Outlook for the Spanish economy in the wake of the energy crisis

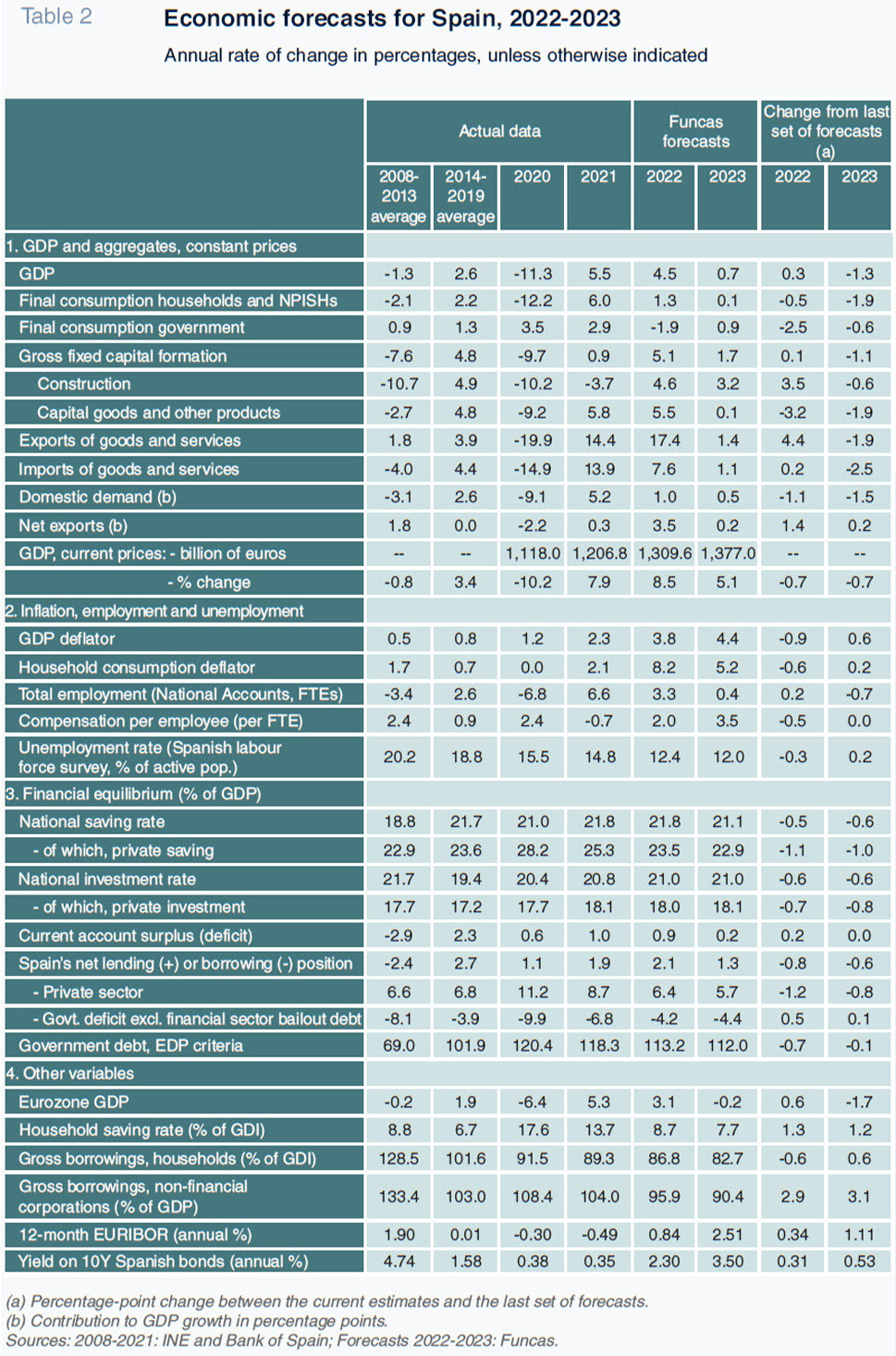

Spanish GDP growth for this year has been revised upwards and is now forecast at a solid 4.5%. Within a context of high uncertainty, underpinned by geopolitical tensions, high energy prices and tighter monetary policy, downside risks are significant and economic weakness will be more tangible in 2023, with inflation possibly easing somewhat, though remaining stubbornly high over the projection period.

Abstract: The combined result of recent revisions to GDP figures reflect GDP growth of 6.7% year-on-year in the first half of 2022, up from the initially published rate of 6.3%, driven essentially by foreign demand, followed by investment, particularly in capital goods. That said, all signs point to an exacerbation of the slowdown increasingly on display in recent months, driven by the loss of household purchasing power as a result of inflation and the consequent increasing impact on household consumption. As well, the intensification of the energy crisis during the winter season could potentially lead to supply disruption, particularly in countries, such as Germany and Italy, which could lead to recession, with adverse consequences for Spanish exports. Growth this year is forecast at a solid 4.5%, up 0.3pp from our last forecast, albeit expected to be highly uneven by quarter and in terms of drivers. The economic weakness will be more tangible in 2023, when the Spanish economy is expected to grow by 0.7%, compared to our last forecast of 2% and inflation too is set to come down over the coming months, albeit remaining high. Geopolitical tensions are injecting a high degree of uncertainty into the forecast scenarios, with more downside than upside risk. Within this context, taming inflation, the economy´s ability to withstand rising interest rates and the persistence of the structural public deficit constitute the main risks for the Spanish economy.

Foreword

The energy markets have been dictating the plight of the Spanish economy since early 2021. The sharp increase in oil and gas prices has had spillover effects on the cost of electricity, transport and, ultimately, the entire production chain, with the war in Ukraine emerging as a compounding factor (Torres and Fernández, 2022). All of which has sent inflation soaring and brought economic momentum to an abrupt standstill. In this paper, after a brief overview of recent trends, we present our economic forecasts for the rest of this year and 2023.

Recent performance of the Spanish economy

According to the revised national accounts figures, Spanish GDP registered growth of 1.5% in the second quarter of this year, which is significantly higher than initially estimated (1.1%), offsetting the simultaneous downward revision to the first-quarter growth figure. The 2021 quarterly figures were also revised and the upshot of all of the changes made was that GDP grew by 6.7% year-on-year in the first half of 2022, up from the initially published rate of 6.3%.

The main source of growth in the first half was foreign demand, more specifically the recovery in international tourism. The next biggest driver was investment, particularly in capital goods. Private consumption, meanwhile, rebounded in the second quarter, but only barely offset the contraction sustained in the first quarter, so that the stagnation observed for several quarters now continues. Lastly, public spending declined in real terms in the first two quarters of the year.

Employment, measured in hours worked as per the national accounts, increased in both quarters, albeit remaining 0.8% below the 2019 average. Productivity per hour worked is another indicator yet to revisit pre-pandemic levels. The number of Social Security contributors continued to register healthy monthly growth throughout the first half, albeit much lower than in the second half of 2021.

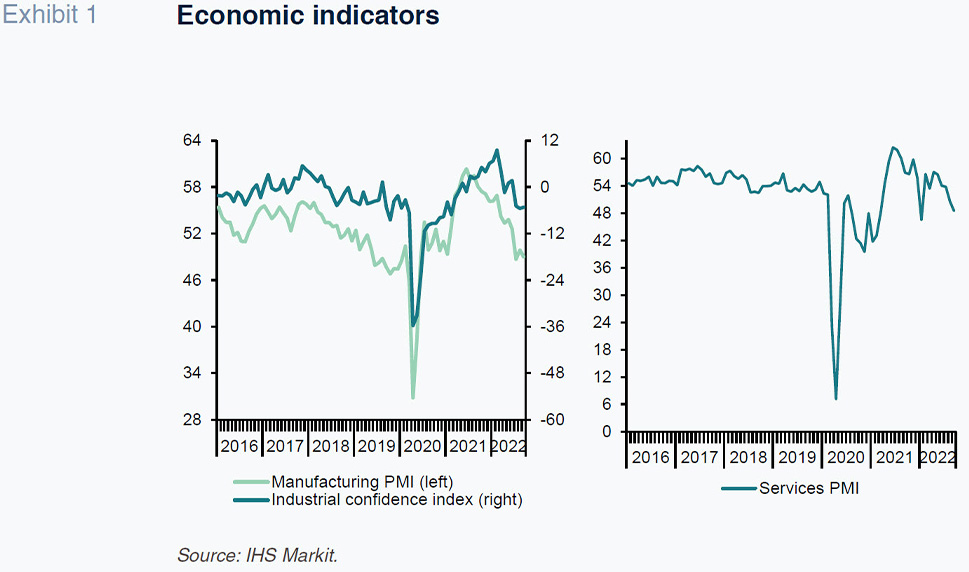

As for the third quarter, based on data up to September, consumption is showing no signs of a rebound, whereas tourism is continuing to recover, although at a considerably slower pace than in the second quarter. Within the industrial sector, some areas, including metallurgy and chemicals, hit hard by the inflation in energy and commodities, reported falling business volumes. However, the remaining sectors were stable or growing, with the jump in activity in the automotive industry standing out. Nevertheless, the manufacturing and services PMIs have been moving lower and both are now below 50, the threshold flagging contraction (Exhibit 1).

Contributor numbers continued to grow throughout the summer, without really giving clear signs of slowing; however, adjusting for seasonality, the figures warrant caution at this time.

Headline inflation peaked at 10.8% in July, with core inflation peaking at 6.4% in August. Price growth was highest in food products: 13.2% year-on-year in August. As for energy products, fuel prices have come down in recent months, in tandem with the drop in oil prices, whereas electricity prices remain extraordinarily volatile.

Besides oil, other commodity prices have trended lower in recent weeks, as have shipping costs, which nevertheless remain well above pre-pandemic levels. There are also signs of reduced friction in global supply chains. The industrial price index, the benchmark for the trend in inflation across the production chain, has been easing slowly since the end of spring. Inflationary pressures may therefore be abating somewhat.

In the real estate market, the volume of home purchases has been stabilising, albeit around a relatively high number – the highest since early 2008 – following sharp growth in 2021. House prices, meanwhile, continue to rise, although at a slowing pace.

Lastly, the public deficit came in at 30.46 billion euros in the first half, compared to 55.68 billion euros in the same period of 2021. Tax revenue dynamics have remained remarkable and on the spending side matters are being helped by the rollback of the social coverage implemented during the COVID-19 pandemic.

Forecasts for 2022-2023

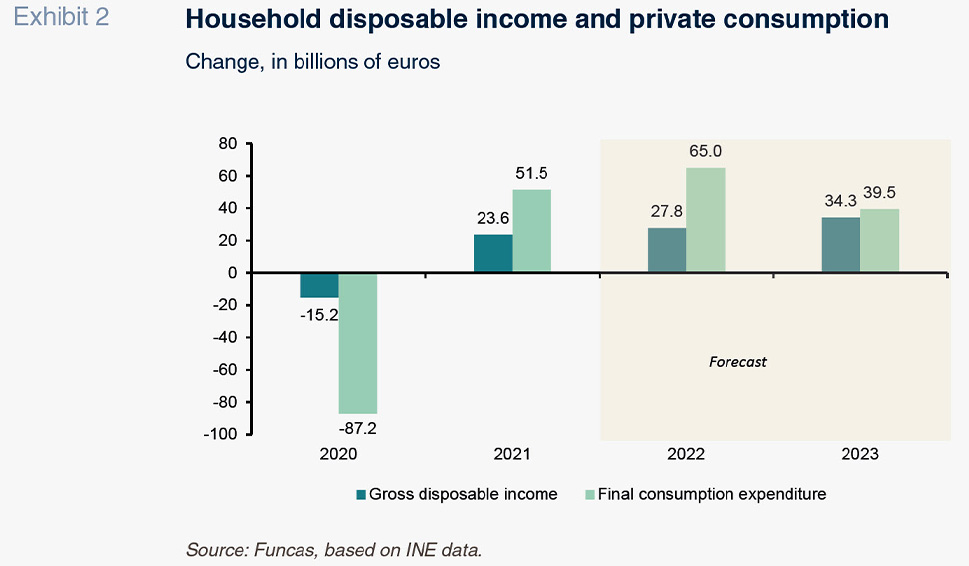

All signs point to an exacerbation of the slowdown increasingly on display in recent months. The main driver is the loss of household purchasing power as a result of prevailing inflation and a foreseeably greater impact on private consumption by comparison with the first half of the year: household savings are back near long-run average levels, which means that many families no longer have a liquidity buffer to make up for the loss of real income (Exhibit 2).

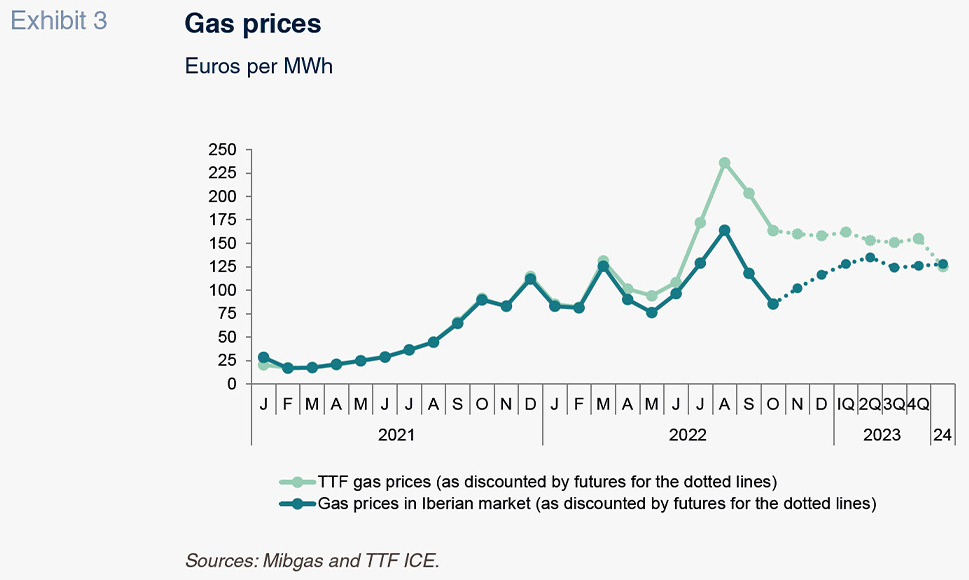

Moreover, the energy crisis induced by the invasion of Ukraine will be felt more intensely during the upcoming winter season and could trigger stoppages in certain sectors, such as the metallurgy or fertiliser sectors, that cannot pass their higher costs onto end prices. The manufacturing sectors in the countries most dependent on Russia for gas, such as Germany and Italy, are facing supply cuts that will almost certainly translate into recession, with adverse consequences for Spanish exports (IMF, 2022). Our forecasts are underpinned by the assumption that GDP in the eurozone will contract by 0.2% in 2023 and that energy prices will continue to climb higher until next spring, at which point they will remain high, in line with the levels currently being discounted by the futures market (Exhibit 3).

Lastly, given inflation’s staying power, the main central banks have embarked on a path of rate tightening with the aim of cooling demand and thereby mitigating the risk of second-round effects. Our forecasts contemplate additional increases in the ECB’s deposit facility rate up to a terminal rate of 2.5% in the second quarter of 2023, from which point we expect rates to be largely stable. The yield on the 10-year bond is expected to rise to 3.5% during the projection horizon.

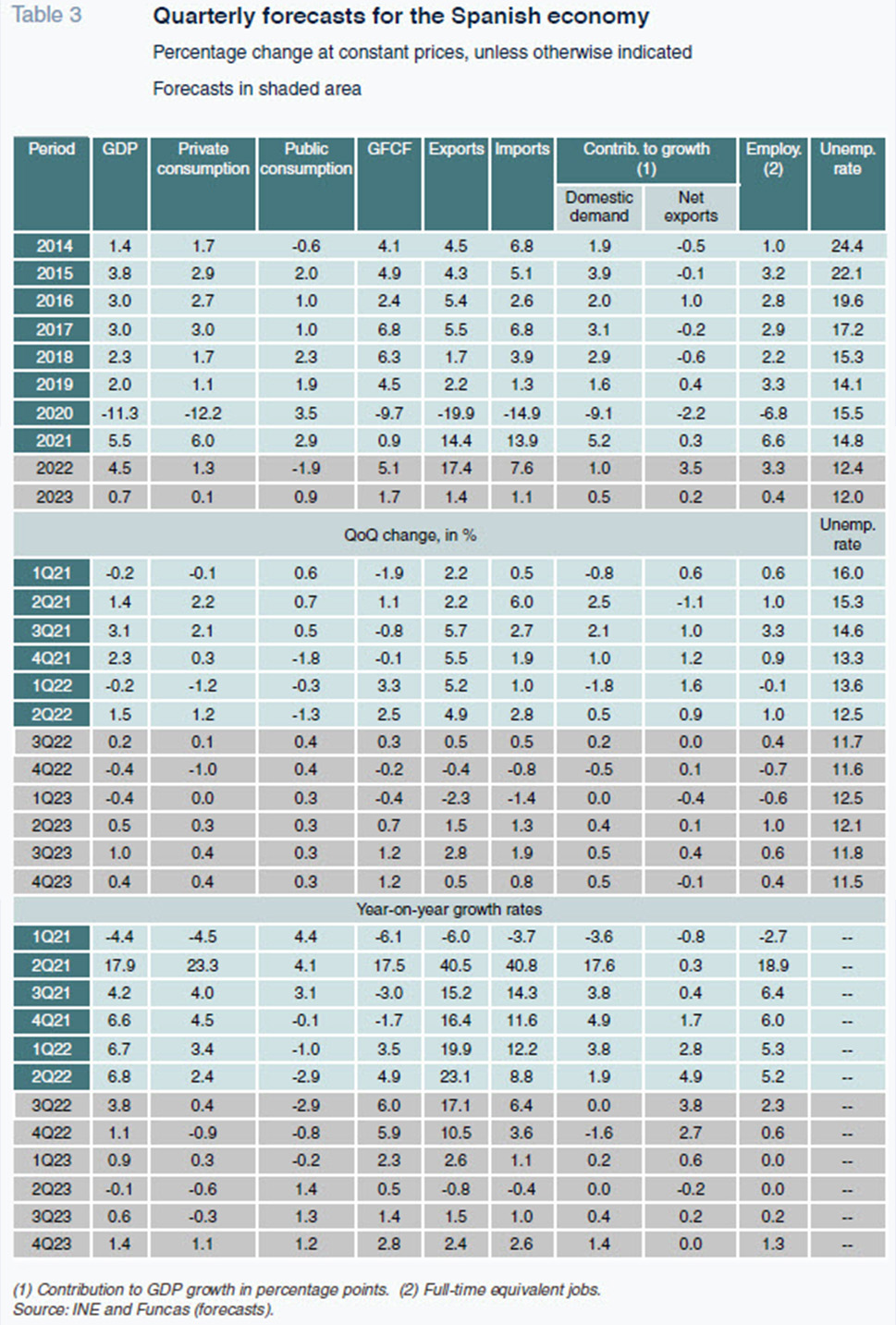

Against that backdrop, following slim (but positive) growth in the third quarter thanks to lingering momentum in tourism and exports, GDP could contract in the last quarter of this year and first quarter of 2023, so constituting a short recession. We are forecasting the possibilitiy of a slight recovery from the second quarter, in line with reduced pressure from energy prices and, later, a pause in monetary tightening.

Growth this year is forecast at a solid 4.5%, up 0.3pp from our last forecast (Table 2). However, that growth is expected to be highly uneven (after the momentum of the first half, GDP is expected to eke out scant growth of 0.2% in the third quarter and to contract by 0.4% in the fourth quarter) by quarter and in terms of drivers. Growth will be driven mainly by the momentum in exports, with net trade expected to contribute 3.5% points (up 1.4pp from our July forecasts). Internal demand, on the other hand, is expected to contribute a meagre 1pp to GDP growth (down 1.1pp from our last set of forecasts), due to the impact of inflation on private and public consumption. Investment is the only driving force within internal demand, buoyed by the momentum in exports, growth in corporate profits and stimulus provided by the European funds.

The economic weakness will be more tangible in 2023, when the Spanish economy is expected to grow by 0.7%, compared to our last forecast of 2%. We have lowered our forecasts for all components of demand. Most notable is the expected continued stagnation of private consumption against the backdrop of an energy and inflation crisis that is undermining consumer confidence despite the small degree of wage recovery anticipated. Global uncertainty and the impairment of the European economy are also likely to weigh heavily on investment, so that internal demand is now expected to contribute just half a point to GDP (down 1.5pp from our last set of forecasts). Likewise, external demand is expected to lose steam as the international economy stutters. However, as imports will slow in tandem with internal demand, net trade should still make a small positive contribution to growth, of an estimated 0.2pp (our last forecast contribution: 0pp).

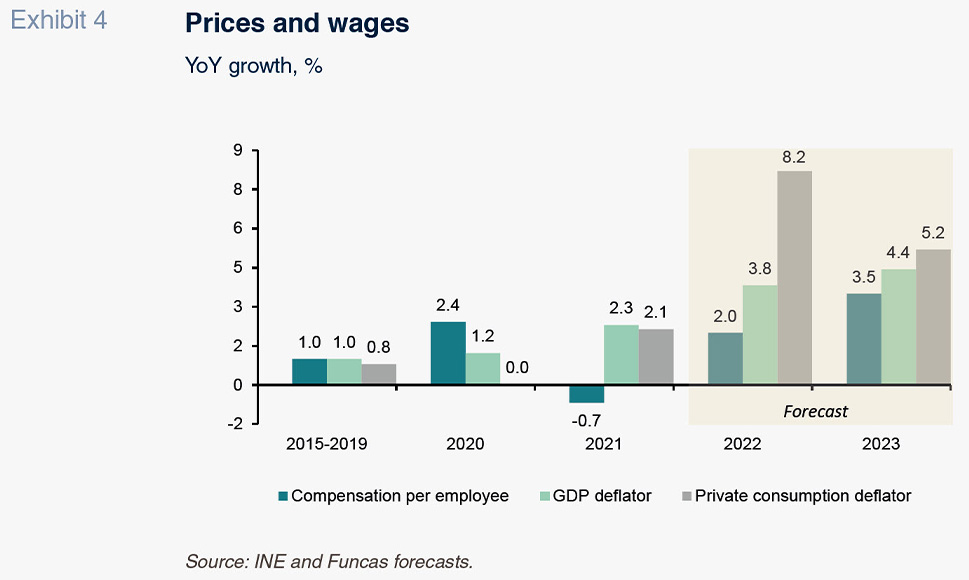

Inflation may start to come down over the coming months, albeit remaining at high levels. Assuming that energy prices continue to rise until next spring before stabilising, at the levels being discounted by the futures market, we are forecasting the consumption deflator at 8.2% this year and at 5.2% in 2023 (Exhibit 4), which is not significantly different from our July forecasts. As for the GDP deflator, the variable that best reflects internal price dynamics, we are forecasting a significantly lower rate of 3.8% this year, and a rate of 4.4% next year. The increase in the GDP deflator in 2023 is attributable to the increase in wages anticipated next year (we are now expecting employee remuneration to increase by 3.5%, up one and a half points from our forecast for 2022).

The increase in the energy bill will hurt Spain’s goods trade deficit, eroding the current account, which will nevertheless remain in surplus territory thanks to Spanish exports’ strong competitive positioning. Thanks to that, and transfers from Europe under the scope of the Next Generation funds (which do not compute for current account calculation purposes), Spain will continue to report a solid overall external surplus throughout the projection period: its net lending position is forecast to reach 1.3% of GDP in 2023.

The labour market is also likely to feel the slowdown but shouldn’t give back the gains notched up in recent months. Our forecasts call for the creation of 220,000 jobs (net) between July 2022 and December 2023, 60,000 fewer than in the first half of this year (adjusted for seasonality and on a full time equivalent basis). That slim growth will, however, be sufficient to ward off a sharp increase in unemployment of the magnitude observed during previous recessionary episodes. Unemployment is expected to hover at around 12% until the end of 2023.

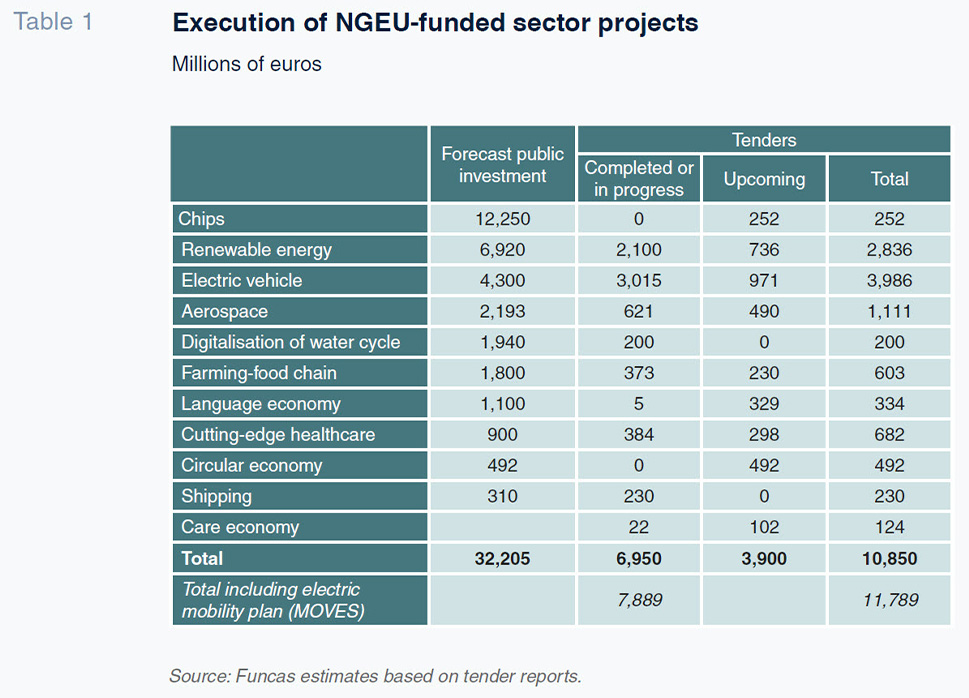

The public deficit is set to come down this year thanks to the interplay of the automatic stabilisers, coupled with inflation dynamics. However, little progress is expected on addressing prevailing imbalances in 2023 on account of the economic cooling and indexation of pensions. The deficit is forecast at around 4.4% of GDP in 2023, which is close to its structural level, with public debt at 112%. In short, fiscal policy faces the challenge of tackling the costs of inflation while addressing budgetary imbalances. The European funds have the potential to make a significant contribution to that task but their execution is spotty to date (Table 1).

Main risks

Geopolitical tensions, particularly the various possible outcomes for the war in Ukraine, mean these forecasts are subject to a significant degree of uncertainty. With all due caution, there is more downside than upside.

Firstly, the energy crisis could prove harsher than forecast, making it hard to tame inflation and exacerbating the risk of recession in the eurozone. The gas market (and its ramifications for electricity), the most sensitive to that geopolitical tension, is of greatest concern. An intensification or spillover of the conflict in Ukraine would have immediate repercussions for oil and gas prices, triggering a deep recession in Europe.

The economy’s ability to withstand the rise in interest rates is another source of risk. Unlike the last crisis, financial risks look moderate today, although a lot depends on the pace of monetary policy normalisation. Moreover, past experience suggests that interest rates affect the economy and financial system in a non-linear manner. The risks at the start of the rate tightening process could be small. For example, in Spain, growth slowed gently between 2005 and mid-2007 despite sharp rate increases. At that juncture the additional rate increases were marginal but sufficient to tip the economy into recession. Today’s situation is not comparable thanks to deleveraging in the Spanish private sector and healthy momentum in the labour market (a key enabling factor of the “manageable” scenario depicted in these forecasts). Nevertheless, if rate increases are too aggressive there is a risk of a prolonged recession.

[1]

Lastly, the persistence of a significant structural public deficit is a threat at a time when the ECB is rolling back its support. Now, more than when interest rates were negative, fiscal sustainability depends on the credibility of the reform path and the transformational impact of public budgets, particularly with respect to the investment projects financed from the European funds.

Referencias

Raymond Torres and María Jesús Fernández. Funcas