The battle for global technological supremacy and the impact on banks

As trade tensions between the US and China have escalated, Big Tech firms have continued to compete for technological supremacy through their foray into the financial services sector. While it is too early to determine the outcome of Big Tech’s market disruption, it is possible that their expansion could impact both the global banking sector and financial stability.

Abstract: Growing trade protectionism has triggered a scramble for international technological leadership. The US government’s decision to restrict Huawei’s operations in the US and their partnership with US firms could have implications not only for Huawei, but also for innovation in general and 5G technology in particular. More broadly, trade tensions are occurring alongside Big Tech’s foray into the banking sector, with Facebook’s plans to launch Libra, a new cryptocurrency, just the latest development. Looking at these trends, it becomes clear that there are three potential outcomes. First, the `Super App´ model that dominates in China could emerge as a paradigm for global interaction. This would involve considerable concentration of financial and payment services, which could undermine competition. Second, Big Tech could help expand financial inclusion. Third, the combination of trade protectionism and market disruption could result in regulatory and technological fragmentation. While Big Tech’s scale could give it an edge over traditional financial institutions, the future interaction between banks and Big Tech will be determined by the latter’s ability (and willingness) to diversify into different financial services.

Introduction: Protectionism from the standpoint of the financial system

Trade protectionism remains a geostrategic factor of the highest order, with the last two months generating new levels of uncertainty. One manifestation of this is the increasingly important battle for technological supremacy. Another aspect that has not been widely covered but could have a considerable, quantitative impact on the financial sector relates to trade tensions and the recent developments in Big Tech, such as Facebook’s decision to launch Libra, a cryptocurrency.

May 15th marked a significant milestone. The US administration took two decisions with respect to China’s Huawei. First, it decided to end the sale of the company’s products in the US. Second, semi-conductor producers are effectively prohibited from supplying Huawei with products essential to the manufacturing of smartphones. Following the sharp contraction in the stock market, the US government announced on May 21st a temporary three-month suspension of these measures. Nevertheless, the mere announcement and threat of permanent measures has sparked a chain reaction with implications for the US and China, third countries and global stock markets. The markets are especially concerned that these tensions will escalate. The US Department of National Security has said that it will publish an exhaustive list of companies and products that pose a “threat” to information security in July while the Department of Commerce will produce the corresponding entity and country black lists. Significantly, other countries have expressed similar security concerns. For example, both Japan and Australia have already blocked some of Huawei’s operations due to suspicions of espionage. Of particular focus is the fear that these countries could lose control over information as they develop their 5G networks. Note that Huawei is the world-leader in 5G, the next generation of wireless communication technology.

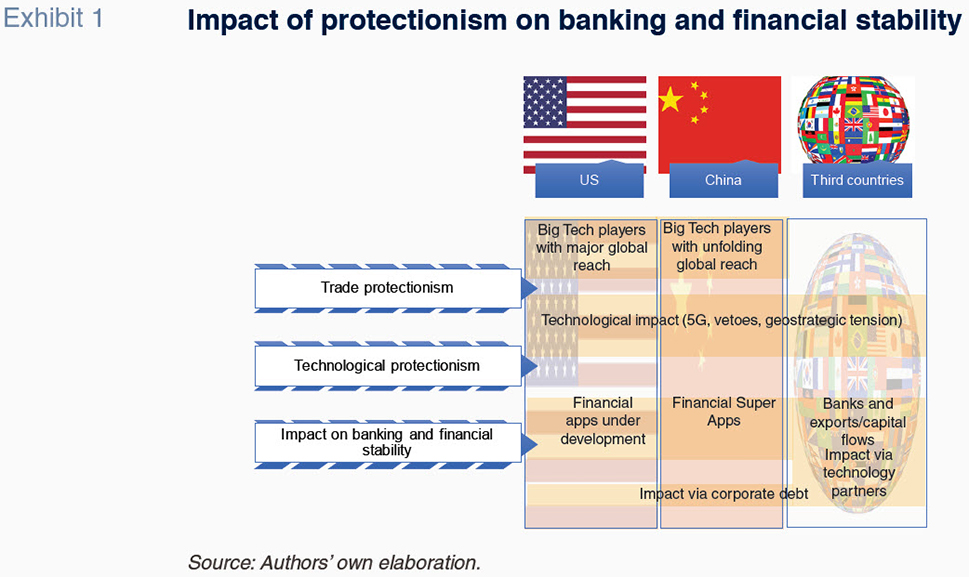

As shown in Exhibit 1, the various ways in which trade protectionism is taking form could have an impact on the banking sector and financial stability. Technology models, which are the focus of the trade dispute between the US and China, are the first source of concern. The US Big Tech firms (Apple, Facebook, Google, Amazon, Microsoft) are characterised by their global presence. Conversely, the global footprint of Chinese tech giants (Tencent and Alibaba) is considerably smaller. That said, their reach in China is substantial, aided by relatively little regulation governing the development and integration of products and services. The second manifestation of trade tensions is the rise of technological protectionism, and the negative effect this could have on innovation. In the case of Huawei, US policy could have ramifications for the expansion of 5G, which in turn restricts the benefits other companies could obtain from the use of that technology.

The different forms of technological expansion across multiple regions have resulted in divergent relationships with the financial sector. For example, American Big Tech firms offer apps that handle and transmit information and their financial activities tend to be limited to payment instruments. By comparison, China has seen the consolidation of so-called ‘Super Apps’- apps (e.g. WeChat and Alipay) that enable communication, purchases, money transfers, payments and even credit transactions from mobile devices. As such, they directly compete with the Chinese banking sector. In China, a high percentage of payment flows are already de facto controlled by these Super Apps. In the US, Apple’s new credit card and Facebook’s foray into the cryptocurrency sphere and development of a payment system platform foreshadow potential disruption that could prove considerable. That said, numerous financial institutions have pursued collaborations with Big Tech firms via communication systems, international activities and retail payment instruments. In the short-term, protectionism could increase the cost of these partnerships or, directly prohibit some of them, with potentially negative consequences. If, for example, Huawei is part of a strategic alliance with a bank, the latter may have to assess to what extent permanent protectionist measures could impact its business.

It is important to point out that not all the transmission effects on banking and financial stability result from the impact of the availability and use of technology. Previous trade wars have also taken a toll on debt markets. In some countries, a large part of the corporate debt depends on the health of export flows. For instance, Sweden, Finland and Germany’s export outlooks have weakened as a result of the trade war, thereby reducing the flows of capital within the country. This has had an adverse impact on those sectors where investment flows have been strongest in recent years, such as the property market.

The central banks are aware of these risks and their possible economic and financial effects. Only 18 months ago, Europe anticipated a gradual rollback of quantitative easing. Now, expectations have shifted in favour of expansionary monetary policy. On June 19th, the Federal Reserve decided to leave its benchmark rates within the range of 2.25%-2.5%. However, its chairman, Jerome Powell, said that “after running close to our symmetric 2 percent objective for most of last year, inflation declined in the first quarter” (...) “the case for a more accommodative policy has strengthened”. And, in reference to protectionism and its potential impact on the economy, he added that “in light of increased uncertainties and muted inflation pressures, we now emphasise that the Committee will closely monitor the implications of incoming information for the economic outlook and will act as appropriate to sustain the expansion, with a strong labour market and inflation near its two percent objective”.

During the European Central Bank’s Forum on Central Banking in Portugal on June 20th, its president, Mario Draghi, recalled that the ECB is predisposed to adopting new monetary stimuli. Such action could take the form of a rate cut, which would bring the ECB into the uncharted territory of negative rates, and/or the reactivation of the ECB’s debt repurchase programme.

The extension of exceptional monetary conditions reflects concern over the state of the economy in which trade protectionism is playing a prominent role. In the eurozone, the extension of quantitative easing has negative consequences for the banks: with rates so low and the expectation that they may be lowered further still, the scope for boosting margins and profitability is very slim.

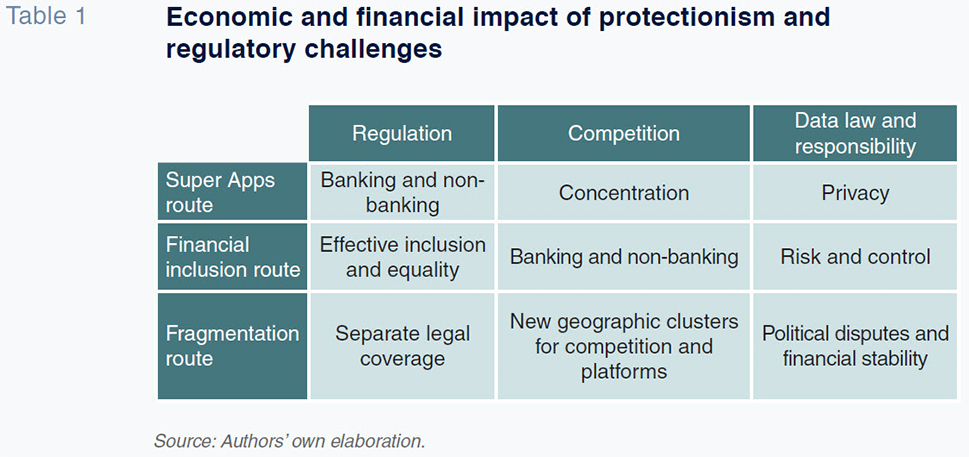

Impact of protectionism: Regulation, competition and data law

Given the current context, it is important to consider how an expansion of protectionist measures might negatively impact the financial sector and the role of regulation in preventing or mitigating these effects. Table 1 outlines alternative routes that might be taken, the kinds of regulations that might be needed, the impact on competition and the challenges posed in terms of data law. First, the ‘Super App route’, China’s approach to app development, involves integrated information and financial transaction platforms. That implies the need for banking and non-banking regulations insofar as these apps not only provide communication systems but also instruments with a significant presence in their users’ everyday financial activities. While this model has been primarily limited to China, if other global Big Tech players add new payment and financial services, it could emerge as a global interaction model. This route implies considerable concentration of financial and payment services, which could have implications for the competitiveness of the financial sector. This is due to the limited number of providers and their possible market shares as well as the concentration of a broad number of activities in a single supply system. These developments also pose a significant risk for privacy, as detailed information about demographics, daily conduct and financial data may accumulate in the hands of just a few firms. As such, regulatory action may be required to ensure the proper treatment and protection of customer data.

The second route is that of financial inclusion. The role of Big Tech in financial services is not only a potential risk to financial stability but also represents an opportunity for reducing economic and financial inequality. Indeed, both companies and governments have highlighted the role that certain technological initiatives can play in improving access to financial services. Perhaps the best known initiative is the Pradhan Mantri Jan Dhan Yojana programme, also referred to as the citizen money management plan or PMJDY for its acronym in Hindu. Through the use of biometric information, the programme is able to identify Indian citizens and open bank accounts for them. Financial inclusion was also one of the arguments used by Facebook when it announced its new digital currency, Libra.

The financial inclusion route implies more intense competition between bank and non-bank providers insofar as the latter proliferate and emerge as the first financial alternative accessible to broad segments of the world’s population. This route is not risk free as the financial implications should not be decoupled from the labour or educational dimensions. Specifically, formal finance will prove scantly effective in the absence of stable and decent work and the knowledge needed to manage financial resources wisely.

Third, there is the fragmentation route to consider. As trade tensions escalate between China and the US, Big Tech collaborations and innovations will become restricted, obliging financial and non-financial service providers to pick sides. This would heighten geographic segmentation and undermine progress in areas such as global data protection and technology system compatibility. Uncertainty regarding regulators’ ability to mitigate these global risks would subsequently rise. The Bank for International Settlements (BIS) recently identified (see BIS, 2019 and Frost et al., 2019) how the dynamics between Big Tech and the world of finance are materialising and their risks in practice:

- The Big Tech firms usually enter the financial services via payment systems and then deepen their presence through the provision of credit, insurance, savings and investment products. This can be done independently or in cooperation with the banks.

- Big Tech firms’ transition into credit activities usually takes place in countries with less competitive banking sectors and scant regulatory pressure (e.g. Argentina and China).

- Although it is too soon to measure Big Tech’s impact on the banking industry, the long-term effects of these activities on financial stability could be considerable.

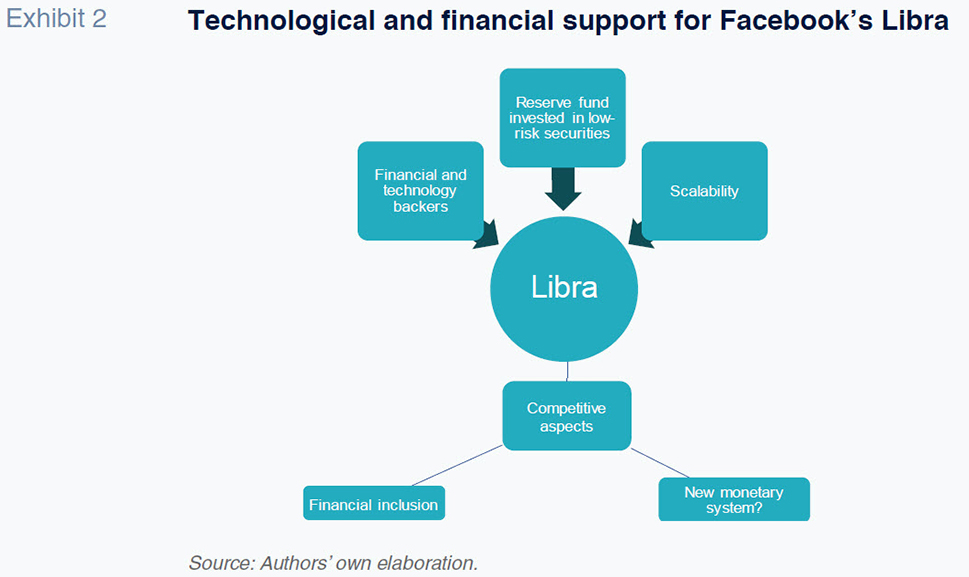

These dynamics have occurred alongside the highly significant announcement of Facebook’s foray into the cryptocurrency sphere with the expected 2020 launch of its own digital currency, Libra. As shown in Exhibit 2, Libra is an integrated technology-financial project of considerable scale. Through its numerous partnerships, it will provide capital for Calibra, a management company. Calibra will consist of communication, digital payments and credit card companies. While it will make use of the services of collaborative networks in industries such music and transportation, it will not rely on other Big Tech players or banks. These efforts will enable the creation of a major fund that will invest in deposits and low-volatility fixed-income securities as backing for Libra.

It will also be possible to exchange the cryptocurrency for fiat currencies such as the dollar. That said, other cryptocurrencies have attempted to achieve exchange stability but have failed due to the lack of scale and support. The reserve fund generated by Libra will be de facto convertible into an alternative money system, although it is too early to determine the extent to which this will succeed.

Libra has also been touted as an opportunity to provide further access to financial services for underbanked populations through the interaction of Facebook and mobile phones. The scale and competitive implications of this new initiative will require enhanced regulatory oversight. While it is too early to determine what form of regulation will emerge, it is likely that the platform will be treated as a hybrid of a payment processor and bank entity.

More than just scale: The interaction between banks and Big Tech

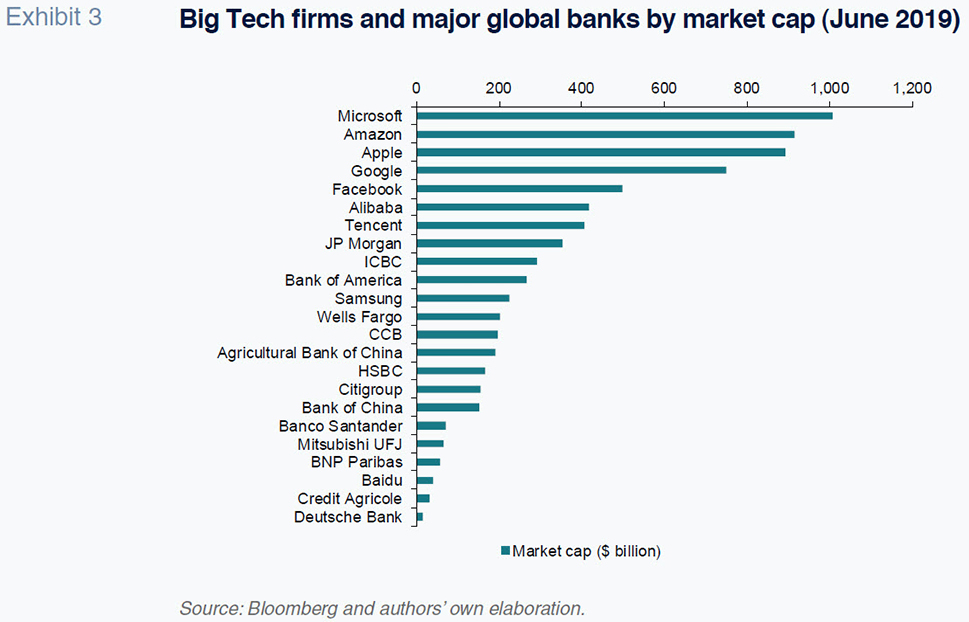

The Big Tech players boast significant scale in comparison with traditional financial institutions. Based on their market capitalization, four major Big Tech firms far exceed the size of the largest financial services firms (Exhibit 3). With the exception of the European financial industry, nearly all of these financial and non-financial companies are located in the US, China or across Asia.

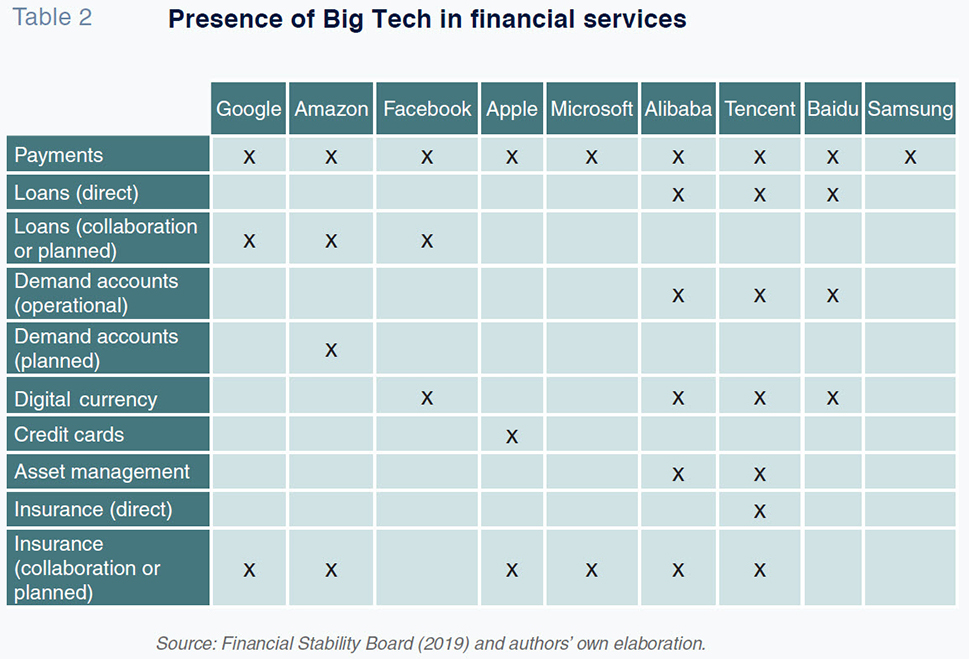

Nevertheless, the future interaction between banks and Big Tech will not be determined on the basis of size but rather Big Tech’s ability (and willingness) to diversify into different financial services. Table 2 outlines the financial services where the global Big Tech firms are already present. They are particularly active, albeit with different levels of intensity, in the payments segment. In the lending arena, the Chinese companies have taken the lead, although Google, Amazon and Facebook have several projects, some standalone, others collaborative, under study or development. Asian Big Tech firms have also expanded into the deposit accounts segment. Here, regulatory factors play an important role. In the US and Europe, these firms’ provision of deposit services would effectively make them banks, thereby resulting in heightened regulatory oversight. In Asia, these firms face far less regulatory scrutiny. Turning to cryptocurrencies, only some Chinese companies have ventured into this realm, making Facebook’s entry all the more significant. As for credit cards, Apple stands alone, whereas nearly every company, regardless of their geographic location, is working on insurance-related initiatives.

Although Big Tech’s entry into the banking sector has been gradual and conditioned by existing regulation, its mere presence is inspiring broad change across the industry. For example, Vives (2019) points out that the banking industry is heading towards a more customer-centric approach and that it will be up to the regulators to discern (directly or indirectly) three essential aspects: i) which players will dominate the financial sector; ii) what level of protection will be afforded to customers; and, iii) how to strike a balance between innovation and financial stability.

Conclusion

As trade tensions escalate, the competition for global technological leadership is taking shape, which could significantly affect financial stability and the future of the banking sector. This paper has analysed these interrelationships, drawing the following conclusions:

- Trade protectionism has an important technological layer that affects the world of finance via the markets (stock market instability), debt (corporate instability and investment flows) and banks (technology alliances curtailed by trade vetoes).

- Although digital disruption presents risks in a protectionist context, if excessive fragmentation is avoided, financial inclusion and enhanced competition could improve the wellbeing of millions of people.

- Regulation is the mechanism for directing Big Tech’s access to the financial sector. That said, divergent regulatory approaches could impede effective control at the global level.

References

BIS. (2019). Big tech in finance: opportunities and risks. In Annual Report 2018/2019, chapter III.

FINANCIAL STABILITY BOARD. (2019). FinTech and market structure in financial services: Market developments and potential financial stability implications, February 14th. https://www.fsb.org/wp-content/uploads/P140219.pdf

FROST, J., GAMBACORTA, L., HUANG, Y., SHIN, H. S. and ZBINDEN, P. (2019). BigTech and the changing structure of financial intermediation. BIS Working Papers, 779.

VIVES, X. (2019). Digital Disruption in Banking. IESE Business School. Mimeo. https://blog.iese.edu/xvives/files/2019/06/Digital-disruption-in-banking_June2019.pdf

Santiago Carbó Valverde. CUNEF, Bangor University and the Funcas Observatory of Financial Digitalisation

Francisco Rodríguez Fernández. Granada University and the Funcas Observatory of Financial Digitalisation