The recovery of European and Spanish bank stock valuations

The latest increase in EU bank stock valuations appears to be driven more by factors other than fundamentals. Expectations of a more favourable regulatory and interest rate climate have helped to provide some much needed breathing room to financial sector shares.

Abstract: After the dismal valuations reached in mid-2016, European – and notably Spanish – bank stocks recovered significantly in the second half of 2016 and into 2017, bringing the price-to-book value close to parity. Paradoxically, the recovery in share prices coincided with the publication of a relatively uninspiring set of 2016 results by the main Spanish and European banks. This apparent contradiction is explained by two factors: the pick up in yield curves and expectations that regulatory pressure will ease.

Heterogeneous results

The publication of European banks’ 2016 results (banks are now publishing their first quarter 2017 results) provides an opportunity to assess their performance, especially in light of a very significant recovery in the stock market value of nearly all European banks, especially Spanish banks.

The significant heterogeneity and volatility across banking systems (and between banks in the same system) is perhaps one of the most notable features of the 2016 results, as is the market’s response to this volatility.

Among the four large euro area countries, only French banks reported a reasonable degree of homogeneity among large listed-banks, presenting a very similar set of results, both in terms of year-on-year growth and market expectations.

Sharp losses at Banco Popular had a negative impact on the overall performance of Spanish listed banks. Profit fell sharply on aggregate, but would have grown modestly excluding Popular.

However, heterogeneity was much greater in Italy and Germany. In Italy, the cleaner banks (Intensa San Paolo and Mediobanca) reported rising profits, but sharp losses recorded by Unicredit and Monte dei Paschi di Siena (MPS) pushed aggregate results for listed banks and the system as a whole into the red. Likewise in Germany, Deutsche Bank continued to post significant losses (albeit less than in 2015 when it undertook provisions of nearly 7 billion euros in order to cover a US Treasury fine of a similar magnitude), while Commerzbank’s profit fell by 70%.

Paradoxical stock market recovery

The extraordinary heterogeneity between and within banking systems, with significant variation in both the amount and the profit/loss situation of banks, is leading to bank shares gaining a reputation for being highly volatile stocks in comparison to the rest of the market. Listed bank stocks rise more sharply when the overall market is on the up and fall more significantly when it is declining.

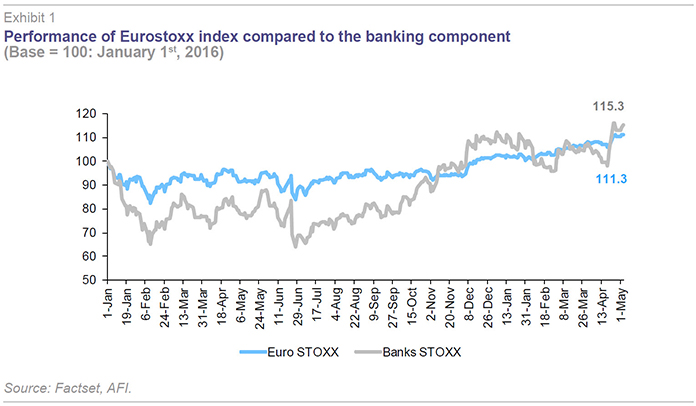

The performance of the stock exchange during the last year is particularly illustrative of the greater relative volatility of bank shares in Europe, as can be seen in Exhibit 1. The Exhibit shows the performance of the overall Eurostoxx index, compared with the banking sector component of the index. During the first half of 2016, European banks almost doubled the losses registered in the overall index, while in the last six months of the year the recovery was much stronger than for the overall index, with this trend being sustained into the first half of 2017.

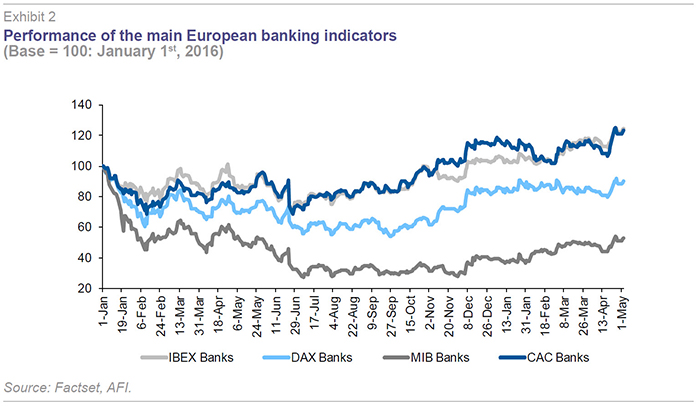

The aggregate performance of European banks masks important differences between countries, both in terms of the initial decline in share prices, but especially in the recovery. Italian banks registered the strongest declines and they have yet to recover the bulk of losses during the first half of 2016, when renewed concerns began to emerge about the outstanding clean-up of their loan books. These doubts have not been resolved and have resulted in several of the large banks putting aside extraordinary provisions, which has led to losses in the system as a whole.

Meanwhile, German listed banks have recovered around half of the losses in the first half of 2016; having been particularly affected by the doubts surrounding Deutsche Bank.

By contrast, Spanish and French bank stock have seen the strongest recoveries since the lows of last June. The relative value (Price/Book ratio) of Spain’s four largest banks now stands at around parity. This is somewhat lower for Sabadell (0.75), while Banco Popular continues to have the weakest valuation at around 0.25 times book value.

Spain has seen the largest recovery in the stock market value of its banks, which also traded at a premium to European counterparts during the height of the crisis. Various factors explain this better relative performance. Firstly, the profitability ratios of Spanish banks are above that of other countries in the comparison. Furthermore, apart from Banco Popular, the bulk of the clean-up effort has already taken place (something which cannot be said, for example, in Italy).

Likewise, the effort to recapitalise Spanish banks was significant, despite solvency ratios remaining somewhat below the EU average. Spanish banks are also set to be more sensitive to a pick up in interest rates than other countries’ banks, with a larger proportion of the loan book referenced to variables rates (by contrast, fixed rates dominate in Germany). This means that as the normalisation of interest rates passes through to the interbank market, Spanish banks will be in a strong position to rapidly increase their profitability.

The same dispersion in relative valuations is present in other European banking sectors and is particularly notable in Italy, where Intesa-San Paolo is valued at 0.9 times book value, with Unicredit at 0.45 and MPS, the most problematic, trading at barely 0.06 times book value.

Reduction in systemic risk

In our opinion, the significant dispersion between bank valuations (which could be considered “positive discrimination”) has a clearly positive interpretation insofar as conerns around sustainability (which is what a low P/BV ratio ultimately reflects) are no longer systemic, as was the case in mid-2016. Instead there is a clear differentiation between banks, essentially on two grounds. In terms of the degree of concern, firstly, around the need for additional asset clean-up and, secondly, banks’ long-term capacity to generate sustainable net interest income.

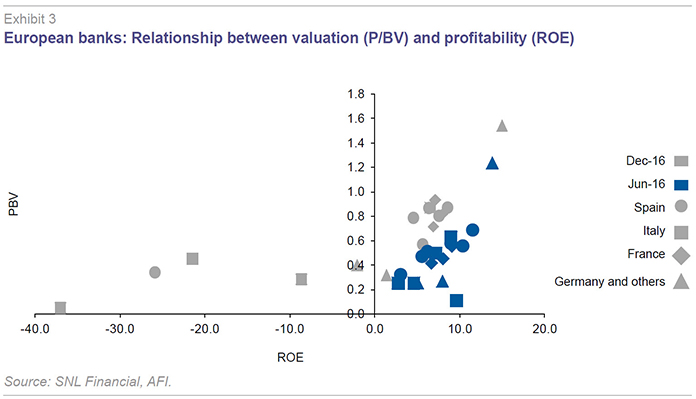

In order to lend credence to the idea of increasing market differentiation between banks, we have analysed two different points in time: mid-2016, when banks’ stock market valuation hit a low point and the end of 2016, following a significant recovery in bank stocks. We correlated each bank’s relative valuation (Price/Book ratio) with the return on equity (ROE) at both points in time.

The results presented in the following exhibit leave little room for doubt: valuation ratios were significantly higher at the end of 2016 than they were in the middle of the year, but most significantly, at the end of 2016, there was much greater dispersion in valuation ratios and a high correlation (around 60%) with each bank’s ROE. This correlation was practically non-existent when valuations hit a trough last June.

However, it is also surprising in the sense that the pick up in bank stocks coincided with increased alarm about geopolitical risks in the second half of 2016. June’s Brexit vote, Donald Trump’s election in November and the Italian referendum have all led to heightened concern. The latter serving as an appetiser for this year’s busy political agenda with elections having taken place in the Netherlands, the Presidential election in France and the upcoming German elections in the autumn.

Although it may seem counter-intuitive, it is highly likely that this convergence of political events may have had a significant influence on the strong recovery of European bank valuations. The line of argument is that these events, especially Brexit and Trump’s election, have led to a reconsideration of two factors which have weighed on banks’ profitability in recent years: (i) the burden of bank regulation; and, (ii) the low interest rate environment. Both the United Kingdom and United States look set to rein in the heavy burden of new regulatory demands on banks and associated uncertainties. The Bank of England’s response to Brexit was to promise a clear relaxation of regulatory demands on British banks, meanwhile one of President Trump’s first moves was to freeze, if not reverse, a significant part of the regulation associated with the Dodd-Frank Act.

Stock market valuation and the yield curve

These moves to relax regulation in the United Kingdom and United States, and the expectation that Europe could follow suit, have likely had a significant impact on the recovery in European bank stocks, especially as elements of political risk come into play given this year’s European electoral calendar.

Another important implication of events in the United Kingdom and the United States is the more than probable change in the monetary-fiscal policy mix, which also likely played into bank valuations. Both countries appear to be taking a path towards a more expansive fiscal policy, taking some of the weight off exclusively monetary-based forms of stimulus and pointing to a possible normalisation of interest rates, which would undoubtedly be very favourable for European banking business.

However, the movements in bank shares not only reflect the implications of the election results. The euro area economy now looks to be moving towards more sustainable territory after several years of (conventional and unconventional) monetary policy stimulus, driving away risks of deflation and the danger of prolonged zero interest rates (“too low for too long”), which significantly would hamper the retail banking business.

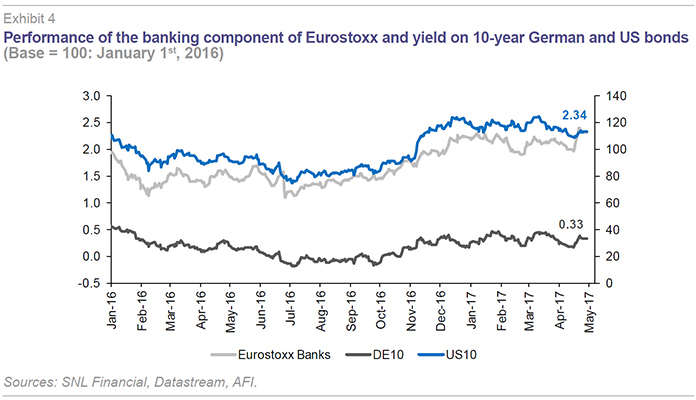

By way of illustrating this idea, we have analysed the correlation between European banking sector stock market valuations and indicators of future interest rate outlook, using both long-term US Treasury bonds and German bunds, as can be seen in Exhibit 4.

The correlation between the share price of Eurostoxx banks and 10-year German and U.S. Sovereign debt is clear, albeit significantly more pronounced for US Treasuries. A possible explanation for this is that the ECB’s public debt purchases are “muddying” the ability of the long-end of the yield curve to anticipate future developments of short-term rates in the euro area; something which the U.S. yield curve can distil more clearly.

Furthermore, extending the analysis to include first quarter 2017 results, which have systematically beaten market expectations, further reinforces the previous analysis, given that the substantial improvement in bank fundamentals indicated by these results has not affected banks’ share prices, which in turn suggests that the market is more sensitive to movements in the yield curve than banks’ underlying performance.

Conclusions

The results leave little room for doubt regarding the significant impact of the pick up in long-term yields on European bank valuations, which is much more significant when compared to US Treasuries than it is for Bunds.

Beyond this statistical observation – the latter is the economic indicator with which the banking component of Eurostoxx is most closely correlated ‒ the results are economically and financially rational. The T-Bond curve has been the first to capture a normalisation of interest rates and a move away from close to ‒ or even below ‒ zero territory, which has had such an adverse impact on the banking system.

This backdrop with a clear sensitivity of bank share prices to the yield curve, albeit with the tapering of ECB stimulus still some way off and likely to be gradual, suggests that the market is beginning to see light at the end of the tunnel for banks. A clearly improved macroeconomic outlook ‒ as indicated by the latest indicators ‒ facilitating a normalisation of interest rates, would give much needed breathing room to banks’ battered income statements.

Ángel Berges, Fernando Rojas and David Ruiz. A.F.I. - Analistas Financieros Internacionales, S.A.