The financial risks posed by inflation

Rapid monetary tightening in response to persistent inflation carries serious risks for business and consumer borrowers. A higher-than-expected increase in borrowing costs would have significant knock-on effects for private sector financing with the property and mortgage markets particularly exposed following a period of robust growth, albeit the impact in Spain is expected to be moderate.

Abstract: Major monetary policy decisions were taken in June to curb rising inflation, which increasingly exhibits considerable structural traits. While central banks are acting, they acknowledge that if the exogenous supply factors contributing to high inflation persist, more aggressive measures would be needed. Central bank action also appears to be more aggressive than initially contemplated in response to rising market expectations. The timing of interest rate hikes should be cautious, due to possible impacts on consumers and businesses, especially if the economy and labour market were to deteriorate. To the extent that inflation remains at elevated levels (even less than present), the real interest rate will remain clearly negative. One of the markets most exposed to the rate environment is the property market and, relatedly, the mortgage market, albeit the impact in Spain is expected to be moderate. In Spain, new home prices increased at 10.1% year-on-year in the first quarter of 2022, with resale house prices not far behind, at 8.2%. Concurrently, home mortgages have been growing at around 1.2% year-on-year in recent months. Despite the sources of concern and uncertainty, business lending has been growing at a rate of 1% to 1.7% year-on-year from January to April 2022, but risks are rising. One such risk is a higher-than-expected increase in borrowing costs, especially if the sovereign risk premium rises, which would have significant knock-on effects for private sector financing.

Historic inflation, extraordinary measures

The series of developments accompanying hard to contain inflation appear to have shattered consensus forecasts and more timid expectations in June and have ushered in fears of sustained structural price increases. The uncertainty is being felt across financial markets, affecting both equity and fixed-income markets alike. For the first time, we are seeing an accelerated sell-off of both asset classes simultaneously, implying that the classic share and bond allocations for risk diversification purposes (e.g., the standard 60% equities versus 40% fixed income) are not of much use at present. There also appears to be no clear place for investors to take refuge. 2022 is turning out to be a challenging year from an investment perspective.

The biggest issue appears to be who should spearhead the effort to control inflation. While central banks constitute the first line of defence, inflation is being shaped not only by demand related factors that push core prices, but also others related with the growth in production costs and supply chain friction. The monetary authorities can help partially counteract the former but will be hard pressed to do much about the latter.

Central banks have been taking more forceful decisions as the structural component of prevailing inflation and lack of consumer and market confidence in how long it might take to tame inflation has become tangible. In the eurozone, the European Central Bank took definitive new steps on June 9th, when it made several announcements. First, it announced the end of net asset purchases under its Asset Purchase Programme (APP) from July 1st, 2022. Nevertheless, it reiterated its intention to “continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when it starts raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance”.

However, the biggest development was the ECB’s “careful review of the conditions which, according to its forward guidance, should be satisfied before it starts raising the key ECB interest rates”. The Governing Council concluded that those conditions have been met, announcing plans to increase its key rates by 25 basis points at its July monetary policy meeting. It also said it “expects to raise the key ECB interest rates again in September”, noting that the “calibration of this increase” will depend on the updated outlook for medium-term inflation, which appears to leave the door open to a bigger rate increase in September. The ECB stressed that after the summer it anticipates “a gradual but sustained path of further increases in interest rates”.

One week after that ECB meeting, June 15th, marked a fresh milestone in monetary policy decisions. Markets were continuing to signal a lack of faith in the measures taken to control inflation, while in Europe, the sovereign risk premiums across the south of the eurozone started to rise sharply, setting off alarm bells. In the US, the Federal Reserve, which had embarked on rate tightening earlier in 2022, stepped up its efforts. The Federal Reserve increased its benchmark rate by three quarters of a percentage point (75 bps), marking the most aggressive move since 1994. The Fed had already issued reports signalling that inflation seemed to be continuing to rise and that the measures taken to date were falling short. However, in its public statement, the US monetary authority emphasised the risks that are hard to control: “The invasion of Ukraine by Russia is causing tremendous human and economic hardship. The invasion and related events are creating additional upward pressure on inflation and are weighing on global economic activity. In addition, COVID-related lockdowns in China are likely to exacerbate supply chain disruptions. The Committee is highly attentive to inflation risks.”

That same day, the ECB also took the markets by surprise, holding an emergency Governing Council meeting “to exchange views on the current market situation.” In the press release, the ECB stressed the fact that it had committed to act against resurgent fragmentation risks in December 2021 and that the spike in risk premiums in some eurozone member states was clearly a risk to that commitment. It flagged “lasting vulnerabilities in the euro area economy which are indeed contributing to the uneven transmission of the normalisation of our monetary policy across jurisdictions.” Based on that assessment, the ECB decided to apply flexibility in reinvesting redemptions coming due in the Pandemic Emergency Purchase Programme portfolio. Most important was the announcement of the design of a mechanism for preventing those fragmentation risks. Specifically, the ECB announced it had decided to “mandate the relevant Eurosystem Committees together with the ECB services to accelerate the completion of the design of a new anti-fragmentation instrument.”

Forecasts and market interpretation

Part of the problem implied by such high inflation from the financial standpoint stems from the decoupling between inflation projections and realized inflation. The short- and medium-term forecasts made by the central banks contrast with the inflationary surprises we have seen. That mismatch prompts investors to readjust their expectations for two reasons. First, they interpret that the now-structural character of inflation might be hard to reverse. Second, they believe that central banks will have to step up their monetary tightening efforts even further.

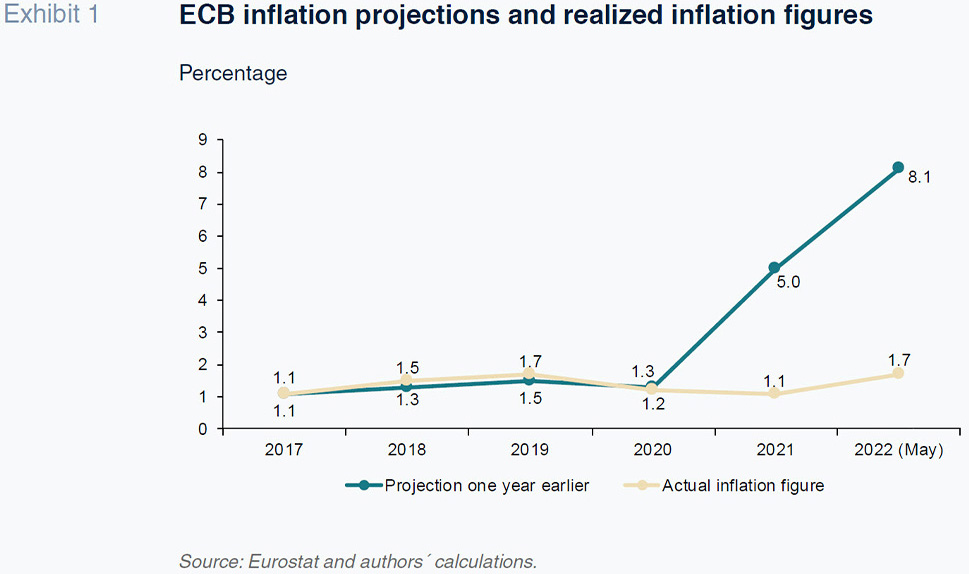

In the years after the financial crisis, reported inflation figures rarely deviated from the ECB’s inflation forecasts by more than a small margin for any matter of time. Those differences were mainly attributable to the fact that prices remained extraordinarily low for longer than expected, and always below the targeted threshold of 2%. In the years prior to the pandemic and the war in Ukraine, there was a consensus of sorts that inflation would remain subdued for some time to come. Indeed, the ECB’s 1-year ahead projected versus realized inflation did not differ significantly prior to the pandemic, as shown in Exhibit 1. However, since the onset of the pandemic and, more so, the outbreak of war in Ukraine, deviations between estimated and actual inflation have become more pronounced. What was initially interpreted as a transitory increase in prices has turned into a full-blown inflationary shock with supply– and demand-side components that are hard to control. That decoupling between expectations and the definitive price readings is sparking even greater concern.

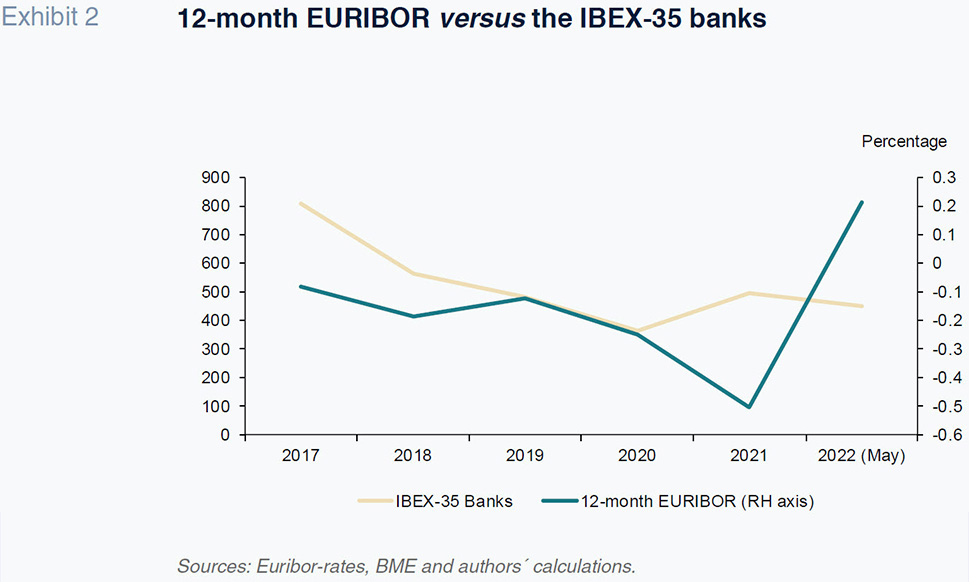

The uncertainty around the ability to tame inflation prompted financial market to discount interest rate increases even before the central banks had signalled such a shift in their forward guidance. That was tangible in the eurozone throughout the spring, with market rates increasing considerably before the ECB had even announced potential hikes in its key rates. Within financial markets, those rate increases are of particular relevance to banks. Financial institutions had been anticipating “monetary normalisation” for some time but would have preferred a smoother transition. As illustrated in Exhibit 2, the 12-month EURIBOR turned positive in April and has climbed considerably since then. As a result, banks may be able to operate in a more ‘normal’ financial environment in the medium-term, but they may also have to navigate a more delicate economic climate. Within the IBEX-35, despite the banking sector being affected by the financial turbulence and macroeconomic risks, bank stocks seem to be outperforming the market. This is due to the fact that the sector had already begun to stage a recovery –before the outbreak of war in Ukraine– compatible with a more robust business climate accompanied by higher interest rates.

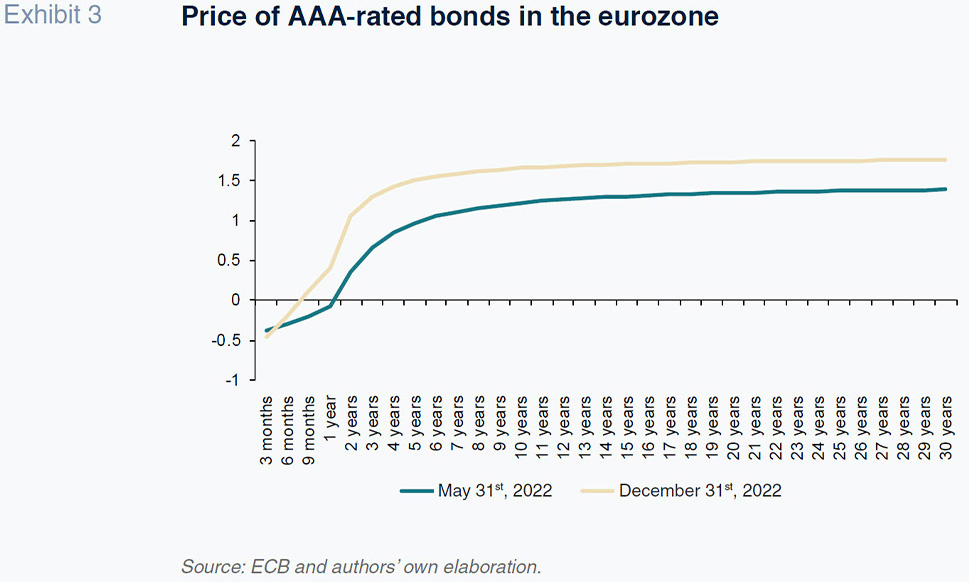

Despite a favourable business environment, rate hikes should be interpreted with caution in terms of their ultimate impact on consumers and businesses. Should inflation remain near its current high levels (or even noticeably lower than at present), the real interest rate (discounting prices) will remain negative. Nevertheless, the pace of rate increases could cause some trouble. The first collateral effects have been seen in the European bond market, where prices have decreased (so that yields have increased). As shown in Exhibit 3, which depicts the trend in average prices on AAA European bonds across different maturities, we have seen a marked decline since the end of the pandemic. Slope-wise, there are significant differences between the yields on the shortest-dated paper and on bonds that mature in two and three years, suggesting the persistence of uncertainty in the short-term. The sovereign debt yield curves for southern eurozone issuers, particularly Italy, have proven particularly vulnerable. This underlines why the ECB has been concerned about: i) the impact of these risks on the sustainability of the affected countries’ public debt; and, ii) the ramifications for general borrowing terms (public and private), with respect to which these factors could create significant fragmentation across eurozone member states.

Persistence and financial normalisation: Effects on the mortgage market and corporate financing

Consumers and businesses are observing the duration of elevated inflation with concern. The measures taken by the government in Spain to curb the cost of fuel and electricity do not appear to be affecting inflation readings. This is partially explained by a boom in demand accompanying supply constraints and cost inflation in certain sectors, caused by the “return to normal”, as economies leave the worst of the pandemic behind.

One of the markets most exposed to the rate environment is the property market and by extension the mortgage market. In the first quarter of 2022, new housing prices jumped 10.1% year-on-year, while home resale prices increased by 8.2%. Some of that price growth is attributable to demand pent up during the pandemic, which is driving price growth to the rates being observed in other eurozone members. Some of the growth is also the result of a lack of investment alternatives in a zero or negative rate world which had brought property investing to the fore. It is hard to quantify how much, but a high percentage of transactions reflects speculative rather than residential investing. As the financial situation normalises and interest rates rise, the property market is likely to cool. It is worth recalling, that with inflation this high, real rates are set to remain negative for some time. Financing may become more expensive but will remain relatively low. Mortgage lending increased by 0.7% during the final months of 2021, and accelerated to 1.2% in 2022 as of April (the latest figure available). These modest levels of mortgage lending growth also seem to suggest that it is possible to rule out excess leverage and the occurrence of a price bubble. Furthermore, pertinent to property and mortgage related risks, consumers are gradually shifting into fixed-rate mortgages. Promisingly, three out of four new mortgages are being arranged at fixed rates with fixed-rate mortgages currently accounting for 48% of the current stock.

Business lending growth increased well above 2% throughout 2021. In 2022, despite the sources of concern, this segment is still growing at between 1% and 1.7% year-on-year from January to April, with ups and downs shaped by uncertainty. Moreover, the business financing landscape is underpinned by the Recovery and Resilience Facility (RRF) and the Next Generation-EU Funds, which will be particularly important for the SME segment. Although that public-private partnership may well bolster the economic recovery, there are sources of uncertainty, including the risk of a higher-than-expected increase in borrowing costs if the sovereign risk premium were to increase. Such a development would have significant knock-on effects for private sector financing.

Conclusion

In the current climate of heightened uncertainty, central banks are coming to the rescue once again. However, they are aware that if exogenous supply-side factors persist, it won’t be easy to tame inflation. Central banks are taking more aggressive action than initially contemplated in order to appease private-sector expectations. The “missing inflation” talked about for so long would appear to have been found, and its reappearance has caught many economies by surprise as policy makers were rolling out fiscal stimulus to kickstart growth in the wake of the pandemic. If contractionary monetary policy cannot tackle all factors contributing to the growth of prices, and should fiscal policy remain expansionary, taming inflation will be no easy task.

In the financial domain, monetary normalisation is not coming in the manner anticipated. Markets expected that increases in interest rates would be gradual and come against the backdrop of a sustained economic recovery. Instead, rate hikes are unfolding at a time of heightened uncertainty and coming much faster than anticipated. Monetary policy surprises will have an impact on the conduct of financial markets that is hard to define. Financial markets are having a tough year due to the difficulty in pinning down how long inflation will last and what impact geopolitical risks might have. This is also occurring at a time when investment portfolio recalibration was expected. Interest rate increases are accelerating this development and a retreat from higher-risk assets (e.g., technology start-ups and crypto-assets) accompanied by a shift into more traditional securities, such as energy and financial businesses.

In the case of the banks, the effects are similarly mixed. On the one hand, long-awaited rate increases that should support increases in margins appear to be on the cusp of materialising. On the other hand, with high inflation and elevated macroeconomic risks, the outlook for the banking business looks more uncertain, albeit still positive so long as employment is not adversely affected.

Santiago Carbó Valverde and Francisco Rodríguez Fernández. Universidad de Granada and Funcas