The potential impact of a COVID-19 vaccine on the Spanish economy

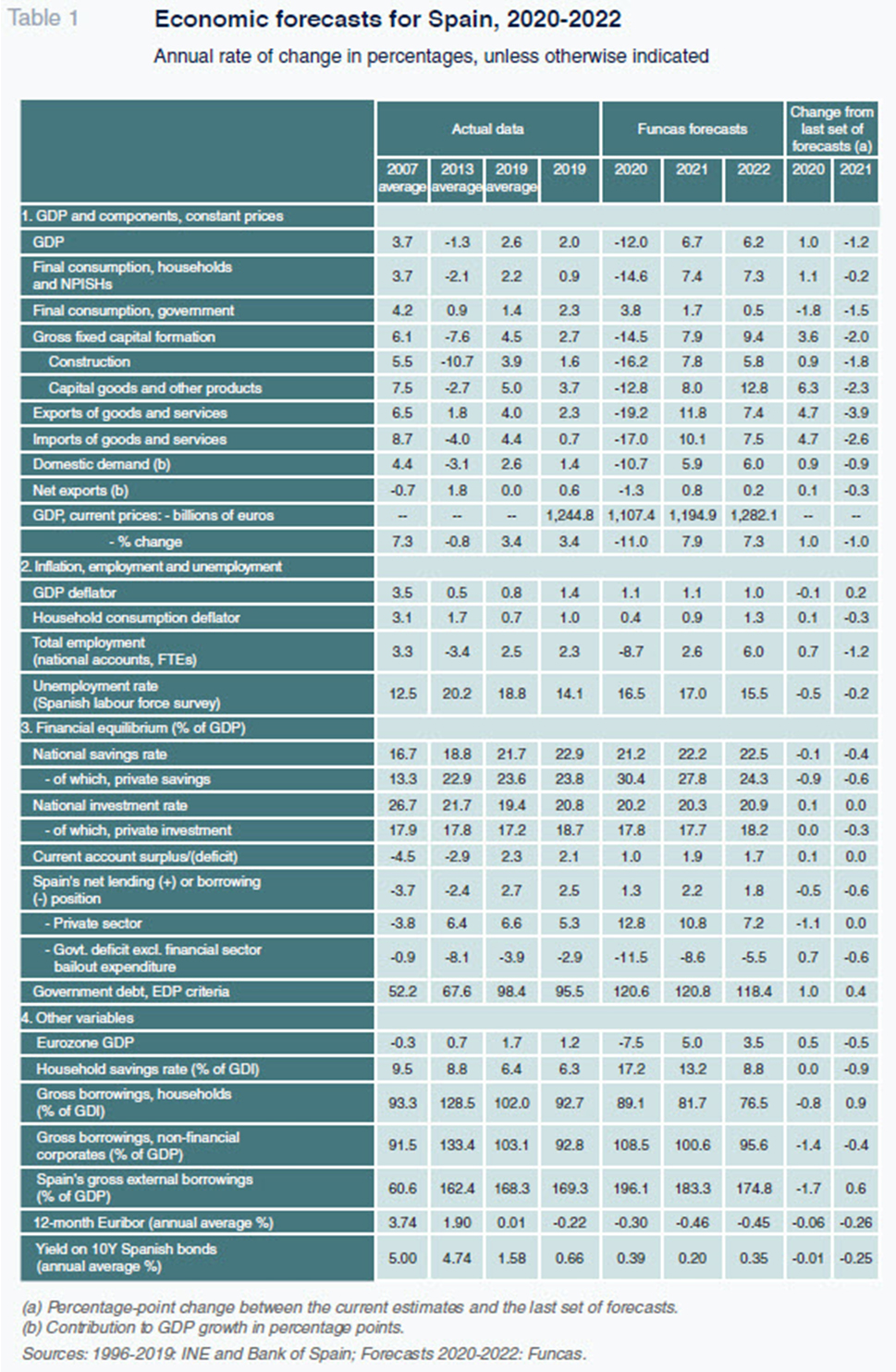

Prevailing trends in Spain’s economy include the divergence in performance between the manufacturing and services sectors, as well as the rise in precautionary savings among households. A vaccine would tackle both recessionary factors and help GDP return to pre-crisis levels by early 2023, one year earlier than in a no-vaccine scenario.

Abstract: Spain has been one of the countries most affected by the COVID-19 crisis. Lack of consumer confidence is one of the key factors behind under-performance. Another is the size of tourism and other services sectors most dependent on mobility. Thus, while indicators point to an encouraging strengthening of manufacturing in recent months, output in the hospitality sector in September was 50% below pre-crisis levels. Looking forward, a vaccine would improve both consumer confidence and mobility prospects, thus triggering a sustained recovery. According to estimates presented in this article, by the end of the projection period, GDP would be slightly above 3% higher than in a no-vaccine scenario. However, a vaccine is not expected to make a significant dent in government debt, which could remain close to 120% of GDP. There are also risks associated with these forecasts related to the potential legacy of long-term unemployment and business failure, as well as the ability to absorb EU funds and the pace of economic reforms.

Recent performance of the Spanish economy

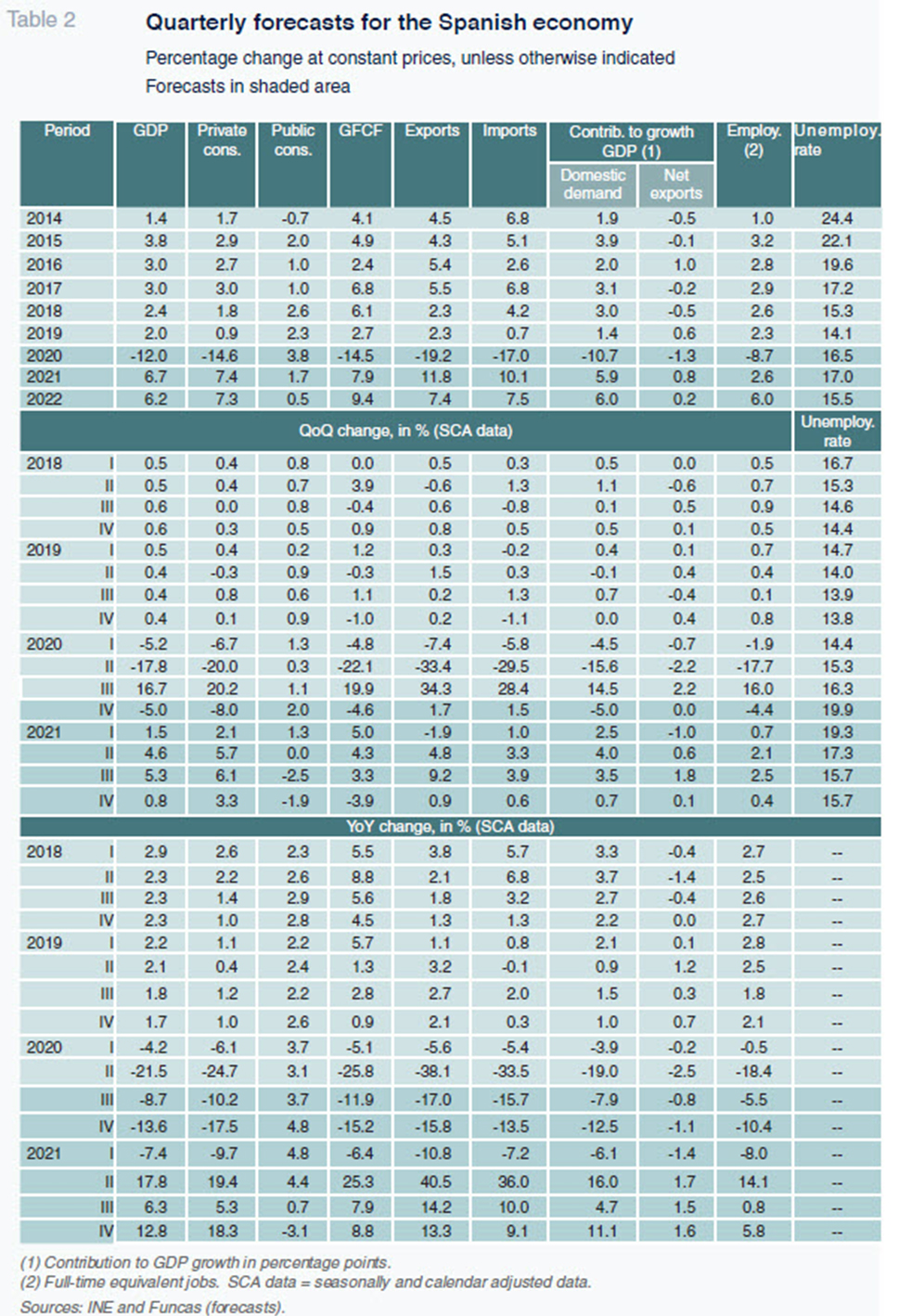

According to the provisional figures, Spanish GDP registered growth of 16.7% in the third quarter, recovering 59% of the output lost in the previous two quarters. Nevertheless, GDP was still 8.7% lower year-on-year.

All components of consumption and investment recovered strongly quarter-on-quarter. Trade also had a positive impact, with growth in exports outweighing the increase in imports. In tourist service exports, however, the recovery was very timid. In real terms, the volume of exports amounted to a scant 26% of the 3Q19 figure. The number of tourists visiting the country was just 20% of 3Q19 arrivals.

Otherwise, growth in GDP was widespread across all sectors. The manufacturing industry stands out with growth of 33%, as do the retail, hospitality and transport services sectors, where growth reached 42.5%. Despite the third quarter rebound, however, those services remained at very depressed levels in comparison with pre-crisis levels. Conversely, the trend in manufacturing and construction exhibited a less severe drop from pre-COVID levels.

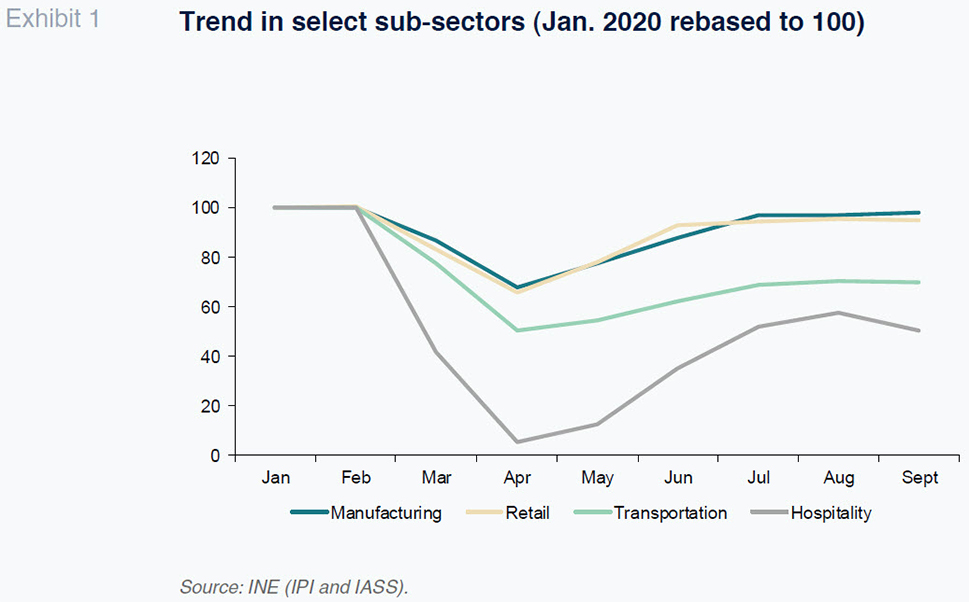

Judging by several indicators, the divergence between the various sectors widened as the quarter unfolded, with manufacturing and construction continuing to recover as the services sector once again stalled. Within the services sector there are also notable differences between the various sub-sectors. The most affected were hospitality (in September output was tracking 50% below pre-crisis levels) together with administrative and auxiliary services, whereas the shortfall in the retail sector was much smaller (at around 5%), with the transportation sub-sector somewhere in the middle (Exhibit 1).

The trend in Spanish manufacturing has been very favourable in comparison with the rest of Europe according to the industrial production index. Whereas the contraction in output was bigger in Spain at the onset of the crisis than in the rest of the major eurozone economies, the subsequent recovery has been stronger. In September, the industrial production index in Spain had recovered to around 3% below January-February levels, compared to 9% relative underperformance in Germany, 5% in France and 4% in Italy.

Turning to the fourth quarter, the indicators released so far point to an interruption in the recovery in GDP as a result of the restrictions imposed to combat the second wave of the pandemic. Tourism took another hit in September and October, according to air passenger numbers, while the services PMI fell significantly in September and then dropped further in October. Although the manufacturing PMI continued to strengthen (with the above-mentioned sector discrepancies widening) the combined reading for the manufacturing and services sectors has fallen below the third-quarter average.

The trend in Social Security contributor numbers in October clearly illustrates the sector divergence. Whereas the manufacturing industry, construction and parts of the services sector continued to create jobs and bring people out of the furlough scheme, the hospitality sector registered, as it had in September, a sharp decrease in employment, a phenomenon that not only hit seasonal hires but also permanent jobs.

In short, the economic theme throughout the unfolding recovery has been the relative strength of the manufacturing and construction sectors, in marked contrast to the plight of certain services sectors, particularly hospitality, which is bearing the brunt of the economic fallout from the pandemic. Moreover, the tightening of restrictions since September in Spain and in most of the European Union will inevitably have significant knock-on effects across the entire economy.

Outlook

Key assumptions

The prospects for the economy will continue to be shaped by how the pandemic unfolds. In the near-term, the economy is bound to feel the impact of the restrictions reimposed on business activities and mobility in order to curb the second wave of transmission. Although measures have been taken all across the country and in all of Spain’s main European trading partners, these restrictions are softer than those imposed last spring. Over the medium-term, however, the advent of a highly effective vaccine bodes well for a significant improvement in the economic outlook. Our forecasts assume that vaccination begins in the spring of 2021 and gradually ramps up throughout the second half of the year across both Spain and the rest of the EU, as the European health authorities have suggested.

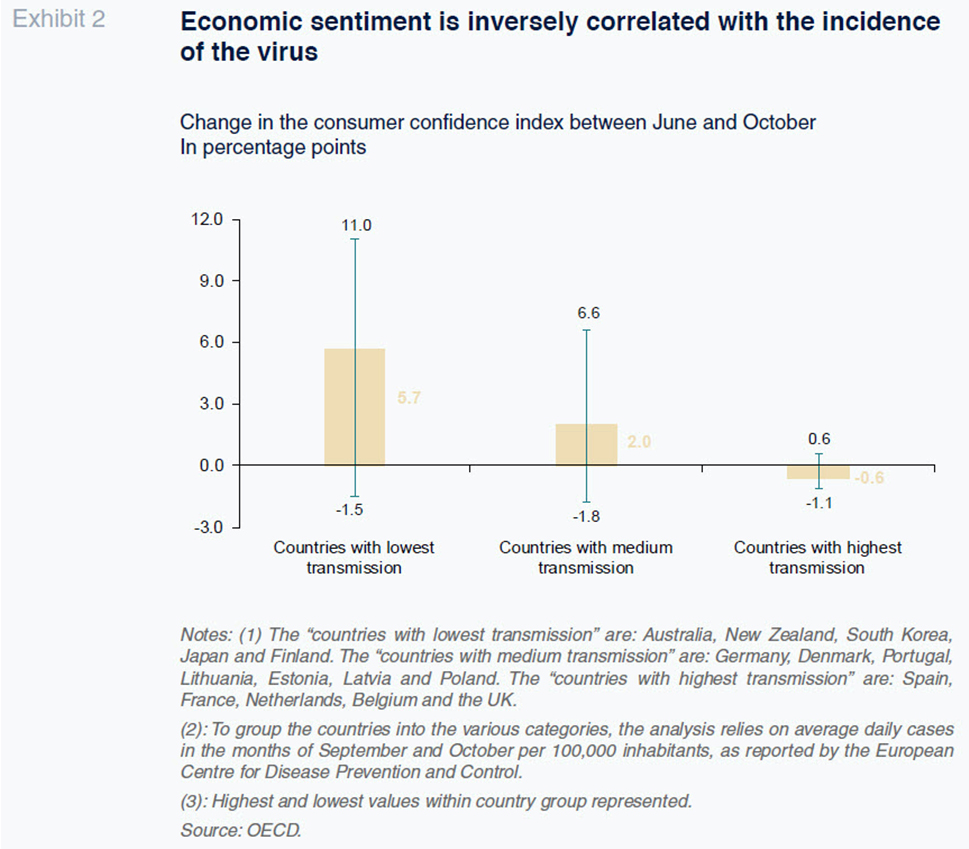

The existence of a COVID-19 vaccine will erode the two main recessionary forces that have depressed economic activity. Firstly, as restrictions are gradually lifted, uncertainty will be reduced, facilitating the gradual normalisation in household savings. Judging by what has transpired in the countries that have had the greatest success in tackling the pandemic (Exhibit 2), and the trend observed in Asia during the SARS-Cov1 crisis, it is likely that thanks to the vaccine, in 2021 private spending will increase by an amount equivalent to half of the surplus savings triggered by the pandemic. The rest of that surplus should disappear in 2022, when the savings rate is forecast to return to 8.8%, which comes close to its estimated equilibrium rate. By comparison to a no-vaccine scenario, consumer spending would increase by 14 billion euros in 2021 and by a further 25.6 billion euros in 2022.

Secondly, as vaccination becomes widespread, a recovery in overseas travel is expected, a trend already on display in Asia, where the pandemic appears to be largely under control. Considering the anticipated timing of the rollout of the vaccine, the tourism sector will only make a partial recovery in 2021. Our assumption is that the sector will recover to 50% of 2019 levels in 2021, compared to 30% in 2020. By 2020, the recovery is expected to be far more palpable (85% of 2019 levels for the year but back up at 90% by the fourth quarter). In a no-vaccine scenario, we estimate that tourism activity would be at 40% of pre-pandemic levels in 2021 and only slightly higher, at 50%, in 2022.

As for economic policy, we assume that exceptionally favourable financing conditions will persist thanks to the quantitative easing measures deployed by the European Central Bank (ECB) in response to the pandemic. We therefore expect interest rates to remain ultra-low throughout the forecast horizon. Specifically, we are estimating a yield on 10-year Spanish government bonds of 0.2%, widening to just 0.35% in 2022. Both EURIBOR and the cost of the long-term refinancing operations (TLTRO III) are expected to remain in negative territory.

Fiscal policy is similarly expected to remain markedly expansionary. Our forecasts assume an increase in public spending, partly financed from the Next Generation EU recovery funds, totalling 14 billion euros in 2021 and 28 billion euros in 2022. We estimate a GDP multiplier effect of slightly over 1 for investment projects and lower than unity for the other types of spending.

In 2021, we also layer in the pension and public pay increases announced by the Spanish government. For 2022, we assume that pensions will increase by the same amount again but that public pay will be frozen. We have not factored in any of the tax hikes included in the draft state budget as they have yet to be passed. What is included is the minimum basic income scheme, relying on the government’s estimates to that end.

Forecasts

Due to the fresh spike in transmission and the resulting restrictions on certain activities, which will hit certain sectors especially hard, we are forecasting a GDP contraction of 5% in the fourth quarter. That forecast is underpinned by the ongoing decline in private sector demand, particularly consumption, which Christmas is not expected to mitigate. Foreign trade should remain a source of good news, in line with the recent manufacturing performance and the relatively favourable competitive position of Spanish exporters. The gap is likely to widen between the manufacturing sector, which is expected to better withstand this new recessionary episode, and the services sector, particularly the segments that are more dependent on human contact such as the tourism, hospitality, restaurant, arts and leisure activities. By the end of 2020, we estimate that manufacturing activity will be back to 3% below pre-crisis levels, with the hardest-hit services segments at around 40%.

We are forecasting a GDP contraction of 12% in 2020 as a whole, a one percentage point improvement from our September forecasts (before the third-quarter growth estimate was released, i.e., 16.7% according to the National Statistics Office, compared to a forecast 11.6%). All components of demand except for public spending are expected to detract from GDP growth in 2020.

The economic weakness anticipated in the final months of 2020 is expected to linger at the start of 2021. However, as the year unfolds, the recovery should gain traction thanks to the arrival of the vaccine and supported, albeit to a lesser extent, by the EU funds. For 2021, we are forecasting GDP growth of 6.7%, down from the 7.9% estimated in September. This time all components of demand are expected to make a positive contribution to growth, with government spending contributing the least. It is worth highlighting the expected rebound in private consumption, unlocked by a growing propensity to spend as uncertainty regarding the path of the pandemic begins to dissipate. A recovery is also estimated for investment, particularly in the public sector, where growth is forecast at close to 40% (albeit starting from very low levels). Foreign trade is expected to buoy GDP, driven by renewed growth across Spain’s trading partners, as well as a slight improvement in tourism during the second half of the year.

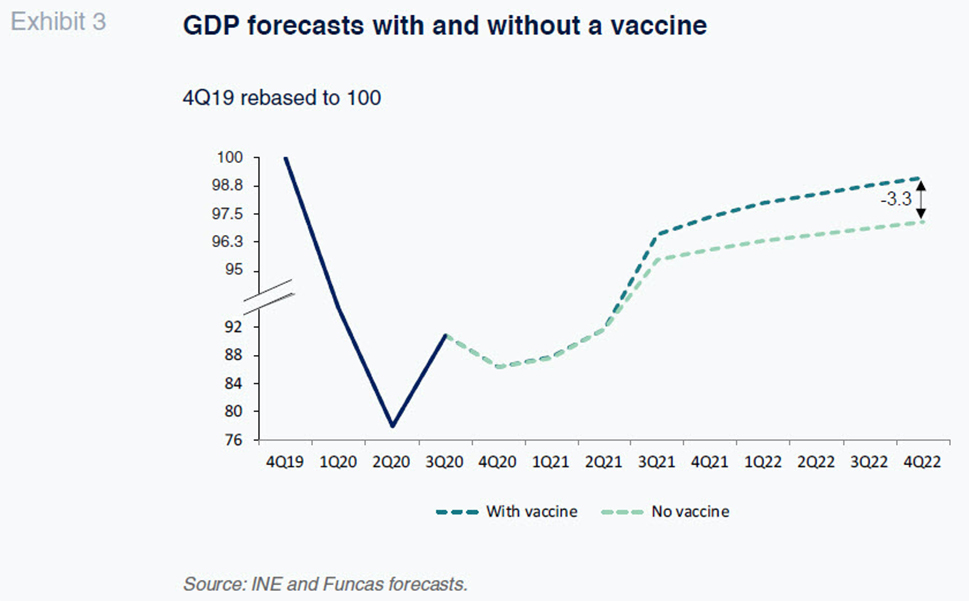

Growth should consolidate in 2022, at 6.2%, underpinned by the same interplay of drivers, notably private consumption, investment in capital goods and tourism. Nevertheless, GDP is not expected to regain all of the ground lost since the start of the crisis until early 2023, one year sooner than in the no-vaccine scenario (Exhibit 3). By the end of the projection period, the vaccine will raise GDP by slightly above 3% compared to a no-vaccine scenario.

The persistence of the external surplus during the pandemic is worth highlighting. It is a positive development (especially considering the collapse in tourism receipts, and the disruption of supply chains induced by the pandemic), and owes much to the relatively favourable competitive position of Spanish exporters. The current account is expected to present a surplus of between 1% and 2% of GDP throughout the projection horizon.

The job market is likely to act as a growth stabiliser, instead of exacerbating the crisis like in previous recessions. We expect that the ongoing furlough scheme, the financial support extended to the self-employed and the internal flexibility measures taken by private enterprises (e.g., arrangements for working from home) will continue to cushion the impact of the pandemic on employment. Nonetheless, it will be some time before the economic recovery starts to create new jobs. We are forecasting an increase in unemployment in 2021, due to the return of discouraged, inactive job-seekers, followed by an incipient recovery from 2022. For that year, we are forecasting an average rate of unemployment of 15.5%, up 1.4 percentage points from 2019.

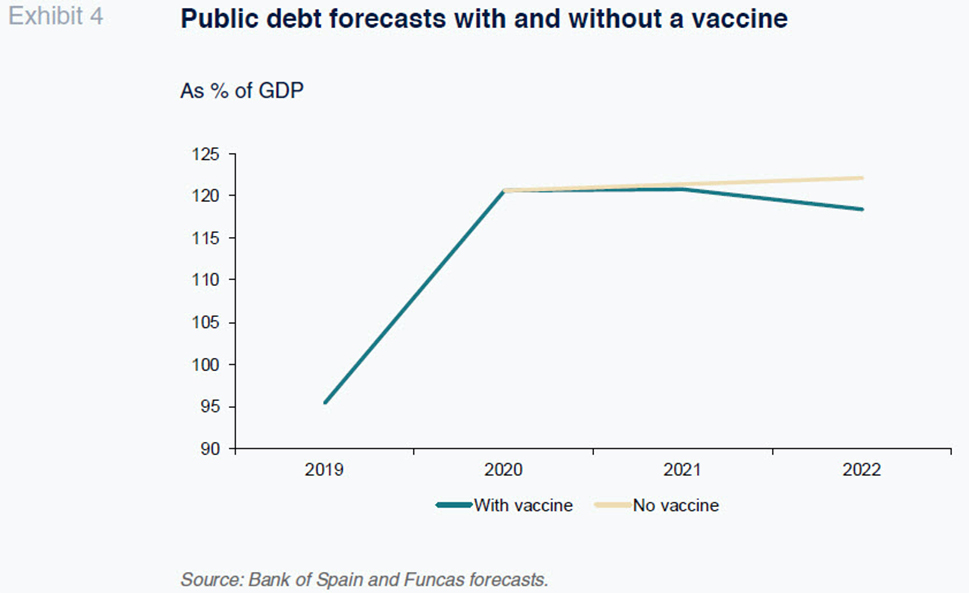

The increase in public spending and collapse in tax revenue will take a toll on the public deficit, which we are forecasting at 11.5% in 2020. As noted, the 2021 estimates factor in the decisions already taken or announced, notably the growth in public spending funded by the EU recovery plan. The result of those assumptions, coupled with the interplay of the automatic stabilisers, will result in an estimated reduction in the deficit to 8.6% of GDP, largely in the structural component. Fiscal policy is expected to remain markedly expansionary in 2022, with the deficit declining towards 5.5% of GDP that year. Public debt will probably stagnate at high levels of close to 120% of GDP, albeit falling slightly below that level in 2022. Therefore, the advent of the vaccine is not expected to make a significant dent in Spain’s pre-existing imbalances (Exhibit 4).

Main risks

It is important to underline the margin of error implicit in any forecasting exercise in a context as uncertain as this. One of the biggest unknowns is how effective the recently-announced vaccines will be. Although the World Health Organization and many experts believe we will have an effective remedy in 2021, it is still unclear what percentage of the population will be willing to have the vaccination or how long the immunity created will last. The estimates presented above show that in the absence of a vaccine, the Spanish economy would take one year longer to recover to pre-pandemic levels compared to the baseline scenario.

There are other downside risks. Firstly, the bouts of economic reopening and closure may leave a legacy of long-term unemployment and business failure, heightening the risk of a financial crisis. Moreover, those sources of hysteresis imply a loss of productive fabric that will be hard to reverse.

Uncertainty regarding the timing of disbursement of EU funds, the potential for poor management of those funds at various levels of government and the economy’s ability to absorb them are other significant risks that could dampen the forecast for recovery. It is crucial that the EU plan provides an impetus for reforms to improve how the economy operates and reduces the economic and social imbalances weighing on Spain. In the current climate those reforms are also essential for generating confidence in the economy’s growth potential and solvency. If not, concerns could increased over the sustainability of public debt, with dire economic and social consequences. In sum, with the EU stimulus package alone and in the absence of an ambitious reform programme aimed at correcting Spain’s shortcomings and boosting its productivity, Spain risks falling behind the rest of the developed economies.

Raymond Torres and María Jesús Fernández. Economic Perspectives and International Economy Division, Funcas