Online banking in Spain: A customer snapshot

While it is premature to say with certainty, there appears to be considerable upside in terms of digital financial penetration in Spain. This trend is not only important from a quantitative/cost-reduction standpoint, but also because it creates new ways of getting closer to the customer and opportunities to enhance the customer experience.

Abstract: This paper presents the main conclusions of a study on digital proficiency, in particular financial digital savviness, based on 3,005 interviews of Spaniards resident in mainland Spain, aged between 18 and 75. The average profile of digital financial service customers in Spain is: working women, mothers, aged 39 or under, resident in towns with over 200,000 inhabitants and with household monthly income of between 3,000 and 5,000 euros. The study reveals that 92% of banking customers regularly use the Internet, while 85.3% have smartphones, 44.3% have at least one computer at home and 47.2% own a tablet. Perceptions about digitalisation – namely related to safety/security, control of expenditure, and user-friendliness – help to partially explain the role cash and some of the more traditional financial services continue to play as key financial services methods in Spain. As regards smartphones, these represent an important digital channel for financial transactions, but also a means of information exchange (communications and social networking tools). 40.8% of smartphone users claim to have received an SMS from their banks over the course of the prior year, with 19.8% reporting the use of a payment app during that time. As regards other online payment providers, 28.9% of those surveyed use Paypal and 15% Amazon Payments. However, 62% said they had not used any online payment service during the past year.

The study: Rationale, design and basic sampling characteristics

The global economy is immersed in a complex transformation process; albeit progressing at varying speeds, we are all headed in the direction of far-reaching change affecting economic interaction, labour institutions and social relations. Change is being prompted by the digitalisation phenomenon. Some believe it is the biggest change since the first industrial revolution. Be that as it may, we are moving towards an economic model in which most industries will substantially reduce their marginal costs and introduce automation and artificial intelligence into a large number of processes. Change in which the ability to handle big data is proving essential.

The services industry is one of the most affected by digitalisation and within it, banks’ services stand to the fore. The financial sector is already undergoing, since the crisis, its own transformation. In part, triggered by a mismatch between supply and demand that is being largely corrected via restructuring and consolidation. However, it is also being driven in part by a more far-reaching and longer-term process, namely product and distribution channel transformation, in which the role of the banks’ physical infrastructure is diminishing, just as their ability to offer electronic services, advanced data processing and personalised and immediate solutions for savings and financing products and payment methods is increasing.

However, as it is an ongoing process that is affecting products and channels across the board, there is scant data about how it is progressing. In this context, Funcas has set up the Observatory of Financial Digitalisation, framed by the foundation’s long-standing goal of analysing the trends that are transforming the ties between social and financial reality, focusing on two key market vectors: supply and demand for digital financial services. It is a joint initiative with KPMG, an unprecedented strategic alliance in Spain created to achieve this goal. On the demand side, a study has recently been published under the title “Online banking in Spain: A customer snapshot”, which is synthesised in this paper. It is a pioneering study, underpinned by an extensive survey carried out by the social research institute (IMOP) for Funcas in which 3,005 Spaniards resident in mainland Spain aged between 18 and 75 were interviewed. The survey focuses on the use of digitalisation-enabled banking and payment services. The methodology used is that of the Survey of Consumer Payment Choice (SCPC) produced by the Federal Reserve Bank of Boston, although in the case of the Funcas survey, a broad range of variables related to customers’ digital proficiency, especially their financial digital savviness, have been added.

The sample was built from phone interviews conducted applying the corresponding demographic filters and taking the opportune sociological precautions. The ‘controlled quota’ calls (age, gender, location) and the methods for weighting them are those used in the Spanish general media survey (EGM).

The sampling error is estimated in the range of ±1.8% for a confidence interval of 95.5%. The sample is balanced and proportionate in relation to demographics and enables breakdown by gender, household size, age and income levels, among other variables.

Digital financial services: Penetration, use and assessment

The first important issue when it comes to analysing this sample is to determine the level of general digital proficiency of the interviewees. The analysis reveals that 92% of bank customers are regular Internet users, 85.3% own a smartphone, 44.3% have at least one computer at home and 47.2% own a tablet. 39.9% of households don’t have a desktop computer at home and 47.1% have at least one. 25.3% of households don’t have a laptop computer at home and 44.3% have at least one. This initial analysis enables us to pinpoint which users avail of certain devices and channels with the aim of devising the scope for using such instruments to carry out their banking business.

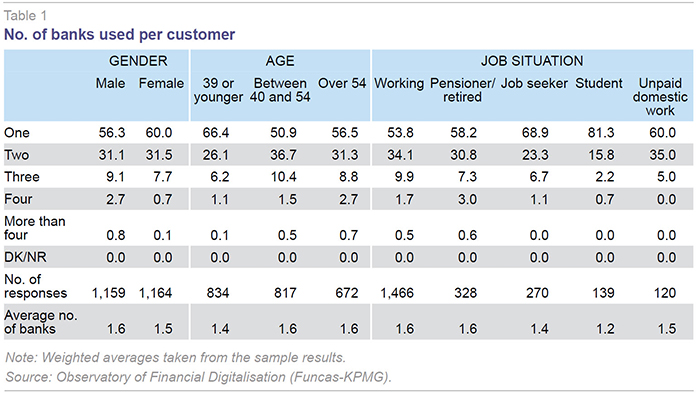

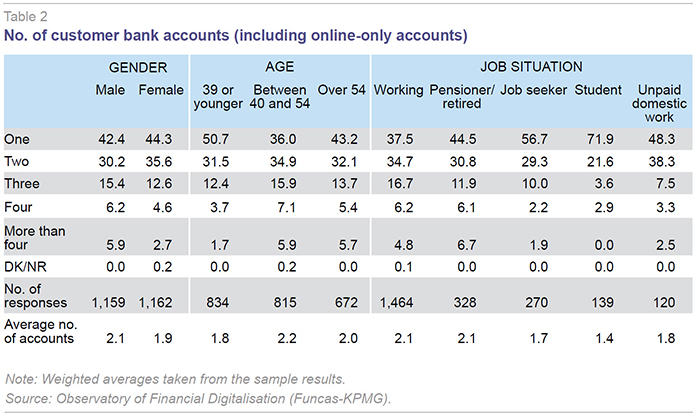

Each customer uses an average of 1.5 banks, there being no major differences between the groups into which the universe of customers were classified. 58.1% of those surveyed transact with just one bank, 31.3% with two and 8.4%, with three (a breakdown by gender, age and job situation is offered in Table 1). 43.3% have just one account; 32.9% have two and 14% have three (a breakdown is shown in Table 2).

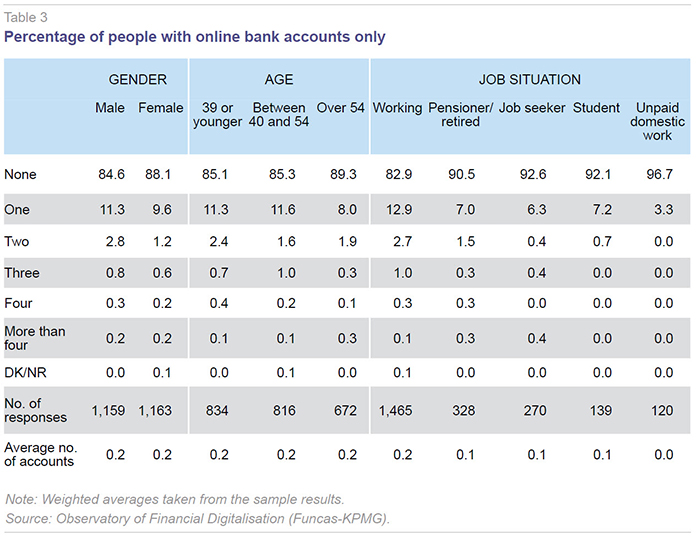

Among the customers who report only having online bank accounts (Table 3), the highest percentages (>11%) are concentrated in the aged 40 - 54 age bracket and among people with jobs (12.9%) relative to job seekers (6.3%) and pensioners (7%).

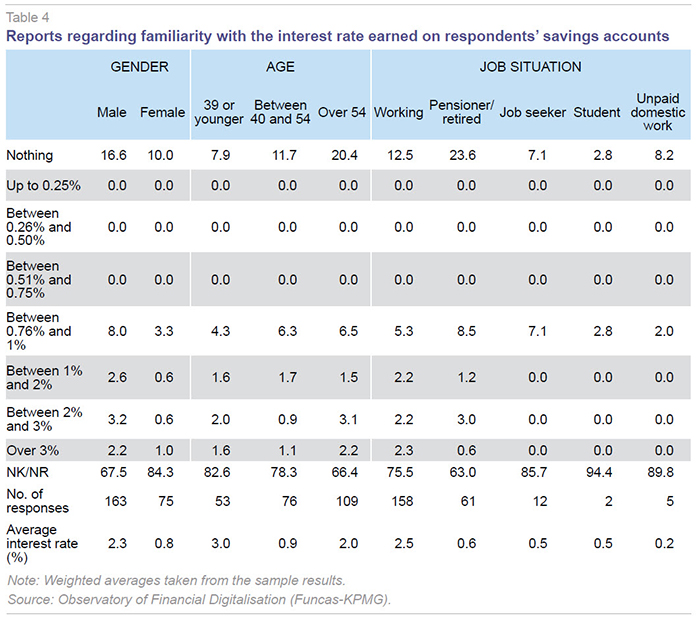

One extraordinarily important aspect is familiarity with the terms on which certain services are provided. To this end, a basic product was taken, namely the savings account, to ask customers whether they knew what interest rate they were earning on those savings, at least within a rough range. The idea was to try and determine to what extent opining on variables such as price is attributable to a general or more society-driven perception than to a more informed and individual familiarity with the reality. Note that while 93.7% of respondents said they had a current account, just 42.2% had a savings account. However, some 75.7% of those with a savings account did not know what interest rate it earned, even within an approximate range. As shown in Table 4, a substantial percentage of the population believes they do not earn any remuneration whatsoever on these accounts (as many as 23.6% of retirees) or at least that is their perception. Interestingly, the men who claimed to know the interest rate reported a rate of 2.3% on average, whereas the women reported a rate of just 0.8%.

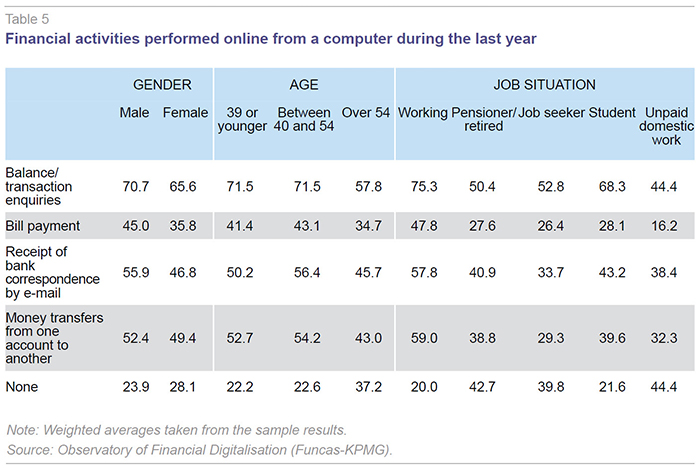

79.1% of those surveyed have a debit card and 50.8%, a credit card. Among the standard financial activities performed online in the past year using a computer (Table 5), balance and transaction checking stands out (68.2%). 27.6% of mobile banking users used their phones to make a transfer during the prior year.

The average profile of digital financial service customers in Spain, calculated as the median of the main users of this type of service (online-only accounts, debit and credit cardholders, mobile banking users) is: working women, mothers, aged 39 or under, resident in towns with over 200,000 inhabitants and with household monthly income of between 3,000 and 5,000 euros.

Perceptions about financial digitalisation and types of use

This section, which addresses perceptions, is particularly relevant as it gives us an idea of which factors may be influencing the preference for traditional services over digital services in the financial industry.

A first discriminating factor is the perceived security of financial transactions. Although the theory and empirical evidence can be used to argue against the logic of this perception, cash payments are seen as safe or very safe by 87.8% of respondents, followed by debit card payments (76.2%). ATM cash withdrawals (66.8%) and credit card payments (65.7%) are viewed as safe or very safe by lower percentages. Whereas 88.8% view direct debiting as safe or very safe, just 54.8% put online banking into this category and an even lower 44.2% so categorise mobile banking. While perceptions about safety/security may be being influenced by fraud in respect of certain payment instruments, a related variable also comes into play: control over expenditure.

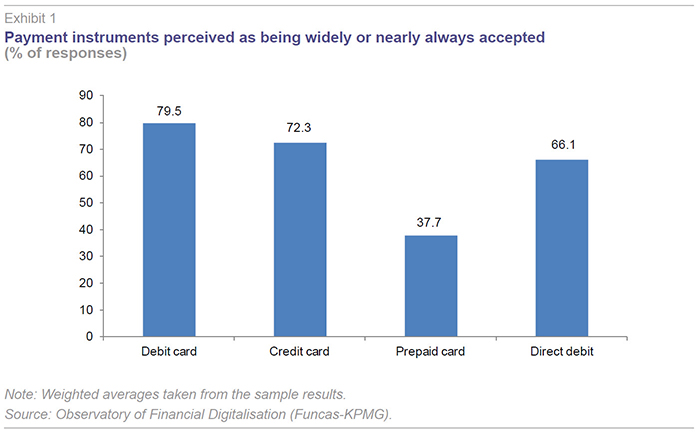

However, there is a perception that cards, whether debit or credit, are more widely accepted as a payment method than direct debits (Exhibit 1).

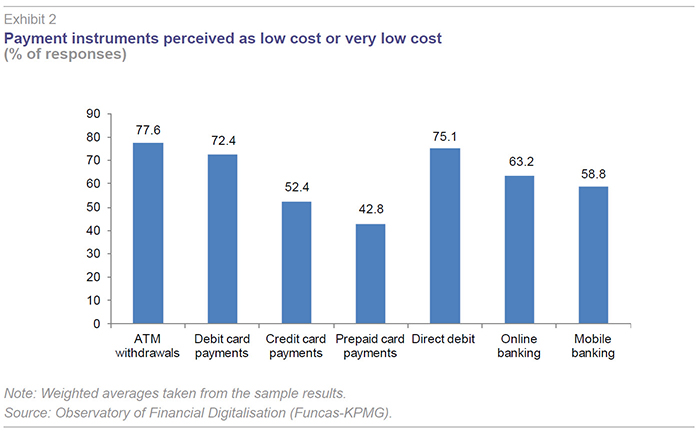

It is noteworthy that just 63.2% view online banking as low cost or very low cost (Exhibit 2) when theoretically the cost of electronic services should imply a competitive advantage; 58.8% said the same of mobile banking, relative to higher percentages for more established services. The differences in perception regarding the utility of the service are similar (more favourable for traditional channels, numbers not provided here).

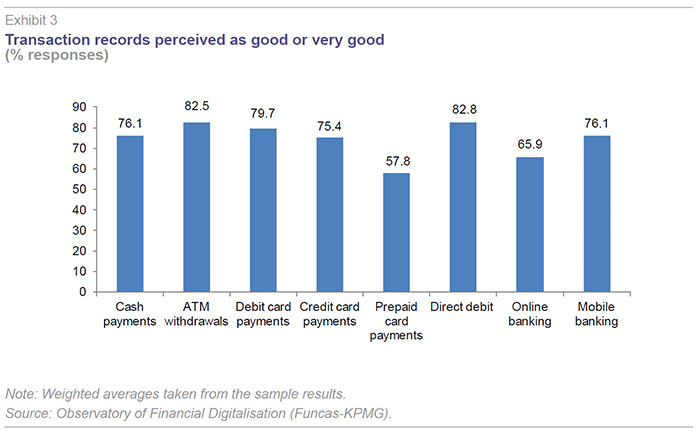

Perceived user-friendliness throws up similar differences between traditional and online services. Whereas over 90% view ATM cash withdrawals and debit card payments as easy or very easy, these percentages fall to 67.8% and 64.4% of users when asked about the user-friendliness of online and mobile banking services, respectively. However, the gap between the assessment of traditional versus digital channels narrows when asked about the availability and quality of transaction records and information (Exhibit 3).

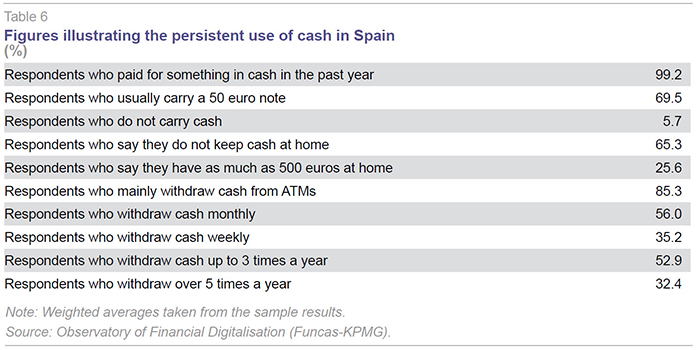

As noted earlier, the differences in perceptions may be partially motivated by the role cash continues to play as a payment method. Particularly the idea that it helps control spending. The results of the survey offer some interesting insight into the persistent use of cash in Spain (Table 6). 25.6% of Spanish households keep as much as 500 euros at home. 69.5% usually carry a 50 euro note on them. Just 5.7% do not carry any cash. These figures are probably also related with a long-standing paradox in Spain in relation to the adoption of new technology in the banking arena and its usage. It is commonplace to observe overlapping new developments such that certain innovations make inroads at an uneven pace. The advent of ATMs is a good case in point: on the one hand, they alleviated the need to go to the bank to perform certain cash transactions; however, in parallel they boosted cash withdrawals, ultimately slowing the use of cards for everyday transactions.

Usage of smartphones, non-banking services and social networks

If there is one device that today’s citizens keep close at hand and use intensively, it is the smartphone. This is why a large part of the banks’ financial digitalisation hopes are placed on this channel. And not only from the standpoint of financial transactions but also the value of smartphones as a communications and social networking tool. All the more so at a time when communication is proving an essential element for the banks, which are looking to strengthen their customer ties, improve their reputations and boost their relationship banking.

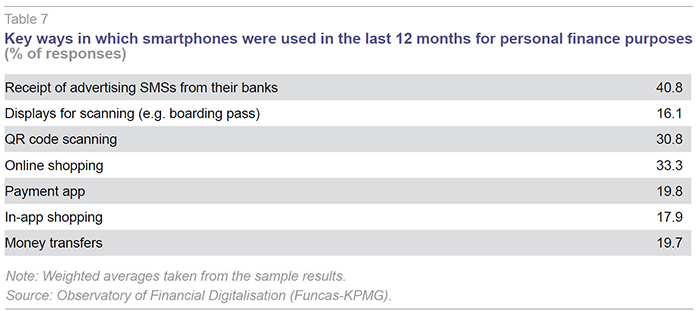

Among the ways in which smartphones are used for personal finance purposes (Table 7), the exchange of information stands out. In the sample, 40.8% of smartphone users reported that they had received a text message (SMS) from their bank over the course of the prior year. A much lower 19.8% said they had used a mobile payments app during that time, although this percentage is already considerable and expected to grow in the years to come.

Whether by mobile, tablet or computer, 56% of those surveyed claim to check their bank account balances weekly, with 34% checking their credit card balances with the same frequency.

The fact that mobiles are used predominantly for the exchange of information is once again related to the safety perception. Only cash is perceived by the majority as a risk-free or low-risk payment method. This percentage falls to 35.6% in the case of m-payment apps and to 15% in the case of payments over the phone.

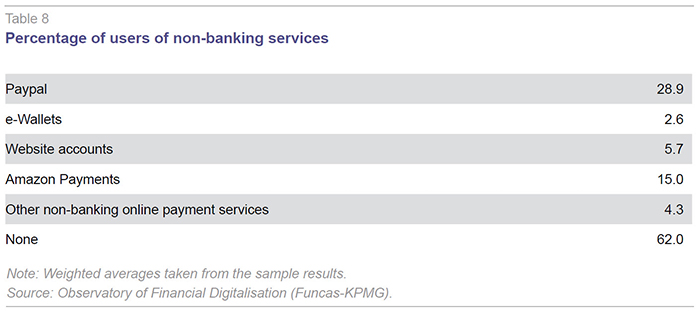

It is important to stress that not all use of electronic payments or digital services relates to banks. Other non-banking providers play an important role. 28.9% of respondents use Paypal and 15%, Amazon Payments. However, 62% said they had not used any online payment service during the past year (Table 8).

Digital channels are gradually replacing branches for matters involving the exchange of information. 37% of those surveyed go to their bank branch at least once a month with enquires. 48% submit enquires at least once a month from their mobile handsets (call or message).

With respect to the exchange of information between banks and their customers, there is little difference in how traditional versus digital channels are perceived in terms of making enquiries or reporting complaints. There is a preference for e-mail over the social networks and it is used primarily to submit complaints.

It is also worth highlighting that 70% of the Internet users surveyed have Facebook accounts and 28%, Twitter accounts. However, the relationship channel created between banks and their customers by virtue of the social networks is used primarily to express complaints or notify technical incidents. There is, therefore, significant scope for further developing these channels.

In general, there is considerable upside in terms of digital channel penetration in Spain, although it is also too soon to say that their presence is already significant. As shown in this paper, this trend is not only important from a quantitative standpoint or in terms of the transformation of financial service industry channels and costs, but also because it creates new ways of engaging customers and swapping information with them: these opportunities for interaction are as, or more, important than existing channels and are set to change the industry radically in the years to come.

Santiago Carbó Valverde. Bangor Business School, CUNEF and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas