Spanish economic growth exceeds expectations, but persistent debt burden poses risks

Spain’s economic growth this year is exceeding expectations and the outlook for next year remains positive. To maintain this momentum, domestic issues, such as over-indebtedness and high long-term unemployment levels, must still be tackled in parallel to the reinforcement of the eurozone’s institutional framework.

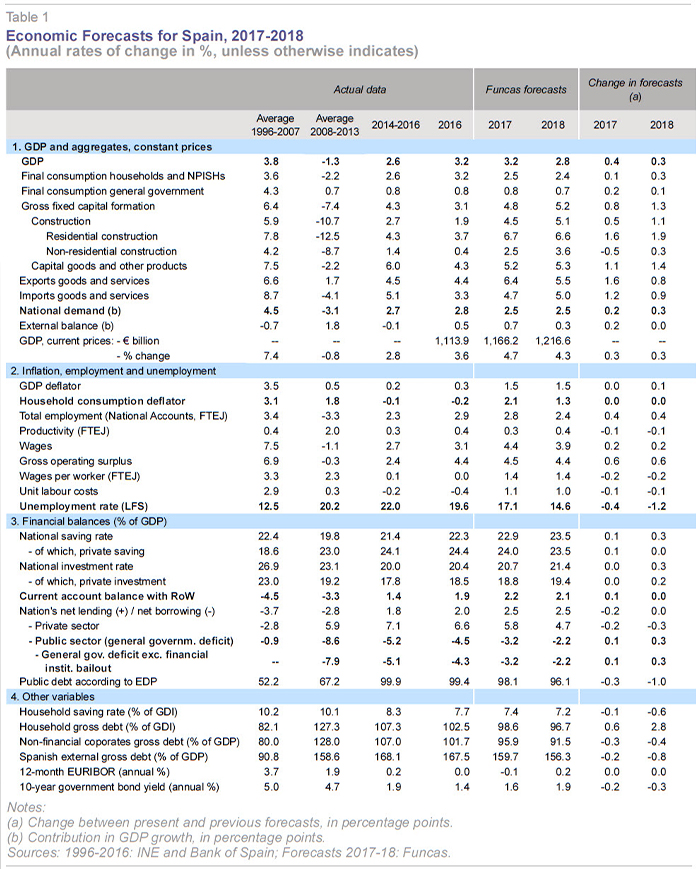

Abstract: The Spanish economy is performing better than expected. The latest indicators point to stronger exports, reflecting the recovery in world markets and the favourable competitive position of Spanish firms. In addition, the slowdown in domestic demand is proving milder than initially foreseen. Altogether, the economy should grow by 3.2% in 2017 and 2.8% in 2018. Despite the slow but steady progress on fiscal consolidation, the main risk to the recovery remains the stock of public debt – expected to reach 98.1% of GDP in 2017 – which is high in comparison with other European countries and almost three times the pre-crisis level. It is crucial to tackle this weakness before the ECB scales down its exceptional arsenal of stimulus measures.

International context

The global economy is showing signs of improvement. The US is expanding at a moderate pace despite certain doubts about the sustainability of this momentum and the announcement of trade restrictions. Japan, meanwhile, is emerging from its protracted episode of economic lethargy, thanks to Abenomics –a strategy set in motion by its Prime Minister, Shinzō Abe–, which combines monetary and fiscal stimuli with structural reforms.

Expectations have also improved in Europe. Business and consumer confidence indicators have picked up, foreshadowing an uptick in activity in the quarters to come. The improvement is partly attributable to the European Central Bank’s expansionary monetary policy (negative intervention rates coupled with purchases of up to 60 billion euros of public and corporate debt securities every month). The fiscal stimulus measures introduced in several countries with room for manoeuvre on the budget front have also contributed to the general improvement, as has the slight correction in oil prices.

In parallel, some of the risks that had presented themselves in emerging markets have dissipated. The Chinese economy’s transition towards a growth model underpinned by satisfaction of domestic demand and less dependent on industrial goods exports is taking place gradually. Economic indicators are headed in the right direction in Latin America and parts of Africa, particularly in those countries which had fallen into recession, such as Brazil and Nigeria.

In addition, international trade, which had stagnated in recent years, has recovered. According to the OECD, trade is expanding at an annual rate of 4.5%, which is virtually double the pace of the last two years. This trend is particularly important for the Spanish economy, which is increasingly dependent on exports.

All of this has prompted the IMF to revise its estimates upwards. Specifically, the IMF’s April forecasts (the most recent available), point to global GDP growth of 3.5% in 2017, up 0.4 percentage points from 2016 and up 0.1 percentage points from its January forecasts. For 2018, experts are predicting growth of 3.6%, unchanged with respect to the January forecasts. Those levels of growth are approaching the average growth rate observed between 1987 and 2007.

Counterbalancing these more optimistic forecasts are lingering sources of uncertainty. The eurozone’s institutional architecture remains a work in progress, undermining the ability of the European member states, particularly the more indebted ones, to tackle fresh turbulence. In addition, following the fall of several banks (most recently in Spain and Italy), doubts have arisen regarding the effectiveness of the European financial system’s supervisory mechanisms. This situation only highlights the obstacles to achieving banking union in Europe. The European Central Bank is expected to gradually roll back its extraordinary monetary policy measures, a move which will undoubtedly evidence the eurozone’s weaknesses.

Elsewhere, certain emerging markets, such as Brazil and China, have sustained excessive growth in private sector lending which in some cases has fuelled real estate bubbles. New conflicts have arisen in oil producing nations, although their impact on international markets has been limited to date. Lastly, significant political risks remain, including the uncertainty created by the UK’s exit from the European Union and the rise in protectionist threats in recent times.

Recent performance by the Spanish economy

GDP expanded by 0.8% in the first quarter of 2017, or at an annualised rate of 3.3% (hereinafter, the quarter-on-quarter rates will be expressed in these terms), marking acceleration from the previous quarter. The year-on-year rate of growth was 3.0%. This performance was in line with expectations in light of the economic indicators released over the course of the quarter but was stronger than expected when the last set of forecasts was prepared, driven above all by a higher than forecast contribution by exports.

Domestic demand contributed 2.6 percentage points to the quarter-on-quarter rate of growth, while net exports contributed 0.7 percentage points, in both instances firming from the levels observed the previous quarter.

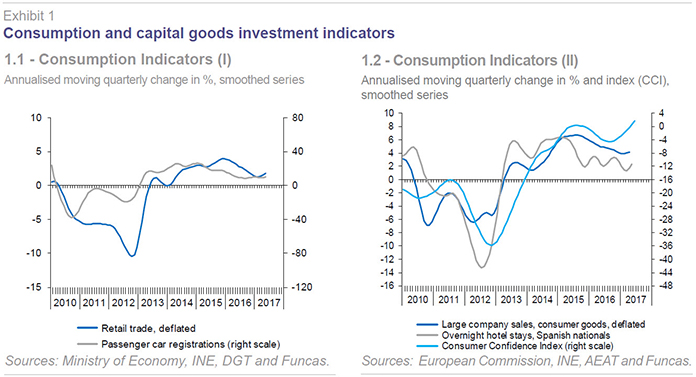

Growth in private consumption eased substantially in real terms in comparison with the last quarter of 2016 due to high inflation during the period; in nominal terms, growth was stable. At any rate, this component of demand has been trending lower, with ups and downs along the way, since the middle of 2015, as is clearly appreciable in the consumption indicators (Exhibits 1.1 and 1.2). However, the most recent data for the second quarter suggest that the downtrend in this variable may have hit bottom; indeed, private consumption may even be rebounding, as a result of the healthy pace of job creation.

In the first quarter, public spending, meanwhile, recovered from the drop observed the previous quarter. This item is registering very low growth: 0.8% year-on-year in nominal terms.

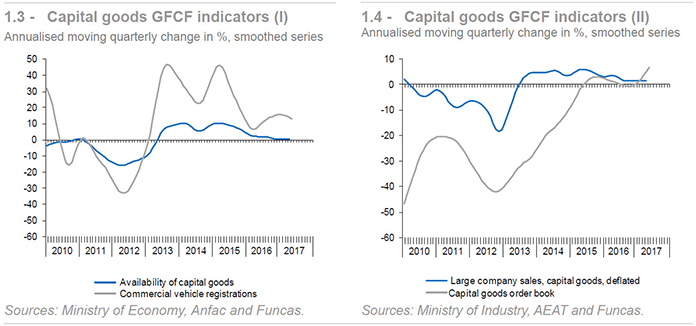

Investment in capital goods and intellectual property products registered a considerable rebound, higher than expected, possibly on account, at least partially, of the pushback of investment plans from the last quarter of 2016 due to the change in corporate income tax regulations in October, which increased corporate taxpayers’ payments on account unexpectedly, obliging them to postpone spending. It may also be a reflection of the materialisation of investment plans postponed throughout 2016 due to political uncertainty. At any rate, the underlying factors substantiating the momentum in this variable are the recovery in corporate profitability driven by cost-competitiveness gains, healthier capital structures and the export boom. The second-quarter indicators released to date point to continued growth, albeit at a slower rate than that observed in the first quarter (Exhibits 1.3 and 1.4).

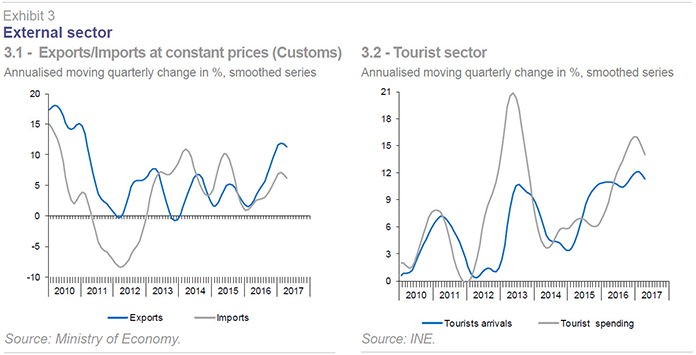

Total exports registered their highest growth rate in 10 years, boosted by buoyant sales of goods and non-tourism services. Tourism exports also registered growth, albeit trailing the growth in the other indicators. Goods imports also sustained strong growth on the back of the sharp growth in exports and in investment in capital goods, variables with respect to which these imports are highly elastic. However, growth in total exports was higher than that in imports in real terms, giving rise to the above-mentioned positive – and higher than forecast – net contribution by exports to GDP growth. At current prices, however, growth in imports outstripped that in exports, due mainly to the increase in oil prices (Exhibit 3.1).

In short, from the demand perspective, the acceleration in GDP growth in the first quarter of 2017 was shaped by a higher contribution by national demand, due to stronger investment in housing construction and capital goods, and a bigger contribution by exports, thanks to buoyant exports of goods and non-tourism services.

On the supply side of the equation, the acceleration originated in the construction and services sectors. It is worth highlighting the fact that growth in the commerce and hospitality sub-sector, i.e., that most closely related to tourism, has weakened according to the national accounting numbers. However, the number of tourist arrivals and the amount they spend continued to rise in the first four months of the year at rates that are higher even than the record numbers registered in 2016 in what is proving another pleasant surprise for the Spanish economy in early 2017 (Exhibit 3.2). In general, the service sector economic indicators showed signs of acceleration in the first quarter, a trend that continued into the start of the second (Exhibits 2.3 and 2.4).

As for the industrial sector, the indicators have produced a mixed bag of results for both the first quarter and the start of the second (Exhibits 2.1 and 2.2). On the one hand, the industrial production index was a little disappointing, in line with sales by the large industrial companies, albeit largely shaped by the drop sustained in the energy sub-sector. The purely manufacturing index fared somewhat better than the overall index, despite being dragged down by the adverse performance by the car manufacturing sector. The manufacturing turnover index and PMI readings were also on the positive side.

Growth in the number of full time equivalent jobs accelerated to 2.7%, implying a productivity gain of 0.6%, even though the productivity gain in the manufacturing industry was 0.1%. In the manufacturing sector, the numbers reveal a slowdown in growth in productivity, such that unit labour costs have begun to rise; however, the wage growth trendline remains below the sector deflator.

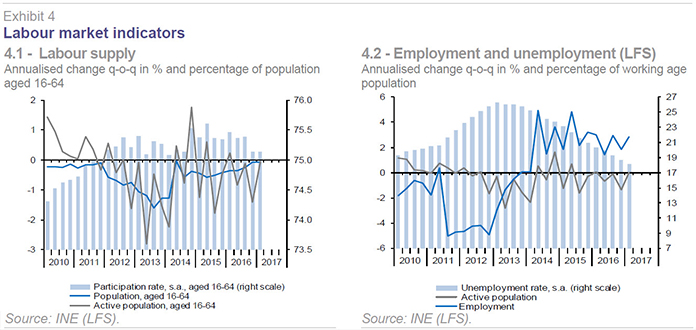

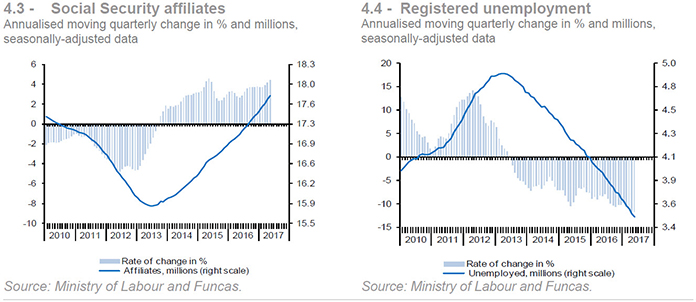

According to the most recent Labour Force Survey, unemployment continued to come down during the first quarter at the same strong pace as last year. The headline unemployment rate increased by 0.2 percentage points to 18.8% but the seasonally-adjusted rate fell to 18.1%. The active population continues to decline due to demographic trends. The participation rate is also trending lower due to lower labour force participation by youths and adults up until the age of 34. Above that age, the participation rate is rising (Exhibits 4.1 and 4.2).

As for the second quarter, the Social Security contributions figures indicate acceleration in the pace of job creation, driven specifically by the market services sector. Growth in employment in the construction sector would appear to be slowing from the high rate observed the previous quarter, with job creation broadly stable in industry compared to the first quarter. The drop in unemployment is similarly accelerating (Exhibits 4.3 and 4.4).

Judging by these employment figures, coupled with the picture being painted by other economic indicators, GDP growth may well have accelerated once again in the second quarter, approaching 4% in annualised terms. A figure which would, as with the first quarter numbers, easily outstrip the estimates contemplated at the start of the year, which foreshadowed as slowdown in growth due to depletion of the impact of some of the factors that had been driving the economy for the last two years. However, the sharp growth in investment and exports, thanks to the improved international context, has provided a new and unexpected boost, which is translating into faster growth in economic activity, employment and consumption, such that the economy, which had lost steam in the second half of 2016, is gathering momentum once again.

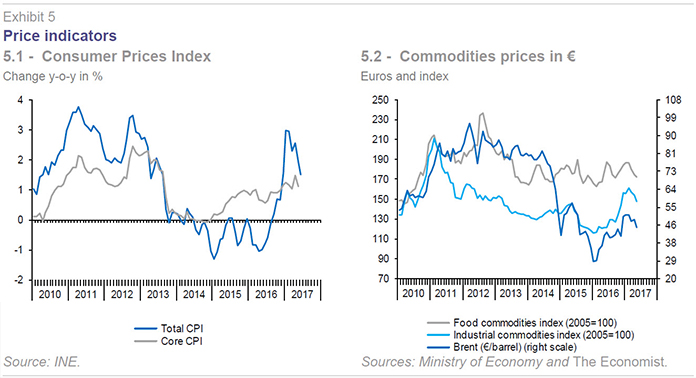

The inflation rate increased to the 3% mark at the start of the year due to transitional factors, specifically a knock-on effect on fuel prices of the increase in oil prices in the second half of 2016, a one-off spike in electricity prices and certain agricultural products due to meteorological conditions. These effects reversed in subsequent months, with inflation dropping to 1.5% in June. Core inflation held steady at around 1% (Exhibits 5.1 and 5.2).

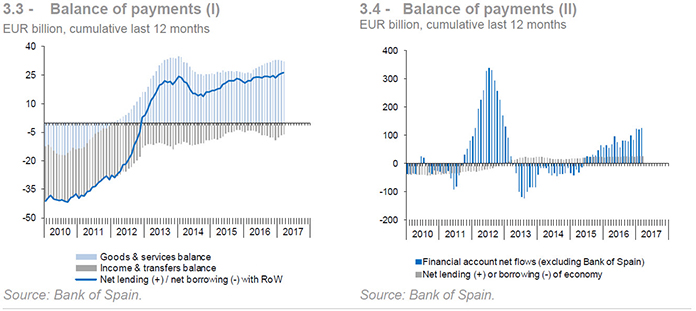

The trade balance to April revealed a significantly lower surplus year-on-year because imports grew faster than exports in nominal terms, mainly due to higher oil prices. According to the customs records, the balance of trade in non-energy goods improved year-on-year. The deterioration in the trade balance was not offset by a reduction in the primary and secondary income deficits, so that the current account deficit came in at 409 million euros, while the first quarter of 2016 recorded a surplus of 1.9 billion euros (Exhibits 3.3 and 3.4).

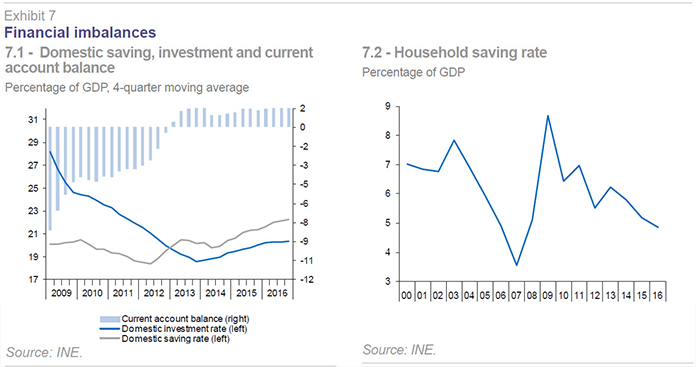

The household savings rate has been trending lower since the start of the recovery. In 2016, it stood at 7.7% of gross available income. Household investment, meanwhile, has been growing over the same period, so that the household segment’s net lending capacity has narrowed from 4% of GDP in 2013 to 1.9% in 2016. The non-financial corporations, in contrast, have been increasing their savings rate but also their investment rate, so that they presented a net lending capacity once again in 2016 equivalent to 2.8% of GDP (Exhibits 7.1 and 7.2).

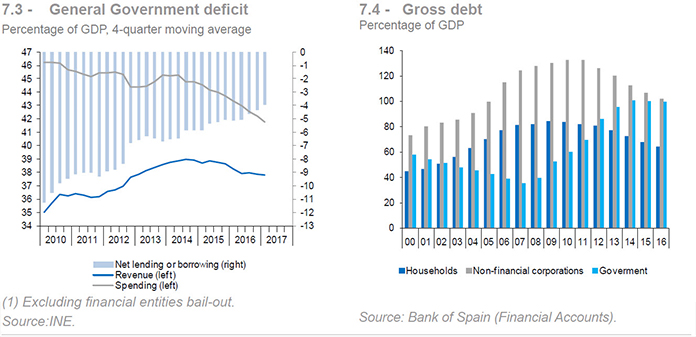

The household and corporate deleveraging processes continued in 2016 albeit at a slower pace than in prior years (there are no data yet for 1Q17). Household leverage has declined to 102.5% of gross disposable income, 32 percentage points below the high of 2007, while that of the non-financial corporations has fallen to 101.7%, 31 percentage points below the peak of 2011 (Exhibit 7.4). Thanks to this deleveraging effort and the drop in interest rates, the debt servicing burden continues to fall in tandem, fuelling consumption and investment in turn. In fact, the drop in interest payments in recent years has been so significant that in 2016, in the case of households and corporations alike, interest payments were lower than in 2000, which marked the start of the prior period of expansion, when borrowing levels were much lower than today.

However, in the case of households, the interest earned on financial assets has also declined and in 2016 the decrease was higher even than the drop in interest payments, so that the net effect of the reduction in interest rates on disposable income for the household segment as a whole was negative last year. Nevertheless, the ultimate impact on consumption was likely positive as the savings rate presented by indebted households is lower than that of households with net assets.

The public deficit decreased to 0.37% of GDP, or 4.28 billion euros in the first quarter, from 7.88 billion euros in the first quarter of 2016 (Exhibit 7.3). The improvement was driven by stronger revenue, as expenditure was slightly higher. On the revenue side of the equation, the trend in VAT collections and social security contributions stands out, although the figures for the first few months of the year tend to be very volatile and scantly representative. The deficit consolidation effort was concentrated at the central and local government levels, offsetting the downturn in the numbers presented by the regional governments and Social Security administration. The deterioration in the latter’s deficit during the first quarter is attributable to the reduction in transfers from the state, given that social security contributions rose by more than expenditure on welfare.

Forecasts for 2017-2018

The current forecast is for growth of 3.2% in 2017, up 0.4 percentage points from the last estimate. The revised estimates are the result of a significantly more dynamic than expected performance on the export front. Growth in exports of Spanish goods is accelerating, thanks to the recovery in the world markets and the favourable competitive positioning boasted by Spanish companies. And the tourist season promises to be a good one in terms of both arrivals and expenditure per tourist. Exports of non-tourism services should also stay on a positive track. The forecast is for accelerating growth in imports, more in line with the level associated with the prevailing trend in demand. As a result, foreign trade is expected to make a net contribution to growth of 0.7 points, up 0.2 points from the last set of forecasts (Table 1 and Exhibits 8.1 and 8.2).

Elsewhere, the slowdown in domestic demand for 2017 is now expected to be less pronounced than initially forecast: it is expected to contribute 2.5 percentage points to GDP growth. The forecast for private consumption has also been revised slightly higher. This revision reflects the impact of stronger job creation on available household income and the savings rate (coming down). Growth in gross fixed capital formation is also forecast to intensify. Households, which are seeing their income grow, have been stirred to invest in housing, taking advantage of the lower rates. Companies are also beginning to invest their surpluses in capital goods and modernisation of their productive capacity (Exhibit 8.3).

The forecast for inflation continues to point to an increase of around 2% in 2017, driven by the year-on-year increase in oil prices. The GDP deflator, meanwhile, should register a somewhat smaller increase of around 1.5% (Exhibit 8.5). Core inflation, thus, is expected to remain moderate.

In 2018, GDP growth is expected to slow to 2.8%, shaped by a lower contribution by net trade. Exports of goods and services are still expected to continue to gain market share, but at a slower pace than during the initial years of recovery. Imports are expected to register growth more in line with the trend in demand (implying an elasticity of close to 2). The forecast is that domestic demand will make a similar contribution to growth as in 2017, with private consumption slowing slightly in real terms (and registering a more pronounced drop in nominal terms) as a result of the slower growth in job creation. Public spending is similarly expected to slow a little, with public investment accelerating. Job growth is forecast to slow to 2.4%, leaving the unemployment rate at under 15%.

The public deficit is expected to improve significantly. On aggregate, the budget deficit is forecast to decline to 3.2% of GDP in 2017, 0.1 point above target, thanks to the freeze on spending implicit in the rollover of the budget and the fiscal measures taken at the end of 2016. In 2018, it is expected to fall to 2.2% of GDP, on target.

Persistent high debt

Spain’s public debt burden remains one of the economy’s key sources of vulnerability. In 2017, it is expected to reach 98.1% of GDP, which is high in comparison with other European countries and almost three times the pre-crisis level (Exhibit 7.4 and Table 1).

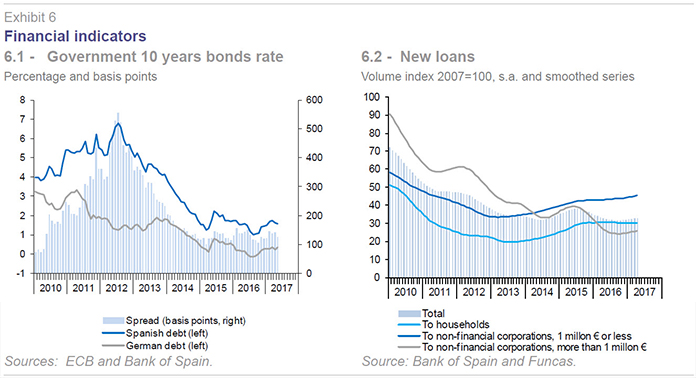

The ECB’s adoption of an arsenal of expansionary monetary policies in 2012 has facilitated a reduction in the cost of debt and country risk premiums. As a result, the increase in public borrowings has had hardly any impact on borrowing costs. In 2016, the yield on 10-year Treasury bonds was under 1.4%, compared to 5.9% in 2012. The risk premium measured as the spread over the German bond yield stood at 120 basis points, compared to nearly 430 points in 2012 (Exhibit 6.1). However, the anticipated rollback of these lax monetary policies will increase the financial burden and exert fresh pressure on budget deficits.

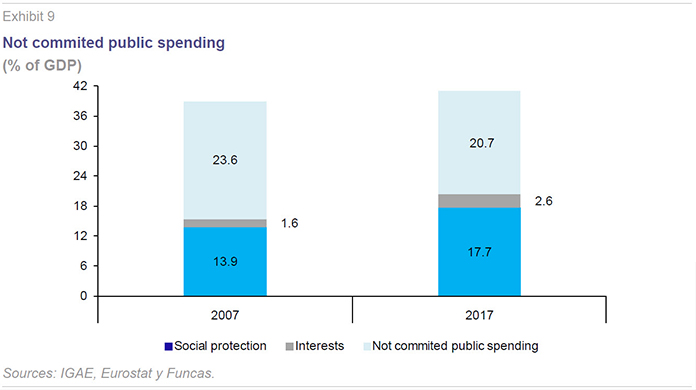

The result will be to further choke off the room for manoeuvre in budget policy which, since elimination of the national currency, is the cornerstone of macroeconomic policy. This ever-narrowing room for manoeuvre is evident in the sharp drop in discretionary public spending. This item is estimated as the difference between total public spending and non-discretionary spending, i.e., interest payments and welfare (budget items that evolve in line with parameters which the government has very little power to influence in the short-term).

In 2017, not commited public spending is expected to fall to 20.7% of GDP, an all-time low (Exhibit 9). This leaves the country with little scope for investing in education, research & development, infrastructure and other public goods which are vital to driving productivity and achieving a successful transition to the digital economy.

Moreover, the foreseeable increase in interest rates will erode the return on the banks’ asset portfolios as the banks are overexposed to sovereign debt as a result of the financial fragmentation that persists in the eurozone.

Household indebtedness, on the other hand, has fallen significantly since the real estate bubble burst. However, all signs suggest that the deleveraging process has ground to a halt. Firstly, households have started to spend beyond their means in terms of income growth. The result is a falling savings rate, a trend expected to continue during the projection period (Exhibit 7.2 and Table 1). Secondly, bank-financed home-buying has increased on the back of cheaper credit.

As a result, household liabilities will still account for 98.6% of their gross disposable income in 2017 and 61.6% of GDP. This level is relatively high according to a recent study by the Bank of International Settlements, which estimates that the threshold above which household leverage poses a risk to sustainable growth is 60% of GDP. Spain’s households are similarly exposed to the rollback of quantitative easing on their borrowing costs, particularly considering the fact that mortgages are usually taken out at floating rates of interest.

However, Spain’s non-financial corporations continue to deleverage. To the extent they resort to credit, they do so on more stable terms than households do.

In short, it is important not to become complacent. The situation calls for a more forceful effort to correct the imbalances plaguing the public accounts, close monitoring of excessive household leverage, particularly households taking on mortgages at floating rates of interest, and more audacious efforts to tackle long-duration unemployment. Lastly, reinforcement of the eurozone’s institutional framework could help solidify the recovery and reduce the risks to sustainable growth posed by public and household borrowing levels. Against this backdrop, it is important to culminate the banking union project and create a macroeconomic management tool for the eurozone.

Raymond Torres and María Jesús Fernández. Economic Trends and Statistics Department, Funcas.