Bank profitability in the context of declining interest rates: Managing funding cost and allocation of household savings

As interest rates decline, Spanish banks face narrowing unit margins, prompting a strategic focus on managing retail deposit funding costs to preserve profitability. Banks with stronger control over deposit costs, particularly in smaller municipalities, are better positioned to stabilize savings flows because of their customers’ profile and the provision of tailored advice.

Abstract: More than six months after the ECB started to cut its rates, and almost one year since the market (Euribor) began to discount those cuts, unit margins (the difference between the return on credit and cost of deposits) have started to contract, partially offset by the slight growth in credit volumes observed for much of 2024. Notwithstanding this recent increase in new credit, the new scenario of falling rates, which is expected to continue for the next couple of years, forces the banks to focus on managing customer funds (striking the right balance between off-balance sheet assets and deposits and within the latter source of funding, between overnight deposits and deposits with agreed maturity) while controlling costs to unlock efficiency gains. Within this context, retail deposit funding costs have proven to be a key competitive advantage for certain banks, especially those with significant exposure to savers in smaller municipalities where deposit pass-through has been more contained. Banks that have managed these funding costs effectively are better positioned to preserve profitability as net interest margins continue to decline, particularly by shifting savings into time deposits and offering tailored advice to retain customers and maintain deposit stability.

Management of funding costs as a competitive advantage

The increases in interest rates from mid-2022 have boosted banking margins all across Europe, all the more so in Spain where the banks are more sensitive to this rate scenario and more exposed to the retail segment, so that customer deposits represent a significant share of their funding structures.

The rate increases have had a gradual impact on net interest rate spreads due mainly to the lag in the repricing of the banks’ credit portfolios, as analysed in a recent paper (

see here). The banks’ net interest margins have been trending higher since the start of 2023 thanks to the above-mentioned credit portfolio repricing phenomenon, coupled with more modest growth in funding costs, notably at the banks whose main, and virtually sole, source of external funding is customer deposits, compared to a bigger increase in average funding costs at the entities that tend to tap the wholesale markets more frequently.

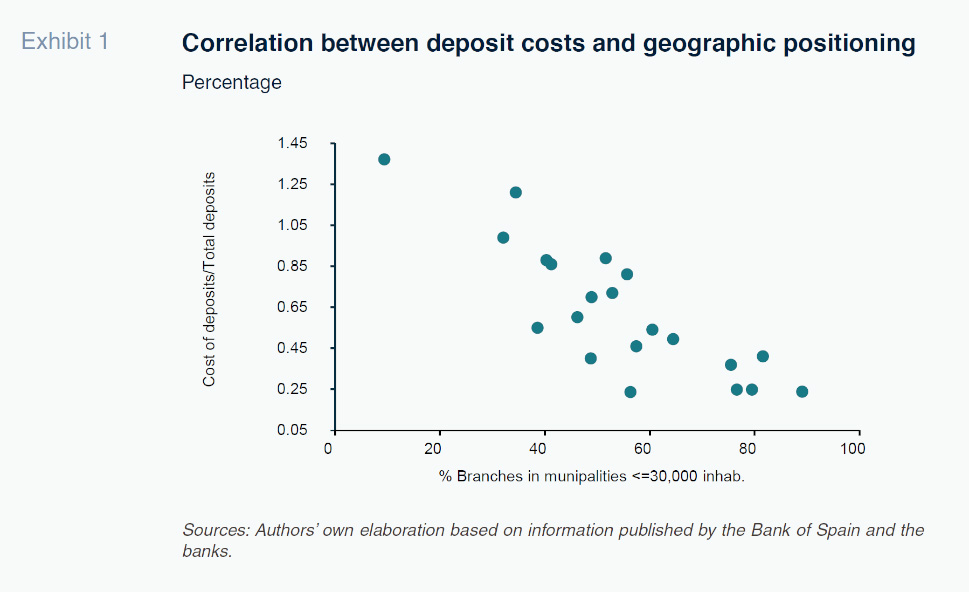

Regardless, considering that the Spanish banks’ main source of funding is customer deposits, it is worth noting that the ability to manage the average cost of retail funds has been uneven across the players, constrained by a series of factors related with their liquidity positions, business models and geographic positioning, among others, which have tended to yield a competitive advantage for certain entities in recent quarters.

Focusing on the last two factors (business model and geographic positioning), what we have seen is that the entities specialised in customer segments with higher average deposit sizes (in both the retail and corporate and institutional banking businesses), customers with a more pronounced investor profile and, probably, greater sensitivity to rates (stronger positioning in personal or private banking customer segments) and entities with greater exposure to more digitally-savvy customers have been forced to offer those customers higher rates on their savings in order to manage the risk of their departure in a context of rising rates.

At the other end of the spectrum, banks with significant exposure to customers more inclined to save, characterised by a far more atomised and homogeneous deposit base and, therefore, smaller average deposit balances, have been better able to “manage” the pass-through of interest rate increases to retail deposit rates.

While we do not have sufficiently detailed public information about average deposit volumes per customer at each bank, it is possible to infer that competitive advantage at entities whose business model relies on pronounced geographic positioning in areas with a higher concentration of ”savers”, such as smaller-sized municipalities, which tend to be home to older populations with reduced propensity to invest.

Analysing the average funding cost and weight of branches in more rural municipalities (towns with fewer than 30 thousand inhabitants) for a representative sample of entities in the Spanish banking sector (Exhibit 1) yields a negative correlation between the two variables. In other words, the entities with a stronger presence in rural areas (with a higher percentage of branches in small towns) have demonstrated more power to manage their average funding costs, i.e., they enjoy lower average deposit funding costs.

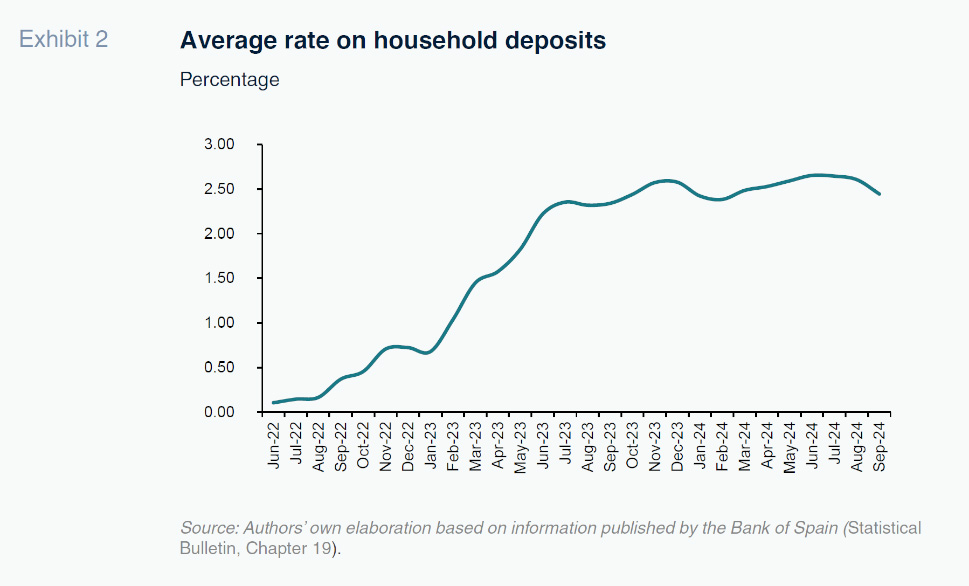

This relatively better positioning in terms of retail funding costs presented by certain entities thanks to their business models should nevertheless be seen against the backdrop of a contained increase in deposit rates across the board, particularly in the first half of 2023, as shown in Exhibit 2. In turn, that phenomenon proved a clear driver of the recalibration of Spanish household savings, as we will analyse next.

Recalibration of household savings in the context of rising rates

As already noted, the sector passed through the market rate increases to deposit rates in a controlled manner during the first half of 2023. That gave way to more intense repricing during the second half of the year in response, to a significant degree, to the impact of their strategy during the first half on where households channelled their savings during that same period.

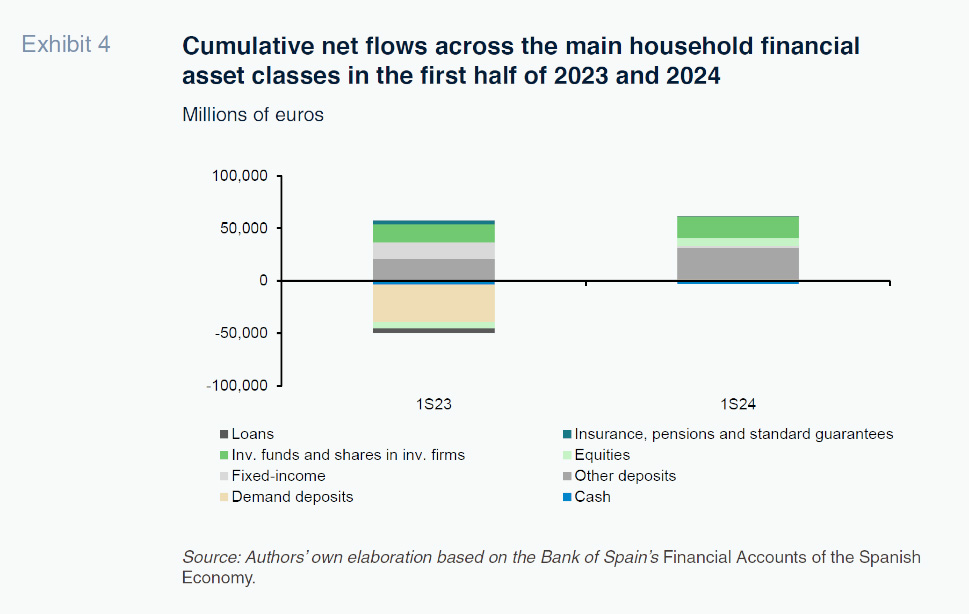

Indeed, during the first half of 2023 the sector sustained a considerable outflow of household and corporate deposits – of over 40 billion euros between January and February with respect to the year-end 2022 balance, with outflows from the household segment reaching close to 18 billion euros. Analysing the trend in household financial savings in detail reveals that in the first quarter of 2023, the significant contraction in the stock of deposits held by Spanish families was channelled into a range of investment alternatives that were looking more attractive at the time.

A significant portion was channelled into investment funds, which recorded a peak in net subscriptions. In fact, that quarter net subscriptions topped the 14 billion euro mark with certain types of funds faring particularly well: money market funds and, most remarkably, short- and long-term euro fixed-income funds.

Elsewhere, another significant share of savings went to direct fixed-income investments, where net purchases amounted to close to 16 billion euros in the first half of 2023, with short-term paper the clear protagonist. These short-term fixed-income investments were predominantly investments in public debt, in line with the tremendous appetite for Spanish Treasury Bills observed during those same months.

Beyond the shifts evidenced by household financial investment flows, it is worth mentioning a third key use of the savings withdrawn from deposits during that and subsequent quarters: debt repayment, mainly the prepayment of mortgages, helping to reduce households’ financial liabilities in terms of long-term loans. This context of rising rates, and the uneven pass-through of the increases to the cost of credit relative to the remuneration offered on savings gave households a clear incentive to deleverage, giving rise to a spike in prepayments that hurt the size of the banks’ loan books beyond the contraction in new lending activity observed in 2023.

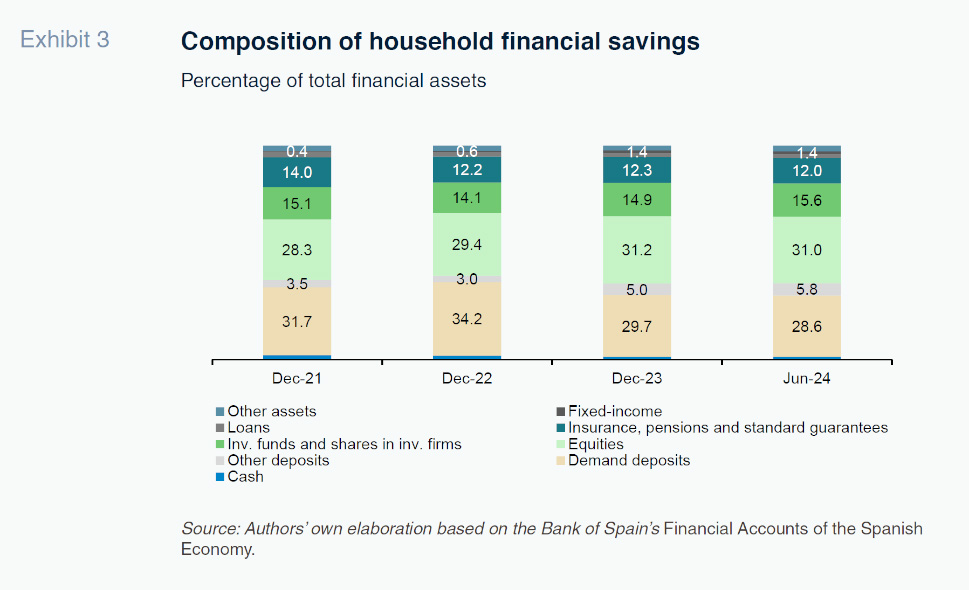

Despite the fact that a more intense increase in the rates offered on deposits during the second half of 2023 gave way to a gradual reduction in deposit withdrawals, the composition of Spanish households’ financial savings changed during the year. As a result, the weight of the most important class of financial assets held by Spanish households, deposits and cash, decreased by three percentage points, from 39.3% of total financial assets in 2022 to 36.3% in 2023. Within the overall stock of deposits, sight deposits sustained the biggest correction (a little over four percentage points) to around 30% of total financial assets at year-end 2023. Some of those withdrawals were channelled to deposits with agreed maturity (5% of the total) so that the contraction in aggregate deposits was somewhat smaller.

In contrast, the weights of the various savings products into which these deposits were channelled increased in 2023. Specifically, the share commanded by investment funds increased to 15% (+0.8 percentage points versus 2022) and the weight of direct investments (fixed-income and equities) increased to 32.5% (+2.5 percentage points from 2022).

This household financial asset restructuring trend continued in 2024, albeit shaped by contrasting flows relative to the previous year. Specifically, the slight growth and stability observed in deposit rates during the first half of 2024, marked by expectations for interest rate cuts, coupled with continued healthy dynamics in the household savings rate last year, favoured a return to net inflows into deposits, to the tune of over 30 billion euros over the course of the first six months of the year.

Despite the growth in deposit inflows, flows into investment funds were even stronger than in the first half of 2023, so that the weight of deposits and cash in total household savings decreased further to 35.8%, with the share of demand deposits stabilising and the weight of time deposits continuing to increase.

Management of funding costs as a profitability driver

In terms of the banking business, this ongoing gradual shift into deposits with agreed maturity and stabilisation in the average rate on household deposits during the first half of 2024 contrast with the trend observed in the sector’s net interest margins, which despite increasing in the year as a whole, are starting to show signs of running out of steam, having probably peaked last year, as suggested by the European Central Bank in its last Financial Stability Review.

According to the data published by the leading players in the Spanish banking sector for the third quarter of 2024, the return on the loan portfolio, the sector’s main source of interest income, stabilised in the first half of the year, going on to start to trend lower in the third quarter, a trend expected to continue for the coming quarters, despite the gradual recovery in the credit balance, which would mitigate that impact.

This gradual tapering in net interest income growth will force the banks to look for new earnings levers: reinforcement of alternative sources of income, such as net fee and commission income, and more efficient management of cost structures and expenditure in order to preserve the levels of profitability attained.

Without question, the key lever on the expense management side has to be management of funding costs, which is vital to preserving unit margins, leveraging the competitive advantage that, as we have seen, certain players have demonstrated. Alternatively, they could manage the flow of savings into time deposits observed in recent quarters, in line with the reduction in deposit rates emerging across the main European banking sectors during the first half of 2024 and more recently in the case of the Spanish banks (Exhibit 2).

This strategy should be implemented not only from the perspective of margin management but also with a view to creating value for customers, particularly savers, by providing advice as to how to channel their savings into products that offer them higher returns.

Conclusions

In 2024, the discounting of a change of rate scenario and its subsequent confirmation with the first rate cuts by the central banks on both sides of the Atlantic mean that the sector’s net interest margins, particularly in the retail banking business, probably peaked during the year and are now starting to taper. This scenario means that the banks need to look for earnings levers in order to preserve the levels of profitability attained. Among these levers, management of funding costs will be key considering the fact the current lower rate environment coincides with high household savings rates, which is fuelling ongoing growth in deposits and also constitutes an opportunity to create value for customers by offering them alternative ways to channel their savings.

Marta Alberni, Ángel Berges and María Rodríguez. Afi