB’s main interest rate) was increased by half a point to 0%, leaving behind a period of eight years in negative territory. Since then, the ECB has tightened rates another four times, with additional increases expected. Those moves have been reflected in market interest rates.

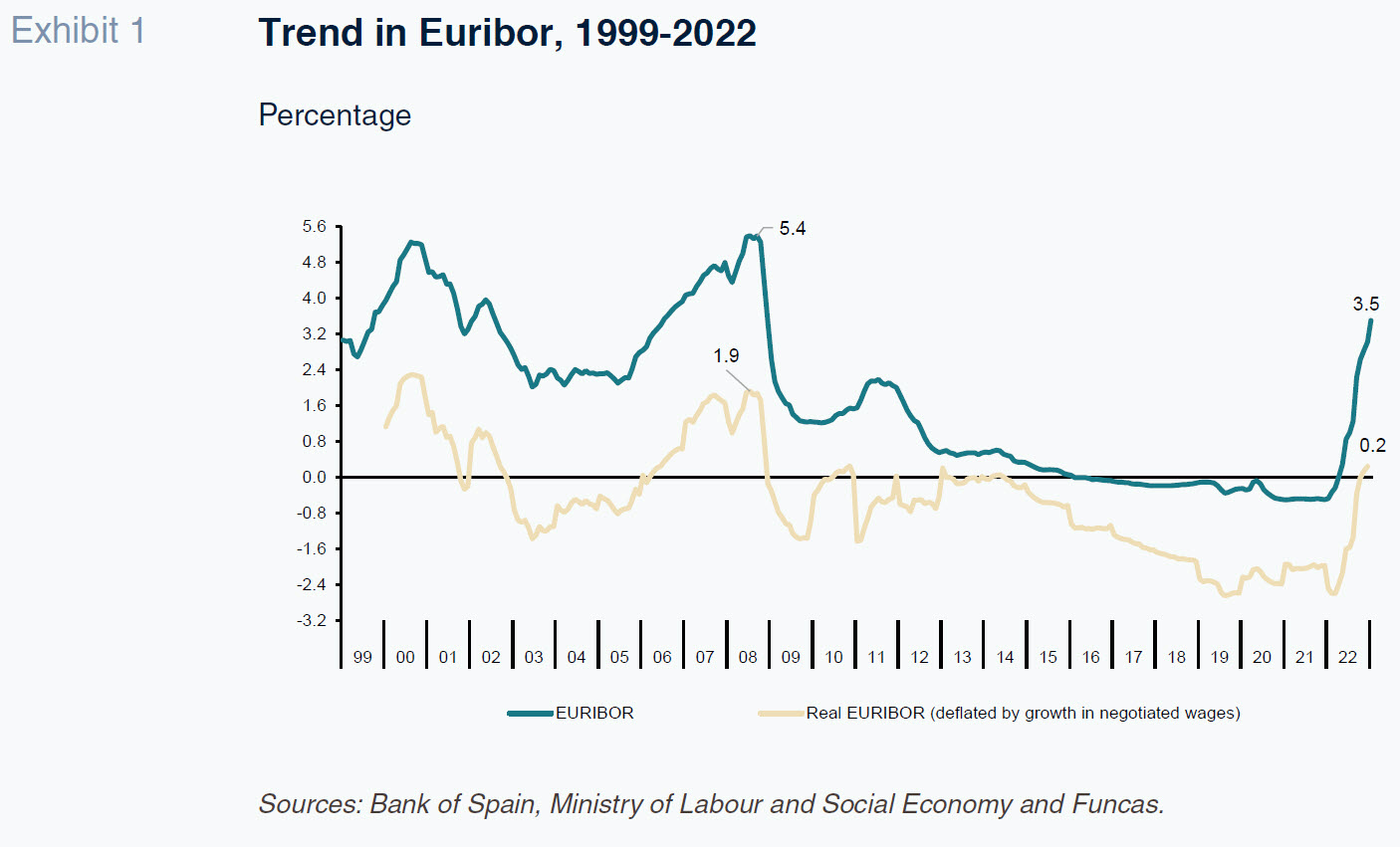

Indeed, 12-month Euribor, the most common benchmark for floating-rate mortgages, has increased from close to -0.5% at the start of last year to over 3.5% today (Exhibit 1). That is the biggest increase since the creation of the euro. In absolute terms, however, Euribor remains below the peak observed during the financial crisis, especially if we factor in inflation, as real rates are close to zero. [2]

To analyse the impact of the increase in Euribor on mortgage costs, it is crucial to assess the size of outstanding household debt. For example, while the average size of a new mortgage is running at close to 145,000 euros (according to the Spanish mortgage association, AHE, for 3Q22, the latest figures available [3]), previously conceded mortgages have been partly repaid, leaving an average outstanding balance of around 82,700 euros, in other words, a little over half of that sum. With those figures in hand, we estimate that for every percentage point increase in Euribor, the monthly payment on an average mortgage of 25 years (the most common maturity) will increase by almost 43 euros. That estimate differs from those based on the cost borne on mortgages issued recently (i.e., those whose repayment has barely begun). For those mortgages, a one-point increase in Euribor translates into a monthly payment increase of 73 euros.

However, those are average values that fail to take stock of the disparity of circumstances. The rise in Euribor does not influence the cost of loans secured at fixed rates–even though, of course, it does push up the cost of new loans of that nature. It is indeed a fact that, discounting inflation, in other words, the factor prompting the restrictive policy, fixed-rate borrowers are benefitting from a reduction in interest burdens in real terms and in relation to their disposable income.

Circumstances likewise vary significantly depending on the age of the loan: individuals with older loans and little outstanding debt will barely feel the increased price of money, unlike those that have taken out loans far more recently. Specifically, of the 5.7 million mortgages currently outstanding, we estimate that 56.8% –those issued over five years ago– will be relatively unaffected. The impact of higher rates will be bigger on the remaining mortgages (those issued less than five years ago), which constitute close to 2.6 million, almost half of which carry floating or mixed-formula interest rates.

[4]

Lastly, the level of household income is another key factor to consider in assessing the impact of the rising price of money. According to the Survey of Household Finances 2020 [5] (the most recent available), indebted households with low- and medium-low income levels bear disproportionate financial burdens (relative to their disposable income) than average indebted households. In the first income quintile, the weight of the financial burden is 75% above the average and in the second quintile, the difference is still 25%. Given the percentage of indebted households within these two quintiles, and assuming a debt age distribution similar to that of the general population, we arrive at a number of households disproportionately vulnerable to the increase in Euribor of 260,000.

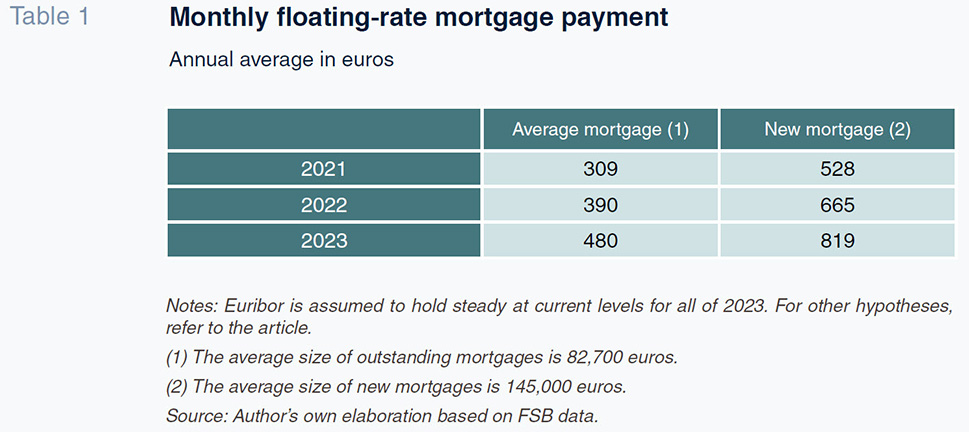

In short, the increase in interest rates has had a very uneven impact. Based on the assumptions outlined above, we estimate that as a result of the four percentage point increase sustained by Euribor over the past year, the monthly payment on an average floating-rate mortgage has gone up by 171 euros (Table 1). However, that figure masks different impacts depending on how long ago the mortgage was issued. For mortgages signed in early 2022, for example, the monthly instalment will have increased by 291 euros (in terms of the average new mortgage size as of one year ago).

Macroeconomic effects

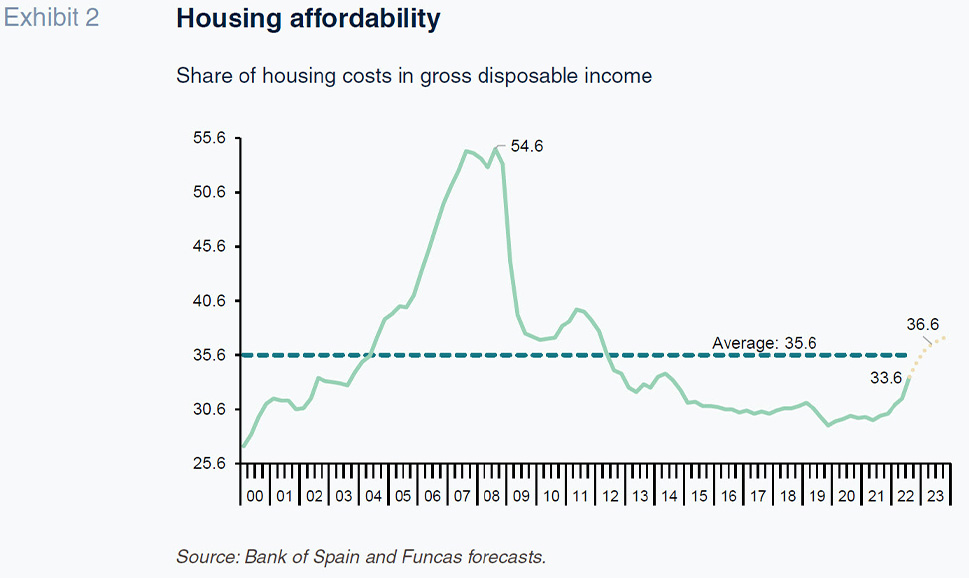

The above analysis suggests that the housing market will feel the pinch from higher rates. [6] As a result of the run-up in Euribor, home purchase affordability metrics have deteriorated considerably; that, coupled with tighter lending terms and conditions, is suggestive of a slowdown in demand. [7]

Under present conditions, considering the floating-rate formulas currently predominating, a household with average income of 30,000 euros (the average according to the National Statistics Office) would have to earmark 36.6% of its income to servicing a new mortgage at the average size of 145,000 euros. If Euribor were to climb another point (a hypothesis that is by no means farfetched judging by recent statements by ECB executives), that percentage would rise above the long-run average –though still remaining below the peak of the property bubble (Exhibit 2). Borrowers looking to lock in fixed rates would assume an even greater burden due to the higher spread with respect to floating-rate loans.

It is therefore not surprising that home purchases have already slowed: the number of home sales contracted by 10.6% quarter over-quarter in the fourth quarter of last year, in contrast with the growth recorded at the start of the year. The price curve is also beginning to bend (with a decline of 0.4% in 4Q22 according the School of Registrars). In line with other analysts, Funcas expects the market to stabilise in the course of this year.

The market is, however, not expected to collapse. The fact that housing serves as a safe haven asset should act as a floor for demand, particularly in the current environment of high inflation, quasi-zero remuneration on bank deposits and price volatility across financial assets. The boom in foreign investment in the property sector is also likely to prop up the market. According to the registry figures, foreign demand is verging on 15% of total transactions, which is close to the series high.

In addition to cooling the housing market, the rise in Euribor impacts the broader economic outlook. Firstly, via lower demand for credit to finance investment and consumption. Secondly, and more directly, as a result of the loss of purchasing power induced by the higher rates. Considering the volume of outstanding mortgage debt at floating interest rates (excluding loans extended to developers), the nearly four point increase in Euribor since early 2022 has pushed up the household debt service burden by around 13 billion euros, translating into gross disposable income erosion of 1.6%.

However, several factors offset that increase, particularly the repayment of loans issued at fixed rates in years in which interest rates were still relatively higher and when the size of the loans tended to be bigger than of late (composition effect). Despite those mitigating factors, however, households will lose purchasing power as a result of the rise in rates. They will also be affected directly by inflation and depletion of the pool of savings built up in prior years. Indeed, we are predicting a sharp slowdown in private consumption this year (Torres and Fernández, 2023).

It is also important to consider the impact of higher rates on the solvency of the more at-risk households, i.e., those with lower-income and floating-rate loans issued more recently. Their plight is undoubtedly a major social issue. From the point of view of the banks, however, the cost of potential defaults looks manageable in light of current provisions and other liquidity buffers. Longer-term, the key lies with the labour market as a household’s ability to service its debt depends largely on its employment status.

In sum, the rise in Euribor does not, for now, imply an excessive risk for the economy. Nevertheless, some households, especially those that have taken out floating-rate mortgages more recently with low- or medium-low income levels face a sharp increase in financial burden relative to their disposable income. All of which signals the importance of measures targeted at those most at-risk.

Notes

To estimate Euribor in real terms, we used the average increase in wages negotiated via collective bargaining as our deflator. That is because the trend in wages is a good proxy for household income. Also, the negotiated wage figures are updated monthly, making it possible to deflate Euribor with that frequency.

Refer to the

AHE’s Quarterly Bulletin for the third quarter of 2022, at

www.ahe.es

The AHE’s bulletin includes mixed-formula loans within the floating-rate category.

Survey of Household Finances (EFF) 2020: methods, results and changes since 2017. Analytical Articles.

Economic Bulletin, 3/2022 (

bde.es).

For an analysis of the correlation between interest rates and the Spanish property market, refer to Torres (2022). The ECB has come up with a recent estimate for the eurozone (2022).

For further details about the market’s performance, refer to Montoriol Garriga (2022).

References

ECB (2022). The impact of rising mortgage rates on the euro area housing market.

Economic Bulletin, 6. https://www.ecb.europa.eu/pub/economic-bulletin/html/eb202206.en.html#toc13

MONTORIOL GARRIGA, J. (2022). The real estate sector is cooling down. December.

The real estate sector is cooling down. (

caixabankresearch.com).TORRES, R. (2022). Housing markets ahead of the threat of recession.

Spanish Economic and Financial Outlook, Volume 11, No. 5, September.

https://www.funcas.es/wp-content/uploads/2022/10/Torres-11-5.pdf TORRES, R. and FERNÁNDEZ, M. J. (2023). Outlook for the Spanish economy in the wake of the energy crisis.

Spanish Economic and Financial Outlook, Volume 12, No. 1, January. https://www.sefofuncas.com//A-preview-and-assessment-of-Spains-budget-for-2023/Outlook-for-the-Spanish-economy-in-the-wake-of-the-energy-crisis

Raymond Torres. Funcas