The potential impacts of changes to the ECB’s deposit facility

While an important tool for the ECB, the prolongation of negative interest rates has resulted in considerable costs for the region’s banks, as well as compressed their profitability. With interest rates likely to remain negative for the foreseeable future, a tiered deposit facility rate could help minimize these unfavourable effects on the region’s banking sector.

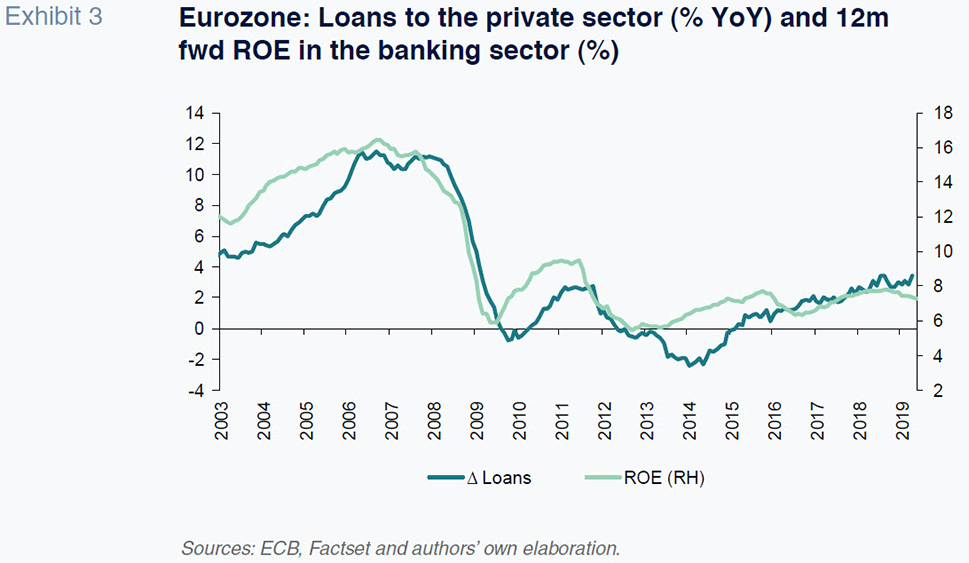

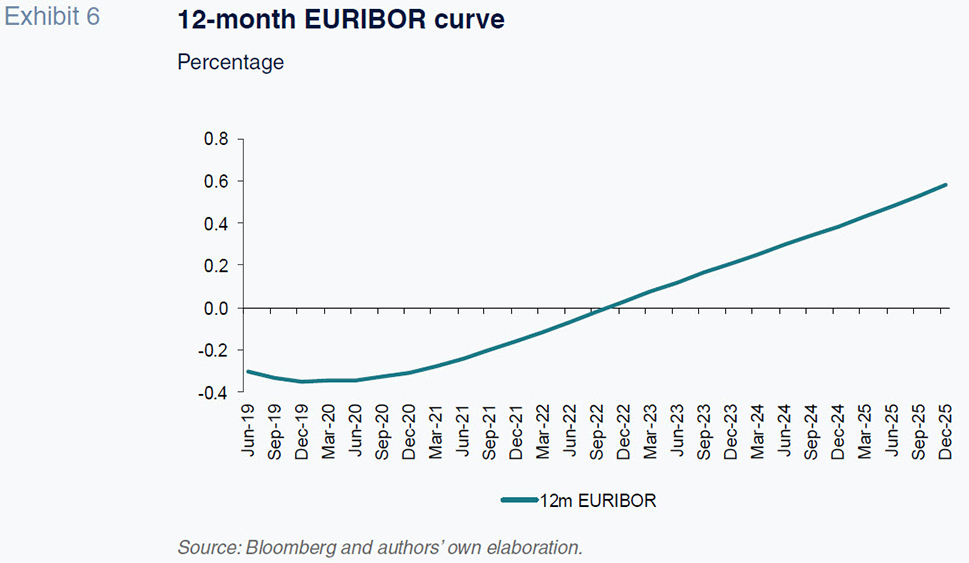

Abstract: While negative interest rates serve a purpose for the ECB in the face of the eurozone’s slowdown, they have both direct and indirect effects on the region’s banks. As of April 2019, the eurozone banking sector had excess reserves of 1.87 trillion euros, which implied costs of 7.5 billion euros a year. Given the unlikelihood of a rate increase, a tiered system for the deposit facility rate could reduce these direct costs. However, the indirect effect of negative interest rates is also problematic, specifically the influence they have on the yield curve, which is used as the benchmark for customer lending and deposit operations. For instance, 12-month EURIBOR, the main benchmark rate for bank lending, had fallen by over 70 basis points, from 0.60% in 2014 to -0.11% by April 2019. Until now, Spanish banks have withstood the adverse effects of negative rates better than the other major European systems. However, a prolongation of negative interest rates is expected to add further downward pressures on Spanish banks’ profitability going forward. More generally, as long as interest rates remain negative, the eurozone banking sector’s return on equity will remain low.

Direct impact of the negative deposit facility rate (DFR)

The ECB has stated on numerous occasions

[1] that negative rates can be a powerful monetary policy tool. Specifically, they reinforce forward guidance for interest rates, accelerate the portfolio rebalancing effect associated with the asset purchase programme (APP) and support the effectiveness of the long-term liquidity injection programmes (TLTROs). With the advent of negative rates, we have witnessed a widespread reduction in market interest rates (

e.g. EURIBOR), which benefits the non-financial sector (companies, households, governments) by reducing the economy’s cost of capital and stimulating consumption and investment.

However, the monetary authority has also acknowledged the downside risk to prolonged use of negative rates, citing a build-up of adverse effects on intermediation, which overwhelmingly affects the banks, and, by extension, financial stability.

[2]

The sharp economic slowdown that began in 2018 as well as an inflation outlook below the ECB’s target has reduced expectations for interest rate increases. However, there is growing debate about the advisability of continuing in this direction, with negative rates acting as a tax on European banks.

[3]

In contrast to the current system, which treats all excess reserves in the same manner, a tiered system for the DFR, akin to those in place in Japan, Denmark, Sweden or Switzerland, would imply no cost for the banking system up to a certain threshold of liquidity on deposits at the central bank, with the negative rate continuing to apply above that threshold.

A tiered system would considerably reduce the cost for banks depositing liquidity with the ECB and improve their profitability, which has remained low in recent years.

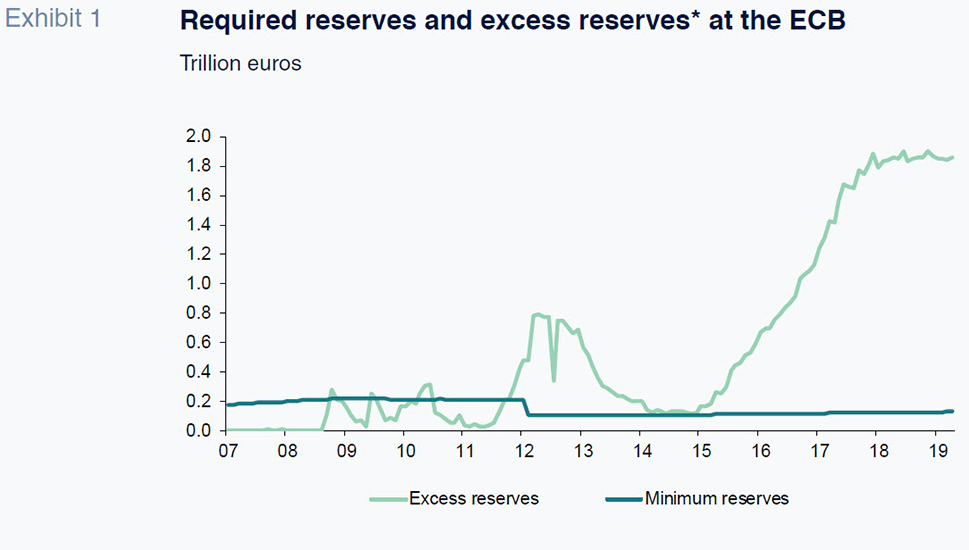

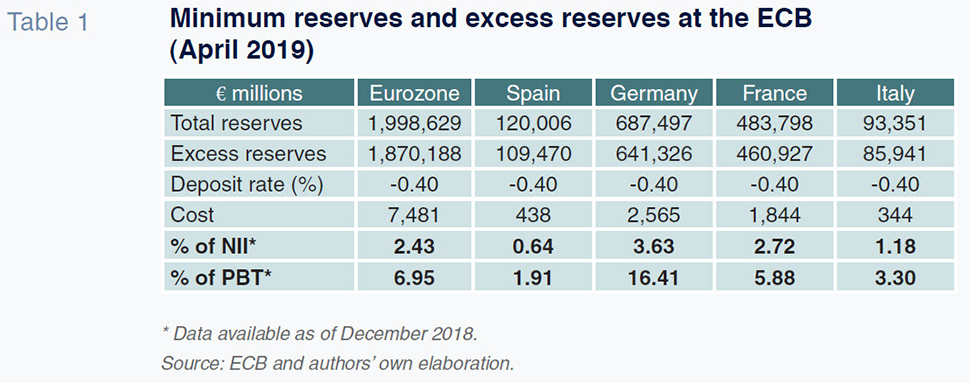

To quantify the impact of the current deposit remuneration/penalisation policy, note that as of April 2019, the eurozone banking sector had excess reserves of 1.87 trillion euros (the sum of excess reserves in the current account plus the deposit facility). With the current DFR at -0.40%, this implies a cost for the Euro Area banks of 7.5 billion euros a year.

The impact varies substantially by national banking system, as illustrated in Table 1. Excess reserves over the minimum requirement range from 86 billion euros in Italy to around 641 billion euros in Germany.

In the case of the Spanish banks, the current volume of excess reserves (almost 110 billion euros) is generating a cost of around 440 million euros, which is below the eurozone average in terms of both the banks’ net interest margin (0.64% vs. 2.43%) and profit before tax (1.91% vs. 6.95%).

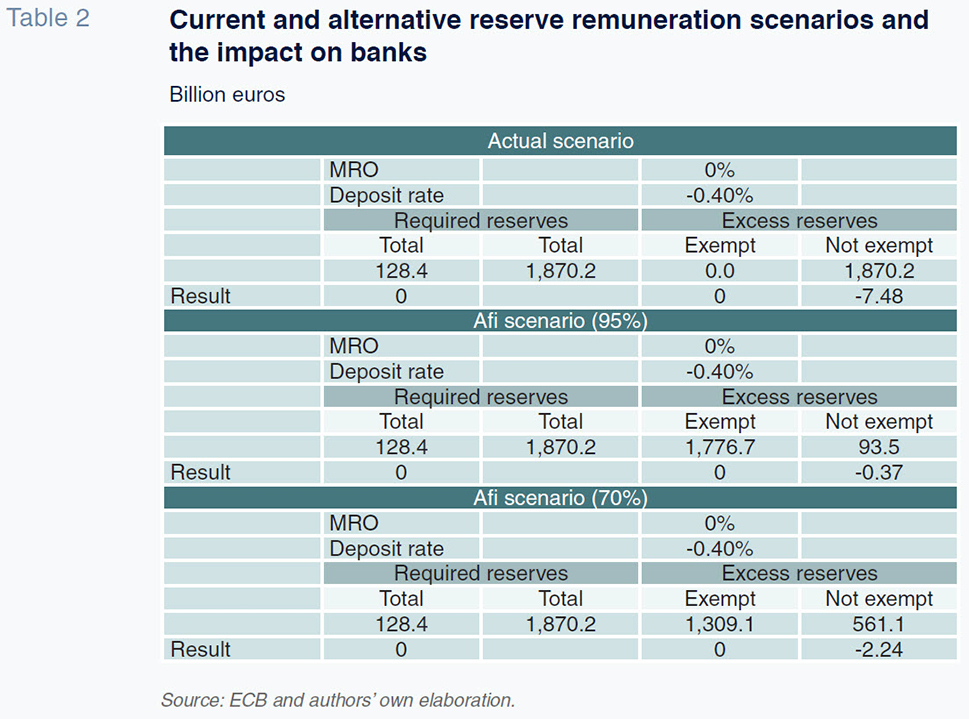

By way of estimation, we have modelled two scenarios for remuneration of the banks’ reserves by the ECB: minimum reserves at the MRO rate (as is currently the case) and between 70% and 95% of excess reserves at 0% (or the MRO, which is at around zero in the current environment), with the rest at the DFR. Table 2 calculates how such a regime would change the banks’ costs, showing that they would go from paying the ECB 7.5 billion euros a year to paying between 2.24 billion euros and just 370 million euros, depending on the scenario (70% or 95%, respectively). We note that although the scenario of remunerating 95% of excess reserves at 0% might appear extreme, that is what the Bank of Japan is doing at present.

[4]

Indirect impact of the negative DFR

This direct impact on European banks’ costs is not the only problem associated with a negative DFR. A potentially far greater impact relates to the anchoring effect that negative rates exert over the yield curve, used as the benchmark for customer lending and deposit operations.

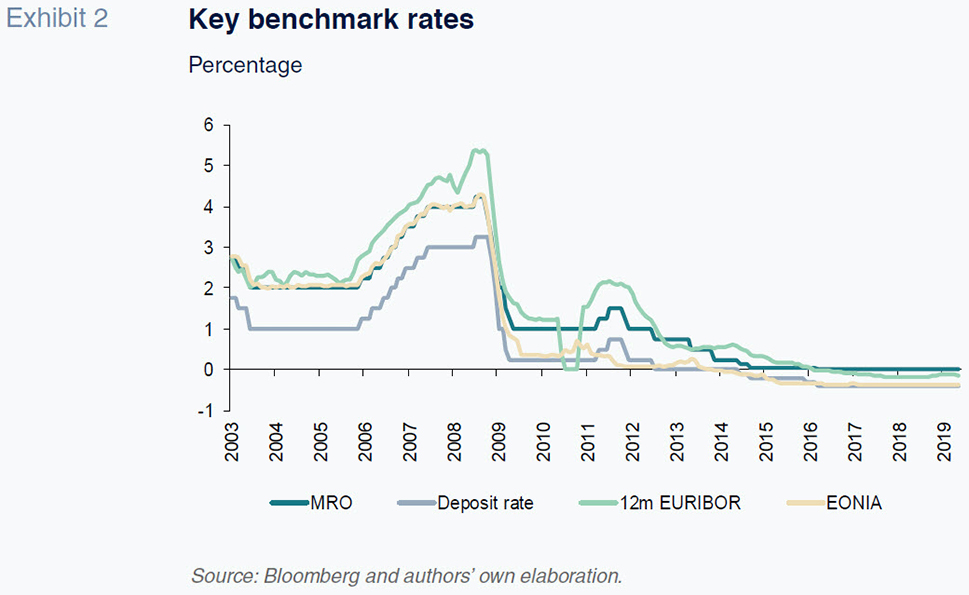

Exhibit 2 depicts the trend in the main benchmark rates in the eurozone from January 2003 to April 2019. The focus of our analysis begins from June 2014 when the DFR entered negative territory for the first time.

By analysing the longer-term trend from 2003 to 2019, we see that EONIA has converged towards the deposit rate since the onset of the financial crisis in 2009. This is due to the surplus liquidity in the system, which reduced the need for banks to raise liquidity among themselves. This means the banks demand the same (or very nearly the same) remuneration as the ECB for receiving excess deposits. The ECB rates are effectively marginal rates and, in an environment of excess liquidity, it is expected that EONIA, the market rate, would align with the deposit rate. Conversely, in normal times where there is no excess liquidity in the banking system (e.g. the period before the crisis), EONIA will track the MRO of the ECB.

Consequently, the decisions made by the ECB to raise or lower the deposit rate will directly affect the market rate. The ECB’s policies nudge the entire money market yield curve in the same direction, which impacts the stock of credit, new lending by the banks, and borrowing costs.

As a result, EURIBOR has fallen considerably over the same period. If we consider the 12-month EURIBOR, the main benchmark rate for bank lending, it has fallen by over 70 basis points, from 0.60% in 2014 to -0.11% by April 2019.

The indirect impact is evident in all sectors in the trend observed in lending and deposit rates (retail business), both of which have dropped substantially, with a direct impact on European banks’ ability to generate income.

The impact on the banking system’s equity prices

Banking profitability is intrinsically related with the trend in interest rates. As long as rate expectations remain subdued, profits will remain low and monetary policy decisions will have a direct impact on banks’ margins.

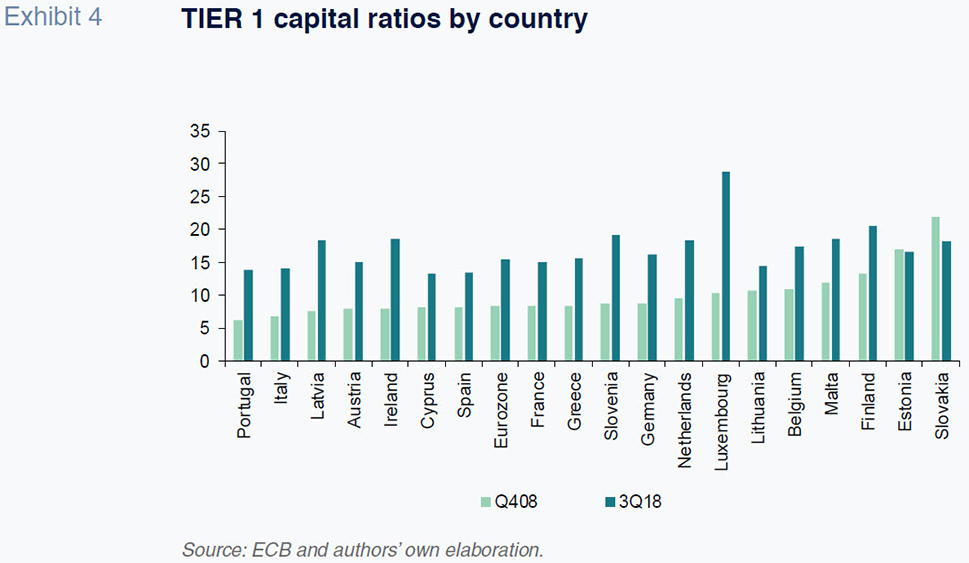

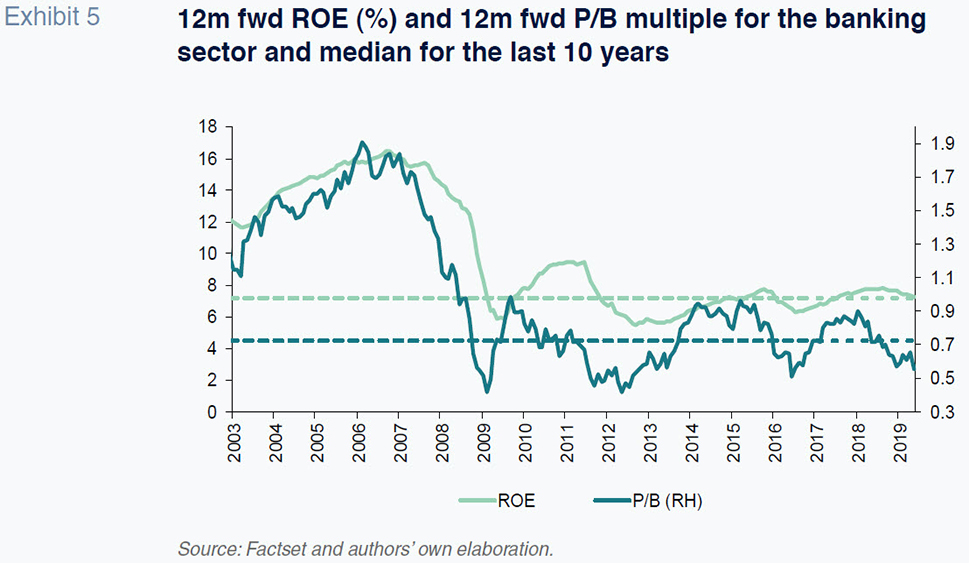

It is unlikely that the sector will revisit the double-digit ROEs it reported prior to the crisis in the future, as regulatory-driven capital requirements are set to remain consistently above pre-crisis levels.

Because of its depressed returns, the sector is currently trading at a price-to-book, or P/B, ratio of 0.56x compared to a 10-year average of 0.73x and above 1.5x seen in the pre-crisis period. Similarly, the forward return on equity (ROE) stands at 7.3% (Exhibit 3). In light of their current profitability outlook, there is very little upside for banks’ share prices in the medium-term, as interest rates are expected to remain abnormally low into the long-term (Exhibit 6). Note that in February 2018, when the outlook for rates was brighter, the sector was trading at a P/B multiple of 0.87x, while in June 2016, when rate expectations were extremely depressed, the sector was trading at 0.57x. With the market pricing in a scenario where the 12-month EURIBOR is expected to remain in negative territory for at least three years, it is hard to envisage any significant improvement in multiples. For that to happen, expectations for interest rates over the medium-term would have to change, which seems unlikely in the current macroeconomic and geopolitical environment.

Conclusions

The policies pursued by the European Central Bank have had the effect of improving the financing conditions faced by the corporate sector and households substantially in the last five years. In contrast, they have had a direct adverse impact on banks’ profitability, with consequences for their business model. Until now, the Spanish banks have been able to weather the drop in income reasonably well, thanks to strong management of their funding costs. However, if benchmark rates remain at 0%, or even in negative territory, for much longer, their net interest income will continue to deteriorate, with increasingly less scope for cutting costs. This trend of keeping rates at or below zero could foreshadow the ‘Japanisation’ of the European economy (interest rates in Japan have been at zero for two decades), marked by low economic growth and lending activity. In such a context, the banks will have to rethink their business model in an attempt to generate profits.

The banking sector has undergone a structural change: the current low returns are not cyclical and even though they could recover in the event of rate increases (in the medium/long-term), we do not envisage a return to pre-crisis levels. In this environment of ultra-low rates, banks’ market values are experiencing strong downward pressures. As long as the expectation is that rates will remain ultra-low for a prolonged period of time, banks are likely to continue to trade at a P/B multiple of less than 1x, as their returns (ROE) are expected to remain depressed at levels below their cost of capital. As this appears to be the ‘new normal’ for the sector, banks must incorporate innovative changes to their existing models to counterbalance some of these negative effects.

Notes

By way of example, see the ECB’s Working Paper No. 2289/June 2019. Is there a zero lower bound? The effects of negative policy rates on banks and firms.

Refer to the speech made by Luis de Guindos on May 1st, 2019: Challenges for bank profitability.

Fernando Rojas, Federica Troiano and Rui da Mota Guedes. A.F.I. - Analistas Financieros Internacionales, S. A.