The yield curve and the bank-public debt nexus

For banks, higher rates mean better interest income, but also higher debt servicing costs for households and businesses and a decline in the value of securities held on banks´ balance sheets. In this context, for the first time since the Eurozone Crisis, the bank-public debt nexus is under renewed scrutiny, as monetary tightening unsettles markets and yield curves shift up.

Abstract: The upward shift in yield curves since mid-2021 carries major implications for European banks. On the positive side, interest rate tightening foreshadows a period of increasing short-term rates, which will support retail bank net interest income following five years of negative rates and downward pressure on margins. On the negative side, rate hikes portend adverse effects for European banks through two channels: i) higher borrowing and energy costs may impact households’ and businesses’ ability to service their debts with implications for rising non-performing loans; and, ii) the direct and immediate losses on public debt securities held by the banks on their balance sheets. The effect of losses on bank balance sheets related to public debt securities threatens reviving memories of the sovereign-bank risk loop unleashed in the eurozone between 2010 and 2012 via the bank-public debt nexus, but there are noteworthy mitigating factors. In the case of Spain, two factors mitigate the fact that domestic sovereign debt exposures are slightly above the European average in terms of their sensitivity to impairment losses on those portfolios. The first is the average maturity of the public debt portfolios, which is shorter in Spain than in Europe and the second is how those exposures are classified for accounting purposes, which, among other things, translates to lower volatility.

Yield curve trends foreshadow margin expansion

Interest rate curves have shifted significantly upwards in both the eurozone and the US, discounting rate interventions by the respective central banks in response to inflation. Inflation is increasingly showing symptoms of becoming persistent and causing second-round effects. The run-up in energy and commodity prices caused by the conflict in Ukraine has prolonged, accelerated and broadened the surge in inflation. Accelerating and above target inflation was initially observed in mid-2021 when the ‘end’ of the pandemic revealed a sharp mismatch between robust demand and tight supply, restricted by the bottlenecks related to closures and lockdowns.

The uptick in rates was initially very good news for the banks’ stock prices as investors´ expectations began to envision the end of zero or negative rates. For more than five years, low rates had eroded net interest income in the retail banking business, a topic closely followed in previous articles of this publication.

The European Central Bank (ECB) has acknowledged that rate normalisation will be highly beneficial for the European banks’ margins. To showcase this potential, the ECB’s most recent Financial Stability Review simulates the impact of a parallel upward shift of the yield curve by 200 basis points on the European banks’ net interest margins. For a sample of 80 significant institutions, the ECB estimates a sizeable positive impact equivalent to between 2 and 4 percentage points in terms of their return on equity (ROE). Within that range, Spanish banks fall at the high end of sensitivity to rate increases as the percentage of loans extended at floating rates in Spain is relatively high.

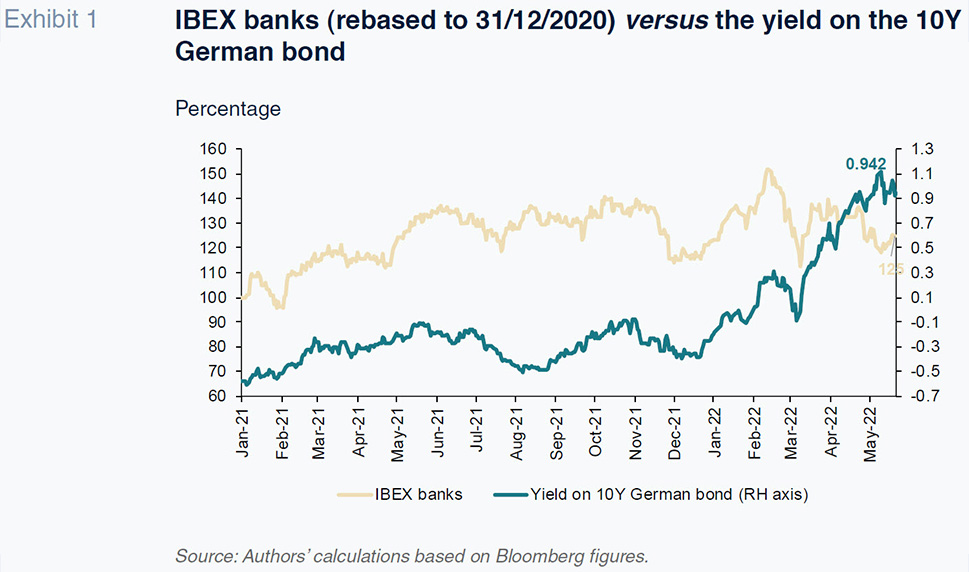

The discounting of the favourable impact of higher rates on net interest income is likely behind the strong performance of European banks’ stocks recently, in addition to the uptick in German bond yields (Exhibit 1). Movements in both these variables are unquestionably the purest embodiment of future expectations for short-term rates.

That initial increase in the banks’ stock prices in response to the upward shift in yield curves has fallen back considerably in recent months. This trend has given way to concerns over a bank-public debt nexus that is considerably more complex to assess than the bright outlook for margin recovery. The intensification and persistence of inflationary pressure is also fuelling a growing fear of damage to economic growth. These concerns have focused on the erosion of household consumption via higher prices as well as the effect of higher rates on more highly leveraged households and businesses.

The ECB’s Financial Stability Review also contained vulnerability analysis modelling adverse growth and inflation assumptions related to the energy shock and the knock-on effects for credit impairment. In response to this scenario, the ECB estimates that the probability of default would increase by between 3 and 5 percentage points over the next two years. It should be noted that estimates were dispersed across a wide range depending on the sector, are highly uncertain, and will likely warrant constant revision.

Bank-public debt portfolios

There is another –direct and immediate– link between the shift in yield curves and bank share prices, namely the volume of public debt (and fixed-income securities in general) recognised on the banks’ balance sheets. As rates rise, the market value of those portfolios will fall significantly, with ramifications for the banking sector, in terms of earnings, equity or value depending on how those fixed-income holdings are treated for accounting purposes. The potential fall in the value of public debt holdings will compound the effects of possible impairment of credit quality due to stressed yield curves.

The link between the value of the stock of public debt and the impact on bank balance sheets played a prominent role in the financial crisis of 2010-2012. This relationship gave rise to the so-called “doom loop”, in reference to the nexus between sovereign and bank risks, and both accelerated and amplified the eurozone financial crisis. Indeed, the push for a Banking Union was largely spurred by an attempt to protect against that nexus, so that no bank’s perceived risk or solvency would be affected by the level of public borrowings of their home state.

The crises that have unfolded over the past two years –the pandemic followed by the war– have once again moved the spotlight on to the bank-sovereign nexus. While this issue likely has a reduced capacity to disrupt financial markets to the extent seen during the last financial crisis, it is still worth paying close attention to.

The International Monetary Fund’s (IMF) spring issue of the Global Financial Stability Report (GFSR) was the first to recall the nexus, albeit noting that it was largely limited to emerging economies. Specifically, the IMF’s GFSR highlights how the pandemic has brought the bank-sovereign nexus to the fore in the emerging economies with particular intensity through the heavy issuance of public debt needed to fund pandemic support programmes, and large absorption of that public debt by local banks. As a result, according to the data published by the IMF, those local banks’ public debt holdings have increased considerably towards around 15% or 20% of their total assets.

The same is not true in the advanced economies (Europe and the US mainly). The main buyers of the pandemic debt issuance by sovereigns have been the corresponding central banks (the Federal Reserve, ECB, and Bank of England) under the umbrella of their asset purchase programmes, framed as part of their quantitative easing policies. According to the GFSR, as a result, the incidence of public debt holdings across advanced economy banking sectors is substantially lower.

That has not stopped the IMF from reviving the old debate about the regulatory treatment of the banks’ public debt exposures. The debate around regulatory treatment focuses on either assigning different capital requirements as a function of sovereign ratings (capital surcharges) or by means of risk concentration limits that would curtail exposure to home market public debt.

An additional factor that could further exacerbate the bank-sovereign nexus in Europe is the risk of fragmentation across various national public debt markets if the ECB were to withdraw its stimulus measures too aggressively. In this regard, we highlight the end of the ECB’s Pandemic Emergency Purchase Programme (PEPP) under which the ECB was able to go beyond strict country shares when it came to repurchasing the public debt.

The ECB itself has flagged fragmentation risks. The ECB has pointed out that increases in the anchor rate –the German Bund– are resulting in uneven increases in sovereign bond spreads across other member states, with the most highly leveraged nations sustaining relatively greater spread widening. The divergence between the spreads of the various issuer countries has become considerably more exaggerated in recent weeks and constitutes one of the main sources of concern for the ECB with respect to potential collateral damage of its monetary normalisation effort.

This context makes it more important than ever to analyse the state of the Spanish banks relative to their European counterparts in terms of their domestic public debt holdings. This includes paying close attention to their sensitivity to movements in the corresponding curves and the potential accounting impacts, depending on how their investment portfolios are classified in their financial statements.

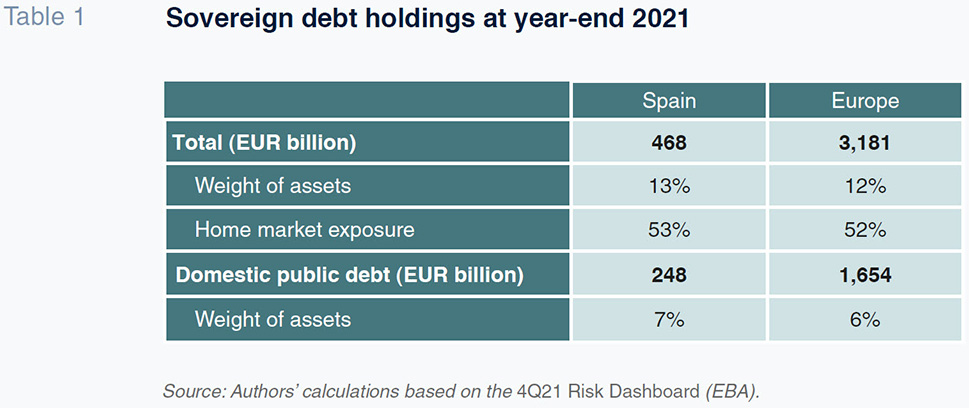

At year-end 2021, according to data published by the European Banking Authority (EBA) in its Risk Dashboard, Spanish banks held 468 billion euros of public debt. For Spain, 53% of these holdings (around 250 billion euros) were in domestic sovereign debt, with the European average of slightly lower at 52% of total sovereign debt exposure (Table 1). In relative terms, expressed as a percentage of total assets, the weight of domestic public debt exposures in Spain is just slightly above the European average, as shown in Table 1.

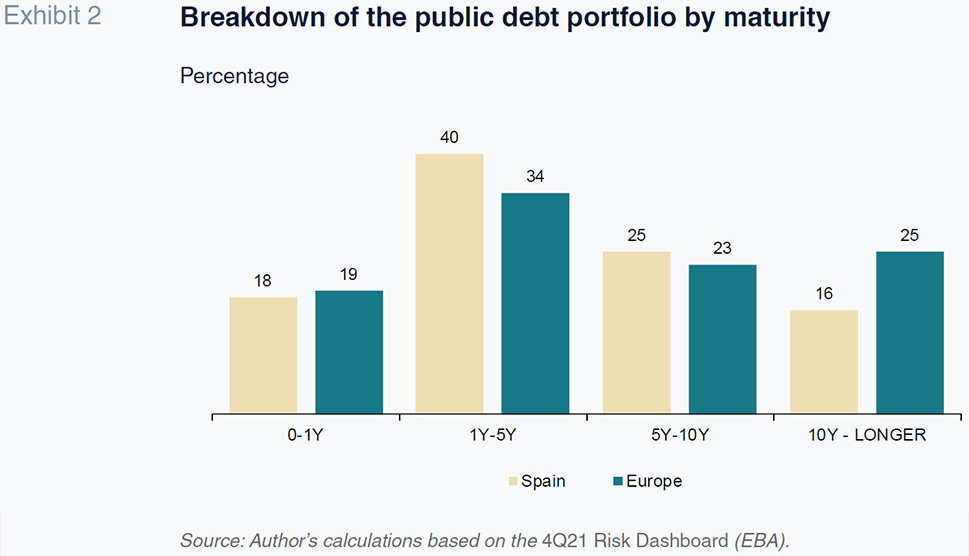

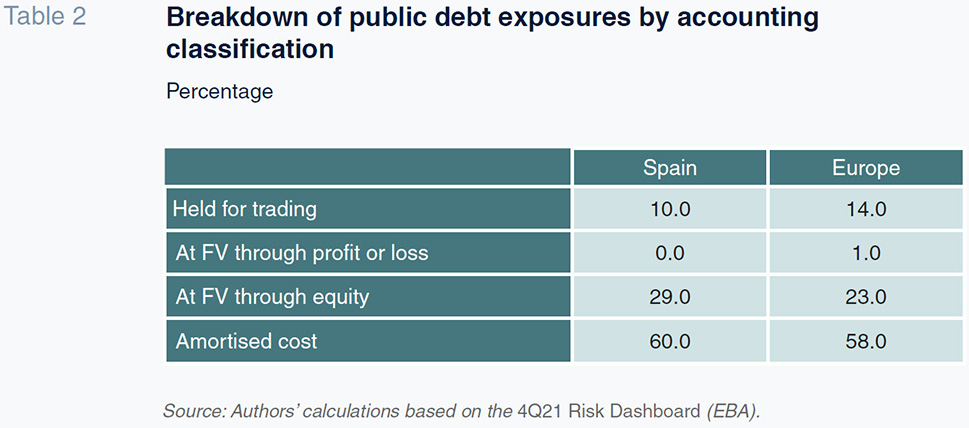

Two factors mitigate the fact that domestic sovereign debt exposures are slightly above the European average in Spain in terms of their sensitivity to impairment losses on those portfolios (the bank-sovereign nexus). The first is the average maturity of the public debt portfolios (Exhibit 2), which is shorter in Spain than in Europe and the second is how those exposures are classified for accounting purposes (refer to Table 2).

Based on the maturity profile data published by the EBA, the average duration of the public debt portfolios held by Spanish banks is estimated at approximately 4.1 years, compared to an average of 4.7 years across other European banks. The shorter duration of Spanish banks’ sovereign exposures helps offset their higher relative exposure in terms of share of assets, as well as the fact that the upward shift in the Spanish public debt curve has been somewhat more pronounced than the European average.

On the topic of how these exposures are classified for accounting purposes at Spanish banks, Table 2 highlights the percentage of assets classified as ‘held-for-trading’. In Spain, the level of assets held for trading is much lower at 10%, versus the European average of 14%. Held-for-trading assets are clearly the most volatile as the impact of changes in their valuations are reflected directly in the banks’ statements of profit or loss. Another 29% of the Spanish banks’ exposures (vs. 23% in Europe) are classified as financial assets at fair value through equity, while the bulk are carried at amortised cost (60%). That classification mixture has the capacity to mitigate the potential adverse effects of rate increases on Spanish banks. The fact that the bulk of exposures for Spanish banks are carried at amortised cost, means that potential valuation losses do not have to be recognised immediately in banks’ equity or earnings.

References

EBA. (2021). Risk Dashboard, Q4 2021. EBA, April.

ECB (2022). Financial Stability Review, May. European Central Bank.

IMF (2022). Global Financial Stability Report, April. International Monetary Fund.

Marta Alberni, Ángel Berges and María Rodríguez. Afi – Analistas Financieros Internacionales, S.A.