Corporate access to bank loans: Assessing the impact of company and loan size

Spanish companies enjoy lower bank borrowing costs than their Eurozone peers, with neither the size of the loan nor the company significantly impacting costs. While micro firms face slightly more obstacles in obtaining loans, the size penalty is far less significant in Spain, making access to finance a relatively minor concern across all business sizes.

Abstract: Spanish companies benefit from lower bank borrowing costs than other Eurozone enterprises, irrespective of loan size. Loan costs are higher on smaller-sized loans, which are more commonly applied for by smaller companies. However, the extra cost paid by smaller enterprises relative to their larger counterparts is very small and much lower in Spain than in the Eurozone. Moreover, only a very low percentage of Spanish companies (4.53%) view access to finance as their main problem and even though that percentage rises among small enterprises (4.91%), the difference with large companies (4.43%) is narrow. Elsewhere, the percentage of companies that face obstacles in obtaining a bank loan is similar in Spain to that observed in the Eurozone (7.9% vs. 7.3%), the main impediment being fear of rejection. Micro enterprises perceive more obstacles although in Spain, this size penalty is virtually negligible. As a result, size counts, but very little in Spain.

Foreword

Job creation and economic growth stem from the investments made by companies. Profitable and, therefore, viable, investments require financing on acceptable terms. High borrowing costs jeopardise returns and could even render investment projects non-viable. This is where the financial system in general and the banking system in particular come into play: their job is to channel savings into investments. The more efficiently they fulfil this function, the better the terms and conditions they will offer in exchange for loans and, as a result, the higher an economy’s investment and growth.

It is well known that company size affects borrowing costs. The main reason is the issue of asymmetric information between lenders (banks) and borrowers (companies), which is less pronounced at larger enterprises, for which more information is available (e.g., existence of audited financial statements). This problem of information asymmetry gives rise to another issue of adverse selection and moral hazard, which is more of a problem at SMEs than at large enterprises. For these reasons, there is a negative correlation between company size and access to finance.

The purpose of this paper is to analyse the terms on which Spanish companies can access bank financing, flagging the differences by company size and comparing the situation in Spain with the broader Eurozone. To do this we focus our analysis on the years elapsing from before the onset of the COVID pandemic in 2019 until today, with the most recent data dating to October 2024. We combine data on the rates of interest on new bank loans by transaction size (as a proxy for company size) with information gleaned from the ECB’s Survey on the access to finance of enterprises for the third quarter of 2024.

Cost of bank financing

The first variable yielded by the information regarding borrowing obstacles faced by companies depending on their size is the loan interest rate, using the differences in rates by loan size as our proxy. The ECB provides information for three loan size intervals: less than 250,000 euros, between 250,000 and one million euros, and over one million euros. It is fair to assume that the larger loans are more characteristic of larger enterprises, while the smaller loans are more typical of micro and small sized enterprises.

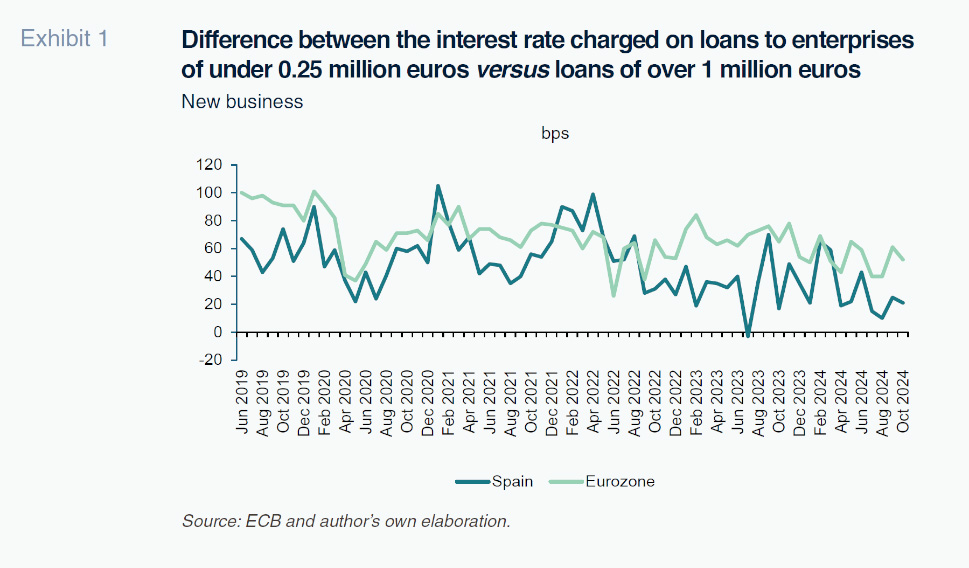

Focusing on the difference in cost between the smallest and largest loans (under 250,000 euros and over one million euros), Exhibit 1 plots the spread in basis points for Spain and the Eurozone. In both instances, except for one specific month in Spain, the difference is always positive, clearly demonstrating that smaller-sized companies face higher borrowing costs. This difference has been as high as >100 basis points (bp) in both Spain and the Eurozone at times. However, since the end of 2023, the gap has been clearly narrowing and by October 2024 stood at just 21bp in Spain and 52bp in the Eurozone. Therefore, using the most recent information available, the extra borrowing cost paid by smaller companies relative to their larger counterparts is very small and much lower in Spain than in the Eurozone.

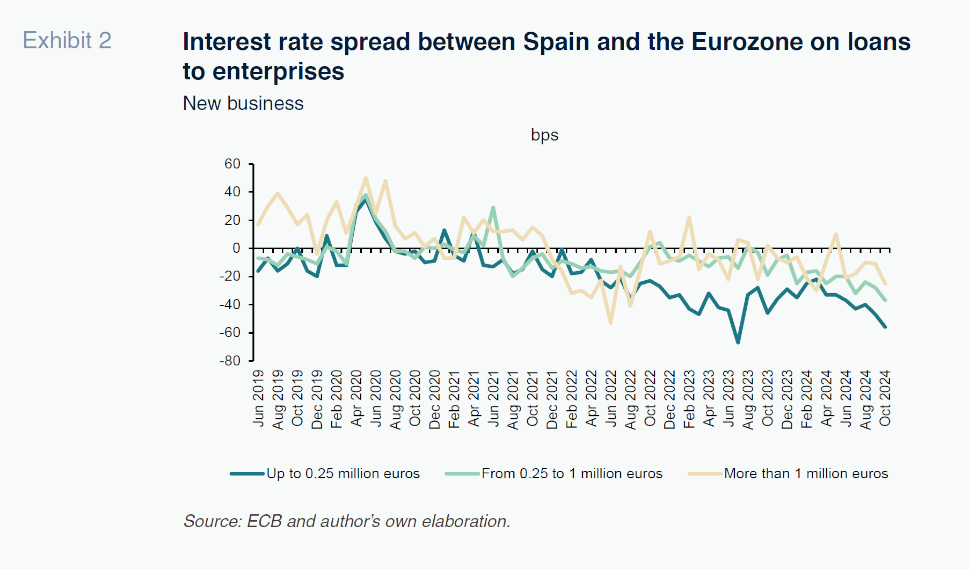

Where do companies pay higher interest on the loans they apply for? Spain or the Eurozone? The answer is found in Exhibit 2, which shows the difference in interest rates paid in Spain versus the Eurozone distinguishing by loan size.

In the smaller loan size category (under 250,000 euros) this spread has been trending lower since mid-2020, and since mid-2021, the interest rate applied by the Spanish banks has been consistently lower than that charged across the Eurozone. The difference reached 67bp in July 2023 and stood at 56bp in October 2024. Therefore, if this loan size is indeed more characteristic of micro and small enterprises, in Spain these sized companies benefit from lower borrowing costs than their counterparts in the Eurozone.

In medium-sized loans (between 250,000 and one million euros), the difference in rates between Spain and the Eurozone has also been narrowing since the summer of 2021 and, in general, has been negative since then, meaning that the Spanish firms in this size segment are also benefitting from lower interest rates. In fact, the biggest difference is observed for the most recent reading, that of October 2024, when interest rates in Spain were 37bp lower in this loan size category.

Lastly, in larger-sized loans (over one million euros), the trend in the spread between Spain and the Eurozone has been more volatile and there is no clear pattern during the years analysed, in which there have been periods of positive differences intermingled with periods of negative spreads. In October 2024, the spread was negative, indicating that Spanish companies applying for loans of this size were likewise enjoying lower borrowing costs than their European counterparts (25bp lower).

If we compare the three loan size categories, the cost difference (benefit) between Spain and the Eurozone is smallest in the largest loan size category (25bp) and highest in the smallest size category (56bp). In the latter category, the Spain-Eurozone spread is double that observed in the largest loan size category.

Bank borrowing costs in the Eurozone: Spain’s ranking

If we turn our attention to the most recent figures (dated to October 2024 | Exhibit 3), the average rate on a new loan extended to an enterprise in Spain was 4.6%, which is lower than the Eurozone average of 4.7%. By comparison with the main banking sectors, borrowing costs in Spain were lower than in Italy or Germany but higher than in France.

For loans of less than 250,000 euros, the Spanish banks were charging a rate of 4.7%, the second lowest in the Eurozone, behind only France (4.6%). In loans sized between 250,000 and one million euros, the cost in Spain is the third lowest in the Eurozone, at 4.4%, with only Luxembourg (4%) and France (4.1%) offering cheaper bank loans. And in loans of more than one million euros, the Spanish banks are the fourth cheapest in the Eurozone (4.5%), charging less than the main Eurozone economies (Germany, France and Italy).

Another variable provided by the information on the differences in obstacles facing enterprises as a function of their size is the percentage that report access to finance as their main problem. This is one of the questions on the survey carried out by the ECB and provides information as a function of company size.

Using the most recent survey available (referring to the third quarter of 2024), only a small percentage of enterprises reported access to finance as their main problem, with the percentage doing so in Spain (4.53%) slightly above the Eurozone average (4.05%). Although there are differences by company size, they are insignificant and in all instances the percentages are small. At any rate, the percentage is higher among small enterprises (4.91%) than among large enterprises (4.43%), and a little lower among medium-sized companies (4.27%). This pattern is repeated across the Eurozone although in all company sizes the percentages are lower than in Spain. The biggest difference between Spain and the Eurozone is observed among small enterprises, where it stands at 73bp: 4.91% vs. 4.18%. For SMEs as a whole, 4.58% of Spanish enterprises report access to finance as their biggest issue, which is higher than the average of 4.06% for Eurozone SMEs.

Obstacles to obtaining a bank loan

The ECB’s regular report on enterprises’ access to finance constructs an indicator that can be interpreted as a financial restriction barometer which measures the percentage of firms that encounter obstacles in obtaining external financing. Specifically, the indicator is constructed by summing the percentage of enterprises that have: 1) submitted loan applications that were rejected; 2) decided not to apply for a loan for fear of rejection (discouraged borrowers); 3) submitted loan applications for which only a limited amount was granted; and 4) submitted applications that resulted in an offer that was declined by the enterprise because the borrowing costs were too high. This information is available for all firms and also by enterprise size: micro, small, medium, large and SMEs.

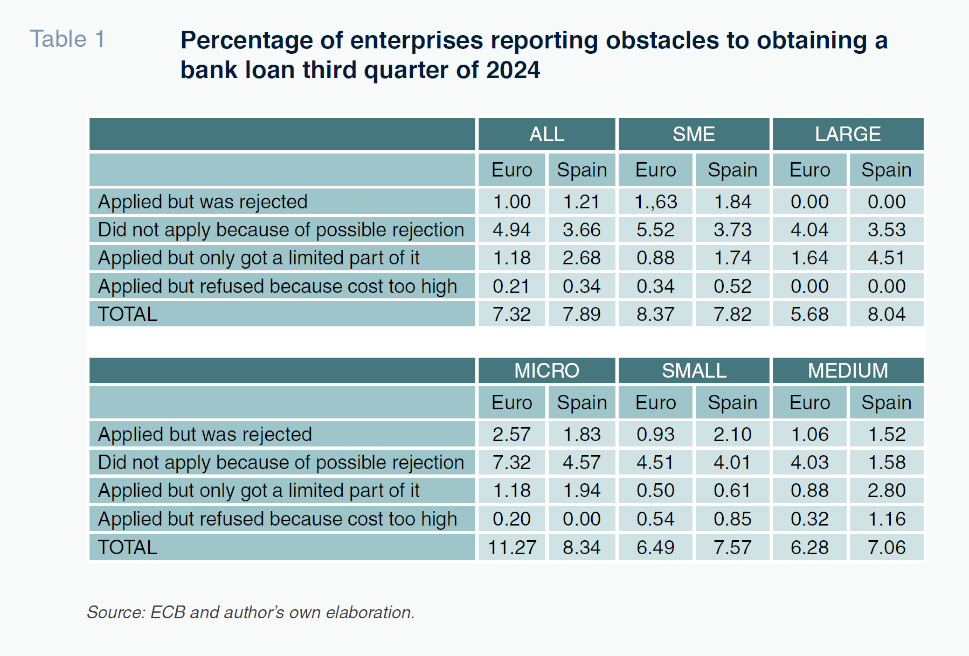

As shown in Table 1, based on the most recent data for third quarter of 2024, the percentage of Spanish companies facing these obstacles in obtaining a bank loan is 7.9%, which is above, although not much, the average for Eurozone firms, of 7.3%. Within this percentage, the main obstacle is the fear of rejection (3.7% in Spain and 4.9% in the Eurozone), which is more than half of the total for the Eurozone and 46% in Spain. It is followed by the obstacle of only being granted a limited amount: 2.7% in Spain, which is more than double the Eurozone average of 1.2%. The other two obstacles are relatively less important, particularly that of declining an offer because the borrowing costs were too high.

If we focus on the aggregate level of financial restriction implied by the sum of the four obstacles assessed, the highest percentage is reported by micro enterprises, albeit at a lower rate than in the Eurozone (8.3% vs. 11.3%). Among these smaller sized companies, the fear of rejection is the chief obstacle, and much more so in the Eurozone (7.3% vs. 4.6% in Spain).

It is noteworthy that in Spain the differences in this financial restriction indicator by company size are smaller than in the Eurozone. In fact, the above-mentioned share of 8.3% for Spanish micro enterprises is just 1.2pp above the percentage of medium-sized companies, which is the size category reporting the lowest overall percentage. In contrast, in the Eurozone, the highest percentage, which corresponds to the micro enterprises, at 11.3%, is twice the percentage reported by the large enterprises (5.7%).

Based on the most recent available information, the main conclusions are as follows:

- Spanish companies benefit from lower interest rates on bank loans than the Eurozone average, irrespective of loan size.

- Although the cost of bank loans is higher the smaller the loan size, the extra cost paid by smaller companies relative to their larger counterparts is very small and much lower in Spain than in the Eurozone.

- Only a very small percentage of Spanish companies (4.53%) view access to finance as their main problem and even though that percentage rises among small companies (4.91%), the difference with large companies (4.43%) is very narrow.

- The percentage of Spanish companies that report obstacles in obtaining a bank loan is similar to the Eurozone average (7.9% vs. 7.3%).

- The differences in the percentage reporting obstacles as a function of company size are smaller in Spain than in the Eurozone. Specifically, the difference in the percentage of SMEs and large enterprises reporting access to finance obstacles is just 0.2pp in Spain, compared to 2.7pp in the Eurozone. It is also noteworthy that this percentage is higher among large enterprises than SMEs in Spain, while the situation is the other way around in the Eurozone.

- Fear of rejection is the main obstacle facing enterprises in obtaining a bank loan and is more prevalent among micro enterprises and more of an issue in the Eurozone than in Spain.

- The bank loan rejection rate is zero for large enterprises in Spain and the Eurozone alike. And although the highest rates of loan rejection fear are reported by micro and small enterprises, the rates themselves are low (around 2%).

On the basis of these findings, it can be said that, at least at present, company size counts very little in terms of access to bank loans in Spain and counts much less in Spain than in the Eurozone. Moreover, the cost of bank loans is lower in Spain than in the Eurozone irrespective of company size, while the obstacles encountered in obtaining a bank loan are similar to those reported in the Eurozone.

References

EUROPEAN CENTRAL BANK. (2024). Survey on the Access to Finance of Enterprises in the euro area, Third quarter of 2024.

Joaquín Maudos. Professor of Economic Analysis at the University of Valencia, Deputy Director of Research at Ivie and collaborator with CUNEF