The recovery of the Spanish mortgage market

Spain’s mortgage market is recovering gradually in the wake of the pandemic, with new transactions outstripping loan repayments. This recovery, however, is very recent, and has not yet consolidated, with lingering and new sources of uncertainty affecting savings and borrowing patterns in ways that are difficult to gauge.

Abstract: Spain’s mortgage market is recovering gradually in the wake of the pandemic, with new transactions outstripping loan repayments. Mortgage lending activity began to register year-on-year growth in April 2021, which has stabilised at around 0.7% in recent months. Average mortgage interest rates are climbing slowly, nudged along by global market trends, and rates could move higher again if the ECB is forced to withdraw its quantitative easing rapidly to curb inflation. Mortgage renegotiations are also on the rise, and we are seeing a rapid switch from floating to fixed-rate mortgages. While it is hard to quantify the potential relationship between monetary policy trends and the Spanish mortgage market, interbank rates –the key benchmark for many floating-rate mortgages– are rising strongly in the eurozone, albeit still in negative territory, which could provide upside support to bank profitability. The mortgage market recovery is, however, very recent, and has not yet consolidated. Lingering and new sources of uncertainty (pandemic, inflation, conflict in Ukraine) are affecting savings and borrowing patterns in ways that are hard to gauge. 2022 could well be a year of stable, yet moderate, growth. It will be worthwhile to monitor potential changes in key variables for this market, including interest rates and inflation.

Introduction

Now that the chief geopolitical risk for 2022 has materialised, economic analysis is clouded by considerable uncertainty. The armed conflict in Ukraine has set off a chain reaction that will end up altering economic decisions. Decisions related to housing and the mortgage market are sensitive to turbulence in key variables that are currently the subject of considerable uncertainty, including inflation, savings and interest rates.

Since the global financial crisis and its ensuing ramifications for European sovereign debt, the real estate and mortgage markets in Spain have been far less buoyant and excessive relative to the early twenty-first century. Imperative house price correction and household deleveraging are largely responsible for the trends unfolding since 2008. However, in the last five years, leaving aside the pandemic on account of its extraordinary nature, there have been some signs of recovery in both transaction volumes and prices. However, mortgages did not embark on much of a recovery until far more recently.

In quantitative terms, the mortgage segment is one of the key lending markets. Its performance is particularly important. Several factors explain why mortgages are recovering. Normalisation of economic and social activity after the worst of the pandemic, with a recovery underway and brighter prospect for this year, is helping households reconsider investments that, on account of their size, constitute important lifetime financial decisions. A significant portion of the savings pent up during the past two years has been channelled into home spending and investment. However, recent figures point to weaker household savings, suggesting that this factor will not necessarily be a significant sustainable driver in the medium-term. That also explains why mortgage lending is beginning to increase in the context of greater interest in housing: having depleted savings, credit plays a bigger role, all the more so in a climate of ultra-low rates, albeit with tightening on the horizon. Right now, the military deployment in Ukraine warrants caution with respect to the economic and financial behaviour of the main implicated parties –potential borrowers and banks.

Although low rates had not played much of a role in the mortgage market until now, the still-expansionary monetary context is encouraging would-be buyers to invest before potential rate hikes materialise. Lastly, intensification in competition on the supply side in recent months, with the odd new tech player coming on the scene, is also likely a factor. There are offers right now not seen for years, particularly deals targeted at younger buyers, with loans for up to 80% of property appraisal values.

At any rate, risks in the mortgage market would appear to be limited for the time being. House prices are rising but in an inflationary context, making it too soon to talk about a bubble. For the medium-term, things look far from explosive –housing supply in Spain is set to increase, even as the population ages, which should mitigate price pressure, except in the unlikely scenario of intense growth in demand for housing from non-residents.

The incipient mortgage market recovery is not exclusive to Spain. In other major economies, including the US, the market already showed signs of significant growth in 2021, with price growth of up to 19%. In 2022, with rate hikes on the horizon, the market is expected to cool a little so that price increases are expected to remain within 3%. Some institutions, such as the Mortgage Bankers Association, think prices could actually fall in the US in 2022, by around 2%. In Europe, the market is very heterogeneous. Interestingly, Germany registered price growth of up to 12% (highly unusual), compared to 4% in Spain, with the outlook for 2022 very similar. It is possible that the prospect of rate increases in 2023 will somewhat weigh on that growth.

In this paper, we analyse recent data for the Spanish market in relation to financing and mortgage terms and conditions, such as loan size and maturities. Lastly, we draw a few conclusions and share our outlook for how the mortgage market might fare in 2022.

Mortgage lending activity

Sustainable growth in mortgage lending requires propitious monetary and financial stability conditions. The most recent Bank of Spain data, which date to January 2022, indicate that household deposits are growing at a year-on-year rate of 4.6%. Spanish households held 959.6 billion euros on deposit as of January 2022. Elsewhere, non-performance of private resident sector loans stood at 4.29% in December 2021, having remained fairly stable throughout the pandemic. When thinking about demand for housing and mortgages, it is important to note that an element of both of those factors –prevailing high level of financial savings and relatively low non-performance– is critical. For example, a high percentage of household deposits are sight deposits and stem from significant growth in precautionary savings related with the pandemic. And part of the incipient recovery in the real estate and mortgage markets reflects the release of some of those savings; however, the upside is, obviously, limited. As for non-performance, the ratio has ultimately stayed low for much longer than anyone was expecting for an economy encountering difficulties as severe as those induced by the pandemic. The rollout and extension in time of mechanisms such as the furlough scheme, credit moratoria, various aid packages and bankruptcy leniency is likely to be responsible for some of that trend; however, some amount of additional non-performance will likely be inevitable once those supports are removed.

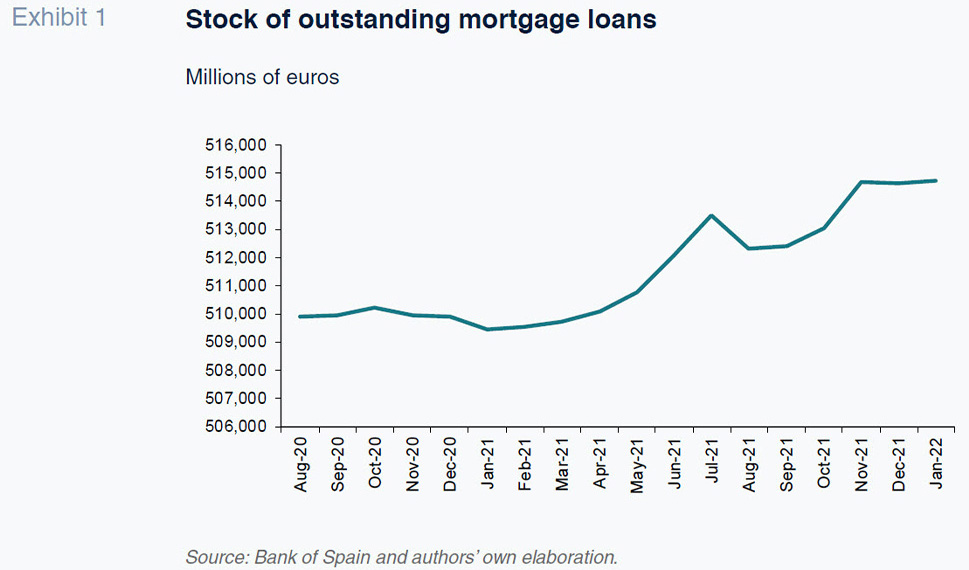

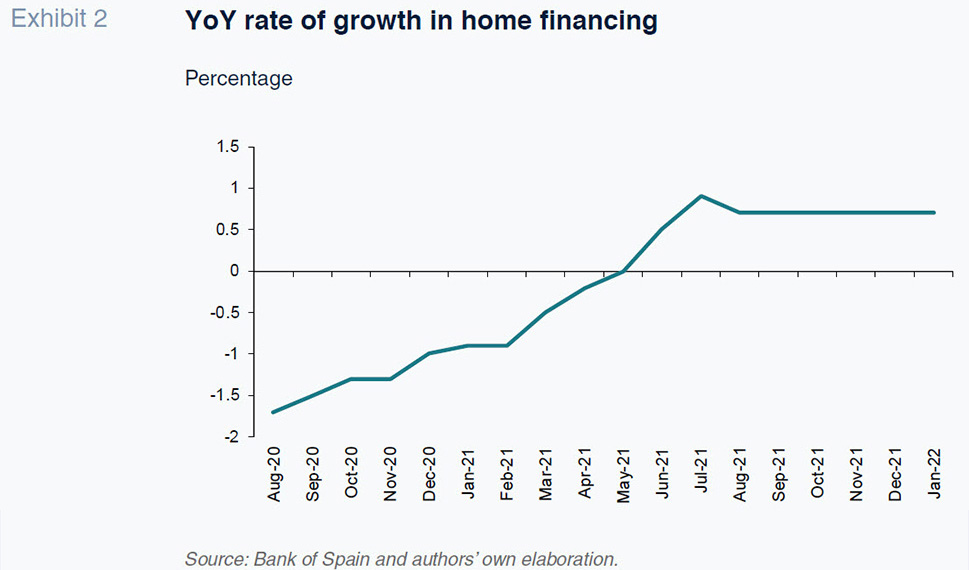

The mortgage market is recovering gradually, with new transactions outstripping loan repayments. However, the recovery has only become palpable very recently and is not yet linear, as shown in Exhibit 1. Having ground to a halt in 2020, with the total stock of mortgage loans actually contracting at the height of the pandemic, in 2021, home lending etched out a couple of spikes before moving on to sustain moderate, yet stable, growth towards the end of that year and beginning of 2022. As shown in Exhibit 2, mortgage lending began to register year-on-year growth from April 2021, which has stabilised at around 0.7% in recent months.

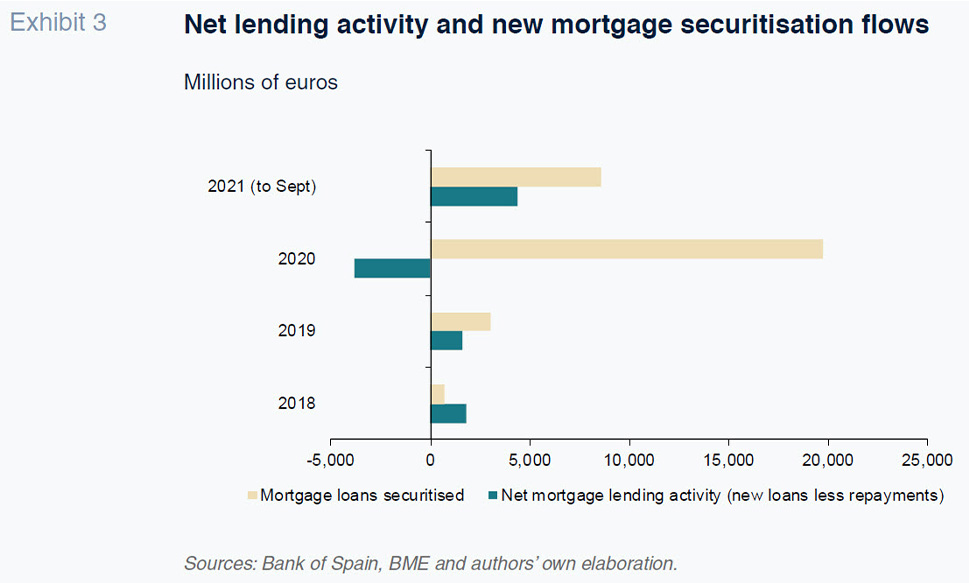

However, the actual flow of credit (new loans less repayments) has only recovered very recently (Exhibit 3). Note that at the times of lowest market volumes, the banks stepped up their securitisation activity as an alternative way to generate liquidity and business. Securitisation accounts for between 22% and 25% of the stock of outstanding credit. There is therefore upside in the securitisation business in the months to come, all the more so when rates start to rise.

Mortgage market dynamics: Transaction volumes, mortgages, interest rates and terms and conditions

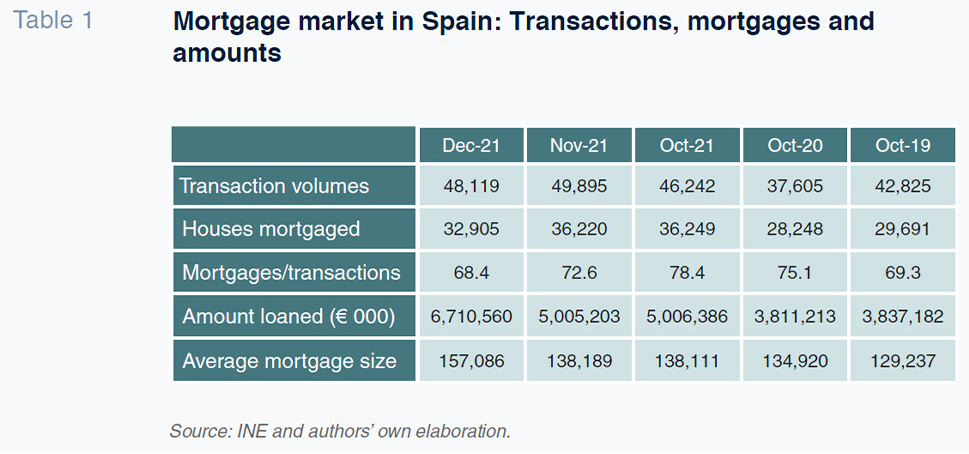

The property ownership transfer and mortgage records kept by Spain’s statistics office, the INE, offer interesting insights into how the home financing market is changing in terms of both supply and demand. As shown in Table 1, transaction volumes are back at pre-pandemic levels and the percentage of transactions financed by a mortgage is increasing, albeit not linearly. The numbers reveal, in general, a rising need for financing.

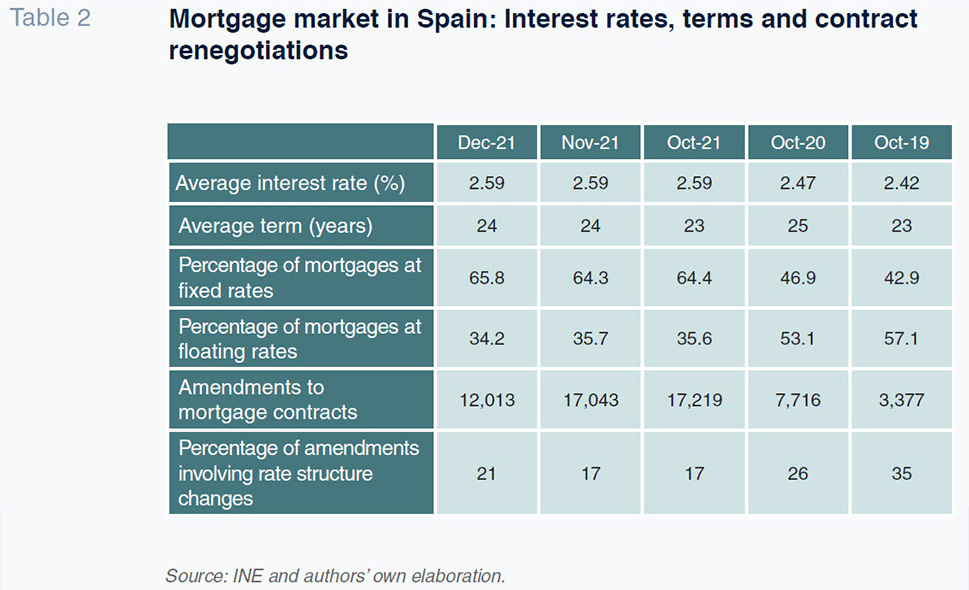

Elsewhere, as shown in Table 2, average mortgage interest rates are climbing slowly, nudged along by global market trends and rates could move higher again if the ECB is forced to withdraw its quantitative easing rapidly. Mortgage renegotiations are also on the rise and we are seeing a rapid switch (or renegotiation) from floating- to fixed-rate mortgages.

It is hard to quantify the potential relationship between monetary policy trends and the Spanish mortgage market. On the one hand, the ECB’s decisions are currently subject to an additional degree of uncertainty due to the escalation of the conflict in Ukraine and its ramifications for inflation, among other things. Elsewhere, it is not easy to establish a direct relationship between expectations for official rates and mortgage rates. What we are seeing is that interbank rates –the key benchmark for many floating-rate mortgages– are rising strongly in the eurozone, even though there is no set timeline for ECB tightening yet. At any rate, those rates remain negative, limiting their impact. In addition, as noted above, three out of every four new mortgages are being arranged at fixed rates, further limiting the impact of movements in market interest rates. Nevertheless, developments in other markets where rate signals are clearer provide some clues. Take the US for example. The average fixed rate on a 30-year mortgage increased by a net 0.5% in 2021 to 2.65%. Most analysts believe rates will increase a further 0.5% in 2022. Those estimates may fall short of the mark, however. The Mortgage Bankers Association reported that the average rate on a 30-year mortgage increased to 3.64% in January, compared to 3.11% in December. That is the highest monthly jump since 2013.

Meanwhile, the Bank of England raised rates from 0.1% to 0.25% in December, and subsequently in February and March, such that the Bank Rate stands at 0.75%. However, 74% of mortgaged homeowners in the UK have fixed-rate loans and are not affected by the measure.

Conclusions

The Spanish mortgage market is increasingly showing signs of recovery. Savers are holding their deposits primarily in sight accounts, with term account deposits falling considerably, suggesting that the banks could resort to securitisation in 2022 to finance growth in mortgages, particularly the securitisation of new and more profitable mortgages. A lot will depend on the ECB’s liquidity facilities.

If mortgages continue to be switched from floating to fixed interest rates, the banks could see their profitability increase in the near-term (because official rates are still below mortgage rates). Judging by the trend in mortgage terms and conditions over the last two years, and with all due caution, rates on new mortgages could increase by around 0.2 percentage points a year in the absence of official rate hikes and by between 0.5 and 0.7 points for every 25bp increase in official rates (in

creases that are not yet on the horizon).

Purely anecdotal evidence gleaned from mortgage market prospecting points to a proliferation of aggressive offers for new loans, compared to the conservative approach taken in recent years (e.g., loan-to-value rates of 80% and even 90%). That relative aggressiveness is coming primarily from the neobanks, whose market share is still very small.

Santiago Carbó Valverde and Francisco Rodríguez Fernández. University of Granada and Funcas