Spain’s 2017 Budget: Lacking reforms to meet the deficit target

Even though the State looks set to have a hard time meeting ambitious deficit targets this year, the expected overall overshoot is likely to be small, thanks to positive contributions once again from the anticipated surplus at the local administration level. However, risks from possible one-offs could increase slippage above current projections.

Abstract: The aim of this article is to analyse the outlook for State revenues and expenditures following the recent approval of the 2017 Budget, which depends primarily on favourable cyclical developments to meet the State’s end of year deficit target. The strong performance of tax revenues in the first part of the year, together with stagnation in discretionary departmental spending, bode well for a significant reduction in the deficit, bringing it mostly in line with the official target for this year. However, the lack of substantive reforms foreshadows difficulties in fully delivering on deficit targets over the longer-term. Moreover, the Budget document does not reflect the reform recommendations considered by the European Commission as key for exiting from the Excessive Deficit Procedure, such as changes to indirect taxation. Likewise, it fails to take account of other reforms currently under review, affecting sub-sectors of government, such as the Social Security system and the Territorial Administrations. The latter, in particular the Regional Governments, are set to see a significant increase in funding following the approval of the new State budget, which should facilitate overall compliance. At the same time, work is ongoing to define a new regional financing model.

The General State Budget once again assumes that the government will comply with its stability targets while at the same time failing to propose substantive structural reforms or changes to fiscal policy. Add to this the fact that it was only approved by a plenary of the Senate on June 26th and the result is that the 2017 Budget is little more than a stopgap; intended to tide the government over until preparations for the 2018 Budget.

The overall deficit target for Spain’s combined public administrations in 2017 is 3.1% of GDP. The State ended 2016 in a relatively more challenging position than other levels of administrations, meaning it will likely struggle to meet its individual target this year. The State registered a deficit of 2.5% of GDP in 2016 – 0.3 percentage points above target – meaning it will need to shoulder a bigger fiscal adjustment this year to account for the overshoot – some 1.4 ppts. Bearing in mind that in recent years the State has failed to reduce its deficit by similar magnitudes, there are good reasons to be sceptical as to whether it will have the capacity to deliver this year. By contrast, the territorial administrations ended 2016 in a position which should be more favourable to meeting this year’s targets: the local administrations increased their surplus (from 0.5% to 0.6% of GDP) and the regions managed to consolidate by almost 1ppt of GDP, albeit slightly deviating from their overall target (0.82% of GDP compared to the 0.7% target).

In this article, we assess the feasibility of the adjustment facing the State this year, by reviewing some of the key questions raised by the 2017 Budget:

- How achievable are the State’s revenue forecasts bearing in mind that the bulk of the impact of the direct tax reform (personal income tax – PIT – and corporation tax) has now been absorbed?

- Will the continuation of measures to increase corporation tax prepayments prove sufficient to ensure compliance in this tax heading?

- What will the fiscal burden look like at the end of the year and how does it compare to the wider EU?

- Are any major changes expected for the composition and development of State public spending or is it more of the same?

- Has State investment touched bottom? Is there any possibility of investment picking up in the current year or does the delayed approval of the 2017 Budget pose another setback to a return to more optimal levels?

- What does the 2017 Budget mean for the territorial administrations awaiting a reform of the regional financing system? Are the regions and local administrations in a position to meet their targets this year?

Budget 2017 revenue forecasts: Feasibility and sufficiency of recent tax measures

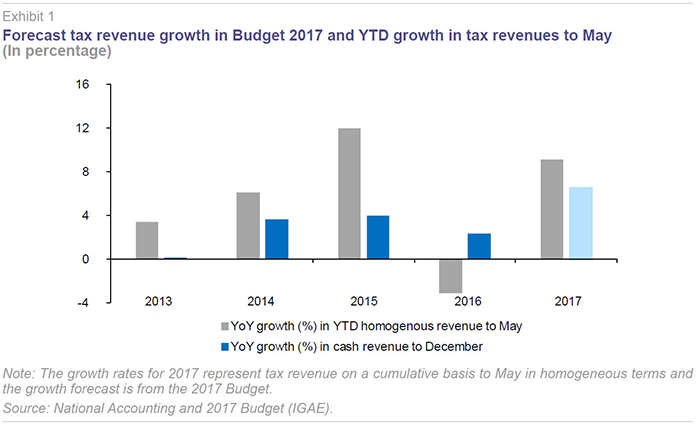

Tax revenues in 2016 were strongly conditioned by the 2015 direct tax reform, which significantly watered down the impact of economic growth on tax revenues. In this regard, the 2017 Budget forecasts tax revenues to grow 7.9% in homogeneous terms this year, well above 2016. Tax bases are projected to grow by 5.5% after 4.3% in 2016, driven by the robust outlook for GDP growth, nominal domestic demand and wage remuneration.

This is in line with the trend in revenue growth to May this year for the main tax headings (PIT, VAT, corporation tax, excise duties). Revenues are up 9.1% YTD, representing the second highest growth to this month since 2013.

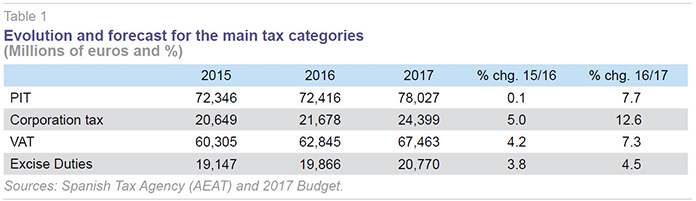

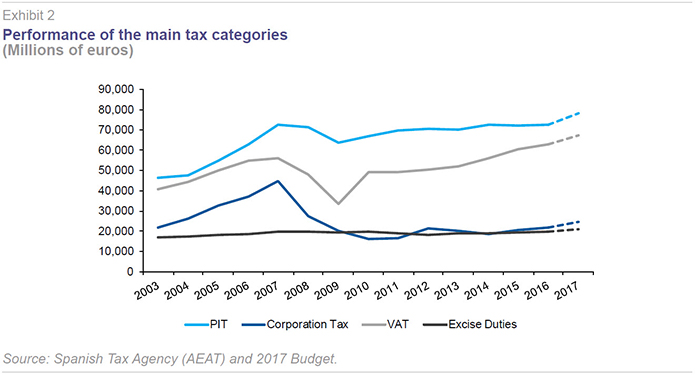

The outlook for tax revenue is mainly contingent on an increase in VAT revenues, which are expected to rise by 4.6 billion euros relative to 2016, and PIT, which – after two years of revenues stagnating at around 72.5 billion euros – is forecast to grow by 7.7%, reaching 78 billion euros. If achieved, this would amount to a record inflow of funds into the State coffers, outperforming pre-crisis revenues. The government justifies the expected VAT performance on the basis of its forecast for nominal GDP growth (4.1%) and the data available on revenue developments at the time of drawing up the Budget.

The VAT forecast looks relatively feasible given the strong year-on-year growth to May in VAT revenues (9% in homogeneous terms), which is explained not only by the underlying performance of final expenditures subject to VAT, but also stricter regulation on the granting of deferrals. Excluding the latter regulatory change, VAT revenues are growing in line with Budget projections.

However, the PIT target looks quite a lot more ambitious, based on an expected increase in average wages and thus average withholding rates. Income tax revenues remained virtually unchanged over the period 2014-16, meaning that the positive impact on revenues from growth was counteracted by the larger than expected impact of the tax cut affecting 2015 and 2016. This led to a 5.984 billion euro shortfall in revenues in 2015 and 6.489 billion in 2016. Although revenues have since picked up as the impact of this reform has begun to drop out, growth in PIT revenue still lags some way behind the Budget forecast, posting 4.3% growth to May compared to the 7.7% forecast. Furthermore, 40.2% of the forecast has been executed during the first five months of the year, meaning that we are still over a percentage point from the average execution at close of the last six years. All in all, growth in PIT revenues might be overestimated by around 2 billion euros.

Finally, corporation tax is forecast to experience the largest year-on-year growth in revenue, partly explained by the impact of the higher tax rate applying to prepayments in April from new measures introduced in 2016 and a more upbeat outlook for corporate earnings. Both factors, underpinned by a positive 5.967 billion euros collected in the April prepayment, suggest the Budget target of 24.399 billion euros may be achievable. Even so, corporation tax remains the only category among the main State taxes, which continues to yield less tax than before the crisis. While both VAT and PIT revenue exceeded 2007 pre-crisis peaks in 2014, corporation tax revenues are only around half the 2007 level (some 20 billion euros lower).

It is also worth bearing in mind the contrast between growing tax revenues (85% of total non-financial resources) and declining non-tax revenues (primarily resulting from differences between redemption and issuance values of Public Debt due to the low interest rates on new issues) which has an important overall impact, meaning total non-financial income is set to fall by -0.3% compared to the close of 2016.

Overall, the revenue scenario looks broadly feasible, albeit with some downside risks to full achievement of tax revenue targets (as happened in 2016), especially in terms of PIT, which could end up some 2 billion euros short of the expected 5.6 billion windfall.

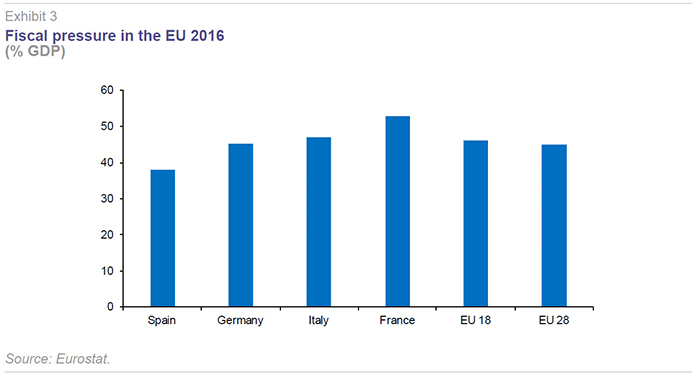

Forecasts for end of year fiscal pressure

Both the Budget and the Stability Programme Update 2017-20 forecast a modest increase in fiscal pressure by the end of 2017, which is set to rise by half a percentage point relative to 2016. Even so, Spain remains towards the lower end of EU countries in terms of fiscal pressure. Taking account of all tax revenues (including those collected by the territorial administrations and Social Security system), Spain’s overall fiscal pressure in 2016 was 8.3 and 7.2 percentage points lower than that of France and Germany, respectively.

In its recent

Country Report on Spain 2017, including an In-Depth Review on the prevention and correction of macroeconomic imbalances, the European Commission warned that the share of tax revenues to GDP in Spain has increased by less than the EU and euro area average. The report also noted that indirect taxes, direct taxes and social security contributions in Spain have almost equal weight in overall tax revenues. In particular, the Commission once again pointed to the low weight of tax on consumption, which is the consequence of a significant VAT gap. This gap is an indicator of VAT revenues that are theoretically forgone due to the application of special deductions on certain goods and services. It is expressed as the revenue that could be collected if all products were taxed at the standard rate, assuming full compliance with tax obligations. The widespread use of exemptions and reduced rates on some goods and services means Spain has a larger VAT gap than the EU average (59% compared to an EU average of 44% in 2014). Furthermore, the European Commission used the EUROMOD model to simulate the potential impact on revenue collection from reducing this gap. The model suggests that under different scenarios, public revenues could increase by 0.2% of GDP simply by increasing the super-reduced rate to 10%, or up to a maximum of 1.4% of GDP by applying a single rate of 21%. As these measures have regressive implications, the Commission recommends they be offset by social transfers.

As in previous years, the 2017 Budget disregards these recommendations on VAT, justifying expected growth (7.3% YoY) on the basis of an improved outlook for final spending subject to VAT (household consumption, new house acquisition, etc.) and limited modifications in the rules setting stricter conditions on deferrals which were approved by Royal Decree Law 3/2016.

The Budget 2017 also fails to consider other recommendations on environmental and property taxation. Environmental taxes in Spain have a low weight in GDP of around 1.8% (2014) compared to the EU average of 2.5%. Indeed, the report notes that transport taxes only raise around half of EU average revenues, with very low excise duties on unleaded petrol and diesel. That said, it is conceivable that the regulation and harmonisation of environmental taxes will be one of these issues tackled by the Expert Committee reviewing reform of the regional finances.

The Commission also noted the lack of significant changes regarding property taxation in recent years, where the only major reform has been the gradual phasing out of mortgage interest deductions. In its report, the Commission argues that recurring charges on property are less harmful to growth and preferable to transactions taxes, facilitating a more efficient allocation of assets and greater labour mobility. However, it is important to bear in mind that substantive changes to this tax, while affecting state revenues, also have an impact on the territorial administrations who enjoy partial devolution of tax powers in this area.

2017 Budget vision for public spending: Turning point or more of the same?

Non-financial State spending is forecast at 153.853 billion euros in 2017, the equivalent of a 1.1% increase relative to disbursed spending in 2016. This limited increase in spending implies the deficit reduction will mainly come through a cyclically-driven increase in revenues.

It is important to remember that the spending which was ultimately disbursed by the State in 2016 was subject to various measures aimed at restricting expenditures, including the approval of a non-availability agreement and the early shut down of public accounts. By contrast, the late approval of the Budget may avoid the need to reapply such budgetary consolidation measures this year, given that the failure to agree a Budget until this late stage means that execution will be limited and capital spending will likely undershoot.

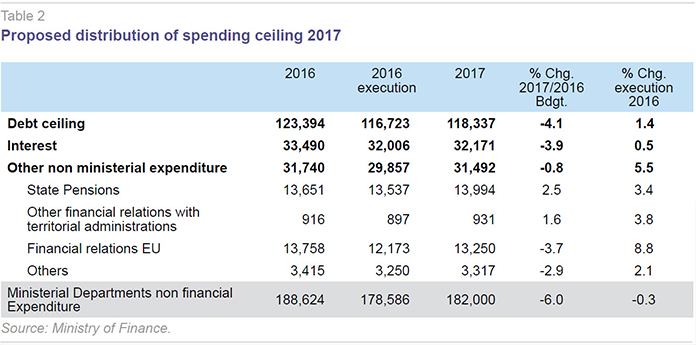

Either way, the distribution of the spending ceiling excluding non-discretionary commitments (interest, state pensions, other financial relations with the territorial administrations and with the EU, etc.), means discretionary spending envisaged under the 2017 Budget and available to government ministries will be subject to a 6% adjustment on the 2016 Budget and 0.3% on final spending last year. Accordingly, the scope to change the direction of ministerial spending in 2017 is practically non-existent, implying a continuation of existing policy.

In terms of the main categories of spending, personnel expenditure is forecast to see a modest increase (+1%), related to an expected update of remuneration, as too are financial outlays (0.5%). Increased spending in these two categories (accounting for 32% of total non-financial spending) are offset to a large extent by a decline in current transfers, which are forecast to drop by -1.2% on the disbursed budget (some 1 billion euros). Excluding headings awaiting implementation from previous years included in the 2017 Budget (1.818 billion euros in real investment corresponding to the Ministry of Defence), capital spending is set to increase by an inconspicuous 2.4%, or a mere 300 million euros on the executed 2016 budget.

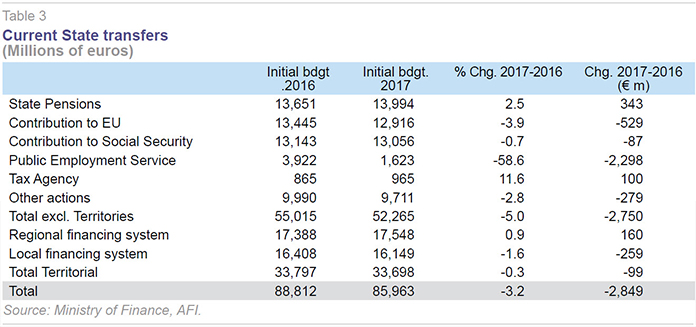

The biggest adjustment in terms of current spending items is set to take place in the Public Employment Service (SEPE), which is forecast to reduce outlays by 2.3 billion euros, reflecting the improved labour market outlook. This adjustment is in line with the reduction in Social Security benefits recorded by SEPE last year (-1.971 billion euros) which was primarily due to a 10% fall in the number of recipients, leaving the coverage rate unchanged at 55% in 2015-16. Meanwhile, the expected contributions to the Social Security system (minimum pension supplement, non-contributory pensions, family protection, etc.) and the territorial administrations are expected to remain broadly constant relative to 2016.

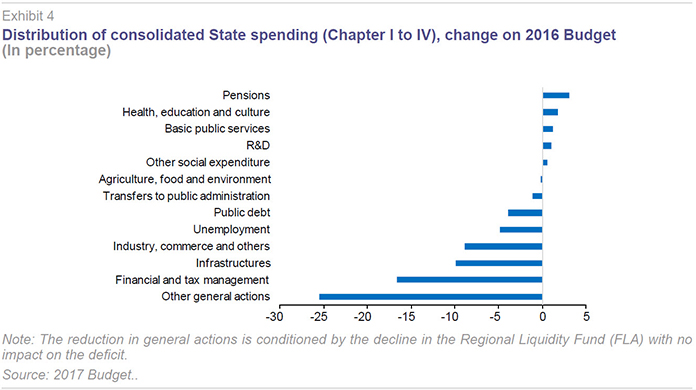

In terms of spending policies, the significant increase in pensions (+3.1%) comes at the expense of an adjustment to non-financial spending on unemployment (transfers to SEPE) and transfers to other public administrations, infrastructures and general services.

Therefore, the main changes to State spending policy and budgetary headings concern modifications to current transfers dependent on external factors (transfers to SEPE based on labour market developments) and the upgrading of pensions and new entrants into the system. This adjustment provides room for a modest increase in personnel remuneration.

Investment policy: Is state investment set to recover?

State investment including capital transfers is forecast at 15.889 billion euros in 2017. This is 9.4% above 2016 levels, on the face of it representing a break with the stability in the investment budget since 2014, after reaching a low point of 10.657 billion euros in 2013. However, these monetary values need to be scrutinised on the basis of investment components to be certain of reaching a robust conclusion.

Within the overall investment profile, there is a notable 46.8% increase in real investment. However, a large part of this is explained by the inclusion of 1.818 billion euros relating to payment commitments associated with special weaponry programmes managed by the Ministry of Defence. Regardless, this amount does not affect the 2017 public deficit, since it relates to deliveries made in previous years. Taking this expenditure out of the picture reduces the increase in investment to 3.412 billion euros, which includes funds for modernising the judicial system.

The two ministries responsible for making the largest amount of investment are set to see their funding cut: by 3.6% in the case of the Ministry of Public Works, equivalent to 1.77 billion euros, most of which is dedicated to road and rail infrastructures; and by 7.8% in the Ministry of Agriculture, Fisheries, Food and Environment, some 787 million euros, mainly destined towards hydraulic infrastructures.

Meanwhile, capital transfers are set to decline by 3.7% on the previous year, primarily because of reduction in funding for subsidised loans. The headings receiving the bulk of resources relate to financing the costs of the electricity system (43.9%), the Territorial Administrations (16.9%) and research programmes (14.6%).

In summary, based on the above, the 2017 Budget implies an effective reduction in receivables for state investment (excluding the 1.818 billion from previous years relating to the Ministry of Defence), extending the decline in investment in GDP terms seen since 2011 to a new low of 1.2% of GDP.

Furthermore, given the late date at which the Budget will take effect, its seems likely that effectively implemented capital spending will be below the approved allocation due to lengthy processing periods, affording the State additional headroom to meet the deficit target.

Implications of the Budget for the Territorial Administrations

Expected funding for the autonomous regions

The State presented the annual Budget for the first time with a note providing detailed information on payments on account – some 92.339 billion euros in total – paid to each of the regions, together with a forecast of provisional back payment adjustments relating to 2015. The overall amount represents a significant increase of 5.585 billion euros relative to the sum that was provided to regions last year. Meanwhile, the ex-post adjustment relating to 2015 is set to once again work to the regions’ favour, coming in at a similar to level to 2014, at 7.405 billion euros. Accordingly, funding for the regions will increase by 5.7%, meaning that regions will have an extra 5.39 billion euros to manage relative to what they received under this heading in 2016.

The increase in funding is concentrated in five autonomous regions (Catalonia, Valencia, Andalusia, Madrid and the Canary Islands). The largest increase in funding, given its relative size, will go to the Canary Islands, explained by the inclusion in the Budget of Final Provision Sixteen, which amends Act 22/2009 of December 18th. This amendment, which takes effect from the 2015 ex-post adjustment and has immediate and ongoing impact from the 2017 Budget onwards, eliminates the second additional provision of this Act regarding the inclusion of the Canary Islands’ Fiscal and Economic Regime in the calculation of the region’s fiscal capacity and per capita funding.

However, the impact is temporarily smoothed, by a softening mechanism which limits the change to 57% in 2015 and 30% in 2016. Overall, the Canary Islands are set to see funding increase by 474 million euros in 2017, of which 219 million euros is explained by the ex-post adjustment (Convergence Funds).

Expected funding for the local administrations

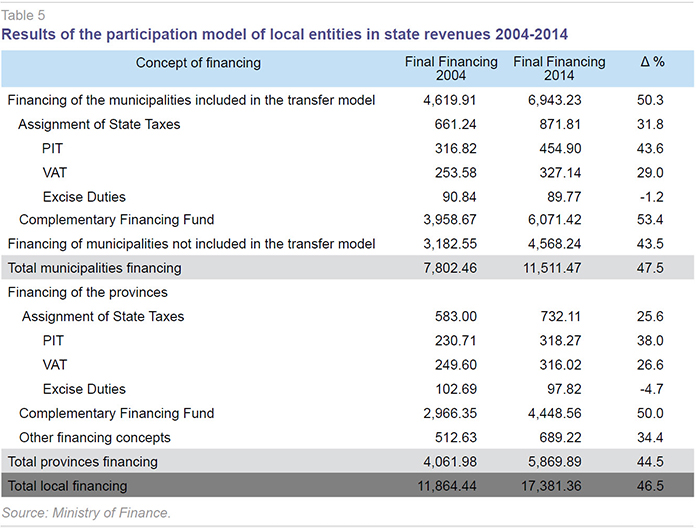

Funding for local administrations is set to ease slightly, amounting to 16.149 billion euros compared to 16.408 billion euros budgeted for in 2016.

The Budget document also reviews the performance of local funding over the period from 2004 to 2014, the last year for which the Budget has been fully locked down. It notes that the current system has been more favourable for municipalities included in the municipal transfer model, who have seen their income rise by 50.3% over the period, compared to 43.5% in other municipalities and 44.5% at the provincial level.

Conclusions: A stopgap Budget

Overall, the following can be concluded about the 2017 Budget:

- No substantive fiscal reforms are introduced capable of having a major impact on revenues and/or public spending. Revenues are dependent on the cycle and the continuation of tax measures approved at the end of 2016 (an increase in corporation tax prepayments and tighter restrictions on the granting of VAT deferrals). Spain continues to have one of the lowest fiscal pressures in the EU

- Spending policy stays on the same track as 2016; the amount of discretionary spending available to Ministries is unchanged, with the heavy lifting entrusted to an adjustment in current transfers to the Public Employment Service related to reduced need, which in turn allows for an increase in public sector remuneration and funding to the regional financing system.

- Investment remains lacklustre, falling even further in effective terms (excluding the impact of the inclusion of defence spending undertaken in previous years). State investment is set to hit a low of 1.2% GDP in 2017, only slightly above the 1% trough recorded in 2013, with the delay in approving the Budget potentially limiting full implementation.

- The 2017 Budget is broadly neutral for local administrations, but is a major resource boost of over half a percentage point of GDP for the regions. On this basis, it is likely that both levels of administrations will post a similar non-financial outturn to last year.

- This article has focused on the State Budget, which is a sub-component of total public administrations. It does not consider the Social Security Budget. Even so, it is worth noting that the overall Budget document does not contemplate any reform to the Social Security System to rebalance the significant deficit in this sub-sector. This will depend on reaching consensus under the Toledo Pact.

- All-in-all, the State looks set to have a hard time meeting its ambitious deficit target this year: although revenues are progressing well, the PIT target looks to be over optimistic to the tune of at least 0.2 percentage points of GDP, and while spending plans are much the same as last year, there are some potential tensions in the pipeline (increase in regional funding, revision of public sector pay, excessively upbeat adjustments in spending on goods and services, etc.) which could dampen the expected adjustment. Even so, the expected overshoot in relation to the overall deficit target of 3.1% of GDP, for the time being, looks to be of the order of 0.2 or 0.3 percentage points, thanks once again to the positive contribution from a likely surplus at the local administration level. However, there are some risks to this from possible one-offs, including the resolution of the bankruptcy ring roads orbiting Madrid and the Constitutional Court ruling on the town hall tax on capital gains in the absence of increase in urban land value.

Ana Aguerrea and Susana Borraz. A.F.I.- Analistas Financieros Internacionales, S.A.