Interest rates and the banking business post pandemic

While central bank policies, such as ultra-low interest rates, have staved off liquidity crunches and episodes of heightened uncertainty, they have also distorted financial markets, reduced bank profitability, and potentially undermined the ability of central banks to meet their medium-term inflation targets. As the economy recovers and interest rates potentially rise, central banks will need to consider other actions that support the health of Europe’s banking sector.

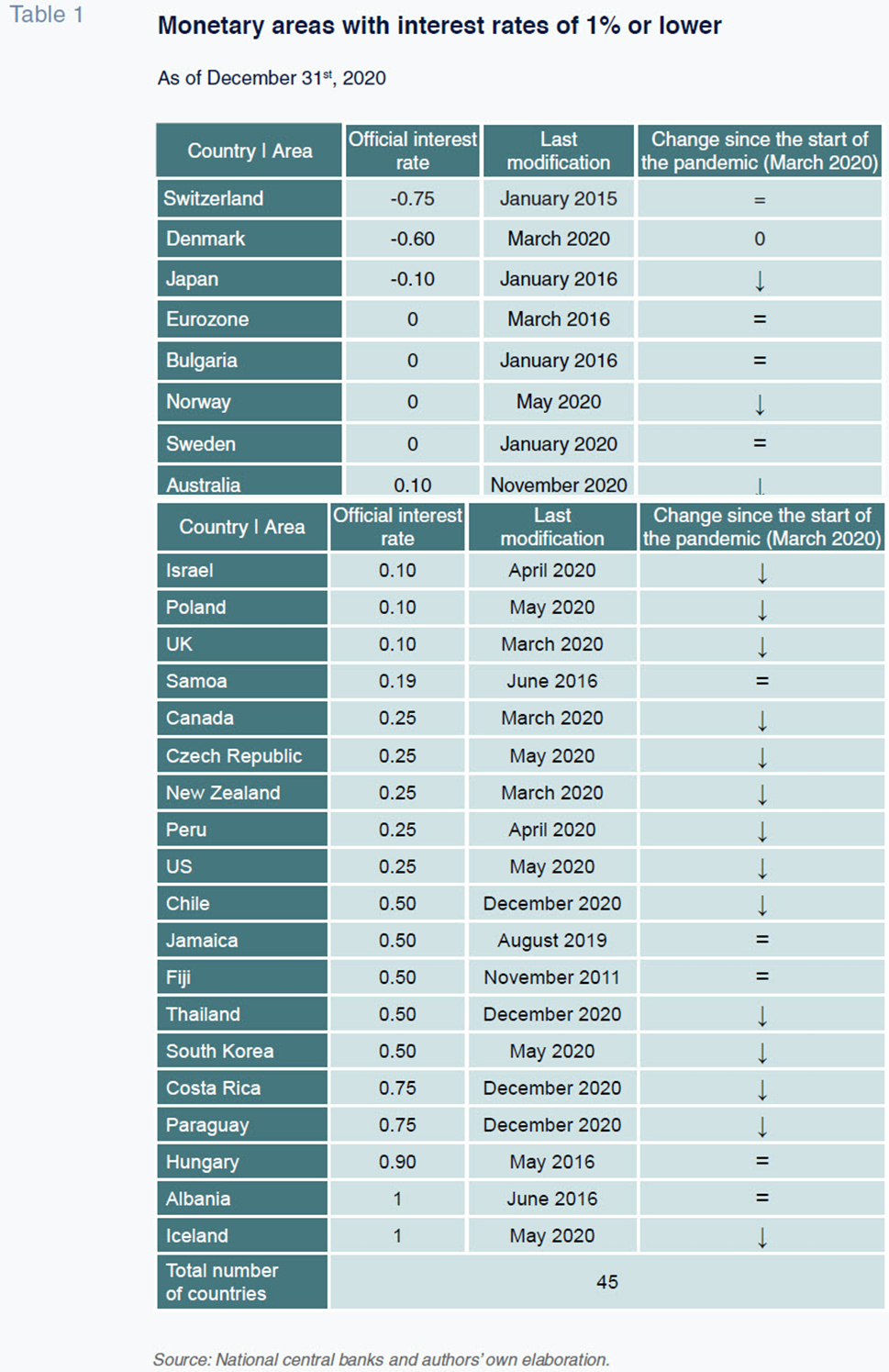

Abstract: The pandemic has led monetary authorities to extend their expansionary policies and shaped the expectation that they will remain lax until at least 2022. Currently, some 45 central banks have introduced interest rates at or below 1%, and yet inflation has remained low. Moreover, the prolongation of ultra-low interest rate levels is generating considerable distortions in the financial intermediation business and in the financial markets. Monetary policy has staved off liquidity crunches and episodes of heightened uncertainty, but it has also facilitated the accumulation of credit risk and debt and placed downward pressure on retail banks’ profitability. Additionally, there are concerns that the extraordinary levels of debt accumulated in recent years will make it harder for central banks to meet their inflation targets, thereby reducing their credibility. Looking to 2021, there are several possible scenarios that could emerge, including a continuation of current monetary policies as the economy recovers, a resurgence in inflation due to expansionary fiscal and monetary policies, or a delayed recovery requiring the extension of monetary stimulus measures. Regardless of which scenario develops, central banks can offer additional support to the banking sector through the creation of a ‘pandemic insurance policy’ that prevents the impairment of loan quality, a pan-European financing plan, reducing minimum reserve requirements, and raising the deposit facility rate.

Introduction

On the monetary policy front, 2020 was marked by the extension of expansionary policies by nearly all central banks in response to the uncertainty sparked by the pandemic. Before the onset of COVID-19, monetary policy was already controversial, mainly due to the protracted nature of the stimulus measures and, more specifically, the potential collateral damage of keeping rates ultra-low, at zero or even at negative levels. There has even been some debate about central banks’ mandates with respect to inflation in light of possible developments in 2021. In a year marked by major fiscal and monetary stimulus measures on both sides of the Atlantic, an increase in prices would be expected, which, within certain limits, would lead to rising interest rates or relatively tighter liquidity conditions. However, this looks unlikely for 2021. After years of aiming for inflation, central banks are in no rush to achieve this goal, with the risks associated with the pandemic weighing heavily on projections and policy action.

This paper analyses the effects of unconventional monetary policies, particularly the impact of negative or ultra-low interest rates on the banking business as well as the outlook for 2021. First, we analyse some of the central banks’ and supervisory bodies’ recent decisions relevant to the banking business. Last December, the Federal Reserve decided to leave its benchmark rates within a target range of between 0% and 0.25%. The US monetary authority also stepped up the purchase of assets in response to the economic fallout from the pandemic. In its statement, the Fed noted that the “COVID-19 pandemic is causing tremendous human and economic hardship in the US and around the world. Economic activity and employment have continued to recover but remain well below their levels at the beginning of the year”. Moreover, in its forward-looking guidance it said it would aim to achieve inflation “moderately” above the target rate of 2% for some time so that inflation actually averages 2% over a given period. In line with this aim, the Fed does not expect to increase rates in the medium-term. Also noteworthy is its decision to increase asset purchases to $120 billion per month until substantial progress has been made on achieving the Fed’s employment and price stability goals.

In December, the European Central Bank (ECB) decided to leave the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility intact at 0.00%, 0.25% and -0.50%, respectively. It also said that it expects its official interest rates to “remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon, and such convergence has been consistently reflected in underlying inflation dynamics.” The ECB also increased the size of its pandemic emergency purchase programme (PEPP) by 500 billion euros to 1.85 trillion euros and extended the horizon for its net purchases until at least the end of March 2022. In the wake of expansionary decisions taken during the December meeting, as expected, no further policy action was taken by the ECB at its January meeting.

The decisions taken on both sides of the Atlantic suggest that banks operating in the US and eurozone will continue to face extraordinary financing conditions for some time. Banks are also facing a number of additional challenges given that the pandemic implies new headwinds on both the business and credit risk fronts, which will weigh on their market values. Other recent developments, such as the limits imposed on dividend distributions, have also taken a toll. On December 15th, 2020, the ECB issued a statement asking banks to refrain from distributing dividends or at least limiting them until September 30th, 2021. Specifically, it said that it wanted “dividends to remain below 15% of cumulated profit for 2019-20 and not higher than 20 basis points of the CET1 ratio.” Although the latest decisions leave a small amount of room for manoeuvre compared to the previous stricter limits, the dividend restrictions will put downward pressure on banks’ share price.

The effects of protracted ultra-low rates on the banks

Presently, there is considerable disagreement about the effects of unconventional monetary policy measures and the direction they should take. [1] On the one hand, there is some consensus that the quantitative easing and ultra-low rates were crucial tools in tackling the long-term effects of the financial crisis and economic recession. In the absence of other options, these tools have helped preserve liquidity and market stability during the COVID-19 crisis. On the other hand, an increasing number of critics worry about the potential existence of an effective lower bound, or ELB, below which interest rates do not efficiently transmit monetary policy.

The evidence shows that negative rates have had a very limited effect on stimulating inflation and lending. Empirical studies have demonstrated that, in certain circumstances, negative rates can even have a “reverse effect”, generating exactly the opposite reaction (less credit and lower inflation expectations) to that initially intended. The impact of unconventional monetary policies, including negative official rates, on the banks’ margins and profitability is also highly adverse. For example, in an environment where the yield curves imply scant, zero or even negative differences between short– and long-term rates, core banking business (raising short-term deposits and providing long-term financing) struggles to generate a profit.

As shown in Table 1, benchmark rates are at or below 1% in 45 countries (some of which are part of common monetary areas). Since the start of the pandemic, only Denmark has raised its official rates; however, after that rate increase it still presented one of the lowest rates in the world (-0.60%). At prevailing levels, rates are having additional adverse financial effects beyond the core banking business. The structure of financial markets (e.g. a proliferation of non-bank and shadow banking services) and liquidity levels (e.g. the accumulation of liquidity and short-term liquidity distortions) could be negatively affected, too. In addition, the widespread use of guarantees in unconventional monetary policy has increased the importance of the debt markets and some of the risks to financial stability. Companies that would normally fail or be obliged to restructure in a competitive market – zombie firms – are increasingly surviving, in part due to abundant liquidity fuelled by ultra-low rates. Although initially it seemed that the pandemic would trigger a cycle of business creation and destruction that would partly address these inefficiencies, the protracted availability of high-risk financing in the bond markets suggest the opposite has occurred. The resilience – on paper only – of those non-viable firms undermines average productivity and displaces growth opportunities for more productive firms. Negative rates also send confusing signals to investors about price formation and economic expectations. These effects are creating considerable distortions in the money, stock and real estate markets.

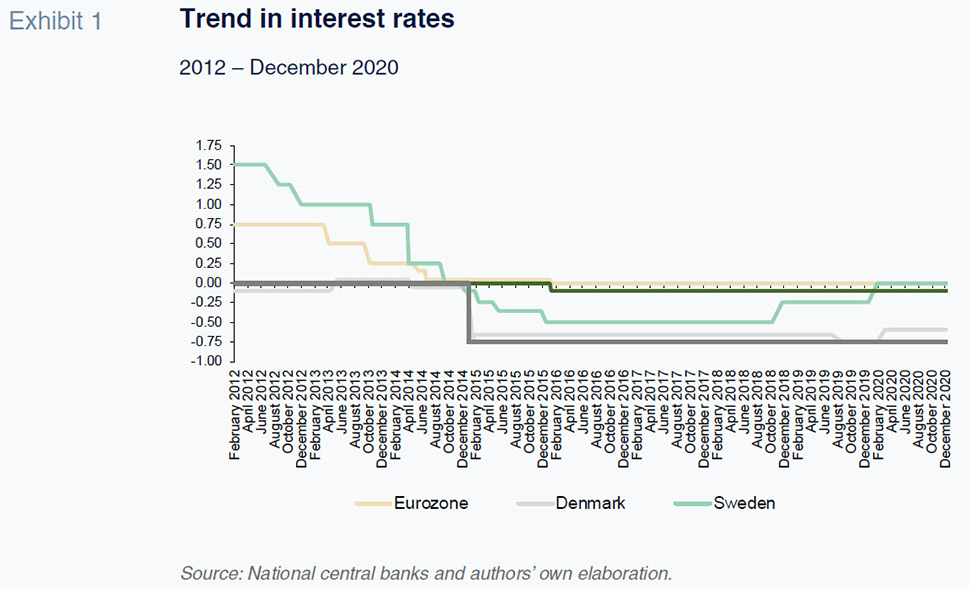

As shown in Exhibit 1, 2019 suggested a shift in monetary policy trends was on the horizon. Some central banks appeared to be moving towards monetary tightening when, towards the end of the year, the threat of recession followed by the pandemic a couple months later, prompted them to leave rates at close to zero or at negative values. In 2020, the quantitative easing response was overwhelming. Since the scale of the pandemic became apparent, the four main central banks (Federal Reserve, ECB, Bank of England and Bank of Japan) have injected 3.8 trillion euros of liquidity, weighing heavily on long-term fixed-income rates and flattening or inverting yield curves.

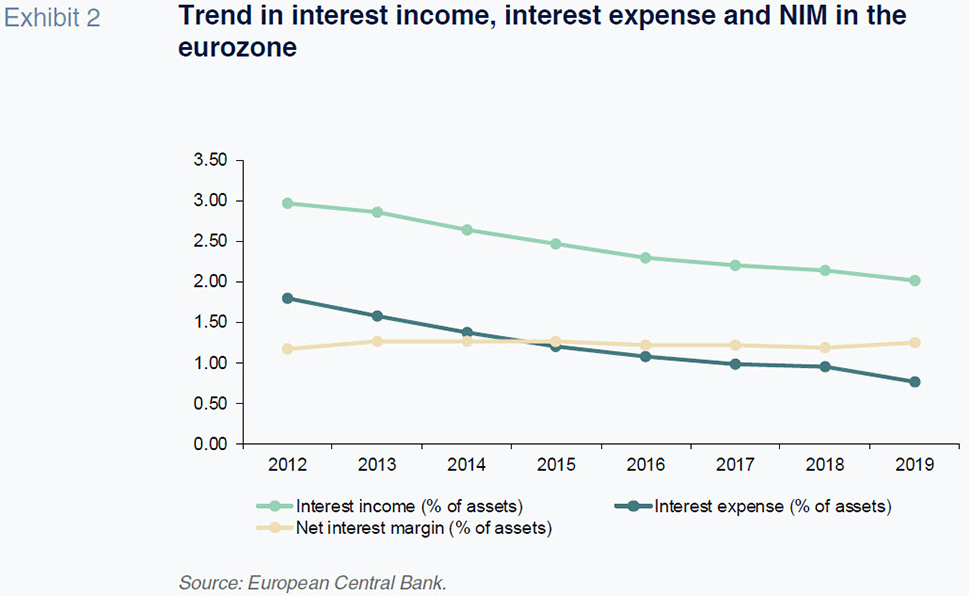

As is shown in Exhibit 2, the resulting levels of official rates and benchmark rates for public and private debt drove interest income and interest expense lower for banks, lowering the average spread between them within a range of 1.1% and 1.3% of assets.

Looking to 2021, there are several possible scenarios that could emerge. The baseline scenario is that the economy will recover as inoculation rates increase. Nevertheless, inflation is expected to remain subdued in this scenario, with monetary policy remaining unchanged until 2022. However, there are two plausible alternative scenarios. The first relates to the possibility of a reasonably vigorous economic recovery, underpinned by considerable fiscal stimulus measures alongside a starkly expansionary monetary policy. Together, these dynamics would fuel a stronger than expected rebound in inflation, requiring monetary policy tightening. The other possibility is that the recovery takes longer than anticipated so that the monetary stimulus measures are left in place for as long as expected or even longer.

There is also an additional consideration regarding the role of inflation in shaping monetary policy and the impact it could end up having on banks and financial markets. Of particular concern is the credibility of inflation targets as the key mission of monetary policy. In the academic world, some observers maintain that the extraordinary levels of debt accumulated in recent years will make it harder for central banks to uphold their commitment to achieving inflation in the medium-term. Some go further still, suggesting that central banks are not setting rates on the basis of the outlook for inflation but rather on the basis of what they believe to be the “natural” interest rate (that which would prevail during times of macroeconomic stability) for certain trends to be sustainable. Those trends include a series of accumulated structural changes, such as the growth in debt, an ageing population and stagnant productivity growth in many economies.

A more conciliatory take is that central banks have identified the structural changes in the economy that are affecting inflation in new ways. The idea is that the natural interest rate has been falling gradually in advanced economies due to factors, such as population ageing and technological developments, that have shifted the balance between the supply of savings and demand for investment. What is unclear, however, is what the normalisation and exit mechanisms are and to what extent monetary policy is turning some of those changing or exogenous conditions (such as the build-up of debt) into endogenous ones.

Implications for the banking sector

Due to the heightened macroeconomic uncertainty resulting from COVID-19, certain central banks have used policy to encourage banks to play an active role in the economy. Examples of such policy action include the easing of capital adequacy rules to make it easier for banks to lend and encouraging banks to restructure loans or provide moratoriums. However, given the negative implications of prevailing low rates on the banking sector, several analysts have suggested stepping up central banks’ support to the banking sector in a number of ways:

- It is possible that if rates are raised too early in the recovery, non-performance could rise sharply. For this reason, the solvency of indebted businesses should be shored up to prevent significant impairment of loan quality. Viable firms should finance themselves temporarily using equity and recapitalisations (even using public funds) so that their financial predicament does not become too weak once a recovery takes hold. That would be equivalent to a “pandemic insurance policy” that ensures ongoing financial stability and facilitates a return to more “normalised” rates. If such measures are not taken and rates remain low, in the long-run, there is a risk that the banks’ margins and lending activity will be eroded further.

- To continue to ensure a secure financial environment and natural rate adjustment, the loans provided to businesses during and immediately after the pandemic could be supported by a pan-European financing plan to complement the national and EU fiscal stimulus plans.

- Given the feasible co-existence of low official rates and inflation, central banks must guarantee adequate monetary conditions for banks. One way of doing that would be to take more decisive action regarding the multi-tier rate system to give Europe greater flexibility, by raising the deposit facility rate. In addition, emulating the experience stateside, the ECB could reduce its minimum reserve requirements.

In general, it would also be advisable to study in greater depth whether ultra-low rates are achieving their objectives and not complicating matters further. Specifically, it should be ruled out that the much-feared “reverse effect” is not at play or about to occur.

Notes

Santiago Carbó. University of Granada and Funcas

Pedro Cuadros Solas. CUNEF and Funcas

Francisco Rodríguez. University of Granada and Funcas