Zero-deficit target for 2022: Where is Spain coming from and where is it headed?

Although Spain managed to bring its fiscal deficit under the 3% threshold set by the EU in 2018, there are doubts as to whether it will achieve its balanced budget target in 2022. Challenges which could undermine achieving this goal include the global economic slowdown as well as domestic political uncertainty, which reduces the probability of approving a budget that could achieve the targeted fiscal consolidation measures.

Abstract: Having brought its fiscal deficit under the threshold of 3% of GDP, Spain exited the excessive deficit procedure in 2018. That target was met following a decade’s-long hard work in the context of a harsh economic crisis that saw a substantial increase in Spain’s public debt. Indeed, between 2008 and 2012, the ratio of debt-to-GDP increased by a total of 46.2 percentage points, compared to the eurozone average of 21.2 points. Significantly, it took Spain ten years to rein in its deficit, twice the EU-28 and eurozone average. However, Spain has now set an ambitious target outlined in its Updated Stability Programme, which includes achieving a balanced budget in 2022. Spain’s independent fiscal institution, the AIReF, believes the country will miss that mark, albeit narrowly, estimating a deficit of 0.5% for that year. Either way, Spain is currently facing two sources of instability in terms of attaining the sought-after fiscal equilibrium. The first is external, namely that generated by the global economic slowdown. The second is internal and relates to the political uncertainty prevailing in Spain since 2015, which is proving a serious obstacle to passing budgets and implementing targeted fiscal consolidation measures.

[1]

Introduction: Spain exits the excessive deficit procedure

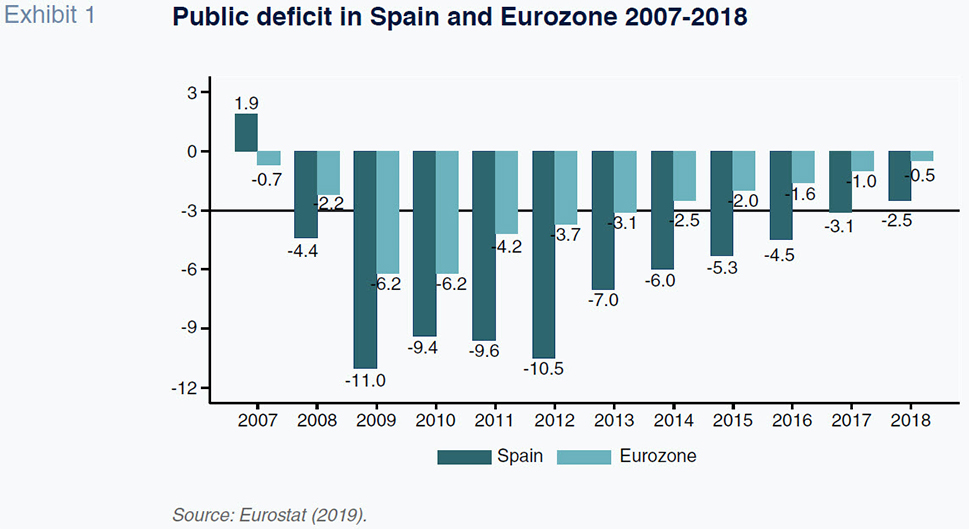

After a painful decade, Spain managed to bring its fiscal deficit below the threshold of 3% in 2018. Specifically, it reduced its deficit from 3.03% of GDP in 2017 to 2.48%, thus enabling it to exit the excessive deficit procedure (EDP) outlined in article 126 of the Treaty on the Functioning of the European Union. As a result, in early June 2019, the Commission proposed terminating the procedure, which had applied to Spain since 2009.

[2] However, the European Commission’s preventative arm continues to keep a close eye on Spain’s public finances. In fact, the Commission recommended that Spain introduce new budget cuts to reduce its high borrowing levels, which had reached 97.1% of GDP in 2018. It also suggested that Belgium, France and Italy make further cuts.

In April 2019, the Spanish government sent the European Commission an updated version of its Stability Programme for 2019-2022 (hereinafter, the USP). According to the USP, the government is targeting a balanced budget in 2022. The roadmap towards that goal entails interim deficit targets of 2.0% in 2019, 1.1% in 2020 and 0.4% in 2021. In tandem with these deficit targets, the USP also aims to reduce public borrowings from 97.1% of GDP in 2018 to 88.7% in 2022. However, the opinion issued by the European Commission on the USP states that there is a risk that the borrowing targets set for 2019 and 2020 (of 95.8% and 94.0%, respectively) will not be met. For this reason, the Commission has proposed a structural annual adjustment of 0.65% of GDP, which corresponds to maximum annual growth in nominal public spending of 0.9%. In nominal terms, that adjustment is equivalent to approximately 7.8 billion euros per annum (European Commission, 2019). For illustrative purposes, that figure is roughly equivalent to Spain’s defence budget for all of 2018. The Commission has also recommended using any windfall gains to accelerate the deleveraging effort.

In sum, following its exit from the EDP, Spain still faces significant challenges and has much work to do to further the fiscal consolidation effort. As shown later, there are two obstacles in its path. The first is the slowdown in the global economy, which is having a direct impact on the Spanish economy. The second is the ongoing political uncertainty in Spain, which since 2015 has made it extraordinarily difficult to form a government with enough clout to inject stability into the budget cycle. This article first analyses the path taken by Spain to exit the EDP in comparative terms. It then looks at the zero-deficit target set by the government for 2022.

Where is Spain coming from? A decade-long effort to abandon the EDP

The path taken by Spain to exit the EDP proved long and replete with difficulties of an economic but also a social and political nature that are worth highlighting. For illustrative purposes, Exhibit 1 depicts the trend in Spain’s deficit relative to the eurozone average. It shows how Spain went from having a surplus of 1.9% in 2007 to a deficit of 4.4% in 2008, the first year of the crisis. Just one year later, in 2009, the deficit surged to 11.0%, well above the eurozone average of 6.2%. The imbalance between public revenue and expenditure would remain at very high levels for the next three years: 9.4% in 2010; 9.6% in 2011 and 10.5% in 2012. Between 2009 and 2012, the cumulative deficit amounted to 432.2 billion euros, which is roughly equivalent to 41.5% of GDP in 2012. Those figures paint a clear picture of the intensity of the impact of the crisis on government borrowings. At year-end 2008, public borrowings stood at 39.5% of GDP. Just four years later, that ratio had climbed to 85.7%.

[3] In short, between 2008 and 2012, the ratio of debt-to-GDP increased by a total of 46.2 percentage points, compared to the eurozone average of 21.2 points. Only Ireland (77.5 points) and Greece (50.2) saw their ratios surge by more.

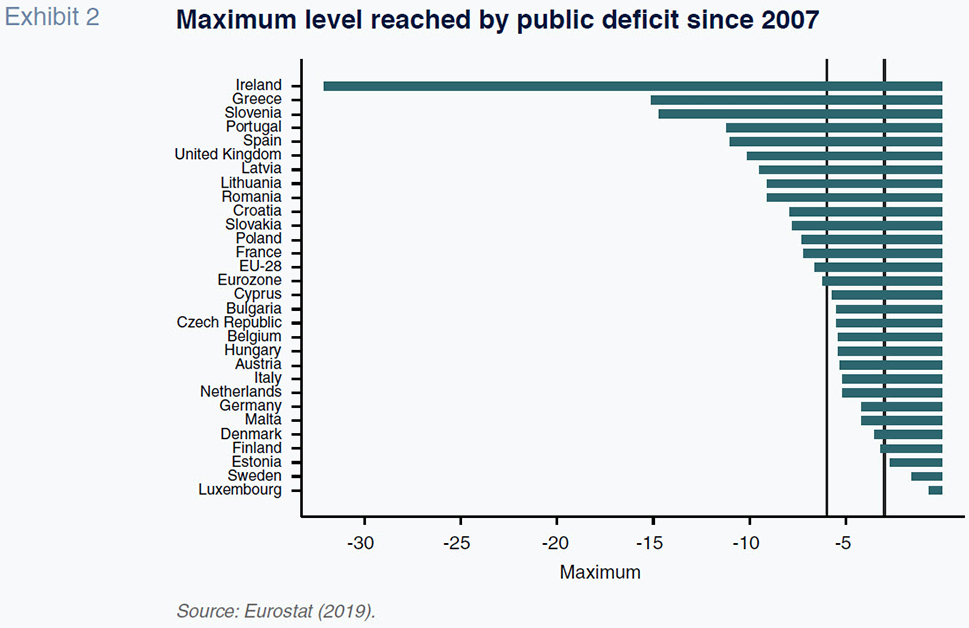

Most of the European Union member states, including Spain, saw their public deficits peak in 2009. Spain recorded a deficit of 11.0% that year (vs. 6.2% in the eurozone) and went on to notch up sizeable deficits, sometimes in the double digits, for the next four years in a row. Indeed, those figures mark all-time highs in the history of Spanish democracy. On average, the eurozone countries took five years to bring their deficits down below 3%, whereas Spain took ten years. Drilling down into the figures reveals significant differences in the levels at which the various member states’ deficits peaked, the number of years needed to bring them below 3%, the percentage points by which those deficits had to be cut to attain that target and the average annual pace of their consolidation efforts. Exhibit 2 shows the peak deficits recorded in the eurozone between 2007 and 2018. Leaving Ireland aside as an exceptional case, the exhibit reveals four categories of countries in terms of peak deficit levels. The first group encompasses the countries whose deficits either did not exceed the 3% threshold (Sweden, Estonia and Luxembourg) or whose deficits did so but only very marginally (Finland: 3.2% and Denmark: 3.5%). The second group consists of the countries whose deficits peaked somewhere between 3% and 6%. It includes Germany (4.2%), Belgium (5.4%), Austria (5.3%), Italy (5.2%) and the Netherlands (5.2%). The third group covers deficit peaks of between 6% and 10% and only includes France within the EU-15; France’s deficit hit a high of 7.2% in 2009. The last group includes the countries whose deficits went above the 10% mark. It includes three Mediterranean markets (Spain, Portugal and Greece), as well as Slovenia, Ireland and the UK.

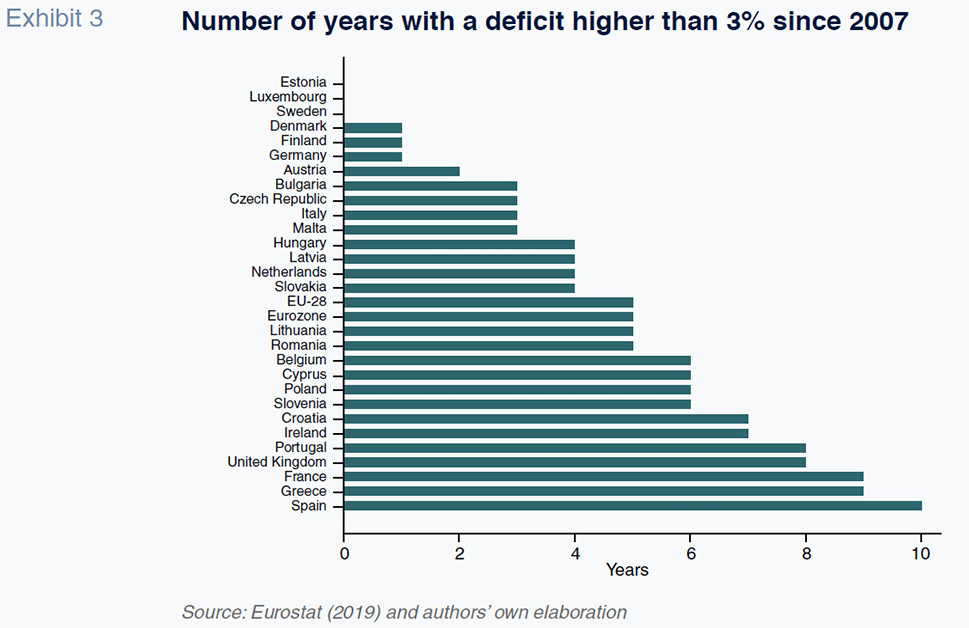

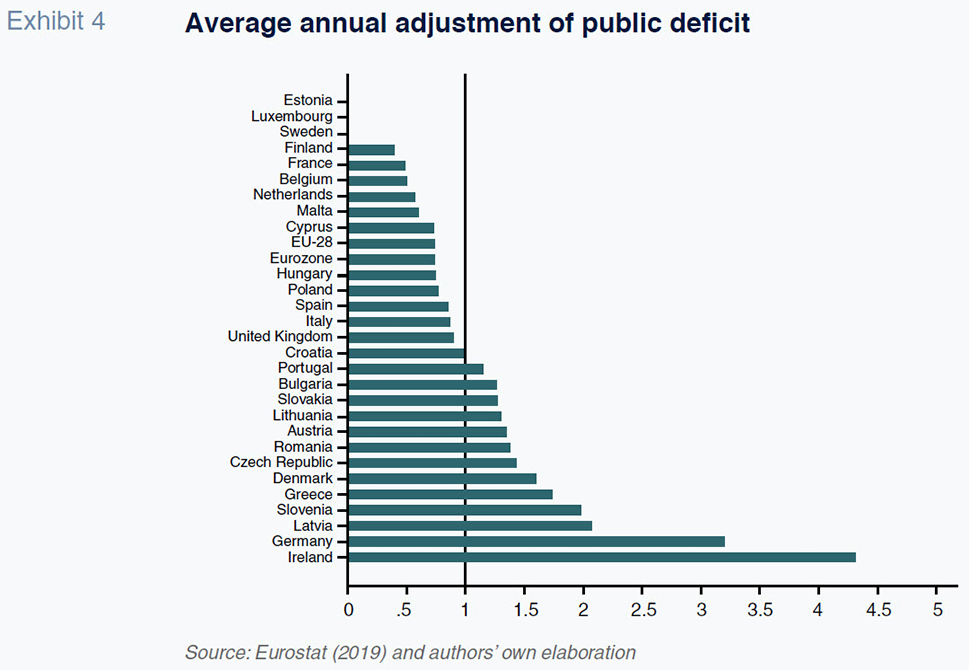

Across the European Union, there are significant differences in the number of years required to go from peak deficit levels to below 3% and in the average pace of the associated fiscal consolidation efforts. As shown in Exhibit 3, at ten years, Spain is the country that took the longest to rein in its deficit. That is twice the EU-28 and the eurozone averages of five years. Behind Spain lie Greece and France (9 years), the UK and Portugal (8 years) and Ireland and Croatia (7 years). The average annual pace of adjustment is depicted in Exhibit 4. Ireland is a case apart: having recorded a deficit of 32.1% in 2010, it managed to slash it to 1.9% in 2015, implying an average annual adjustment in its deficit-to-GDP ratio of 4.3 percentage points. That figure is very significantly above the pace of adjustment observed for the EU countries as a whole, of 0.74 percentage points. Leaving Ireland aside, the countries that recorded the highest deficits during the crisis (in descending order: Greece, Slovenia, Portugal, Spain, the UK and Latvia) reduced their ratios at very different speeds. The fastest paces were observed in Greece and Slovenia with average annual reductions in their deficit-to-GDP ratios of 1.73 and 1.98 percentage points, respectively, followed by Portugal (1.15), the UK (0.90) and, in last place, Spain (0.85). In the rest of the countries, the pace of adjustment varies significantly. Germany, for example, slashed its deficit from 4.2% to 1.0% in just one year. In contrast, France took nine years to bring its deficit from 7.2% to 2.8%, with an average annual reduction of 0.49 percentage points. The comparison between France and Spain is interesting. Both countries took almost the same number of years to bring their deficits below 3%. However, Spain started from a much higher level (11%

vs. 7.2%) and reduced its deficit at a far more intense annual pace (0.85 percentage points

vs. 0.49).

However, the pace of adjustment in Spain was slower than in other EU-15 economies which recorded similar peak deficit levels. Specifically, Portugal’s deficit went nearly as high as Spain’s (11.2%) but was reduced with somewhat greater annual intensity (1.15 percentage points vs. 0.85). In the UK, the deficit peaked below that of Spain (10.1%) and was brought down at a slightly faster pace (0.9 percentage points vs. 0.85). Lastly, it is worth noting that the pace of the deficit cuts in Spain was highly uneven from one year to the next: a 3.5 percentage point reduction in the deficit-to-GDP ratio in 2013, 1.0 in 2014, 0.7 in 2015, 0.8 in 2016, 1.4 in 2017 and, finally, 0.6 points in 2018.

However, the effort made by Spain to deliver the 3% target was intense in socioeconomic terms. Firstly, the economic crisis had a very significant impact on Spanish GDP. In the decade between 2008 and 2018, Spain faced four years of intense crisis in which its GDP contracted. Specifically, Spanish GDP contracted by 3.6% in 2009, 1.0% in 2011, 2.9% in 2012 and 1.7% in 2013. In fact, in nominal terms, Spanish GDP would not top 2007 levels until 2015.

[4] Secondly, the crisis had a dramatic impact on unemployment in Spain, which rose from 8.2% in 2007 to 26.1% in 2013, compared to the EU average of 10.5% (surpassed only in Greece, where unemployment peaked at similar levels in 2012). The crisis was particularly devastating for those under 25. where the rate of unemployment reached 56.9% in the first quarter of 2013. Thirdly, it is important to note that the effort to rein in the public deficit in Spain took place in a context in which the ‘at risk of poverty and/or exclusion’ (AROPE) index tracked by Eurostat peaked at 28.1% in Spain in 2014 (which is the equivalent of 13.1 million people).

Where is Spain headed? The zero-deficit target for 2022

According to the USP, Spain will balance its budget in 2022. Delivery of that fiscal consolidation target means navigating two significant challenges over the next three years. The first is external: weak global economic growth. The second is domestic: political instability in Spain is affecting budgetary approval, timing and content. On the external horizon, the global economy is faced with significant uncertainty as a result of a combination of factors, notable among which are the UK’s exit from the European Union, a harder than expected landing in China and trade war proliferating in the Trump-Xi Jinping era. Against that backdrop, the International Monetary Fund recently shaved its forecasts for global growth in 2019 and 2020 by 0.1 percentage points (to 3.2% and 3.5%, respectively) (IMF, 2019). Nevertheless, Spain continues to post solid growth, above that of the European Union, fuelled by strong domestic demand (2.2% in 2019 and 2.0% in 2020 vs. 1.4% and 1.6% in the EU) (Funcas, 2019).

As for the political uncertainty, the rotation between the two traditional parties (PSOE on the left and Partido Popular on the right) with clear mandates between 1982 and 2015 has given way to a new era of weaker governments, marked by voter fragmentation. The reason is the advent and rise of new parties on either side of the political spectrum in the general elections of 2015, 2016 and 2019 (Unidas Podemos, Ciudadanos and Vox). The governments resulting from those elections have faced tremendous difficulty in getting budgets through and in rolling out budget policies designed to accelerate fiscal consolidation. Indeed, the state budget of 2017, drawn up by the government led by Mariano Rajoy (Partido Popular) had to be carried over in 2018 (as had also happened with the 2016 budget). President Rajoy lost power to Pedro Sánchez on June 1

st, 2018, as a result of the no-confidence vote presented by the Socialist party. President Sánchez, however, agreed to take on the 2018 budget formulated by Mariano Rajoy’s government, whose approval took until July 3

rd, 2018.

[5] Unfortunately, Pedro Sánchez’s administration was not able to push its 2019 budget through as it failed to secure enough votes from other parties, forcing it to call fresh general elections in April 2019. And so, the 2018 budget was rolled over (the third budget carry-over since 2015), once again leaving control over the deficit at the mercy of the growth anticipated in tax revenue from economic momentum alone. Indeed, the Sánchez administration had intended to add a host of tax measures to its 2019 budget in order to increase tax revenue this year by around 5.6 billion euros. Since that has not been possible, Sánchez is planning to bring the measures in 2020 once he gets his budget for that year approved. However, since Sánchez has failed to form a government, Spain will once again face general elections, the fourth since 2015. As a result, the state budget would have to be carried over again, for the fourth time since 2015.

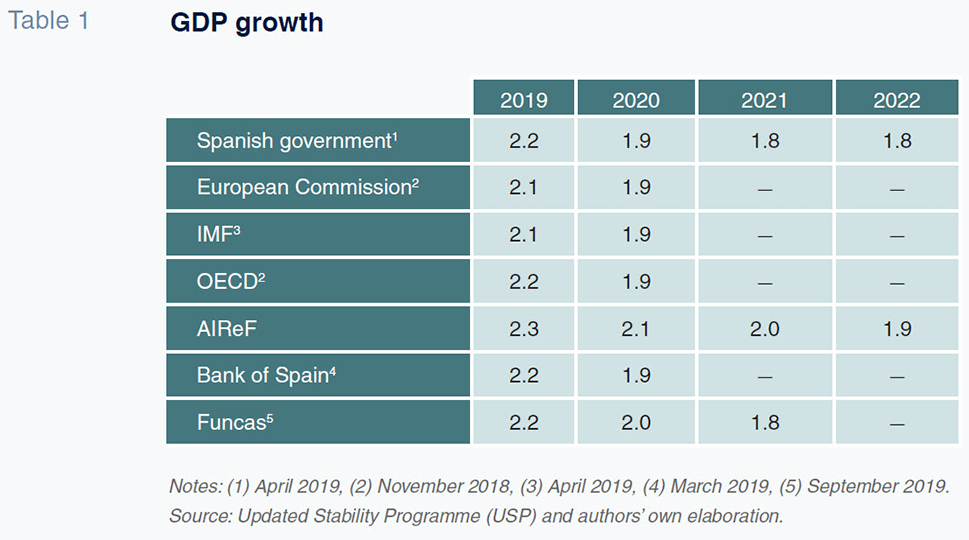

Table 1 shows the growth rates forecast for Spain between 2019 and 2022. For comparative purposes, it provides the current estimates of the main international organisations (EC, IMF and OECD), alongside those formulated in Spain by the AIReF, the Bank of Spain and Funcas. It is worth highlighting the role played by the AIReF as public and independent fiscal control body. Set up at the behest of the European Union, one of its core missions since 2014 has been to continuously assess the budget cycle and public debt situation. The government’s forecasts point to growth of 2.2% in 2019, easing slightly to 1.8% in both 2021 and 2022. The table reveals considerable consensus about where growth is headed in 2019 and 2020. Specifically, the forecasts for growth in 2019 range between 2.1% and 2.3%, the official forecast being 2.2%. In 2021 and 2022, the official estimates point to growth of 1.8% in both years, which is slightly below those presented by the AIReF (0.2 percentage points less in 2021 and 0.1 percentage point less in 2022). Despite the differences, the AIReF has expressly endorsed the macroeconomic projections presented in the USP, describing the growth projections as prudent.

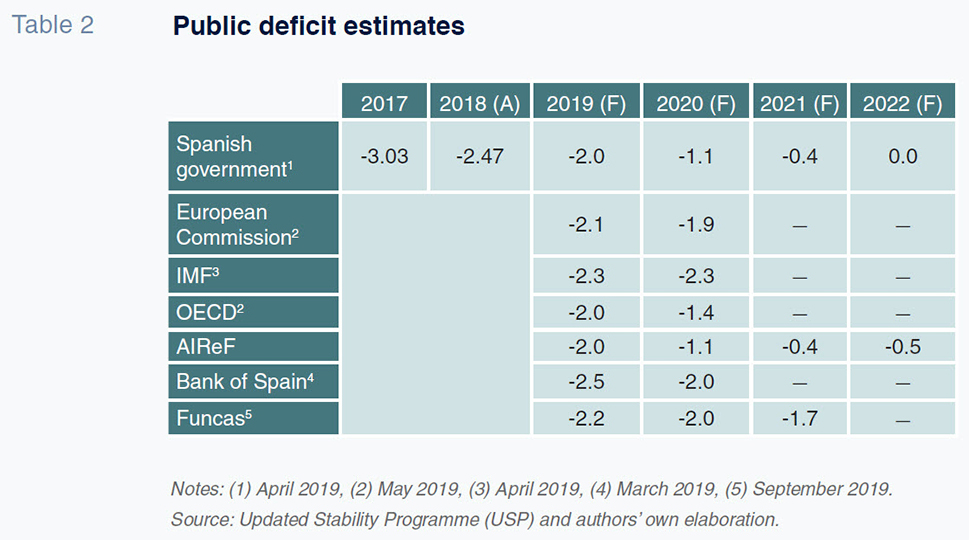

Framed by those growth forecasts, the government estimates provided in Table 2 reveal fiscal deficit targets of 2.0% in 2019; 1.1% in 2020; 0.4% in 2021; and a balanced budget in 2022. The government’s estimate for a deficit of 2.0% in 2019 coincides with the estimates presented by the OECD and the AIReF. Other forecasts, such as those of the IMF, Bank of Spain and Funcas, point to a slightly higher —between 0.1 and 0.5 points of GDP— deficit. Several factors contribute to the differences. Firstly, the breakdown of the forecast GDP: the official estimates contemplate stronger domestic demand and weaker external demand, favouring higher public revenue in the former. Secondly, the official estimates contemplate stronger job and wage growth, which translates into higher revenue from social security contributions, even though public spending is expected to offset the positive impact on the deficit. Lastly, the official estimates contemplate a higher GDP deflator and therefore higher growth in nominal GDP, implying stronger growth in the denominator of the deficit-to-GDP ratio.

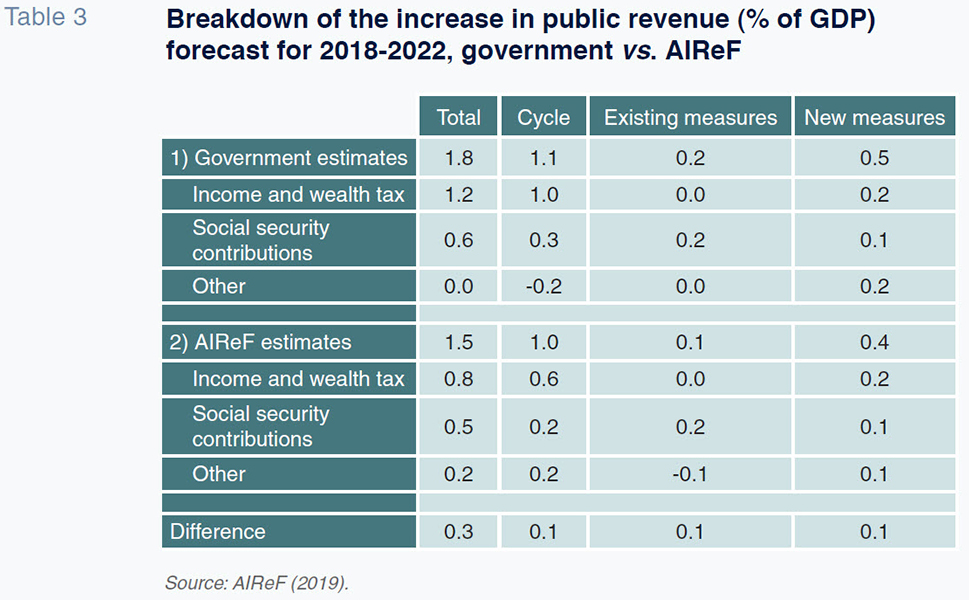

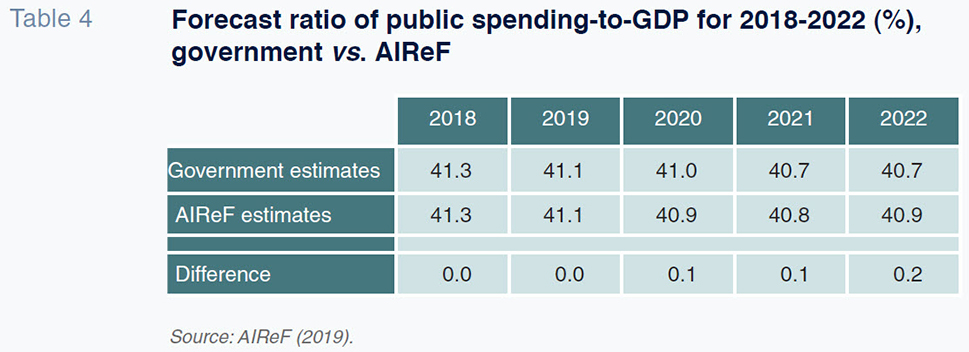

The fiscal consolidation roadmap contemplated in the USP has also been endorsed by the AIReF. Nevertheless, that institution believes it is improbable that Spain will balance its budget in 2022, instead forecasting a deficit of 0.5% that year. The reasons become clear if we look at Table 3. The government expects to lift public revenue by 1.8 percentage points of GDP between 2018 and 2022, estimates which the AIReF views as optimistic, instead forecasting an increase of 1.5 percentage points. By the same token, the USP is estimating a decrease in the ratio of public spending-to-GDP from 41.1% in 2019 to 40.7% in 2022. However, the AIReF is forecasting a 0.2 percentage point smaller reduction, to 40.9%. In sum, the lower growth in public revenue forecast by the AIReF (0.3 percentage points) coupled with its forecast for a narrower reduction in the public spending ratio (0.2 percentage points) explains the 0.5 point shortfall with respect to the government’s deficit forecast.

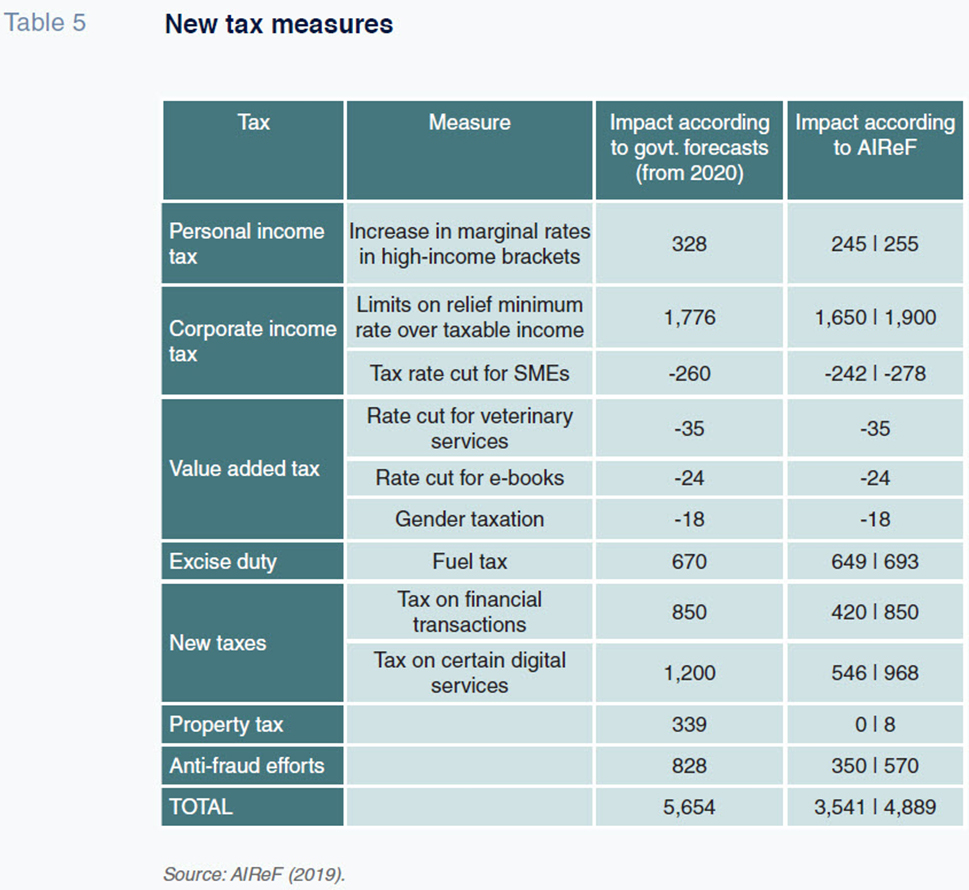

Drilling down into the revenue figures, Table 5 breaks down the forecasts, distinguishing between the effect of the economic cycle and the impact of the planned new tax measures. It shows how the biggest impact is expected to come from the forecast economic growth, specifically an increase in tax revenue equivalent to 1.1 percentage points of GDP, according to the government’s forecasts. Of that increase, 1 percentage point corresponds to income tax and 0.3 percentage points to social security contributions. As for the new tax measures, the government is planning to bring in a fiscal package, which will include changes in the main tax instruments (personal income tax, corporate income tax, VAT and excise duties) as well as new taxes (a tax on financial transactions and on certain digital services). Specifically, the new tax on financial transactions will constitute a levy of 0.2% on the brokered purchase of shares in publicly traded Spanish companies with a market cap of over 1 billion euros (

i.e., excluding SMEs and unlisted companies). And the new tax on certain digital services has been set at 3% of revenue from online advertising, online intermediation services, and the sale of user data by companies with worldwide revenue of over 750 million euros and with revenue in Spain of over 3 million euros. With these two new taxes, the government expects to raise 850 million euros and 1.2 billion euros, respectively. The tax revenue forecasts for each of the measures included in the tax package are itemised in Table 5. The government expects to collect 5.65 billion euros. However, the AIReF is forecasting lower revenue, of between 3.54 and 4.89 billion euros,

i.e., between 14% and 38% below the government’s forecasts. As for the new taxes, the AIReF is forecasting revenue of between 966 million euros and 1.82 billion euros, compared to the government forecast of 2.05 billion euros.

The roadmap set out by the government contemplates four years of deficit-cutting to eliminate the deficit by 2022. Specifically, it is aiming to reduce Spain’s deficit by 0.47 percentage points of GDP in 2019, 0.90 in 2020, 0.7 in 2021 and 0.4 in 2022. Those figures are equivalent to an annual correction of 0.62 percentage points of GDP, which is less than the average of 0.85 percentage points eked out during the 10 years it took to get Spain out from under the excessive deficit procedure. According to the USP, the biggest adjustment will come in 2020, followed by that forecast for 2021. As already noted, the reason for that spike is the carry-over of the 2019 budget, which has prevented the introduction of the package of tax reforms which, according to the Sánchez administration, will take effect in 2020.

Notes

The authors would like to thank María Jesús Fernández (Funcas).

With the exception of Estonia and Sweden, all of the European Union member states are under surveillance by the European authorities for breach of their deficit and debt targets.

The outcome of this situation is well known. Spain’s sovereign risk premium climbed steadily to peak at 637 basis points in July 2012.

This adverse climate explains why Spain has been obliged to ask for extensions to deficit target deadlines on four occasions since 2009. In 2016, the Commission recommended that penalties be applied to Spain and Portugal for failure to do enough to correct their deficits.

In the end, however, it opted against the fines in order to avoid generating an adverse impact on growth in the two economies.

In normal times, the 2018 budget should have been approved before the end of 2017.

References

Desiderio Romero-Jordán. King Juan Carlos University and the FUNCAS Public Finance Observatory (OFEP)

José Félix Sanz-Sanz. Madrid’s Complutense University and the FUNCAS Public Finance Observatory (OFEP)