Monetary decoupling in a fragmented world: How far will the ECB’s interest rate cuts go?

The Federal Reserve’s stable interest rate policy contrasts with the European Central Bank’s continued rate cuts aimed at stimulating weak eurozone growth. While monetary policy divergence is strengthening the dollar, albeit not consistently, and driving capital flows to the US, geopolitical fragmentation and protectionism are exacerbating economic uncertainty, generating bond market volatility and weakening global policy coordination.

Abstract: The divergence in monetary policy between the Federal Reserve and the European Central Bank is raising concerns about financial stability and growth in a fragmented global economy. While the Fed maintains stable interest rates amid strong US economic performance, the ECB is continuing its strategy of rate cuts to combat weak eurozone growth. This discrepancy is strengthening the dollar and attracting capital flows to the US, although the dollar’s appreciation has been inconsistent in recent weeks. Meanwhile, geopolitical fragmentation and protectionism are exacerbating these issues, weakening global policy coordination and generating bond market volatility. The future of European monetary policy will depend heavily on how trade tensions with the US, increased European defense spending, and Germany’s expansive fiscal package will influence inflation and growth. While additional rate cuts remain an option, there is growing pressure on the ECB to reconsider its strategy for economic reactivation, especially if inflation accelerates due to fiscal expansion or higher imported inflation from a weaker euro. Balancing these factors will be critical to maintaining financial stability and supporting economic growth in the eurozone.

Foreword

The recent monetary decoupling between the US and eurozone is attributable to marked differences in the monetary policies adopted by the Federal Reserve (Fed) and the European Central Bank (ECB). While the Fed has opted to keep rates stable in response to inflationary pressures and economic growth, the ECB has been steadily trimming its official rates, in a bid to stimulate a weakened European economy, having announced its most recent cut at its meeting on 6 March. This paper examines the causes of this decoupling, its implications for the European economy and current financial conditions – all of which needs to be analysed against the backdrop of geopolitical developments. In the last two months, the world has been witnessing growing institutional fragmentation that goes beyond traditional protectionist measures. This phenomenon is materialising in the erosion of long-standing western alliances, the resurgence of nationalist policies and parties and the redefinition of the spheres of geopolitical influence. The recent escalation of tensions between the US and Ukraine illustrates this trend. International policy coordination is falling apart, diplomatic relations are becoming increasingly unpredictable and traditional alliances are weakening. These trends inexorably affect monetary policy.

On the macroeconomic front, the dynamism observed in the US in recent years has been underpinned by a combination of structural and cyclical factors. Heavy investment in technology and digitalisation, coupled with expansionary fiscal policy, has kept consumption and investment growing at a solid pace, despite relatively high interest rates. In contrast, the eurozone has faced structural obstacles that are limiting its growth. The slowdown in Germany, shaped by a slump in industrial demand and the energy transition, has affected the entire region. In addition, productivity remains a persistent drag in Europe, where investment is too low in key sectors. This macroeconomic context underlines the complexity of the monetary decoupling and its potential long-term effects.

Until the end of 2024, the US economy was posting solid growth, underpinned by a resilient labour market and inflation, while moderate, is within the Fed’s targets. The US stock markets, particularly NASDAQ, extended their rally until December 2024. This economic and market buoyancy has led the American central bank to leave rates at around 4.5% as it waits for more evidence about unfolding economic trends. In contrast, key European economies like Germany have sustained significant slowdowns, knocking the regional economy off kilter. Inflation in the eurozone has eased somewhat, allowing the ECB to justify a more accommodating monetary policy. It has lowered its interest rates several times, leaving the deposit facility rate at 2.50% after its most recent cut, with a view to fostering economic growth and sidestepping potential deflation.

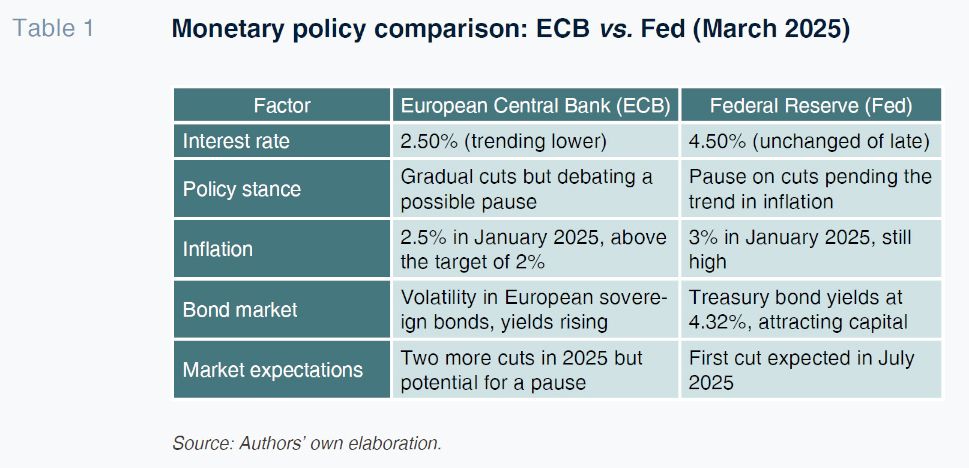

As shown in Table 1, the ECB has forged ahead with its policy of gradual rate cuts although there is increasing discussion about a potential pause, reflecting uncertainty around the trend in inflation. Meanwhile, the Fed has left its rates intact, postponing its first cut until July or maybe even September. Inflation remains above targeted levels in both economies, advising caution. In the bond markets, European sovereign bonds have demonstrated volatility, with yields on the rise, whereas US Treasury bonds, at 4.32%, are attracting capital. The market is discounting additional rate cuts in the eurozone but does not rule out policy adjustments if inflation or growth are surprisingly strong.

Theoretical implications of monetary decoupling for the European economy

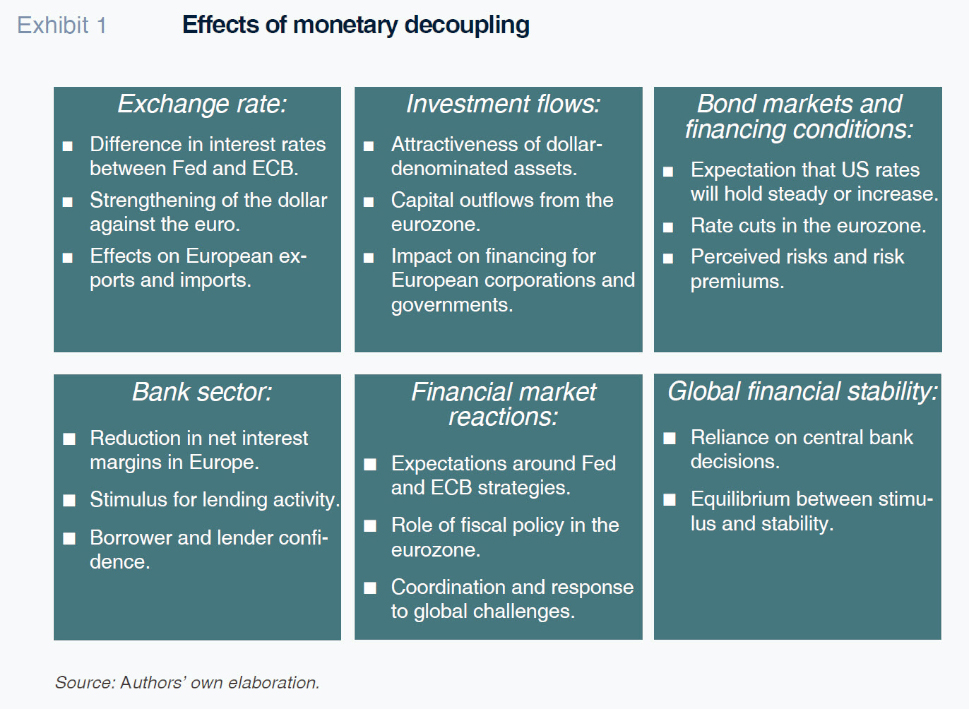

The impact of the differences in monetary policy on either side of the Atlantic is multidimensional (Exhibit 1). Firstly, there is a direct effect on the value of the euro relative to the dollar. An interest rate differential can influence capital flows, which are always chasing higher returns, affecting exchange rates. It is true that in recent weeks the rate of exchange between the dollar and euro has oscillated, perhaps reflecting uncertainty about the likely success of such contradictory policies in the US as protectionism as well as tax cuts, which may have eroded economic confidence on the other side of the Atlantic. On the other hand, the financial relief brought about by the successive rate cuts and recently announced fiscal packages could help reactivate the EU economy, as the comparatively favourable performance by the European stock markets would suggest. In any case, rate stability in the US and rate cuts in the eurozone could ultimately strengthen the dollar relative to the euro.

Monetary policy differences also influence investment flows. Higher rates in the US could draw capital to dollar-denominated assets, such as Treasury bonds, considered safe and profitable. That could continue to drive capital flows out of the eurozone, hurting its corporations and other European economic agents. Higher demand for dollar-denominated assets would also further strengthen the currency, amplifying the effects on the rate of exchange and competitiveness of European exports.

As for the bond markets and financing conditions, in the US, the expectation that rates will hold steady or even rise could reduce bond valuations and lead to higher yields. In the eurozone, in contrast, the ECB’s rate cuts would keep yields on sovereign and corporate bonds low, facilitating access to credit for businesses and governments. In Europe, on the one hand, if investors perceive risks associated with economic weakness, they could demand higher risk premiums, which would increase borrowing costs. On the other hand, another source of rising borrowing costs has been the announcement of expansionary fiscal packages, with Germany, for example, seeing its sovereign bond yields move higher. As a result, the European bond markets have been volatile in the face of the prospect of additional ECB rate cuts. In Germany, the yield on the 10-year Bund has risen to 2.92%, driven by the announced expansionary fiscal package focused on defence and infrastructure, which shook Europe’s debt markets. This has led to adjustments in the prices of French and Italian bonds, suggesting that investors are reassessing sovereign debt risk in the current climate of uncertain monetary policy. Moreover, the divergence with respect to the Fed’s monetary policy is driving capital flows to the US, where Treasury bonds are offering 4.32%.

With respect to the bank sector, the European financial institutions could see their net interest margins dip on the back of lower rates, hurting their profitability. However, more favourable financial conditions could stimulate lending activity, spurring investment and consumption. The key will be borrower and lender confidence in the current economic context.

In the coming months it will be important to watch how the financial markets react to this divergence and the strategies pursued by the Fed and the ECB to manage the emerging challenges. Elsewhere, it is important to note that in an interconnected world, financial stability does not depend solely on the individual decisions of each central bank but also their coordination and joint response to global challenges. The recent distancing between the US and the rest of the world and its unilateralism has hugely weakened global cooperation and the effectiveness of cooperative strategies.

Lack of coordination of global economic policies… on top of protectionism

Recent decisions have evidenced the lack of consistency around global economic policies. The combination of protectionism and divergent monetary strategies could have unanticipated ramifications. In the US, higher tariffs could spark higher inflation and prolong the Fed’s contractionary monetary policy. This in turn would reinforce the dollar against the euro and other currencies, making US exports more expensive and increasing pressure on emerging markets.

Meanwhile, in the eurozone, the divergence with the US will continue to set the tone in the markets. For as long as key economies such as Germany and France remain weak, the ECB is likely to continue to reduce the price of money. This difference with respect to the Fed would have an impact on the financial markets: the dollar would end up appreciating, leaving European imports more expensive (particularly energy goods), adding inflationary risks. Moreover, US bonds would remain more attractive than European bonds, drawing capital to the US. In equities, the uncertainty around Fed strategy could affect US economic growth, particularly the tech sector, which until a few months ago had been benefitting from the prospect of rate cuts. In Europe, in contrast, the markets could find some relief in more favourable borrowing terms, although the threat of a slowdown would linger.

Protectionism in the US would have multiple effects. Firstly, tariffs would increase import prices, possibly fuelling inflation and forcing the Fed to stick with its contractionary policy for longer. That would further strengthen the dollar, affecting the competitiveness of American exports and putting pressure on its trading partners. In turn, the affected counties and blocs, such as the EU, Canada and China, would respond with their own tariffs or currency depreciations, something we are already seeing to a degree, intensifying the global trade conflict. For emerging markets, the combination of tariffs, a strong dollar and high interest rates in the US would imply considerable additional challenges. Investors would probably continue to prioritise American assets, which could trigger capital outflows from developing economies and increase financial volatility.

How far could eurozone rate cuts go?

Risk of excessive cuts and tensions within the ECB

One of the key debates within the ECB is how far to continue with the ongoing rate cuts. Whereas the market is discounting several additional cuts in 2025, some members of its governing council, including Isabel Schnabel and Pierre Wunsch, have warned of the risk of “sleepwalking” into too many rate cuts. [1] Schnabel said in a recent interview that risks to inflation were increasingly becoming “skewed to the upside” due to factors such as wage growth and higher energy costs. Wunsch, for his part, warned that the ECB should not head for 2% without a more detailed assessment of the economic data.

Uncertainty around inflation lingers. Despite falling from the highs of 2022-2023, in February 2025, eurozone inflation was still at 2.5%. On either side of the debate are those who believe that the risks are balanced versus those who maintain that ECB policy may have ceased to be restrictive sooner than expected. These different approaches mirror growing division among monetary policy decision-makers.

The ECB has cut interest rates by 150 basis points since June 2024 and some analysts think that the speed of these cuts could be easing financial conditions too much, warranting reconsideration of current strategy in April or June. Fed policy is another key factor: if the US economy remains strong and inflation stays at over 2%, the Fed could push back its own rate cuts, intensifying divergence with respect to the ECB.

Monetary outlook

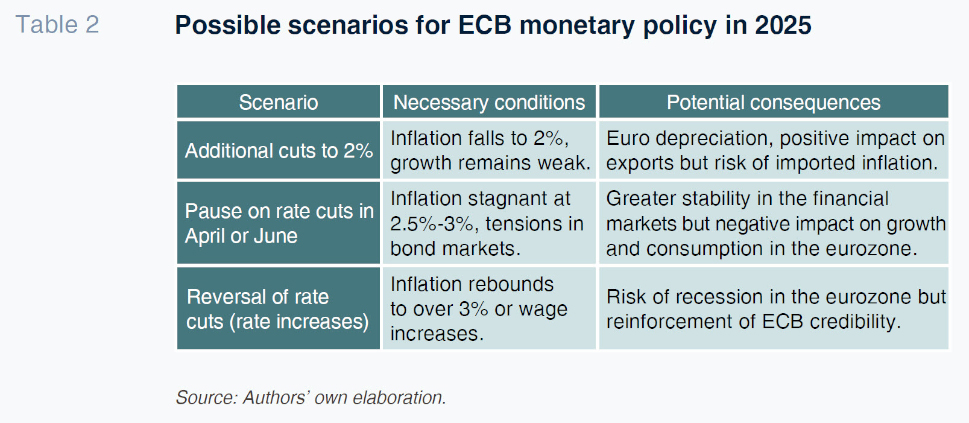

Table 2 sums up some of the main scenarios. Whereas the European context justifies a more accommodative stance, the pressure of a strong dollar and pull of higher US bond yields could limit the effectiveness of its policy. With the ECB’s governing council consensus fragmenting and the volatility in the financial markets, the central bank’s room for manoeuvre is narrowing and may prompt it to fine-tune its strategy in the coming months.

Previous episodes of monetary decoupling between the Fed and the ECB may offer some insights. In 2015-2016, the Fed embarked on rate increases while the ECB left its stimulus measures in place, driving dollar appreciation and a slowdown in emerging market economies. During the euro crisis of 2011-2012, the lack of a coordinated monetary response exacerbated tensions in the fixed-income markets. These precedents suggest that if the current divergence widens excessively, the effects on financial stability and exchange rates could be bigger than expected.

Notes

Santiago Carbó Valverde. University of Valencia and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas