Shadow banking: Spain in the global context

The scale of shadow banking in Spain remains limited and has traditionally been contained by regulation and supervision. However, the proliferation of non-bank operators in the euro area, and the potential for contagion and systemic risk, requires constant surveillance.

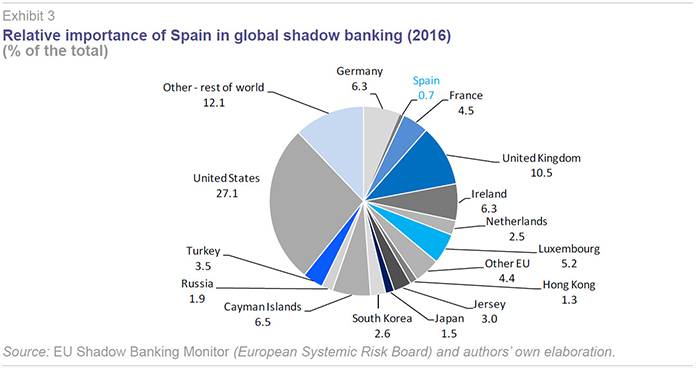

Abstract: Shadow banking encompasses a range of lending activities provided by non-banking vehicles, often outside of a defined regulatory perimeter and which are prevalent around the world, with potential for systemic implications. In Spain, partly because of the predominance of the banking sector in the finance framework, such activities have only developed to a relatively limited extent. Shadow banking in Spain scarcely accounts for 0.7% of the global total. Even so, the combined non-banking sector managed 1.34 trillion euros in assets in 2016, a decline from 1.53 billion euros in 2010 – primarily because of a downturn in securitisation fund assets. However, growth in shadow banking in the euro area and potential contagion risks make it an issue worth monitoring. To this end, regulatory and supervisory authorities coordinate internationally to try to reduce contagion risks from a business that continues to experience rapid growth.

Defining shadow banking and its systemic importance

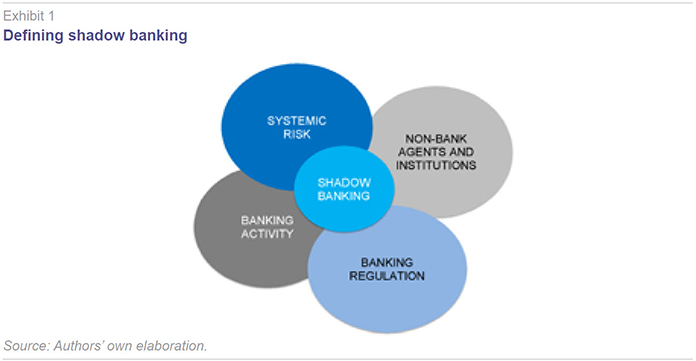

The name “shadow banking” implies a certain murkiness or underhandedness, but the term itself has often been used without derogatory connotations. If anything, it is employed in a preventive context. The Financial Stability Board (FSB) is probably the institution responsible for developing the most widely accepted definition of shadow banking as credit intermediation involving entities and activities (fully or partially) outside the regular banking system. As this type of business has become more common and widely commented, during and in the aftermath of the crisis, various definitions began to circulate describing shadow banking as financial intermediation outside the scope of regulation or even on the fringes of the law. However, this is potentially a misleading or inaccurate definition because the importance of shadow banking has more to do with its systemic potential and because it refers to activities that, while regulated, are subject to less oversight than the banking sector which is, in some cases, incomplete or insufficient. Exhibit 1 uses set theory to illustrate the concept. We are talking about a financial business that is comparable to banking, developed by non-banking institutions but with systemic implications and subject to little or insufficient regulatory oversight.

The G20 meetings convened to address the severe financial crisis were responsible for “shadow banking” becoming the accepted terminology rather than other terms, such as “market-based banking” or “banking outside of regulation”.

The FSB has tried to give some practical meaning to the definition, making progress in two areas. Firstly, from 2011 onwards, the FSB – in coordination with various national authorities as part of their monitoring reports – has pioneered the development of an extremely comprehensive map of institutions and activities in each country which fall within shadow banking. Secondly, since 2015, the FSB has developed an additional technical definition, the so-called “narrow measure” of shadow banking, which restricts the definition to non-bank institutions which the authorities consider to be involved in credit intermediation activities associated with potential systemic risks. This excludes institutions not undertaking (whether directly or indirectly) credit intermediation activities or which are integrated within a consolidated banking group. It is also worth noting that “credit activities” encompasses a wide range of possible leverage and indebtedness options.

This article aims to analyse the state of play and recent developments in shadow banking in the global context, considering Spain’s position and outlook. In Spain’s case, shadow banking is of interest primarily for preventive reasons. In this sense, while shadow banking could be considered one of the causes of the crisis (risk transmission generated by structured products), this type of contagion was limited in Spain, thanks in part to the role played by supervisory authorities (who limited or imposed significant provisions on the development of such activities). But it is worth highlighting that one of the key defining elements of shadow banking is the possible risk of contagion to the banking sector.

Indeed in June, the Bank of Spain published a “Report on the financial and banking crisis in Spain, 2008-14”.

[1] This reports describes some of the regulatory efforts undertaken in regard to shadow banking and notes that “the accumulation of risks outside the banking system had major implications for the outbreak of the crisis, causing the G20 to introduce measures to avoid the risk of banking activities migrating towards unregulated, or less regulated, participants or mechanisms in the financial system (shadow banking)... As a result of FSB recommendations, regulatory measures were developed to tackle risks linked to securitisation and the interconnections between banks and other entities (for example, via improvements in rules regarding the consolidation of off-balance sheet vehicles and improvements in prudential regulation).”

Spain in a global context

How prevalent is shadow banking at the global level? Where does Spain fit in this picture? The FSB’s latest "Global Shadow Banking Monitoring Report 2016,"

[2] provides some interesting conclusions in this regard. Firstly, it suggests that nearly all non-bank financial intermediation activities have continued to grow in recent years, especially in the euro area which started from a lower base than other jurisdictions. Secondly, the report considers that the interconnection between non-bank and bank activities has declined in light of the regulatory response, but remains at higher levels than before the crisis. Furthermore, it highlights that various types of collective investment vehicles have been the main driver of growth in these activities.

In Europe, various financial stability reports published by the ECB in recent years suggest that the euro area’s financial system has proven resilient to occasional bouts of volatility in financial markets but they also warn of increased potential for a sharp increase in risk premia at the global level. Such an increase may very likely come from the shadow banking world, which many analysts consider to be the main threat to international financial stability. This is a concerning backdrop for the ECB at a time when sovereign and private sector debt levels remain elevated in many countries.

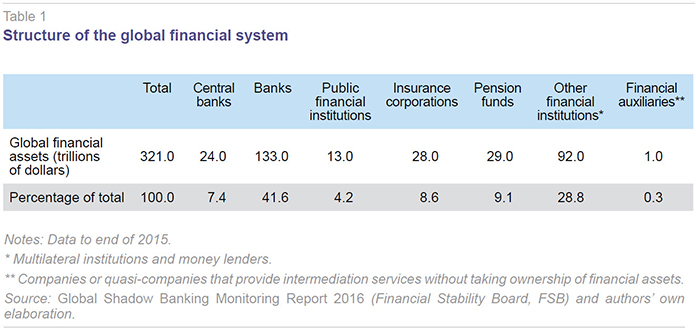

As can be seen in Table 1, global financial assets are estimated at 321 trillion dollars, of which private banks manage 133 trillion but with the so-called “other financial institutions” already accounting for 92 trillion dollars, 28.8% of the total.

Also noteworthy is the 17.7% share corresponding to insurance companies and pension fund managers. This is important as their operations are sometimes more complex than they may appear and their involvement in investment activities subject to contagion risk is also significant.

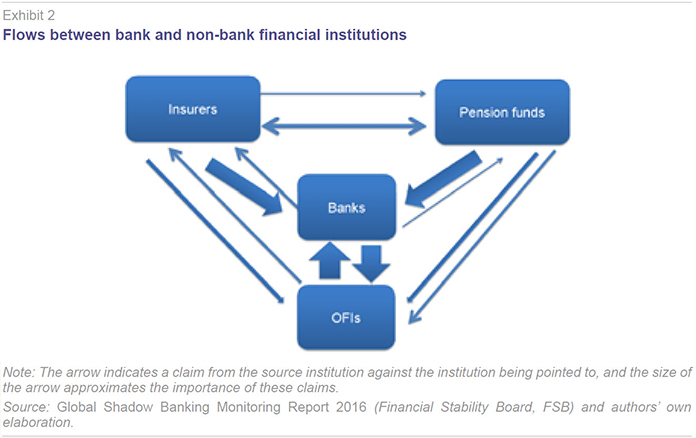

Some of these links between banks and non-bank institutions are described in Exhibit 2 based on the FSB’s own flowchart in its 2016 monitoring report. Other financial institutions (OFIs) are formed by a wide variety of institutions, including investment funds, hedge funds, financial auxiliaries and captive financial institutions and money lenders. OFIs may channel part of their activities through banks and/or take positions in banks or offer vehicles or services constituting risks in financial flows which can also potentially affect bank business. Insurers and pension funds also have links to banks and OFIs insofar as they deposit or channel their funds and investments through these institutions, or they invest in areas which could be affected by OFIs and banking activity.

It is important to mention that recent statements from the FSB show some optimism about the way OFIs and shadow banking are being held under control. Mark Carney, FSB chairman and governor of the Bank of England made some relevant remarks on June 3rd, 2017, ahead of the G20 meeting in Hamburg, in the presentation of the annual report of the FSB. “Over the past decade, G20 financial reforms have fixed the fault lines that caused the global financial crisis.” The FSB report itself assures that reforms put in place by the G20 nations have successfully tackled the most pressing issues that contributed to the crisis, including improvement of the supervision of shadow banks.

In Spain’s case, the Bank of Spain has taken an active role, in coordination with the CNMV and other Spanish authorities, in FSB-led analysis of possible institutions belonging to the shadow banking sector. Other European institutions, such as the European Systemic Risk Board (ESRB) are also monitoring these trends. As can be observed from Exhibit 3, according to ESRB data, Spain has a very limited stake in overall global shadow banking activity, accounting for a mere 0.7%. This contrasts with other euro area countries such as Germany (6.3%), France (4.5%) or Luxembourg (5.2%) and even more so with the United Kingdom (10.5%) and, especially, the United States (27.1%).

The relatively low presence of shadow banking in Spain is attributable to the country’s idiosyncratic and long-standing institutional finance structure, in which banks having a predominant role. Either way, as previously mentioned, this does not make it any less important to monitor these flows inside and outside Spain’s borders, given that shadow banking is inherently systemic in nature and has the potential for contagion from non-banks to the banking system.

Non-bank financial institutions in Spain

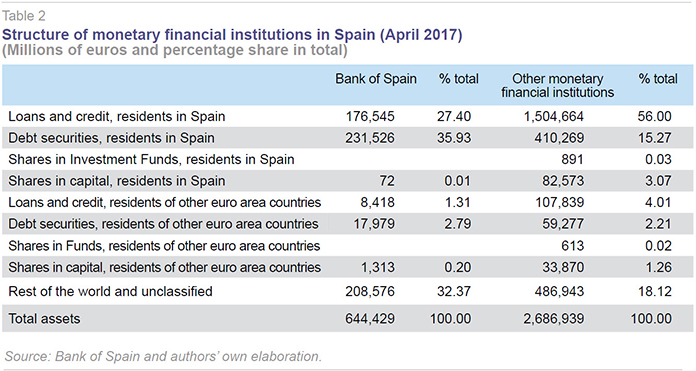

Table 2 shows the structure of monetary financial activity in Spain using latest data available to April 2017. These are therefore activities which lie outside the narrowest definition of shadow banking. This obviously includes the Bank of Spain as watchdog. And also “other monetary financial institutions” – banks, specialised credit institutions and monetary funds. 56% of total assets relate to loans and credit, while 15.27% are debt securities. 3.07% are equity investments and the rest are smaller investments in funds and other securities. Overall, “other” monetary financial institutions handle 2.69 trillion euros in Spain.

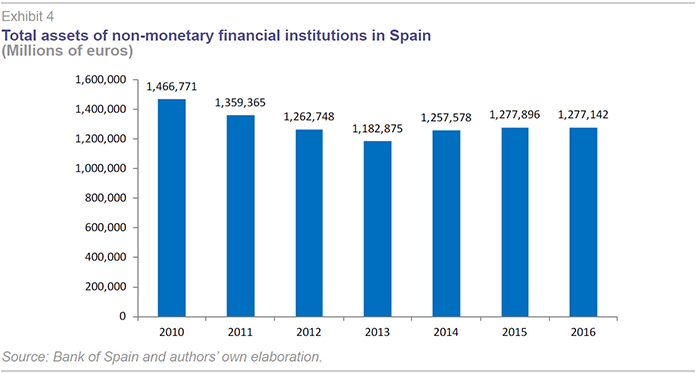

Exhibit 4 shows total assets in the other side of the financial system – non-monetary financial institutions – formed of non-monetary investment funds, other financial intermediaries (such as securitisation funds), financial auxiliaries (such as stock brokers), insurance corporations and pension funds. The assets managed by these institutions are significant. Although movements have been somewhat volatile in recent years, assets amounted to 1.27 trillion euros in 2016, practically half of the assets managed by monetary institutions, as shown below.

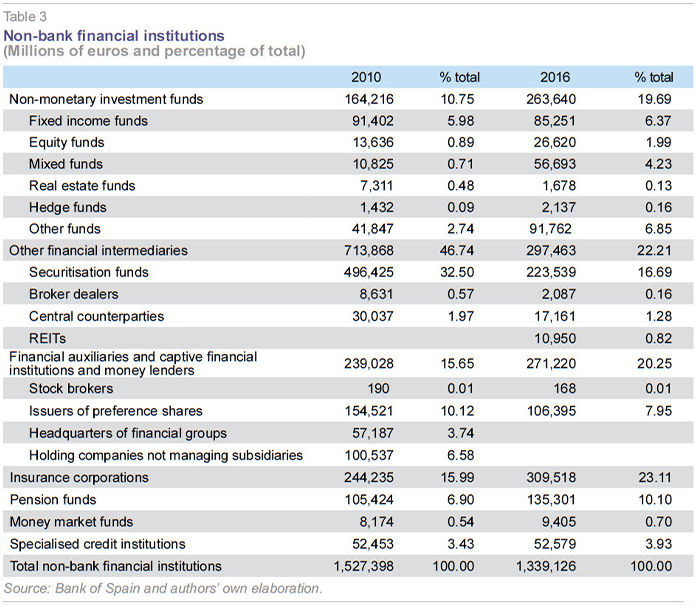

Taken together, non-monetary institutions plus non-monetary funds and specialised credit institutions (even if they are outside the more restrictive “narrow” definition of shadow banking), constitute non-bank financial institutions. Table 3 provides a description of these institutions and recent developments between 2010 and 2016.

Non-monetary funds have significantly increased their involvement in the financial system from 2010 (10.75%) to 2016 (19.69%), at the same time as market conditions have improved in relative terms. However, “other financial intermediaries” – notably securitisation funds – have lost substantial weight over the same period, falling from 46.74% to 22.21%. It is worth noting the emerging popularity of REITs (Real Estate Investment Trusts) within this category, which managed assets amounting to 10.95 billion euros in 2016.

Preference share issuers also have a significant weight among financial auxiliaries, accounting for 7.95% of total non-bank financial institutions.

The most important group of non-bank financial institutions are insurers (23.11%), and pension funds, also representing a significant share (10.1%).

The most important group of non-bank financial institutions are insurers (23.11%), and pension funds, also representing a significant share (10.1%).

Overall, non-bank financial institutions managed 1.34 trillion euros in 2016, representing a decline from 1.53 trillion euros in 2010. The bulk of this downturn is attributable to a decline in securitisation fund assets.

Conclusions

Even though shadow banking sometimes has a derogatory connotation, it forms a very significant part of any financial system, where the least desirable aspects concern the potential for systemic risk. In this regard, the goal of international regulators and supervisors is to coordinate their activity in order to monitor and calculate the risks and probabilities of contagion and to ensure that these activities do not circumvent necessary regulation.

The scale of shadow banking in Spain is limited and has traditionally been contained by regulation and supervision. However, the proliferation of non-bank operators in the euro area, and the potential for contagion and systemic risk, requires constant surveillance. This article has shown how shadow banking in Spain accounts for a mere 0.7% of global shadow banking. Even so, combined non-bank operators and activities amounted to 1.34 trillion euros in 2016, under a broad definition.

Over the coming years, it will also be necessary to analyse the potential role played by other non-bank operators. Such institutions could include developments within the world of Fintech. Companies in this arena may develop shadow banking characteristics if they transcend the world of payments – where they are currently concentrated – to become more involved in lending and other traditional banking activities.

Notes

Santiago Carbó Valverde. Bangor Business School, CUNEF and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas