Spanish economic forecasts panel: January 2025*

Funcas Economic Trends and Statistics Department

GDP estimated to grow by 3.1% in 2024

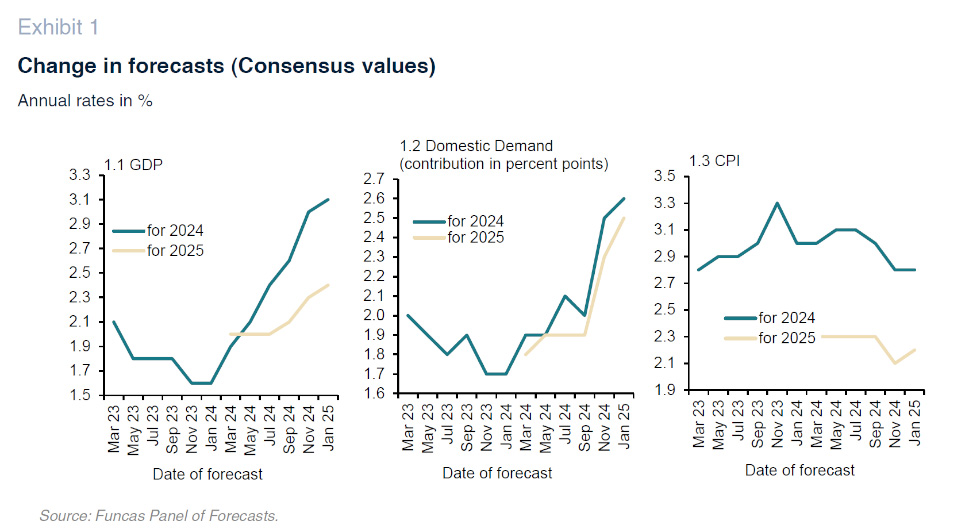

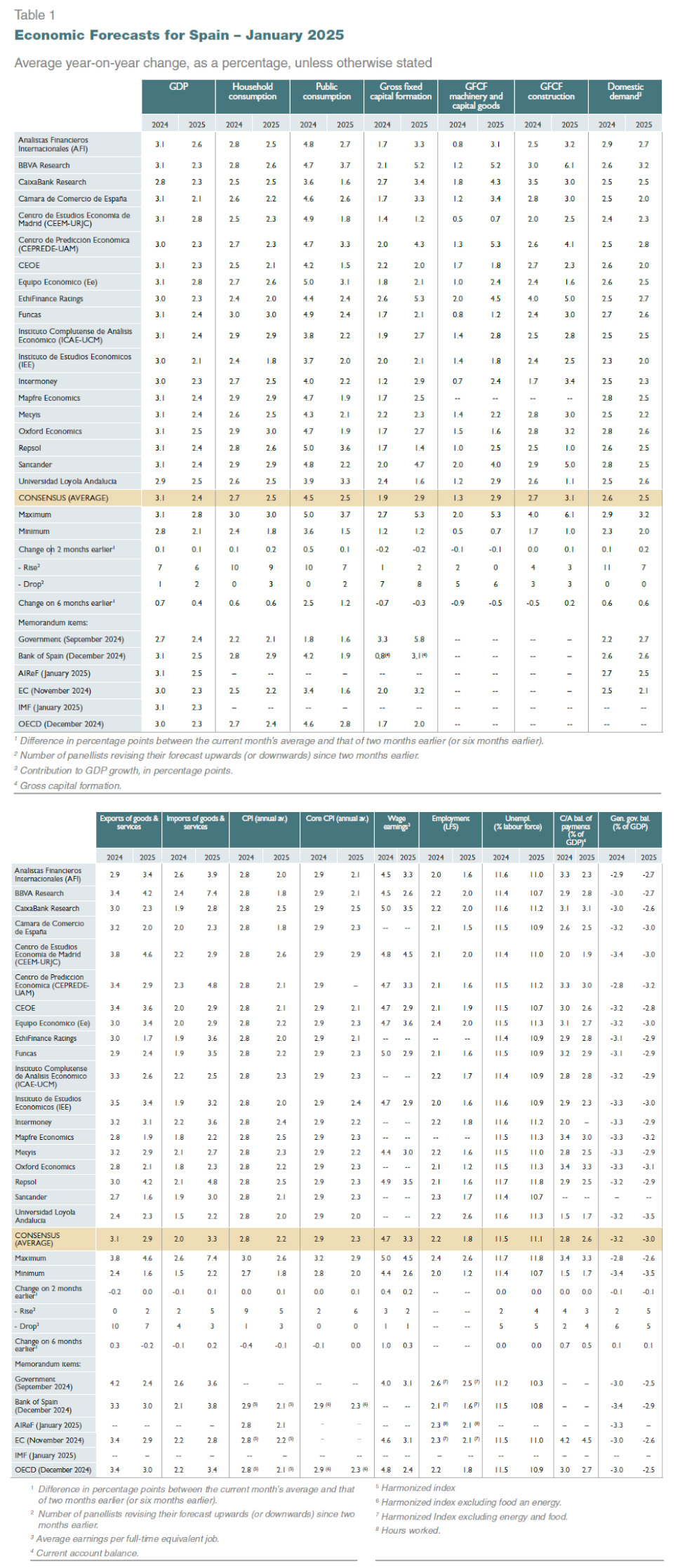

According to the analysts’ consensus, GDP grew by 3.1% in 2024, one tenth of a percentage point more than anticipated in the November Panel. Likewise, GDP is estimated to have grown by 0.7% in the fourth quarter of the year, one tenth of a percentage point more than expected in November.

Domestic demand was projected to have contributed 2.6 percentage points to GDP growth (one tenth more than expected in the previous consensus) and the foreign sector, 0.5 percentage points (one tenth less). Estimates for consumption, both private and, especially, public, have been revised upwards, while estimates for investment have been maintained for construction and reduced by one tenth of a percentage point for machinery and equipment. As for the external sector, growth estimates for both exports and imports have been reduced, more in the case of exports than imports (Table 1).

Forecast for 2025 rises to 2.4%

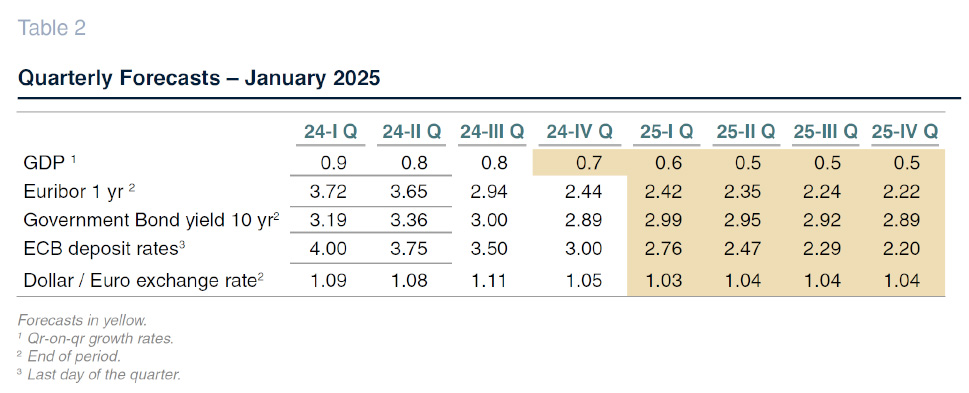

The consensus forecast for GDP growth in 2025 has been raised by one tenth of a percentage point to 2.4%, slightly below that of the Bank of Spain and AIReF and above that of international organizations such as the European Commission and the OECD (Table 1). An increase of 0.6% is expected in the first quarter, followed by growth of 0.5% in each of the remaining quarters (Table 2).

For the year as a whole, domestic demand is expected to contribute 2.5 percentage points of growth, two tenths of a percentage point more than in the previous forecast, while the foreign sector is expected to subtract one tenth of a percentage point. The slowdown compared to 2024 is expected to be felt in consumption, especially in the public sector, and in the foreign sector, due to a greater increase in imports than in exports. Investment, on the other hand, should show more vigor than last year, especially in machinery and equipment (Table 1).

Inflation forecast for 2025 revised upward

The headline inflation rate in 2024 declined until September. Since that month, it rebounded, as expected, to end the year at 2.8% in December, the same figure as the annual average. Core inflation continues to show downward resistance and oscillated since September in the 2.4%-2.6% range, with an annual average of 2.9%.

Headline inflation is projected at 2.2% in 2025, one tenth of a percentage point more than in the previous Panel. The year-on-year rate for December is estimated at 2.1% (Table 3). Regarding core inflation, the forecast for the annual average has also been raised by one tenth to 2.3%.

Labor market resilience

According to Social Security enrollment figures, job creation in the fourth quarter was in line with that of the previous quarter, although it was slightly lower than in the first two quarters of the year.

The consensus estimate for LFS employment growth in 2024 is 2.2%, and for 2025 a growth of 1.8% is forecast (no comparisons are made with the November forecasts because this is the first Panel to request employment forecasts in LFS terms, as opposed to full-time equivalent employment in previous editions). Productivity and unit labor costs (ULC), calculated from forecasts of GDP growth, wage compensation and employment in LFS terms, are estimated at 0.9% and 3.8% for 2024, respectively. For 2025, the forecast is 0.6% and 2.7%, respectively.

The average annual unemployment rate is estimated at 11.5% in 2024, according to the consensus, and is expected to fall to 11.1% in 2025 (Table 1).

Historic external surplus

The current account balance recorded a surplus of 45.8 billion euros up to October, the best figure for this period in the historical series. This result reflects the strong services balance, driven mainly by tourism services, which more than offsets the deterioration of the income balance. The consensus estimate points to a surplus of 2.8% of GDP in 2024 as a whole, the same as in the previous Panel, and 2.6% in 2025, also unchanged from the November Panel (Table 1).

Public deficit forecast is maintained

Public administrations, excluding local corporations, recorded a deficit of 16.6 billion euros up to October, compared with 19.6 billion euros in the same period of the previous year. This improved result is a consequence of a solid increase in government revenues, especially tax receipts and social security contributions, which more than offset the increase in public expenditure.

The analysts’ consensus is for a public deficit of 3.2% and 3% of GDP for 2024 and 2025, respectively, one tenth of a percentage point higher in both cases than in the previous forecast. Both figures are higher than those contemplated by the Government and the main international organizations (Table 1).

Relative decline in the Eurozone

After the surprise of the third quarter, the Eurozone economy appears to have stagnated again at the end of the year. The weakening is particularly marked in Germany, which has now been in negative territory for two years. Conversely, the expansion is continuing in the U. S., as witnessed by the latest job creation data, and the tax cuts announced by President Donald Trump foretell a new boost to demand. Inflation could also prove more persistent, especially if announcements in the area of tariffs and immigration were to materialize. Markets anticipate that the Federal Reserve will have little room to maintain the path of interest rate cuts.

In its January economic outlook, the IMF projects for the U. S. robust growth of 2.7% in 2025 (half a point higher than in the October round). This is almost triple the 1% forecast for the Eurozone (two tenths of a point less than in the Fall round). In addition, the Fund stresses the risks of fragmentation of international trade and increased uncertainty because of the protectionist wave on the horizon, which would be particularly damaging for the European economies, among the most dependent on exports. Geopolitical tensions could also affect the price of raw materials. It is a fact that oil and gas have tended to become more expensive since the last Panel, given the threat of new disruptions in the markets.

The Panel maintains its pessimistic view of the international environment, particularly in the EU. Of the 19 panelists, 17 believe that the context is unfavorable in Europe, and 13 feel the same about the non-European situation. Moreover, the majority opinion is that the situation will not change in the near future (Table 4).

Slight decline in interest rates

The monetary environment is less conducive to a rapid decline in interest rates than anticipated in November. The relative robustness of the U.S. economy, together with persistent inflation, has made the Fed’s discourse less accommodating. In Europe, disinflation is more likely to continue, given the economic weakness. However, the downward pressure on the euro is a challenge that could force the ECB to cut more gradually than expected. All in all, the consensus is for a cut in ECB benchmark rates of around 75 basis points by the end of the year (Table 2).

This gradualism is perceptible in the markets. The one-year Euribor has rebounded since the beginning of December to around 2.6% and is only expected to fall by around 35 basis points by the end of the year, according to the consensus forecast. Longer-term maturity market rates have rebounded even more sharply, on expectations of rising government bond yields globally. The 10-year government bond is trading at around 3.2%, half a point higher than a month and a half ago, in line with the upward trend observed in international debt markets, and is expected to fall by only 30 basis points by the end of this year (Table 2). There is no pressure on the Spanish risk premium.

Euro nears parity with the dollar

The persistence of a significant growth outlook and interest rate differential between the Eurozone and the U. S. has been reflected in the currency markets. The euro has continued to depreciate, losing 3% of its value against the dollar since the last Panel. Analysts do not forecast a recovery in the short-term, with the exchange rate likely to be around 1.04 by the end of this year, compared to 1.09 in the previous assessment (Table 2).

Fiscal policy is being expansionary and monetary policy restrictive

Macroeconomic policy assessments suffered few variations in relation to the previous Panel. Fiscal policy is being expansionary, when most panelists would recommend a neutral position, more in line with the growth cycle of the Spanish economy (Table 4). Conversely, the majority opinion is that monetary policy is overly restrictive, in light of the weak economic situation. In sum, what emerges from the Panel is that a change in the policy mix would be desirable.

Notes

*

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, circulated since 1999, is a bi-monthly publication issued in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organizations are also included for comparison, but do not form part of the consensus forecast.