Monetary policy and business lending: Impact on pricing

The recent reversal of the ECB´s unconventional monetary policy is already driving interest rates higher, raising the risk of triggering an increase in corporate bankruptcies, which would increase the private sector´s marginal cost of borrowing even further. As interest rate hikes have started around the world, global central banks will have to determine whether or not they choose to live with inflation, or risk adverse consequences for the economy.

Abstract: When Mario Draghi promised to do “whatever it takes” on July 23rd, 2012, he managed to stabilise the euro and avert the sovereign debt crisis. Those words also cemented the unconventional monetary policy measures first rolled out in response to the financial crisis of 2008. Later, the health crisis induced by the COVID-19 pandemic ushered in new challenges for monetary policy design which translated into new EU recovery programmes. The purpose of this paper is to analyse the measures implemented since the financial crisis of 2008 and the extent to which they have affected the real economy, with a focus on how they have affected business loan price formation. Our analysis shows that both the ECB´s corporate bond buyback program and its liquidity scheme have played a particularly important role in reducing the cost of borrowing for SMEs since 2014. The reversal of those unconventional monetary policies will drive interest rates higher, as we are already seeing. That phenomenon could trigger an increase in corporate bankruptcies, which would increase the business community’s marginal cost of borrowing even further. The thorny issue for the central banks is whether the existence of inflation per se has more adverse consequences for the economy than the path of rate tightening they establish. This will be the crux of the difficult debate for governing councils´ of central banks globally going forward, particularly since monetary policy has already begun shifting direction all around the world, as exemplified by the ECB’s recent moves to hike its key rates by 50 basis points and subsequently by 75 basis points and provide new forward guidance.

Beyond the imaginable: Unconventional monetary policy

In economic history, there are turning points that mark an era, conditioning the economic agents’ decisions, actions, and developments. In recent years, in the case of Europe, the words, “whatever it takes”, pronounced by then European Central Bank (ECB) President, Mario Draghi, on July 23rd, 2012, came as relief for the euro, in the midst of the sovereign debt crisis, but also cemented the unconventional monetary policy measures that were first rolled out in response to the crisis of 2008. The ECB’s recent decisions to raise its three key interest rates, i.e., the rates on its marginal deposit facility (“MDF”), main refinancing operations (“MRO”) and marginal lending facility (“MLF”), by 50 basis points and subsequently by 75 basis points marks an inflection point in European monetary policy, abandoning negative rate territory for the first time since 2014.

From a global perspective, the unconventional monetary policy measures were created with the aim of re-establishing the (conventional) monetary policy transmission channels, which had been affected by the fallout from the financial crisis. They were also shaped by the fact that the official interest rate had reached its natural lower limit of 0% without alleviating concern about the deflationary and recessionary dynamics on display (CaixaBank, 2013). The measures were therefore designed to stimulate economic growth in the eurozone while fending off, framed by the ECB’s price stability target, the risk of deflation (Cano, 2020).

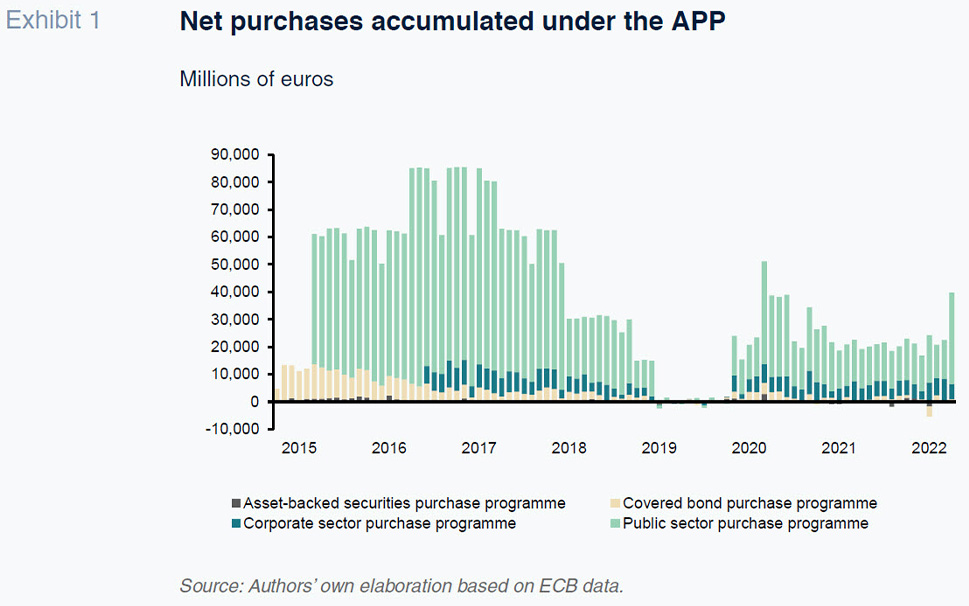

To that end, unconventional monetary policy can be classified into two types of measures, both of which have had the effect of increasing the size of the central bank’s balance sheet: (i) the provision of liquidity facilities to financial institutions on advantageous terms (particularly the Targeted Long Term Refinancing Operations or TLTROs); and, (ii) asset purchase programmes, including the purchase of sovereign bonds (notably the Public Sector Purchase Programme or PSPP) and of corporate bonds (the Corporate Sector Purchase Programme or CSPP). In addition to those two types of programmes, it is common to add a third element on account of its growing and inseparable importance with respect to the programmes: namely, messaging about where monetary policy is headed, known as forward guidance.

These measures have had a significant impact on growth in the ECB’s balance sheet, given their influence in nudging eurozone economic growth along, while resolving the sovereign debt crisis and liquidity crunch in the financial and corporate sectors, an aspect analysed in depth in this paper.

Monetary policy and business sector financing

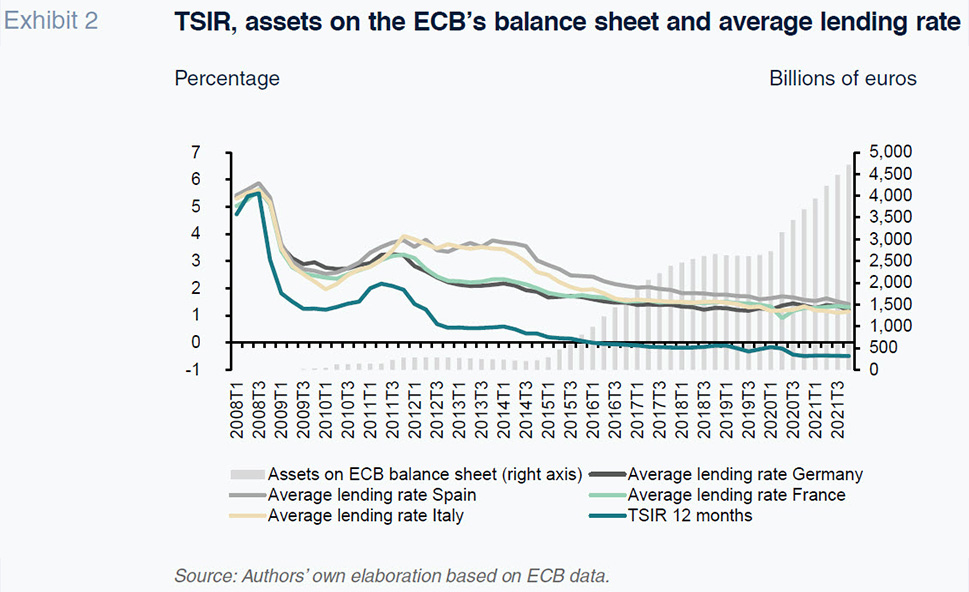

Implementation of the above-mentioned monetary policies, which as we have said include liquidity facilities for the banks and asset purchase programmes, have an impact on the rates at which European businesses can borrow money. As shown in Exhibit 2, both the purchase of assets by the ECB and the term structure of interest rates (TSIR), a variable that serves as a proxy for the liquidity programmes are negatively and positively correlated, respectively, with the average rate on business lending.

With respect to the ECB’s efforts to provide the banks with liquidity on advantageous terms, the relationship of cause and effect with business lending terms is deemed direct due to the following: if the banking sector is able to obtain liquidity at a lower cost and at longer maturities, that should translate into lending at lower rates, particularly if the provision of credit is a prerequisite for accessing that liquidity, as is the case with the TLTRO programmes.

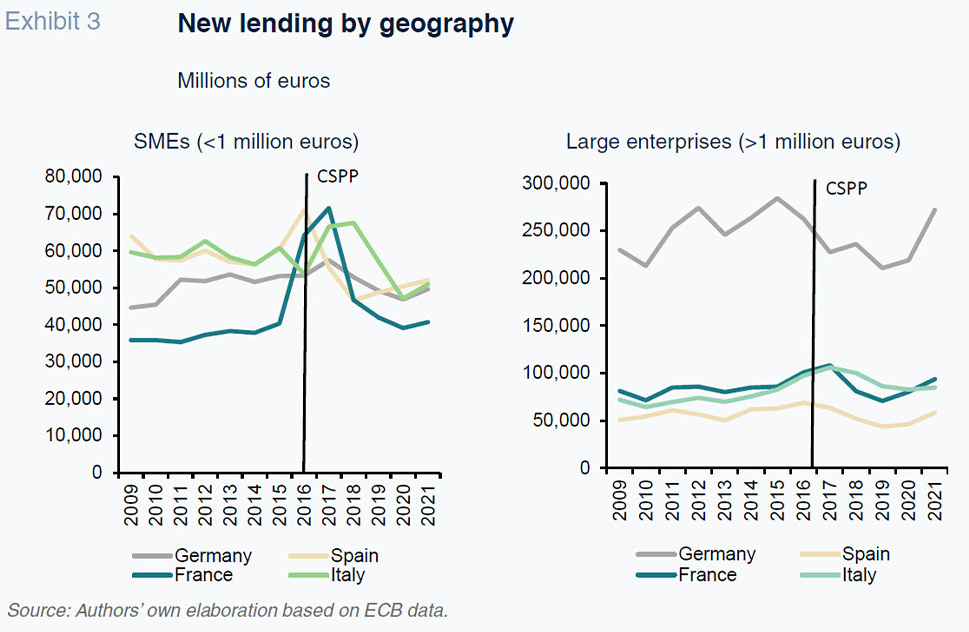

As for the asset repurchase programmes, limiting our analysis to the programme that affects the corporate sector only (the CSPP), the relationship between implementation of the programme and borrowing terms is, at least apparently, less direct, as only a relatively small percentage of the European economies’ firms finance themselves with bonds that are eligible for that programme. [1] However, the empirical evidence suggests that implementation of the CSPP, by altering the internal rate of return (IRR) or yield on the eligible bonds, has an impact on the terms at which the broader business universe can borrow. Specifically, implementation of the CSPP should increase demand for investment grade bonds, driving their prices higher and their yields lower.

Lastly, by rendering bond issues less costly (regardless of whether or not eligible for the CSPP), more eligible issuers are encouraged to take the capital markets route rather than relying on bank financing. Ultimately, the reduced demand for bank credit by large enterprises drives its price down, making borrowing cheaper for all companies that do not tap the markets, as was the case with the rates on loans provided to SMEs.

All of this interplay, commonly known as the monetary policy transmission mechanism, allows the ECB to influence borrowing terms, by reducing yields on bonds not eligible for the CSPP and lowering the cost of bank financing.

To study the impact of the two types of monetary policies with the greatest influence on the price of business loans, we have divided our analysis into two parts: in the first, we estimate pricing based on the risk on the credit extended to businesses in the four main European banking systems, which represent over 78% of total eurozone assets (Spain, Germany, France and Italy); in the second, we study, using the impulse-response function (IRF) the cause-and-effect relationship between monetary policy and the pricing derived in the first part of our analysis.

Estimation of the theoretical average lending rate

When lending money, the banks study potential borrowers’ creditworthiness, assigning credit scores or ratings, which determine the price of each loan they grant. That loan price or interest rate needs to incorporate four main variables: the entity’s capital structure or funding cost; the entity’s operating expenses, essentially staff and administrative costs; the associated cost of risks; and, remuneration for their shareholders.

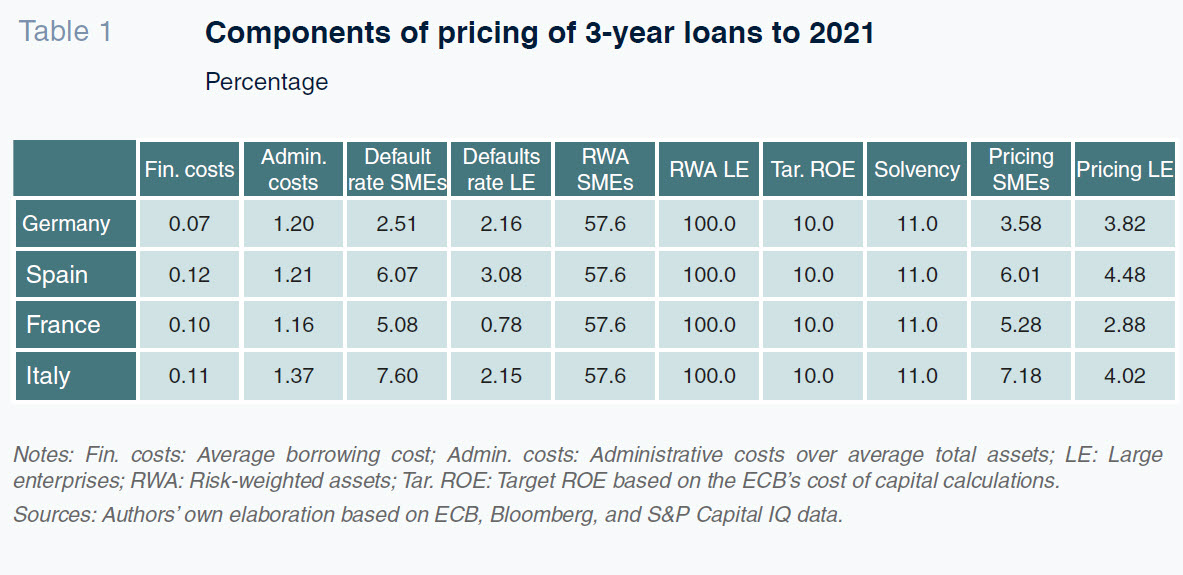

To conduct our theoretical and comparative analysis, we estimate the risk-based prices [2] associated with loans to SMEs and large enterprises extended for an average term of three years, quarterly between 2008 and 2021, for each of the four major eurozone economies: Spain, Germany, France, and Italy.

To determine the funding cost, we start from the historical liability structure presented by the banking systems across the four countries itemised, distinguishing between:

- Average rates on sight deposits.

- The rate offered to attract term deposits.

- The yield on senior wholesale issues, plus the TSIR spread for each term.

- The yield on subordinated wholesale issues, plus the TSIR spread for each term.

To estimate the average cost of financing we weighted the cost of each source of financing by its weight in each banking system.

To determine administrative costs, we used administrative costs over average total assets for each quarter comprising our sample timeframe, so using an average cost model, which is the most appropriate method for a price formation exercise, according to Mota (2019).

In addition, to calculate the cost of risk for each business lending segment (SMEs vs. large enterprises), we start from the aggregate business loan default rate in order to, subsequently, and based on historical analysis of the PDs of the main entities in each of the countries, estimate the rate of non-performance associated with SMEs versus large enterprises.

Lastly, for shareholder remuneration, we estimated the cost of capital associated with banking, which stands at around 10% (the market standard, according to the ECB [2021]), and the historical average capital requirement, which stands at around 11% for the European banks according to the supervisory capital analysis conducted by the SSM (2022). Lastly, to distinguish between the two segments –SMEs versus large enterprises– the calculation was adjusted using the average weighting applied to calculate the capital requirements defined in Basel III: 57.56% for SMEs; and 100% for large enterprises.

The sum of the four components gives us the risk-based pricing for each of the banking systems, as shown in Table 1.

Impact of monetary policy on loan pricing

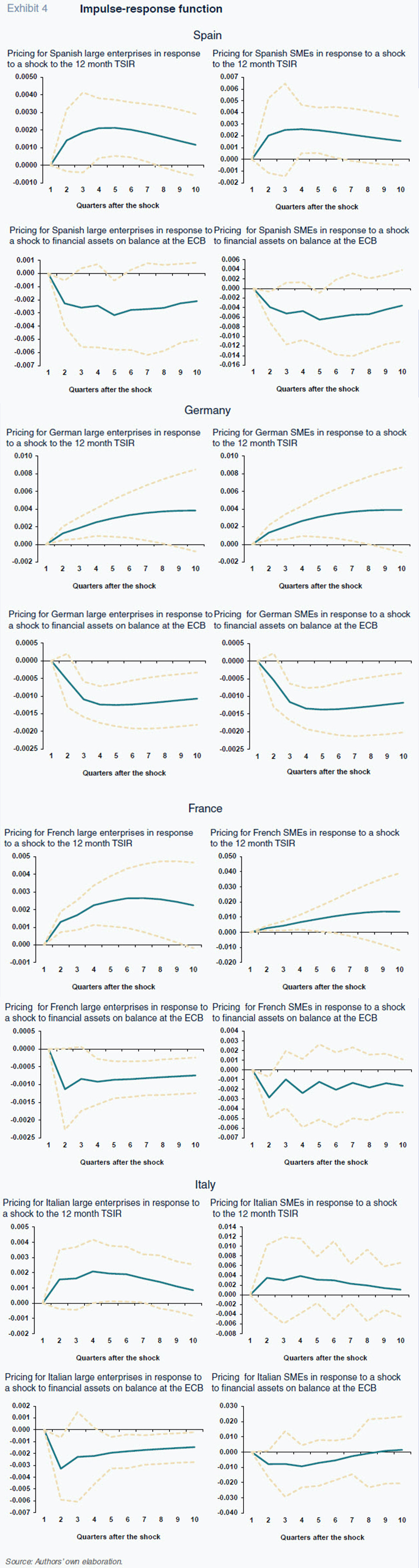

In order to study what impact the expansionary monetary policies rolled out had on the risk-based pricing so derived, in this section we conduct impulse-response analysis. To do that, we studied the stationarity of our variables, the potential cointegration of the variables and, by extension, developed VAR (vector autoregressive) models.

By way of impulse variables (i.e., those that introduce the shock), we used: (i) the 12-month TSIR as a proxy for the liquidity programmes provided to the banks as that curve is virtually risk-free and because of the role played by interbank rates on its formation (considering the fact that those liquidity schemes are channelled via the banks); and, (ii) the ECB’s balance-sheet assets as a proxy for the asset purchase programmes.

By way of response variables (i.e., those that receive the shock), we used the 5-year risk-based pricing obtained in the previous section for SMEs and large enterprises in each of the major European banking systems referenced above.

That led to the construction of four VAR models for each of the banking systems under study (Spain, Germany, France, and Italy), each one structured as follows:

- Model 1: The endogenous variables selected are: (i) 5-year risk-based pricing for large enterprises; and (ii) the 12-month TSIR.

- Model 2: The endogenous variables selected are: (i) 5-year risk-based pricing for SMEs; and (ii) the 12-month TSIR.

- Model 3: The endogenous variables selected are: (i) 5-year risk-based pricing for large enterprises; and (ii) the financial assets held by the ECB on its balance sheet.

- Model 4: The endogenous variables selected are: (i) 5-year risk-based pricing for SMEs; and (ii) the financial assets held by the ECB on its balance sheet.

Note that all of the regression models were estimated using a single exogenous variable.

Exhibit 4 charts the impulse-response function resulting from each of the models built. It shows how, in general terms, implementation of the liquidity programmes for the banks has had a statistically significant impact [6] on the price of the loans awarded to large enterprises and SMEs in the main eurozone economies. A positive (negative) shock to the TSIR, derived from implementation of the bank liquidity programmes, increases (decreases) loan grant rates. It also shows how the impact of a shock to the TSIR on loan pricing is not statistically significant in the short-term in the case of the Spanish and Italian economies and that that impact is not statistically significant for all four economies beyond two years (eight quarters) after the shock in the case of either the SMEs or the large enterprises.

Elsewhere, the asset purchase programmes have a statistically significant impact on the average rate charged to SMEs and large enterprises to borrow money. An increase (decrease) in asset purchases by the ECB reduces (increases) the rate charged to SMEs and large enterprises as a result of the monetary policy transmission mechanisms discussed previously. The analysis reveals that the impact of the purchase programmes on lending rates is especially significant in the case of Germany (for SMEs and large enterprises alike) and in the case of large enterprises in France and Italy, with a statistically significant impact even two years after introduction of the shock. In Spain, the impact is statistically significant for the first 18 months after the onset of the shock.

Conclusions

Global central banks’ monetary policies have served as a buffer against the fallout from the crisis of 2008 and, more recently, that emanating from COVID-19. It is impossible to tell what might have happened in their absence but there is no doubt that it would have been counter-productive for the European economies in general and for their banking sectors in particular.

Although all of the unconventional monetary policy programmes designed have had, to a greater or lesser degree, an impact on yield curves, on business lending and on the cost of risk, among other things, the ECB’s corporate bond buyback programme and its liquidity scheme for the banks have made the biggest contribution to reducing the cost of borrowing for companies.

By means of impulse-response analysis, we show that both types of programmes have played a particularly important role in reducing the cost of borrowing for SMEs since 2014. By the same token, we can deduct from our analysis that the reversal of those unconventional monetary policies will drive interest rates higher, as we are already seeing. That phenomenon could trigger an increase in corporate bankruptcies as a result of the higher cost of borrowing, which would increase the business community’s marginal cost of borrowing even further.

The thorny issue for the central banks is whether the existence of inflation per se has more adverse consequences for the economy than the path of rate tightening they establish. This will be the crux of difficult debate for governing councils´ for central banks globally going forward.

Notes

This is particularly relevant in the case of the Spanish market as a result, primarily, of the difficulty faced by smaller-sized firms in tapping the capital markets. It is less traditional in the Spanish financial system for smaller firms to issue listed bonds and, as a direct result, the fixed-income markets are less developed, with bank lending more predominant relative to other neighbouring financial systems (particularly the Anglo-Saxon systems).

We refer to the construction of loan pricing by breaking it down into the four variables referenced considering non-performance in each segment during the period under analysis and the average maturity of the loans.

Probabilities of default.

The stationarity study was performed using the Augmented Dickey-Fuller (ADF) and Kwiatkowski-Phillips-Schmidt-Shin (KPSS) tests, which are the two most widely used tests in stationarity studies. To test for cointegration, we used the Johansen test, which detects the existence of cointegration relationships in multivariable models such as ours. In addition, to estimate the impulse-response function, we chose the Cholesky decomposition method to identify the structural VAR, so that we were sure that the shock introduced was exogenous.

We used the logarithm of this variable to stabilise the series and facilitate interpretation of the impulse-response analysis.

The impulse-response exhibits should be interpreted as follows: if the value 0 falls within the confidence interval (orange lines) in a given quarter after introduction of the shock, the conclusion is that the impact of the impulse variable on our response variable is not statistically significant at 95% of the confidence interval that quarter. The opposite holds if the 0 value falls outside the confidence interval.

References

CAIXABANK RESEARCH (2013). Unconventional monetary policy: An (unfinished) story of (limited) success.

The Spanish Economy – Monthly Report La Caixa, February, pp. 23-25.

CANO, D. (2020). La política monetaria (no convencional), clave para mitigar los efectos económicos del COVID-19 [Monetary policy (non-conventional), key to mitigating the economic effects of the COVID-19].

Documento Opinión. ieee.es.

ECB (2021). Measuring the cost of equity of euro area banks.

Occasional Paper Series, 254 / January 2021.

ECB BANKING SUPERVISION (2022). Single Supervisory Mechanism: Aggregated results of SREP 2021.

https://www.bankingsupervision.europa.eu/banking/srep/2022/html/ssm.srepaggregateresults2022.en.htmlMOTA, A. (2019).

Fijación de colchones de capital anticíclicos: una nueva aproximación [Setting anti-cyclical capital buffers: A new approach] [Unpublished doctoral thesis]. Madrid’s Autónoma University.

Antonio Mota. Madrid’s Autónoma University

Diego Aires. Madrid’s Carlos III University

Fernando Rojas. Madrid’s Autónoma University

Francisco del Olmo. Alcalá University and IAES