Spain’s banking and insurance sectors: A contrasting story

Both the Spanish banking and insurance sectors have seen a major improvement in solvency over the last decade. In terms of profitability, however, the insurance sector has held up reasonably well, while banks have struggled in recent years to generate profits above their cost of capital.

Abstract: The recent crisis has significantly altered the behaviour and relative positioning of Spanish insurance companies and banks. The former have performed much more strongly, reducing the gap to the banking sector in terms of size, solvency and profitability. Meanwhile, both sectors have substantially improved their solvency levels at the cost of lower returns to shareholders. But there is a noteworthy difference: insurance companies are sustaining double-digit profitability, while the returns offered by banks are much more limited.

The Spanish banking sector recently published its 2016 results. Although the equivalent data for the insurance industry are still not available, it is possible to make a reasonable estimate based on published information pertaining to the first three quarters. As in previous years, there are important differences. The aim of this article is to compare the performance of the two sectors, not just over the last year but taking account of developments over the last ten years, marked by the profound international economic-financial crisis affecting the Spanish and global economies.

A quick review of headline data points to significant differences in relative size in various aspects. This is a distinguishing feature of the Spanish financial sector relative to neighbouring economies. The crisis has also had very different impacts on both sectors. As is well-known, the Spanish insurance sector is significantly smaller than the banking sector. However, as we will see, the gap has closed substantially due to developments in key performance indicators. While the crisis did not pass unnoticed in the insurance sector, the sector has proven to be more robust and much less sensitive to the cycle.

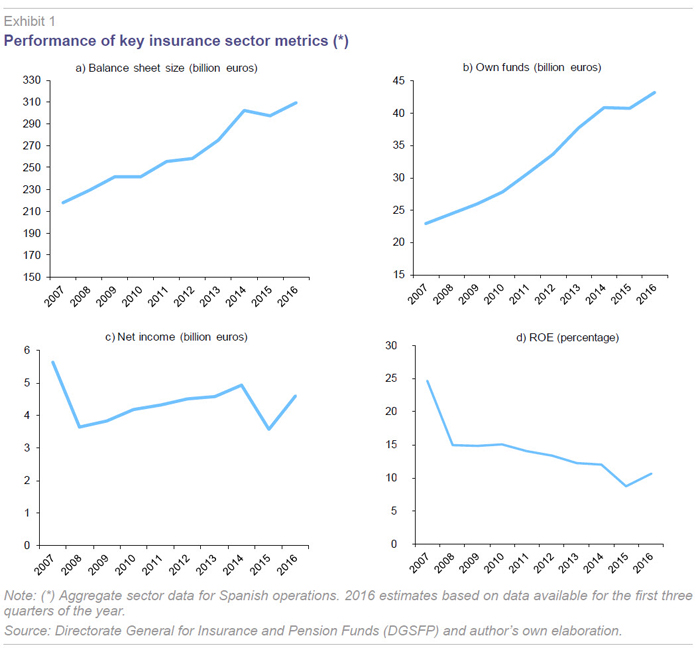

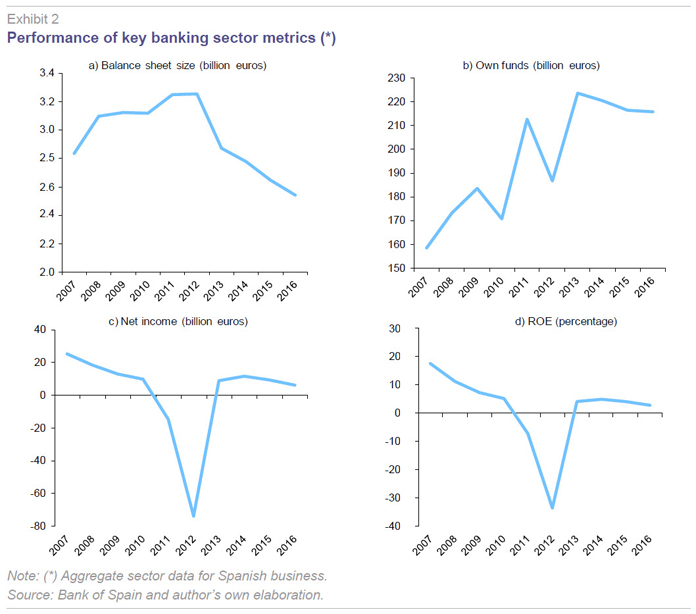

The exhibits in the following sections show the performance of both sectors using different metrics: balance sheet size, equity, net income and profitability (ROE). These metrics are provided in aggregate terms for the companies’ Spanish operations.

The insurance sector – weathering the crisis

The insurance sector (Exhibits 1a to 1d) has registered sustained balance sheet growth over the last ten years, increasing from a little over 200 billion euros the year before the crisis to over 300 billion euros. In other words, an increase of around 50%. Logically, this growth is largely associated with mathematical provisions for the life business, ultimately representing the total volume of savings managed by life insurance.

Alongside this balance sheet expansion, there has also been a strengthening of the sector’s equity, which has risen from 23 billion euros to 43 billion, almost doubling. Consequently, this has led to a significant reduction in leverage in the sector, with the balance sheet moving from a ratio of ten-times equity to seven-times, at the same time as it has continued to grow.

Despite the crisis, robust results over the last ten years have proved sufficient to drive solvency improvements by themselves. Except for 2007, in which there was a large volume of long-term savings insurance rescues provoked by the fiscal reform of 2006

[1], overall growth in results has been relatively stable since 2008. In reality, this has been the case up until the last two years when low interest rates began to take their toll on the sector.

Results of over 4 billion euros on average have enabled the sector to sustain reasonable, even high, profitability levels (ROE) (typically between 10% and 15%, excluding a one-off 25% in 2007). Though it is also true that the sector’s profitability has been on a gradual downward path to now. The driving factor is not so much a deterioration in the underlying income statement but rather the strengthening of the sector’s equity position, due to both greater regulatory capital requirements (Solvency II) and as a response to economic and market instability.

Banking sector clean up but poor profitability

Developments in the banking sector have been starkly different (Exhibits 2a to 2d). The overall balance sheet for Spanish banks’ domestic business continued growing until well into the crisis. In fact, the balance sheet hit a maximum of 3.25 billion euros in 2012 carried along by inertia from exceptional growth in the years leading up to the crisis. The massive growth in refinancing operations at the start of the crisis also contributed to prolonging the adjustment process, together with a delayed response by most banks in cleaning up their deteriorating balance sheets. It was only later on, and fuelled by the restructuring of the sector itself, that banks fully confronted the task of cleaning up their balance sheets. This, together with a strong decline in lending activity, resulted in a sharp fall of over 20% in the sector’s balance sheet.

At the same time, as in the insurance sector, equity has also been reinforced. However, the lack of sufficient operating surplus and even losses in some years has meant that banks were forced to boost equity largely via major injections of capital, mainly public (bank rescue) as well as private. Thus, the sector’s equity levels have increased from 160 billion euros at the start of the crisis to a little over 215 billion euros, a 35% increase. The combination of a shrinking balance sheet and an increase in equity have led to notable improvements in banking sector solvency. Overall balance sheet leverage to equity has fallen from multiples of 18 to 12 over the last ten years.

The flip side of the clean up is that the banking sector’s overall net profit for domestic business over the nine years from 2008-2016 remains in the red. ROE has barely scraped 5% at best in recent years, following the sharp losses in 2011-2012. This represents less than half the ongoing return generated by the insurance sector.

Moreover, Spanish banks’ domestic results have been buoyed by their involvement in insurance companies. In fact, if we focus solely on typical banking business, excluding the contribution to bank results from their insurance activities, banks’ results in 2016 would have been much smaller and not very different from the insurance sector in absolute terms.

Finally, it is worth pointing out that the surpluses generated by the banking sector are significantly larger when also considering their foreign operations. Historically, this foreign presence has been concentrated in the two largest banks, Santander and BBVA, although Sabadell and Caixabank have recently expanded abroad. While foreign operations make a very significant and notable contribution to Mapfre’s results, the insurance sector still lags a long way behind the banking sector in terms of the aggregate contribution of foreign operations.

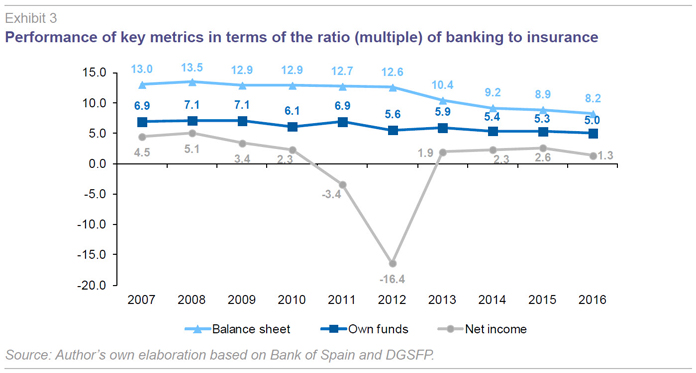

Insurers and banks in contrast

Recent performance – with a contraction in the banking sector and sustained growth in insurance – has closed the gap between the two sectors. The following developments can be observed when comparing the relative performance of both sectors from 2007 to 2016, as shown in Exhibit 3:

- The banking sector’s aggregate balance sheet has moved from a ratio of thirteen-to-one to eight-to-one relative to the insurance sector,

- meanwhile equity has dropped from a ratio of seven to five,

- and finally, in terms of net profit, the relative ratio has fallen from five-to-one at the start of the period to a little over one-to-one in the

last year.

There has also been a narrowing in terms of employment in both sectors. While the banking sector employed 278,000 people at the start of the crisis, ten years later it employs just 194,000, 30% less. By contrast, the insurance sector employed 43,000 people at the end of 2016, similar to the overall workforce in 2007.

In sum, based on the metrics reviewed in this article, the Spanish banking sector still retains a predominant position in terms of its relative weight in the financial system, but the gap has narrowed significantly over the last ten years.

However, both sectors have seen a major improvement in solvency with significant increases in equity. For the banking sector this has involved significant recourse to external public and private sector injections, meanwhile the insurance sector has managed to improve solvency out of own cash flow. Moreover, this improvement in solvency in the insurance sector has come against the backdrop of steady balance sheet growth, while in the banking sector it has been accompanied by a simultaneous, sustained reduction in risk exposure.

The improvement in solvency has not been matched by profitability developments in both sectors. Quite the opposite, in both cases profits have deteriorated albeit by different orders of magnitudes. The insurance sector has not seen a substantial deterioration in its overall profits. They have held up at reasonable levels, providing double digit returns (albeit slowing). However, even leaving to one side the massive losses generated during the worst of the crisis, the banking sector (domestic business) has struggled in recent years to generate returns in excess of the cost of capital.

It seems likely that these trends will continue for some time in both banking and insurance. However, we have only looked at the latter from an overall perspective and it is worth distinguishing between life and non-life businesses.

Note

Which led to exceptional profits in that year at the cost of reducing future profits.

Daniel Manzano. A.F.I. - Analistas Financieros Internacionales, S.A.