Deterioration in Spain’s public finances in the wake of COVID-19

The spike in Spain’s deficit in 2020 was the result of higher spending and lower tax revenue due to the COVID-19 pandemic. Although the government is forecasting smaller deficits in the coming years, Spain lacks a credible deficit consolidation plan.

Abstract: Spain reported a public deficit of 10.1% of GDP in 2020, which ultimately rose to 11.0% following the assumption of the reclassified deficit of the SAREB, or Spain’s so-called bad bank. Much of this was concentrated in the central government, whose deficit came in 0.89 percentage points of GDP higher than initially forecast due in large part to transfers made to sub-central governments. The deficit is the result of two primary factors: an increase in spending and a fall in revenue. Specifically, spending rose to finance furlough schemes, healthcare expenses and income support for the self-employed. While personal income tax receipts rose in 2020, VAT and corporate tax receipts plummeted. The 2021 General State Budget includes a deficit of 8.4% of GDP in 2021.

[1] Upward pressure on the deficit could come from solvency support for the corporate sector and the rollover of fiscal and bankruptcy protection. Downward pressure on the deficit could arise from a positive trend in corporate income tax, VAT revenue and the gradual withdrawal of the measures passed in 2020 to mitigate the effects of the pandemic. However, the uncertainty regarding the economy and, particularly, the absence of a medium-term consolidation plan, raises considerable doubts about the forecast trajectory in public debt over the coming years.

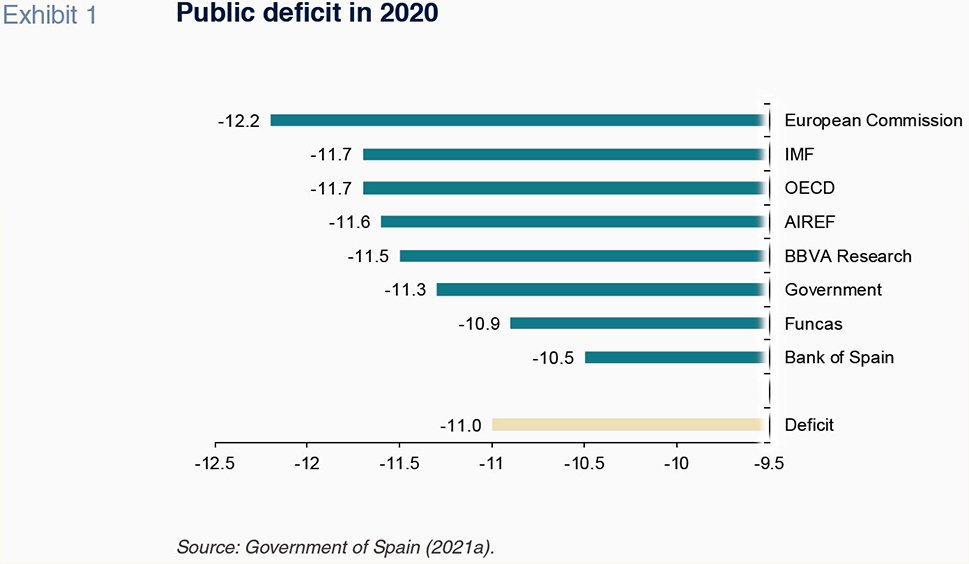

The starting point: Back to a double-digit deficit in 2020Spain reported a public deficit of 10.1% of GDP in 2020, which is equivalent to 113.17 billion euros. That figure was well below the 11.3% originally estimated by the government in October 2020 in the General State Budget for 2021 (Government of Spain, 2020). As shown in Exhibit 1, that official forecast was in line with the consensus forecast presented by Funcas but below the estimates of AIReF, BBVA, the OECD, the IMF and the European Commission, which were projecting a deficit ranging from 11.5% to 12.2%. However, in March, Eurostat obliged the Spanish government to assume

the deficit of the SAREB —of nearly 9.9 billion euros— in its 2020 figures.

[2],

[3] Following the reclassification of the SAREB’s deficit, the total 2020 deficit, which includes all levels of government, ultimately amounted to 10.97% of GDP, equivalent to 123.07 billion euros. The 2020 deficit is very close to the peaks recorded in 2010 and 2012 (11.28% and 10.74%, respectively) during the financial crisis of 2008. Therefore, the economic crisis induced by the pandemic has led Spain back to a double-digit deficit, one that will necessitate a major fiscal consolidation process for the second time in a just over two decades.

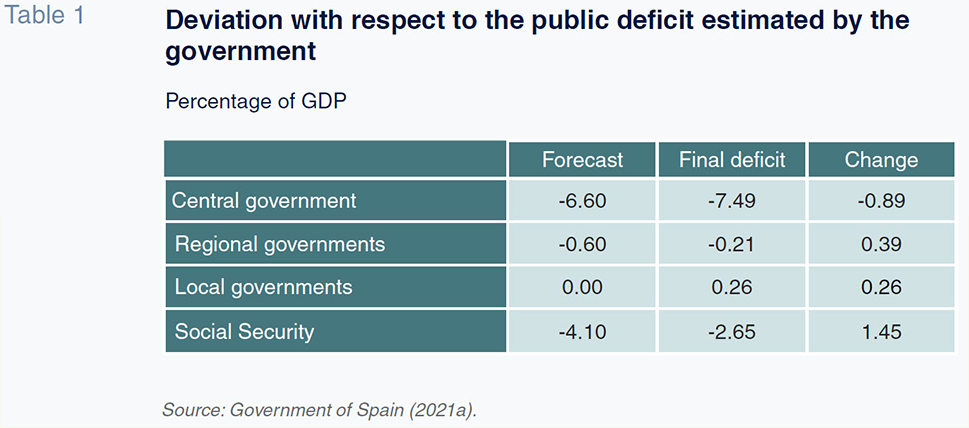

The only positive note within the sharp deterioration in Spain’s public finances is the fact that the 2020 deficit came in 0.33 percentage points below the October forecast. The breakdown of the aggregate deviation from the target by level of government, excluding the deficit generated by the reclassification of the SAREB deficit, is shown in Table 1. Specifically, that table shows how the central government deficit came in 0.89 percentage points of GDP higher than initially forecast, at 7.49%. The deterioration in the central government’s deficit is the result of transfers made to sub-central governments. In contrast, the Social Security deficit was 1.45 percentage points of GDP below the initial forecast. The regional and local governments also performed better than expected, with the former reporting a deficit of 0.21% (0.39 percentage points below the target) and the local governments reporting a surplus of 0.26% (the target was for a balanced budget at this level). In fact, eight of the 17 regional governments went from a deficit in 2019 to a surplus in 2020: Andalusia, Aragon, Asturias, Balearic Islands, Cantabria, Castile-La Mancha, Castile & Leon and La Rioja. In total, the regional governments’ deficit decreased by 65.7%, from 7.11 billion euros in 2019 to 2.31 billion euros in 2020.

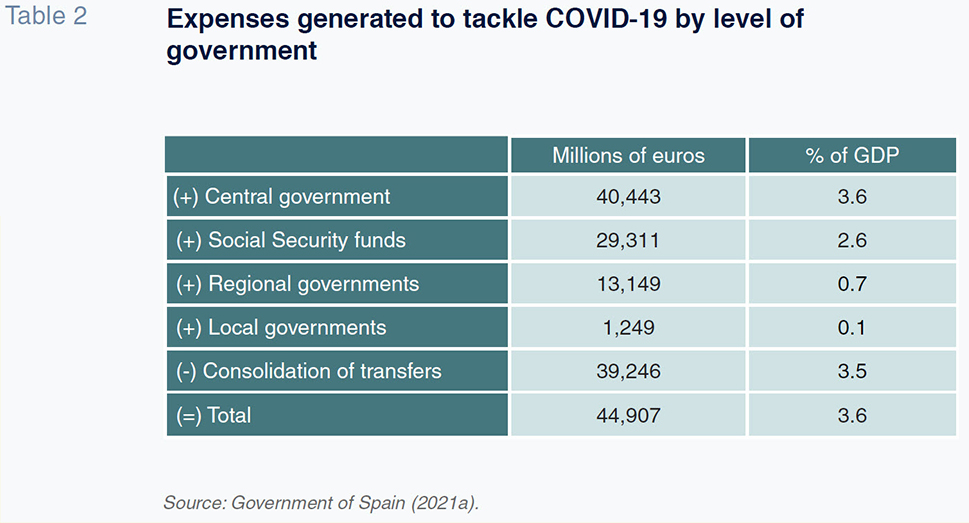

The public deficit reported in 2020 is the result of the interplay of two factors: (i) a drastic increase —of 62.9 billion euros —in public spending (growth of 12.0% of GDP), accompanied by a decrease, albeit smaller than expected, of 24.5 billion of public revenue (an increase of 2.1% of GDP due to the strong decrease in the denominator of the ratio) (IGAE, 2021). On the expenditure side, the Spanish government implemented a highly expansionary fiscal policy to cover the health and financial holes left by the pandemic. Specifically, the volume of discretionary spending amounted to 44.91 billion euros, with an estimated impact on the deficit, according to BBVA Research, of four percentage points of GDP (BBVA Research, 2021). According to that research report, the remaining five percentage point increase in the deficit was shaped by the ordinary correction in economic activity on account of the pandemic. Most of the discretionary spending was concentrated in the following three items: (i) 47.9% was used to cover the furlough scheme; (ii) 18.4% went to finance healthcare expenses which were managed by the regional authorities; and, (iii) 17.3% went to income support for the self-employed. As shown in Table 2, the central government assumed the financing of 90% of the expenditure generated by COVID-19, which in absolute terms translated into an outlay of 40.44 billion euros. It is worth highlighting the 16 billion euros transferred (non-repayable) to the regional governments to finance the COVID-19 fund

[4] and the 22.36 billion euros earmarked to the Social Security administration. The latter transfers were used to finance the furlough scheme and income support for the self-employed. As a result of that expansionary fiscal policy, total public spending, at all levels of government, reached an all-time high of 576.49 billion euros in 2020, pushing the ratio of public spending over GDP up from 42.0% in 2019 to 51.5% in 2020 (Government of Spain, 2020, 2021a).

The historical drop in GDP in 2020 triggered a reduction in tax revenue of 7.8% (IGAE, 2021). As a result, tax revenue decreased from 212.81 billion in 2019 to 194.05 billion in 2020. However, the pandemic had a very uneven impact on the various key taxes. Personal income tax receipts were nearly flat, up 0.03%, whereas revenue from the other key taxes plummeted. Specifically, VAT receipts and excise duties both decreased by 12.8% and the corporate income tax take decreased by 12.7%. In the case of personal income tax, the increase was driven by: (i) growth of 2% in public sector salaries and of 0.9% in pensions; and, (ii) the role of the furlough scheme in propping up income (the number of people on that scheme peaked at 3.55 million in April 2020). The contraction in corporate tax revenue stands out and is closely related with the fall in business activity. According to the Bank of Spain (2021a), enterprise revenue increased on average in 2020 at companies with over 50 employees (by 4.4% at companies that size) but fell at companies smaller than that (by 1.3% at firms with fewer than 10 employees). The drastic reduction in VAT and duties is attributed to the collapse in household consumption, the most severe in the series, and the rout in tourism (foreign visitors plummeted by 77% in 2020). Lastly, revenue from Social Security contributions increased by 0.8% in 2020, for similar reasons to those given for the growth in personal income tax receipts.

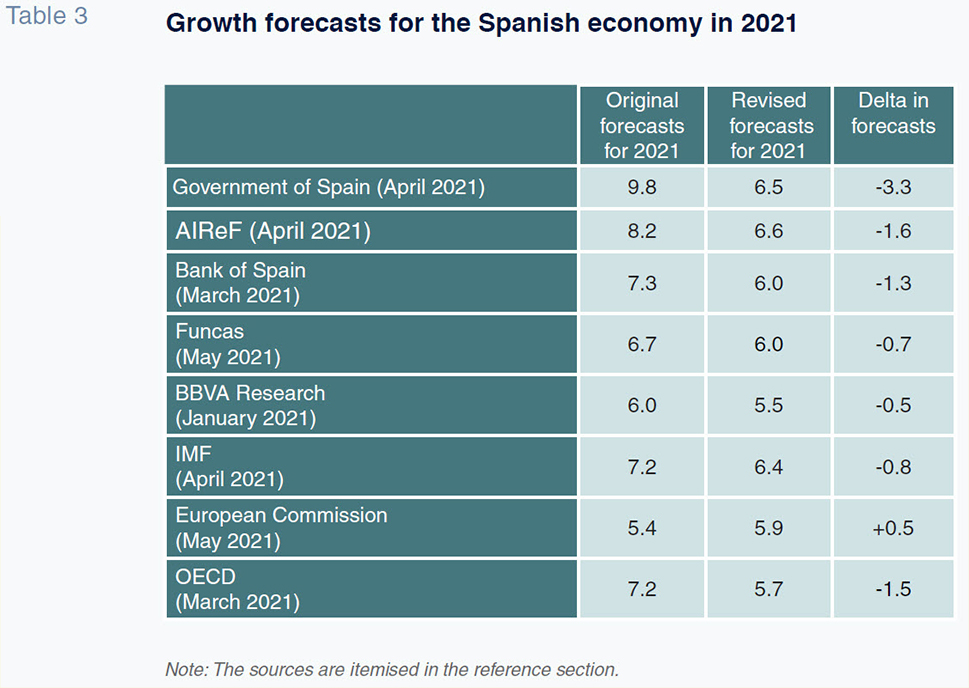

2021 deficit: A worsening outlookThe 2021 General State Budget, passed last December, was framed by an overly optimistic forecast for GDP growth of 9.8%. As shown in Table 3, that forecast was significantly above the growth forecast at the time by most economic research institutions, which, shaped by the significant uncertainty, ranged between 5.4% (European Commission) and 8.2% (AIReF). The Stability Programme Update (SPU) —2021 (Government of Spain, 2021b) cuts that growth forecast to 6.5%, a significant 3.3 points of GDP. However, even the new figures look optimistic in light of the revised forecasts presented by the main analysts, which call for growth of between 5.5% and 6.6%. The uncertainty prevailing over the economic recovery —pace of inoculation, European funds, normalisation of tourism— will affect the public finances in 2021 on the spending and revenue sides alike:

- The government’s revised forecasts estimate that 70% of the Spanish population will be vaccinated by the end of the summer. The number of people vaccinated by mid-April was less than 9% of the population, albeit the rate is expected to accelerate considerably in the coming weeks (Ministry of Health, 2021).

- As for the arrival of the European funds, there is no information as to when exactly the 140 billion euros from the European Recovery Fund will start to arrive, although the SPU-2021 assumes it won’t be launched until the second half of the year. In April, the Spanish government approved the broad areas of the reforms required by Brussels in exchange for receiving those funds. However, the labour market and pension reforms are yet to receive the greenlight from the European Commission [5] [6] [7]. In terms of fiscal reforms, in early April the government set up a tax reform commission which is due to deliver its main findings at the start of next year. The SPU-2021 estimates that the European funds will boost GDP by 2 percentage points and create over 800,000 jobs over the next three years. However, the uncertainty surrounding the specific projects to which the funds will be earmarked, the execution timeframes, management of the funds and their economic effects has prompted AIReF to lower its estimate of the economic impact in 2021 to 1.6 percentage points of GDP [8].

- Lastly, the World Tourism Organisation believes that international tourist flows will not recover until the end of 2022 or early 2023, depending on how the pandemic unfolds around the world.

The government is forecasting a deficit of 104.4 billion euros, or 8.4% of GDP, in 2021. Surprisingly, the updated deficit figure implies an upward revision of 8.7 billion euros (0.7 percentage points of GDP) with respect to the forecasts sent to Brussels as recently as March 31

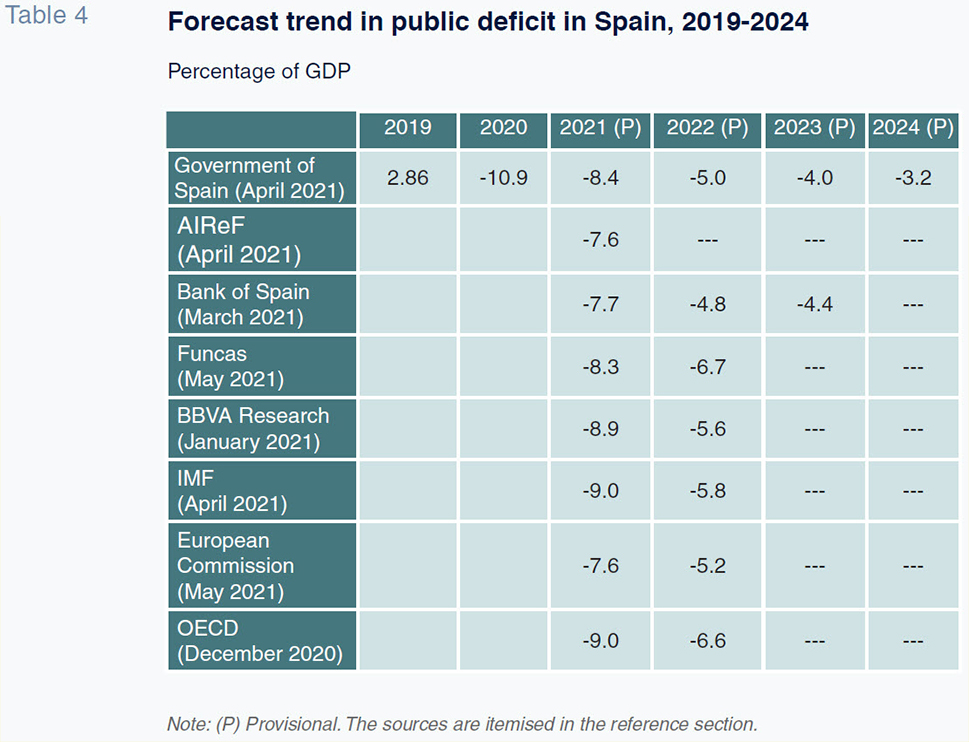

st, 2021 (Government of Spain, 2021). In sum, the SPU-2021 now assumes that the drastic downward revision to the GDP forecast for 2021 will have a much bigger impact on the deficit than was initially estimated. As shown in Table 4, the deficit forecast by the government is higher than that forecast by AIReF (7.6%), Funcas (8.3%) and the European Commission (-7.6) but below that forecast by BBVA Research (8.9%), the IMF (9.0) and the OECD (9.0%).

The SPU-2021 does not provide details about the weight of the various factors expected to shape the forecast increase in the deficit in 2021. For illustrative purposes, AIReF (2021) expects that the 1.6 percentage point reduction in its GDP growth forecast for 2021 will lift the public deficit by one percentage point. In that same report, AIReF estimates the upward impact on the deficit of the new measures approved at the various levels of government at one percentage point of GDP. Those measures notably include 11 billion euros of direct solvency support for the corporate sector and the rollover of fiscal and bankruptcy protection measures with an estimated impact on the deficit of 0.7 percentage points

[9]. On the other hand, AIReF believes three factors will push the deficit lower. Firstly, the final deficit figure recorded in 2020, which was lower than expected, coupled with the positive trend in corporate income tax payments on account and VAT revenue in the first few months of 2021, could reduce the deficit by 2.3 percentage points. Secondly, the gradual withdrawal of the measures passed in 2020 to mitigate the effects of the pandemic could reduce the deficit by a further percentage point. Lastly, the fact that the reclassification of the SAREB deficit in 2020 was a ‘one-off’ will reduce the deficit in terms of GDP by another percentage point.

The SPU-2021 contemplates a downward trend in the public deficit between 2021 and 2024. Specifically, it projects deficits of 8.4% of GDP in 2021, 5.0% in 2022, 4.0% in 2023 and 3.2% by 2024. This amounts to a reduction of 7.7 percentage points in just four years. That reduction is expected to be driven by two forces: (i) on the spending side, the definitive withdrawal of the measures implemented in 2020 to tackle COVID-19; and, (ii) on the revenue side, the growth momentum created by the Recovery Transformation and Resilience Plan (RTRP). Thus, there is no specific budget consolidation plan underpinning the optimistic outlook for the deficit contemplated in the SPU-2021. Moreover, that document contemplates the passage of certain budgetary measures whose net effects only add further uncertainty to the ability to deliver the deficit cuts. Specifically, on the spending side, the plan is to restate public salaries and pensions in line with the consumer price index, a move that will increase structural public spending. Regarding revenue, the idea is to eliminate the current deduction for joint personal income tax returns. That measure, included in Appendix IV of the plan sent to Brussels but not publicly announced, would boost tax revenue by 2.4 billion euros per annum (Sanz and Romero, 2020). However, the strong criticism it has garnered makes it unclear whether it can be pushed through. In short, the deficit reduction forecasts gleaned from the SPU-2021 should be viewed with caution in light of the following two factors: (i) the lack of a credible and rigorous consolidation plan; and, (ii) Spain’s recent experience with consolidation in the wake of the 2008 crisis (Romero and Sanz, 2019). In fact, as shown in Table 4, the estimated deficit for 2022 —5% of GDP— is below the forecasts of most of the analysts, which put it at over 5.5%.

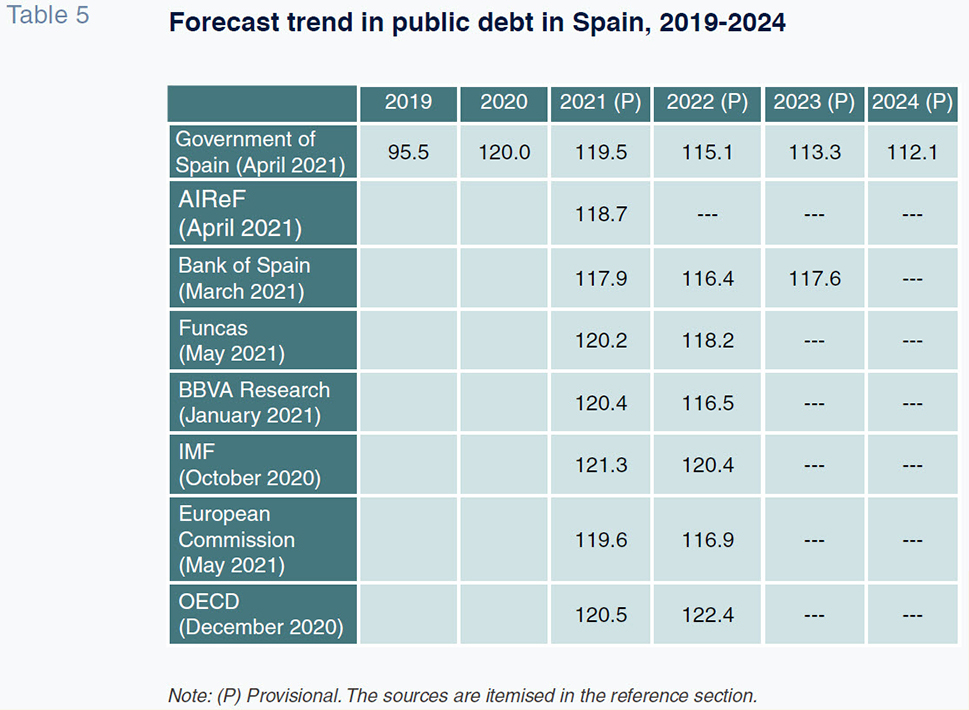

Escalation in public borrowings: Consolidation plan requiredTable 5 outlines the trajectory in public debt between 2019 and 2024. It shows that as a result of the pandemic, the public debt ratio climbed from 95.5% of GDP in 2019 to 120.0% in 2020. In other words, Spain’s public debt increased by 156.73 billion euros in 2020 (growth of 13.2%) to a record level of 1.35 trillion euros. Indeed, Spain tops the ranks of developed countries in terms of growth in debt, exceeding Italy (21 percentage points of GDP), the U.S. (18.9) and France (15.4). According to AIReF (2021), that 24.5 percentage point increase is attributable to three factors. First, 10.5 percentage points correspond to the denominator effect (

i.e., the collapse in economic activity in 2020). Second, 11 percentage points are attributable to the growth in the public deficit in 2020. Third, 3 percentage points are the result of the reclassification of the SAREB debt, forcing the government to consolidate 35 billion euros of borrowings. Most of Spain’s public debt is concentrated at the central government level (1.2 trillion euros), followed by the regional governments (0.3 trillion euros), the Social Security (0.09 trillion euros) and the local governments (0.02 trillion euros).

The government is forecasting public debt equivalent to 119.5% of GDP in 2021, down 0.5 percentage points from 2020. As depicted in Table 5, that forecast looks optimistic in light of most analysts’ projections. Indeed, BBVA (120.4%), the IMF (121.3%) and the OECD (120.5%) all put Spain’s public debt above the 120% threshold in 2021. The uncertainty regarding the economy and, most especially, the absence of a medium-term consolidation plan, raises considerable doubts about the forecast trajectory in public debt over the coming years. By way of illustration, the level of debt estimated by the government in 2023 is 113.3% of GDP, whereas the Bank of Spain is forecasting that ratio at 117.6% in its baseline scenario. In sum, the government is forecasting a 6.2 percentage point reduction in public debt over GDP between 2021 and 2023, while the Bank of Spain is projecting a much narrower decrease of 0.3 percentage points.

There is no date for the reintroduction of the fiscal rules in the European Union, although most observers expect it will happen in 2023. Spain needs to urgently devise a rigorous and credible budget consolidation plan that ensures the sustainability of its debt in the long-term. Unfortunately, the Spanish experience over the past decade raises many flags. The medium-term deficit and debt targets set down in the annual stability plans have been consistently pushed back in time. As a result of that poor budget discipline, the state of Spain’s public finances in early 2020 was much weaker than would have been desirable to handle an exogenous shock of the intensity of COVID-19. The sustainability of Spain’s public debt is highly dependent on the persistence of low interest rates in the long-run. Around half of the public debt issued by Spain in 2021 was issued at negative rates. However, the withdrawal of instruments such as the Pandemic Emergency Purchase Programme (PEPP) by the ECB, slated for 2022, will generate an uptick in borrowing costs that could usher in other risks in the future if not tackled urgently.

Notes

The figure in the Budget is -7.7% although this was later revised to -8.4%.

SAREB is the acronym in Spanish for Spain’s bad bank, a company whose remit is to manage the non-performing assets received by the government in the midst of a bank restructuring. It was set up in 2012 with the government taking a shareholding stake of 45%, to manage the banking sector’s “toxic assets” in the wake of the financial crisis of 2008.

The government initially opted not to include the SAREB’s deficit in its deficit based on its understanding that it was not required to do so as it owned less than 50% of the company. However, Eurostat has obliged Spain to consolidate it within the public deficit, going against the government’s criteria, for two reasons. First it guarantees the debt issued by SAREB. And second, it includes losses compiled by SAREB since its creation.

Those broad areas include reforms in: (i) pension restatements; (ii) retirement age (later); (iii) the Social Security earnings cap; and, (iv) self-employment pensions. The government expects to pass the first two reforms in the third quarter of 2021, with the second two on hold until 2022.

The key aspects of the proposed labour market reforms are: (i) simplification of contract types; (ii) changes in collective bargaining; (iii) digitalisation; and, (iv) subcontracting.

The government will receive an advance payment of 9 billion euros when the European Commission approves the national reform package. That payment will be followed by twice-yearly payments of 16 billion euros in 2021, twice-yearly payments of 27 billion euros in 2022, with the remaining balance, to lift the total to 70 billion euros, due in 2023.

Indeed AIReF has criticised the lack of information about the timing and breakdown of the funds and reforms, information it needs to calculate the impact of the recovery plan more accurately.

The direct aid for self-employed professionals and enterprises has an envelope size of 7 billion euros and will be managed by the regional governments.

References

AIReF (2021).

Report on the initial budgets of the Public Administrations in 2021. Retrievable from:

https://www.airef.es/wp-content/uploads/2021/04/PRESUPUESTOS-INICIALES/Informe-Ptos-iniciales-2021-.pdfBANK OF SPAIN (2021a).

El impacto de la crisis del covid-19 sobre la situación financiera de las pymes españolas [Impact of the Covid-19 crisis on the financial health of Spain’s SMEs]. Retrievable from:

https://www.bde.es/f/webbde/GAP/Secciones/SalaPrensa/Intervenciones

Publicas/DirectoresGenerales/economia/arce180221Cepyme.pdfBANK OF SPAIN (2021b). Macroeconomic projections for Spain, 2020-2023.

Economic Bulletin, 1/2021. Retrievable from:

https://www.bde.es/bde/en/areas/analisis-economi/analisis-economi/

proyecciones-mac/Proyecciones_macroeconomicas.htmlBBVA RESEARCH (2021). Spain |

Fiscal watch 1Q21. Retrievable from:

https://www.

bbvaresearch.com/publicaciones/espana-observatorio-fiscal-1t21/EUROPEAN COMMISSION (2020).

European Economic Forecasts, 2012-2022. Autumn 2020. Retrievable from:

https://ec.europa.eu/

commission/presscorner/detail/en/ip_20_2021FUNCAS (2021). Spanish Economic Forecasts Panel.

Spanish Economic and Financial Outlook, Vol. 10(3), May.

GOVERNMENT OF SPAIN (2020).

Presentación del Proyecto de Presupuestos Generales del Estado [Presentation of the Draft National Budget]. Retrievable from:

https://www.sepg.pap.

hacienda.gob.es/sitios/sepg/es-ES/Presupuestos/PGE/PGE2021/Paginas/PGE2021.aspxGOVERNMENT OF SPAIN (2021a).

Ejecución presupuestaria de las Administraciones Públicas en 2020 [Budget outturn figures for 2020]. Retrievable from:

https://www.igae.pap.hacienda.gob.

es/sitios/igae/es-S/Contabilidad/ContabilidadPublica/CPE/EjecucionPresupuestaria/Paginas/

EjecucionPresupuestaria.aspxGOVERNMENT OF SPAIN (2021b).

Stability Programme Update, 2021 - 2024. Retrievable from:

https://www.hacienda.gob.es/es-ES/CDI/Paginas/EstrategiaPoliticaFiscal/Programas

deestabilidad.aspxIGAE (2021).

Quarterly Report of the Public Administration. Fourth Quarter. Retrievable from:

https://www.igae.pap.hacienda.gob.es/sitios/igae/es-ES/Contabilidad/ContabilidadNacional/Publicaciones/Documents/Cap_Trim/IT_4T_2020.pdfINTERNATIONAL MONETARY FUND (2020).

IMF Country Report, No. 20/298. Retrievable from:

https://www.imf.org/en/Publications/CR/Issues/2020/11/12/Spain-2020-Article-IV-Consultation-Press-Release-Staff-Report-and-Statement-by-the-Executive-49883MINISTRY OF HEALTH (2021).

GIV-Covid 19. Gestión integral de la vacunación COVID-19 [COVID-19 Vaccination Management Overview]. Retrievable from:

https://www.mscbs.gob.es/

profesionales/saludPublica/ccayes/alertasActual/nCov/documentos/Informe_GIV_comunicacion_

20210416.pdfOECD (2020).

Economic Outlook, No. 2. Retrievable from:

https://read.oecd-ilibrary.org/

economics/oecd-economic-outlook/volume-2020/issue-2_39a88ab1-en#page1ROMERO, D. and SANZ, J. F. (2019). Zero-deficit target for 2022: Where is Spain coming from and where is it headed?

Spanish Economic and Financial Outlook, Vol. 8, No. 5, September. Retrievable from:

https://www.sefofuncas.com/The-ECBs-shift-back-towards-QE-Impact-on-the-banking-sector/Zero-deficit-target-for-2022-Where-is-Spain-coming-from-and-where-is-it-headedSANZ, J. F. and ROMERO, D. (2020). Foregone revenues in respect of Spain’s key taxes.

Spanish Economic and Financial Outlook, Vol. 9, No. 6, November. Retrievable from:

http://www.sefofuncas.com/The-Spanish-economy-Outlook-for-recovery/Foregone-revenues-in-respect-of-Spains-key-taxes

Desiderio Romero-Jordán. Rey Juan Carlos University and Funcas

José Félix Sanz-Sanz. Madrid Complutense University and Funcas