Recent developments in bancassurance in Spain

Spanish banks’ insurance business, particularly in life insurance, have been a crucial source of earnings, directly contributing nearly 14% of their domestic profits in 2023. This contribution remains essential for banks’ profitability, with further growth expected from premium adjustments and rising non-life insurance activity.

Abstract: Of the roughly 176 insurance providers doing business in Spain, 29 have ties to the main banking groups. Their weight in the country’s insurance business, especially the life insurance segment, and their contribution to their parent banks’ domestic earnings are very significant. This contribution has been key to propping up the banks’ financial statements during periods in which they had to recognise significant loan-impairment provisions and/or navigate ultra-low margins as a result of low market interest rates. Today, the bancassurance business accounts for nearly 14% of banks’ domestic earnings directly, with the life insurance segment generating the bulk of that profit. Although traditional banking profits have surged due to rising interest rates, bancassurance remains a key revenue stream, with its contribution expected to grow further, driven by premium repricing and increased non-life insurance activity.

Introduction

The close connection between the traditional banking business and other businesses in which the products sold contain an important financial component and/or whose marketing relies on the banks’ distribution capabilities is well documented. All the more so in Spain, where the banks possess a highly valuable and far-reaching retail banking network. Good examples of these “para-banking” businesses include asset management and the insurance business, the focus of this paper. More specifically, we will focus our analysis on the Spanish banks’ presence in the insurance business and how the latter contributes to their earnings.

Spanish banks’ presence in the insurance business

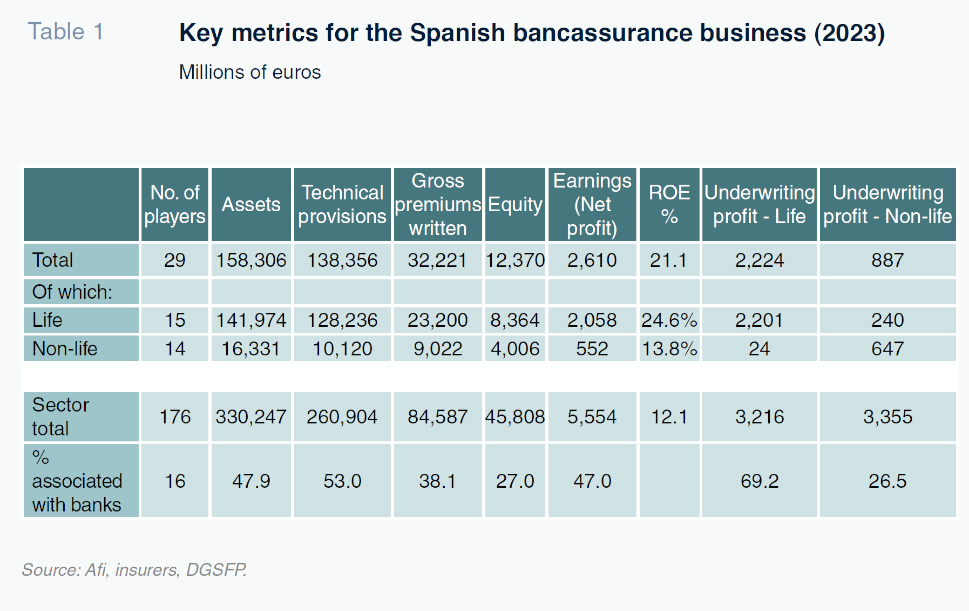

Of the 176 insurance and reinsurance companies operating in Spain at the end of 2023 (19 fewer than at year-end 2022), 29 were related to bank groups or entities, which is three fewer [1] than the year before, due mainly to the consolidation process ongoing in Spain’s banking sector in recent years. Of the 29, 15 operate in the life insurance business, making the banks the main channel for the distribution of life insurance in Spain (both savings and risk-life insurance). The remaining 14 operate in the non-life segment, in which, despite a minority presence, the banks have been showing growing interest. [2]

As shown in Table 1, the 29 insurers with bank ties continue to account for around 50% of the insurance business in Spain measured in terms of assets, technical provisions managed or earnings. Those entities’ long-standing heavyweight status in the Spanish insurance sector is, nevertheless, clearly concentrated in the life business (which has a significant financial component). In 2023, they were responsible for almost 70% of the aggregate income generated by the life insurance segment. Their presence in the non-life segment is less significant, with the insurers related to banking groups generating just over 25% of its total income.

In addition to their important presence in the insurance business, the bank-related insurers stand apart for their ability to generate more profits relative to their own funds (capitalisation) compared to the rest of the insurance providers. By way of illustration, in 2023, these 29 firms generated 47% of the insurance sector’s earnings (44% in 2022), while their equity accounted for just 27% of the total of the players operating in Spain. Here there are two factors at play: (i) relatively lower capitalisation levels at the entities associated with banking groups as a result of the preference to place ‘surplus’ capital at the parent (a bank); and, in parallel (ii) relatively greater business efficiency (compared to the universe of entities not associated with banks), with a positive impact on earnings.

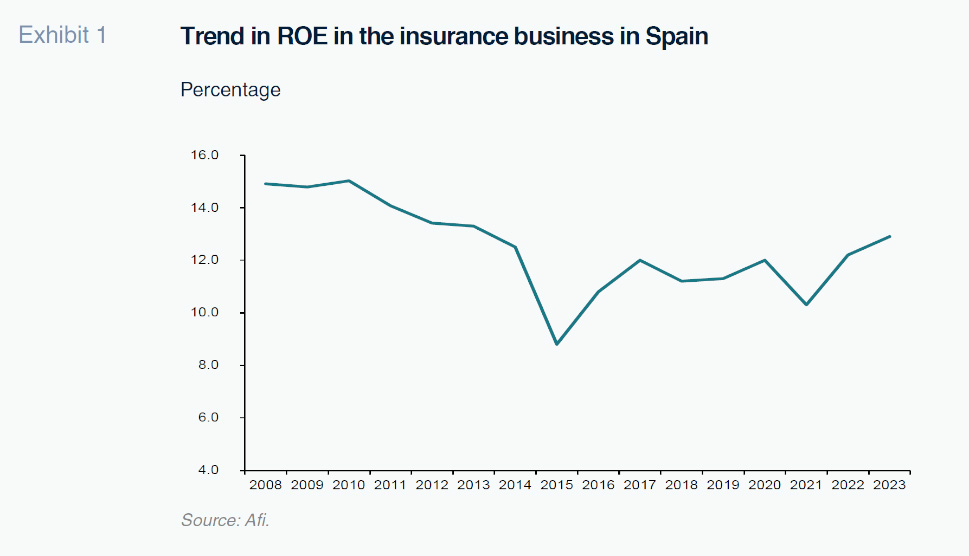

The combination, in relative terms, of higher earnings and reduced use of own funds for accounting purposes translated into considerably higher profitability compared to the rest of insurance providers: the average ROE [3] of the 29 insurers related to banking groups in 2023 was 21.1%, which is well above the overall sector average of 12% and marks an even bigger gap, logically, with the average for the non-bank insurers, which was under 9%. [4]

Looking back in time, as shown in Exhibit 1, insurance sector profitability is running at a high for the past decade. A major contributing factor was the level reached by interest rates, a high for over a decade, fuelling extraordinary growth in the placement of life-savings products as the rates offered on bank deposits remained moderate.

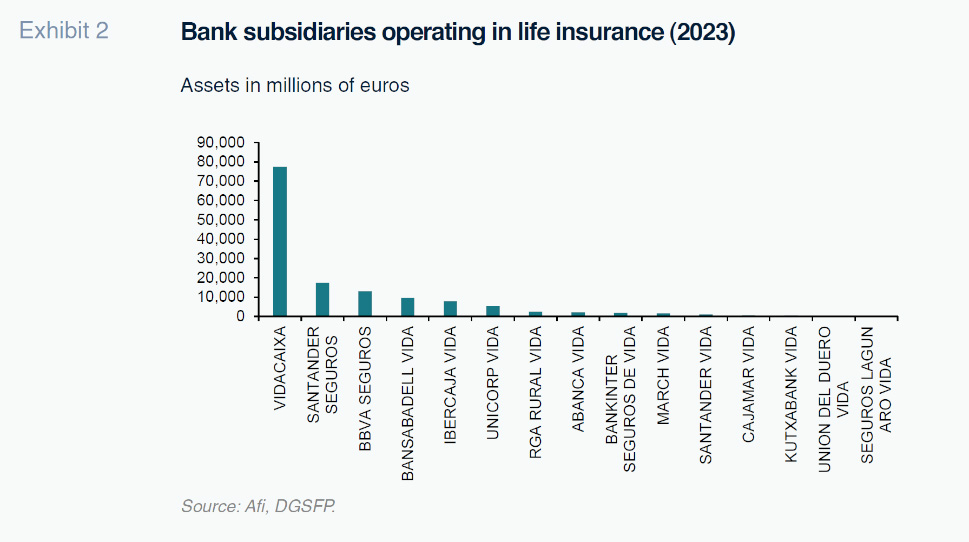

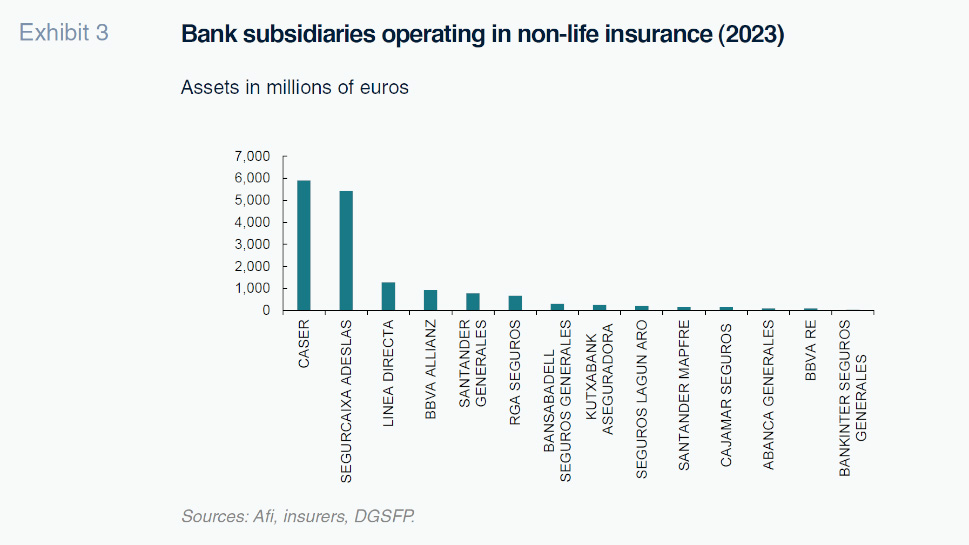

The insurers with ties to the banking industry continue to present a mix of organisational and ownership structures in both the life and non-life segments. In life, half of the banking groups have opted for autonomous operation of the insurance business, including the leaders, CaixaBank and BBVA. In non-life, however, very few banks operate in the segment independently, with most sharing ownership with specialist insurance partners.

The fact that the banks are the predominant distribution channel in the life insurance business (for both savings and risk products) fosters the banks’ supremacy in this segment (70%, as noted, in terms of the underwriting profit of the insurers with ties to the banks in the life segment). Contributing factors include the reach of the Spanish banks’ branch networks, the proximity between savings insurance and the financial business and the importance of mortgages in the sale of risk-life insurance products.

All of the banking groups considered have ownership interests in insurance companies active in this segment, although the relative importance of this business varies considerably from one to another, as shown in Exhibit 2. Not only is there a very clear leader, CaixaBank, whose life insurance business is more than four times the size of that of its nearest competitors, that business garners almost 40% of the life insurance business in Spain, a position that has only increased in recent years in the wake of several acquisitions, most notably that of Bankia. Overall, the seven biggest banking groups account for over 90% of the life bancassurance business in Spain, which generated 2.06 billion euros of profits in 2023. [5] A very substantial portion of that figure, almost 90% of the total, [6] translated into profits for the banks last year.

Albeit much smaller than in the life insurance business, the banks’ share of roughly 25% of the non-life insurance business is not insignificant and is particularly relevant at certain specific institutions. One company, SegurCaixa Adeslas (a joint venture between CaixaBank and Mutua), accounts for the bulk of this business’ contribution to the banks’ earnings. The non-life insurers associated with the banks generated a little over 552 million euros of profits in 2023 (down slightly from 2022), of which 55% constituted a direct contribution to their shareholding banks’ P&Ls. [7]

How the insurance business contributes to the banks’ earnings

Although the bancassurance business in Spain is considerably profitable across the board, the breakdown of the contribution is very uneven. Such healthy profitability, particularly by comparison with that of the “typical” banking business, coupled with significant shareholdings by most of the banks active in the life insurance business, and also in the non-life segment at certain entities, translates into a significant contribution to the banks’ overall profits. Indeed, in 2023, their interest in the domestic insurance business contributed 2.15 billion euros to the universe of Spanish banks’ aggregate earnings, [8] marking annual growth of around 18%, driven by momentum in the life insurance business.

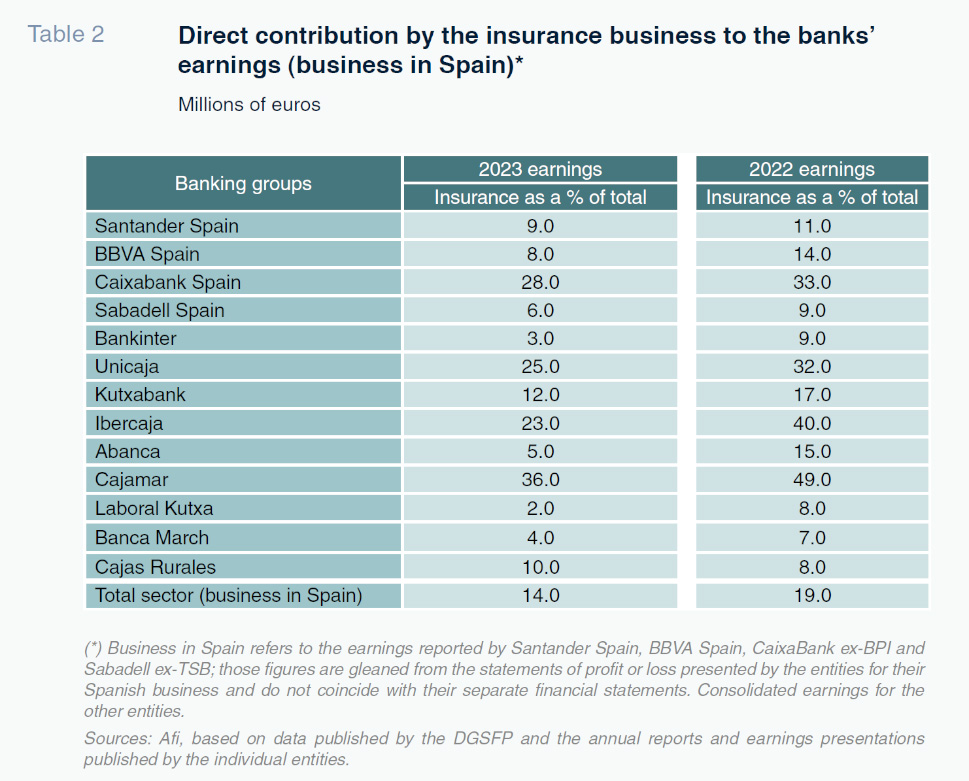

In some cases, that contribution is very significant. Table 2 below provides an estimate for 2023 and 2022 of the weight of the profits attributable to the insurance companies associated with the banks relative to those banks’ total earnings from their business in Spain.

- The importance of the insurance business for the banks’ business in Spain: its direct contribution alone (profit attributable to their interests in their insurance subsidiaries) represented around 14% of their earnings in 2023. That does, however, mark a dip from the 19% reported in 2022 (and even higher percentages in prior years), attributable to a much higher contribution to profits by the traditional banking business in the wake of far higher interest rates.

- In addition to this direct contribution in their capacity as shareholders of their insurance investees, the banks earn fee and commission income from the distribution of those policies via their branch networks. [9] Although the public information available is not sufficiently detailed to make an accurate estimate, it is reasonable to assume that layering in that indirect contribution, the insurance business (summing the direct and estimated indirect contribution) contributes one-quarter (and probably more) of the banks’ earnings in Spain.

- In absolute terms, the contribution was higher than in 2022. However, in relative terms it narrowed as a result of the extraordinary growth in 2023 in the profitability of the typical banking business thanks to much higher interest rates and strong economic growth.

- The business conditions observed in 2024 suggest that in all likelihood the insurance business’ absolute contribution to the Spanish banks’ earnings will once again register strong growth. And we would not be surprised if its contribution also increases in relative terms: according to the ICEA, in the first nine months of last year, earnings in the insurance sector in Spain increased by an estimated 25% year-on-year, fuelled mainly by the non-life business on this occasion, helped by the “repricing” of the premiums collected in this sector to adjust for the impact of the bout of inflation sustained in prior years on claims costs.

- Table 2 also shows how the relative share of the individual banks’ earnings generated by the insurance business varies significantly from one entity to the next. The insurance business makes an outsize contribution at some entities, most notably CaixaBank, the leading player, garnering (through its interests in Vidacaixa and Segurcaixa Adelas) over half of all of the profit contributed by the insurance sector to the bank sector in Spain. Insurance is also an important contributor at Unicaja, Ibercaja and Cajamar.

Notes

Merger of Sa Nostra into VidaCaixa and of Liberbank Vida into CCM Vida at Unicorp.

See, for example, the creation in recent years of companies such as Santander-Mapfre in car insurance and BBVA-Allianz in general (non-health) insurance. In parallel, specialist insurers are displaying an interest in increasing their marketing and distribution capabilities through alliances with retailers, such as that between Mutua Madrileña and El Corte Inglés.

Measured as net profit over equity at year-end.

This universe of firms includes a host of mutual societies. Although their relative weight as a cohort is small, their non-profit status tends to lead to very low returns.

This figure of 2.06 billion euros is the aggregate profit for 2023 of the 15 bank subsidiaries active in the life insurance segment. Of that total, the bulk, nearly 1.85 billion euros, trickles through to the banks’ P&Ls thanks to their generally majority interests in their subsidiary life insurers.

The share at each individual bank depends on their ownership interests in their insurance investees.

This figure of 552 million euros is the aggregate profit for 2023 of the 14 bank subsidiaries active in the non-life insurance segment. On the basis of their ownership interests and resulting consolidation methods, the banks recognised 304 million euros in their statements of profit or loss in 2023.

Of which, 1.21 billion euros (over half) inflated earnings at a single entity, CaixaBank, thanks to its interests in Vidacaixa and Segurcaixa Adeslas.

The insurers owned by the banks recognised over 2.85 billion euros of policy acquisition costs in their financial statements in 2023, a substantial percentage of which are fees and commissions paid to market and sell their policies through banking networks.

Daniel Manzano. Partner at Afi