Spain’s Social Security budget for 2021

Expenditure and revenue outlays in the 2020 and 2021 Social Security budgets are highly impacted by both COVID-19 and regulatory changes. However, a consistent theme is the Social Security budget deficit, requiring decisive corrective measures to stabilise the pension system and overall Spanish public sector.

Abstract: While much of the budgeted Social Security expenditure is predetermined by the rules that govern it, both the 2020 and 2021 budgets contain financing and expenditure novelties. The preliminary budget outturn numbers for 2020 point to a deficit of 19.77 billion euros. Notably, this is not due to COVID-19 as the Spanish state stepped up its transfers in order to cover those effects. The consolidated Social Security budget for 2021 forecasts a deficit of 14.29 billion euros, with expenditure falling in some areas like income support for the self-employed and rising in categories such as contributory pensions. Somewhat unexpectedly, taxpayer contributions to the Social Security are expected to increase by 3.8%; however, this figure will likely change now that the furlough scheme has been extended. The Social Security budget for 2021 is also shaped by regulatory developments which provide for an annual state transfer. Stagnant at 1.5% of GDP since 2014, the deficit is undoubtedly the key issue facing the Social Security. Although the government has previously provided loans, this is not considered a sustainable approach. The government has built some noteworthy recommendations into its pension reform programme, but the current fiscal situation of the Social Security implies that measures are needed to ensure the sustainability of the pension system and, by extension, the Spanish public sector.

Introduction

The Social Security budget forms part of the general state budget (GSB) and, as such, moves through parliament along with the state and regional government budgets and those of any other state bodies governed by Spanish budget legislation. The Social Security represents 42.1% of the total consolidated expenditure contemplated in the GSB 2021. Nevertheless, the margin for political decision-making with respect to the Social Security budget is significantly limited by the contributory regime governing most of system’s benefits. What that means is that much of the budgeted expenditure is predetermined by the rules that govern it, for example, qualification for the receipt of contributory pensions or benefits for workplace illnesses or accidents. As a result, the trends in Social Security spending and income are relatively stable irrespective of which party is in government.

However, both the 2020 budget outturn and the budget for 2021 contain major novelties as a result of (i) the contingencies that had to be covered by the Social Security in the wake of the COVID-19 crisis; and (ii) regulatory changes that affect how it is financed and some of the benefits paid out. Before analysing the 2021 budget, it is worth taking a brief look back at the trend in Social Security revenue and expenditure over the course of 2020.

2020 budget outturn

The preliminary budget outturn numbers for 2020 point to non-financial spending of 171.79 billion euros and a deficit of 19.77 billion euros. As we will show, that deficit is not attributable, for the most part, to the effects of the pandemic on contributions and benefits, as the Spanish state stepped up its transfers in order to cover those effects.

Included in the increase in spending triggered by COVID-19 is the extraordinary income support paid out to self-employed professionals affected by pandemic-related business restrictions (5.79 billion euros) and the extraordinary COVID-19 sick leave coverage (825.6 million euros). However, the biggest impact on the Social Security’s accounts came via contributions foregone due to the exemptions given to employers and wage-earners included in the government-sponsored furlough scheme and to the self-employed employees affected by business restrictions. The draft budget for 2021 (Plan Presupuestario 2021 – Government of Spain, 2020) estimates the cost of that tax relief at 9.06 billion euros. To cover those benefits and make up for the shortfall in revenue, the state transferred 14 billion euros to the Social Security in 2020.

The 2020 budget outturn numbers also include the first payments under the new minimum income scheme, a new, permanent and non-contributory benefit designed to provide individuals and households living in extreme poverty with a guaranteed income. It is equivalent in size to a non-contributory pension for individual beneficiaries (5,538 euros per annum in 2020) and increases in size depending on the number of people in the household (with an extra supplement for single-parent families). The problems associated with the application process limited the actual use of the scheme, such that the related expenditure amounted to just 1.03 billion euros in 2020.

To support the Social Security’s financial stability, the state transferred 1.33 billion euros last year, an annual transfer introduced in 2018. Going forward, in the wake of the so-called Toledo Pact Assessment and Reform Report (House of Deputies, 2020) dated November 2020, that transfer will be specifically linked with the first recommendation set down in that report: consolidation of the delineation of financing sources and uses and restoration of financial equilibrium. Lastly, the budget carry-over of 2020 also contemplated a loan from the state, as in prior years, of 13.83 billion euros, which was increased by a further 16.5 billion euros in response to the measures taken to tackle the COVID-19 crisis.

2021 budget

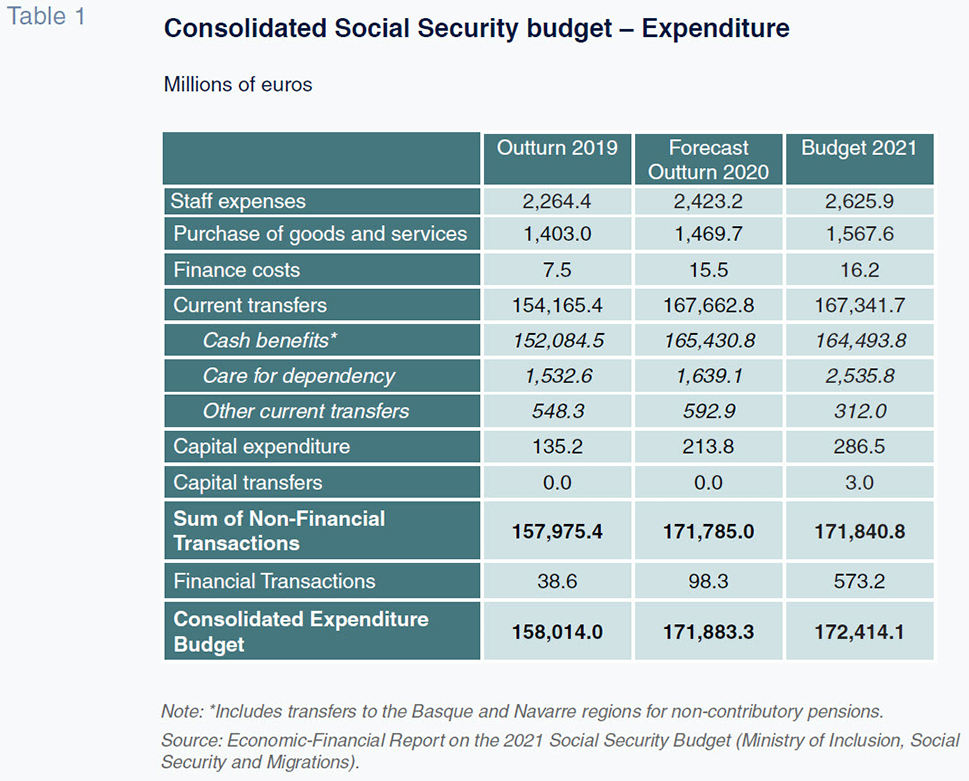

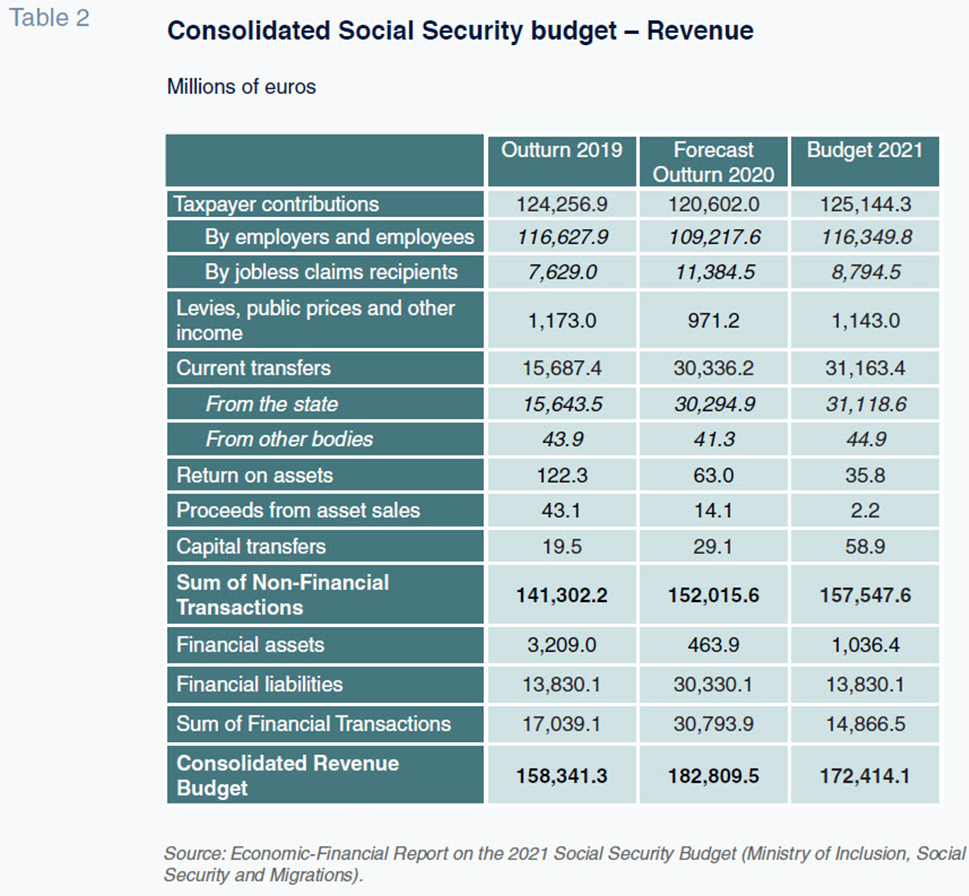

The consolidated Social Security budget for 2021 contemplates non-financial spending of 171.84 billion euros and revenue of 157.55 billion euros, resulting in a deficit of 14.29 billion euros. With respect to the preliminary budget outturn figures for 2020, that would imply growth in non-financial spending of just 0.3% and growth in revenue of 3.64% (Tables 1 and 2). However, that apparent stability in the headline figures masks a number of developments related with the anticipated easing of the COVID-19 pandemic. The related expenditure is expected to decline considerably by comparison with 2020 and there are certain changes introduced by the government to the Social Security’s financing regime that take effect from 2021.

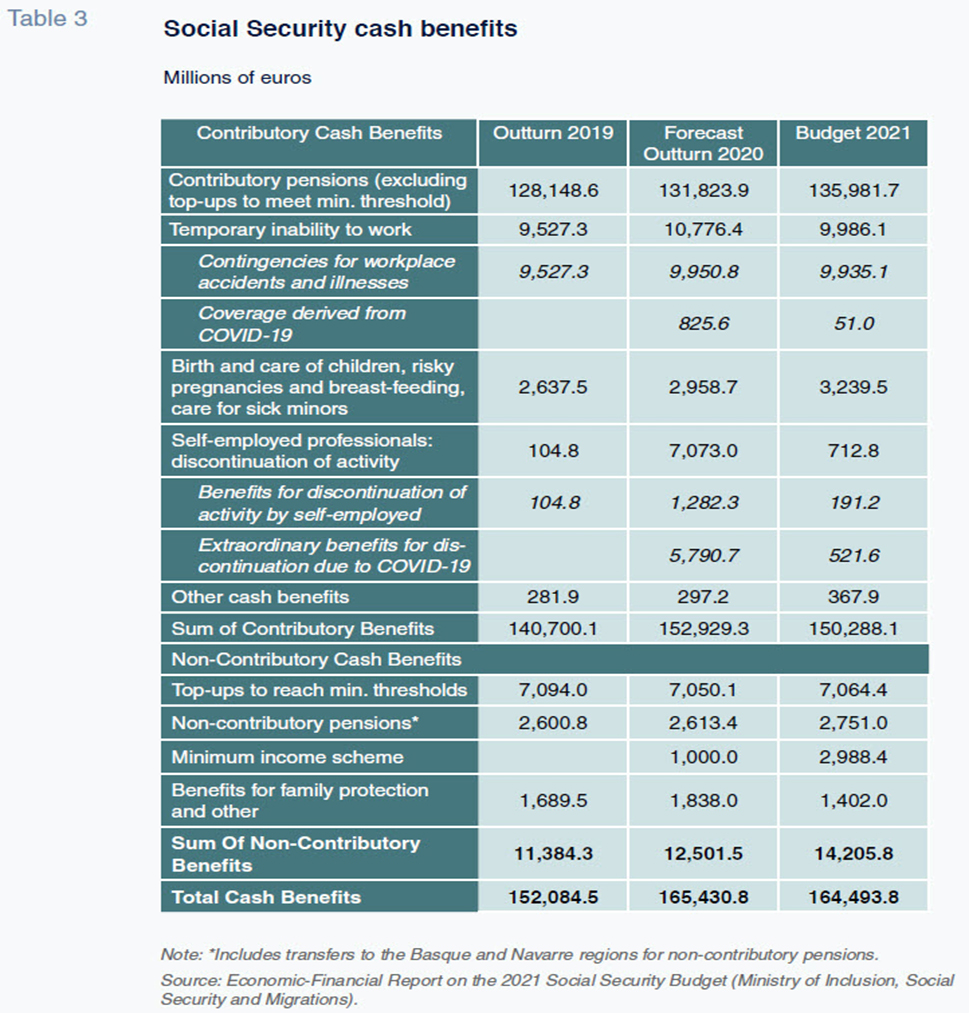

On the expenditure side (Tables 1 and 3), certain headings register sharp decreases, mainly those related with COVID-19: income support for the self-employed (-6.36 billion euros) and the temporary sick leave benefits associated with COVID-19 (-774.6 million euros). On the other hand, the headings that registered the highest growth include contributory pensions (+4.17 billion euros), the minimum income scheme (+1.99 billion euros) and transfers for dependency care (+896.7 million euros). In the case of contributory pensions, the impact of their restatement by 0.9% is estimated at 1.29 billion euros (Government of Spain, 2020); the remaining projected growth is the result of the estimated rise in the number of pensions and in the average pension size. In light of how the pandemic has evolved during the first few weeks of January and the measures the government has recently agreed upon with the associations of the self-employed which entail extending the current benefits scheme until May 31st, it seems clear that the amount set aside for income support for self-employed professionals will fall short of the mark and that this will also have a negative impact on income from contributions.

On the revenue side (Table 2), taxpayer contributions to the Social Security are expected to increase by 3.8% (+4.54 billion euros). That headline figure masks even stronger growth in contributions by employers and employees (+7.13 billion euros), which is offset by a sharp drop in contributions from the public employment service on behalf of recipients of jobless claims (-2.59 billion euros). However, those forecasts may similarly be altered by the extension of the furlough scheme beyond the current deadline of January 31st and that measure’s effects via contributor tax relief, as well as by less dynamic job creation than the government initially forecast for 2021. As for the transfers from the state, more noteworthy than the quantitative growth (+823.7 million euros) is the change in the use of funds. In 2020, those transfers amounted to 30.29 billion euros, of which nearly half (14 billion euros) went to cover the drop in revenue and growth in expenses related with COVID-19, while 1.33 billion euros was earmarked to shore up the system’s financial equilibrium. In 2021, both those headings will be eliminated and replaced by a new one – in the amount of 14 million euros – designed to comply with the first recommendation of the Toledo Pact Assessment dated November 2020. Elsewhere, the transfer contemplated to cover the minimum income scheme has been increased to 3.02 billion euros. The remaining state transfers are earmarked for highly specific uses – top-ups for contributory pensions, non-contributory pensions, family protection and other benefits – and do not change significantly.

As shown in Table 2, total current transfers from the state to the Social Security budgeted for 2021 are similar to the estimate for 2020, but the composition differs considerably. Firstly, the extraordinary 2020 contribution to cover the needs derived from the COVID-19 pandemic are eliminated from the 2021 budget and a new – permanent – transfer is added in the amount of 13.93 billion euros. Secondly, the 2021 budget factors in the rollout of the minimum income scheme, which is allocated the sum of 3.02 billion euros.

Cash benefits constitute the most significant expense heading. Those are transfers that go directly to the beneficiaries and account for over 95% of consolidated spending by the Social Security. Outlays in respect of contributory pensions, including top-ups to reach minimum thresholds, represent 83% of total budgeted expenditure. As such the trajectory of this heading is critical to future expenditure projections and the financial sustainability of the system as a whole. Among noteworthy benefits that stand out included those earmarked for temporary disability and the extraordinary benefits paid out to self-employed professionals affected by business restrictions (Table 3). In total, the contributory benefits account for over 90% of expenditure on cash benefits, while non-contributory benefits, which are financed from tax revenue, account for a little under 10%.

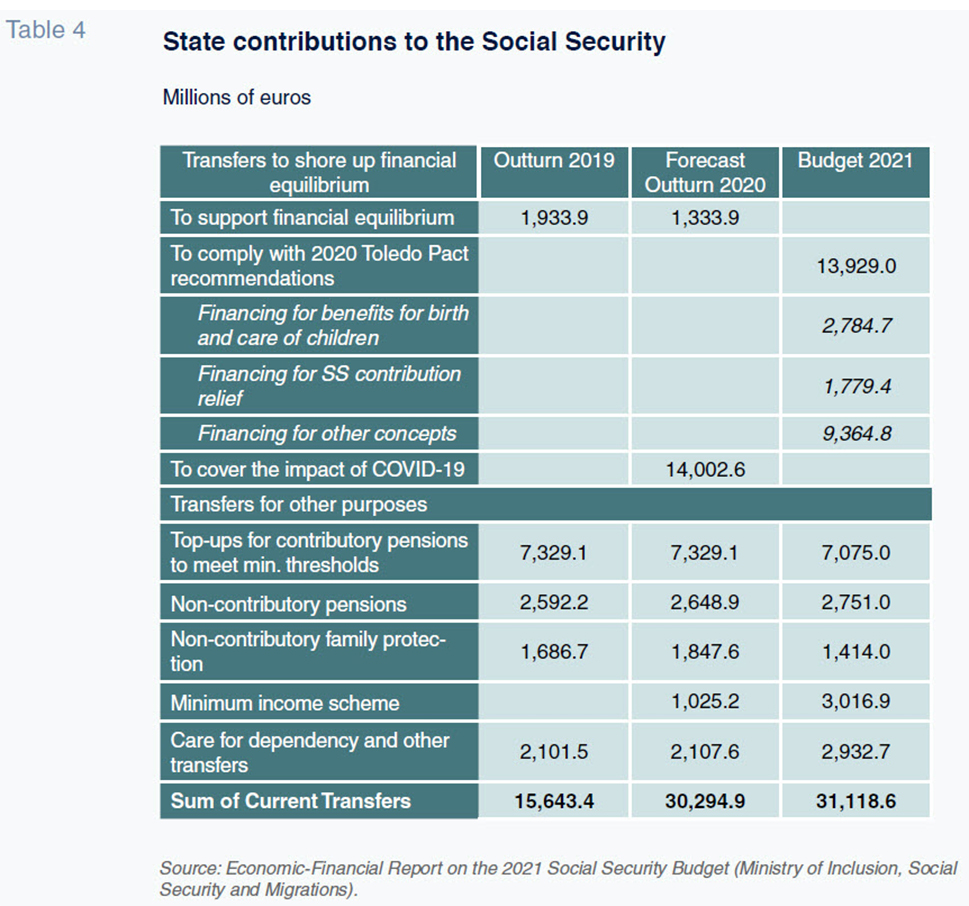

The state’s financial support for the Social Security mainly takes the form of transfers which, since the enactment of the Toledo Pact in 1995 and, later, Law 24/1997, on the consolidation and rationalisation of the Social Security system, are tied to the financing of non-contributory benefits. However, the process of separating the sources and uses of funding was not finalised until 2013, when it was agreed to finance top-ups to contributory pensions to meet minimum thresholds with transfers from the state budget. As is shown in Table 4, there are a number of transfers that are earmarked to finance specific benefits, notably contributory pension top-ups, non-contributory pensions and, since 2020, the minimum income scheme. The bigger changes are found in the transfers made with the aim of shoring up the Social Security’s financial equilibrium.

The Social Security budget for 2021 is also shaped by regulatory developments that reflect the government’s intention to reinforce the system’s funding via state transfers, i.e., to finance a higher percentage of expenditure via tax revenue. Law 11/2020 (December 30th, 2020) on the state budget for 2021 (2021 Budget Act) introduces a new provision to the General Social Security Act to enact an annual state transfer. These funds offset the cost to the system implied by the contribution relief provided to certain groups, cover the contribution gaps affecting pension calculations, and support early retirement schemes when additional contributions have not been contemplated. To that end, the 2021 Budget Act details the use of the contributions by the state to the Social Security’s budget, specifically the use of 13.93 billion euros in new, permanent, transfer obligations (Table 4).

Elsewhere, the 2021 Budget Act introduces major reforms to complementary welfare benefits. The upper limit on the deduction of pension plan contributions from taxable income has been reduced and the tax relief has been shifted to employment plans. In a bid to broaden the use of pension plans, the government plans to set up pensions plans to be sponsored publicly with management awarded via open tender.

Social Security budget deficit

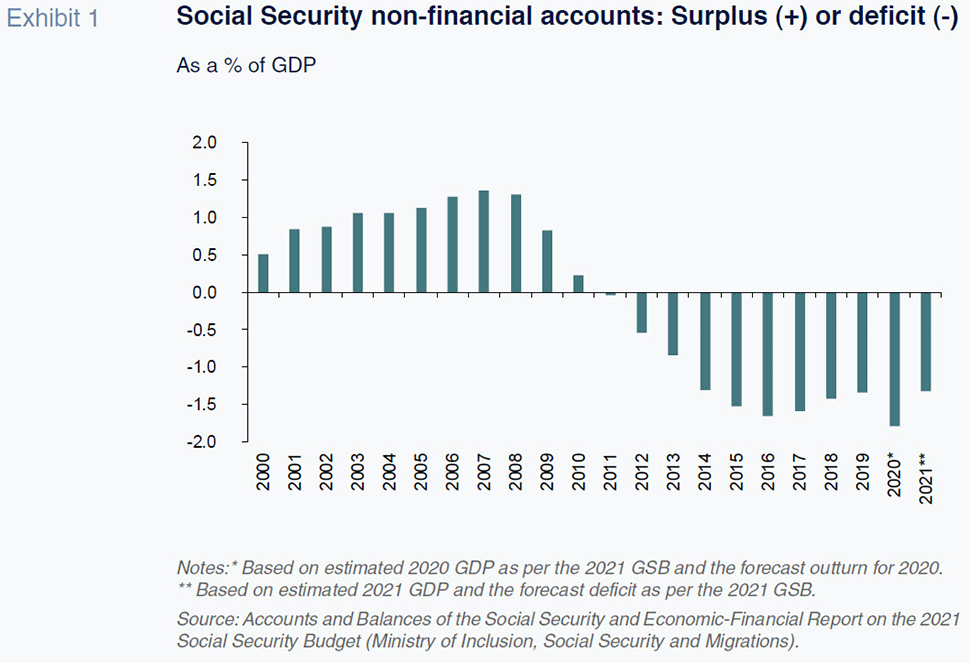

The key issue facing the Social Security is its budget deficit. That deficit has been stuck at around 1.5% of GDP since 2014 (Exhibit 1). Even before the COVID-19 crisis, Spain’s independent fiscal institute, AIReF (2019), had forecast a structural deficit of between 1.3% and 1.5% of GDP.

The surpluses accumulated in the so-called Reserve Fund during the years of growth in the Spanish economy (when the Social Security recorded a surplus), plus the return earned thereon, has since been used to cover a portion of the Social Security’s deficits, to the tune of 80.34 billion euros between 2012 and 2019. However, those funds set aside to cover the system’s future needs in terms of contributory pensions have not been sufficient to make up for those deficits in full and the state has had to step in with loans and transfers.

The state lent the Social Security money in the 1990s, a time when the Social Security was managing the public healthcare system (Insalud). The first loan was to cover obligations pending allocation to the Insalud budget while subsequent funds financed the Social Security’s deficit and treasury needs. At year-end 2016, the Social Security had 17.26 billion euros of debt. Nevertheless, as noted by the Court of Auditors (Tribunal de Cuentas, 2020), the state’s budget laws estimated the contributions the Social Security had to earmark to Insalud between 1989 and 1998 at 32 billion euros. This is despite the universalisation of healthcare introduced by the General Health Act of 1986 and the separation of funding sources embarked on in 1989, when the state was contributing 70% of the financing for healthcare provision funded by the Social Security. Unquestionably, changes of such a magnitude require sufficiently long periods of adaptation, including on the financing front. That being said, the volume of healthcare costs funded from contributions significantly outweighed the volume of state loans to the Social Security during the 1990s. Although the Social Security’s balance sheet includes those loans within its long-term liabilities and some of those loans have since fallen due, the state has not sought their repayment. The Court of Auditors (2020) has reiterated the fact that there is “no reason to justify maintaining those borrowings on the Social Security’s balance sheet”, going on to urge, “solutions to enable the definitive write-off thereof” (p. 36).

In the wake of the Great Recession, the Social Security’s finances deteriorated, leaving a deficit that increased from 5.67 billion euros in 2012 to 18.53 billion euros in 2016 (Exhibit 1). It was possible, however, to cover all of those deficits via drawdowns against the Reserve Fund, so that the Social Security did not have to take on additional borrowings at that stage (Bandrés, 2019). The rapid drop in the Reserve Fund balance and the potential political fallout from its depletion opened the door to fresh loans from the state and a commitment to supplementing the system’s non-financial income with transfers earmarked specifically to achieving a balanced budget. Between 2017 and 2021, state loans to the Social Security will reach 82.02 billion euros, with a peak sum of 30.33 billion euros granted in 2020 in the context of the COVID-19 crisis.

The successive governments that had to navigate the Great Recession and tackle the fallout on the Social Security’s accounts were aware of the structural nature of the deficit in the contributory pension system, as evidenced by the reforms passed in 2011 and 2013. At this point it was clear that the shortfalls that could be covered from the Reserve Fund were no match for the forecast growth in pension spending in the decades ahead. However, the sustainability factor and the new pension restatement index approved in 2013 were suspended in 2018, leaving new pension reform measures pending.

The government has set itself the target of balancing the Social Security’s budget in 2023 by means of increased transfers from the state, i.e., tax-driven financing of what have been dubbed the system’s “undue expenses”. By “undue expenses” the government refers to relief from company contributions in order to stimulate job creation; the benefits provided for the birth and care of children; pension supplements for maternity; support measures (implicit grants) for special regimes for specific sectors; coverage of contribution shortfalls and operating expenses. In providing testimony before the Toledo Pact Committee, the Minister for Inclusion, Social Security and Migration estimated “undue expenses” in 2023 at 22.87 billion euros.

The government has therefore sought to adopt one of the two recommendations made by Spain’s independent fiscal institute in its Opinion 1/19 (AIReF, 2019), specifically that of having the state assume the financing for the above-mentioned expenses in order to eliminate the Social Security’s prevailing structural deficit in the near-term. The other recommendation made by AIRef was to increase, in relative terms, the contributions earmarked to common contingencies (payment of pensions) at the expense of the unemployment insurance allocated to the state public employment service (SEPE for its acronym in Spanish).

It is questionable whether all of the concepts classified by the government as “undue” warrant such categorisation. For instance, the contributory benefit for the birth and care of children or operating expenses should be borne by the specific insurance policy holders/beneficiaries and not by the country’s citizens as a whole. Moreover, charging costs of that nature to the state budget or delegating a portion of the unemployment contributions to finance the Social Security’s general contingencies clearly does nothing to address the budget deficit in the public sector as a whole, which has been exacerbated by the adverse effects of COVID-19.

Taking a longer time horizon, the projections for pension spending and the revenue allocated to fund it reveal a growing gap between the two metrics. Employer contributions trend in line with nominal GDP due to the correlation with salaries. The latter correlate to productivity, making it unlikely that contributions will increase as a percentage of GDP unless changes are made to the bases or contribution rates. Pension spending, on the other hand, is widely expected to increase as a percentage of GDP by between 4 and 6 percentage points over the next 30 years, depending on the demographic and economic assumptions made (De la Fuente, García Díaz y Sánchez, 2018; García Díaz, 2019 and Conde-Ruiz, 2019).

The Social Security’s current structural deficit implies that measures are needed to ensure the stability of the pension system and Spanish public sector. If the political will is to recalculate pensions in line with inflation, it will be necessary to change the rules for qualifying for pension receipt by adjusting the retirement age and the calculation methodology. In short, Spain needs to reduce the pension replacement rate in relation to average earnings and the last earnings received by retirees.

With this in mind, AIReF (2019) recommended two specific reforms which the government has built into its pension system reform programme: (i) modification of the requirements for qualifying for a pension in order to push back the effective retirement age and bring it closer to the statutory age; and, (ii) gradually increase the stipulated contributory period required to receive a full pension from 25 years in 2022, to 35 years.

These two proposals are still subject to specific regulations, which will require parliamentary and social support for their approval. The sooner that dialogue begins and the reforms are implemented, the greater the scope for distributing the costs of the related adjustments across multiple generations.

References

AIReF (2019). Opinion on the sustainability of the Social Security system. Opinion, 1/19.

BANDRÉS, E. (2019). Las cuentas de la Seguridad Social [The Social Security’s Finances]. Papeles de Economía Española, 161, pp. 2-16. Madrid: Funcas.

CONDE-RUIZ, J. I. (2019). Pensiones del Siglo XXI [Pensions in the 21st Century]. Papeles de Economía Española, 161, pp. 29-41. Madrid: Funcas.

CONGRESO DE LOS DIPUTADOS (2020). Informe de evaluación y reforma del Pacto de Toledo [Toledo Pact Assessment and Reform Report]. Official Journal of the General Courts, No. 175, November 10th 2020, pp. 14-126.

DE LA FUENTE, A.; GARCÍA DÍAZ, M. A. y SÁNCHEZ, A. R. (2018). La salud financier del Sistema público de pensiones español: proyecciones a largo plazo y factores de riesgo. Fedea Policy Papers, 2018/03.

GARCÍA DÍAZ, M. A. (2019). Situación actual y perspectivas del sistema público español de pensiones [Spanish Public Pension System: Status and Outlook]. Papeles de Economía Española, 161, pp. 17-28.

GOVERNMENT OF SPAIN (2020). Plan Presupuestario 2021 [Draft Budget for 2021] October 15th, 2020.

TRIBUNAL DE CUENTAS (2020). Informe de Fiscalización sobre la evolución económico-financiera, patrimonial y presupuestaria del sistema de la Seguridad Social y su situación a 31 de diciembre de 2018 [Court of Auditors oversight report on controls over the performance of the Social Security system in financial, wealth and budget terms and situation as of year-end 2018].

Eduardo Bandrés Moliné. Funcas and University of Zaragoza