Spanish economic forecasts panel: January 2018*

Funcas Economic Trends and Statistics Department

2017 GDP growth estimated at 3.1%

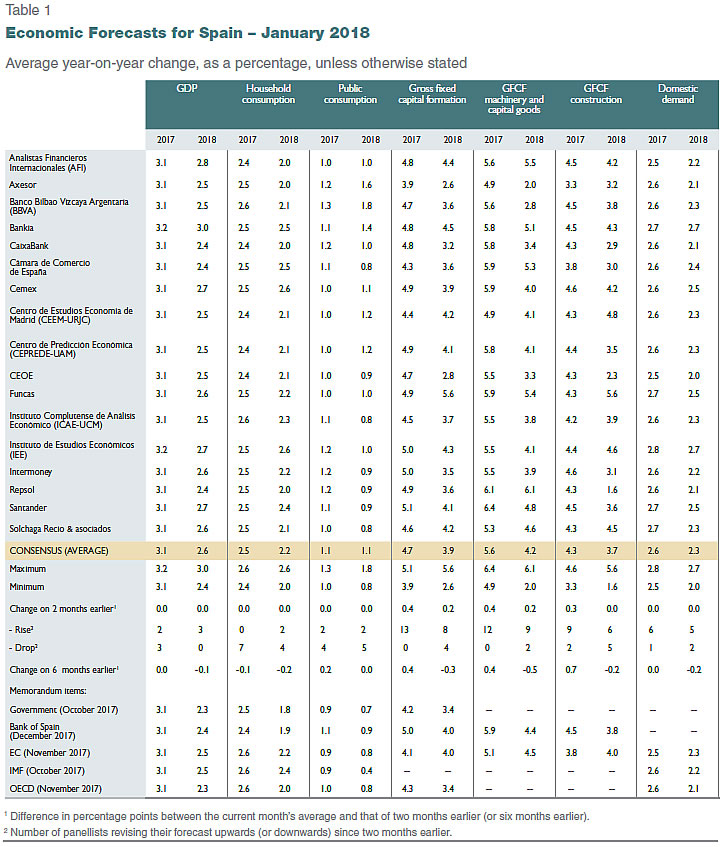

The consensus forecast for GDP growth in 2017 stands at 3.1%, unchanged with respect to the last Panel. Domestic demand is expected to contribute 2.5 percentage points and foreign demand the remaining 0.6 percentage points. According to these estimates, the Spanish economy will have grown by 0.7% during the fourth quarter of 2017 (Table 2).

The forecast for 2018 is unchanged at 2.6%

There have been no changes in the average estimate for GDP growth in 2018, at 2.6%, or in any of its drivers. In this instance, domestic demand is expected to contribute 2.2 percentage points and foreign demand 0.4 percentage points. Growth is expected to be very even from one quarter to the next at around 0.6%, slowing slightly only in the last quarter.

Inflation projections raised due to oil prices

In 2017, the annual rate of inflation averaged 2%, compared to -0.2% the previous year. The uptick was shaped primarily by the turnaround in energy prices, which went from falling by 8.6% in 2016 to registering growth of 8% in 2017, driven by higher oil prices. A barrel of Brent oil was 25% more expensive on average in 2017, offset only slightly by euro appreciation.

Oil prices have risen further throughout December and the initial weeks of January, pushing towards the 70 dollar-mark. As a result, the Panel analysts have raised their average forecast for annual inflation in 2018 by 0.1 percentage points, to 1.6%. The forecast for core inflation has been reduced by 0.2 percentage points since the last Panel to 1.2% The forecasts imply a year-on-year inflation rate in December of 1.5% (Table 3).

Slight slowdown in job creation in 2018

According to the Social Security contributor numbers, job creation once again registered strong growth in the fourth quarter, after having slowed in the third. Growth was 3.6% in 2017 as a whole, which is equivalent to 626,000 new contributors, one of the best performances in the series, which dates to 2000, and only surpassed in 2005 and 2006 due to the legalisation of undocumented workers.

In terms of full-time equivalent jobs, the growth in 2017 is estimated at 2.8% (unchanged from the last Panel) and is expected to slow to 2.3% in 2018 (up 0.1 percentage point relative to the last set of forecasts).

Based on the projections for growth in GDP, job creation and wage remuneration, it is possible to estimate growth in labour productivity and unit labour costs: the former is expected to register growth of 0.3% in both 2017 and 2018, while ULCs are expected to increase by 0.1% and 0.8% in 2017 and 2018, respectively.

The average annual unemployment rate fell to 17.1% in 2017 and is expected to decline to 15.3% in 2018 (no change from the last Panel).

Another solid current account surplus expected in 2018

The current account surplus stood at 14.1 billion euros to October, compared to 15.2 billion euros in the same period of 2016. This slight decrease is attributable to the higher deficit in the goods trade balance, reflecting the rise in oil prices. The services trade surplus widened, while the income deficit narrowed year-on-year.

Consensus forecasts point to a surplus equivalent to 1.8% of GDP in 2017 and 1.6% in 2018.

Spain will meet its public deficit target in 2017

In the first 10 months of 2017, the combined deficit of all levels of government (except for the local corporations) stood at 18.9 billion euros, down from 30.3 billion euros over the same period of 2016. Public revenues increased by 4.4%, while expenditure was virtually flat. The improvement is especially strong at the state level, but also at the regional level: on aggregate, the autonomous regions recorded a surplus in the first 10 months. By contrast, the Social Security Fund’s deficit widened, albeit due to a reduction in the transfers received from the state’s public employment service (SEPE for its acronym in Spanish). The Social Security System’s deficit declined slightly, by close to 1 billion euros, despite intense growth in contributions, which barely outpaced the growth in benefits.

The consensus forecast for 2017 is for a fiscal deficit of 3.1% of GDP, i.e., the analyst community is expecting Spain to deliver on its target. For 2018 panellists are forecasting a deficit of 2.4% of GDP, which is 0.2 percentage points above the target.

Bright prospects for the global economy

The international environment is favourable. The IMF is forecasting global growth of 3.6% in 2017 and of 3.7% in 2018, having raised its last estimates by 0.1 percentage points for both years. Moreover, growth was recorded in all of the major economies in 2017, with Argentina, Brazil, Nigeria and Russia emerging from recession. The European economy, particularly the eurozone, was one of the most surprising areas of growth. Prevailing momentum is expected to extend into this year, despite the uncertainty deriving from Brexit. The tensions evident in the commodities markets, particularly the gas, oil and metals markets, are not expected to significantly impact global growth.

Overall, virtually all of the Panel members expect the international climate to remain favourable in the months to come, both within the EU and outside it. Just one analyst is forecasting a downturn in the non-European environment (as was the case in the last Panel).

Long-term rates expected to move higher

There have been no major changes in monetary policy. The European Central Bank has decided to continue apace with its purchases of sovereign debt and corporate bonds. In addition, its key benchmark rates − the rates on the deposit facility, the main refinancing operations and the marginal lending facility − remain at the historically-low levels attained in March 2016. As a result, 3-month Euribor (the interest rate that serves as a reference for the cost of short-term interbank lending) also remains at an all-time series low of around -0.33%. All Panel members view this level as low and the majority believe that these favourable credit conditions will continue in the months to come (no change from the last Panel).

The yield on the 10-year Spanish bond has fallen slightly since our last publication, to around 1.5%. The risk premium over the German Bund has narrowed slightly, to 100 basis points. Nearly all the Panel members consider that long-term interest rates remain low. However, the majority expect bond yields to rise in the coming months (as was the case in our last publication).

Euro appreciation against the dollar

The euro has appreciated considerably against the US dollar, trading at close to 1.23 dollars, up from 1.18 dollars at the date of the last publication. The improved outlook for the European economy, the expectation that the ECB might scale down its expansionary policies slightly earlier than previously thought and the dissipation of political risk in the eurozone may well be behind this trend.

Most of the analysts believe that the euro is trading at close to equilibrium levels and that it will stay steady in the months to come. However, whereas some analysts are forecasting further appreciation, no panellists expect depreciation.

Neutral fiscal policy and expansionary monetary policy

The analysts’ assessment of prevailing macroeconomic policies is unchanged since our last publication. The majority believe that fiscal policy is neutral and that this is the correct stance. Some call for a more restrictive fiscal policy.

As for monetary policy, all of the analysts continue to view it as expansionary. None of the analysts are expecting monetary tightening in the coming months, as was the case in our last Panel publication.

The Spanish economic forecasts panel is a survey run by Funcas which consults the 17 research departments listed in Table 1. The survey, which dates back to 1999, is published bi-monthly in the frst fortnights of January, March, May, July, September and November. The responses to the survey are used to produce a “consensus” forecast, which is calculated as the arithmetic mean of the 17 individual contributions. The forecasts of the Spanish Government, the Bank of Spain, and the main international organisations are also included for comparison, but do not form part of the consensus forecast.