Revenue and employment at Spanish manufacturing firms reach pre-pandemic levels

Spain’s manufacturing industry has overcome the pandemic induced bust, but sector level trends appear to be diverging. In most sectors, revenue and employment are above pre-pandemic levels, while other sectors have used the pandemic to find efficiencies and downsize workforces, with the transportation material sector struggling with shortages and the green transition.

Abstract: At the headline level, the Spanish manufacturing industry appears to have fully overcome the harsh effects of the pandemic, with revenue and hiring back to pre-pandemic levels. However, the new geopolitical paradigm and supply side frictions are weighing on growth once more. The situation in the transport materials sector is of particular concern, with revenue and employment still 10% and 8% below 2019 levels. Meanwhile, other sectors have fully recovered and have grown revenues and workforces above pre-pandemic levels, except for the textile and clothing and the paper, publishing, and graphic arts sectors. While revenue is back above pre-pandemic levels for these two sectors, firms have taken advantage of the pandemic to find efficiencies and downsize their labour forces. At the opposite end of the spectrum, sectors experiencing strong sales growth, such as the food, beverage and tobacco and chemicals and pharmaceuticals sectors, are generating new jobs.

Introduction

The economic collapse triggered by the pandemic in March 2020 sent the manufacturing sector into free fall (Moral, 2021). Two years on, it is timely to analyse how Spain’s manufacturing firms have fared and gauge whether indicators of their economic performance have reached pre-pandemic levels. To assess this, we analyse the quarterly sales and employment figures reported by firms to the Spanish tax authorities (AEAT) in their VAT and employer tax withholdings. Our starting point for comparison is the first quarter of 2019, as the impact of the pandemic had already become apparent in the data for the first quarter of 2020. The figures and the data used are presented with a quarterly frequency.

We first look at the key trends for the manufacturers as a whole. We then analyse the trends in sales in Spain relative to exports, and in employment, across nine manufacturing sub-sectors. Understanding the nature of the recovery from the pandemic-related shock is key to detecting potential weaknesses that may emerge in the face of new sources of uncertainty, including the war in Ukraine and the associated surge in oil prices and shortage of supplies.

Spain’s manufacturing firms’ earnings have recovered

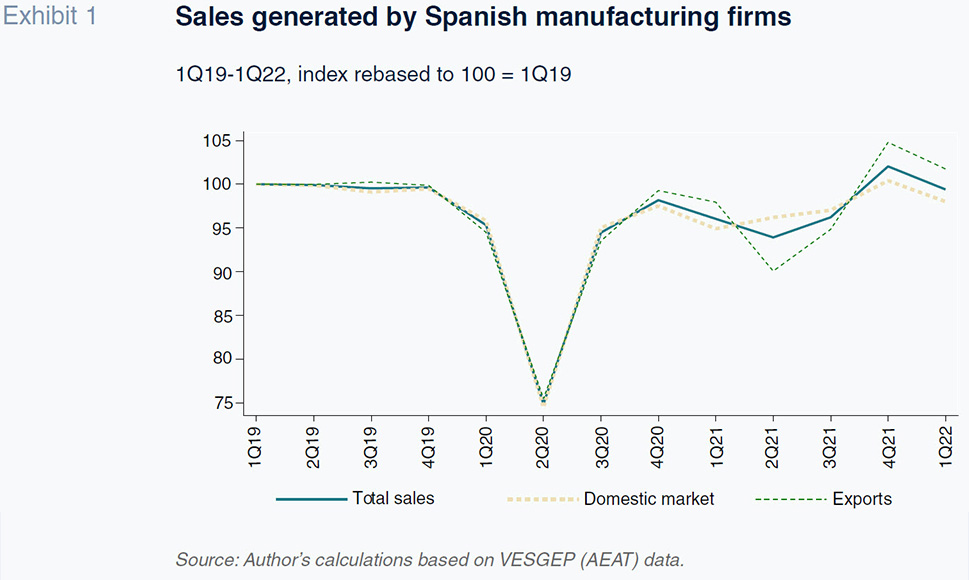

To assess the performance of Spanish manufacturing firms, we review quarterly firm sales and employment figures from the first quarter of 2019 to the first quarter of 2022. These indicators are sourced from data firms submit to tax authorities related to VAT returns and employer tax witholdings reports. [1] The data used (from Spain’s VESGEP survey) is highly representative of Spain’s manufacturing sector in that it accounts for 98.4% of total sales revenue and 99.7% of the exports of manufacturing firms of all sizes. The VAT returns itemise total revenue and distinguish between home market sales and exports. Exhibit 1 provides the trend in those variables in index form, rebased to the first quarter of 2019.

The sector bounced back rapidly from the collapse in activity triggered by the pandemic in the second quarter of 2020 (as evidenced by the pronounced “V” shape of the exhibit). The initial recovery in manufacturing activity was excellent, with Spain’s manufacturers’ sales running just 1.81% below their 2019 levels at the end of 2020. However, the worsening of the pandemic and increase in COVID transmission at the start of 2021 (when the vaccination effort was still very nascent) stalled the initial recovery, and it wasn’t until the second half of 2021 that vigorous growth resumed. By the end of 2021, sales were tracking above pre-pandemic levels by 2.0%.

The most recent data available, for the first quarter 2022, reveal a modest pause in the recovery trend, with sales dipping 0.6% below their 2019 level. This weakness reflects the shortage of certain manufacturing inputs and the onset of war in Ukraine on February 20th, 2022. Based on the recovery prior to the first quarter of 2022, it is fair to conclude that the manufacturers overcame the rout generated by the pandemic. At present, however, fresh sources of uncertainty around energy prices, the availability of supplies, as well as rising inflation and interest rates, are set to weigh on manufacturers’ earnings throughout 2022.

Exports have played an important role in the recovery of sales, despite experiencing more volatility compared to domestic sales (volatile export demand pre-dates recent geopolitical events). Over the three-year period analysed, the reported value of revenue from exports by Spanish manufacturers increased by 1.7% in real terms.

The recovery in manufacturing activity is evident in the quarterly Business Turnover Index but is less obvious in manufacturers’ quarterly gross value added. [2] Accordingly, the analysis of the real sales figures provided by the tax authorities generates more precise, conclusive, and compelling results about the state of the manufacturing firms.

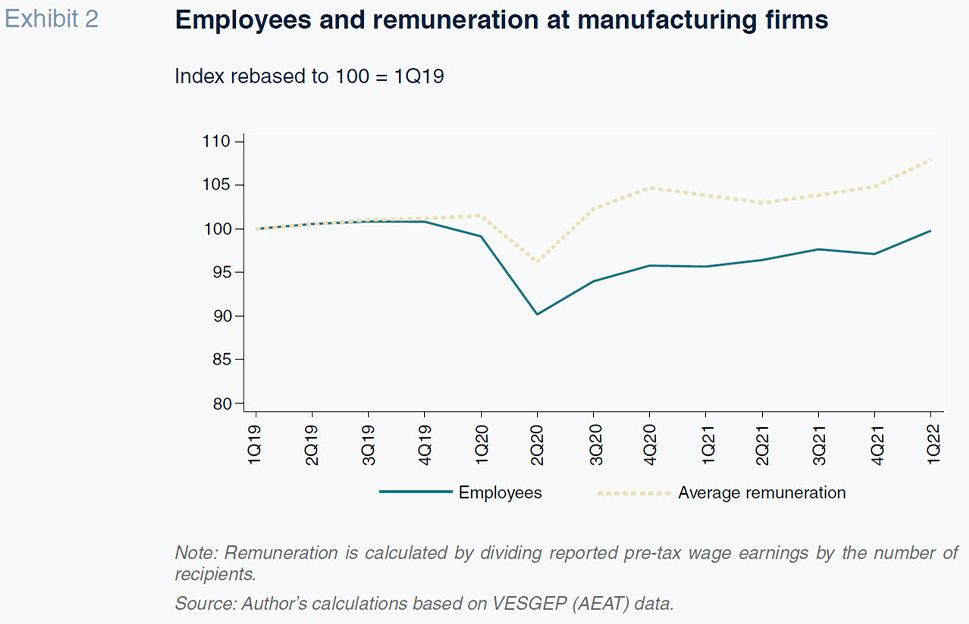

The trend in employees and their average remuneration (Exhibit 2) suggests that the destruction of jobs caused by the pandemic was far less severe than the contraction in sales (10%

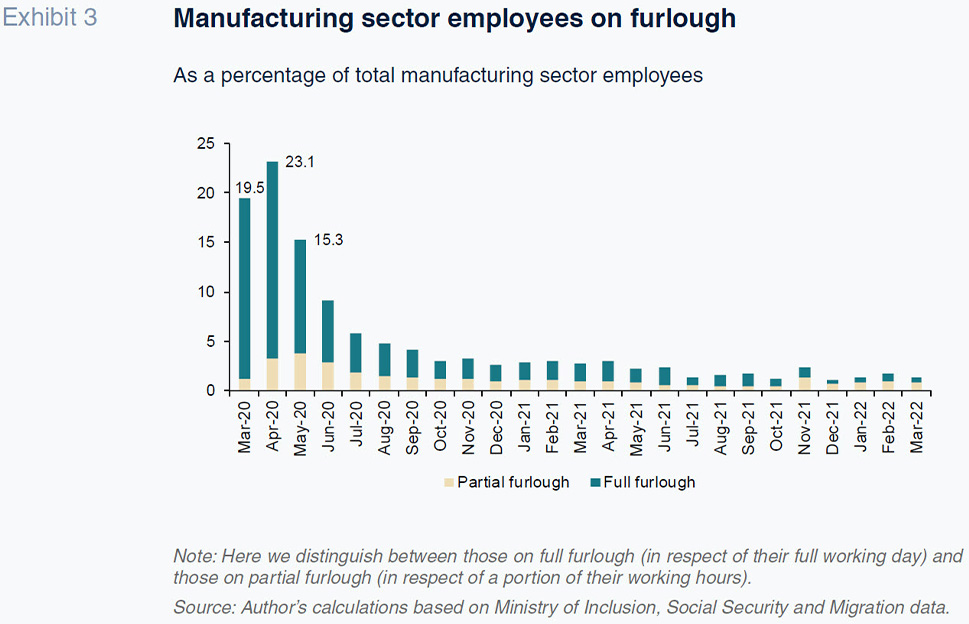

versus 25%). This contrasts with previous episodes in Spain, where during times that production activity had contracted, employment tended to fall far more intensely. In the wake of the pandemic, job destruction was curtailed by the implementation of the furlough scheme. The furlough job protection mechanism was activated in March 2020. As part of this scheme, the government covered up to 70% of the affected employees’ earnings. During the first three months under the scheme, it was applied to 19.5%, 23.1% and 15.3%, respectively for each month, of the manufacturing industry’s employees (Exhibit 3). By June 2020, that figure dropped to 10% and by September 2020, just 4.1% of manufacturing sector employees remained on furlough.

Despite having contracted less severely, the return to pre-pandemic employment levels was slow. Nevertheless, by the first quarter of 2022, manufacturers reported that they were paying social security contributions for the same number of employees as in the first quarter of 2019.

It is worth examining a detail related to the recovery in average employee earnings. Normally, as was the case in 2019, over short periods of time, average employee earnings should tend to be stable and generally smooth, given that this data series is deflated and adjusted for seasonality and calendar effects. However, average employee earnings experienced a steep fall in the second quarter of 2020, and rapid partial recovery, why?

The exceptional volatility in this series can be explained by two factors. First, some employees were only furloughed for part of their working hours. In the first quarter of 2020, one out of every five employees on furlough were on “temporary suspension”. Employers only paid employees on partial suspension for the hours effectively worked and that remuneration was obviously considerably lower than their normal remuneration and was topped up by the furlough payments. A second explanation is that some companies topped up the remuneration of their furloughed employees so that they were computed as recipients of salaries in the corresponding social security filings, but obviously those amounts were significantly below their normal salaries.

Separately, this last hypothesis becomes evident by examining data on salaries per hour effectively worked, which is tracked by the Harmonised Salary Cost Index (compiled by the INE). Salaries per hour effectively worked increased by 5.2% in the first quarter of 2020. This may be because some of the remuneration paid went to employees who did not effectively complete any hours of work for the reporting companies, and not because those employees’ salaries were raised.

Nevertheless, having overcome the extraordinary shock induced by the pandemic, at the end of 2020, average remuneration was 4.7% higher than the year before. Considering that by then most of the employees on furlough were back at work and employment was not back at pre-pandemic levels, that increase in average earnings is attributable more to a change in the worker mix than an actual increase in average earnings. It appears that the employees that were let go were, on average, less skilled and had been on their employers’ payroll for less time so that the workers who kept their jobs had, on average, higher salaries.

In 2021, average remuneration did not change significantly overall. However, in the first quarter of 2022, average remuneration increased by 3.1% quarter-on-quarter, and in this episode the growth is not attributable to the furlough arrangement. Moreover, given that the remuneration figures are deflated, the rebound is not attributable to an increase in salaries in response to the spike in inflation at the end of 2021. Therefore, the growth in average remuneration in the early months of 2022 suggests that employees are gaining purchasing power. This development may be related to implementation of Royal Decree-Law 32/2021 (of December 28th, 2021) on urgent labour reform measures. [3]

Sector level trends

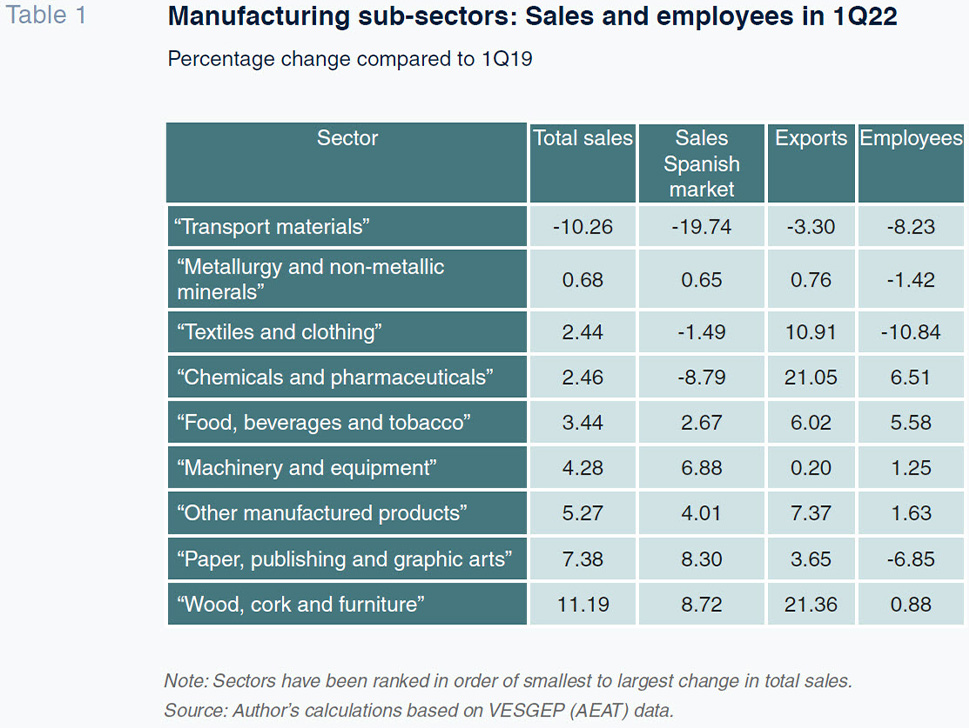

In this section, we explore these trends in more detail, distinguishing between nine manufacturing sub-sectors, [4] namely: “Metallurgy and non-metallic minerals”, “Machinery and equipment (installation and repairs)”, “Transport materials”, “Chemicals and pharmaceuticals”, “Food, beverage and tobacco”, “Textiles and clothing (including footwear)”, “Paper, publishing and graphic arts”, “Wood, cork and furniture”, and “Other manufactured goods”. Table 1 presents the percentage change in total sales (distinguishing between domestic sales and exports) and employees between the first quarters of 2022 and 2019 for each of these sub-sectors.

The breakdown in Table 1 shows that, on average, the recovery observed was not even across the various manufacturing sub-sectors. To further highlight the differences in Table 1, the sub-sectors have been ranked in order of the laggards to the leaders in sales recovery.

The transport materials sector appears to be experiencing the greatest difficulty recovering to its pre-pandemic sales levels,

[5] with the slow recovery of this sector generating a drag on the overall picture. That sector’s home-market sales have fallen by 19.7% in three years. Also worrying is the transport material sector’s export trends. This sector exports about 80% of its production, and exports are down 3.3% over the previous 3 years. Although this sector has been significantly affected by the shortage of supplies and parts, other sectors which have encountered similar issues are nevertheless reporting growth in sales by comparison with 2019.

The key to understanding the decline in domestic sales and exports for the transport materials sector is that it is immersed in a transformational process shaped by the sustainable mobility thrust, [6] to which it has yet to fully adjust. The problem goes beyond the lack of chips, which will eventually be resolved. Changing the sector’s product mix is a slow process, and in reality the production of electric vehicles remains marginal in Spain. In 2020, just 7.3% of the vehicles produced in Spain fall into the ‘alternative vehicles’ category, which includes battery electric vehicles (BEVs), plug-in hybrid electric vehicles (PHEVs), standard hybrid vehicles and gas-powered vehicles (ANFAC, 2020).

The chemicals and pharmaceuticals sector was obviously the most resilient in 2020 due to the growth in demand for medicines and other disinfectant and cleaning products (Moral, 2021). The upshot is that over the last three years, the sector’s overall sales growth of 2.5% has been underpinned by stellar exports, with employee numbers increasing 6.5% by comparison with 2019. The food, beverage and tobacco sector is not far behind, reporting growth in sales and net employment of 3.4% and 5.6%, respectively.

Exports have also played a crucial role in other sectors’ healthy performances, particularly in textiles and clothing where, despite a drop in sales in Spain, overall sales are up 2.4% compared to 2019 due to strong export gains. Despite strong exports, this sector has taken advantage of the pandemic shock to downsize, reducing its workforce by 10.8% over the three-year period. In paper, publishing and graphic arts, employment also decreased by 6.9% while sales revenue increased by 7.4%. Although the loss of jobs in these two sectors has been precipitated by the pandemic, the origin of this trend lies with more complex problems affecting their overall business models. The textile sector is navigating a very serious offshoring problem. In Spain, it nevertheless boasts leading global players. In paper, publishing and graphic arts, the issue is the shift in the business model to digital devices away from paper products (newspapers, books, magazines, advertising, etc.), which has forced it to move the business into –less labour intensive– editing and design.

Conclusions

The main takeaway from this analysis of Spanish manufacturing firms’ performance is that they have recovered from the shock generated by the pandemic with sales in all segments of the manufacturing spectrum, except for transport materials, higher in 2022 than in 2019. Not all sectors have revisited their 2019 employment levels with some, including the textile and clothing and the paper, publishing, and graphic arts sectors, using the pandemic rout as an opportunity to downsize workforces. At the opposite end of the spectrum, sectors experiencing strong sales growth, such as the food, beverage and tobacco and chemicals and pharmaceuticals sectors are generating new jobs.

Notes

That data used have been adjusted for seasonality and calendar effects. In addition, the monetary variables have been deflated (AEAT, 2021).

Data on gross value added are published in the quarterly National Accounts. Both indicators are compiled by Spain’s National Statistics Office (INE).

Although firms had all the first quarter of 2022 to implement several of the changes in contract types.

The “Oil refining” sector is not included due to its relationship with the energy sector.

Moral (2020) analyses the sector’s performance during the first few months of the pandemic.

Refer to the debate set down in issue number 171 of Papeles de Economía Española (2022).

References

AEAT (2021).

Metodología de la Estadística de Ventas, Empleo y Salarios en Grandes Empresas y Pymes (VESGEP) [Large enterprise and SME sales, employment and salary statistical methodology].

www.agenciatributaria.esANFAC (2020).

Annual Report 2020. www.anfac.esMORAL, M. J. (2020).“Challenges for Spain’s auto industry: Mobility model uncertainty and collapse in exports.”

Spanish Economic and Financial Outlook, 9(4), July, 2020, 69-78.

http://www.sefofuncas.com/pdf/Moral9-4-1.pdfMORAL, M. J. (2021).

La actividad manufacturera está dejando atrás el colapso provocado por la pandemia [Manufacturing activity is emerging from the rout induced by the pandemic]. Funcas Technical Note, April 2021.

https://www.funcas.es/wp-content/uploads/2021/04/Actividad-manufacturera_Abril-2021.pdf.

VV.AA. (2022). Infraestructuras Terrestres, Transporte y Movilidad de Personas [Land infrastructure, transportation and passenger mobility].

Papeles de Economía Española, 171.

https://www.funcas.es/revista/infraestructuras-terrestres-transporte-y-movilidad-de-personas/

María José Moral. UNED and Funcas