Spanish economic forecasts panel: July 2017*

Funcas Economic Trends and Statistics Department

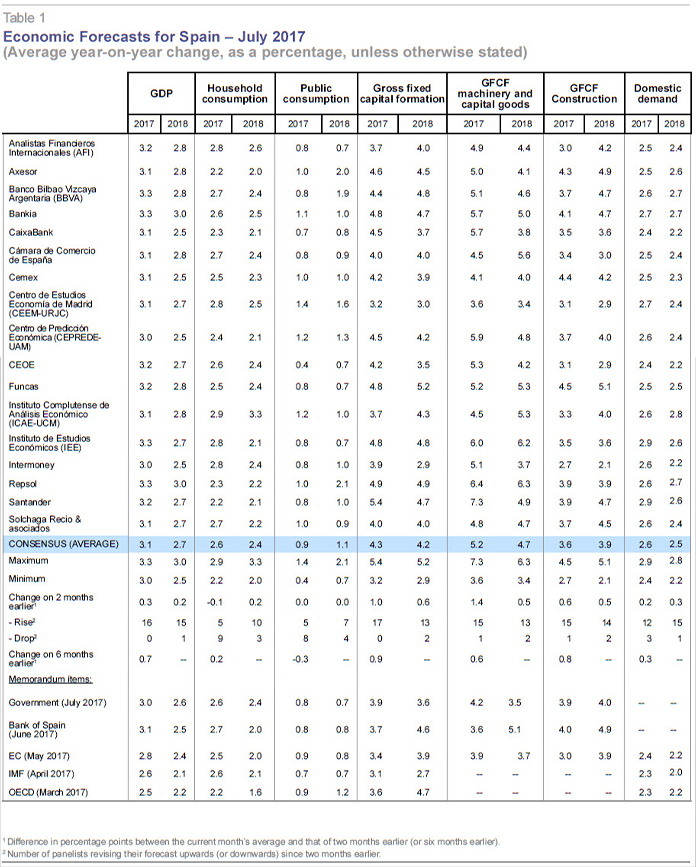

GDP growth revised up to 3.1% in 2017

GDP grew by 0.8% in the first quarter of 2017. Private consumption slowed on the back of a pick up in inflation, but investment gained renewed momentum, both in terms of capital goods and residential construction. Exports also grew robustly, resulting in a positive contribution to growth from the external sector. Leading indicators for the second quarter of the year point to growth being somewhat faster than in the first quarter. Consensus now sees quarterly GDP growth coming in at 0.9% (Table 2). Consumption appears to have recovered renewed impetus, while investment looks set to ease relative to strong growth in the first quarter.

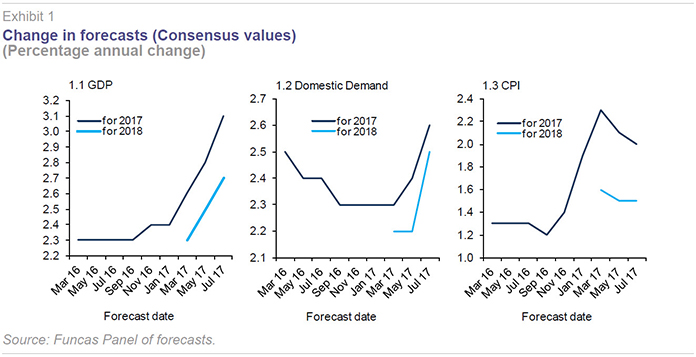

The average annual growth forecast now stands at 3.1%, representing an upward revision of 0.3 percentage points on the May panel. This is explained by a more optimistic outlook for the contribution from both domestic demand (2.5 percentage points) and the external sector (0.6 percentage points). The outlook for household consumption has been revised down slightly, with investment now forecast to see much stronger growth. Quarterly growth rates are forecast to moderate to 0.7% in the second half of the year.

Growth of 2.7% forecast for 2018

Consensus forecasts GDP growth of 2.7% in 2018, representing an upward revision of 0.2 percentage points. The main driver is a more bullish outlook for the contribution from domestic demand, primarily gross capital formation. The external sector will continue to contribute positively to growth, albeit less so than in the current year.

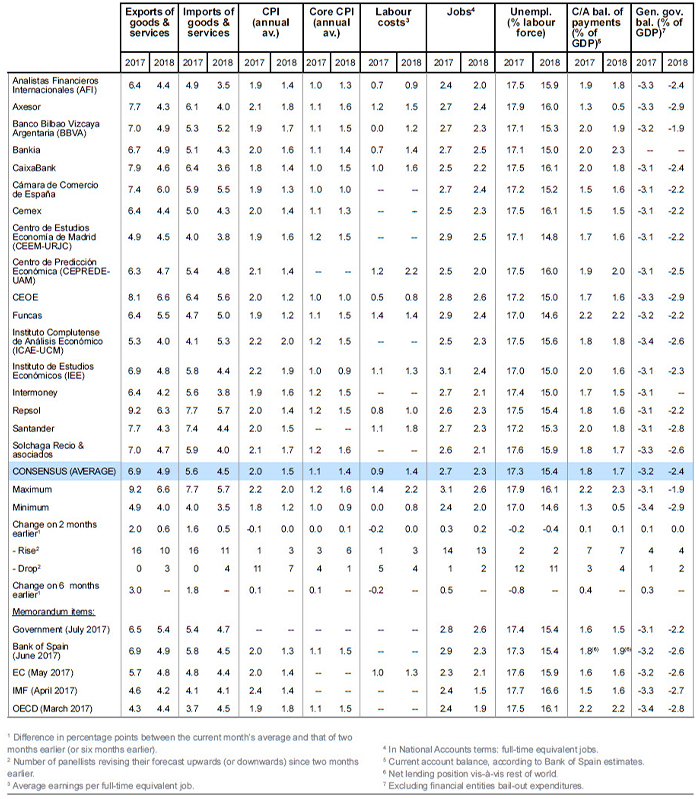

Spike in inflation in 2017 and moderation in 2018

Headline inflation fell sharply from 2.6% in April to 1.5% in June, primarily due to the expected slowdown in energy price inflation. Prices of energy products have been weaker than expected in recent times, due to the decline in oil prices and a notable appreciation of the euro.

As a result, the consensus forecast for annual average inflation in 2017 has been revised down to 2%, while the outlook for core inflation remains stable at 1.1%. Headline inflation is forecast to moderate to 1.5% in 2018, with core inflation rising to 1.4%. Forecasts for year-on-year inflation in December have also been revised down, to 1.2% this year and 1.5% next year.

Positive employment developments

Employment accelerated in the second quarter of the year according to Social Security registrations data, thanks to strong growth in services sector employment. Employment growth slowed in industry and, especially, the construction sector following robust growth recorded in the previous quarter.

Consensus now sees a stronger outlook for employment, with growth of 2.7% in 2017 and 2.3% in 2018. Based on consensus estimates for GDP, employment and wage remuneration, it is possible to obtain an implicit forecast for growth in productivity and unit labour costs (ULC). Productivity is set to grow by 0.4% this year and the next, while ULC are forecast to increase by 0.5% in 2017 and 1% in 2018.

The annual unemployment rate is on track to fall to 17.3% in 2017 and 15.4% in 2018.

Solid current account surplus maintained

The current account registered a cumulative deficit of 409 million euros to April, compared to a surplus of 1.945 billion euros over the same period last year. The deterioration is due to a worsening of the trade balance. According to Customs data, this was due to the recovery in oil prices, given that the non-energy balance posted a larger surplus than in the same period last year.

Consensus forecasts a surplus of 1.8% of GDP for the year as a whole and 1.7% in 2018.

Public deficit to shrink but failing to meet targets

The public deficit, excluding local corporations, to April was 4,171 billion euros smaller than the same period last year, thanks to a much stronger increase in revenues than expenditures. The State and Social Security system both registered improved results, but the regional deficit deteriorated.

In light of the improved growth outlook, consensus now sees the public deficit coming in at 3.2% of GDP, a downward revision on the previous Panel but still 0.1 percentages points above target. That said, nine of the sixteen panellists who provide forecast for this variable now believe the Government will deliver. A deficit of 2.4% of GDP is forecast for 2018, also above target.

Improvement in global economic outlook

Economic data in recent months point to a strengthening of global growth. Particularly of note is the increase in qualitative and economic sentiment indicators in the eurozone.

A larger majority of panellists now consider the EU environment to be favourable. Furthermore, the majority of forecasters in this Panel also judge the non-EU context to be favourable (in the previous Panel the majority saw the backdrop as neutral). Likewise, few foresee significant changes to the outlook over the coming months. Nobody regards the context as unfavourable or likely to deteriorate.

Long-term interest rates ticking up

Short-term interest rates (3-month Euribor) have remained stable in recent weeks at -0.33%. All analysts consider rates to be low, given the strong momentum in the Spanish economy. These favourable conditions are expected to be maintained over the next six months.

The yield on long-term debt (10-year sovereign) has fallen from a monthly average of 1.57% in May to 1.45% in June, slightly below the maximum of 1.8% recorded in March, but above pre-US election levels. This level is still considered to be relatively low given conditions in the Spanish economy. However, forecasters are now expecting an increase in interest rates in the near future.

Euro continues strengthening

Recent declarations by Draghi, which have been interpreted as a warning that extraordinary monetary policy measures could be wound-up more decisively than expected, have given renewed stimulus to the euro. Accordingly, the euro has continued to track up against the dollar to a monthly average of 1.13, from 1.10 in May (and 1.06 at the start of the year).

Even so, most panellists believe the euro is below its equilibrium level, though major movements are not foreseen in the coming months.

Fiscal policy is no longer expansive

Compared to the previous Panel, the majority of forecasts judging fiscal policy to be neutral has increased. Most also consider this to be an appropriate stance. There are no changes in opinion on monetary policy. Panellists are unanimous in considering the stance to be expansionary with the majority judging this to be the right approach.

* The Spanish economic forecast panel is a survey of seventeen research services carried out by Funcas and presented in Table 1. The survey has been undertaken since 1999 and is published every two months during the first fortnight of January, March, May, July, September and November. Panellists’ responses to this survey are used to create consensus forecasts, which are based on the arithmetic mean of the seventeen individual forecasts. For comparison purposes the Government, Bank of Spain and main international institutions’ forecasts are also presented; however, these do not form part of the consensus.