The link between previous experience and survival of new export relationships in Spain

An empirical analysis of Spanish exporters’ survival rates shows that, while early-stage survival is difficult, new trade relationships make a significant contribution to aggregate export growth over time. In any event, the large degree of heterogeneity across successful export relationships in Spain should be a key consideration at the time of designing export promotion policies.

Abstract: This article provides an empirical examination of the importance of previous experience to the survival of new trade relationships in Spanish exports over the period 1997-2015. Export survival is difficult: 78% of the new trade relationships fail within the first two years of existence. However, surviving relationships significantly contribute to the growth of aggregate exports over time: new trade relationships created after 1997 account for 73% of Spanish total exports value in 2015. Interestingly, there exist remarkable differences in survival prospects among new trade relationships. Exporting products previously sold to another country to a new destination exhibits the largest probability of survival over time. New trade relationships based on selling new products have a high failure rate. These findings point out the existence in heterogeneity at the firm-, product- and destination-level that may be related to differences in sunk export-entry costs and/or uncertainty at product and destination level.

Every year, many firms try exporting, and existing exporters initiate new export relationships from different combinations of product and/or destination markets. Yet, survival is very low, leading to a high churn rate. A remarkable share of new exporting relationships fail shortly after entry. Yet, those relationships that manage to make it during their first few years tend to grow significantly over time.

In this paper, we use data on all Spanish annual export transactions at the firm-product-destination level in order to examine the determinants of survival of the new export relationships over the period 1997-2015

[1]. The duration of an exporting spell is defined as the number of consecutive years (since it started) in which a firm exports a product to a destination market. To investigate the impact of previous experience at the firm-, product-, and destination-market levels on the length of the survival of trade relationships, we split all new trade relations into five exhaustive and mutually exclusive categories according to their origin along the firm-product-country dimensions:

- A firm starts exporting (new firm,NF);

- an existing exporter exports a new product to a familiar country (NP, OC);

- an existing exporter sells familiar product to a new country (OP, NC);

- an existing exporter exports a new product to a new destination (NP, NC);

- an existing exporter sells a familiar product to a familiar destination, but leading to a new product-country combination (OP, OC, NPC);

With this classification of the new trade relationships, we perform two separate analyses:

- Which new trade relations contribute more to aggregate exports?

- Which new trade relations exhibit longer survival rates and what can we learn about the importance of previous experience to export survival?

The contribution of new trade relationships to aggregate exports

This section performs the decomposition of both the number and value of all export relationships in 2015 into the intensive margin, that is, the existing trade relations, and the extensive margin, that is, the new trade relations split according to the five types of new trade relationships categories described before. In order to define a new trade relationship in 2015, we need a previous year as a reference. We have selected three years: 2014 (1 year gap), 2008 (6 years gap) and 1997 (19 years gap). For example, when we use 1997 as the reference year, a trade relationship is new in 2015 if a firm exported a product to a country in 2015 but it did not in 1997, whatever happened between 1997 and 2015.

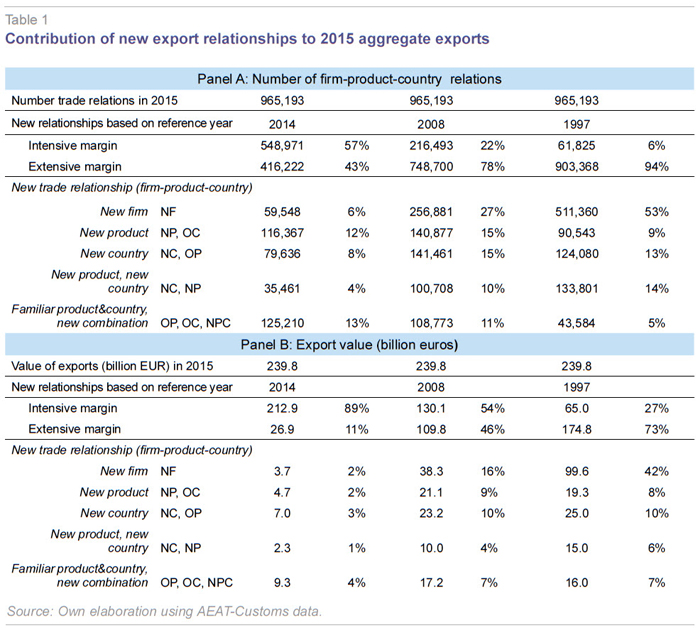

Table 1 shows the results of the decomposition of the number of (panel A) and the export value (panel B) of all firm-product-country relationships in 2015 into the intensive and the extensive margins. In 2015 there were 965,193 firm-product-country export relationships with a total value of 239.8 billion euros.

Column 1 highlights the rich dynamics in export markets in any single year. New exporting relationships, that is, the extensive margin amounts to 43% of total trade relations in 2015. However, their share in total trade is relatively low as they account for 11% of the export value. Entry is relatively common, but at a low scale

[2]. In a year-by-year analysis, the intensive margin clearly dominates the evolution of the number and value of aggregate exports. In the extensive margin, the most abundant type of new export relationship was (OP, OC, NPC), that is, existing exporters that create a new pair (product-country) combination from previously exported products to previously exported destinations, followed by (NP, OC), that is, existing exporters expanding their product portfolio. The share of new firms (NF) was only 6% of all relationships and 2% of aggregate exports.

When we use 2008 as a reference year (column 3), the importance of new trade relationships in aggregate exports increases significantly up to 78% of all firm-product-country relationships and 46% of exports value in 2015. The share of each type of new trade relationship also increases significantly in the number and the value; new firms (NF) experience the biggest increment up to 27% of relationships and 16% of export value in 2015. Finally, when we use 1997 as a reference year (column 5), the extensive margin accounts for 94% of the number of relationship and 73% of the export value of 2015. Again, new firms (NF) increase significantly their share in the number and value of exports: 53% and 42%, respectively.

Table 1 shows that existing trade relationships dominate trade in the short run (year-on-year basis) but the new trade relationships gain importance quickly as we consider longer time frames. This trend can be explained by survival upon entry, and growth conditional on survival. Esteve et al. (2017) examine this question in detail and find some interesting patterns. First, turnover is rather high for new trade relations involving new products to familiar countries by incumbent exporters. They are fairly common, start with a small scale and face high attrition. Second, new trade relations by new exporters have lower survival rates than those by existing exporters. However, successful survivors experience faster growth in export value than existing firms creating other types of new trade relationships.

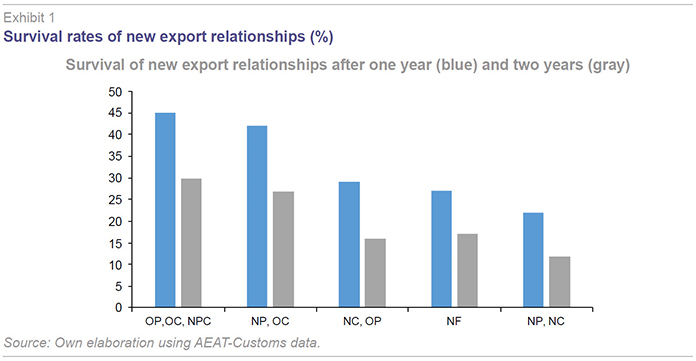

Survival of new trade relationships: The role of previous experienceWhen we consider all new trade relationships, we find that about 65% of new export relationships fail in their initial year, and approximately 78% have failed after two years. That is, only 35% (22%) of new relationships survive beyond one (two) years. Survival is fairly low in the initial years. Interestingly, as shown in Exhibit 1, there are differences in survival prospects depending on the type of new trade relationship

[3].

The new trade relationships with the highest survival rates are those created by existing firms when they start a new product-country combination from products and countries already in their exporting portfolio: 42% (30%) of OP-OC-NPC relationship survive more than one (two) years. Notice that, in this type of trade relationship, experience occurs at the three levels: firm, product and destination.

Existing exporters that start selling a new product to a familiar destination (NP-OC) lead to the second-largest survival rates. It is worth pointing out that their survival rates are significantly superior to those based on exporting a familiar product to a new country (OP-NC). Therefore, previous experience in destination increases survival more than that at the product level.

Finally, the highest risk of failure occurs among those new relationships generated by existing firms that try to export a new product to a new destination (NP-NC). In the case of new exporters (NF), they face tough survival conditions in their first year, which are rather similar to those faced by incumbent exporters when they try with non-familiar products and destinations. Yet, the survival chances of new exporters’ export relationships significantly increase beyond their first year.

Conclusions

We use the universe of firm-product-country relationships in Spanish exports over the period 1997-2015 to analyse the determinants of survival of new trade relationships, with special attention to the role of previous experience.

The results point out that: (i) New relationships (the extensive margin) explain most of the aggregate export value when we consider long time periods (in our case, 1997-2015) and, among the different types of new relationships, new exporters make the largest contribution; and, (ii) Previous experience increases the survival prospects of the new trade relationships. Regular exporters that expand their portfolio using new combinations of existing products and destinations exhibit the highest survival rates; on the contrary, the risk of failure is higher for new exporters as well as for regular exporters that sell abroad a non-familiar product to a unknown destination market.

Our empirical results have implications in the design of export promotion policies, since the risk of failure faced by a new exporter is very different to the ones faced by regular exporting firms that decide to expand their product-country portfolio. Moreover, the risk of failure of a regular exporter that expands its portfolio of products is very different to the one that opts for expanding its portfolio of countries of destination of exports.

ESTEVE, S.; DE LUCIO, J.; MINGUEZ, R.; MINONDO, A., and F. REQUENA (2017), “La supervivencia exportadora. Un análisis a nivel de empresa, producto y destino,” Cuadernos de Economía, 258, Funcas, forthcoming.

Notes

Data for this paper was provided by Inland Revenue-Customs (AEAT-Aduanas) along with financial support from Ministerio de Economía y Competitividad (MINECO ECO2015-68057-R & ECO2016-79650-P, cofinanced with FEDER), and the regional governments of the Basque Country (IT885-16) and the Valencian Region (Prometeo II-2014-053). The data set contains 12,995,865 firm-product-country observations over the period 1997-2015, obtained from 386,679 exporting firms selling 7,610 8-digit Combined Nomenclature products to 198 countries. A detailed description of the construction of the database is available in Esteve et al. (2017).

This result holds for any two-year period considered over 1997-2015 – see Esteve et al. (2017).

In Esteve et al. (2017) we also use empirical duration models to investigate the determinants of survival of new trade relationships. We confirm the existence of heterogeneity of survival rates across firms, products and countries.

Silviano Esteve-Pérez. Universitat de València

Juan de Lucio. Universidad Nebrija, Madrid

Raul Mínguez. Universidad Nebrija, Madrid

Asier Minondo. Deusto Business School e ICEI

Francisco Requena. Universitat de València