Spain’s insurance sector: Profitability, solvency and concentration

Spain’s insurance sector currently outperforms the country’s banking sector, as well as the EU average. That said, challenging conditions are bound to trigger further concentration, particularly affecting the smallest players.

Abstract: Spain’s insurance sector has proven far more robust than its banking sector since the crisis. However, although returns have remained above the 10% mark on average, profitability has been clearly trending lower, driven primarily by the low interest rate environment in recent years. This factor is likely to exert even more pressure on the sector’s margins during the next few years, mainly due to the impact rates are having oninvestment portfolios in the life insurance segment. Despite this, the Spanish insurance sector’s margins continue to compare very favourably with those of its European counterparts. The sector has also reinforced its solvency substantially, once again comparing favourably with the European average and that of the major EU economies, other than Germany. As has been the trend in the financial sector, the insurance business has undergone concentration, albeit to a far lesser degree than the banks. Concentration has been more pronounced in the life insurance segment, closely correlated with concentration in the banking sector, which is the main distribution channel for this insurance product. M&A activity will foreseeably continue, marked by the takeover of small and very small players.

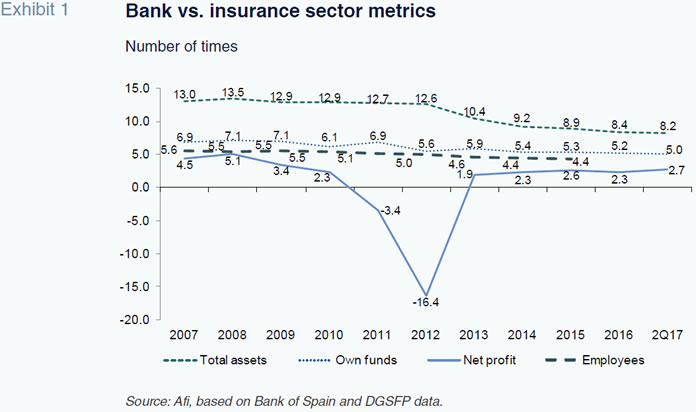

IntroductionAs analysed in detail in an earlier paper (Manzano, 2017), the Spanish insurance sector’s bill of financial health looks very good compared with that of the Spanish banking sector. This phenomenon is illustrated in Exhibit 1, updated and enhanced from our previous publication. At present, even assuming a certain degree of ‘normalisation’ in the banking sector (we exclude the recent adverse impact of the failure of Banco Popular), the following holds: in order to generate around two-and-a-half times the earnings generated by the insurance sector, Spanish banks need eight times more assets, five times more equity and around four-and-a-half times more direct employees. Moreover, today the banks are generating only two-and¬a-half times the insurance sector’s earnings (in both instances looking at their businesses in Spain), compared to five times as much before the crisis.

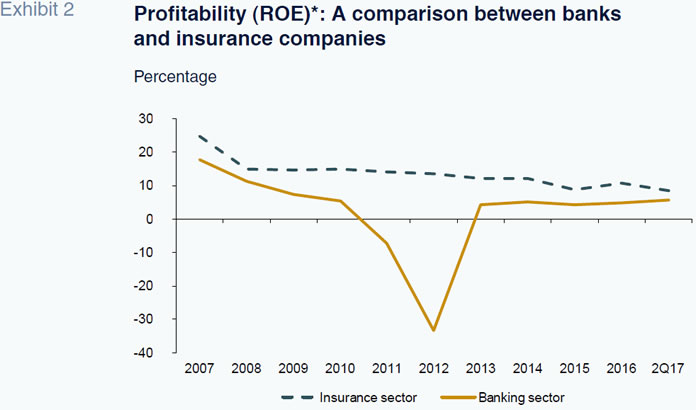

It is hardly surprising, therefore, that profitability in the insurance sector — around 10% in terms of ROE — is currently a little over twice that of the banks, as evidenced by Exhibit 2.

It is also true, however, that despite its strong relative performance, the insurance sector’s profitability has narrowed over the course of the last decade. Having peaked at 25% in 2007, it stayed flat at 15% until 2011 and in recent years has been struggling to defend the double-digits. The reasons are many, but the drop in returns on the sector’s investments in recent years has played a significant part. This, in turn, is being affected by the ultra-low interest rate environment

[1].

In this paper, in addition to providing a more in-depth analysis of the breakdown of the insurance players’ earnings in Spain (for the sector as a whole, as well as individually for the life and non-life insurers), we also contrast their position with that of their European counterparts in terms of profitability and solvency and look at the unfolding phenomenon of concentration.

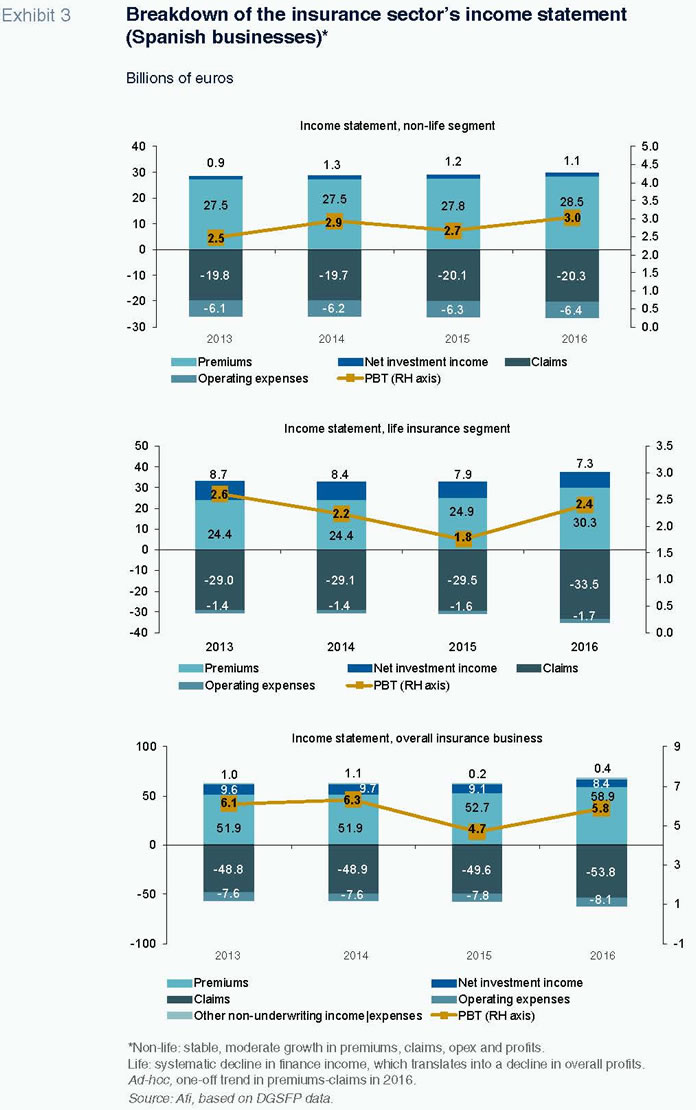

Investments less profitable, but still-robust ROE and solvency levelsThe insurance sector generates profits in two ways. Firstly, its so-called underwriting profit, which is calculated as earned premiums less payouts for claims. Secondly, finance income from the management of its investments. In order to assess the relative relevance of these two sources in the recent earnings trend, Exhibit 3 provides for each of the last four years, the contribution to the sector’s income statement of the major headings (earned premiums, investment income, claims and operating expenses), positive or negative as appropriate. The orange line represents overall profit, expressed as profit before tax (PBT).

This analysis tells us that profits in the non-life segment have been growing at a relatively stable and modest rate, in line with the trend in premiums and claims throughout the period as a whole. Although finance income in this segment has been trending slightly lower in the last three years, its weight is relatively small (a little over 1 billion euros of the roughly 3 billion euros this sub-segment has been consistently earning).

Overall profit in the life insurance segment has been marked by a pronounced decline during the same period (with the exception of the uptick in 2016). Note that this segment’s finance income has been falling almost continuously (7.3 billion euros contribution in 2016, down from 8.7 billion euros in 2013) in parallel and in this instance, accounts for a much higher percentage of total earnings. The investment portfolios in this sub-segment are much bigger than those of the non-life business as a result of the accumulation of premiums collected (savings) on this side of the business.

Note that the significant spike in PBT in 2016 is attributable to exceptional growth in premiums earned that year

[2], which substantially outstripped growth in claims incurred that year. Stripping out that one-off, PBT in this segment (which surpassed the 2 billion euros of the prior year, which is smaller than the contribution by the non-life segment) would have fallen by more due to the adverse trend in finance income

[3].

In other words, it looks as if in the absence of substantial growth in premium volumes in the life insurance business (as was the case in 2016), the burden implied by the low interest rate scenario is set to continue to exert downward pressure on earnings in the life insurance business and, by extension, profitability in this segment and, inevitably, that of the overall insurance business.

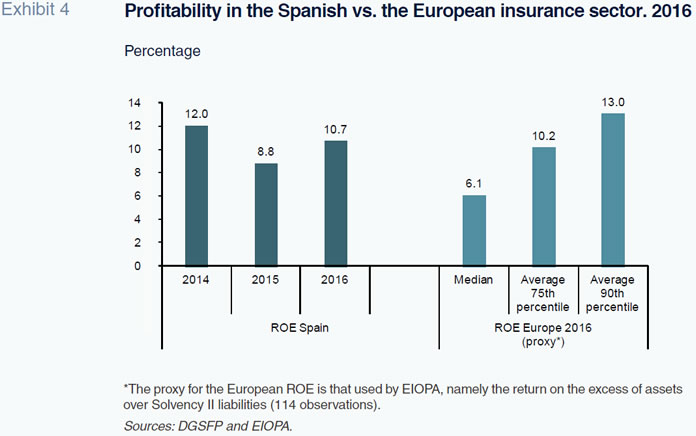

Despite the downtrend in profitability, the industry compares favourably with the European insurance sector as a whole, as illustrated by Exhibit 4. The ROE of 10.7% posted by the sector in 2016 is significantly higher than the European sector median of 6.1%. In fact, it is even higher than the 10.2% posted by the 75th percentile.

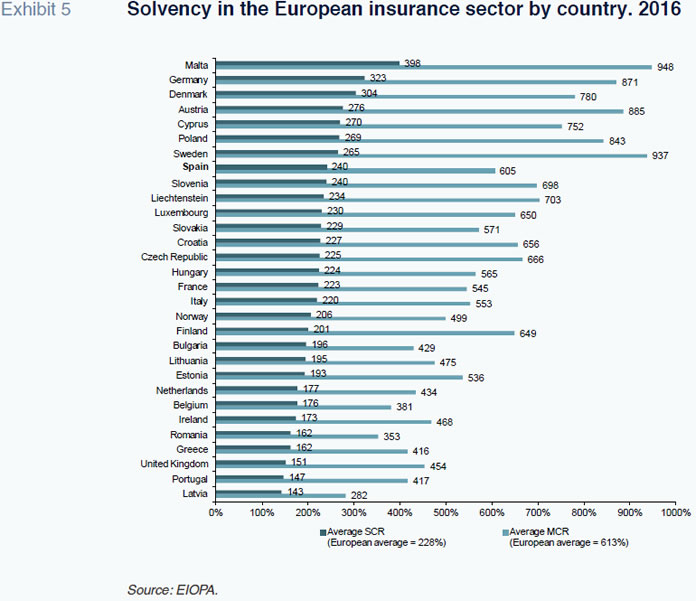

All of which despite the fact that the Spanish sector boasts, as a whole, a position of relative strength in terms of solvency, as can be observed in Exhibit 5. Its solvency ratio of 240% exceeds the European average of 228% and, with the exception of Germany, the ratios of the other major European economies.

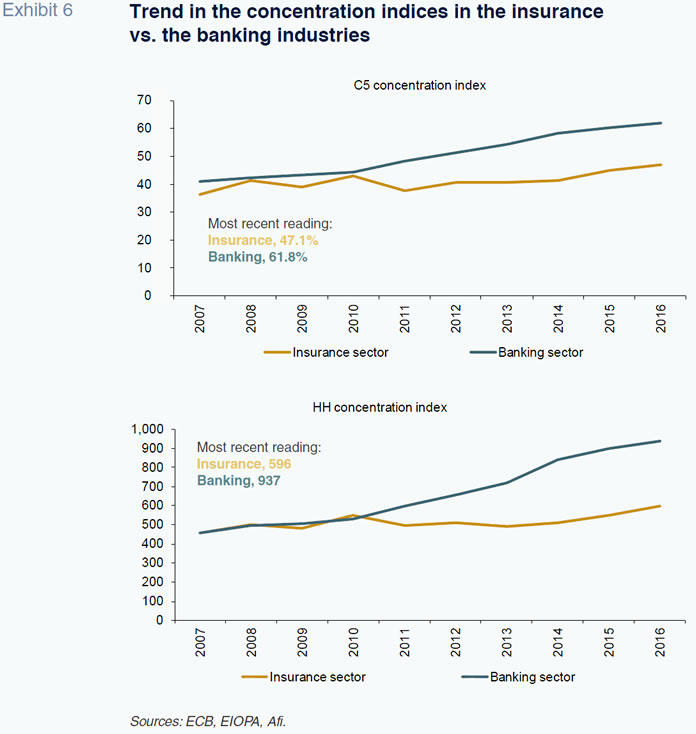

Still moderate sector consolidationThe improvement in solvency and the slight downward trend in profitability has gone hand in hand with sector concentration, which has been, nevertheless, far more contained than in the banking sector. Exhibit 6 contrasts the C5 index (aggregate market share commanded by the top five players) and the traditional Herfindahl index for the banking and insurance industries.

The reduction by nearly half in the number of players in the banking sector and the increase of 20 percentage points in the market share commanded by the five largest banks

[4] is clearcut evidence (being the largest increase among the four largest eurozone economies) of this fairly widespread concentration phenomenon. However, in the insurance sector, this concentration process has been significantly less intense. This is partially attributable to its far greater resilience to the crisis, having managed to keep its margins considerably higher. The increase in the C5 concentration index is 12 percentage points, from a share of 35% to 47%. Comparing the Herfindahl index only serves to further highlight the dual speeds at which the two sectors are concentrating.

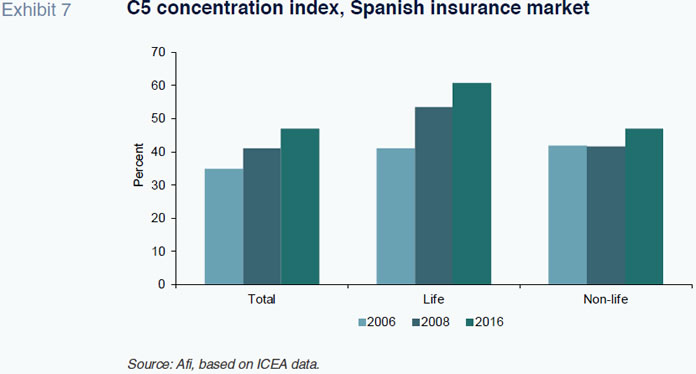

It is also worth highlighting the fact that within the insurance sector, concentration has been more pronounced in the life insurance segment than in the non-life segment, as shown in Exhibit 7. The fact that the channel overwhelmingly used to distribute life insurance is the now far more concentrated bank network is sufficient to explain this divergence. The above-mentioned increase of 12 percentage points is mainly the result of growth and increased concentration in the life insurance segment, in which the top five players corner 60% of the market, almost 20 percentage points more than in 2006.

Elsewhere, it is interesting that the increase in concentration in the Spanish market has been accompanied by very substantial changes in the players’ relative rankings. This is largely due to the restructuring and concentration of the banking sector (whose network is the main outlet for life insurance), in addition to the bancassurance agreements struck prior to the crisis; however, it is also a sign of the strategic commitment made by certain specific entities, such as CaixaBank, to the life insurance segment and by others, such as Mutua Madrileña, to the non-life segment, in the latter instance also in the form of M&A-led growth.

Factors remain that are destined to continue to foster concentration in the sector, specifically the persistence of low rates, the costs of growing regulatory pressure, the transformation required by emerging technologies and an increasingly intense competitive landscape. Combined, these business factors are bound to trigger a significant reduction in the number of small-sized insurers, still plentiful today. It is highly likely that the concentration process, particularly the unfolding decline in the number of players, will continue, with the smallest entities being the most affected.

Notes

This topic was also the subject of analysis in a prior paper published in this same journal (Galdeano and Aumente, 2016).

A one-off phenomenon concentrated among a few entities which posted sharp growth in life-savings products and life and temporary annuities, primarily, which is not expected to be sustained going forward.

Indeed, the growth in premiums from these products offsets the underwriting loss posted by this segment.

Nearly 30 percentage points factoring in the merger of Banco Popular into the Santander Group in 2017.

References

BANK OF SPAIN (2017), Annual Report 2016.

DGSFP (2017), 2016 Insurance and Pension Funds Report.

ECB (2017), Financial Stability Review.

EIOPA (2017), Annual Report 2016.

GALDEANO, I. AND AUMENTE, P. (2016), “The impact of low interest rates on the insurance sector”, SEFO Vol. 5, No. 5, September 2016.

MANZANO, D. (2017). “Spain’sbanking andinsurance sectors: A contrasting story”, SEFO, Vol. 6, No. 4, July 2017.

Daniel Manzano. A.F.I. - Analistas