Spanish economic forecasts panel: May 2021*

Funcas Economic Trends and Statistics Department

Outlook for recovery in 2021 GDP largely unchanged

The Spanish economy contracted by 0.5% in the first quarter of 2021, 0.1 percentage points more than the consensus forecast. Domestic demand detracted from growth by 0.9 percentage points, while external demand contributed 0.4 percentage points, shaped by a bigger drop in imports relative to exports. As for the end of the first quarter and beginning of the second, available indicators are sending broadly positive signals, with some, specifically the PMI and confidence readings, staging very strong recoveries.

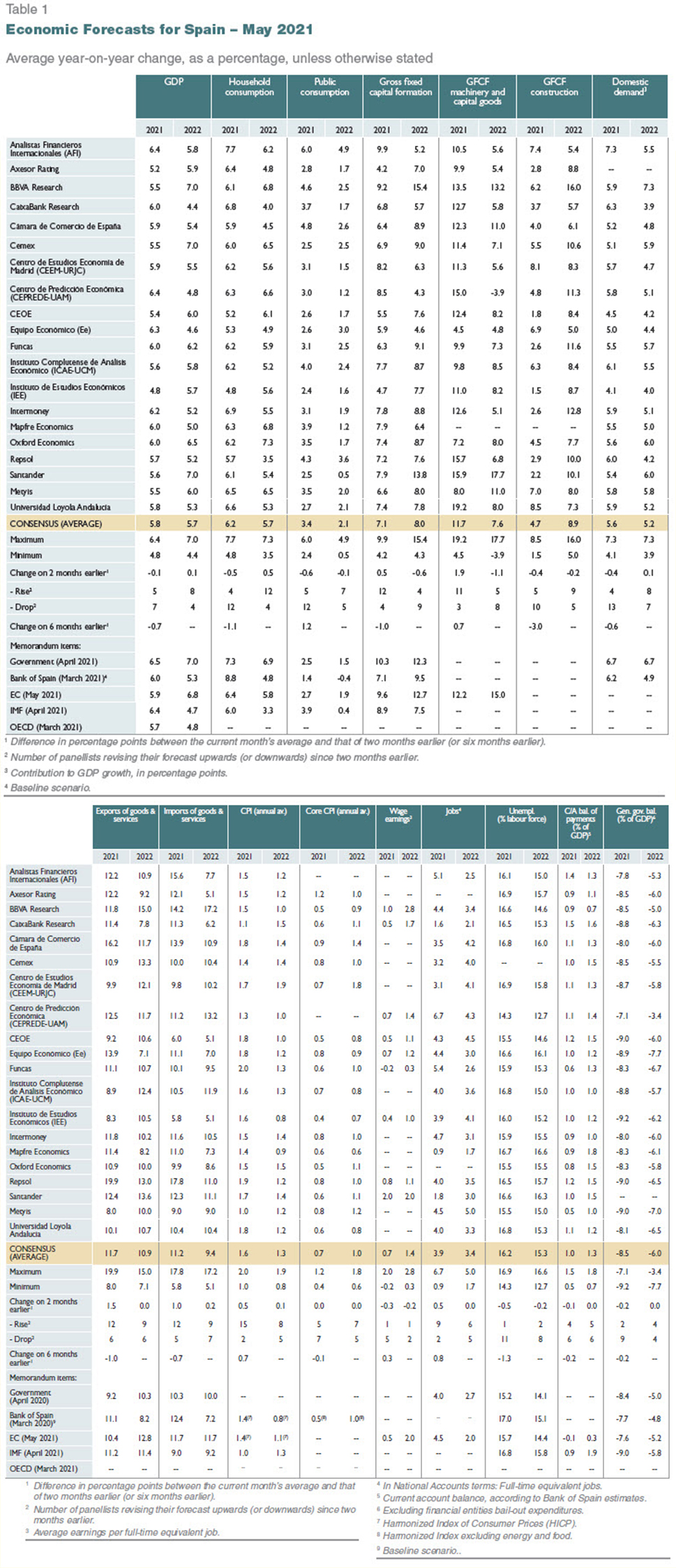

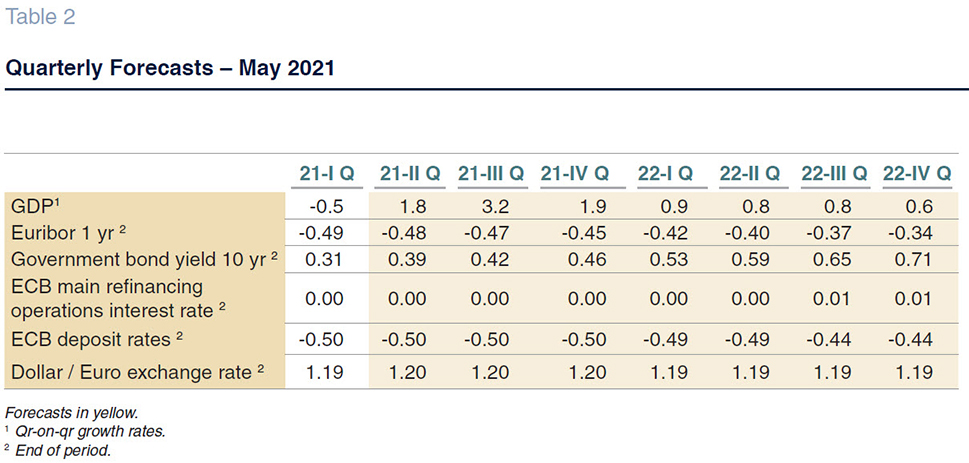

The consensus forecast for GDP growth in 2021 has been trimmed by 0.1 percentage points since our last survey, to 5.8%, reflecting small adjustments in analysts’ estimates as well as the slightly stronger than expected first-quarter contraction. In terms of the quarterly pattern, the second and third-quarter forecasts have been raised a little, while the fourth-quarter forecast is unchanged (Table 2). Most of the analysts are expecting a recovery in tourism exports to around 40% of pre-pandemic levels during the high season (third quarter).

Domestic demand is expected to contribute 5.6 percentage points of growth, which is 0.4 percentage points down from the last set of forecasts. External demand is now expected to contribute 0.2 percentage points (vs. -0.1pp in the last survey), due to a higher upward revision to estimated growth in exports relative to that in imports. The analysts have lowered their forecasts for public and private consumption, but raised their estimate for growth in gross fixed capital formation (Table 1).

The GDP forecast for 2022 has been raised by 0.1pp to 5.7%

The consensus forecast for GDP growth in 2022 has been raised by 0.1 percentage points to 5.7%, shaped by stable quarterly growth of around 0.8% to 0.9% in the first three quarters, with momentum expected to taper a little by the last quarter (Table 2). The new consensus forecast is higher than the Bank of Spain’s and IMF’s current projections and lower than those of the Spanish government and the European Commission. On average, the analysts are expecting a recovery in tourism to over 80% of pre-pandemic levels by the end of 2022.

The slight ease-up in growth in 2022 is attributable to a lower contribution by domestic demand, in turn shaped by slower growth in public and private consumption and in investment in capital goods, more than offsetting the increase in construction investment (Table 1). External demand is expected to contribute 0.5 percentage points, up from 0.2 percentage points as per the last survey.

Note that half of the analysts are forecasting stronger growth in 2022 than in 2021, while the other half expect a slowdown.

Upward revision to estimated 2021 CPI

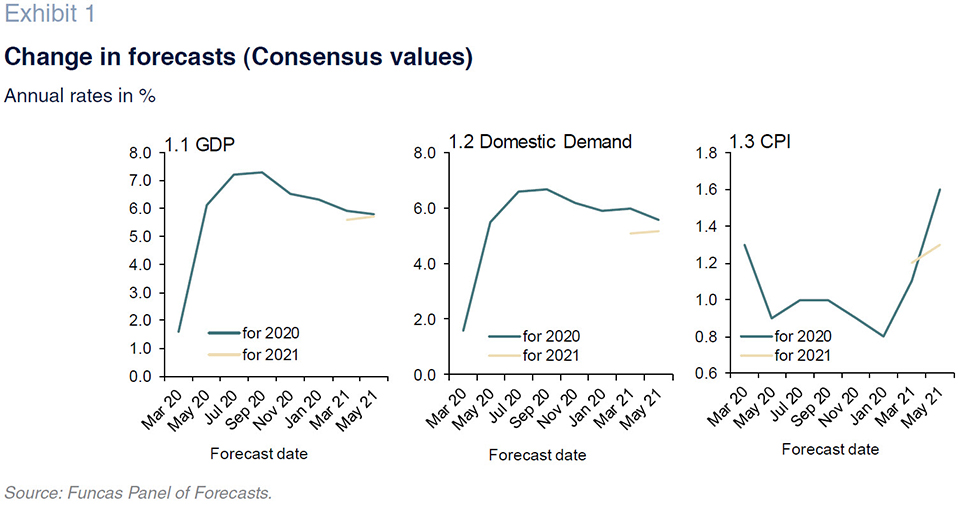

The rally in oil prices during the first quarter, coupled with other factors - some of which are transitory - has pushed year-on-year inflation back into positive territory. Inflation is expected to strengthen further from April (Exhibit 1) as a result of a “step” or base effect in energy prices. Core inflation, however, would remain subdued.

The consensus forecast is for average inflation of 1.6% in 2021, up 0.5 percentage points since the last set of forecasts. The projection for 2022 is for inflation of 1.3%. In terms of core inflation, although the forecast for 2021 is unchanged at 0.7% it is expected to increase slightly to 1% in 2022.

The year-on-year rates forecast for December 2021 and December 2022 are 1.9% and 1.3%, respectively.

Unemployment expected to rise to 16.2% in 2021

According to the latest labour market survey, employment increased by 0.4% in the first quarter, controlling for seasonal effects. The unemployment rate increased to 16%, up 1.6 percentage points year-on-year.

The growth in the number of Social Security contributors trailed that indicated by the labour market survey. However, it is worth highlighting the high number of people coming out of furlough and going back to work in March and April, so that effective employment has increased by around 150,000 people, adjusting for seasonality –figures that point to a stronger job market in the second quarter.

The consensus forecast for employment, in terms of full-time equivalents, is for an increase of 3.9% in 2021 - up 0.5 percentage points from the last survey - and 3.4% in 2022. The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULCs). Productivity is expected to gain 1.9% this year, down 0.6 percentage points from the last survey, and 2.3% in 2022, up 0.1 percentage points. ULCs, meanwhile, are projected to contract by 1.2% in 2021 and by 0.9% in 2022, having risen sharply in 2020. However, these trends should be interpreted with caution due to the distortion created by the furlough scheme.

The average annual unemployment rate is expected to increase to 16.2% in 2021 (down 0.5pp from the last set of forecasts) and to fall back to 15.3% in 2022.

Improvement in external surplus

According to the revised figures, Spain recorded a current account surplus of 7.4 billion euros in 2020, down 70% from 2019. In the first two months of 2021, the trade surplus deteriorated year-on-year, while the income deficit widened, so that the current account balance deteriorated.

The consensus forecasts continue to call for a current account surplus of 1% of GDP (down 0.1 percentage points from last set of forecasts) in 2021 and 1.3% in 2022 (unchanged).

Consensus public deficit forecasts: 8.5% of GDP in 2021 and 6% in 2022

In 2020, the deficit amounted to 123 billion euros, compared to 35.6 billion euros in 2019. The deterioration is the result of a 24.5 billion euro drop in revenue coupled with growth of 63 billion euros in spending, of which around 45 billion euros is related to the pandemic. Public debt, meanwhile, increased by 156.7 billion euros to 120% of GDP in 2020.

The analysts are expecting the overall deficit to come down over the next two years. The forecast for 2021 is for a deficit of 8.5% of GDP (which is 0.2pp higher than the last survey), declining to 6% in 2022.

Nearly all analysts are expecting an improvement in the external environment

Progress on the vaccination front, albeit highly uneven, has ushered in the change in global economic momentum that had been foreshadowed by the indicators already published at the time the previous survey was conducted. The improvement in the US stands out, with the economy having grown by 1.6% in the first quarter, fuelled by private consumption following the easing of the restrictions put in place to control the pandemic, as well as the new stimulus package rolled out by President Biden. The Chinese economy, meanwhile, continues to expand, albeit losing a little steam in recent weeks due to fresh outbreaks in Asia, particularly in India. In its April economic outlook, the IMF raised its forecast for global growth to 6% in 2021 and 4.4% in 2022, up 0.5 and 0.2 percentage points from the January outlook, respectively. The IMF forecasters have improved their outlook for all regions, except for Southeast Asia. According to IHS Markit, the global PMI reached a ten-year high in April, heralding consolidation of the unfolding recovery in the months to come.

The wave of growth is reaching Europe. In its Spring outlook , the European Commission revised its growth forecasts for the EU upwards to 4.2% in 2021 and 4.4% in 2022, up 0.1 and 1.4 percentage points, respectively, compared to its Autumn outlook.

However, the fears of more pronounced inflation are growing as the price rally in commodities and technology components continues. Price pressures are particularly intense on the other side of the Atlantic, where inflation is running at 4.2%, but are beginning to spread to Europe, too.

Overall, the analysts are less pessimistic about the current state of the global and European economies. Nearly all agree that the economic context will improve over the coming months, an outlook already foreshadowed in the last survey.

Yield on government bonds rising but still at low levels

The markets have started to price in an increase in inflation, demanding higher yields in order to purchase debt. Spain’s 10-year government bonds are trading at a yield of over 0.5%, which is nearly 20 basis points higher than in March. 12-month EURIBOR has hardly budged, however, and is trading just above the ECB deposit facility rate (-0.5%).

Central banks, starting with the Federal Reserve and followed by the ECB, have reiterated their commitment to leaving the monetary stimuli in place for as long as is necessary, despite inflationary pressures. Their reaction has not, however, managed to stem a slight upward shift in market interest rates.

Against that backdrop, the analysts continue to expect that market rates will trend higher during the projection horizon, albeit remaining low by historical standards (Table 2).

Slight euro depreciation

Since our last Panel survey, the euro has mapped out two opposite trends, depreciating until the end of March (reflecting the lower growth expected for the region at the time) and later wiping out those losses, as signals emerged that the recovery was spreading to the eurozone. The analysts continue to believe the exchange rate will remain close to current levels over the coming months.

Macroeconomic policy should remain expansionary

The analysts unanimously consider that monetary and fiscal policies are expansionary and virtually all of them believe they should remain so for the coming months (Table 4). No changes of substance are expected in ECB benchmark rates over the projection horizon.

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 20 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 20 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.