Spanish economic forecasts panel: March 2025*

Funcas Economic Trends and Statistics Department

Growth in 2025

Forecast for 2025 is revised upward to 2.5%

GDP grew by 0.8% in the fourth quarter of 2024, one tenth more than expected in the January Panel. A carry-over effect is derived from this figure, which is what has led most panelists to raise their forecasts for 2025 to 2.5%, one tenth more than the previous consensus forecast (Table 1), as quarter-on-quarter growth forecasts are unchanged (Table 2). The contribution of domestic demand to GDP growth has been revised upwards by two tenths of a percentage point to 2.7%, due to the expected higher growth in investment, which will offset the expected moderation of private and public consumption. The external sector, on the other hand, will subtract two tenths (one tenth more than in the previous Panel). As for the quarterly profile of GDP growth, quarter-on-quarter growth of 0.6% is expected in the first quarter, followed by advances of 0.5% in the remaining of the year (Table 2).

Projection risks are mainly on the downside for 7 panelists, compared to 4 who believe that growth could be higher than expected in 2025. It should be noted that the panelists’ responses were compiled just before the recent escalation of tariffs by the US and the EU, and before the associated stock market declines.

Growth in 2026

The projection for 2026 is 1.9%

In this Panel, GDP forecasts for the year 2026 are requested for the first time: the average stands at 1.9%, with a minimum of 1.7% and a maximum of 2.3%. The deceleration with respect to 2025 is expected to come from the components of national demand, which panelists expect will reduce its contribution to 2.1 percentage points, so that the contribution of the foreign sector would be a negative two tenths of a percentage point. The average forecast of this Panel is below the figures contemplated by the Government or the European Commission and is higher than that of the IMF (Table 1). Quarter-on-quarter GDP growth rates are expected to be around 0.5% (Table 2).

Inflation

The inflation rate will remain above 2% at the end of 2026

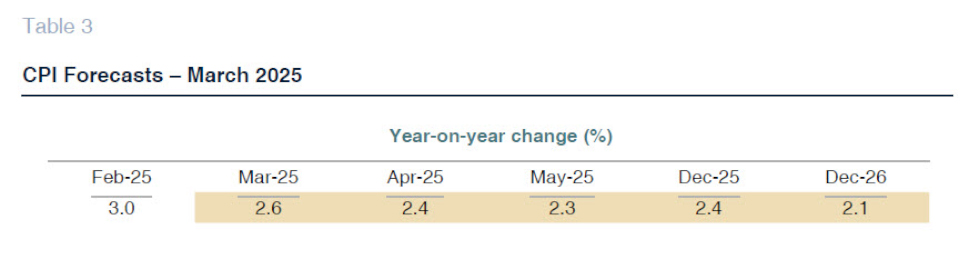

The headline inflation rate reached a peak of 3% in February, mainly due to the VAT hike in January and the later increase in electricity prices. The panelists expect headline inflation moderation in the coming months (Table 3). Core inflation, for its part, recorded a drop of two tenths in February to 2.2%, the lowest value since the end of 2021.

For this year as a whole, an average annual rate of 2.5% is forecast for the general rate (three tenths of a percentage point higher than the previous consensus forecast) and 2.3% for the core rate (unchanged). For 2026, the forecast for average annual rates stands at 2.1% for both overall and core (Table 1).

Labor market

Labor market continues to show strength

The labor market maintains its dynamism. According to Social Security enrollment, job creation has continued to perform strongly since the beginning of the year.

The consensus of panelists estimates a growth of 1.9% (one tenth more than the previous Panel) for EPA employment in 2025 and a slowdown to 1.4% by 2026. The expected average annual unemployment rate for this year is 10.7% (four tenths lower than the previous consensus forecast) and 10.3% in 2026 (Table 1).

Productivity and unit labor costs (ULC), calculated based on forecasts of GDP growth, wage compensation and employment in PPS terms, are expected to be 0.6% (the same as in the previous Panel) and 2.6% (one tenth of a percent lower), respectively, for 2025. For 2026, the forecast is 0.5% and 2.2%.

Balance of payments

All-time high in trade balance

The current account recorded a surplus of 48.4 billion euros (provisional figures) in 2024, the best result in the historical series in nominal terms. Relative to GDP, the surplus was 3%, only below the historical high of 2016 (3.1%), and exceeding the expectations of the previous Panel. Of particular note was the trade balance, which recorded an all-time high-both in nominal terms and as a percentage of GDP-, mainly due to an exceptional performance in the tourism services balance.

The consensus estimate for the current account balance in 2025 has been raised to a surplus of 2.7% of GDP, and that of 2026 is set at 2.5% (Table 1). These values would still be at very high levels in terms of the historical series.

Public deficit

Public deficit estimate is reduced

The deficit figures for the general government as a whole for 2024 are not yet available. Up to November, public administrations excluding local corporations recorded a deficit of 29.4 billion euros, compared to 28.9 billion euros in the same period of the previous year. The result was slightly worse despite the strength of revenues, in which social security contributions and tax collection stand out, with higher growth compared to the previous year due to the normalization of VAT.

The analysts’ consensus estimate for the public deficit is 2.9% of GDP for this year (one tenth of a percentage point less than the previous Panel). For 2026 it is also expected to stand at 2.9% of GDP, although it should be noted that there is a large difference between the lowest and the highest individual forecast, and that the average is above the forecasts of the Government, Bank of Spain and European Commission (Table 1).

International context

Tariff threats lead to a deterioration in confidence

Since taking office, President Donald Trump has multiplied his trade policy announcements. The back-and-forth of protectionist measures and their recent extension to the European Union has opened an episode of instability in the markets. US stock markets have lost the gains accumulated since the November election period, while uncertainty has taken hold. Economic indicators point to a pronounced slowdown in the US, which could contain inflationary pressure and allow for an easing, albeit small (given the expected impact of tariffs), of monetary policy. The European economy, on the other hand, has yet to take off, although the latest PMI indicators suggest a mild recovery may be underway in the manufacturing sector.

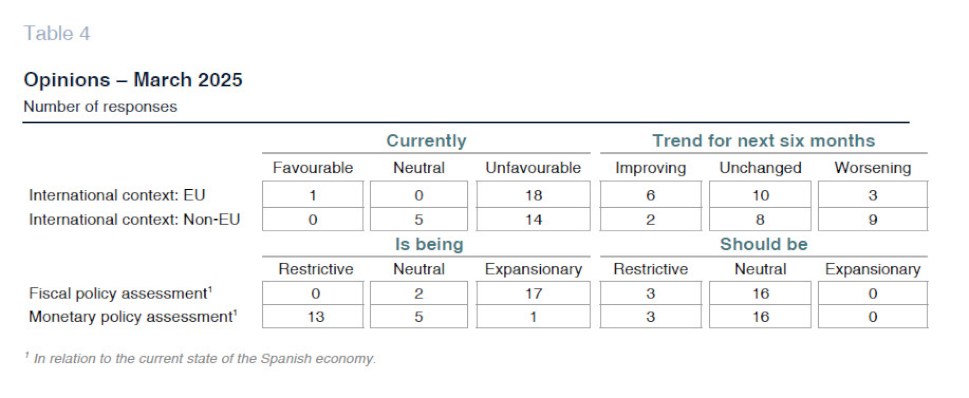

The Panel reflects the intensification of global uncertainties. Of the 19 panelists, 18 consider the context to be unfavorable in Europe, and 14 take the same view regarding the non-European situation. In addition, the number of pessimistic views about the trend in the coming months is increasing, particularly outside the European Union (Table 4).

Interest rates

Slight decline in interest rates and upward pressure on government bond yields

The escalation of tariffs complicates the task of central banks. On the one hand, the slowdown in the US economy, together with persistent European weakness, creates an environment conducive to interest rate cuts. On the other hand, the imposition of tariffs is putting upward pressure on prices, forcing some caution on the part of central banks. Such a careful stance may also be warranted by the expansionary fiscal announcements. The Trump Administration has promised steep tax cuts, potentially aggravating an already ballooning public deficit. In the EU, governments are pledging to sharply increase defense spending, which would lead Germany to ease the debt ceiling.

All in all, the consensus points to a cut in ECB benchmark rates of around 50 basis points by the end of the year. The deposit facility is forecast to remain at around 2% through 2026 (Table 2).

Recent volatility and fiscal policy announcements have led to an increase in the yields on government bonds. The Spanish 10-year bond is trading at around 3.5%, and projected to fall below that level towards the end of the forecast period, according to the consensus (Table 2). Meanwhile, the risk premium, or spread with respect to the German benchmark, has narrowed slightly.

The one-year Euribor has remained at around 2.5% and is projected to fall only by around 30 basis points between now and the end of the year, according to the consensus forecast.

Foreign exchange market

Volatility in foreign exchange markets

After approaching parity with the dollar, the euro has rallied since the previous Panel in line with the change in market sentiment about the economic cycle. The risk of a sharp slowdown in the US economy has become more palpable, while at the same time European governments moved closer together to increase defense spending. In a volatile environment, analysts expect the exchange rate to hover around current levels over the forecast period, reaching around 1.08 by the end of next year, compared to 1.04 in the previous assessment (Table 2).

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, circulated since 1999, is a bi-monthly publication issued in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organizations are also included for comparison, but do not form part of the consensus forecast.