Spanish economic forecasts panel: July 2022*

Funcas Economic Trends and Statistics Department

Consensus 2022 GDP forecast trimmed 0.1pp to 4.2%

The revised first-quarter GDP figure revealed growth of 0.2%, shaped by a slump in private consumption and a sharp increase in investment in capital goods and in exports of non-tourism services. Tourism service exports continued to recover, albeit at a slower rate than in the two preceding quarters due to the restrictions imposed in a number of countries towards the end of the year in an attempt to curtail the spread of the Omicron variant.

Leading indicators for the second quarter point to accelerating growth, fuelled by services, especially a major recovery in tourism. Sector sources are expecting the summer season to be nearly as strong as before the pandemic. Nevertheless, towards the end of the year, growth could come under pressure from the sharp rise in inflation, the uncertainty surrounding the war in Ukraine and its impact on the energy markets (particularly gas supplies).

Growth for the second and third quarters is estimated at 0.4%-0.5%, whereas the consensus forecast for the last quarter is for growth of 0.3%, down from the levels forecast at the time of the May survey (Table 2). As a result, the consensus forecast for GDP growth in 2022 has been trimmed by 0.1pp to 4.2%, with net trade expected to contribute 1.6 percentage points of the total, the highest level since 2012, thanks to the normalisation of international tourism.

Uncertainty weighing on forecasts for 2023

The lower rate of growth now forecast for the second half of the year has a more pronounced effect on the 2023 forecast, which, as a result of the reduced carryover effect, has been cut by 0.5pp to 2.5%. Quarterly growth is expected to gather momentum as the year unfolds, with rates forecast at between 0.7% and 1% (Table 2). Net trade is expected to detract slightly from growth in 2023.

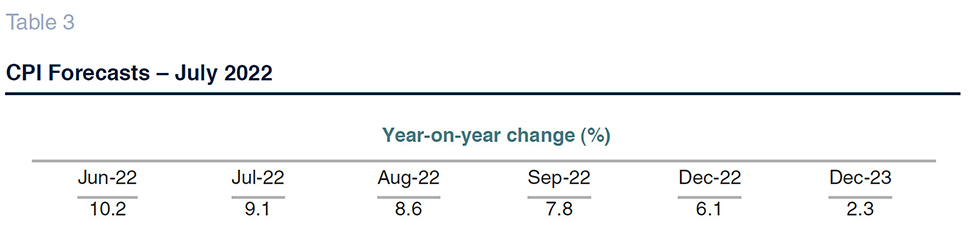

Inflation continues to top expectations

In June, the headline inflation rate increased to 10.2%, significantly above expectations, with core inflation also rising sharply to 5.5%.

The average rate of headline inflation forecast for this year has been increased once again, to 7.9%, up one percentage point from May, while the headline inflation forecast for 2023 has also been revised upwards by 0.9 points to 3.1%. Recall that just last January, the consensus forecast for this year was for an average annual rate 3.5%. The forecasts for core inflation have been increased by similar amounts to 4.6% and 3.3% for 2022 and 2023, respectively.

Brighter outlook for unemployment

The favourable trend in unemployment in the first quarter, coupled with ongoing healthy job dynamics throughout the second quarter, according to the Social Security contributor reports, have prompted the analysts to raise their forecasts for growth in employment and lower their forecasts for unemployment. Specifically, the average unemployment rate estimated for this year has been lowered by 0.2pp to 13.5%, falling to 13.1% in 2023.

The forecasts for growth in GDP, job creation and wage compensation yield implied forecasts for growth in productivity and unit labour costs (ULC). Productivity per FTE job is expected to increase by 0.8% this year and by 0.1% in 2023. Meanwhile, ULCs are expected to increase by 1.8% in 2022 and by 2.5% in 2023.

Trade surplus continues

To April, Spain presented a current account deficit of 4.13 billion euros, compared to a surplus of 535 million euros in the same period of 2021, as a result of sharp deterioration of the trade surplus and a wider income deficit.

The balance of payments deficit presented in the first few months of the year is highly seasonal. In fact, the analysts are forecasting a surplus for the year as a whole equivalent to 0.5% of GDP, down 0.1pp from the last set of forecasts. The consensus forecast for 2023 has been raised by 0.2pp to 0.9%.

Public deficit projected at 4.7% in 2023

The fiscal deficit, excluding local authorities, amounted to 7.89 billion euros in the first four months of 2022, compared to 26.87 billion euros in the same period of 2021. The improvement was driven by growth in revenue of 16 billion euros and a reduction in expenditure of 3 billion euros. The improvement is evident across all levels of government.

The analysts expect the overall deficit to come down this year and next. They have lowered their deficit forecasts for 2022 and 2023 by 0.3pp and 0.1pp, respectively, compared to May. Specifically, they are forecasting a deficit of 5.2% of GDP in 2022 and of 4.7% in 2023. Note that those forecasts are more pessimistic than those of the Spanish government and the Bank of Spain.

Geopolitical tensions and the energy crisis are clouding the international outlook

Concern about global economic prospects has intensified since the last survey. The OECD’s June forecasts call for global growth of 3% this year, down almost 1.5 points from its prior estimate, and the organisation has flagged the risk of stagflation. The invasion of Ukraine has compounded existing tensions in the energy and commodity markets, spilling over to other prices and driving inflation to levels not seen in the developed world since the 1980s. Importing nations, notably the EU, are facing a loss of purchasing power that is weighing on the recovery expected in the wake of the pandemic. The inflationary environment is prompting monetary policy tightening, with the Federal Reserve at the fore, followed by the ECB.

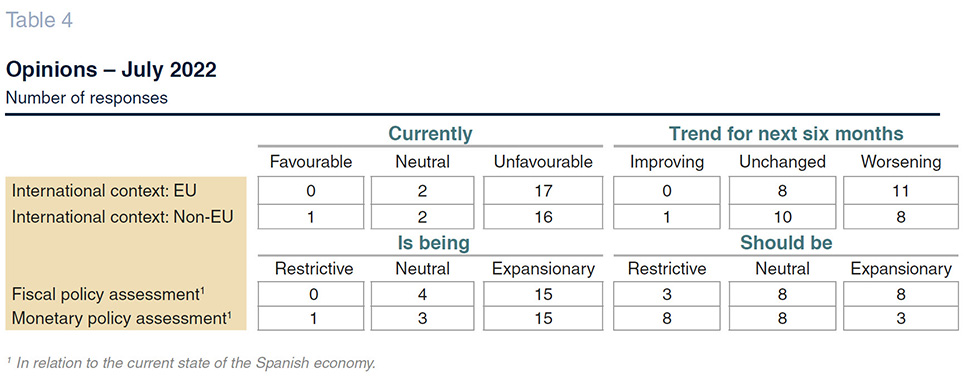

Virtually all of the analysts surveyed view the external climate as unfavourable, both in the EU and beyond, an assessment unchanged from the last Panel. Moreover, a wide majority of analysts believe this negative environment will persist or deteriorate in coming months.

The central banks’ task is becoming thornier

Monetary policy faces the tricky task of curbing inflation without derailing the recovery and sparking new financial risks. The main central banks have accelerated the reversal of their monetary stimuli. In June, the ECB put an end to its debt purchase programme, forcing the member states to finance their new issues in the market, without the direct support of the central bank. It is also getting ready to raise its key rates (emulating the Federal Reserve which has already increased its benchmark rate three times and announced further increases for the months to come). The challenge is to contain second-round effects from energy inflation without sparking financial fragmentation in the eurozone of the calibre seen in 2011. Indeed, when sovereign risk premiums began to rise last month, the ECB stepped in with an extraordinary meeting, announcing the upcoming rollout of an anti-fragmentation instrument, the details of which are still unknown.

The markets have taken stock of the shift in monetary policy. 12-month forward EURIBOR (the leading indicator for the trend in the deposit facility rate, controlled by the ECB) has increased from close to 0.25% in May to nearly 1% at the time of writing. The yield on Spain’s 10-year bonds has widened slightly since May and is currently trading at around 2.3%. The risk premium stands at around 110 basis points, down from the level at which it was trading before the ECB’s extraordinary meeting.

The analysts believe that market rates will continue to climb higher throughout the projection period (Table 2). The consensus forecast is that EURIBOR will reach 1.8% by the end of 2023, compared to 1% in May, and that the yield on the 10-year bond will end up at 3%, up 0.5pp from the May forecast.

Euro depreciation against the dollar

The markets believe the US economy is better positioned than the European economy to withstand the geopolitical and energy shocks, as is evident in the forecast trend in interest rates. That spread is drawing capital flows to the US and is in turn mirrored in the trend in the rate of exchange between the two regions’ currencies. The dollar is currently trading at close to parity, compared to $/€1.04 in May. The analysts expect the euro to continue to trade below the long-run average exchange rate throughout the projection period (Table 2).

The Spanish Economic Forecasts Panel is a survey run by Funcas which consults the 19 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the months of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 19 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.