Spanish economic forecasts panel: March 2022*

Funcas Economic Trends and Statistics Department

Spanish GDP grew by 5% in 2021

According to provisional figures, the Spanish economy grew by 2% in 4Q21, which, if maintained in the definitive report, would imply annual growth of 5%, 0.1% above the consensus forecast in January.

Forecast growth for 2022 has been cut by one point in the wake of the conflict in Ukraine

The consensus forecast for GDP growth in 2022 stands at 4.8%, down 0.8% from the last survey. However, four analysts have responded that they have not yet modified their forecasts to incorporate the impact of the invasion of Ukraine. Considering only those who have layered in that impact, the average GDP forecast drops to 4.6%, down one percentage point from the January consensus.

The range between the high and low predictions is unusually wide, even if we only consider the analysts who have already adjusted their forecasts, evidencing significant differences in the starting assumptions on which each participant bases their baseline scenarios. Uncertainty over where the conflict in Ukraine is headed, potential new sanctions and energy product prices is currently very high and the analysts’ growth forecasts may differ significantly depending on the assumptions made regarding those sources of uncertainty.

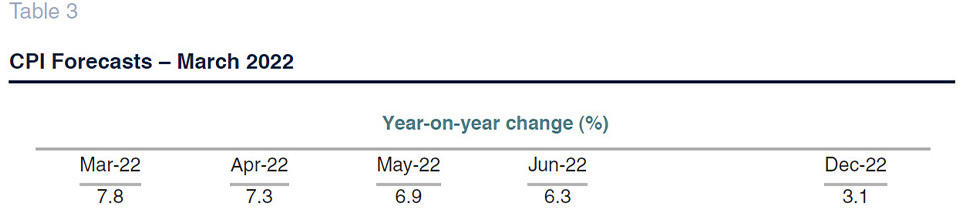

Significant upward revision to CPI forecasts

Inflation has continued to trend higher, reaching 7.6% in February, with core inflation at 3%. Pre-existing inflationary pressures, derived from higher commodity prices and supply-chain bottlenecks, have only worsened since the invasion of Ukraine, leaving the inflation outlook even more uncertain. The average forecast for headline inflation in 2022 has increased by 1.9 percentage points to 5.4%, while the consensus for core inflation now stands at 2.8%, up 0.8 percentage points. The increase is even higher for both rates if we only consider the forecasts that have been modified to factor in the impact of the war: 5.8% for headline inflation and 3% for core inflation.

The unemployment rate should continue to trend lower

According to the still-provisional quarterly accounts, full-time equivalent (FTE) employment increased by 6.7% in 2021. Moreover, the Social Security contributor reports suggest that job creation has continued in the first two months of the year, albeit slowing from the second half of last year. The average forecast for 2022 has been trimmed by half a point to 3.5% (3.4% excluding the analysts who have not yet revised their forecasts).

The unemployment rate averaged 14.8% in 2021. The consensus forecast for 2022 is for 13.9%, three decimals less than in the last report, despite lower growth projections (in this case the forecast is unchanged if we only take the analysts who have factored in the impact of the war).

The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). Productivity per FTE job, which decreased by 1.7% in 2021, is expected to increase by 1.3% this year. Meanwhile, ULCs are expected to increase by 0.7% in 2022, having increased by 1.2% in 2021.

Ongoing balance of payments surplus

Again based on provisional figures, the current account balance of payments showed a surplus of 8.43 billion euros in 2021, or 0.7% of GDP, down a little from the prior-year surplus of 9.25 billion. The consensus forecast is for a surplus of 0.7% once again in 2022 (unchanged if we only consider the panellists who have factored in the war impact).

2021 public deficit below the government’s forecast

To November 2021, the overall public deficit, excluding local government, was running at 55.48 billion euros, which is equivalent to 4.6% of annual GDP. December, however, always has a big impact on the deficit, which is why the analysts are forecasting an average annual deficit of 7.3% of GDP.

The average deficit forecast for 2022 is 5.5% of GDP (5.7% considering only those that have updated their forecasts for the war), compared to a forecast of 5.4% as of January.

External environment clouded by the war

The global economy faces a supply shock as a result of the impact of the conflict on energy and other core commodity markets. The disruption of supplies exported from Russia and the prospect of escalating sanctions and retaliation measures have sent the price of energy products soaring. Since the last Panel survey, TTF gas prices have jumped 34%, marking all-time highs in the first few days after the invasion. Oil prices have also swung wildly: a barrel of Brent is trading above the $100 per barrel mark, compared to $89 in January, having peaked at over $130. Basic food and feedstock products, such as wheat and corn, have etched out similar patterns on the back of plummeting exports from Ukraine. Elsewhere, bottlenecks in the supply of metals and chips, highly dependent on Russian commodities, have intensified.

The shock has the dual consequence of aggravating the inflationary pressures already being felt since the pandemic and delaying economic recovery. Europe is one of the regions most exposed to the risk of stagflation due to its proximity to the hostilities and its dependence on Russia, especially for gas, a key input for electricity generation. In its latest projections, the ECB raised its forecast for CPI to between 5.1% (baseline scenario) and 7.1% (assuming stressed energy prices), up 2 to 4 percentage points compared to its December forecasts, respectively. Elsewhere, it trimmed its forecast for eurozone GDP in 2022 by half a point to 3.7%, and to 2.3% in its adverse scenario.

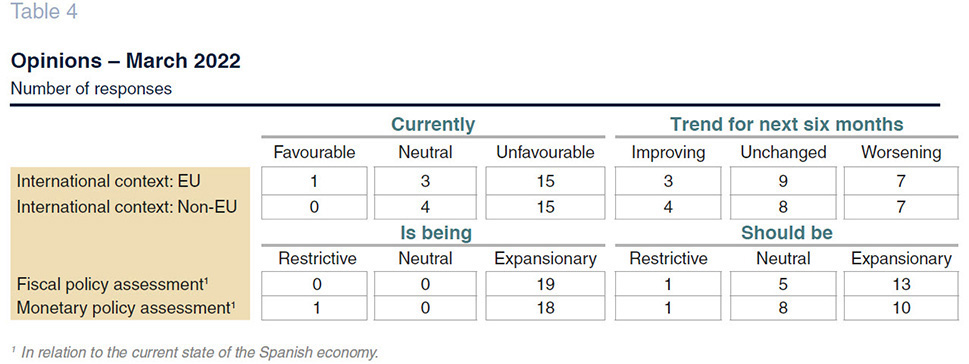

The analysts have factored those trends into their assessment with the majority now clearly pessimistic regarding the international context in the EU and beyond. Nearly all think that such a negative context will continue for the coming months or even deteriorate further.

Central banks walking fine line of containing inflation without harming economy

Before the conflict, monetary authorities had announced plans to scale down the stimulus measures rolled out during the pandemic. Their position was never easy: they were aiming to curb inflation without affecting the post-pandemic recovery. Faced now with the risk of stagflation, that dilemma has become even trickier. For now, the central banks have opted to stick with the rollback of their public debt purchase programmes, with the ECB even accelerating its timeline for so doing, while opening the door to initial rate hikes. This highlights central banks´ concerns over inflation trends and possible second-round effects on wages.

Already, markets are discounting a rate increase. 12-month EURIBOR (which can be regarded as a leading indicator for the deposit facility rate, controlled by the ECB) has tightened from close to -0.5% in January to -0.24% at the time of writing this panel. Elsewhere, the yield on 10-year Spanish bonds has doubled since our last report, to above 1.3%. The risk premium has also widened a little, pricing in the looming rollback of public debt purchase volumes, with the Spanish benchmark 10 year bond reflecting a spread over its German counterpart of close to 100bp –still a moderate level by past standards.

Analysts expect market rates to continue to inch higher over the projection horizon (Table 2), reflecting sharper tightening than they had been forecasting in January.

Euro depreciation

In light of the ongoing shift in US monetary policy and the prospect of sharper and sooner rate hikes than in the eurozone, the dollar has tended to appreciate against the euro since the last survey. Going forward, the analysts are forecasting scant movement in the exchange rate until the end of the forecast horizon (Table 2).

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.