AI in banking through the eyes of the consumer

Digitalisation and artificial intelligence (AI) are redefining the relationship between customers and their banks by enhancing personalization, security, and efficiency; but not without risks. Striking a balance between innovation and trust, highlighting the role of transparency, ethical data management and human interaction, will be keys to its successful integration.

Abstract: Digitalisation has transformed banking interactions, with 94% of customers using digital channels for everyday transactions. Younger users are reliant predominantly on mobile applications while older cohorts demonstrate a preference for web platforms. AI excels in its ability to enhance security, particularly through its role in fraud detection, but has generated scepticism around autonomous decision-making in the areas of lending and investing. Satisfaction levels are high with the basic digital tasks but there is room for improvement with respect to more complex matters, such as incident resolution. Going forward, successful application within the financial sector lies in blending AI’s capabilities with customer-centric strategies that address generational and technological divides, enabling banks to strengthen relationships and maintain competitiveness in an evolving market.

Foreword

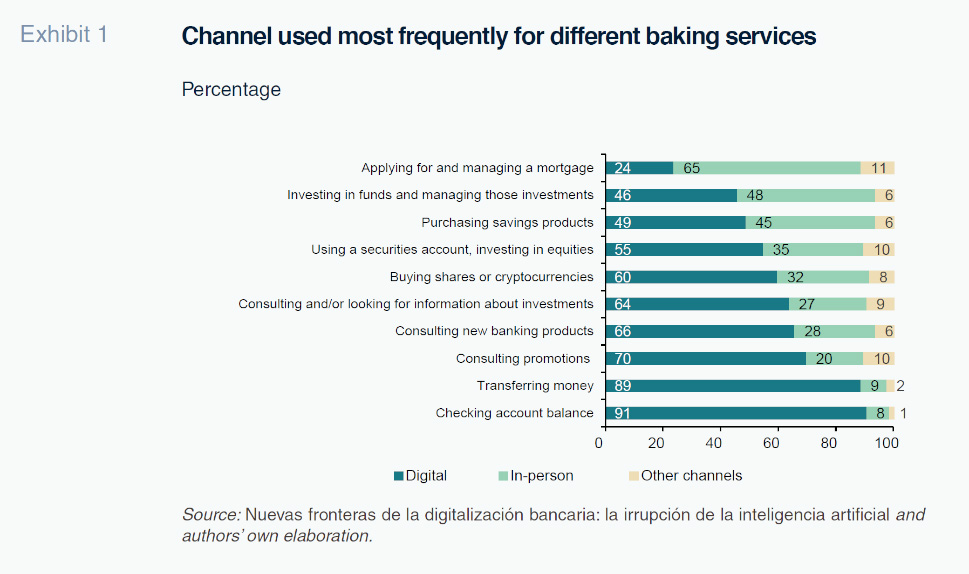

The banking sector is in the midst of crucial transformation, marked by the convergence of two technological forces: the maturity of the digitalisation thrust and the advent of artificial intelligence (AI). Over the last few decades, digitalisation has evolved from being an optional and differentiating element to become a universal norm in customer-bank relations. Over 90% of bank users rely on mobile apps and/or web platforms to perform their most basic banking business, such as making transfers or checking their account balances, evidencing the extent to which the digital channel has become a core part of the financial day to day. However, in the wake of its mass adoption, digitalisation has become somewhat of a commodity: a functional yet homogeneous experience that is now harder for the banks to leverage to set themselves apart. Today’s bank customers take a good digital experience for granted. Against this backdrop, AI is emerging as an opportunity to transforms and refresh this relationship and add a new level of value-added.

AI promises to revolutionise the banking industry on several fronts. From better fraud detection and credit risk management to financial product and service personalisation, the possibilities are as broad as they are ambitious. In addition, the introduction of virtual assistants and intelligent chatbots is helping to redefine customer service, making it more agile and accessible. However, this technological revolution also faces resistance. Although many customers appreciate the enhanced security and efficiency ushered in by AI, many have plenty of misgivings about its use in sensitive areas such as autonomous decision-making around investments or in credit assessment. This balance between innovation and trust has become a key challenge for the sector.

A recent study, New frontiers in bank digitalisation: The advent of artificial intelligence (Nuevas fronteras de la digitalización bancaria: la irrupción de la inteligencia artificial), compiled by Funcas and The Cocktail Analysis, based on a representative sample of bank users in Spain, specifically 2,018 users aged between 18 and 75, sheds light on these tensions. Many of the conclusions presented in this paper are based on data gleaned from that survey. One of its main findings is that the youngest generations, which are more familiar with digital technology, are more receptive to the use of AI in their financial dealings. In contrast, older customers, even if they are using digital channels for their basic banking business, continue to prefer in-person interactions for more complex financial decisions. This generational contrast suggests that the banks may need to adapt their strategies to satisfy diverse expectations in an increasingly heterogeneous ecosystem.

However, the challenge is not limited to generational gaps. AI brings a paradox: customers are demanding more personalised and sophisticated products, yet they fear losing the control and autonomy the digital channel has given them in recent years. The key will lie with how transparently the banks integrate AI, demonstrating that this technology can coexist alongside the traditional values of trust and proximity, while offering customers a more enriching experience in parallel.

This paper explores how digitalisation and AI are redefining the relationship between banks and their customers. In the next section, we analyse how digitalisation has laid the foundations for this transformation, flagging the idea of user segmentation according to their digital behaviour. We then take a closer look at the areas where AI is already generating value, like security, and the misgivings that linger in areas of greater complexity. In the subsequent section we tackle the strategic challenges facing the banks in their quest to turn AI into a competitive advantage without eroding customer confidence. The paper ends with some final thoughts about how AI can become the central axis of a new period of transformation, making practical recommendations for overcoming existing barriers and maximising its potential.

Digitalisation: The (mainstream) basis of customer satisfaction

Digitalisation has overhauled the relationship between banks and their customers, cementing its place as the main channel for interaction and redefining the manner in which banking services are provided and perceived. According to the data analysed, 94% of bank users in Spain use digital platforms such as mobile apps and websites to manage their everyday financial needs. Exhibit 1 illustrates the channels used more frequently for the various banking operations. It shows how the digital channel prevails over the in-person channel (bank branch) in most financial activities. Activities such as balance checks, money transfers and bill payment have become fast and easy to perform from anywhere, giving customers an unprecedented amount of autonomy and convenience. This change has marked the definitive step towards an environment in which digital banking is the norm, relegating in-person interactions to ad-hoc or exceptional situations.

Despite the advances it has ushered in, digitalisation has also created new challenges in terms of customer satisfaction. One of the most noteworthy is the growing diversity of user profiles and expectations. Far from a uniform group of users, banks are facing a mosaic of customers with different needs, expectations and behavioural patterns in the digital space. The above-mentioned study identifies five main categories of digital customers which run the gamut from “basic” users, who carry out simple and sporadic tasks, to “sophisticated, self-sufficient” users, who manage their finances online in a proactive and complex manner. These differences not only reflect varying levels of digital know-how and confidence, but also generational factors. Younger users, who have always been familiar with mobile devices, prioritise the immediacy and faster experience offered by the apps. Older customers tend to prefer the more traditional web platforms where they feel more familiar and in control.

This mainstreaming of digital banking has also led to a degree of “commoditisation” of banking services. Sixty-eight per cent of users take a fully functional digital channel for granted. While continuing to value the features provided by the digital tools, customers no longer perceive these characteristics as differential. In other words, having a user-friendly and functional banking app has become a prerequisite and is no longer a driver of loyalty. This creates a paradox for the banks: as they digitalise and standardise their services, the barriers to switching diminish: customers can move their accounts or products to a competitor without perceiving major differences in the user experience.

The level of satisfaction reported by customers with their digital services conveys this dichotomy. The more frequent tasks, such as checking an account balance or transferring money, receive very high scores of over eight out of ten. However, when asked about more complex operations, such as incident resolution or the purchase of specific financial products, satisfaction levels are lower. This suggests that there is still further room to improve digital channels to tackle aspects where the customer experience may be affected by a lack of human interaction or the rigidity of the current interfaces.

Another critical aspect is how digitalisation has altered customers’ perception of control and confidence. On the one hand, the digital platforms offer greater autonomy, allowing users to manage their finances without having to depend on an advisor or manager. On the other hand, this new-found autonomy can generate a sense of isolation or vulnerability, especially when customers encounter problems, they cannot resolve easily using the digital interface. This creates an important opportunity for the banks: not only must they ensure a functional experience, they must also develop tools that bolster customer confidence in critical situations.

AI looks like a possibly promising solution for surmounting this challenge. Thanks to its ability to analyse data in real time, personalise recommendations and predict needs, AI has the power to inject a new layer of differentiation into the digital channels. Moreover, it can tackle areas where digitalisation is not currently managing to fully satisfy customer expectations, such as proactive customer service in the event of incidents or the creation of personalised experiences that foster loyalty. We will address these issues in the next section, analysing AI’s potential impact on bank customers’ perceptions and satisfaction levels.

Artificial intelligence: Expectations and misgivings

Artificial intelligence (AI) already embodies the next revolution in the banking sector, with the potential to transform the customer experience as well as the banks’ internal processes. However, despite its promises, users perceive this new technology with ambivalence, marked by a mix of expectations and misgivings. According to the source study, customers acknowledge the value of AI in areas such as security, service personalisation and repetitive task automation but express considerable misgivings when the technology forays into areas perceived as either more intrusive or riskier. Nevertheless, familiarity with digital technology predisposes users to be more receptive to AI, suggesting that less digitally-savvy customers will probably need more information and/or positive experiences to climb aboard the AI train.

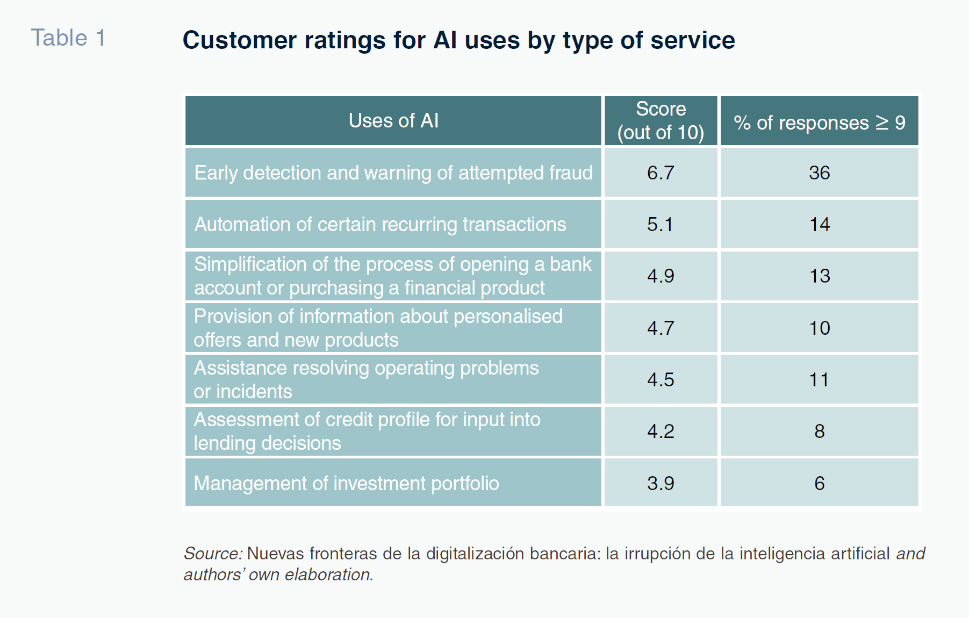

One of the highest rated attributes of AI is its ability to enhance security, a recurring customer concern. AI-based tools, such as systems that detect fraud in real time, generate confidence by taking preventive action in the face of suspicious account activity. This tangible attribute leads many users to accept and value the use of AI in this field, where its impact is visible and its protective role clear. In fact, the study indicates that the positive perception of AI in security is significantly higher than that attained by other uses of this technology. Table 1 shows how the use of AI to prevent fraud is its most highly-rated application, with a score of 6.7 out of 10.

Another area where AI has begun to win over customers is personalisation. The possibility of receiving offers and recommendations adapted for their specific needs is perceived as a benefit, particularly by younger and more tech-savvy customers. For example, the algorithms that analyse spending patterns and suggest suitable financial products have been well received for their ability to make financial dealings simpler and more efficient. However, this acceptance is not universal. Where some see personalisation as an advantage, others see this data harvesting as an invasion of their privacy, one that generates mistrust around their banks’ intentions.

The use of AI in more complex areas, such as investment management or loan approval, sparks even more scepticism. Although some customers value the possibility of using algorithms to eliminate human bias and optimise financial decisions, many fear losing control over critical processes that affect their economic wellbeing. This fear is related not only with not understanding how these systems work but also a perception of dehumanisation. For many, delegating these decisions onto a machine implies an emotional disconnection that undermines trust, even if the results may be objectively better.

In addition, the study underlines that misgivings around AI are not distributed evenly across the various demographic groups. While younger users tend to be more open to experimenting with new technologies, older customers remain more cautious, especially when it comes to areas related with the autonomous management of their money. This contrast evidences the need for the banks to tailor both their technology and communication strategies to address the specific concerns of each segment.

Banks must enhance transparency around data use and algorithms while ensuring human advisors remain available for customers seeking personal interaction. The challenge, therefore, lies not only with developing AI-based solutions but also integrating them in such a way that customers perceive them as a complementary feature that improves their experience without compromising their autonomy or privacy. The banks need to work on two fronts: firstly, on increasing transparency around how they use customer data and how their algorithms work; secondly, on ensuring that there is always a human option available for those who prefer to interact with an advisor. Only in this way will it possible for AI to become a tool for creating customer trust and loyalty instead of remaining a source of uncertainty.

The challenges facing banks

Aside from promising to improve operating efficiency and the customer experience, the implementation of AI in the banking system also raises major strategic and ethical challenges for the banks. Although many banks have already begun to implement AI-based technology to streamline internal processes and personalise services, the path to full integration is far from simple. Not only do the banks need to ensure that the technology works correctly, they also need to address key questions related with trust, ethics and sustainability in an environment of increasing social scrutiny.

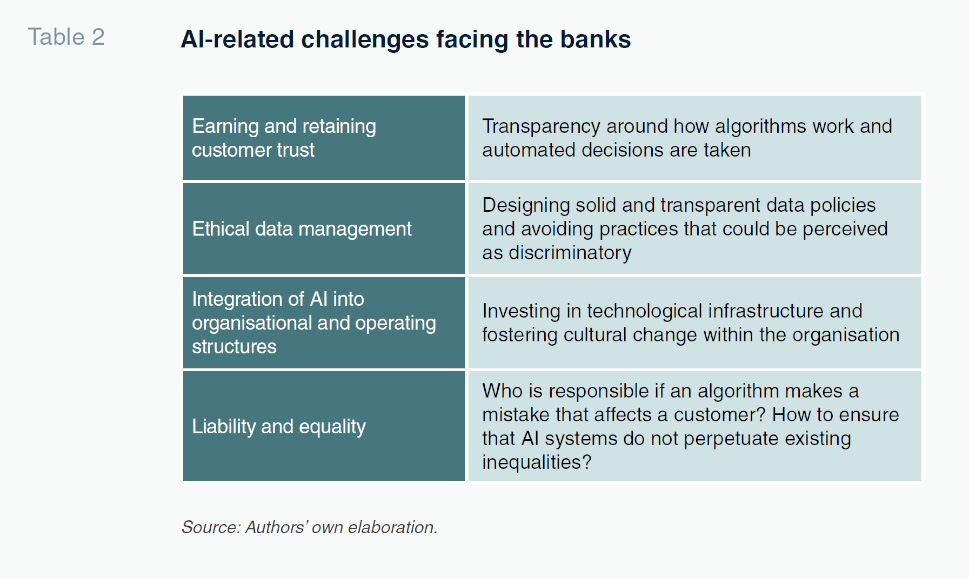

One of the biggest challenges for the banks is earning and maintaining customer trust. Users tend to express more misgivings about AI in areas they perceive as invasive or high risk, such as autonomous decision-making in investing or lending activities. To overcome these barriers, the banks need to work on transparency and customers’ ability to understand how the algorithms work and how the decisions are taken. This implies developing explainable technologies (“explainable AI”) as well as educating users so that they understand the benefits and limitations of these tools.

Ethical data management is another fundamental challenge. AI depends of massive volumes of data to work effectively but the harvesting and use of that data raise privacy concerns. Customers need certainty that their data is being protected and used fairly and in their best interests. This requires the banks to design solid and transparent data policies while complying with strict regulations like Europe’s General Data Protection Regulation (GDPR). They must also steer clear of practices that could be perceived as discriminatory or reinforcing of biases, ensuring that the algorithms are auditable and designed to mitigate inequalities.

Another significant challenge lies with the banks’ ability to integrate AI into their organisational and operating structures. Although many institutions have adopted advanced tools, they continue to encounter difficulties in adapting their internal legacy processes and systems for the new technology. This problem implies the need for substantial investments in technological infrastructure and employee upskilling so that their employees can work more effectively with the new AI. Moreover, the introduction of AI needs to be accompanied by cultural change within an organisation, fostering a mindset of innovation and adaptability at all levels of the hierarchy. The study also emphasises the importance of balancing automation with human interaction. Although AI can automate a broad range of tasks, from customer service to risk assessment, users continue to want human contact, especially in complex or emotional situations. The banks therefore must reconsider their service strategies, combining their AI capabilities with empathy and human judgement in order to offer a more holistic experience.

Lastly, AI has ethical and social implications that cannot be ignored. The automation of financial decisions raises difficult questions about liability and equality. Who is responsible if an algorithm makes a mistake that affects a customer? How to ensure that AI systems do not perpetuate existing inequalities? These dilemmas not only affect how the public perceives the banks, they also have the potential to unleash regulatory and legal conflicts if they are not tackled proactively.

Conclusions

Artificial intelligence is destined to be a central axis of banking sector transformation. However, its successful implementation hinges upon a tricky balance between technological innovation and customer trust. As detailed throughout this analysis, the advances made in digitalisation have laid the foundations for an environment in which AI can contribute real value but has also revealed some of the challenges intrinsic to its implementation. For the banks, it is not just a question of adopting the more cutting-edge technology but also a matter of integrating it in a transparent and ethical manner, aligned with customer expectations.

One of the key takeaways is that trust and transparency are fundamental to user acceptance of AI. In a context in which customers are increasingly valuing security and personalisation, the banks need to be clear about how they use their customers’ data, how their algorithms work and what specific benefits they offer users. AI should not be seen as a substitute for human contact but rather as a tool that enriches the relationship between a bank and its customers by resolving problems proactively and generating more personalised experiences. It is also crucial that the banks do not lose sight of the diversity of their customer bases. Differences across generations and in digital conduct require tailoring strategies for a variety of profiles. Whereas younger users tend to be more receptive towards AI, older customers continue to value in-person interaction and the familiarity of the traditional way of doing things. The key lies with providing a hybrid approach in which AI capabilities are combined with empathy and human judgement at the moments that really count.

It is also worth highlighting the importance of addressing the ethical dilemmas associated with AI. Aspects such as data privacy, non-discriminatory decision-making and responsibility for possible errors are matters that need to be resolved before they become a problem. The banks naturally need to comply with the existing body of regulations, but they should also spearhead the debate about how AI can be used responsibly and fairly, positioning themselves as benchmarks in this area.

Lastly, the integration of AI must go beyond mere operational efficiency. The banks have the opportunity to use this technology to redefine their value propositions by optimising their processes as well as offering new forms of interaction with the potential to reinforce their customer relationships. AI, well applied, has the power to become a catalyst for recovering a competitive edge in a market in which digitalisation has levelled the playing field.

Santiago Carbó Valverde. University of Valencia and Funcas

Pedro Cuadros Solas. Cunef University and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas