Payments in year two of the pandemic

The pandemic has accelerated the use of new payment technologies, such as mobile and P2P payments, with future growth projected in the use of QR codes and biometric payments. However, only once the crisis dissipates will it be possible to assess the strength of these trends.

Abstract: COVID-19 has accelerated shifts in social and economic patterns that pre-date the crisis, including those in the retail payments sphere. Last year, there were 4.7 billion card transactions at the point of sale (PoS), up 4.4% from 2019. This is despite the overall drop in the volume of transactions due to strict lockdowns and social distancing requirements. Although the growth rate in card payments is lower than seen in previous years, the contraction in cash sales was considerably more pronounced in 2020. Evidence also shows an increased willingness of consumers to use alternative digital payment options. For example, the percentage of the population that made a payment from their mobile handset increased from 55.66% before the pandemic to 63.22% during the final months of 2020. Meanwhile, the percentage of the population using P2P applications to transfer money increased from 62.79 % to 75.26% over the same timeframe. Looking forward, QR codes and biometric payments are expected to grow in popularity due to their user-friendliness, security and speed. Nevertheless, it will not be possible to determine the extent of the shift in consumer preferences for payment technologies until some degree of normality returns.

Payments in the midst of a pandemic

In the 21st century, the manner in which we pay for things has become a symbol of the society we live in. Purchase transactions reveal information about our preferences for technology, propensity to save, financial planning, data usage and our appetite for debt. Unexpected disruptions, such as the COVID-19 pandemic, and the uncertainty they usher in can radically change some of those preferences, with retail payments mirroring these shifts. In this article, we analyse the pandemic-induced changes in Spanish retail payments and the extent to which some market trends may have accelerated as a result.

Several payment instrument trends have emerged forcefully in recent years, although there are marked differences between countries depending on institutional, technology infrastructure and even psychological/social factors. Academic research shows that payment trends tend to be entrenched, with consumer preferences changing slowly over the long-term. Each region has a payments ‘culture’. Nevertheless, a gradual transition from physical payments (i.e. cash) towards electronic and digital methods is emerging. In the broadest sense, the aim is to move towards more efficient, secure and fiscally transparent transactions. It is important to focus on attainment of those objectives rather than the promotion of specific payment instruments, as society and technology evolve and adapt in response to the shift in preferences. It is still too soon to determine to what extent the pandemic has contributed to changes in payment but some data suggest that we have evolved in just 12 to 15 months to a position that would otherwise have taken several years to reach. Four main changes have been observed in Spain during the pandemic:

- In general, the volume of transactions has fallen during the periods of lockdown or tighter restrictions, in tandem with the contraction in consumption and growth in savings, a trend that is mirrored in other countries.

- Cash payments have declined in weight relative to payments with electronic instruments but remain a priority and persistent form of payment for a broad spectrum of citizens.

- Contactless mobile payments are becoming more popular, this being one of the payments instruments registering the strongest growth during the pandemic.

- The use of instant money payment or transfer apps has also proliferated. In Spain, the use of Bizum stands out. Alongside mobile and P2P payments, new transacting methods, such as those based on quick response, or QR, codes, are emerging, albeit still in the early stages of adoption.

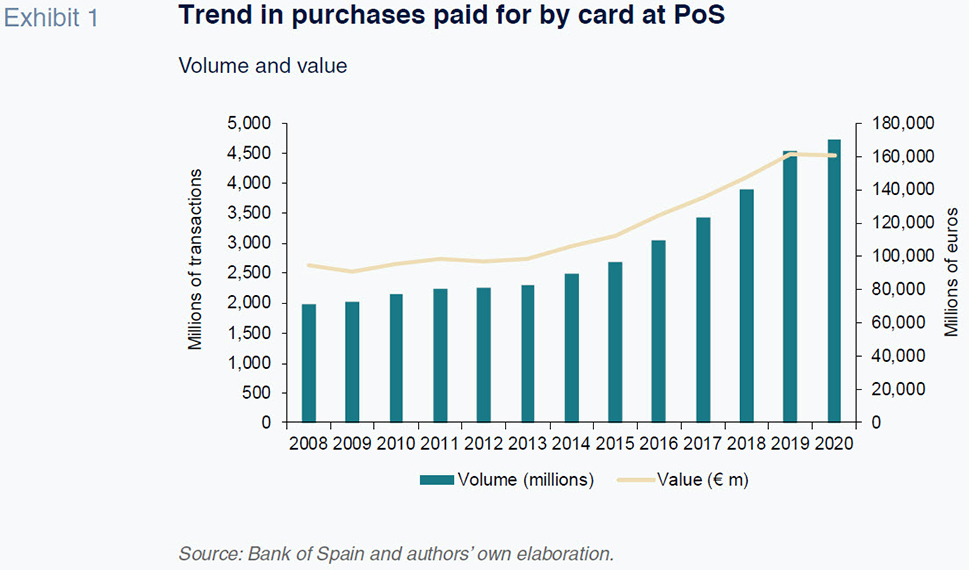

The data published by the Bank of Spain until the end of 2020 provide insight into payments made throughout the pandemic. Exhibit 1 shows that there were 4.7 billion card transactions at the point of sale (PoS) last year, up 4.4% from 2019. This indicates a notable slowdown, compared to the double-digit annual growth rates registered since 2016. Note, however, that volumes only contracted in the second quarter (not shown in the exhibit), specifically by 16.3%, which is when the most stringent lockdown was in place. Value-wise, card PoS transactions amounted to 160.55 billion euros in 2020, down 0.49% from 2019.

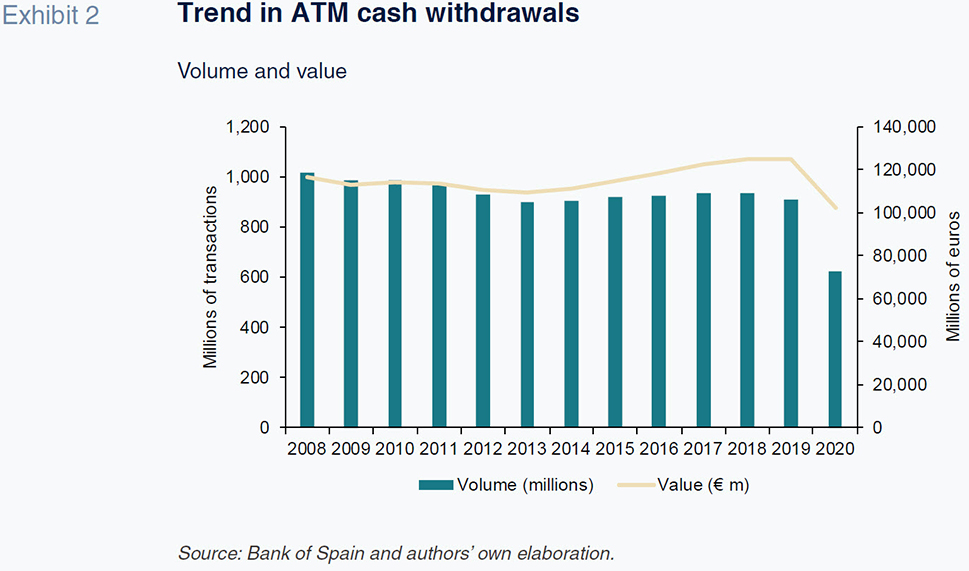

Although the Bank of Spain does not publish statistics on cash payments in retail establishments, it does track ATM cash withdrawals (Exhibit 2). The drop in withdrawals is noteworthy. The number of transactions declined by 31.2% from 908 million in 2019 to 604 million in 2020. The value of those transactions declined by 18.4% from 125.19 billion euros to 102.2 billion euros.

Shifting preferences: Mobile and P2P paymentsThe Funcas Observatory of Financial Digitalisation (ODF-Funcas) has been analysing changes in the demand for payment instruments as part of the financial digitalisation of the Spanish population. The last edition of the Financial Innovation Barometer

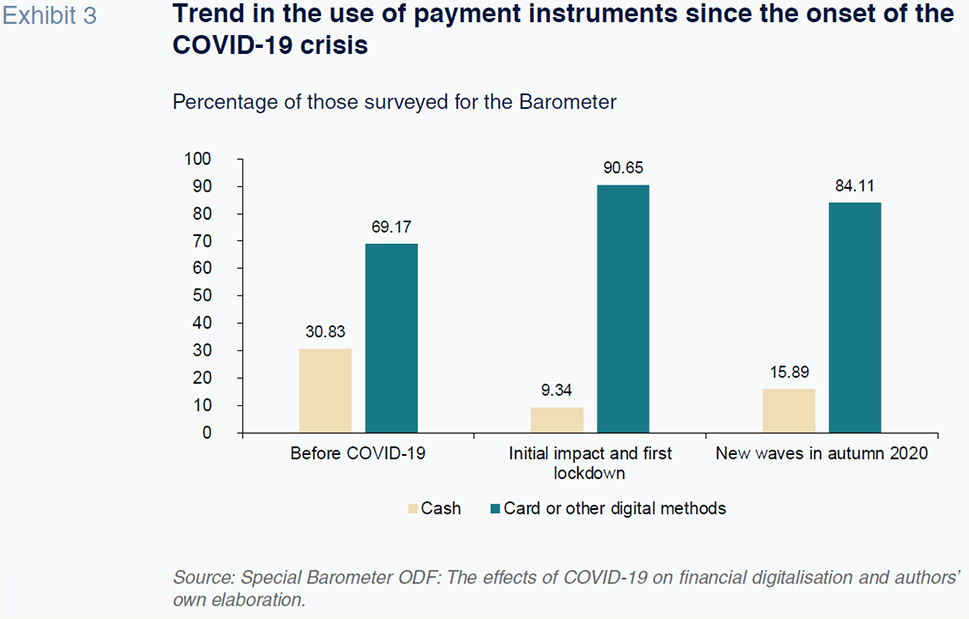

[1] examined patterns before COVID-19, during the first lockdown and the subsequent waves of transmission and restrictions in the autumn of 2020. In analysing the use of cash versus cards and other digital methods, there are some important caveats to note. Although the statistics regarding the use of notes and coins are scant and not systematic, a significant difference has been observed in the use of cash and other payment methods and the opinions expressed in surveys about user preferences. While the European Central Bank (2020) has calculated that Spaniards, like citizens of other European countries, use cash for over 80% of their transactions, the surveys suggest a growing preference for other means of payment. Specifically, the Barometer (Exhibit 3) shows that before the onset of COVID-19, Spaniards strongly preferred electronic or digital payment instruments (69.17%) over cash (30.83%). When the pandemic broke out and during the initial hard lockdown, those percentages jumped to 90.65% and 9.34%. That mix rebalanced only slightly (at 84.11% and 15.89%, respectively) during the subsequent waves and less-stringent restrictions in the autumn of 2020.

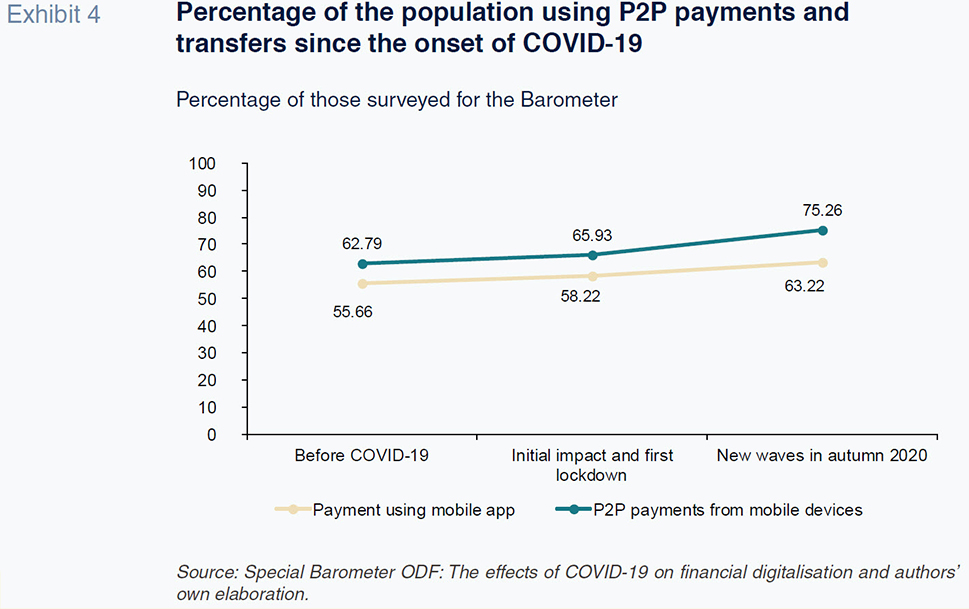

By examining digital payment instruments, particularly transactions completed from mobile phones or other handheld devices, we can see significant additional changes in how Spaniards are processing and sending their money. According to the Barometer, the percentage of the population that made a payment from their mobile phone increased from 55.66% before the pandemic to 58.22% during the first lockdown and to 63.22% during the final months of 2020. The percentage of the population using peer-to-peer, or P2P, applications to transfer money, the most popular of which is Bizum in Spain, increased from 62.79% to 65.93% and to 75.26% over the same timeframes.

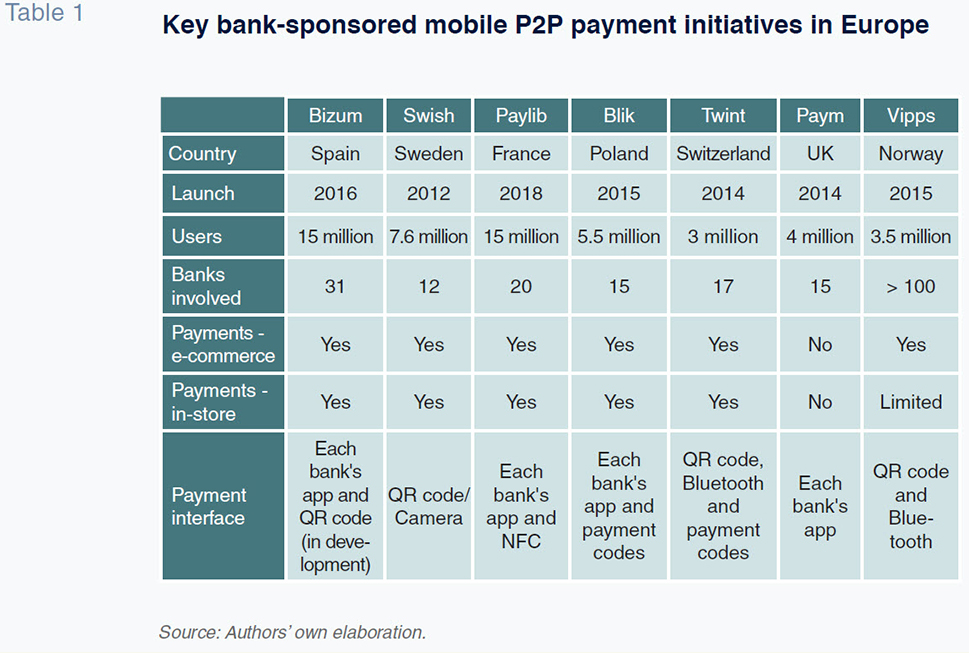

The surge in P2P payments warrants special attention. A broad variety of social interactions and transactions that involve money, from dividing up the bill at a restaurant to making a donation — are changing shape. In Spain, as noted above, the leading platform is called Bizum, a company owned by the main banks (currently encompassing 31 financial institutions) that have come together to develop this innovative payment solutions. As shown in Table 1, there are similar projects in other European countries whose market penetration is rising at a similar pace. It is important to note that those platforms, although initially created as a way of facilitating person-to-person transfers, are gradually embedding the ability to pay online and in physical stores, thereby building a solid bank-backed alternative to the payment platforms offered by tech companies (such as Paypal, GooglePay, SamsungPay and ApplePay). The multi-channel features offered by Bizum and similar platforms in Europe, which range from mobile apps to QR codes and other contactless or near-field communication (NFC) payment technologies, are key reasons for the growing popularity of these payment solutions.

On the horizon: New payment alternatives

Although new technology adoption occurs at varying speeds, certain payment technologies have proven especially popular in Spain during the crisis, pointing to the future of payments post-pandemic. In particular, the growing use of QR codes stands out. Although the technology was available before the pandemic, consumer interest in it has increased. With the imposition of health and safety measures, consumers have become used to scanning these codes to perform multiple activities, not all of which financial (e.g., reading the menu in a restaurant) and have transitioned to using them to make payments. The upside for QR payments lies with their user-friendliness, security and speed. Customers simply scan the code, select their bank and authenticate payment from their mobile phones. Growing familiarity with those uses suggests QR payments’ market penetration will continue to grow. Some studies indicate that over 73% of Spaniards plan to use a QR code as a method of payment in the near future (Mobilelron, 2020). Bizum has already announced plans to introduce QR-code enabled payments in the second half of 2021.

Biometric payment constitutes another high-potential method that is rising in popularity. Biometric payments rely on user identification technology such as voice, face, fingerprint or iris recognition. Worldwide, the biometric payments market is expected to grow by 49% between 2019 and 2027 (Research Nester, 2020). Here the value-added lies with the scope for improving the customer experience by eliminating transaction friction. In today’s touchless world, biometric payments are synonymous with the so-called ‘invisible’ or contact-free payment methods.

The introduction of biometric techniques is also affecting existing hardware. A good example is the biometric payment card which features a fingerprint reader. Unlike traditional cards, instead of typing in a PIN when paying for a good or service, users simply need to touch the fingerprint reader on the front of their cards. Moreover, all such cards are equipped with NFC technology to enable contactless payments. Voice payments, albeit still a nascent technology, could also provide benefits in the post-pandemic world. Consumers are becoming increasingly used to carrying out everyday tasks using voice commands (turning on lights or a home appliance, playing music, etc.), paving the way towards its eventual use in payments. Some of the technology players such as Google are already testing solutions that would allow voice authentication for payments. The challenge lies with the fact that the technology needs not only to understand the content of the message (the consumer command accepting the payment) but also to recognise its origin in order to authenticate the payer’s identity. Research is also underway in the area of face recognition technology that goes beyond facial features. The idea is to embed a camera into a device that recognises physical characteristics and decides which gestures determine a transaction. That technology is already being used in China, where Alibaba has introduced a ‘smile-to-pay’ system whereby consumers can pay in stores by smiling at a camera. It is worth noting that the EU has just announced plans to regulate AI, including the use of facial recognition.

Adoption and the sustainable use of all of these new forms of payments depend largely on whether consumers perceive them as easy and safe to use. What the current trends do seem to indicate, however, is that the COVID-19 pandemic has shifted preferences and spawned an experimental environment in which some of these new technologies may thrive. We will not be able to tell, however, to what extent these trends prove structural until some degree of normality in social contacts and mobility returns.

Notes

References

Santiago Carbó Valverde. University of Granada and Funcas

Pedro Cuadros Solas. CUNEF and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas