The Spanish banks in a European context: From transition to recovery

Spanish banks have taken advantage of the crisis to implement measures, which now appear to have given them some relative advantages with respect to many of their European peers. Despite a seemingly more benign outlook going into 2017, major challenges remain on the international scene for both the Spanish and eurozone banks.

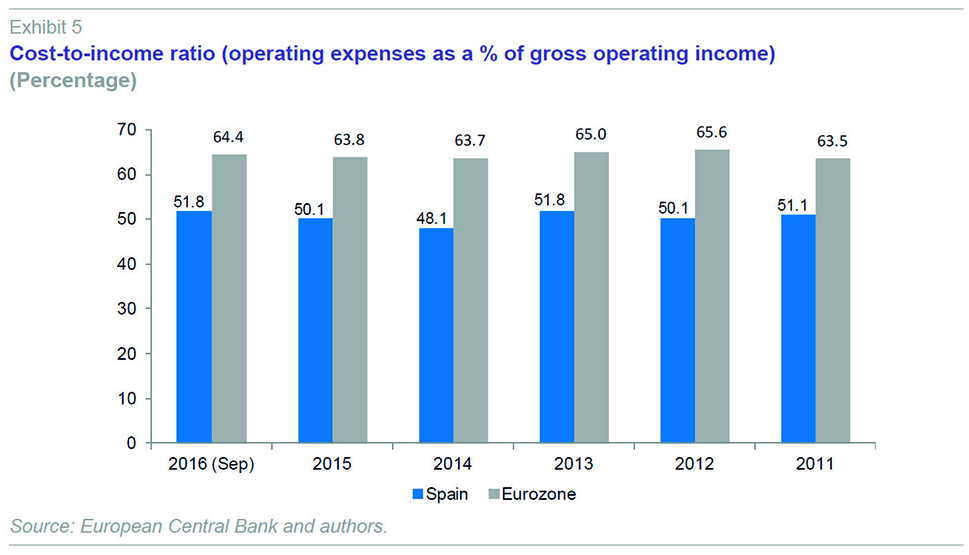

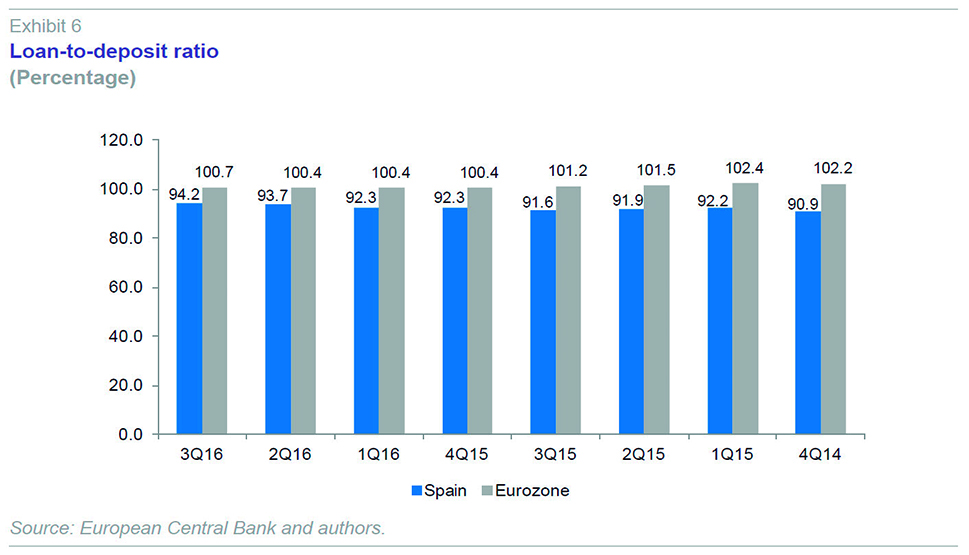

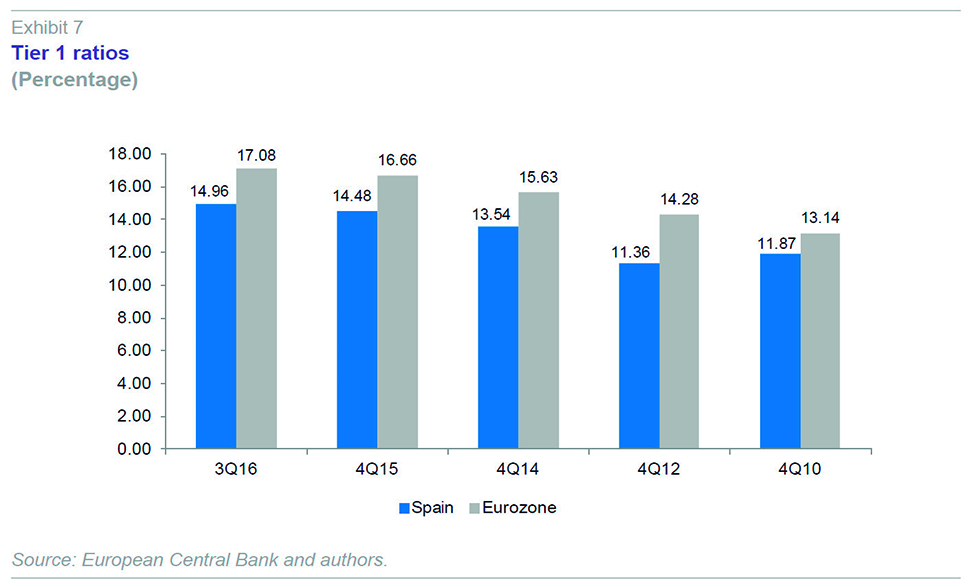

Abstract: Spain’s banks appear to have more reason for optimism in 2017 than they did in 2016 ‒ a year marked by uncertainty and market jitters since its onset. The scrutiny of the European and international institutions and the efforts made by the sector itself appear to have translated into a significant improvement in the robustness and earnings prospects of the Spanish banks, which are nevertheless still making adjustments, significant in some cases, in a market environment that still cannot be described as risk-free. Relative to the eurozone as a whole, the Spanish banks continue their ‘deleveraging’ effort in an attempt to match supply with the new demand paradigm. However, the prospects for credit are improving little by little. Spanish banks also appear to present a relative advantage in terms of their cost-to-income ratios and income-generating capabilities. Two-thirds of the gross operating income generated by the banks in the single currency area are gobbled up by their administrative and wage costs, compared to just half in Spain. Finally, the Spanish banks’ Tier 1 capital ratio rose from 11.87% to 14.96% between 2010 and 2016 ‒ somewhat below the eurozone average, but comfortably above regulatory requirements and demonstrating reinforced transparency. Going forward, both Spanish and eurozone banks face a challenging international context, mainly due to uncertainty surrounding Brexit implementation, potential spillover effects from US financial deregulation, and the upcoming stress test exercise.

The backdrop: Earnings at the Spanish banks, outside scrutiny and ratings actions

So far, 2017 has not been free from uncertainty for the European banks, although the markets have not been as convulsive or volatile as in 2016. Monetary conditions remain exceptional, with the ECB expected to continue to provide abundant liquidity and real rates still in negative territory.

Doubts about the health of the Italian banks linger. The solution offered to date for the bailout of Monte dei Paschi di Siena is incomplete and unlikely to address three problems: (i) tainted sector credibility given the persistent lack of transparency; (ii) correct application of the mechanisms contemplated by the single supervisor, given that the situation has been defined as a bailout and not a ‘bail-in’ (in which shareholders and bondholders would assume part of the costs); and, (iii) non-performance across the Italian banking industry as a whole. Although the Italian authorities have offered up to 20 billion euros of contingent aid for the country’s banks presenting solvency issues, an exhaustive analysis of the banks’ assets is still lacking.

In the midst of the doubts about the Italian banks, the ECB itself has made statements suggesting that it might be a good idea to create a pan-European asset management company (a so-called bad bank) to provide a faster exit route for the impaired assets still in the hands of the eurozone’s banks. This avenue would offer an additional solution for the Italian banks and those of other countries, potentially even complementing the bad banks already set up in some instances. Whatever happens, the transparency-related problems have yet to be definitively resolved.

As for Spain, the banks have just wrapped up reporting their 2016 results. The six largest Spanish banks ‒ Santander, BBVA, CaixaBank, Bankia, Popular and Sabadell ‒ posted aggregate net profit of 8.76 billion euros, marking a drop of 22.3% from 2015. The loss recognised by Banco Popular (3.49 billion euros) had a considerable effect on the overall performance. Stripping Popular out, sector profits would have risen by 8.5%.

In the middle of earnings season, the European Commission (EC) published an important report (on February 22nd) titled Country Report Spain 2017 ‒ Including an In-Depth Review on the prevention and correction of macroeconomic imbalances (Brussels, 22.2.2017 SWD [2017] 74 final). Although the document broadly addresses the full spectrum of macroeconomic policies and the recent performance of the Spanish economy, it also assesses financial aspects of considerable interest.

Specifically, in this working document, the EC affirms that the “financial sector has continued to show a high degree of stability, supported by its ongoing restructuring, low funding costs and the economic recovery.” In reference to the banking sector, it notes that it has “further strengthened its capital buffers and all six Spanish banking groups that were subject to the EBA stress tests of July 2016 comfortably met capital requirements under this exercise.”

The EC maintains that the non-performing loan ratio will continue to trend in the right direction, noting that the “aggregate non-performing loan ratio fell to just above 9% in November 2016. As elsewhere in Europe, squeezed profitability, against the background of low interest rates and remaining scope to further improve the sector’s business model, is the main challenge.”

In sync with the outlook which most economists continue to express, the report notes that although the outstanding volume of credit is still falling, this trend may well revert in 2017; indeed bank lending to small and medium-sized enterprises is already registering considerable growth. There are also signs of some recovery in consumer credit.

The report also underlines the solvency of the Spanish banks, observing that the system “has ample access to liquidity and can comfortably meet the regulatory capital requirements. Solvency levels are resilient to a stress scenario, strengthened.”

Taking a longer-term perspective, although the authors applaud the private sector’s deleveraging efforts, they also indicate that “the indebtedness of the Spanish economy remains high, with the stock of private non-financial sector debt amounting to 167.5% of GDP in Q3-2016. Mirroring the net external liabilities, the high level of debt remains a macroeconomic imbalance, the associated financial burden constraining domestic demand and increasing vulnerability to interest rate shocks.”

Elsewhere, in terms of the environment facing the Spanish banks, it is also worth highlighting the fact that certain court decisions are among the factors exerting downward pressure on profitability. On December 21st, 2016, the EU Court of Justice ruled that the outlawing of the so-called mortgage ‘floors’ in Spain in May 2013 should have full retroactive effect. Although a good deal of the potential impact had been provisioned for by the banks as a reasonably probable legal risk, the ruling had the effect of reducing the profits reported by a considerable number of banks in 2016. On January 20th, 2017, the Spanish government approved a free, voluntary and expedited out-of-court settlement procedure for dealing with demands for reimbursement in connection with the mortgage floors. Note that a sizeable number of financial institutions consider that the eventualities contemplated in the ruling do not affect some or all of their existing mortgage agreements.

In terms of the sector’s improving reputation, it is worth noting that on February 9th, Standard & Poor’s (S&P) upgraded Bankia’s issuer rating from BB+ to BBB-, restoring this entity to investment grade status. S&P left its ratings outlook at stable. This ratings agency also lifted the ratings of Bankinter (from BB+ to BBB-), Ibercaja (from BB to BB+) and Abanca (from B+ to BB-) by one notch, leaving them all on watch positive. It also put its issuer ratings for Santander, CaixaBank, Kutxabank, Cecabank and Caja Laboral on watch positive. On the other hand, Fitch downgraded Banco Popular from BB- to B+ on February 15th.

In parallel and in this same arena, Spain’s House of Deputies and the Bank of Spain have been scrambling to take transparency measures in the midst of intense controversy concerning their preventative and supervisory actions before and during the financial crisis in Spain. Both institutions have announced they will compile reports analysing these matters in detail.

Situation relative to the eurozone

Several qualitative aspects of what sets the Spanish banks apart from their European peers have been analysed in detail in prior editions of the Spanish Economic and Financial Outlook. Specifically, the following three aspects:

- A unique effort to step up transparency (beyond the usual regulatory requirements) in a bid to dispel doubts about the quality of their assets.

- A deeper restructuring effort which has driven a bigger adjustment in supply and demand for retail banking services in Spain; this effort, moreover, remains intense.

- Application of a broad package of requirements as a result of the financial aid provided by the EU, notable among which the assumption of bail-in mechanisms, even though: a) at the time the Single Resolution Mechanism had yet to be set in motion; and, b) these mechanisms have not been applied in Italy despite being effective since January 2016.

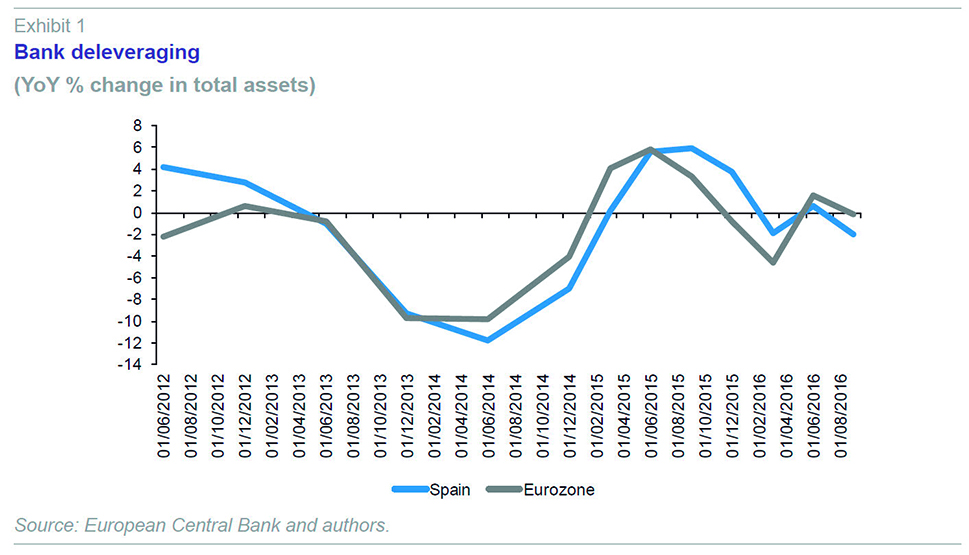

That being said, Spain continues to display certain tendencies that are evolving in line with those unfolding in the rest of the eurozone. The most recently updated figures in the European Central Bank’s Statistical Data Warehouse enable a comparison of the Spanish banks relative to the eurozone average as of September 2016. The first thing that jumps out is the deleveraging process: total banks assets have been contracting sharply since 2015 (Exhibit 1) and although there was a brief let-up towards the end of 2016, there are few signs of a recovery that would suggest that the size of the eurozone banking sector will increase any time soon.

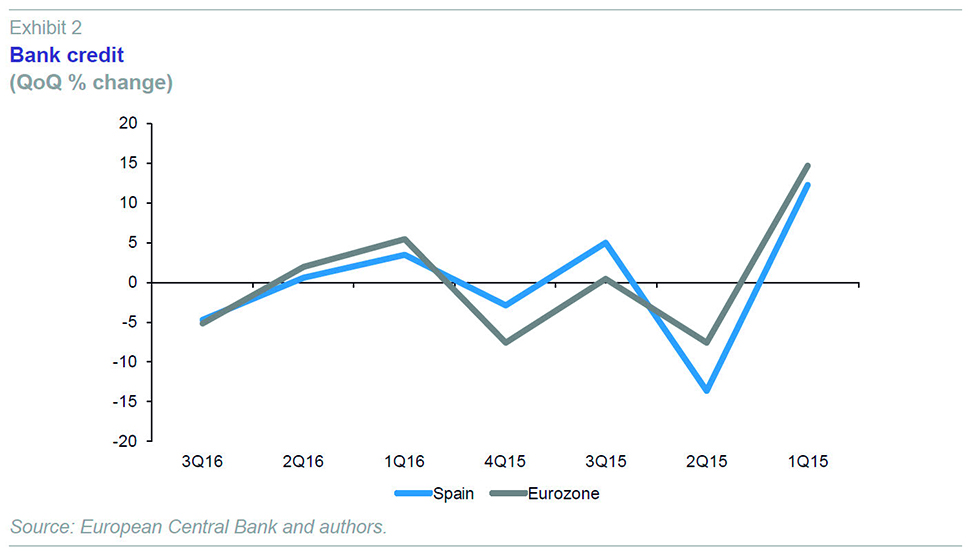

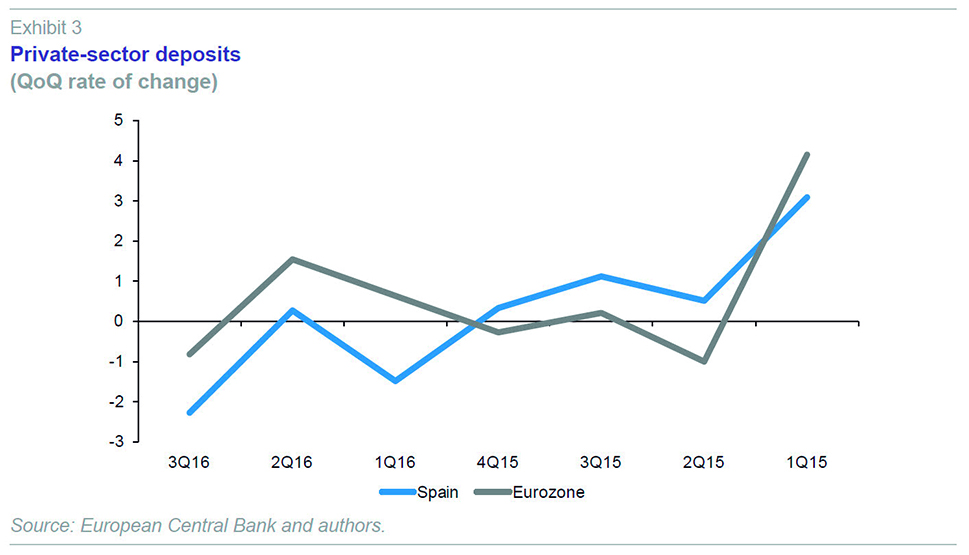

This contraction in overall assets is evident in the credit balance, which, as noted above, began to recover in 2015 before going on to fall once again in the face of market uncertainty throughout 2016. As shown in Exhibit 2, the quarter-on-quarter rate of change was negative in 2016 and there are no signs of a significant turnaround. The proliferation of elections and the associated uncertainty is partly responsible for containment of the growth in credit. On top of this, the banks face regulatory pressure and reduced demand for financing at a time when indebtedness remains high. Nevertheless, the outlook for 2017 is brighter.

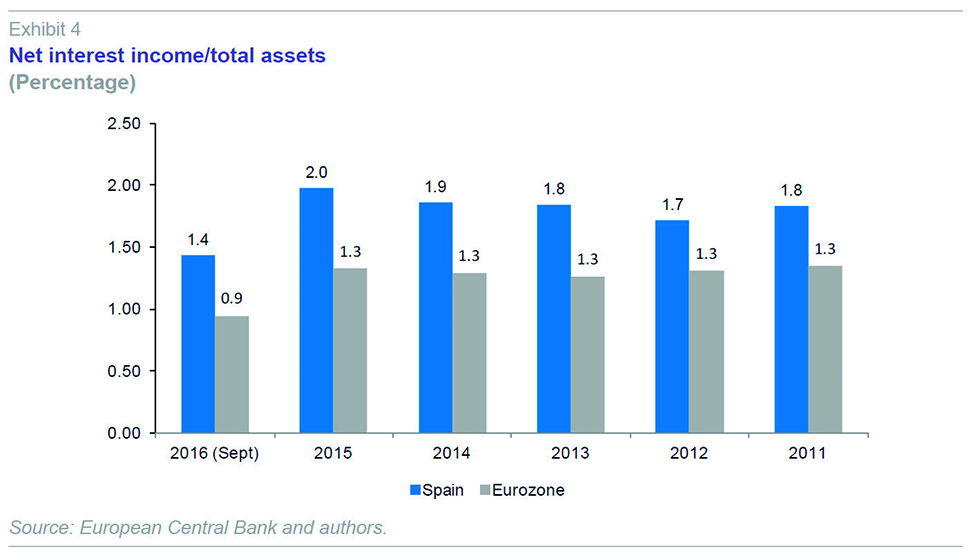

As for the business side of things, the negative rate environment is the key obstacle in the way of the European banking industry’s path back to profitability. This challenge relates not only to the generation of interest margin but also to matters less widely discussed such as the technical challenge of designing contracts when rates are negative or the outlook for demand when the cost of money is shaped by the central bank’s actions rather than reflecting the real risk of potential borrowers. All of which framed by the widespread public perception, albeit somewhat biased, that the current rates favour the banks but not households. However, the majority of households and companies have been able to repay their debts with significantly greater ease in the current environment of negative real rates. For the banks, however, it is more challenging to apply the risk premium needed to get credit flowing more decisively. As shown in Exhibit 4, net interest income as a percentage of total assets held steady between 2011 and 2014 (averaging 1.8% in Spain and 1.3% in the eurozone) but fell substantially in 2016.

One of the aspects on which the Spanish banks started out with a competitive advantage relative to the eurozone was efficiency. Given that sector restructuring has been relatively more intense in Spain, it is not surprising that the sector has maintained its edge in this respect. The cost-to-income ratio (operating expenses/gross operating income) presented in Exhibit 5 reveals a figure of 51.8% for the Spanish banks compared to a eurozone average of 64.4%. This means that two-thirds of the gross operating income generated by the banks in the single currency area are gobbled up by their administrative and wage costs, compared to just half in Spain.

Where the Spanish banking sector continues to evidence the higher indebtedness of the private sector relative to the European average is on the ‘loan-to-deposit’ ratio (Exhibit 6). This simple ratio provides an approximation of how much of the credit awarded has been backed up by the banks’ main source of liquidity: Deposits. In Spain, despite the cumulative drop in outstanding credit, the loan-to-deposit ratio stood at 94.2% in September 2016, having risen from 90.9% in 2014. However, the eurozone has continued in the opposite direction, with the average falling from 102.2% in 2014 to 100.7% by September 2016.

Another aspect to have contributed meaningfully to renewed confidence is the observed increase in capital adequacy ratios. The Spanish banks’ Tier 1 ratio increased from 11.87% to 14.96% between 2010 and 2016 (Exhibit 7). The eurozone continues to have somewhat of an edge in this respect, presenting an average Tier 1 ratio of 17.08% in 2016. Nevertheless, and continuing the thread of the analysis performed in the last section, an appropriate level of transparency regarding asset quality is just as important as having a high capital ratio, if not more so.

Challenges in 2017

Even though the markets appear to be a little firmer, 2017 is not free from risks for the Spanish banks or their European peers. By way of conclusion, here we summarise three of the major international challenges looming and their potential impact on the Spanish and eurozone banks:

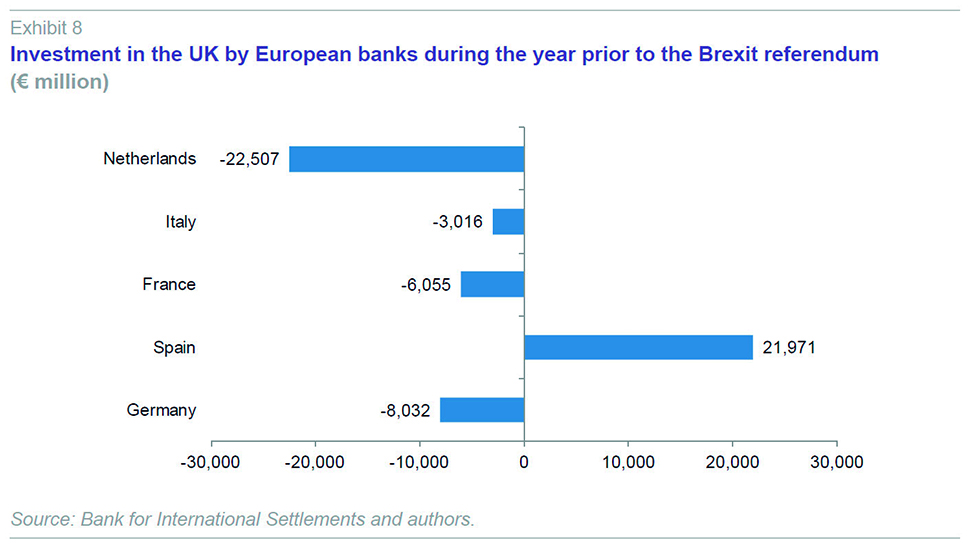

- One of the most controversial: Brexit. The triggering of this process in March 2017 is particularly important for the Spanish financial institutions on account of their exposure to the UK market. In fact, as illustrated in Exhibit 8, the Spanish banks were the only institutions among the major European countries to increase their exposure to the UK in the year prior to the referendum of June 23rd, 2016. Specifically, by 21.97 billion euros. This increase, however, should be viewed against the backdrop of the Spanish banks’ relative presence in the British market and their recent acquisitions. Moreover, as outlined in the last edition of SEFO, the risk of changes in the regulatory environment governing Spanish banks operating in the UK market do not appear excessive, although it is too soon to calibrate these changes.

- Financial deregulation pressure stateside: although this issue is still on his ‘wish list’ and lacks concrete form, President Trump has suggested that the regulations brought in under the Dodd-Frank Act are excessive and inappropriate and should be largely rolled back. If he were to do this, dismantling much of this legislation without introducing sufficient counterbalances, it could turn out to be an error of gigantic proportions for two reasons. Firstly, because it could lead to the assumption of inadequate risk by the US and a proliferation of ‘shadow banking’ activities. And secondly, because it would seriously damage already-tenuous international financial coordination, an effort which at least has found a certain amount of common ground and success on certain aspects, such as capital adequacy. This loss of coordination could catch the eurozone off-guard at a particularly delicate time given the evident fragility of the banking union’s financial architecture in the face of the Italian banking crisis.

- Lack of transparency benchmarks: The European Banking Authority faces a major challenge in 2017. This year there will be just one transparency exercise in the banking sector, while the next stress tests have been put off until 2018. The Italian banking crisis and lingering questions about certain institutions suggest that this transparency exercise could go in either direction. It could turn out well if sufficiently stringent and robust. But it could also turn out badly if, as until now, it overlooks important risks that end up materialising in the form of fresh episodes of bank stress, as happened with Monte dei Paschi di Siena. For the Spanish banks, this transparency exercise may prove the definitive opportunity for showing that the market is correctly assessing relative risk factors.

Santiago Carbó Valverde. Bangor Business School, CUNEF and Funcas

Francisco Rodríguez Fernández. University of Granada and Funcas